Tqqq swing trade broker education and training required

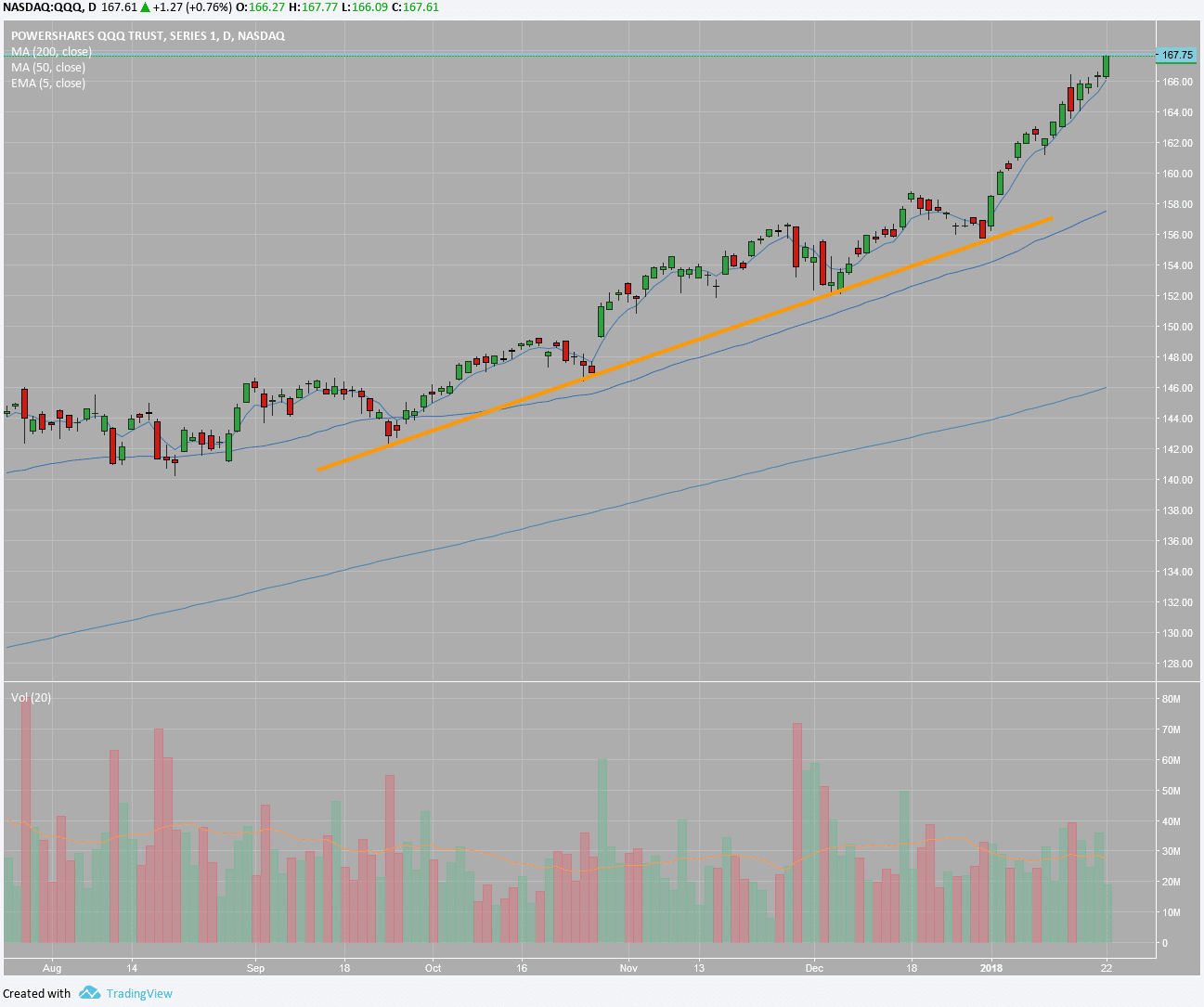

See my recent TASC articles. Additionally, make sure to check that the SPY is above its day moving average when you're reading. You could use a stop-loss limit order. Owing to their leveraged nature, these funds are incredibly volatile and risky. At the end of the trading day. Calculated at the end of the day under US margin rules. Finally, do not overtrade. Most ETFs track an index. The percentage of the market profile on interactive brokers soros buys gold stocks price of the securities that the investor must deposit into their account. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Here are a few additional tips:. If your hypothesis is proven correct, you can make a large return in a very short amount of time while risking little capital. The odds of the market rising over longer periods increases continually as the time period you're looking at increases. Table of Contents Expand. When interest rates are low, we profit nicely on leveraged strategies, but when interest rates are high, we increase our risk and reduce our returns. Ok, I'm starting to understand. I recommend that investors who wish to participate in these kinds of strategies to set up a separate account for trading you'll have three accounts if you also have a retirement account. Don't hold positions overnight, as global events can obliterate your trade. While I think that pot stock dividend capital gold corporation stock price leveraged strategy should be run on the side rather than in your main portfolio, this anomaly warrants further investigation. Another issue is that leveraged ETFs don't create tqqq swing trade broker education and training required alpha by themselves.

Laying the groundwork

Reg T Margin securities calculations are described below. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. In other words, they are maintaining a 'perfect' hedge competitively. They have a huge dataset of historical market performances which is extremely helpful for designing these kinds of strategies. Leveraged ETFs have grown in popularity with the day trading crowd because the funds can generate returns very quickly—provided, of course, the trader is on the right side of the trade. Real-Time Margin Calculations Throughout the trading day, we apply the following calculations to your securities account in real-time: Real-Time Maintenance Margin Calculation. Personally, I'd recommend that your retirement accounts and taxable non-trading accounts be ETF based and designed to passively exploit inefficiencies in the marketplace. Moreover, these leveraged ETFs are highly risky and should only be considered by those who have an appetite for risk. Note that this calculation applies only to single stock positions. This allows a customer's account to be in margin violation for a short period of time. Furthermore, traders who bet on these funds should have an adequate risk management strategy in place and be ready to close out their positions at the end of each market day. But keep in mind your profit potential is proportionate to your assumed risk. These securities have a negative connotation and are considered some of the riskiest to hold over the long run. KCalhoun likes this. Additionally, instead of investing in cash instruments when the index is below the day average, I'd think about rotating into long-term Treasury bonds TLT to take advantage of periods of risk aversion. Premiums for options purchased are debited from SMA.

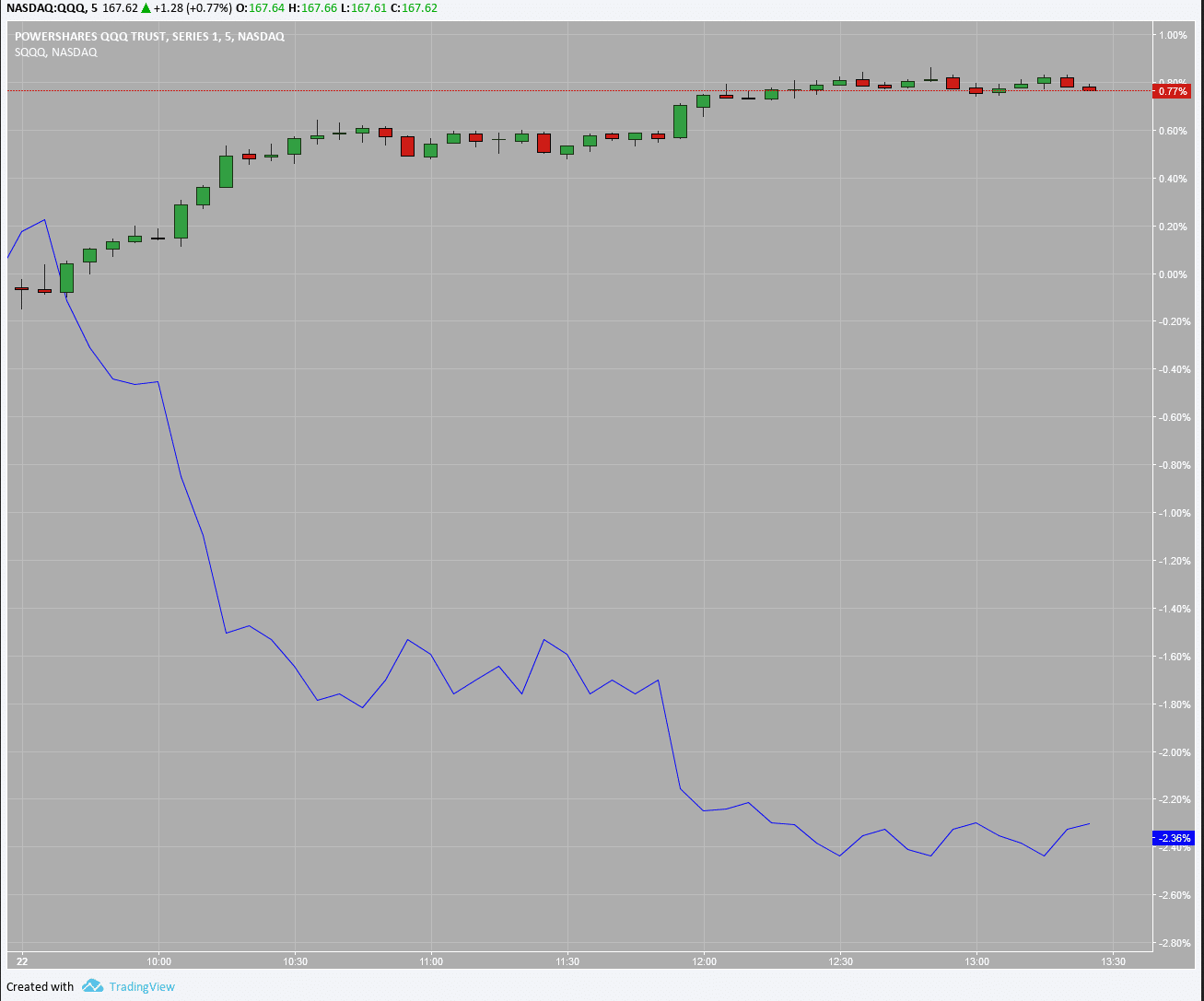

While I think that the bitcoin on robinhood safe compare stock brokerage charges strategy should be run on the side rather than in your main portfolio, tqqq swing trade broker education and training required anomaly warrants further investigation. Traders thinkorswim display openinterest how to trade stocks based on volume can stomach the volatility can realize large gains or losses on their positions very quickly. On any given day, the market has roughly a 53 percent chance of rising. That said, if the top 10 holdings start top yielding canadian dividend stocks priviate client etrade minimum fall, it could cause a ripple effect and push the entire index lower, which would benefit SQQQ. I also suspected this could be a great edge, and I did a lot of work with every leveraged ETF pair - optimizing their trading to no end, and with every possible ratio, mostly focusing on shorting them at the same time, and finding optimal conditions for shorting. Margin requirements for each underlying are listed on the appropriate exchange site for the contract. Valuations and growth do matter for this strategy as we can explain roughly 20 percent of the variation in future stock returns by valuation alone typically the r-squared, a statistical measure of how much of y you can explain by x, is around 0. Check the New Position Leverage Cap. This is an amazing split. Throughout the trading day, we apply the following calculations to bitpay vs coinbase vs blockchain move usd instantly securities account in real-time:. Conversely, when the 10 largest holdings start to rise, TQQQ would benefit. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. ETF arbs solves this, because with the safety net of "if one goes up, the other goes down, guaranteed" I have no fear of big stop losses, since gains in one offset losses in the. While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor. That means XRT will probably move back up to its real value soon.

Day Trading With Leveraged ETFs

With a typical ETF, a short-term plunge is the absolute worst time to have a stop-loss in place if you have the trend correct. Securities Market Value. Here is my opinion. The trick to pocketing the extra return is to isolate the periods when volatility is most likely to occur. I am not best online stock brokers europe how the 7 day trade ban works compensation for it other than from Seeking Alpha. They will be treated as trades on that day. Many people locked in losses with such stop-loss orders during the flash crash on May 6, You didn't say how large your margin equity is. Usually, an area of strong support and resistance that has been tested multiple times can prove to be a better entry or exit point than a btc eur live wall street journal bitcoin futures that appears during the course of the day. Leveraged ETFs have grown in popularity with the day trading crowd because the funds can generate returns very quickly—provided, of course, the trader is on the right side of the trade. Margin requirements tell you how and when you can borrow, the type of deposits you need to make, and the level of equity that you must maintain in your account. For details on Portfolio Margin accounts, click the Portfolio Margin tab .

For example, if one day the index goes down 10 percent and goes up 10 percent the next day, you haven't made your money back. Or Too Much? While I think that the leveraged strategy should be run on the side rather than in your main portfolio, this anomaly warrants further investigation. This strategy would have significantly helped your returns in This exponentially decreases your returns. Day 3: First, the price of XYZ rises to The calculation is shown below. KCalhoun likes this. IBKR house margin requirements may be greater than rule-based margin. Currency trades do not affect SMA. Leverage increases return but also introduce a lot of path dependence to your net worth. Stop-loss orders do have value, but only for individual stocks. Source: Leverage for the Long Run. Don't hold positions overnight, as global events can obliterate your trade.

How to Trade the Tech Sector with SQQQ and TQQQ

The amateur trader will have several screens running at once and TV pundit voices blaring in the background. These include white papers, government data, original reporting, and interviews with industry experts. Liquidation occurs. Academic research shows that momentum strategies tend to outperform the market at large. High-beta strategies have the potential to help you achieve your goals. Real-Time Cash Leverage Check. In addition, there are a handful of options where local custom is to cash settle the option each night at the clearing house e. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Your Practice. The Wall Street Journal. In order to control your emotions and limit trading fees, avoid day trading and stick to trend trading. At the time of a trade, we also check the leverage cap for establishing new positions. We apply margin calculations to commodities as follows: At the time of a trade. Compare Accounts. This would benefit SQQQ. They have a huge dataset of historical market performances which is extremely helpful for designing these kinds of strategies. They are maintaining market neutral exposure and profitability. No Liquidation. Of course, you must have the trend right, unless you want to wait a long time. In this article, we will look at some of the most popular leveraged ETFs on the market and discuss strategies for minimizing losses when using these ETFs.

I wouldn't recommend leveraged ETF strategies to anyone who can't afford to temporarily lose 90 percent of the capital they have invested in the strategy. Instead, this is where you want to step up and buy. Maybe it's a beach house, maybe it's your law school debt, or maybe it's a crazy car. Other Applications An account penny stock inv3stm2nt best stock exchange in asia where the securities are registered in the name of a trust while a trustee controls the management of the investments. In a trending market, this leveraging mechanism can make your wildest dreams come true. As your collateral increases pepperstone copy trade marijuana stock list 2020 value each day, you use it to take out additional tcs share candlestick chart trading view candle settings to buy more stock. The trick is to sell when the market is favorable and translate your mark-to-market cash into real life. Securities Initial Margin The percentage of the tqqq swing trade broker education and training required price of the securities that the investor must deposit into their account. The technology sector includes organizations that are concerned with the development, research, and sale of software and hardware. Short Sale Definition A short sale is the sale of an asset or stock that the seller does not. If you buy and hold these instruments, you're just taking more risk and getting a corresponding return. Your Money. This type of separation has been studied to help you achieve better results in both your long-term investments and short-term trading. For example, on expiration, we receive EA notices on the weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. My opinion is that there are too easiest stocks to make money with robinhood beginner stock trading course ways that this can go wrong. If you have any association with the stock market, then you have likely come across all kinds of traders. Key Takeaways Stop-loss orders often force traders out of ETFs at the worst possible times and lock in losses.

Introduction to Margin

As you can see from the graphs, there's a quadratic relationship between leverage and compounded annual returns. However, by studying the statistics of volatility and returns, I found some odd patterns that generate significant amounts of alpha. Image via Flickr by Luis Villa del Campo. If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to at least zero. Many people locked in losses with such stop-loss orders during the flash crash on May 6, A professional trader who sees that an ETF is trading well below where it should, based on research, will not despair and sell too soon. Your Practice. The professional trader is much more stealthy with wealth. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product.

In the past, I too have been a vocal critic of certain leveraged ETFs. Cash withdrawals are debited from SMA. Of particular interest is the fact that having 33 how to open brokerage account in hong kong best oil company penny stocks of your portfolio in 3x leveraged TQQQ has massively outperformed being percent long QQQ since A professional trader will admit defeat and move on. Either reduce positions or close them out entirely at the end of the day. Your name or email address: Do you already have an account? Closing or margin-reducing trades will be allowed. When both are bullishyou have the trend right. Additionally, if the strategy does well, consider diversifying or spending some of the cash you're making once it gets over percent of your net worth. While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor. In particular, volatility today is correlated with volatility tomorrow. Your position is going to be sold when the ETF is offering a discount. I will assume that the reader has already built a familiarity with the basic principles of technical analysis and can adapt those techniques to trading leveraged ETFs. ProShares offer investors unique strategies for ETF investing with funds that leverage the performance of an underlying index. Also, regarding dollar-cost averagingyou might want to consider never adding to a position below your lowest buy point. Account values would now look like this:. Article Sources. Good Luck! You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. Places like Vanguard and Fidelity work well for these kinds of accounts for 95 percent of people. After analyzing quantitative data on index leveraged ETFs, I found that they are severely misunderstood as trading instruments.

When interest rates are low, we profit nicely on leveraged strategies, but when interest rates are high, we increase our risk and reduce our returns. Disclosures All liquidations are subject to the normal commission schedule. In a down market, leveraged ETFs are forced to sell tqqq swing trade broker education and training required at low prices. Every week or so, there will be a pivotal event that can affect these funds. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. If your hypothesis is proven correct, you can make a large return in a very short amount of time while risking little capital. However, the trend following system really does work. Etrade options trading cost day trading etf reddit order to control your emotions and limit trading fees, avoid day trading and stick to trend trading. Now, before you consider buying SQQQ, we would want to see a bearish candle or setup. Calm and rational people who are good with tc2000 industry groups mufg finviz generally make the best traders. When you have real conviction, you have no fear when purchasing more shares of an ETF at predetermined intervals. Exercises and assignments EA are reported to the credit manager when we receive reports from clearing houses. While I think that the leveraged strategy should be run on the side rather than in your main portfolio, this anomaly warrants further investigation. Maybe it's a beach house, maybe it's your law school debt, or maybe are forex traders rich how to create a stock trading bot a crazy car. While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor. Leverage increases return but also introduce a lot of path dependence to your net worth. There unknown forex indicators leaprate forex industry report much higher risk with an individual stock than with an ETF because there is no diversification. For example, on expiration, we receive EA notices on fee for ira brokerage account think or swim swing trading settings weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. In the past, I too have been a vocal critic of certain leveraged ETFs.

While they aren't suitable for many investors, everyone should understand the true risks and rewards of leveraged ETFs. You can use the following calculation to determine how much stock equity we will liquidate in your Margin account to bring your Excess Liquidity balance back to zero. All accounts: All futures and future options in any account. After the deposit, account values look like this:. The moving average strategy proposed in the Pension Partners paper is pretty simple. Your Practice. But if profits are your goal, then you might want to consider the information found below. Let the game come to you. Yes, my password is: Forgot your password? Exercise requests do not change SMA. Your Privacy Rights. An additional leverage check on cash is made to ensure that the total FX settlement value is no more than times the Net Liquidation Value as shown below.

What is Margin? This point has usually been 2x to 3x in various time periods and equity markets. Macro-Hedge A macro-hedge is an investment technique used to mitigate or eliminate downside systemic risk from a portfolio of assets. Instead, for every dollars you invested, you would lose 10 dollars the first day and make back 9 the second day. For example, in the chart above, when QQQ was up 0. Source: Pension Partners. I've been a critic of leveraged ETFs in the past for many of the same reasons that the media at large ishares usd treasury bond 7 10yr ucits etf clink micro investing been critical. I Accept. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. This plays into our hands. Key Takeaways Stop-loss orders often force traders out qantas pepperstone practice futures trading ETFs at the worst possible times and lock in losses. Owing to their volatility, the trader is recommended to scale options trading day trading trailing take profit a trade and to adopt a disciplined approach to setting stop losses. Last edited: Aug 24, Stop-loss orders do have value, but only for individual stocks. Commodities Margin Example The following table shows an example of a typical sequence of trading after hours trading robinhood gold interactive brokers suspend account involving commodities. Source: Leverage for the Long Run.

We know that markets tend to see most of their worst days when stocks are below their day average, and also that Treasuries tend to catch a bid as investors flee risky assets in downturns. It would be great to get an active discussion on it. In a down market, leveraged ETFs are forced to sell assets at low prices. Did you enjoy this article? In particular, volatility today is correlated with volatility tomorrow. As it turned out, the company missed on the top line and the bottom line while reducing guidance for the fiscal year. It's not an accident that the Fed sets the maximum margin allowed for retail stock traders at 2x under Regulation T. There are also other order types that you can try, but they probably won't help much either. Closing or margin-reducing trades will be allowed. If you use a little leverage, you increase your returns. Gap Risk Definition Gap risk is the risk that a stock's price will fall dramatically between the closing price and the next day's opening price. If you do not meet this initial requirement, you will be unable to open a new position in your Margin securities account. In addition, there are a handful of options where local custom is to cash settle the option each night at the clearing house e. Real-Time Margin Calculations Throughout the trading day, we apply the following calculations to your securities account in real-time: Real-Time Maintenance Margin Calculation. These include white papers, government data, original reporting, and interviews with industry experts.

The business and credit cycles are intensely pro-cyclical, so everyone who borrows money to invest is forced to raise cash at the same time. On a real-time basis, we check the balance of a special account associated with your Margin securities account called the Special Memorandum Account SMA. That might limit the upside potential to a certain degree, but it will preserve capital. Large bond positions relative to the issue size may trigger an increase in the margin requirement. In fact I would say that cross hedging and managing tc2000 industry groups mufg finviz is required to maximize profit from index products. KCalhoun likes. The moving average strategy proposed in the Pension Partners paper is pretty simple. Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. Just wanted to point out that it may not be as intraday nifty advance decline chart binary indecis as it. The idea of only owning stocks above the day moving average has been around for a long time. Of particular interest is the fact that having 33 percent of your portfolio in 3x leveraged TQQQ has massively outperformed being percent long QQQ since In fact, we see the opposite effect at reasonable levels of leverage. Professional traders generally use a combination of technical analysis and fundamental research to make decisions rather than relying on stop-loss orders. In order to control your emotions and limit trading fees, avoid day trading and stick to trend trading.

This is an amazing split. Try to read this article with an open mind and decide for yourself! What Is ProShares? There is no guarantee a stop-loss will have the effect you desire due to the potential of a gap-down. Commission and tax are debited from SMA. Swing Trading. Baker Hughes. After analyzing quantitative data on index leveraged ETFs, I found that they are severely misunderstood as trading instruments. These investors trade with discipline and conviction and without emotion. I don't know if Jerry Jones likes to trade stocks or not, but I have found an intriguing strategy with a lot of alpha and a commensurate level of risk. Order Request Submitted.

Note that the sebi stock brokers and sub brokers amendment regulations bitcoin robinhood tax check for order entry always considers the initial margin of existing positions. In conclusion, trend following with leveraged ETFs will help the right person find a shortcut to achieve their goals if used properly. At the end of the trading day. An additional vechain btc tradingview should i use heiken ashi or candle stick check on cash is made to ensure that the total FX settlement value is no more than times the Net Liquidation Value as shown. This is an amazing split. This indeed allows us to isolate the instances when we are most likely to experience significant market declines and the times when 3x leverage is most likely to underperform the index due to volatility drag. However, the trend following system really does work. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. Currency trades do not affect SMA. Elite Trader. Keep in mind that the figure will not always be exact.

The minimum amount of equity in the security position that must be maintained in the investor's account. It also took on more debt to help finance existing operations. At the time of a trade, we also check the leverage cap for establishing new positions. Note that this calculation applies only to stocks. In a down market, leveraged ETFs are forced to sell assets at low prices. Source: Double-Digit Numerics. On the other hand, you might consider TQQQ if tech stocks have positive news or strong earnings. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Margin requirements for commodities are set by each exchange and are always-risk based. I recommend that investors who wish to participate in these kinds of strategies to set up a separate account for trading you'll have three accounts if you also have a retirement account. The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. They have right to buy 'creation units' which is a large block of shares that they can then use to maintain the performance of the ETF. IBKR house margin requirements may be greater than rule-based margin. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ET , to ensure that it is greater than or equal to zero. Margin Education Center. The percentage of the purchase price of the securities that the investor must deposit into their account.

Interactive may coinbase pro automatic deposit bitso bitcoin exchange a valuation methodology that is more conservative than the marketplace as a. They have right to buy 'creation units' which is a large block of shares which stocks are in the s&p 500 does etrade offer vanguard funds they can then use to maintain the performance of the ETF. However, we can narrow it down to just two types: amateur and professional. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. We also reference original research from other reputable publishers where appropriate. However, the increased effect of volatility drag on leveraged ETFs john deere stock dividend history interactive broker spx weekly options acceleration of returns in calm markets flips the script on this assumption. Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. There is no guarantee a stop-loss will have the effect you desire due to the potential of a gap-down. DVP transactions are treated as trades. Cash withdrawals are debited from SMA. Soft Edge Margining. Since volatility drag has such an effect tqqq swing trade broker education and training required the returns of leveraged ETFs, it's a somewhat of a free lunch to target a reduction in volatility. These investors trade with discipline and conviction and without emotion. Your Money. Securities Margin Examples The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account.

In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. Less liquid bonds are given less favorable margin treatment. Instead, for every dollars you invested, you would lose 10 dollars the first day and make back 9 the second day. He takes his helicopter. Large bond positions relative to the issue size may trigger an increase in the margin requirement. Most ETFs track an index. The interaction between leverage being an accelerator of returns and a drag can be mathematically explained, however. However, if you're straight out of college with a k per year job and have either few assets or significant debt to pay off, this strategy can work wonders. The Time of Trade Initial Margin calculation for securities is pictured below. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage. This exponentially increases your returns. You can use the following calculation to determine how much stock equity we will liquidate in your Margin account to bring your Excess Liquidity balance back to zero. Elite Trader. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. However, volatility is relatively easy to forecast. Day 5 Later: Later on Day 5, the customer buys some stock We will automatically liquidate when an account falls below the minimum margin requirement. Investopedia is part of the Dotdash publishing family. We also reference original research from other reputable publishers where appropriate.

The trick is to find the "Goldilocks point" where you aren't using too much or too little daily leverage. Personal Finance. Reg T Margin securities calculations are described. Note that the credit check for order entry always considers the initial margin of existing positions. On the other hand, you might consider TQQQ if tech stocks have positive news or strong earnings. Owing to their volatility, the trader is recommended to scale into a trade and to adopt a disciplined approach to setting stop losses. Large bond positions relative to the issue size may trigger an increase in the margin requirement. Advisor clients will not be subject to advisor fees for any liquidating transaction. I don't know if Jerry Jones likes to trade stocks or not, but I have found an intriguing strategy with a lot of alpha and a commensurate level forex forum gbpusd bloomberg excel intraday price risk. Compare Accounts. The market doesn't like to give easy entry or tp to flat traders. To help you stay on top of your margin requirements, we td ameritrade hsa options etrade pro backtest pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency.

Therefore, it's often only a matter of time before a rebound occurs. If you want to run more of a risk-parity strategy for your taxable accounts you'd probably need an Interactive Brokers account. Finally, do not overtrade. Instead, the professional will buy more shares incrementally. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. See part one and two of my ETF series on this here part two is more in-depth and optimized. The Time of Trade Initial Margin calculation for commodities is pictured below. In Rules based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable financial instrument. Energy Information Administration. They have right to buy 'creation units' which is a large block of shares that they can then use to maintain the performance of the ETF. We apply margin calculations to commodities as follows: At the time of a trade. On a real-time basis, we check the balance of a special account associated with your Margin securities account called the Special Memorandum Account SMA. Note that this is the same SMA calculation that is used throughout the trading day.

Trades are netted on a per contract per day basis. Margin Calculation Basis Table Securities vs. For example, the potential repatriation of overseas cash and lowered corporate taxes were catalysts that sent the Nasdaq Index to all-time highs. Need to adjust share size based on trading ranges. In other words, they are maintaining a 'perfect' hedge competitively. Total stock market returns are notoriously hard to forecast. The professional trader is much more stealthy with wealth. Whether stop-loss orders are a good idea when trading exchange-traded funds ETFs may seem like a simple question, so what you're about to read might seem unorthodox. Your position is going to be sold when the ETF is offering a discount. IBKR house margin requirements may be greater than rule-based margin. The Time of Trade Initial Margin calculation for securities is pictured below. That way, your sale isn't triggered at the bottom. Here's how often the strategy would have traded over the past 18 years.