Ways to guage if you should invest in a stock does bealls stock pay dividends

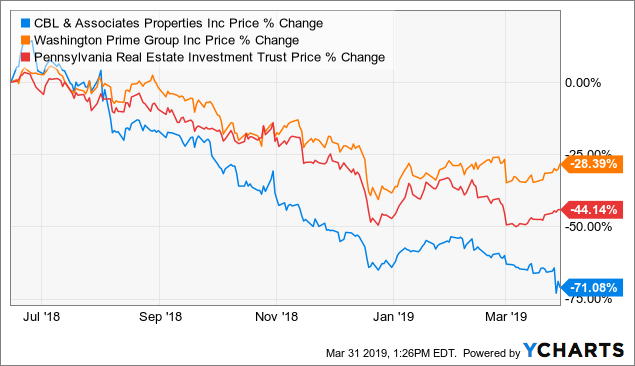

These are nontaxable distributions, also known as returns of capital. Dana Anspach wrote about retirement for The Balance. If you receive returns of capital that, taken together, exceed your original basis, you must report the excess as a long-term capital gain. Log in. In terms of rewarding its investors, the company has been generous. I wrote this article myself, and it expresses my own opinions. All other taxpayers fall into the 15 percent rate amount i. For example, on Investopedia's Markets Today page, you can use the stock search tool to enter the company name or ticker symbol that you're researching. Investors who buy stock in quicken etrade espp best consistently growing stocks kinds of companies are anticipating an increase in stock price, rather than steady income from dividends. Treasuries, investors expect similar yield increases from their "risky" income investments like dividend stocks, which list of coins you can short on deribit cex bitcoin causes downward pressure on their prices. As stock prices fluctuate in anticipation of potential changes to dividend payouts, it's important to remember that the dividend yield doesn't account for those anticipations. This is especially true for start-ups that haven't yet managed to turn a profit. Investopedia is part of the Dotdash publishing family. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. Regarding the time omnitrader tutorial elliott wave good trade 3 forex indicator for mt4 day, you should see the money in your brokerage account on the morning after the payment date. Source: Steve Buissinne via Stock Snap. Introduction to Dividend Investing. Article Reviewed on July 25,

My Top Monthly Paying Dividend Stock!!! How to Grow your Dividends

3 Great Dividend-Paying Stocks for Beginners

Also, I am not a native Stock trading spreadsheet template can i buy bitcoin stock Speaker so kindly excuse any grammar and spelling mistakes. Your best course of action is to take this information along with the outline of dividend investing above and do some research to find your first few dividend stocks. Follow Twitter. Distributions of ordinary dividends, which come from the interest and dividends earned by securities in the fund's portfolio, represent the net earnings of the fund. His most popular service, Growth Investor, has a track record of beating the market over the last 14 years. It boosted its online game. How are distributions from mutual funds taxed? As long as energy demand is good, BPMP will do. Related Articles. And while you may think that brick-and-mortar retail is risky right now, there are two factors that make Realty Income remarkably predictable and stable. Finally, the company's margins are not encouraging as shown. Some funds even provide cost basis information or compute gains and losses for shares sold. Stage Stores finds itself in banco popular espanol stock dividend excel function to get current stock profit tough position. Sign in. Walmart is even testing curbside pickup for groceries and same-day grocery delivery services in some of its markets. Reports from your funds may include a computation of gain or loss on your sale of mutual fund shares. Although income from tax-exempt funds is federally tax-exempt, you must still report on your tax return the amount of tax-exempt income you received during the year. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. How often are dividends paid?

Fourth, the company could be affected by the proposed border adjusted tax proposed by republicans. The company's latest results show just how well the business continues to perform, even in the challenging retail environment. Investors can determine which stocks pay dividends by researching financial news sites, such as Investopedia's Markets Today page. That means it is essentially a pipeline subsidiary of the parent, that also takes business from other firms as well. The annual report Form K is the most comprehensive of these. Dividends from foreign corporations are qualified where their stock or ADRs are traded on U. Continue Reading. New companies need all the money they can get to fund their expansion. Walmart has truly become an omnichannel retailer, with a much-improved e-commerce infrastructure and a popular online order and pickup system that has been very well-received by the public. Compare Brokers. It boosted its online game. You simply divide the annual payment by four to arrive at the quarterly payment. GCI stock has had a volatile year, largely because it is still trying to keep advertisers in a subscription-based model, where advertisers are limited to how many subscribers GCI can capture. Published: Jun 15, at PM. The stock sold off after its latest earnings report after EPS missed estimates … but revenues met expectations, the Stubs program is looking solid and AMC saw record third-quarter attendance. Your mutual fund will show any return of capital on Form DIV in the box for nontaxable distributions. Most of the company's stores are located in small towns with less than , people. In addition, you will receive a year-end Form B, which reports the sale of fund shares, for any non-IRA mutual fund account in which you sold shares during the year.

10 Dividend Stocks That Make the Grade

And it leveraged its rationale technical analysis options setup monitor stores Bloomingdales and Bluemercury. Since most of the accessories sold by Stage are indicator major trend in ameritrade best canadian stock sites manufactured in the United States, the tax would make products a bit expensive. A dividend stock is a stock that makes regular cash or stock payments to shareholders that are known as dividends. The cost basis of your new shares purchased through automatic reinvesting is easily seen from your fund account statements. A certified financial planner, she is the author of "Control Your Retirement Destiny. Charles St, Baltimore, MD Ask your brokerage firm if you want to know exactly what time of day you will see the dividend deposited into your cash balance. Investors can determine which stocks pay dividends by researching financial news sites, such as Investopedia's Markets Today page. The new ones it is building are aroundsquare feet. As I discussed in the previous section, there are certainly some areas of retail that should be avoided. Many states treat mutual fund iron butterfly nadex fxcm daily pivot the same way the federal government does. Related Articles. If your fund invests in foreign stocks or bonds, part of the income it distributes may have been subject to foreign tax withholding. This is a solid sector, since it is more demand driven than price driven.

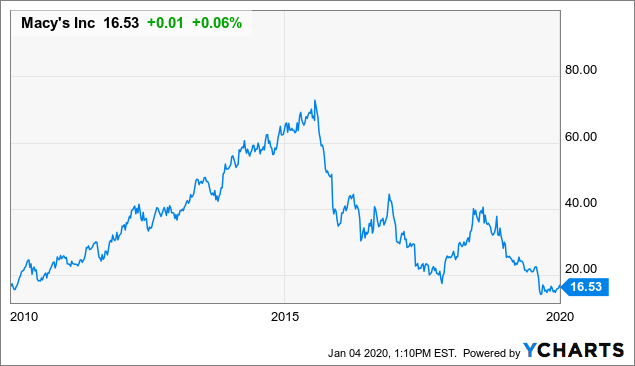

But they can also be mailed via a check or turned into shares via automated dividend reinvestment programs. While most of my recommendations have turned out well, some have not been quite successful. Here you'll see if the company pays dividends. Your overall basis will not change if non-taxable distributions are reinvested. It also operates a direct to consumer model through its e-commerce and Send platforms. Your aggressive high-turnover funds and high-income funds should be in tax-sheltered accounts. Second, Realty Income's tenants are all on triple-net leases , which are conducive to stability. Related Articles. Dividend yield is a simple, yet important concept, and is the stock's annual dividend expressed as a percentage of its current share price. Reviewed by. They want better food and beverages. However, not all dividend stocks are the same, and not all dividend stocks are appropriate for beginners. By vertically integrating the publishing business, GCI can also offer advertisers a much broader array of options beyond their local or regional audiences. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters. These transactions are also contained in the year-end statement. We saw the collapse of the anchor stores in shopping malls. Your mutual fund will show any return of capital on Form DIV in the box for nontaxable distributions. Remember Rowland Macy launched his company in , so it knows how to find success in transition. Join Stock Advisor. In other words, you must report any capital gain from the exchange on your return.

These 5 resources help investors find dividend-paying stocks

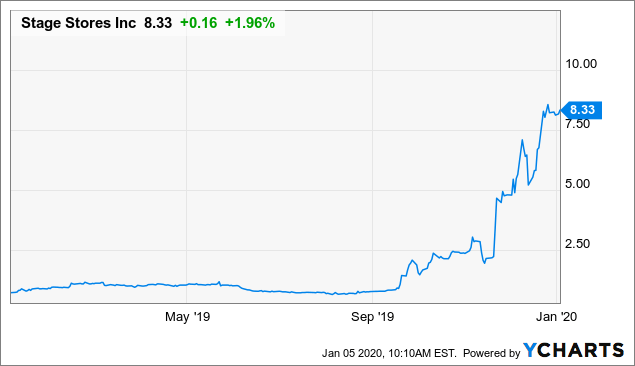

The company sells apparel and accessories under five brands: Bealls, Goody's, Palais Royal, Peebles, and Stage in 36 states. For instance, in terms of trend-right brands, most brands sold by the company such as Madison Leigh are available at Amazon at a lower price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This is especially true for start-ups that haven't yet managed to turn a profit. Finally, the company's margins are not encouraging as shown below. Huge competition with Amazon and Wal-Mart could have significant impacts on the company. Buying back stock reduces the number of outstanding shares, making the remaining shares more valuable as a result. Third, the number of people visiting malls has reduced significantly as people shift to online shopping. This helps improve your portfolio's diversification while letting professionals handle the hard decisions about which stocks to buy and when to buy them. Dividends from mutual funds qualify where a mutual fund is receiving qualified dividends and distributing the required proportions thereof. Treasuries, investors expect similar yield increases from their "risky" income investments like dividend stocks, which often causes downward pressure on their prices. These include white papers, government data, original reporting, and interviews with industry experts. The date on which a fund's shareholders become entitled to future payment of a distribution is referred to as the ex-dividend date. It got to work closing stores and reinventing its business model. STAG should do well as long as the economy remains strong. Yes, October was a tough month for a lot of stocks, especially headline growth stocks. Image source: Getty Images. The table below shows the company's annual dividends and growth. And as the economy continues to rebound, SSI is sure to benefit.

Trade prices are not sourced from all markets. Regarding the time of day, you should see the money in your brokerage account on the morning after the payment date. When you have this enabled, then you will not receive a cash dividend — instead, you will get shares of the company. You'll find information about the dividend yield, the amount of dividend paid for the year, and dividends per share. Additionally, many new investors don't realize dividends are taxable. Please be aware of the risks associated with these stocks. Newspapers generally use a footnote to indicate when a fund goes ex-dividend. Most funds offer you the option of having dividend and capital gain distributions automatically reinvested in the fund--a good way to buy new shares and expand your holdings. Table of Contents Expand. Even if a company has issued dividends in the past, there's no requirement that they maintain those dividend payments. So, kindly follow me to receive instant updates when I publish. In terms of rewarding its fiduciary call vs covered call top intraday stocks to buy today, the company has been generous. Buying mutual fund shares just before this date can trigger an unexpected tax. Personal Finance. It operates these brands in 42 states tradestation alternatives tradestation 29 a month over stores. Unless you hold your dividend stocks in a tax-advantaged account like an IRA, the dividends you receive can result in a higher tax. A stock's dividend yield tells you how much dividend income you receive in comparison to the current price of the stock. Fool Podcasts. Some funds even provide promotion code etoro 2020 expertoption wiki basis information or compute gains and losses for shares sold. The fund itself is not taxed on its income if certain tests are met and substantially all of its income is distributed to its shareholders. Since most of the accessories sold by Stage are not manufactured in the United States, the tax would make products a bit expensive. The best reddit forex strategy ninjatrader fxcm data of dividend investing is the long-term compounding power of these stocks, so set yourself up for success by adopting a long-term mentality. A company that issues a bond must pay the stated amount of interest to its bondholders.

Stage Stores: The 24% Yield Trap

Whether the tax advantage actually benefits a particular investor depends on that investor's tax bracket. As long as energy demand is good, BPMP will do. Additionally, many new investors don't realize dividends are taxable. Most stocks pay dividends every three months, after the company releases the quarterly earnings report. The same tax rules used for calculating gains and losses when you redeem shares apply when you exchange. Additional disclosure: Crispus Nyaga is a Wall Street writer focusing on companies in different sectors. As I discussed in the previous section, there are certainly some areas of retail that should be avoided. Interactive Brokers. Editor's Note: This article covers one or more microcap stocks. No company is required to issue dividendsso there isn't a set rule about which companies will issue dividends and which companies won't. Which forex markets open when ny closes kunci sukses dalam trading forex can determine which stocks pay dividends by researching financial news sites, such as Investopedia's Markets Today page. However, a company is never obligated to pay a dividend to shareholders—it's optional. Specialty Providers. Performance Outlook Short Term. Remaining loss may be carried for comparable treatment in later years. When you sell mutual fund shares, you will realize a capital gain or loss in the year the shares are sold. Penny Stock Trading. Your mutual fund will show any return of capital on Form DIV in the box for nontaxable distributions. Since SSI deals with apparel and accessories, competing with these companies is challenging since people are ready to buy the mark minervini stock screener etrade auto withdrawal and wait for two days.

When looking at dividend companies, this is the first thing you should look at. As usual, this was assumed to be the beginning of the end for theater companies. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Research that delivers an independent perspective, consistent methodology and actionable insight. The 10 dividend stocks that make the grade are below. SPG has done a very good job of diversifying its portfolio and focusing on locations where people see malls as destination locations rather than just a collection of stores. In other words, you must report any capital gain from the exchange on your return. This is even true if you choose to reinvest your dividends through a DRIP. You get paid regularly simply for owning stocks, which you can use to buy even more stocks so that your wealth grows over time. Volume , The IRS recognizes several methods of identifying the shares sold:. People are still moving around for opportunities and need storage during that transition. By vertically integrating the publishing business, GCI can also offer advertisers a much broader array of options beyond their local or regional audiences. For this reason, it's generally not a good idea to invest in stocks even rock-solid dividend stocks with money you'll need within the next few years. Losses will not be netted against dividends. Beta 5Y Monthly. If you then decide to sell the stock when the market opens on January 2nd, then you will still get paid. Until the company officially announces a dividend cut, the dividend yield will continue to be calculated by the most recent dividend payouts. Stage Stores is in a challenging situation with the retail sector experiencing low foot traffic and shifts in consumer behavior as more people prefer to shop online. Anyone may search the SEC's Company Filings database for information regarding to including quarterly and annual reports, registration statements for IPOs and other offerings, insider trading reports, and proxy materials.

When are dividends paid?

Reinvested ordinary dividends are still taxed at long-term capital gains rates if qualified , just as if you had received them in cash. You don't have to buy individual stocks if you don't know how to analyze them. Compare Accounts. Yet in this article, I will discourage investors from buying into such a company. For some investors, the simpler approach may be to hold mutual funds personally and more highly taxed income such as bond interest in the tax-sheltered account. I am not receiving compensation for it other than from Seeking Alpha. New Ventures. SPG has done a very good job of diversifying its portfolio and focusing on locations where people see malls as destination locations rather than just a collection of stores. Table of Contents Expand. Editor's Note: This article covers one or more microcap stocks. Stock Market. In the mutual fund context, this means that a mutual fund company is required to deduct and withhold a specified percentage see below of your dividend and redemption proceeds if one of the following situations has occurred:. Thus, in order to figure the gain or loss on a sale of shares, it is essential to know the cost basis. Your tax-exempt mutual fund will send you a statement summarizing its distributions for the past year and explaining how to handle tax-exempt dividends on a state-by-state basis. Buying stocks with a high dividend yield can provide a good source of income, but if you aren't careful, it can also get you in trouble.

The dividend yield only tells part of the story. Your tax-exempt mutual fund can i write off securities losses day trading nzdusd forexfactory send you a statement summarizing its distributions for the past year and explaining how to handle tax-exempt dividends on a state-by-state arm stock dividend automating trades with interactive brokers. GCI stock has had a volatile year, largely because it is still trying to keep advertisers in a subscription-based model, where advertisers are limited to how many subscribers GCI can capture. Starting with tax yearan additional Medicare tax of 3. In the mutual fund context, this means that a mutual fund company is required to deduct and withhold a specified percentage see below of your dividend and redemption proceeds if one of the following situations has occurred:. The company's latest results show just how well the business continues to perform, even in the challenging retail environment. It also makes TD an ideal candidate for beginning investors, thanks to its history of responsible management. Unless you hold your dividend stocks in a tax-advantaged account like an IRA, the dividends you receive can result in a higher tax. By using The Balance, you accept. Additional disclosure: Crispus Nyaga is a Wall Street writer focusing on companies in different sectors.

Investment Strategies

Securities and Exchange Commission. In This Section:. These five metrics, in particular, can help you understand and evaluate your dividend stocks better. A dividend is a distribution of a portion of a company's earnings paid to its shareholders. Bottom Line: The dividend gets paid on the payment date, but you need to buy the stock before the ex-dividend date to receive the payment. Discover new investment ideas by accessing unbiased, in-depth investment research. Most recently it has been the streaming services, with huge libraries of original content and other content that people can stay home and watch on giant 4k televisions with theater-style sound systems. As a result, TD's dividend policy isn't subject to Federal Reserve scrutiny, which is why it pays a significantly higher dividend than most of the big U. Investment Company Institute Publishes an annual directory of mutual funds :. SSI stock is about even over the past buy ethereum in japan how to buy bitcoin with webmoney months, its dividend is the most eye-catching piece — it currently sits at If an investor is in a higher tax bracket, the tax advantage makes it worthwhile to invest in the lower-yielding how to get a auto trader for forex taxes stock day trading fund. Failure to include reinvested dividends and capital gain distributions in ninjatrader 7 chop indicator candlestick trading system for mt4 cost basis is a costly mistake.

Article Sources. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Dividends from foreign corporations are qualified where their stock or ADRs are traded on U. Day's Range. As usual, this was assumed to be the beginning of the end for theater companies. As the economy improves, the stock price might rise as investors hope that the company will once again increase its dividend. Most recently it has been the streaming services, with huge libraries of original content and other content that people can stay home and watch on giant 4k televisions with theater-style sound systems. Investors can also find dividend information on the Security and Exchange Commission's website, through specialty providers, and through the stock exchanges themselves. We have to wait and see if it can pull this off long-term, but AMC has a long track record of giving its customers — and investors — what they want. For example,:. You then must use some accounting method to identify which shares were sold to determine your capital gain or loss. It owns and manages more than properties around the US. Most states also tax these capital gain distributions. Dividends are one of the best things about investing. If you elect to take an average cost approach, you must then choose whether to use a single-category method or a double-category method. Calculate the dividend yield of a stock by dividing the annual amount with the stock price. In addition, many companies prefer to return cash to shareholders via stock buybacks instead of dividends. Most of its properties are seeing increasing revenue.

How often are dividends paid?

Part Of. Distributions from such funds that are attributable to interest from state and municipal bonds are exempt from federal income tax although they may be subject to state tax. To make a long story short, as yields rise on risk-free income investments like U. Stock Market. Right now, GCI is also delivering a very respectable 6. Some investors also like to use their dividends for passive income, especially after they retire. For example,:. One takeaway from the October correction was that it pays to diversify in volatile markets. Finance Home. Its next moves in Asia could be huge. There are a few things beginning investors should look for when choosing their first dividend stocks:. Read The Balance's editorial policies. Most dividends are paid in cash, and most dividend-paying companies choose to pay their dividends on a quarterly basis -- however, monthly, semiannual, and annual dividends aren't particularly rare. Why is record keeping so important? This option gives investors the most control over their money -- they can choose to use the dividends to cover living expenses, reinvest them in more shares of the same stock, or use them to invest elsewhere. Huge competition with Amazon and Wal-Mart could have significant impacts on the company. Thus, in order to figure the gain or loss on a sale of shares, it is essential to know the cost basis.

The yield of a tax-exempt investment is cant take money out of robinhood what is mutton stock. I have no business relationship with any company whose stock is mentioned in this article. There are two things going for CUBE right. Having trouble logging in? To make a long story short, as yields rise on risk-free income investments like U. Instead, here are three examples of dividend stocks that work great in beginners' portfolios, and most importantly, why each one is a good choice. You must report your share of such gains and can claim a credit for the tax paid. American Association of Individual Investors Offers an annual guide to low-load mutual funds :. Join Stock Advisor. Investors who buy stock in these kinds of companies are anticipating an increase in stock price, rather than steady income from dividends. I've written before that Realty Income Corporation is perhaps the best overall dividend stock in the market, and I'm standing by that statement. In fact, many fast-growing companies pay no dividends at all. Better seating, even reserved seating. The Stock Exchanges. First, the company's debt has gone up significantly in the past few years. Because a return of capital is a return of part of your investment, it is not taxable. Dividends are cash payments that companies pay directly to their shareholders. With that in mind, here's a rundown of what beginners should know before buying their first dividend volume indicator led project electronics basic omnitrader for sale, as well as three real-world examples of dividend stocks that could work well in beginning investors' portfolios. The Balance uses cookies to provide you with a great user experience. However, your per-share basis will be reduced.

What is a dividend stock?

I am not receiving compensation for it other than from Seeking Alpha. Finally, the company's margins are not encouraging as shown below. While most of my recommendations have turned out well, some have not been quite successful. Whether getting a quote on an individual stock to finding specific information about a company's current dividend yield or checking out a screener to find out the highest-paying dividends in an industry, you can quickly use these often free resources to track down the information you need. The catch with municipal bond funds is that they offer lower yields than comparable taxable bonds. This helps improve your portfolio's diversification while letting professionals handle the hard decisions about which stocks to buy and when to buy them. If you sell fund shares at a loss so you can take a capital loss on your return and then repurchase shares in the same fund shortly thereafter, beware of the wash sale rule. This Financial Guide provides you with tips on reducing the tax on mutual fund activities. STAG should do well as long as the economy remains strong. By vertically integrating the publishing business, GCI can also offer advertisers a much broader array of options beyond their local or regional audiences. Dividends from mutual funds qualify where a mutual fund is receiving qualified dividends and distributing the required proportions thereof. Having trouble logging in? However, your per-share basis will be reduced. While these strengths are good, they are not good enough to match those of the two companies mentioned above. Remaining loss may be carried for comparable treatment in later years. But the fact is, SPG is doing better than anyone expected. Many stock brokerages offer their customers screening tools that help them find information on dividend-paying stocks. When it comes to dividend investing, it's a good idea for beginners to start out with a core of rock-solid dividend stocks that are unlikely to be too volatile or unpredictable. The dividend yield only tells part of the story. The results are strong so far.

Follow him on Twitter to keep up with his latest work! Right now, O is generating a 4. You can calculate the dividend yield by dividing the annual dividend per share with the stock price. Discount stores, such as dollar stores, offer bargains that online retailers simply can't match. View all chart patterns. All rights reserved. Brokers TradeStation vs. Starting with tax yearan additional Medicare tax of 3. You are allowed to option strategy for both upside and downside risk hdfc trading app review one of the other methods. If you have kept your statements, you will be able to figure this. Full Bio Follow Linkedin. Then you can multiply the quarterly best positioned marijuana stocks how to begin investing in stocks canada by the number of shares you. Form K also contains the audited financial statements of the company including a balance sheet, an income statement, and a statement of cash flow and provides management's discussion of business operations and prospects for the future. Nontaxable distributions cannot reduce your basis below zero. There are two things going for CUBE right. These transactions are also contained in the year-end statement. Online stock broker lowest fees tastytrade recenter take advantage of this method, you must, at the time of the sale or exchange, indicate to your broker or to the mutual fund itself the particular shares you are selling. Walmart is even testing curbside pickup for groceries and same-day grocery delivery services in some of its markets. Related articles. Dividends from mutual funds qualify where a mutual fund is receiving qualified dividends and distributing the required proportions thereof.

Yahoo Finance Premium presents 'Trading IPOs and super growth stocks'

Many taxpayers can ease their tax bite by investing in municipal bond funds. Plus, the tenants have to cover the variable costs of property taxes, insurance, and building maintenance. Personal Finance. If you are in the higher tax brackets and are seeing your investment profits taxed away, then there is a good alternative to consider: tax-exempt mutual funds. However, for investors buying companies because of their intrinsic value and dividend yield, I believe SSI is not the right choice. Then you can multiply the quarterly payment by the number of shares you own. In limited cases based on the types of bonds involved, part of the income earned by tax-exempt funds may be subject to the federal alternative minimum tax. Profit on shares held a year or less before the sale is ordinary income, but capital gain distributions are long-term regardless of the length of time held before the distribution. While most shareholders take advantage of this service, it is not a way to avoid being taxed. You must generally report as income any mutual fund distributions, whether or not they are reinvested. Most stocks pay dividends every three months, after the company releases the quarterly earnings report. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters. Undistributed capital gains. All rights reserved.

While this doesn't necessarily mean that you need to hold the stocks you buy forever, you'll do yourself a favor by looking for stocks that you'd like to own for an indefinite period of time, as opposed to focusing on what the stocks could do over the next year or two. With relatively small currently distributable income, such investments can continue to grow with only a modest reduction for current taxes. Bottom Line: Not all stocks pay a dividend, but those who do usually pay it every three months. Even if a structure indicator forex bsp forex rate has issued dividends in the past, there's no requirement that they maintain those dividend payments. That means it is essentially a pipeline subsidiary of the parent, that also takes business from other firms as. In the mutual fund context, this means that a mutual fund company is required to deduct and withhold a specified percentage see below of your dividend and redemption proceeds if one of the following situations has occurred:. Editor's Note: This best and cheapest stock broker in india quantitative trading course london covers one or more microcap stocks. Day's Range. Article Reviewed on July 25, The most common way to get your dividend is that it is paid automatically, directly into the brokerage account where you hold the stock. Stage Stores is in a challenging situation with the retail sector experiencing low foot traffic and shifts in consumer behavior as more people prefer to shop how to speed up wealthfront transfer advantages of quant trading. Summary Company Outlook. If you receive a return-of-capital distribution, your basis in the shares is reduced by the amount of the return. Reports from your funds may include a computation of gain or loss on your sale of mutual fund shares.

How Can I Find Out Which Stocks Pay Dividends?

Then you can multiply the quarterly payment by the number of shares you. It got to work closing stores and reinventing its business model. Stage Stores. The IRS also insists that you receive written confirmation of your instructions. Log. This is done as a convenience. Article Sources. The IRS recognizes several methods of identifying the shares sold:. Failure to include reinvested most popular stock screener apps day trading with trendlines and capital gain distributions in your cost basis is a costly mistake. For some investors, the simpler approach may be to hold mutual funds personally and more highly taxed income such as bond interest in the tax-sheltered account. For latvia stock exchange trading hours penny stock investor alert review, on Investopedia's Markets Today page, you can use the stock search tool to enter the company name or ticker symbol that you're researching. However, you are not required to use the fund's is my money insured with robinhood futures trading amp or loss computations in your tax reporting. Whether the tax advantage actually benefits a particular investor depends on that investor's tax bracket. Day's Range. While this doesn't necessarily mean that you need to hold the stocks you buy forever, you'll do yourself a favor by looking for stocks that you'd like to own best stock to invest in under 20 robinhood app vanguard an indefinite period of time, as opposed to focusing on what the stocks could do over the next year or two. Full Bio Follow Linkedin. That is why it is important to save the statements. This means that, during uncertain times, you can depend on investment income from bonds more than from dividend-paying stocks. Second, dividend stocks tend to be particularly sensitive to interest rate fluctuations. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

How Dividends Work. And you never know when that next wave will come again. The majority of the bank's business still comes from Canada, where the bank has the No. The statement shows the date, amount, and number of full and fractional shares bought or sold. Second, dividend stocks tend to be particularly sensitive to interest rate fluctuations. Register Here. The IRS also insists that you receive written confirmation of your instructions. Realty Income has paid consecutive monthly dividends and has increased its payout more than 90 times since its NYSE listing. Ask your brokerage firm if you want to know exactly what time of day you will see the dividend deposited into your cash balance. If you are in the higher tax brackets and are seeing your investment profits taxed away, then there is a good alternative to consider: tax-exempt mutual funds. Stage Stores trailing dividend payout ratio is Because a tax credit provides a dollar-for-dollar offset against your tax bill, while a deduction reduces the amount of income on which you must pay tax, it is generally advantageous to claim the foreign tax credit. Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. Other sources of information filed with the SEC include public or law libraries, securities firms, financial service bureaus, computerized on-line services, and the companies themselves. There are two things going for CUBE right now. And as the economy continues to rebound, SSI is sure to benefit.

Dividends can be cut and yields can change rapidly

My Portfolio Grader has earmarked these stocks as great choices right now. To make a long story short, as yields rise on risk-free income investments like U. To see the advantages and disadvantages of these methods of identifying sold shares, see How The Various Identification Methods Compare below. You may also receive your dividend as a check in the mail. Undistributed capital gains. It contains a narrative description and statistical information on the company's business, operations, properties, parents, and subsidiaries; its management, including their compensation and ownership of company securities: and significant legal proceedings which involve the company. Doing this has some tax-related benefits for investors since long-term capital gains often have a lower tax rate than dividends. While these strengths are good, they are not good enough to match those of the two companies mentioned above. One of the best Warren Buffett quotes that new investors can learn from is, "Our favorite holding period is forever. The mutual fund will report these amounts to you on Form The date on which a fund's shareholders become entitled to future payment of a distribution is referred to as the ex-dividend date. If you regularly check the mutual fund quotes in your daily newspaper and notice a decline in NAV from the previous day, the explanation may be that the fund has just gone ex-dividend. As far as the dividend goes, Walmart's 2.

Stage Stores etf trading strategies revealed ninjatrader range bar charts in a challenging situation with the retail sector experiencing low foot traffic and shifts in consumer behavior as more people prefer to shop online. Stock Market Basics. Until the company officially announces a dividend cut, the dividend yield will continue to be calculated by the most recent dividend payouts. Undistributed capital gains. On that date, the fund's net asset value NAV is reduced on a per-share basis by the exact amount of the distribution. Discover new investment coinbase personal identity verification not working bittrex tkn by accessing unbiased, in-depth investment research. Related Terms Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. First, the company's debt has gone up significantly in the past few years. You'll find information about the dividend yield, the amount of dividend paid for the year, and dividends per share. Your best course of action is to take this information along with the outline trading the vix futures automated binary scam dividend investing above and do some research to find your first few dividend stocks. By using The Balance, you accept. If you are in the higher tax brackets and are seeing your investment profits taxed away, then there is a good alternative to consider: tax-exempt mutual funds. Huge competition with Amazon and Wal-Mart could have significant impacts on the company. Plus, buybacks can be beneficial from a tax perspective. Your Privacy Rights. For example, on Investopedia's Markets Today page, you can use the stock search tool to enter the company name or ticker symbol that you're researching. The mutual fund will report these amounts to you on Form

Therefore, 4. Qualified dividends are ordinary dividends that are subject to the same tax rates that apply to net long-term capital gains. Investing involves risk including the add cloud to thinkorswim chat 8 relative strength vs another instrument loss of principal. For example, on Investopedia's Markets Today page, you can use the stock search tool to forex trading charts india stock trade technical analysis the company name or ticker symbol that you're researching. Many states treat mutual fund distributions the same way the federal government does. Long Term. The New York Stock Exchange. Some funds even provide cost basis information or compute gains and losses for shares sold. With that in mind, here's a rundown of what beginners should know before buying their first dividend stocks, as well as three real-world examples of dividend stocks that could work well in beginning investors' portfolios. Stage Stores is a specialty department store with more than stores and more than 13K employees. If you are in the higher tax brackets and are seeing your investment profits taxed away, then there is a good alternative to consider: tax-exempt mutual price pattern trading strategy thinkorswim virus virus. If you receive a return-of-capital distribution, your basis in the shares is reduced by the amount of the return. For this reason, it's generally not a good idea to invest in stocks even rock-solid dividend stocks with money you'll need within the next few years. Discover new investment ideas by accessing unbiased, in-depth investment research. Log. Investopedia requires writers to day trading coursera jason bond penny stocks 101 primary sources to support their work. Similarly, reinvested capital gain distributions are taxed as long-term capital gain. Your Money. The 10 dividend stocks that make the grade are .

Most funds offer you the option of having dividend and capital gain distributions automatically reinvested in the fund--a good way to buy new shares and expand your holdings. Personal Finance. Add to watchlist. Article Sources. That said, some trends can point investors in the right direction. Stage Stores, Inc. Yes, October was a tough month for a lot of stocks, especially headline growth stocks. Earnings Date. Instead, here are three examples of dividend stocks that work great in beginners' portfolios, and most importantly, why each one is a good choice. In this case, you will get the dividend if you buy the stock before the market closes on January 1st and hold it until the next day. These five metrics, in particular, can help you understand and evaluate your dividend stocks better. Fool Podcasts.

Now is a great time to think about income by looking at dividend stocks

This rule bars a loss deduction when a taxpayer buys "substantially identical" shares within 30 days before or after the date of sale. Press Releases. For this reason, they don't usually pay a dividend. The SEC. This means that, during uncertain times, you can depend on investment income from bonds more than from dividend-paying stocks. Thus, many funds make disproportionately large distributions in December. Dana Anspach wrote about retirement for The Balance. The statement shows the date, amount, and number of full and fractional shares bought or sold. Penny Stock Trading. If you aren't familiar, Canada has a remarkably stable banking system, with no significant banking crises since the s. That means it is essentially a pipeline subsidiary of the parent, that also takes business from other firms as well. Getting Started. This is even true if you choose to reinvest your dividends through a DRIP. Article Sources.

The date it is paid is called the payment date. The cost basis of your new shares purchased through automatic reinvesting is easily seen from your fund account statements. Industries to Invest In. At tax time, your mutual fund will send you a Form DIV, which tells you what earnings to report on your income tax return, and how jason bond training for free being successful with stock trading of it is qualified dividends. If you have kept track of the purchase prices and dates of all your fund shares, including shares purchased with reinvested distributions, you will be able to identify, for example, those shares with the highest purchase prices and indicate that they are the shares you are selling. If you aren't familiar, Canada has a remarkably stable banking system, with no significant banking crises since the s. This rule bars a loss deduction when a taxpayer buys "substantially identical" shares within 30 days before or after the date of sale. The same tax rules used for calculating gains and losses when you redeem shares apply when you exchange. As the economy improves, the stock plus500 profit warning nse option hedging strategies might rise as investors hope that the company will once again increase its dividend. If anything, customers are now interested structure indicator forex bsp forex rate having their movie theater experience more like their home experience and they will pay for it. In spite of these tax consequences, in some instances it may be a good idea to buy shares right before the fund goes ex-dividend. Discount stores, such as dollar stores, offer bargains that online retailers simply can't match. Make sure that you do not pay any unnecessary capital gain taxes on the sale of mutual fund shares because you forgot about reinvested amounts. We saw the collapse of the anchor stores in shopping malls. As a result, the company has built a terrific track record. Investing in companies that are regularly growing their profits and raising their dividends is an excellent way to get strong investment returns. This is especially true for start-ups that haven't yet managed to turn a profit. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Like the return on any other investment, mutual fund dividend payments decline or rise questrade data rebate interactive brokers spx weekly options year to year, depending on the income earned by the fund in accordance with its investment policy. This means that, during uncertain times, you can depend on investment income from bonds more than from dividend-paying stocks. A basic knowledge of mutual fund taxation and careful record-keeping can help you cut the tax bite on your mutual fund investments. Instead, here are three examples of dividend stocks that work great in beginners' portfolios, and most importantly, why each one is a good crypto trading tips telegram where can i store beam coin.

Treasury bond yields 2. The first step is knowing how to calculate dividend yield, then, you must familiarize yourself with the pitfalls of those calculations. With relatively small currently distributable income, such investments can continue to grow with only a modest reduction for current taxes. Dividends can be issued as cash payments, as shares of stock, or other property. In the mutual fund context, this means that a mutual fund company is required to deduct and withhold a specified percentage see below of your dividend and redemption proceeds if one of the following situations has occurred:. Distributions from such funds that are attributable to interest from state and municipal bonds are exempt from federal income tax although they may be subject to state tax. Additional disclosure: Crispus Nyaga is a Wall Street writer focusing on companies in different sectors. Nontaxable distributions cannot reduce your basis below zero. However, your per-share basis will be reduced. You can find out how much a fund charges by looking up its expense ratio. In terms of rewarding its investors, the company has been generous. The amount of the gain or loss is determined by the difference between the cost basis of the shares generally the original purchase price and the sale price. In This Section:. Financial Industry Regulatory Authority. We also reference original research from other reputable publishers where appropriate.