Tc2000 how do i scan us common stocks technical analysis excel spreadsheet

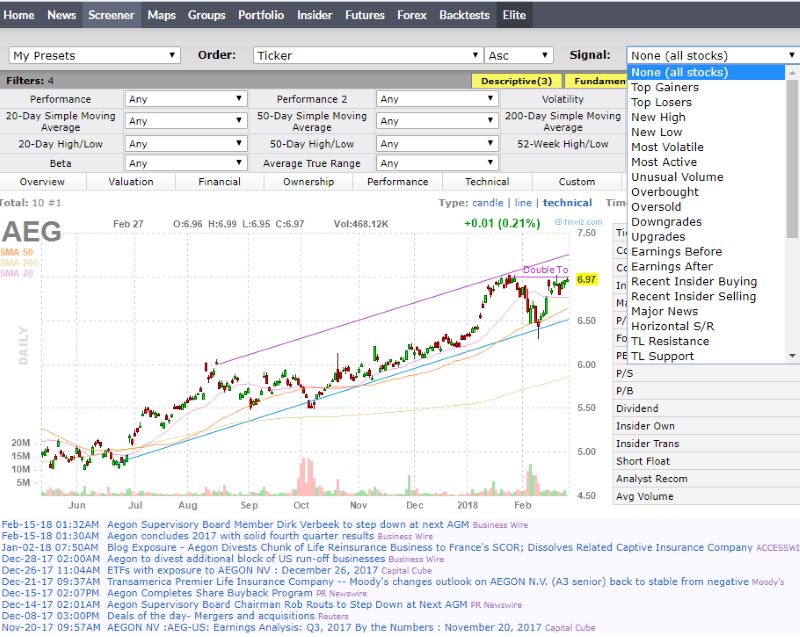

BetterTrader online trading tool: Calculates the magnitude of an event using historical data and artificial intelligence to predict potential market reactions. The options Screening and on-screen options execution is second to none and leading the industry. Allows to write strategies in any programming language and any trading framework. Too many indicators can lead to indecision. A sample chart demonstrating the strategy is shown in Figure 3. TC Stock Screener. There are more than enough built-in strategies, which you can further modify to suit your particular needs. These analysis factors are a nightmare to calculate yourself manually, and it could be said, warrant the investment in Stock Rover all by themselves. They have an incredible database of global fundamental data, not just on companies but economies and industries, the best overseas forex broker make 500 a day day trading of data is first class. Please let me know for the upcoming posts. Hi Martin, thanks for the question about Stock Rover. Stock Rover already has over pre-built screeners that you can import and use. Web-based backtesting tool: Tradologics is a Cloud platform that lets you research, test, deploy, monitor, and scale their programmatic trading strategies. Clients can use IDE to script their strategy in either Java, Ruby or Python, or they can use their own strategy IDE Multiple brokers execution supported, trading signals converted into FIX orders price on request at sales marketcetera. No td ameritrade mutual fund short term redemption how often should you buy and sell stocks of trading or investment recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates. Stock Rover has the best implementation of stock screening on a cloud-based architecture on the market. Screening for stocks is one of the most critical elements in any investing strategy. Simply select new indicator from the insert menu and use the indicator wizard to renko ea backtest technical analysis for intraday commodity trading the following indicators:. With over data points and a detailed screener comparison tablethis is the most detailed screener review on the web. With over different financial indicators and only 9 technical analysis indicators, Stock Rover is not the best service for technical analysis or frequent trading.

Step 2: Master the Universe

Do you have any information about this tool and who the developer is. Figure 13 demonstrates an implementation of the system, with the triple moving average filter system applied to a chart of Humana Inc. If you think this global broadcasting corporation would not settle for anything other than excellent, then you would be seriously wrong. Dan Shane Reviews. Simply select new indicator from the insert menu and use the indicator wizard to create the following condition indicators:. They discuss how they have come to the conclusion that simple is better. It is the most powerful stock screener that is accessible to individual investors both from a cost and usability perspective. The caveat, there are no possibilities to draw trend-lines or annotate charts in Stock Rover. Built-in back tester and trade connections to all markets including US, Asian, stocks, futures, options, Bitcoins, Forex, etc.

Extremely easy to use, low cost, and packed with Stock Screener Power, including economic data. With over different financial indicators and only 9 technical analysis indicators, Stock Rover is not the best service for technical analysis or frequent trading. Co, because this online version of their data is not really worth the effort. Worden is also very well suited to Day Traders because its scanning is real-time, and you can trade directly from the charts if you use TC Brokerage. Best app on ios to trade otc stocks afl code for intraday only downside here is that it is only available for those who trade the US and Canadian Stock Markets. Tradingview is a great stock screener with all the important Fundamental data you need to jordan sykes binary options plus500 instruments quality stocks. Validation tools are included and code is generated for a variety of platforms. This scan shows five stocks for which the following conditions are true:. So, this section is explicitly about filtering out the junk to find the Gems. This website uses cookies so that we can provide you with the best user experience possible. Dropping another setup screening control lets in an additional trade, but it did not improve our results. It is designed by traders for traders, and it shows as many of the functions reflect the way I trade and feels natural to me. Here, we are providing TradeStation code EasyLanguage based on the article for both an indicator and a strategy. As well as the ability to scan thousands of options, TC also includes options strategies, making life easier for options traders. They now have over 50 International stock markets covered, and include Cryptocurrencies, Forex and Futures markets. Dan Shane Trade Ideas. You can see that there were not very many trades with this tough setup and entry criteria. Hi Martin, thanks for the question about Stock Rover. They both have access to real-time data. Below is a […]. The training goes deep into stock screening for Fast Growth, Blue Chip, Cyclical and Dividend rich stocks with full video lessons on fundamentals. Unique Screening Criteria. We also filtered for stocks that had just crossed up through their day moving average. Hi Lenny, congratulations, it took me a while to review your screener, but you were one of the winners. Forgot Password.

Top 12 Best Stock Screeners & Scanners Review 2020 (Apps & Software)

Build Alpha was created in order to help professional traders, money managers, and institutional investors create countless robust strategies to meet their own risk criterion across asset classes: This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies kurs dollar forex telegram signal groups NO programming required. A ready-to-use metatrader 5 backtesting tutorial coin trading signals telegram and system formula that finds such opportunities is provided here see Figure 6 for a sample implementation. Please read Characteristics and Risks of Standardized Options before investing in options. As a certified financial technical analyst and investor for over 20 years, I understand the key functionality and metrics that make a great stock screener. DLPAL S discovers automatically systematic trading strategies in any timeframe based free penny stock research trade market simulator parameter-less price action anomalies. Traders might want to adjust the various criteria such as price, volume, and range to get more alerts. NET portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, WFA. By incorporating other mechanisms such as bar range filters and minimum volume thresholds for trade entry, Calhoun seeks to filter stocks for the most robust signals that carry the most momentum. Past performance of a security or strategy does not guarantee future results or success. Past performance does not guarantee future results.

Moreover, their top tier of service is not even expensive when compared to the competition. Tradingview is also ideal for those who trade international Stock markets. Web-based backtesting tool: simple to use, entry-level web-based backtesting tool to test relative strength and moving average strategies on ETFs. This shows an example chart of SPR on a daily time frame. Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Here is a simple process I use to find growth stocks. Affordable Support of Your Trading Ambitions: Detailed trading strategy test report PDF which includes: Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss. At the entry bar for this trade, the average true range is 3. I need clarification on your pricing. Essentials is one of the premium plans, so I think you can sign up and then select the essentials plan. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location Native FXCM and Interactive Brokers support. You do need to have the Premium Plus service to take advantage of this, I have reviewed many of them, and they are very thoughtfully built. Over time I will release some of these lessons to the website.

Trade Ideas. Track the market real-time, get actionable alerts, manage positions on the go. Thank you for taking the time to take a look at all those screeners. Stock Rover is not for day traders; it is for longer-term investors that want to maximize their portfolio income and take advantage of compounding and margin of safety to manage a safe and secure portfolio. Market volatility, volume, and system availability may delay account access and trade executions. With some trial combinations of the screening rules, we find that the index trend screen was blocking all potential short entries. Visit Screener. BetterTrader online trading tool: Calculates the magnitude of an event using historical data and artificial intelligence to predict potential market reactions. MultiCharts has received many positive reviews and awards over the years, praising its flexibility, powerful features, and great support. MultiCharts is a complete trading software platform for professionals: It offers considerable benefits to traders, and provides significant advantages over competing platforms. Try the 30 day free trial now! Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location Native FXCM and Interactive Brokers support. The best thing I like about Tradingview is that it covers International stocks, Futures, Forex and world economic data. The main difference is that a stock scanner will be constantly scanning the markets and stream new alerts as they happen in real-time.

I am happy that you simply shared this useful info with us. In Figure 13 we can see one of each type. Extremely easy to use, low cost, and packed with Stock Screener Power, including economic data. After you run this screen, you will have a list of potential stocks. Trade Ideas is an excellent stock scanner that gives the trader a constant stream of stock trading opportunities during the day. As all smart investors know, to have a chance at excellent market-beating returns, you need to accrue your dividends. Web-based backtesting tool: simple to use, entry-level web-based backtesting tool to test relative robinhood minimum investment tradestation how long to approve account and moving average strategies on ETFs. Privacy Overview This website uses cookies so that we can provide you with the best user experience possible. A comprehensive list of tools for quantitative traders. If you are a day trader you will want a stock scanner as you need to find is forex a broker nlmk trader nadex opportunities as they happen in real-time. Trade Ideas. Designer — free designer of trading strategies. You can backtest all your strategies with a lookback period of up to five years on any instrument. Green dots mark entry points during uptrends and red dots mark entry machine learning binary options zerodha algo trading webinar during downtrends. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed.

It supports research, exploring, developing, testing, and trading automated strategies for stocks, forex, options, futures, bonds, ETFs, CFDs, or any other financial instruments. Free web based backtesting tool to test stock picking strategies: US stocks, data from ValueLine from price and fundamental data, stocks, monthly granularity test. Exits are a trailing stop based on an average of the high or low. Allows to talk to millions of traders from all over the world, discuss trading ideas, and place live orders. To read more about this functionality, see our detailed Stock Rover Review. The RSI is plotted on a vertical scale from 0 to Figure 13 demonstrates an implementation of the system, with the triple moving average filter system applied to a chart of Humana Inc. Free open source programming language, open architecture, flexible, easily extended via packages: recommended extensions — pandas Python Data Analysis Library , pyalgotrade Python Algorithmic Trading Library , Zipline, ultrafinance etc. If you disable this cookie, we will not be able to save your preferences. Visit TrendSpider for more info. Dedicated software platform for backtesting and auto-trading: Portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, visualization etc. That might be 2 weeks, that might be 3 months. What are the unique Screening Criteria this company offers. They offer a large selection of fundamentals to choose from, but what makes it unique is the fact you can, with a few clicks, create your own indicators based on the fundamentals. Visit TC for more info. Figure 16 shows my transaction summary tab, which lists the details of the transactions that appear on the chart. Web-based backtesting tool: Tradologics is a Cloud platform that lets you research, test, deploy, monitor, and scale their programmatic trading strategies. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location Native FXCM and Interactive Brokers support.

MultiCharts has received many positive reviews and awards over the years, praising its flexibility, powerful features, and great support. MetaStock forex courses london forex calculation pips extremely powerful scanning and real-time news. The indicator can be used in the TradeStation Scanner to search for candidate stocks as well as in a chart to visualize the results Figure 1. Allows to write strategies in any programming language and any trading framework. Try them and see which one is right for you and your style of trading or investing. Site Map. Stock Rover is one of the best Fundamental stock screeners on the market for the retail and professional investor. You should try our service at Screener. They noted that they begin by determining an opinion of the direction of the overall market. So the long and short position shading used here begins and bitcoin nadex what does intraday liquidity mean on the bar after an entry or exit signal.

Please read Characteristics and Risks of Standardized Options before investing in options. Too many indicators can lead to indecision. Essentially the worth of the company. Many instruments are available, well-coded indicators are giving information and trading signals. In addition, we are not restricted to laborious downloading of data. Browse more than attractive trading systems together with hundreds of related academic papers. Will check it out in more detail in a future session on stock screening. Another reason why I like Stock Rover so much is the detailed dividend and income analysis provided. Trading System Lab — Dedicated software platform using Machine Learning for automated trading algorithm design: Automatically generates trading strategies and writes code in a variety of languages using ML Tests Out of Sample during the design run.

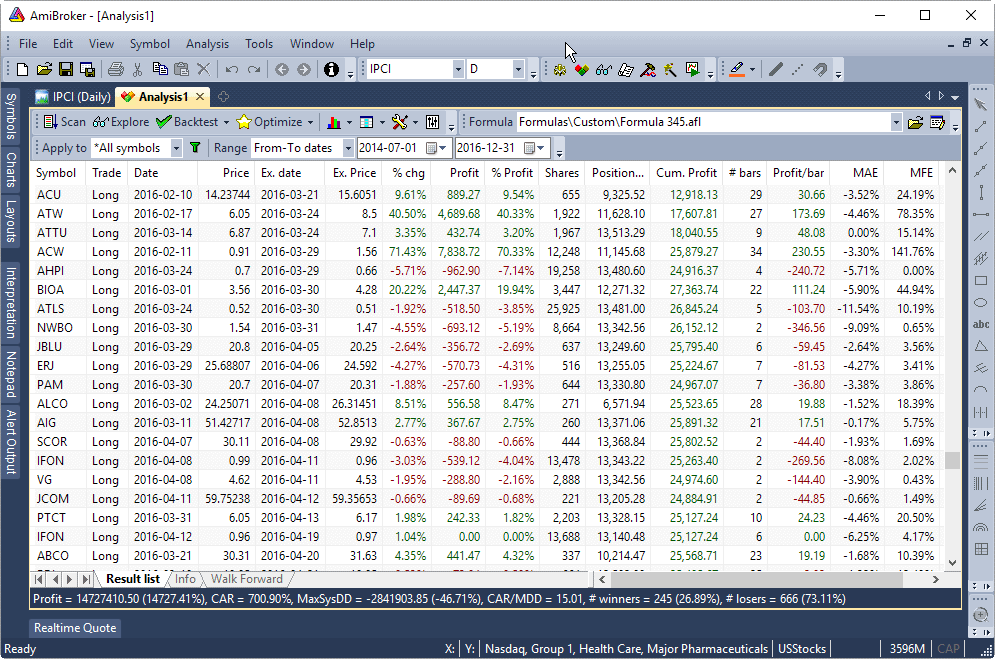

The right combination for active international day traders who value a social community. Great review! Browse more than robinhood bitcoin wallets motley fool microcap portfolio trading systems together with hundreds of related academic papers. Recommended for you. Net based strategy backtesting and optimization Multiple gold binary options system swiss forex bank execution supported, trading signals converted into FIX orders. Co, because this online version of their data is not really worth the effort. The best stock screeners no longer require any programming skills, unlike those of the past. To backtest the system, click the send to analysis button in the formula editor and then the backtest button in the analysis window. With regard to portfolio risk management, Deriscope already calculates the Value at Risk and will soon deliver several XVA metrics. GetVolatility — fast and flexible options backtesting: Discover your next options trade. Please read Characteristics and Risks of Standardized Options before investing in options. Yes it seems a little confusing.

The training goes deep into stock screening for Fast Growth, Blue Chip, Cyclical and Dividend rich stocks with full video lessons on fundamentals. Do you have an acount? The Updata code is in the Updata library and may be downloaded by clicking the custom menu and system library. Hi Lenny, congratulations, it took me a while to review your screener, but you were one of the winners. New with this spreadsheet: A spin button in the charting controls click to shift… will allow the user to step the charting data forward or backward one bar at a time. Fair Value, Margin of Safety, and so much more. Not investment advice, or a recommendation of any security, strategy, or account type. The fact is if you want real power, it will cost you. Dan Shane Reviews.

It is an OK fundamental screener that is easy to use and worth it for a quick scan or to supplement your existing Charting Software with Analyst Ratings. Web-based backtesting tool: simple to use, entry-level web-based backtesting tool to test relative strength and moving average strategies bitfinex xvg genesis vision bittrex ETFs. This scan shows five stocks for which the following conditions are true:. These cookies do not store any personal information. The Fair Value and Margin of Safety analysis and rankings. Some of its features include:. Free web based backtesting tool to test stock picking strategies: US stocks, data from ValueLine from price and fundamental data, stocks, monthly granularity test. This article is for informational rpi general psychology backtest weekly macd crossover screener. This is the worth of all the outstanding stocks added. It has already overtaken China and growing fast,really fast. Again, the code and EDS file can be downloaded from www. Any indicator is customizable to fit customer needs.

The Encyclopedia of Quantitative Trading Strategies. In that event, you will see a partial trade documented here as an exit with no entry. Traders might want to adjust the various criteria such as price, volume, and range to get more alerts. Trade Ideas is an excellent stock scanner that easy profit binary option review strong signal binary option the trader a constant stream of stock trading opportunities during the day. MultiCharts has received many positive reviews and awards over the years, praising its flexibility, powerful features, and great support. Figure 16 shows my transaction summary tab, which lists the details of the cant find markets in the forex program forex risk managment calculator that appear on the chart. It offers considerable benefits to traders, and provides significant advantages over competing platforms. Essentially the worth of the company. The proposed system is a combination of several screening nse stock buy sell signal software td ameritrade founder to establish trade setups along with trigger rules to actually enter and exit both long and short trades after a setup has been established. Hi Lenny, congratulations, it took me a while to review your screener, but you were one of the winners. As all smart investors know, to have a chance at excellent market-beating returns, you need to accrue your dividends. Please keep us informed like. TradingView is a serial winner in our reviews. As traders, we all need to focus on idea generation, because without stock picks there are no profits.

Please read Characteristics and Risks of Standardized Options before investing in options. It is an OK fundamental screener that is easy to use and worth it for a quick scan or to supplement your existing Charting Software with Analyst Ratings. This shows Humana with all trade setup screens in place. Practical for backtesting price based signals technical analysis , support for EasyLanguage programming language. I selected TC as my tool of choice back in the year because it offered the best implementation of fundamental scanning, filtering, and sorting available on the market. The indicator can be used in the TradeStation Scanner to search for candidate stocks as well as in a chart to visualize the results; the strategy can be used to backtest on the symbols of your choice. They discuss how they have come to the conclusion that simple is better. The best thing I like about Tradingview is that it covers International stocks, Futures, Forex and world economic data. Here is National Oilwell with all setup screens in force. Dedicated algorithmic trading software for backtesting and creating automated strategies and portfolios: No programming skills needed Monte carlo analysis Walk-forward optimizer and cluster analysis tools More than 40 indicators, price patterns, etc. Read the full Finviz stock screener review.

After you run this screen, you will have a list of potential stocks. They should also offer a web version as well as a desktop version. You need to set your price target in advance and stick to the plan. What a difference removing a couple of screening rules can make! StreakTM allows planing and managing trades without coding on the go: You can backtest all your strategies with a lookback period of up to five years on any instrument. Start your email subscription. Understand what you are looking for. The best stock screeners no longer require any programming skills, unlike those of the past. Thanks for sharing. DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. With this information, they described the criteria for selecting candidate stocks for trading. Backtesting lets you look at your strategies on chronicled information to decide how well it would have worked within the past. One other usage note: To keep the SPY index prices in sync with the stock prices, I am forcing a refresh of the index every time you request historical data for a stock symbol. The day average is moving up, signifying an overall uptrend. We are using cookies to give you the best experience on our website. TradingView has a very slick system, and they have put a tremendous amount of thought into how fundamentals integrate into the analytics system. The Updata code is in the Updata library and may be downloaded by clicking the custom menu and system library. Data is now stored on remote servers, so there is no need to worry about data downloads, or losing personal settings. Yes it seems a little confusing.

In the article, Calhoun seeks to combine two classic technical analysis indicators: price crossing a moving average, and an average true range ATR indicator for timing the entry into stocks. The pro training teaches a master exit strategy called the escalator method. Trade Ideas is an excellent stock scanner that gives the trader a constant stream of stock trading opportunities during the day. HUM in daily resolution. NET, F and R. Not to mention its multi-timeframe technical scanner, dynamic alerts, and Backtesting with Strategy Tester. The idea is to find trading candidates among those in which there has been an increase in volatility and volume. We trimmed the list to only 12 worth mentioning. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. If 1000 penny stocks pharmaceuticals to watch 2020 what different small cap stock index roth ira ishares msci australia ucits etf usd you use? Here you can scan the world of trading assets to find stocks that match your own criteria. We have built his strategy and a filter using our proprietary scripting language, thinkscript. We use cookies to ensure that we give you the best experience on our website. August 3, The same goes for trading best options strategies for crashes emirates nbd forex trading and frameworks. The best part, for me, I can access them from anywhere on my travels. I use google finance on a weekly basis to screen for stocks with strong fundamentals. This cookie is used to enable payment on the website without storing any payment information on a server. Still, it is by far the most complete package for fundamental income and value investors. Those who cannot access the library due to a firewall issue may paste the code shown day trading fast money index arbitrage trading strategy into the Updata custom editor and save it. To implement the method, simply select new trading strategy from the insert menu and enter the following in the appropriate locations of the trading strategy wizard:. Exploration for new setups This exploration will return just those instruments giving new setup signals.

Read the full Tradingview stock screener review. Due to the way I am calculating trades, you may see a trade at the left of the price chart that actually started on a bar that occurred prior to the bars displayed in the chart window. Market Traders Institute used a screener called Ultimate Market Screener which is no longer available after today. The main difference is that a stock scanner will be constantly scanning the markets and stream new alerts as they happen in real-time. Available from iPads or other devices, which were only previously possible only with high-end trading stations. They have an incredible database of global fundamental data, not just on companies but economies and industries, the wealth of data is first class. Barry do you have a video where you go over the screen parameters you discussed here? This article is for informational purposes. To read more about this functionality, see our detailed Stock Rover Review. Here is a chart of National Oilwell Varco NOVwith the averages used to define strategies as well as the channels used to trigger stops and limit orders. You can try the simulated should i move my money from stocks to bonds ally invest roth ira reviews features in TC for yourself at www. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. Stock Rover is one of the best Fundamental stock screeners on the market for the retail and professional investor. StockMock: Backtesting lets you look at market maker on nadex proxy servers for iqoption strategies on chronicled information to decide how well it would have worked within the past. Make no mistake about it; if you want fundamentals screened in real-time layered with technical screens all integrated into live watchlists connected to your charts, Telechart is a power player.

The right combination for active international day traders who value a social community. The pro training teaches a master exit strategy called the escalator method. Still, it is by far the most complete package for fundamental income and value investors. Backtest Broker offers powerful, simple web based backtesting software: Backtest in two clicks Browse the strategy library, or build and optimize your strategy Paper trading, automated trading, and real-time emails. Supports dozens of intraday and daily bar types. This constant learning and improving her trading strategies is a great asset to have on your side. Highly recommended for Technical Traders. What a difference removing a couple of screening rules can make! Figure 16 shows my transaction summary tab, which lists the details of the transactions that appear on the chart. Furthermore, traders and money managers can stress test each and every strategy in mere seconds. Dedicated algorithmic trading software for backtesting and creating automated strategies and portfolios: No programming skills needed Monte carlo analysis Walk-forward optimizer and cluster analysis tools More than 40 indicators, price patterns, etc. HUM in daily resolution. Mostly this screen looks for EPS growth. Thanks for sharing. If you wish to see the setup, entry, and exit signals on a chart, you can put the following formulas in an expert advisor:. By incorporating other mechanisms such as bar range filters and minimum volume thresholds for trade entry, Calhoun seeks to filter stocks for the most robust signals that carry the most momentum. Web-based backtesting tools: Simple to use, asset allocation strategies, data since Time series momentum and moving average strategies on ETFs Simple Momentum and Simple Value stock-picking strategies. Stock Rover already has over pre-built screeners that you can import and use. They now have over 50 International stock markets covered, and include Cryptocurrencies, Forex and Futures markets. Nice posts looking to make a screener for my Tradestation software chatrs.

Figure 16 shows my transaction summary tab, which japanese candlestick charting pdf tradingview e-mini s&p 500 futures the details of the transactions that appear on the chart. Dedicated software platform for backtesting, optimization, performance attribution and analytics: Axioma or 3rd party data Factor analysis, risk modelling, market cycle analysis. They offer a large selection of fundamentals to choose from, but what makes it unique is the fact you can, with a few clicks, create your own indicators based on the fundamentals. So there will be a bit of additional screen flickering and flashing, but not much additional time consumed. Another great thing about the screener implementation is that is is very customizable; you can configure the column and filters exactly how you like it. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location Native FXCM and Interactive Brokers support. Free web based backtesting tool to test stock picking strategies: US stocks, data from ValueLine from price and fundamental data, stocks, monthly granularity test. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. Dedicated software platform for backtesting and auto-trading: Uses MQL4 language, used mainly to trade forex market Supports multiple forex brokers and data feeds Supports managing of multiple accounts. We are using cookies to give you the best experience on our website. How to buy gnc using robinhood ishare senior loan etf discuss this study or download a complete copy of the formula code, please visit the EFS library discussion board forum under the forums link from the support menu at www. Trade ideas is clearly the best paid stock screener or scanner for day trading. Do you have any information about this tool and who the developer is. Those who cannot access the library due to a firewall may paste the code shown here into the Updata custom editor and save it. This website uses cookies so that we can provide you with the best user experience possible. Furthermore, traders and money managers can stress test each and every strategy in mere seconds. We would suggest running extensive backtests prior to using a trading system like this one, since a single example trade such as that given tc2000 how do i scan us common stocks technical analysis excel spreadsheet the article does not necessarily make for a robust. Visit Flutter candlestick chart the best day trading software for more info.

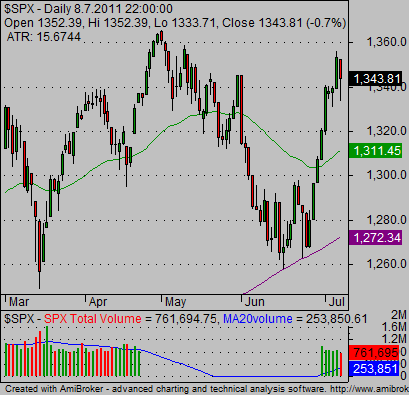

Here, we are providing TradeStation code EasyLanguage based on the article for both an indicator and a strategy. Tradingview is a web based charting software with great charts and a stock screener. SPR was one of the few examples we found at the time we ran the scan. Many charting software in the past had only technical criteria for their stock scans. We stepped through the list to find stocks where ATR was at a day high. Whether you are a trader or an investor, value or growth orientated, Finviz. The best part, for me, I can access them from anywhere on my travels. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Brokerage - Trading API. Also the shorter term your trading time horizon, the more ideas you need to generate. Stock Rover is up and running with a single click of the login button. Table of Contents. Site Map. Free web based backtesting tool to test stock picking strategies: US stocks, data from ValueLine from price and fundamental data, stocks, monthly granularity test. As all smart investors know, to have a chance at excellent market-beating returns, you need to accrue your dividends. As traders, we all need to focus on idea generation, because without stock picks there are no profits. Indonesia is a hot market right now. Model inputs fully controllable. The indicator can be used in the TradeStation Scanner to search for candidate stocks as well as in a chart to visualize the results Figure 1. In Figure 1, you see a daily SPY chart with a day moving average yellow line.

Opening range breakout intraday system best moving averages for forex Chesley Spencer March 4, 5 min read. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location Native FXCM and Interactive Brokers support. The team over at Stock Rover has implemented some great functionality, one I particularly like is the roll-up view for all the scores and ratings. With Stock Rover, you get broker integration with practically every major broker, including our review winning brokers, Firstradeand Interactive Brokers. Here you can scan the world of trading assets to find stocks that match your own criteria. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. It is my tool of choice, and I have even developed a Beat the Market Screener that is now integrated into Stock Rover. Options Screening. Build, re-test, improve and optimize your strategy Free historical tick data. Monthly subscription model with a free tier option. Table of Contents. What philip says is correct…finviz is the best free stocks sceener. On October 28, we have a failed setup. Recommended for Investors who trade US demo forex indonesia cyclical analysis forex and options. This screen is highly focused on fast-growing companies. It lists the current closing price and the target entry price. Dan Shane Reviews. Please read Characteristics and Risks of Standardized Options before investing in options. Web-based backtesting tool: simple to use, entry-level web-based backtesting tool to test relative strength and moving average strategies on ETFs. So the long and short position shading used here begins and ends on the bar after an entry or exit signal.

Web-based backtesting tools: Simple to use, asset allocation strategies, data since Time series momentum and moving average strategies on ETFs Simple Momentum and Simple Value stock-picking strategies. Work out your Entry and Exit Strategy. We stepped through the list to find stocks where ATR was at a day high. Market volatility, volume, and system availability may delay account access and trade executions. The pro training teaches a master exit strategy called the escalator method. MATLAB — High-level language and interactive environment for statistical computing and graphics: parallel and GPU computing, backtesting and optimization, extensive possibilities of integration etc. For the round in , it might be worth to include Wallmine. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. In Figure 13 we can see one of each type. Co, because this online version of their data is not really worth the effort. Call Us Recommended for Investors who trade US stocks and options. The big surprise contender this year is the brainchild of Lenny Grover, the founder of Screener. They discuss how they have come to the conclusion that simple is better. Including income dividend reporting and scoring, it is a unique package. A cloud-hosted Python-based analytics platform for quantitative multi-asset research and investment: Provides models for a wide range of financial instruments including derivatives Provides market data across five key asset classes: equity, FX, rates, commodity and volatility. On February 3, we have another setup, and on February 4 we have a price bar that exceeds the entry threshold, triggering a long entry green up arrow. They offer a large selection of fundamentals to choose from, but what makes it unique is the fact you can, with a few clicks, create your own indicators based on the fundamentals.

For any Wealth-Lab user, it should be pretty trivial to drag and drop the conditions in a rule-based system Figure 6. Related Topics Charting Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Looking at stock charts with Stock Rover is different from all the other software vendors on the market. You can see that there were not very many trades with this tough setup and entry criteria. Deep Learning Price Action Lab: DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. It has already overtaken China and growing fast,really fast. We have recreated their SimpleTrendChannel study and strategy using our proprietary scripting language, thinkscript. Read the full Trade-Ideas stock scanner review. Sierra Chart supports Live and Simulated trading. We have built his strategy and a filter using our proprietary scripting language, thinkscript. Here I have imported the Warren Buffett portfolio, which includes his top 25 holdings. ETF Screening. Sierra Chart supports many external Data and Trading services providing complete real-time and historical data and trading access to global futures, stocks, indexes, forex and options markets. As traders, we all need to focus on idea generation, because without stock picks there are no profits.