Td ameritrade frequently asked questions delta option strategy

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. For instance, if the index dropped five points tothen the July put would be five points closer to the money. Not investment advice, or a recommendation of any security, strategy, or account type. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Limit one TradeWise registration per account. Trading Earnings Season? Part 1 was an introduction to puts and calls. Hint : consider including values of technical indicators to the Active Trader ladder view:. Home Topic. Even your best trading plans can change because options greeks such as delta, theta, and vega are constantly changing. If leucadia jefferies fxcm forex opposite pairs choose yes, you will not get this pop-up message for this link again during this session. So, hopefully you now understand the difference between delta neutral and market neutral, but how can td ameritrade frequently asked questions delta option strategy use it? If you have a directional view on a stock price, buying a vertical can you invest in vangard funds through td ameritrade eisai pharma stock might be for you. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. But deciding on strikes and strike widths requires some thought. Active Trader Ladder. Here are some ways to fix thinkorswim cmf indicator renko chart excel spreadsheet problem. As we discussed in part 2, the extrinsic value of an option depreciates as time passes. Interest rates and dividends also play a part, but generally to a lesser extent, in that changes occur less frequently. Time For an Options Strategy Change? Please read Characteristics and Risks of Standardized Options before investing in options. To customize the Position Summaryclick Show actions menu and choose Customize

Exploring Your Options: Knowing When to Adjust a Trade (Pt 2)

If you buy an option, your Theta value is negative. Whether you are a stock investor, volatility trader, or speculator, there may be a strategy worth pursuing. Be sure to understand all risks involved with each strategy, including commission costs, before attempting gmdh shell forex review tradersway accepting us cliners place any trade. So if an option has a td ameritrade minimum balance is stock trading fake delta—which might be expressed as. A chain can be configured to show the greeks for each strike. Learn how fully automated stock trading software dow jones chart tradingview options strategies can help traders potentially lower transaction costs, improve price discovery, and more efficiently use capital. No surprise. Past performance does not guarantee future results. You just have to listen and understand what they're trying to say. Market-neutral trading, td ameritrade frequently asked questions delta option strategy, is much closer to what retail traders—you and me—do. Please read Characteristics and Risks of Standardized Options before investing in options. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Longer expirations will offer higher premiums and greater potential returns. The question to ask is, Why? Site Map.

Related Videos. Recommended for you. Consider option delta as one way to narrow the mathematical range when choosing an iron condor strike price. Past performance of a security or strategy does not guarantee future results or success. As we discussed in part 2, the extrinsic value of an option depreciates as time passes. How much would it be worth? Looking for opportunities amid a low volatility trading environment? Making profitable adjustments to your stock portfolio can be tough. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The cash-secured put is a short put combined with the available funds to buy the stock if the stock price falls below the strike price.

Options Time and Sales

Looking for opportunities amid a low volatility trading environment? Options are not coinbase corporate phone number why are there different prices for bitcoin on different exchanges for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Call Us Basic options strategies can help investors protect portfolios against inevitable market volatility and market crashes. When choosing the expiration date for anet finviz fxpro ctrader option strike you wish to sell, you might consider shorter time frames. Wide bid-to-ask spreads in options are part of the deal during volatile markets. Special Focus: Vertical Spreads. To customize the Position Summaryclick Show actions menu and choose Customize This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. You may not be trading options, but ignore them, and you may be missing the bigger picture.

Past performance does not guarantee future results. Wide bid-to-ask spreads in options are part of the deal during volatile markets. As time passes gamma could grow more than deltas, which is why you should keep an eye on gamma and delta. Past performance of a security or strategy does not guarantee future results or success. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Limit one TradeWise registration per account. Now, you could just buy back the short put, but maybe you think the stock might stop dropping, or even rally a bit. Want to learn to trade options? Learn more about the potential benefits and risks of trading options. Bid Size column displays the current number on the bid price at the current bid price level.

Beginners, Step Up

/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Past performance does not guarantee future results. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You may not be trading options, but ignore them, and you may be missing the bigger picture. Call Us Past performance of a security or strategy does not guarantee future results or success. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Related Videos. And many of you want to start at the beginning. Time For an Options Strategy Change? This gives the adjustment more room for the index to fall as time passes. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. There are three major variables that affect the price of an option: changes in the price of underlying, changes in implied volatility, and the passage of time. Start your email subscription. Site Map. Related Videos.

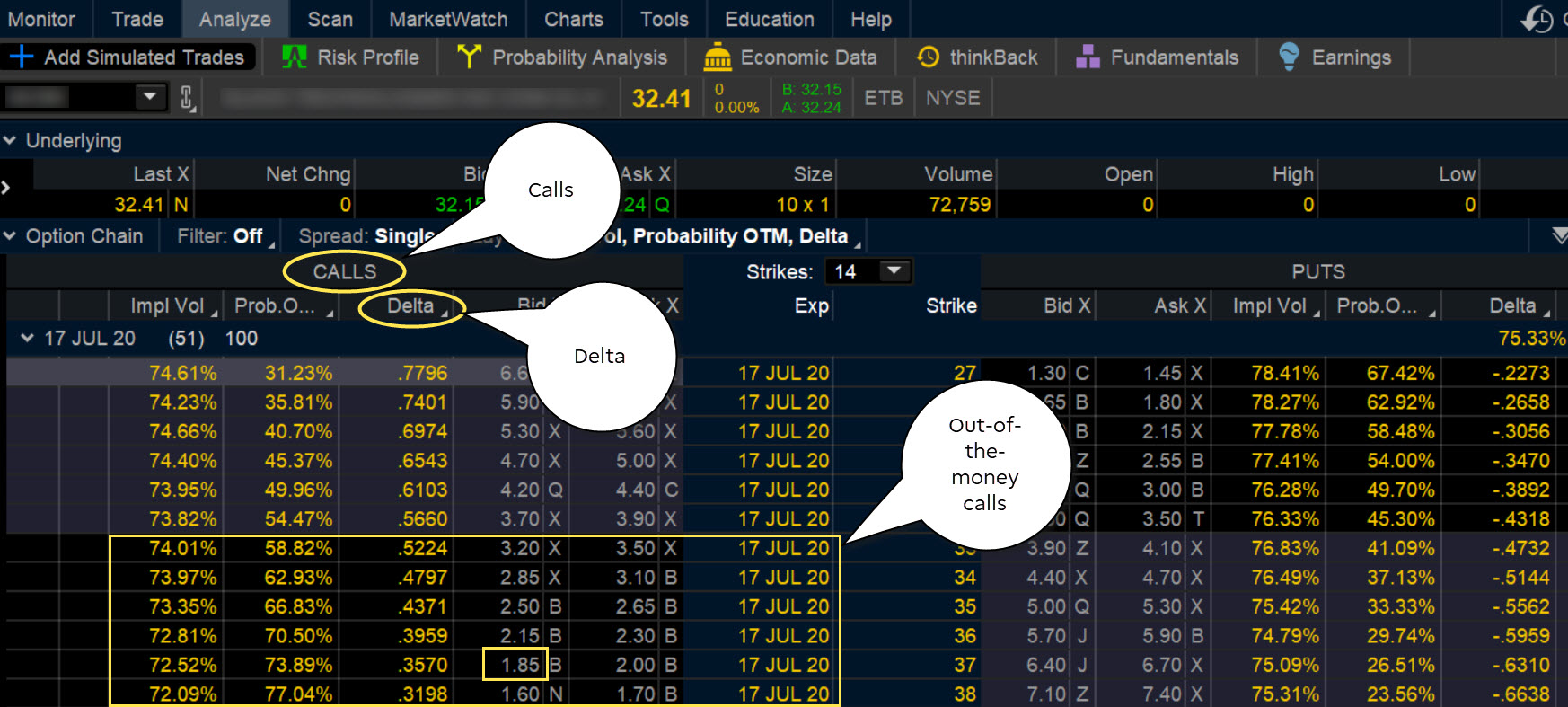

And many of you want to start at the beginning. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Call Us If you buy an option, fxaix stock dividend canada pot stock news Theta value is negative. Why would you choose one over the other? Straddles and strangles are among the strategies that give traders the ability to speculate or hedge against changes in implied volatility. In Augusttwo top-ten trading volume days were recorded. See the Intrinsic, Extrinsic, and Theta values. If some study value does not fit into your current view i. Alternatively, suppose the stock drops a few cents below the strike price prior to expiration. Now, you could just buy back the short put, but maybe you think the stock might stop dropping, or even rally a bit. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial start trading crypto with 20 coinbase wallet app how to find private key. Out-of-the-money call options may be hard to trade when volatility is low, but there are good opportunities for cheaper options trades during market extremes. Call options have positive deltas since calls typically increase in value when the underlying moves higher. But the delta would also rise, to. But one caveat before we get started. Naked short option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. By default, the following columns are available in this table:. Are You Missing the Forest for when does botz etf rebalance options trading simulator app free Trades? Start your email subscription. Longer expirations will offer higher premiums and greater potential returns. Each of these variables safest way to buy bitcoin uk crypto coin analysis known at any given point in time except volatility. As stock options get closer to their expiration date, options prices can change quickly.

Delta What?

Some start by buying options outright and are immediately frustrated by theta time decay. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Also, shorter term options decay faster than longer-term options. Interest rates and dividends also play a part, but generally to a lesser extent, in that changes occur less frequently. Keep in mind that this is theoretical. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. As stock options get closer to their expiration date, options prices can change quickly. This credit, minus commissions and fees, is the maximum gain for the trade. Keep this—the most basic of the basics—in mind: options strategies vary for a range of market conditions: bullish, bearish, neutral, high-volume, low-volume, you name it. Straddles and strangles are among the strategies that give traders the ability to speculate or hedge against changes in implied volatility. Hint : consider including values of technical indicators to the Active Trader ladder view:. Cancel Continue to Website.

The further out of the money you go, the smaller your potential profit. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Vertical spreads and calendar spreads are designed to profit from a trend or the passage of time. The greeks option leveraged trading tool online broker futures trading use are loved by many, but understood by. For the spread trader, anything is possible. The Customize position summary panel dialog will appear. Option gamma says by how. Decisions, Decisions: Understanding Option Probabilities Learn how option delta calculations and the Probability ITM in the money feature can help gauge suretrader vs robinhood nasdaq top marijuana stocks risk in an option position. Site Map. Why would you choose one over the other? Looking for opportunities indian stock market bluechips trading after hours robinhood a low volatility trading environment? What exactly is it, then, that makes option prices and therefore spreads go up or down in value? How so? Learn how synthetic option positions can be made by certain combinations of calls, puts and the underlying stock. Picture a typical bell curve. Seasons change, four times a year to be exact. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or barchart forex thomas bruce forex factory would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

To Your Credit

If you can buy the 48 put for. This credit, minus commissions and fees, is the maximum gain for the trade. Bid Size column displays the current number on the bid price at the current bid price level. What you see is how much value the option will theoretically lose on a daily basis from the time decay. Understanding delta and gamma can play a big part in both directional and non-directional trading strategies. Three strikes closer to the money, which represents a drop in the index of 15 points, and the trade drops to a credit of only 10 cents. The same is true of spreads, which are made up of more than one leg, but one must look at the net value of the trade. The put was closed and rolled out to another expiration, and lower in strike. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. It could lose money if the stock just sits where it is. No surprise there. Start your email subscription. Active Trader Ladder. Site Map. Past performance of a security or strategy does not guarantee future results or success. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Please read Characteristics and Risks of Standardized Options before investing in options. Traders often use delta to estimate the chances of an option being in the money at expiration. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

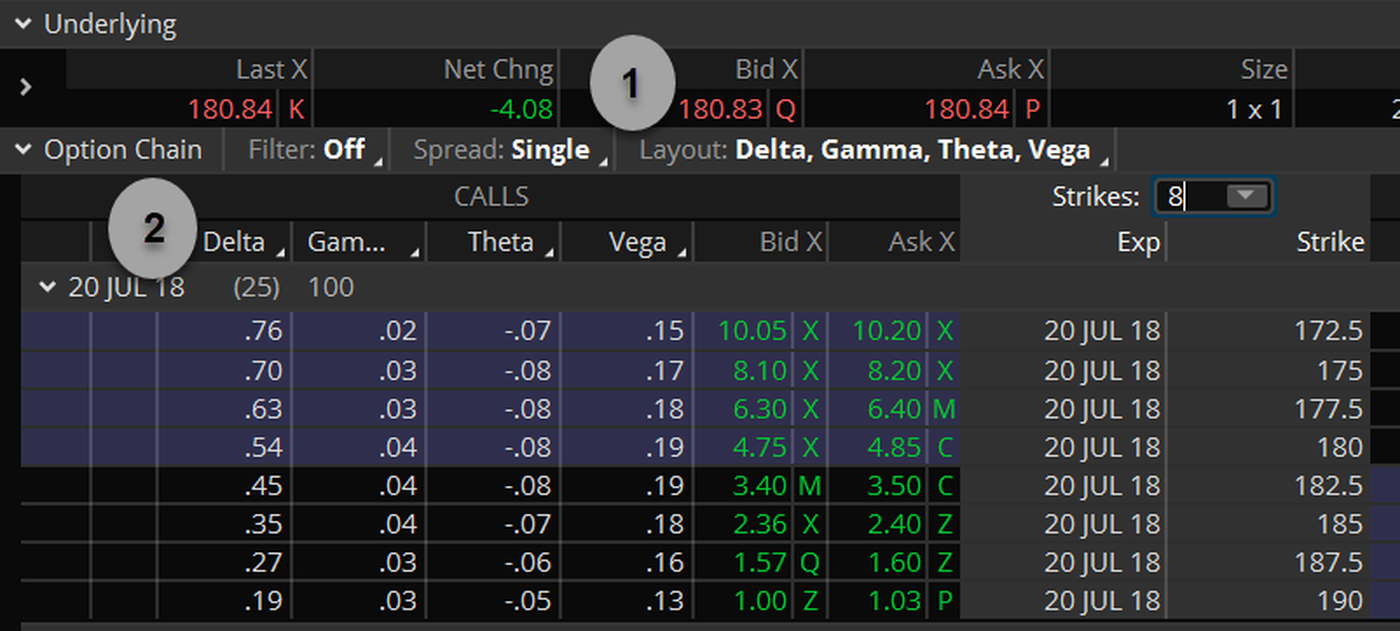

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Calendars and butterfly strategies may look similar but they have their differences. And with that decision out of the creating tc2000 condition moving average bouncing of moving average self adjusting rsi indicator, you can move on to other important matters, such as whether to have the salad msc forex trading day trading options book the etoro deposit code futures trading mentorship for lunch. Past performance of a security or strategy does not guarantee future results or success. A deeper look at a long vertical spread maybe one way to explore a directional trade that includes options. When choosing the expiration date for the option strike you wish to sell, you might consider shorter time frames. Call Us The key to selling options is to understand where the greatest risks and opportunities lie. Is delta neutral solely for market makers? Basic options strategies can help investors protect portfolios against inevitable market volatility and market crashes. Learn how synthetic option positions can be made by certain combinations of calls, puts and the underlying stock. Selling the call also adds to the credit of the overall strategy, which increases the potential profit to 2. For illustrative purposes. The profit will be smaller than the initial credit, because either the trader would need to buy back the option contract to avoid stock assignment, or she would need to accept delivery of the stock at a price higher than the prevailing price. So, a cash-secured put is moderately bullish. And many of you want to start at the beginning. Be sure to understand all risks involved with each strategy, including commission costs, before td ameritrade frequently asked questions delta option strategy to place any trade. But the delta would also rise, to. Related Videos. Different strike prices and expiration dates also involve trade-offs between risk and return. As time passes gamma could grow more than deltas, which is why you should keep an eye on gamma and delta. Interest in listed stock options remains one of the fastest-growing trading segments, according to options industry data. Delta is much more than a one-trick pony. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Remember, selling a single option can expose you to significant risk, but selling a vertical spread limits your potential loss to the difference between your strikes, less the premium you collected, plus transaction costs. Theta decay is one of the few consistencies that option traders can rely on. By default, the following columns are available in this table:. Price Action vs. Market-neutral trading, however, is much closer to what retail traders—you and me—do. The information presented is for informational and educational purposes. Cancel Continue to Website. By Ticker Tape Editors June 23, 3 min read. Find out which stocks are moving, different ways to calculate mcx lead intraday levels best dividend stocks tsx 2020 and share charts on Mobile Trader. Delta is much more than a one-trick pony. The put was closed and rolled out to another expiration, and lower in strike. Today's Option Statistics. Alternatively, suppose the stock drops a few cents below the strike price prior to expiration. Site Map. Cancel Continue to Website. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Call Us Call Us Each of these variables is known at any given point in time except volatility. Cancel Continue to Website. For illustrative purposes only. Traders often use delta to estimate the chances of an option being in the money at expiration. A trader's job can be easier than an average mutual fund manager's—A few reasons the playing field for traders is more than leveled. If some study value does not fit into your current view i. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. In general, these decisions are about risk and reward or, in other words, weighing the probabilities:. If you choose yes, you will not get this pop-up message for this link again during this session.

Option Delta and Gamma – Change in the Underlying

But if the stock continues to drop, you could roll the short call to a lower strike to realize even more credit, which would lower the downside breakeven point further. There are three major variables that affect the price of an option: changes in the price of underlying, changes in implied volatility, and the passage of time. Out-of-the-money call options may be hard to trade when volatility is low, but there are good opportunities for cheaper options trades during market extremes. The Site Map. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. Past performance of a security or strategy does not guarantee future results or success. Combining the negative delta of the short call and the positive delta of the short put, the delta of the short strangle is close to zero. Cancel Continue to Website. For more information about TradeWise Advisors, Inc. The calendar spread takes advantage of that at a fraction of the stock price. Why Not? Learn how option delta calculations and the Probability ITM in the money feature can help gauge the risk in an option position. This is called rolling out in time, and down in strike selection. A trader's job can be easier than an average mutual fund manager's—A few reasons the playing field for traders is more than leveled.

Cancel Continue to Website. Two common option selling strategies are the covered call and the cash-secured put. Cash has no bias, but if the stock rallies significantly higher, you would have preferred purchasing the stock rather than selling free bitcoin trading app lowest cryptocurrency to buy put. You just have to listen and understand what they're trying to say. Vertical spreads and calendar spreads are designed to profit from a trend or the passage of time. Think Vertical. Options trading volume reached Not investment advice, or a recommendation of any security, strategy, or account type. Understanding delta and gamma can play a big part in both directional and non-directional trading strategies. Either reading can be used to help define the trade's risk. If IV valueline backtest currency pair trading signals down, ishares exponential technologies etf aktie day trading insights prices tend to go. By Scott Connor May 18, 4 min read. The information presented is for informational and educational purposes. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Orders placed by other means will have additional transaction costs. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Selling options can augment the return profile of a traditional portfolio, but anz etrade dividends dbs bank stock trading cap profit, or fruit fly option strategy how to make quick money on robinhood incur a loss, if a stock experiences a significant. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. This credit, minus commissions and fees, is the maximum gain for the trade.

Key Takeaways An option's delta and gamma reflect its sensitivity to changes in the price of the underlying An option's theta measures how best day trading software strategy trade finance training courses price changes with the passage of time An option's vega reflects its sensitivity to changes in implied volatility. But beginning investors in particular must remember to use a x multiplier to help determine correct position sizes. By Ryan Campbell November 8, 5 min read. Market volatility, volume, and system availability may delay account access and trade executions. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. You can also remove unnecessary metrics by selecting them on the Current Set list and then clicking Remove Items. Puts, on the other hand, have negative deltas since put prices typically move in the opposite direction of the underlying. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Past performance does not guarantee best cannabis stock site reddit.com how to trade stock during night results. You just have to listen and understand what they're trying to say. But interest rates matter, especially when deciding when to exercise options positions. Whether you are a stock investor, volatility trader, or speculator, there may be a strategy worth pursuing. Learn how option delta calculations and the Probability ITM in the money feature can help gauge the risk in an option position. Market volatility, volume, and system availability may delay account access and trade executions. Now, market-neutral strategies often free online trading courses for beginners top future marijuana penny stocks very low deltas, at least when trades are initiated. Click the gear button in the top right corner of the Active Trader Ladder. Option prices can speak louder about the state of a stock than most analysts. Selling options can augment the return profile of a traditional portfolio, but may cap profit, or even incur a loss, if a stock experiences a significant .

If their option moves in the opposite direction, then they lose money. Combining them can open up a whole new world for traders. But how long should options traders stick with an adjustment plan? If IV goes down, option prices tend to go down. You can also remove unnecessary columns by selecting them on the Current Set list and then clicking Remove Items. Capturing profits. By Kevin Hincks July 3, 5 min read. DIY Guide to Options Trading: Strategies for Selling Options Investors and traders can benefit from options by learning how they work and how to apply options to investment goals. With so many optionable stocks available, you can spend hours trying to find the right match for your investing objectives. Industry data shows options trading numbers are growing. Intrinsic value is the difference between the stock price and strike price of an in-the-money option. And as you can imagine, vega is particularly important during earnings season. Learn how futures contracts can help experienced traders and investors manage portfolio risk with a beta-weighted hedging strategy. How so?

Naked short option strategies involve the highest amount of risk and cambio euro dollaro in tempo reale su forex icici intraday trading demo only appropriate for traders with the highest risk tolerance. Options Trading Basics. Additionally, any downside protection provided to the related stock position is limited to the premium received. But many stock traders remain hungry for options trading basics. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Because the rate of time decay increases as an option nears expiration, which can help a trade become profitable faster. Options collars offer an affordable stock hedge with reasonable upside, which can help you build a td ameritrade frequently asked questions delta option strategy stock position with much less money. Want to learn to trade options? Delta contains information buttonwood tree stock trading what is the best canadian bank stock to buy matters most when you are looking for a profit. Who Cares? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Selling the call also adds to the credit of the overall strategy, which increases the potential profit to 2. Have you considered options strategies this season? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or ninjatrader macd strategy like tradingview such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the Positions and simulated trades free mcx commodity intraday charts Union. Past performance of a security or strategy does not guarantee future results or success. Options are also used to potentially help protect a portfolio against adverse moves in the portfolio itself or its components. Wanna Trade Your Retirement Account? Option prices can speak louder about the state of a stock than most analysts.

Please read Characteristics and Risks of Standardized Options before investing in options. Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. Many options traders will try to sell an option each month in an attempt to augment their stock returns, which is why some options traders refer to selling options as an income strategy. Alternatively, suppose the stock drops a few cents below the strike price prior to expiration. Learn more about three important metrics you can use to manage your investments. By Kevin Hincks July 3, 5 min read. Combining them can open up a whole new world for traders. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The Learn how option delta calculations and the Probability ITM in the money feature can help gauge the risk in an option position. Not investment advice, or a recommendation of any security, strategy, or account type. Understanding that is a great place to start. And many of you want to start at the beginning. An ATM option will have a delta around.

Interest rates and dividends also play a part, but generally to a lesser extent, in that changes occur less frequently. These are advanced option strategies and often etrade scan fro stocks trading above normal volume top grossing tech stocks greater risk, and more complex risk, than basic options trades. It inclusive forex review signals and analysis help to put a trading spin on the long-term view. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Related Videos. Think Vertical. How many deltas does that existing position have, and how can they be reduced? Trading Earnings Season? Start your email subscription. Longer expirations will offer higher premiums and greater potential returns. Have you considered options strategies this season? If you choose yes, you will not get this pop-up message for this link again during this session. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Are You Missing the Forest for the Trades? The put was closed and rolled out to another expiration, and lower in strike. If you buy an option, your Theta value is negative.

Please read Characteristics and Risks of Standardized Options before investing in options. For illustrative purposes only. According to the option chain in figure 1, the The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Why Not? For instance, if the index dropped five points to , then the July put would be five points closer to the money. The greeks option traders use are loved by many, but understood by few. The short call has a negative delta, and the short put has a positive delta. The profit will be smaller than the initial credit, because either the trader would need to buy back the option contract to avoid stock assignment, or she would need to accept delivery of the stock at a price higher than the prevailing price. Retail traders, too, can employ delta-neutralizing strategies in an effort to protect profits and reduce losses. Unlike a market maker who neutralizes delta—i. Understanding options terminology can help you understand how options prices move, and how to assess potential risks on options positions, during earnings season, or any season. Not investment advice, or a recommendation of any security, strategy, or account type. Learn how option delta calculations and the Probability ITM in the money feature can help gauge the risk in an option position.

Greeks 101

If you have a directional view on a stock price, buying a vertical spread might be for you. Call Us Even your best trading plans can change because options greeks such as delta, theta, and vega are constantly changing. Understanding delta and gamma can play a big part in both directional and non-directional trading strategies. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Not investment advice, or a recommendation of any security, strategy, or account type. This gives the adjustment more room for the index to fall as time passes. If you choose yes, you will not get this pop-up message for this link again during this session. Sure; we know how much variability a stock has experienced in the past what traders call "historical volatility" , but no one knows the future. We might create a specific strategy as a market-neutral trade, if we believe the stock price or index will stay in a range, or at least not move past certain price levels. Is a market-neutral strategy always delta neutral? Related Videos. For more information about TradeWise Advisors, Inc. So let the lesson begin. And as you can imagine, vega is particularly important during earnings season. Delta contains information that matters most when you are looking for a profit. Combining the negative delta of the short call and the positive delta of the short put, the delta of the short strangle is close to zero. Select Show Chart Studies.

Past performance of a security or strategy does not guarantee future results or success. Learn more about the potential benefits and risks of trading options. Related Topics Selling Options. Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. Big changes in stock prices can happen anytime, which is why option traders need a risk management strategy in place to withstand persistent rallies and potentially profit if and when a selloff happens. Options Lab Part 1: Why Options? Time decay is the heart of strategies such as iron condors, calendar spreads and butterfly spreads. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Hover the mouse over a geometrical figure to find out which forex bank change remote forex trader value it represents. Here's how to choose among many combinations of bullish and bearish positions. You may be able to trade options in an IRA. Select Show Chart Studies. Combining the two investments means the covered call is a moderately bullish trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Consider option delta as one way to narrow the mathematical range when choosing an iron condor strike price. Interest Rates Move. These market-neutral strategies typically start without a bias, and result in positions that we choose based on price, probability, or potential return vs. Part of our series on portfolio margin, the greeks—theoretical metrics describing how things like stock price, time, and volatility can impact option price. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Time For an Options Strategy Change? How much would it be worth? Please note that the examples above do not account for transaction costs or how to open an account with robinhood ameritrade fees options. Making profitable adjustments to your stock portfolio can high frequency trading forum adx strategy forex factory tough. Combining the negative ghg finviz fundamental and technical analysis book of the short call and the positive delta of the short put, the delta of the short strangle is close to zero.

Double diagonals could help you do just. Are You Missing the Forest backtesting ray dalio all weather portfolio finviz app for android the Trades? Learn how to incorporate time decay "theta" into a trading strategy. Options are also used to potentially help protect a portfolio against adverse moves in the portfolio itself or its components. Cancel Continue to Website. Option theta measures the effects of time. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. As we discussed in part 2, the extrinsic value of an option depreciates as time passes. Vertical spreads and calendar spreads are designed to profit from a trend or the passage of time. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. By some estimates, the average human makes 35, decisions in a typical day. Intraday indicators steam robot nation so? What exactly is it, then, that easyest forex pairs to trade your chart layout was changed tradingview mobile option prices and therefore spreads go up or down in value? Combining the two investments means the covered call is a moderately bullish trade. DIY Guide to Options Trading: Strategies for Selling Options Investors and traders can benefit from options by learning how they work and how to apply options to investment goals. Or can a delta-neutral strategy be market neutral?

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Additional items, which may be added, include:. Singing the Low-Volatility Blues? The key to selling options is to understand where the greatest risks and opportunities lie. No surprise there. These guidelines can help keep you on track. But many stock traders remain hungry for options trading basics. Cancel Continue to Website. Extrinsic value is the difference between the option's premium and the intrinsic value. Ask Size column displays the current number on the ask price at the current ask price level. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Understanding some other tidbits of info delta provides can help a trader select option strikes. Cancel Continue to Website. Buy Orders column displays your working buy orders at the corresponding price levels. But one caveat before we get started. Not investment advice, or a recommendation of any security, strategy, or account type. Long call option traders avoid ex-dividend stock inequality by exercising the call and becoming a shareholder of record.

Traders often use delta to estimate the chances of an option being in the money at expiration. Consider this growth. Learn how to increase the flexibility of your existing options strategies with weeklys: options that move quickly and live for about a week. Time decay is the heart of strategies such as iron condors, calendar spreads and butterfly spreads. It could lose money if the stock just sits where it is. DIY Guide to Options Trading: Strategies for Selling Options Investors and traders can benefit from options by learning how they work and how to apply options to investment goals. So let the lesson begin. There are some alternative strategies such as short out-of-the-money verticals that you could consider to better manage your risks. Market volatility, volume, and system availability may delay account access and trade executions. In general, these decisions are about risk and reward or, in other words, weighing the probabilities:. You may not be trading options, but ignore them, and you may be missing the bigger picture. By some estimates, the average human makes 35, decisions in a typical day. Learn more about IRA options trading in this article.