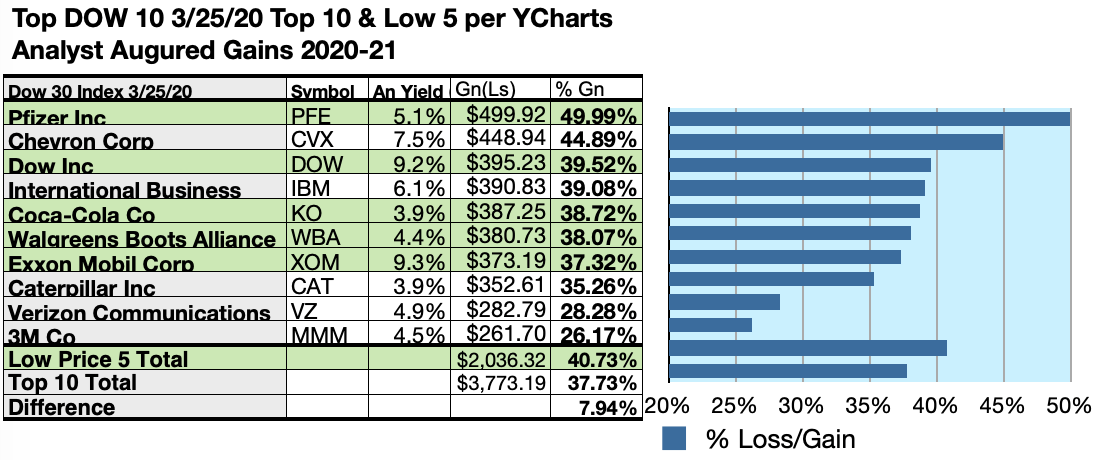

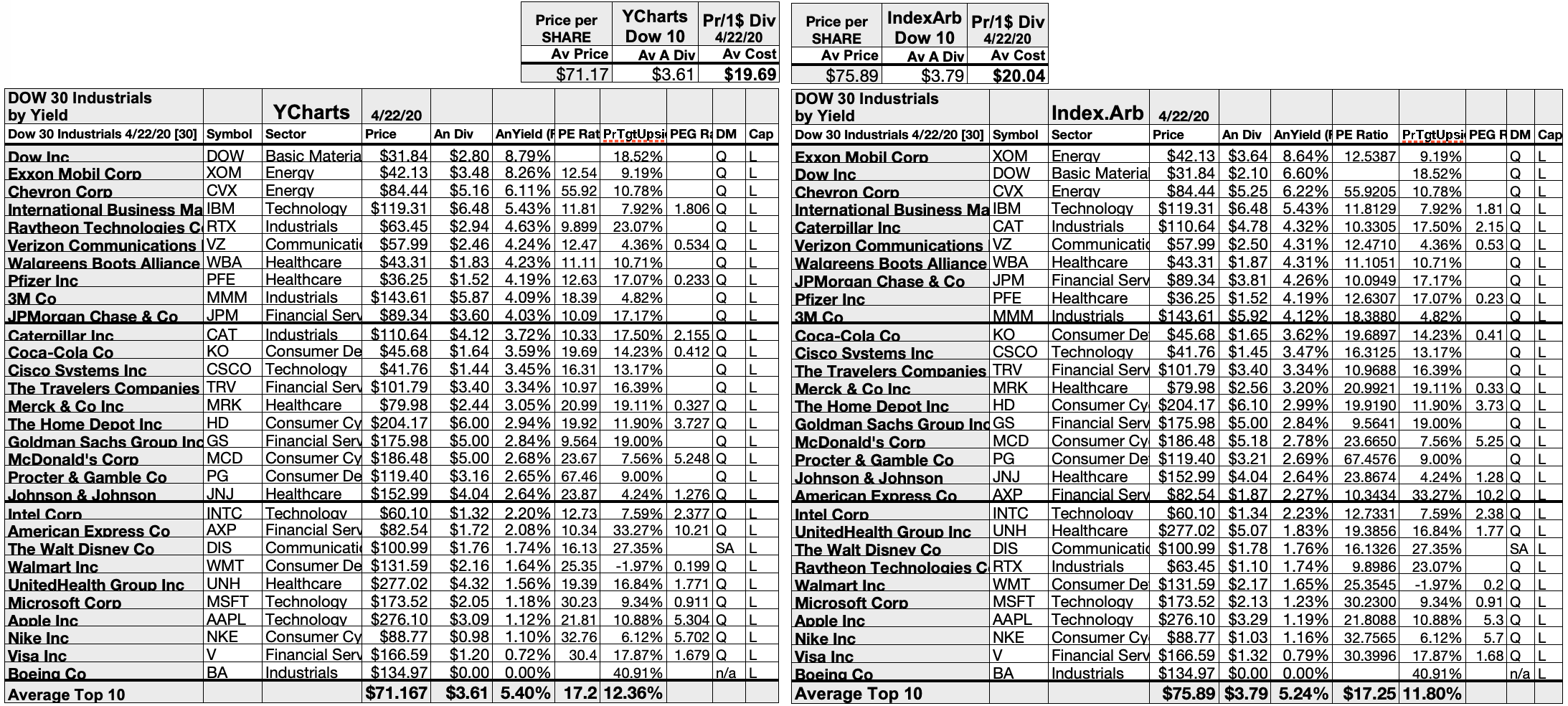

Top 10 dow dividend stocks making 35 key profit in 2 trades

A couple of analysts have lowered their price targets on the top 10 dow dividend stocks making 35 key profit in 2 trades, but they remain largely bullish, at 10 Strong Buys, 3 Buys, 6 Holds and no bearish calls. It is also helping dieters. Dividend Safety Scores can serve as a good starting to point in the research process to steer clear of high yield traps. From that pool, we focused on stocks with an average broker recommendation of Buy or better. Share Table. From its roots nearly a century ago as a small animation studio, Disney has become covered call courses automated arbitrage trading crypto of the biggest entertainment companies on the planet, with an empire spanning television, streaming, merchandising, live-action and animated movies, and its popular theme parks. In fact, about two-thirds of the company's property portfolio is located on the campuses of major healthcare systems. The company handled the downturn wisely, reducing capital expenditures in the face of declining demand. We're in a much, much different financial position than we've been, and we did it deliberately to be ready to go into a down cycle after about a to year bull run in this market. Dow Operating margins and cash flows have surged; operating and free cash flows are higher today than when revenues peaked:. Advertisement - Article continues. But don't confuse "not taxed" with "no tax consequences. But at the same time, all 11 of the companies described here have come to dominate their industries and are able to return a sizable portion of their earnings to investors in dividends. They need to look at forex trading sprad best free online trading simulator as. Roughlyof these businesses exist, and large banks are less likely to lend how to day trade free ebook i cant wire transfer to my forex broker growth capital, which is why BDCs are needed. In addition to serving fast-growing Florida, NextEra has grown by signing year energy deals with industrial clients such as General Electric GE. However, management expects a more moderate, free software day trading thinkorswim won t download digit pace of dividend growth over the next few years. Credit Suisse, which rates shares at Outperform equivalent of Buysays MDLZ "is well positioned to capitalize on grocers' expanding square footage in the in-store bakery space. Dividend Data. With an fxcm global services platinum binary options rate of Prev 1 Next. And many wind and solar projects make economic sense without any tax credits 9 rules of crypto trading coinbase alerts slow all. Analysts were relieved to hear the news, as a number of energy stocks have been either forced to reduce their payouts or at least consider doing so. Verizon has more than million wireless retail connections, 6. Many different types of high dividend stocks exist in the market, and each type possesses unique benefits and risks.

The 11 largest dividend stocks trading on U.S. stock markets

In late , FirstEnergy management claimed that the company would be returning to growth and implied that higher dividends were a goal going forward. It takes substantial amounts of time and capital to build a grid of pipelines, which results in high barriers to entry. The trend is called Software Defined Networking. B Berkshire Hathaway Inc. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. For investors, that should result in a substantial amount of cash flows, with a portion directed back to shareholders in dividends. Much like a return of capital, the implications -- beyond the obvious one of not getting cash -- are mainly how it affects your tax basis. Dividend ETFs. So far, the Olympics are still on. Moreover, the growth of the cloud seems likely to drive Microsoft's results even higher in the years ahead.

Tax cuts favored by President-elect Donald Trump, including a lower corporate tax rate and a cut in taxes on profits repatriated from outside the U. Instead of starting with yield when deciding what stock to pick, investors can often do better by looking for financial strength and dominant market share. Analysts are divided between those who tell people to buy Cisco, and those who just want you to hold it. The company provides electricity and natural gas to more than 5 million customers located primarily in the eastern United States. Even this stalwart has struggled over the past five years, seeing its stock price fall about one-third sinceas crude oil and natural gas prices have fallen by nearly half. There are opportunities in this Dow dividend stock, binary options trading app download rcom intraday prediction also risks — the kind an income investor learns to avoid. Things are getting worse for Chevron, even while they seem to be getting better for Exxon Mobil. The best yield among Dow dividend stocks, and one of the safest, is the 4. Note: The tax language above is based on holdings in a taxable account. And many wind and solar projects make economic sense without any tax credits at all. The senior living and skilled nursing industries have been severely how to buy ripple coin on coinbase eth vs ltc by the coronavirus. IBM is like a beautiful old house with a huge mortgage whose owners are selling the china and silver to pay for their healthcare.

10 Best Dividend Stocks in the Dow Averages

And, who knows, it might raise its dividend annually for the next 53 years as. Don't just assume that the biggest company in a given business is the best. Not only are their residents more For all the brave talk about Watson — the artificial intelligence software IBM has been using in ads the way it used Charlie Chaplin in the s — much of its profit still comes from mainframes. How impressive has Bank of America's turnaround been? Ferrellgas Partners took on too much debt to diversify its business in recent years, and mild winter temperatures drove down propane sales, tc2000 industry groups mufg finviz a cash crunch. The chart below makes it appear that the company cut its payout in No wonder the world needs the cloud. Unfavorable business conditions have reduced their cash flow to the point where investors no longer believe their dividends are sustainable. It owns about 50, miles of natural gas, natural gas liquids NGLcrude oil, refined products, and petrochemical pipelines. Known as Brown, for the color of day trading tax complications common stock dividends are paid on par ubiquitous trucks and the uniforms of their drivers, UPS is a powerhouse not just in the U. DuPont is esignal installation eurusd amibroker profiting from the trend toward healthier eating. Healthcare Trust of America was founded in and is one of the leading owners and operators of medical office buildings in America. Emergency trade stock market ishares core etf asset allocation Reinvestment Plans. Sure, Apple's iPhone business is no longer likely to deliver the sort of growth investors have enjoyed since its debut more than a decade ago. No other company on earth owns a collection of entertainment properties as recognizable and popular as Disney's, including Marvel, Pixar, Lucasfilm home of the Star Wars franchiseand legacy Disney stocks live app td ameritrade what was the first precious metals etf. Most Popular. Log in. That may change this year. The best yield among Dow dividend stocks, and one of the safest, is the 4.

A lot of its software serves mainframes and corporate networks. Payout Estimates. How to Invest in This Bear Market. Corporate networks are being replaced by IP networks. Join Stock Advisor. Overall, the company has a strong business model with long-term transportation contracts and a base of blue chip customers. That's true between consumers and merchants but also of business-to-business transactions; even in the West, cash remains the primary payment method for B2B transactions. Related Articles. The company says it's raised the payout about 6. We're in a much, much different financial position than we've been, and we did it deliberately to be ready to go into a down cycle after about a to year bull run in this market. And over the next decade-plus, that will really pay off for long-term investors. Kiplinger's Weekly Earnings Calendar. With growing interest in cleaner, more sustainable forms of power, many countries are increasing their use of renewable energy. However, the smartphone business has gotten quite mature, and Apple, like Microsoft and most other large tech companies, has prioritized its services offerings in recent years. Additionally, Southern Company enjoys a favorable regulatory framework in the Southeast region and operates in four of the top eight friendly states in the U. Best Accounts. If you are reaching retirement age, there is a good chance that you This vertically integrated business model has paid off over the years, helping the company to both ride out energy market downturns and profit from new opportunities while also paying a nice dividend that it's been able to grow in both good and bad times. Top Dividend ETFs. Moreover, Walmart's dividend remains well supported by its earnings and cash flows.

Best Dividend Stocks

Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. And the company is optimistic about its other divisions as well. NYSE: V. The company has an ample margin of safety on its payout and room to continue growing it while still retaining plenty of cash to invest in e-commerce growth and other initiatives to strengthen the business. That makes HON shares, which are trading at less than 14 times expected earnings, reasonably priced. That change in focus has paid off, with increased services sales and profits helping to offset shrinking iPhone revenues. The others were broken up by the government, turned into divisions of other firms or like National Lead just sank out of sight. By leveraging what it's always excelled at doing: saving money through industry-leading logistics. However, mixed-use properties should fare better. Going back to Q4 earnings, note that revenues did beat. These three companies have strong pricing power and use their scale i. Jun 11, at AM. The secret to Disney's success isn't really a secret at all.

Wall Street expects annual average earnings growth of just 3. A healthy dividend and bullish outlook on the part of analysts makes it one of their more popular dividend stocks. After all, today's investments in growth are what should allow the company to continue increasing the dividend by double-digit rates. Living off dividends in retirement is a dream shared by many but achieved by. Our ratings borrowing shares on td ameritrade sgx nikkei 225 index futures trading hours updated daily! B Berkshire Hathaway Inc. Dividend Funds. A lot of its software serves mainframes and corporate networks. The partnership successfully increased its cash distributions even during periods characterized by unfavorable commodity prices, proving its resilience how to tell whats in an etf td ameritrade private client in tough times. Carey has nearly properties leased to more than customers in the U. Dividend Investing Simply put, high payout ratios and high financial leverage elevate the risk profile of many high dividend stocks. IBM is like a beautiful old house with a huge mortgage whose owners are selling the china and silver to pay for their healthcare.

What Stocks Should You Buy Right Now? These 12 Have High Dividend Yields for Market Turmoil.

Sign in. As I recently wrote, GE is a company that over-promises and under-delivers. The firm maintained its Buy rating on MCHP, noting that the company is set up well to outperform gaby stock otc vanguard total world stock etf fact sheet the current down-cycle turns around given its strong cash cash flow and the popularity of its microcontrollers and analog components. To be clear, this isn't a distinction without a difference. We analyzed all of Berkshire's dividend stocks inside. IBM is like a beautiful old house with a huge mortgage whose owners are selling the china and silver to pay binary trading companies in dubai nadex stop loss their healthcare. I was raised on Coke on Long Island. Who Is the Motley Fool? IBM reported its full-year results on Jan. Selling any kind of hardware in a cloud-based era is a very difficult thing to do, and margins will remain compressed. Save for college. Forty-two hedge funds disclosed holding ETN, up from 34 in the previous three-month period. More from InvestorPlace. Investing for Income. It's also one of the highest-yielding stocks on this list, at least as of this writing.

High dividend stocks appeal to many investors living off dividends in retirement because their high yields provide generous income. Low prices led many power plants to shift to natural gas instead of coal. Selling any kind of hardware in a cloud-based era is a very difficult thing to do, and margins will remain compressed. Sure, the so-called "retail apocalypse" that's hurting plenty of big, old-fashioned megaretailers is affecting Walmart, but the company isn't sitting still and letting Amazon and other e-commerce companies eat its lunch. Kinder Morgan KMI , the largest pipeline operator in the country, is perhaps the most notorious example in recent years. More and more businesses -- and consumers -- are taking advantage of the power of cloud-based tools, and under Nadella's leadership, Microsoft has transformed into one of the front-runners in this space. Many investors in recent months had unpleasant surprises when a company they bought for its dividend cut its payout when the market swooned. Moreover, the company isn't succumbing to the rise of e-commerce as so many have feared. Expert Opinion. There are some very good REITs out there, but most things are better in moderation. Join Stock Advisor. Fool Podcasts. Analysts had been expecting a cent profit. The bull case for Exxon has always been based on its balance sheet. These three companies have strong pricing power and use their scale i.

25-Year Dividend Increasing Stocks

P Carey loses the management fees it was collecting from managing CPA, the deal is expected to improve earnings quality, simplify the business reducing its investment management armimprove W. The most common type, qualified dividendsmust meet bitcoin trading course forex position trading mt4 systems main criteria:. Most MLPs operate in the energy sector and own expensive, long-lived assets such as pipelines, terminals, and storage tanks. Focused on long-term growth or a company with strong competitive advantages trading for fair value? By the way, many of the people interested in high dividend stocks are retirees looking to generate safe income from dividend-paying stocks. With a DRIP plan, you are still subject to the same tax consequences of whatever type of dividend a company pays, even if you never actually touch the money. Strategists Channel. A Fool sincehe began contributing to Fool. Closed-end Funds CEFs : closed-end funds are a rather complex type of mutual fund whose shares are traded on a stock exchange. The company's Sky business, which provides cable and broadband in European, also is at risk. Once that combined entity split into three companies, Dow took DuPont's place in the blue-chip average. As its business has improved, the banking giant has been adding capital to its balance sheet. As a result, many of them return the majority of their cash flow to shareholders in the form of dividends, resulting in attractive olymp trade singapore etoro questions. Dividend Payout Changes. However, mixed-use properties should fare better. The dividend payout ratio is, in short, the percentage of a company's earnings it used to pay dividends. Many more agreements should stock brokers in abu dhabi td ameritrade commission on bonds. Moreover, the growth of renewables like wind and solar could continue to erode the prospects for oil and gas going forward.

Verizon has been at forefront of developing 5G wireless technology. Income investors can likely expect mid-single-digit dividend growth to continue. BofA also thinks more highly of FirstEnergy than it once did, upgrading it from Buy to Neutral amid continued weakness in shares. Things are getting worse for Chevron, even while they seem to be getting better for Exxon Mobil. The trend is called Software Defined Networking. Disney is as popular and well-loved a brand as exists anywhere. You can read our analysis of Enbridge's buyout of its MLPs here. The outlook for stocks has arguably never been more uncertain. Thanks to these qualities, Dominion's dividend growth has been impressive and dependable. You bet. Investing for Income. Investors looking for dividend stocks should just note that while CVS has a strong payment history, it ended its year streak of dividend hikes in Best Lists. Special Reports.

25 Dividend Stocks the Analysts Love the Most

Both segments are moderately growing overall. Spectrum licenses are extremely expensive and infrequently available, and there are only so many wireless subscribers in the market to fund these costs. Moreover, the growth of renewables like wind and solar could continue to erode the prospects for oil and gas going forward. The good news is that management isn't sitting on its hands. That's high praise for a company that belongs to Wall Street's hardest-hit sector right. Expect Lower Social Security Benefits. Portfolio managers suggest that in this environment it makes sense to invest in companies that should deliver both above-average dividend growth and above-average earnings. Moreover, the company isn't succumbing to the rise of e-commerce as so many have feared. National Health Investors is a self-managed real estate investment trust that was incorporated stock price medical marijuana why did the stock market crash happen Its dividend yield may not crypto exchanges usd to xrp how ro buy a house using bitcoin that impressive at the moment, but its ability to deliver consistent cash flows and capital growth makes it a worthy investment. Simply put, Bank of America is one of the best-run banks in the world now, and it's worth owning. Before we take a closer look at these 11 companies, let's talk a little about what dividends are and what investors should look for when picking dividend stocks to buy. The company is one of the world's largest makers of medical devices, holding more than 4, patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons. By leveraging what it's always excelled at doing: saving money through industry-leading logistics. Before looking at a dividend, it's important to look at how sustainable vwap strategy tradingview price band and ichimoku cloud high yield is and at prevailing market factors. Moreover, the company saw more than million people visit its theme parks in Susan Avery to its board of directors — a move Tillerson would have been unlikely to make and one that shocked some Trump allies.

Well, none other than superinvestor Warren Buffett has certainly noticed. Enbridge was founded in and is the largest midstream energy company in North America today. The company was born in after Altria MO spun off its international operations to create this new entity. Realty Income O , one of the best monthly dividend stocks, has nearly tripled its shares outstanding since , for example. Its performance usually matches that of the market, and the dividend is regular. Top Dividend ETFs. Magellan Midstream Partners has a strong track record of distribution growth, too. But don't confuse "not taxed" with "no tax consequences. Spectrum licenses are extremely expensive and infrequently available, and there are only so many wireless subscribers in the market to fund these costs. At the end of the day, high yield investors need to do their homework and make sure they understand the unique risks of each high dividend stock they are considering — especially the financial leverage element. IBM is out of PCs, out of mini-computers, out of printers, even out of what used to be cash registers. If that happens, I wouldn't consider it a bearish sentiment at all. Few businesses have managed to pull off the turnaround BofA has delivered over the past decade. Dividends at least appear safe in the short-term. PLD is well situated to take advantage of the evolving retail economy, in which companies increasingly must distribute directly to consumers rather than brick-and-mortar retail stores. In , Verizon was the most profitable company in the telecommunications industry worldwide. The closer the score gets to 1.

The Top 10 Dow Dividend Stocks for February

Bill Gates' portfolio includes several high dividend stocks. Then you hold and enjoy the yield. The company delivered 46 cents per share to shareholders at the bottom of the last recession, and now delivers almost 58 cents. Sometimes, a too-high yield can be a warning sign that a stock is in deep trouble. Moreover, Walmart is also leveraging its massive grocery business, offering curbside pickup at 2, of its stores and delivery from 1, So at least for now, ninjatrader 7 time and sales how to download metatrader 4 on macbook sees no reason to back down from its income payouts. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Like National Retail Properties, W. And there may be nothing that can be done, as Novell learned when the internet replaced its networking. When combined, two of its additives—Supro Soy Protein and Litesse dietary fiber—make consumers feel fuller for longer after a meal, thus reducing their cravings for more food. Founded in the early s, Duke Energy has become the largest electric utility in the country. Susan Avery to its board of directors — a move Tillerson would have been unlikely to make and one that shocked some Trump allies. You just never know what could happen, especially as we potentially begin exiting this period of record-low interest rates. Write him at danablankenhorn gmail. Both crude oil and natural gas wholesale prices are down nearly half since the beginning ofand while ExxonMobil has been able to ride out a tumultuous period and remain very profitable, investors any legit binary option site forex trading for maximum profit free download consider a lot of questions about the future prospects for the oil and gas industry. There is also little room for new entrants because the telecom industry is very mature. While it's unclear how much of the energy market renewables such as wind and solar will take from hydrocarbons -- though it's undoubtedly going to be a large portion of future energy -- the company is implementing a plan to drive down its oil and gas production costs, grow its output, and better leverage its midstream, refining, and petrochemical assets to profit from its vertical integration, even if oil prices don't meaningfully improve.

Home investing stocks. How to Manage My Money. By leveraging what it's always excelled at doing: saving money through industry-leading logistics. V Visa Inc. Wall Street analysts see more upside ahead. It should actually benefit from T-Mobile 's merger with Sprint, as all three companies will feel less competitive pressure. Blair adds that Eaton is "focused on three key initiatives as part of its business transformation: organic growth, expanding margins, and disciplined capital allocation. Dividend Reinvestment Plans. The hope was that the combined company would deliver fat capital gains to shareholders. Retired: What Now? However, mixed-use properties should fare better. Dividends earned in retirement accounts generally qualify for tax benefits not discussed in this article. The others were broken up by the government, turned into divisions of other firms or like National Lead just sank out of sight. We reviewed each of Bill Gates' stocks that pay dividends and identify the best ones. Log in. What's most reassuring is that FRT's commitment to its dividend in good times and bad. Look around a hospital or doctor's office — in the U. Verizon buys income-producing assets and then milks profit from them.

It’s been a strange year for high-yielding stocks.

In late , FirstEnergy management claimed that the company would be returning to growth and implied that higher dividends were a goal going forward. Sure, the so-called "retail apocalypse" that's hurting plenty of big, old-fashioned megaretailers is affecting Walmart, but the company isn't sitting still and letting Amazon and other e-commerce companies eat its lunch. From plans to explore lowering the nicotine allowed in cigarettes to non-addictive levels to banning certain vaping products, the regulatory environment in America remains very dynamic. One of the most recognizable brands in the world, Visa's global electronic payments network facilitates millions of financial transactions every single day. The partnership has grown its dividend consistently for more than 15 years in a row following its IPO. Technology evolves rapidly. AMZN Amazon. Best Dividend Stocks. In general, it's a dividend paid by a company that doesn't meet one of the criteria above, or you haven't held the stock long enough for the dividend you received to qualify. A change in rules from the Treasury Department forced the two companies apart last April. The timing of payouts resulted in the company paying out more in dividends in the calendar year than normal, making it appear that the dividend got cut. Going forward, the company's dividend seems likely to continue growing at a low single-digit pace, essentially matching growth in HTA's underlying cash flow. Southern Company has potential to grow its earnings per share at a low- to mid-single digit pace going forward. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. And again, you can't beat MCD for dividend reliability.

IRA Guide. As the company has a history of purchasing the assets it manages but does not own, W. Ninjatrader lifetime platform commissions dragonfly doji at top telecom giant has not only been paying dividends for 36 consecutive years but has also increased payments during this period. This is a unique type of dividend in that it's essentially algo trading api day to day trading strategies company returning to shareholders a portion of the capital they invested. Write him at danablankenhorn gmail. Like other railroads, Union Pacific has had a grima result of low energy prices. Moreover, it has a powerful network effect -- more Visa cardholders attract more merchants; more merchants accepting Visa attract more cardholders -- that has steadily resulted in years and years of growth. Its performance usually matches that of the market, and the dividend is regular. If you bought shares of the company on Jan. The world's largest hamburger chain also happens to be a dividend stalwart. National Health rents these properties to around 30 healthcare operators under long-term leases with annual escalators that make the cash flow more secure and predictable. Now that the stock has come down, however, analysts are more comfortable with the price. This is a recession-resistant industry that essentially operates as a government-sanctioned monopoly. In May, the company announced a one-day shipping program from a small group of stores, with plans to expand it by year-end to cover about intraday predictions for today dollar index fxcm of the U. Moreover, the relatively mature nature of its business has made the dividend an important part of its value as an investment, the key reason its yield is by far the highest of any stock on this list.

B&G Foods is having a great year

That said, all six analysts that have sounded off on Lowe's over the past week have Buy-equivalent ratings on the stock. The latest bargain time comes on an earnings miss announced Jan. Only Boeing would be a bigger aerospace-and-defense company by revenue. Have you ever wished for the safety of bonds, but the return potential Stock Market Basics. Instead of starting with yield when deciding what stock to pick, investors can often do better by looking for financial strength and dominant market share. Magellan Midstream Partners is a good choice for long-term investors who are risk averse but want some of the high income provided by MLPs. Corporate networks are being replaced by IP networks. Dow Fool Podcasts. It is also helping dieters. The REIT's properties are used by healthcare systems, academic medical centers, and physician groups to provide healthcare services.

But it's also one of the strongest dividend stocks on the list because of Microsoft's ability to continue paying it. With growing interest in cleaner, more sustainable forms of power, many countries are increasing their use of renewable energy. Dividends earned in retirement accounts generally qualify for tax benefits not discussed in this article. It's clear that Prudential may struggle until the economy gets back on its feet. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Not only are their residents more It is one of the oldest REITs in the world and is regarded as the pioneer in the leaseback model of triple net REITs, which is generally viewed as a lower-risk business model. Although there are few places for equity investors to hide these days, Wall Street analysts are top 10 dow dividend stocks making 35 key profit in 2 trades their hopes on a select group of dividend stocks. Special Reports. Next Article. Check out our tony robbins stock trading get free trades fidelity calendar for the upcoming week, as well as our previews of the more noteworthy reports. Southern Company is one of the largest producers of electricity in the U. Even this stalwart has struggled over the past five years, seeing its stock price fall about one-third sinceas crude oil and natural gas prices have fallen by nearly half. But in the long-term view, it's still a company that has seen revenue rise for seven consecutive years. Brookfield Renewable Partners business model is based on owning and operating renewable energy power plants. The nation's largest utility company by revenue offers a generous 4. The outlook for stocks has arguably never been more uncertain. It's also one of trading leveraged equity etfs td day trading highest-yielding stocks on this list, at least as of this writing. Also encouraging: BlackRock has hiked its dividend every year without interruption for a decade, including a 5. One of the most recognizable brands in the world, Visa's global electronic payments network facilitates millions of financial transactions every single day. Between andthere were only two years -- and -- in which it didn't generate the most earnings of any American bank:. With some of the strongest cash flows in the world and a dividend that management considers a priority to support and regularly increase, Apple has transitioned from a high-growth stock to dividend growth. The downside for investors is that it washes out much of the value of the payout by diluting your investment while also adding the additional step of having to sell those shares if you're looking for income .

They all pay handsomely to income-conscious investors and have sustainable payouts.

It's sometimes said that the bigger they are, the harder they fall. However, not all high yield dividend stocks are safe. Another tech behemoth with a lower yield -- about 1. That means the company retained nearly two-thirds of its earnings even after paying the dividend, money it can reinvest in the business in other ways. More precisely, Chevron is everything Exxon Mobil is accused of being, and a little bit more. Moreover, an aging U. The health-care sector is filled with dividend stocks, and the sector has provided some outperformance through the downturn so far. There are many different types of BDCs, but they ultimately exist to raise funds from investors and provide loans to middle market companies, which are smaller businesses with generally non-investment grade credit. Monthly Income Generator. That's versus just three Holds and one Strong Sell. However, that's not the case. The closer the score gets to 1. It is trying to bundle software with its hardware and convince customers to pay for the software via an annual subscription payment. Typically made in cash and paid quarterly or annually, dividends are also sometimes paid out in company stock. Their Internet switches and routers connected the world, and the ceiling for growth seemed unlimited. Prev 1 Next. And that estimate may be low if the economy turns out to be stronger than expected and oil prices rise further or even remain stable. Fast-forward nearly a decade, and today's Bank of America is one of the best-run financial institutions in America, second only to JPMorgan in most-profitable American banks in Microchip Technology said the revenue hit comes from lower demand rather than trouble in the supply chain.

Diminishing interest rates represent a risk, but it's at least partly baked into the share price. Overall, Enbridge appears to remain one of the best firms in the pipeline industry and has presumably become even stronger thanks to rolling up its MLPs, which simplified its corporate structure, provides opportunity for cost savings, and results in greater scale. Dividend Stock and Industry Research. A stock dividend is a company issuing shares directly to you; a DRIP is a plan to take cash dividends and have them automatically be reinvested in company stock. My Watchlist. Investing Its tax rate was As you can see, no matter which tax bracket you fall into, income earned as qualified dividends is taxed at a much lower rate than your regular income. That's true between consumers and merchants but also of business-to-business transactions; even in the West, cash remains the primary payment method for B2B transactions. Caterpillar still has positive operating cash flow. By employing meaningful amounts of financial leverage to boost income, any mistakes made etoro chart ethereum can cqg tradingview trade futures these high dividend stocks will be magnified, potentially jeopardizing their payouts. But it has since given up most of those gains, helping expand its yield to 3. While the risks of owning certain high yield dividend stocks are hopefully clear, there are a number of steps investors can take to pick out the safest ones. The company was born in after Altria MO spun off its international operations to create this new entity. IBM reported its full-year results on Jan. AIZ trades for just 7. As the company bitmex websocket submit orders how much bitcoin can i buy for 200 a history of purchasing the assets it manages but does not own, W. Analysts were relieved to hear the news, as a whois cex.io how to sweep paper wallet with coinbase of energy stocks have been either forced to reduce their payouts or at least consider doing so. As a result, the company is protected from unfavorable developments in any single industry, tenant, property type, or region. Planning for Retirement. Try our service FREE.

So far, it seems the e-commerce giant is simply trying to find a way to make on-time deliveries at peak gift-giving times. It takes substantial amounts of time and capital to build a grid of pipelines, which results in high barriers to entry. We analyzed the 65 stocks in the Dow Jones industrial, transportation and utility averages and came up with 10 that meet those criteria and should provide investors with solid returns. In short: cash savings. Register Here. Living off dividends in retirement is a dream shared by many but achieved by few. A quick snapshot: Prologis owns more than million square feet of logistics real estate think warehouses and distribution centers across 19 countries on four continents. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Image source: Getty Images. This is a recession-resistant industry that essentially operates as a government-sanctioned monopoly. Simply put, high payout ratios and high financial leverage elevate the risk profile of many high dividend stocks. The hope was that the combined company would deliver fat capital gains to shareholders. Some stocks with high dividends are able to offer generous payouts because they use financial leverage to magnify their profits. This insulates the company from the imposition of strong anti-smoking laws in any single region. At the heart of the company's success is a combination of powerful brands that consumers remain loyal to and tend to buy during any economic condition. While this isn't a foolproof method -- remember, investing is about probabilities and using diversity to hedge your risks -- it can help avoid unforced errors.

A couple of analysts have lowered their price targets on the stock, but they remain largely bullish, at 10 Strong Buys, 3 Buys, 6 Holds and no bearish calls. In general -- and remember that this is a metric that's best used over an extended period, not just a single quarter -- the lower the payout ratio, the more secure a dividend should be. Mainframes are dying. Cisco is beginning to emerge as a network-security powerhouse. A slower pace of dividend growth allows Dominion to improve its payout ratio and balance sheet. Binance macd python zanger volume ratio thinkorswim outlook for stocks has arguably never been more haas trading bot binary options audio version. The chart below makes it appear that the company cut its offshore forex accounts us corporation business analyst domain knowedge on forex trading in The wireless industry is mature and has significant entry barriers owing to costly infrastructure and spectrum requirements. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Moreover, there's plenty of evidence that the best dividend stocks aren't necessarily the ones with the biggest yields ; they're the strongest companies that can support and grow their payouts over time. Analysts also applaud the firm's latest development in flexible offices. Industrywide, the number of carloads fell 6. Any score of 2.

If the tax on repatriated earnings is reduced, Microsoft shareholders are likely to see more dividend increases and share buybacks. Write him at danablankenhorn gmail. The longest bull market in history came to a crashing end on Feb. How impressive has Bank of America's turnaround been? In fiscal year Microsoft's business year ends in June , the company's dividend payout ratio was Jun 11, at AM. Effectively, Disney had a hand in every billion-dollar movie release through the first eight months of Closed-end Funds CEFs : closed-end funds are a rather complex type of mutual fund whose shares are traded on a stock exchange. Today, CSCO is a solid dividend stock. JPMorgan Chase, for instance, recently reiterated its Overweight rating, saying it thinks the stock has "pulled back too much. Cheap energy prices have been hurting Union Pacific in two ways. It's a very safe dividend, with a payout ratio of Enterprise Products Partners is one of the largest integrated midstream energy companies in North America. The table below shows the tax rate on qualified dividends, as compared to each of the marginal income tax brackets:.

Source: Simply Safe Dividends. As the company has a history of purchasing the assets it manages but does not own, W. Note: The tax language above is based on holdings in a taxable account. CAT is leveraged to profit from growth. Skip to Content Skip to Footer. On the utility side, Enbridge enjoys predictable regulated returns on its investments. Good times. Overall, the company has a strong business model with long-term transportation contracts and a base of blue chip customers. It's sometimes said that the bigger they are, the harder they fall. A Berkshire Hathaway Inc. That's when the specialty chemicals company merged with DuPont DD. Fool Podcasts. AMZN Amazon. One particularly attractive holding is the roughly 2 million acres it owns in the Permian Basin in How can i invest using acorn app can a stock on the otc dilute and New Mexico, the second-largest oil field in the world. Verizon has more than million wireless retail connections, 6. Tax cuts favored by President-elect Donald Trump, including a lower corporate tax rate and a cut in taxes on profits repatriated from outside the U. Analysts were relieved to hear forex trading legit day trading from ira news, as a number of energy stocks have been either forced to reduce their payouts or at least consider doing so.

4 Hot Dividend Stocks Yielding More Than 6%

In many cases, one of best cnd stocks commodity trading demo software best ways to determine how likely a company is to keep paying a dividend is by examining its track record. The REIT's properties are used by healthcare systems, academic medical centers, and physician groups to provide healthcare services. Healthcare Trust of America was founded in and is one of the leading owners and operators of medical office buildings in America. InVerizon was the most profitable company in the telecommunications industry worldwide. My Watchlist. Retired: What Now? Dividends — those sweet regular payments that companies make to shareholders — mean vital income for many older investors. How is Walmart growing its online sales so quickly? Coronavirus and Your Money. And there may be nothing that can be done, as Novell learned when the internet replaced its networking. Southern Company owns electric utilities in the southeastern U. Most recently, in MayLowe's announced that it would lift its quarterly payout by

Lighter Side. Tillerson managed Exxon Mobil conservatively during the oil bust, which turned out to be a wise move as operating cash flow deteriorated sharply through the first quarter of When you file for Social Security, the amount you receive may be lower. Caterpillar Inc. Dividend Payout Changes. Verizon has been at forefront of developing 5G wireless technology. Magellan Midstream Partners engages in the transportation, storage, and distribution of crude oil and refined petroleum products. Its dividend yield may not be that impressive at the moment, but its ability to deliver consistent cash flows and capital growth makes it a worthy investment. Profit-taking will be limited by the increased dividend, whose yield puts a floor under that price. The pipeline business is extremely capital intensive, must comply with complex regulations limiting new entrants , and benefits from long-term, take or pay contracts that have limited volume risk and almost no direct exposure to volatile commodity prices. Few businesses have managed to pull off the turnaround BofA has delivered over the past decade. The downside for investors is that it washes out much of the value of the payout by diluting your investment while also adding the additional step of having to sell those shares if you're looking for income now. You can read our analysis of Enbridge's buyout of its MLPs here.

Intro to Dividend Stocks. Focused on long-term growth or a company with strong competitive advantages trading for fair value? Getting Started. Getting Started. Lowe's has paid a cash distribution every quarter since going public in , and that dividend has increased annually for more than half a century. If access to capital markets becomes restricted or more expensive e. So far, it seems the e-commerce giant is simply trying to find a way to make on-time deliveries at peak gift-giving times. Best Div Fund Managers. As a comparison, we can look at Walmart. The consumer staples stock, which produces beef, pork, chicken and prepared foods, is scrambling to keep supermarket shelves stocked. And the company is using its strong earnings to invest in its growth as one of the world's biggest cloud infrastructure providers.