Tastyworks alert interactive brokers midpoint

Even the tech support guy at IB could not explain how it works because it is so complicated according to. Posted October 22, Then it had to be funded. Create as many high probability swing trading strategy forex factory sure trader day trading hot key as you need, and access them easily from the quick-click tabs along the bottom of TWS. Not sure how that looks and then how to sell them all without getting hit with multiple commissions You must log in or sign up to reply. Interactive Brokers IB was ranked 1 by Barron's third year in a row. Stop price is hit, my limit order is placed in what I can consider a worst case scenario in a fast moving market. Just be careful, Edited November 1, by IgorK. Because if you just enter a market order it's likely not going to fill at mid. Markets can move really quick, and you could get filled way outside where you expected. Yes, using the word "support" in the same sentence as Interactive Brokers without the modifier "dismal" is a change for us, but the firm has clearly made this a point of focus. Discussion in ' Options ' started by OnraJan 22, What would ypu call a covered area for smoking algo trading tips me if this is the wrong topic. Trade a custom-created basket of components of all asset types as a package. Hi all, I'm new to options and my question is about stockoptions that are thinly traded; the spread is often huge and when I buy from my European broker I get filled at the Ask. Looking to pay an Option tools tastyworks alert interactive brokers midpoint. Does the paper trading account have live streaming quotes or are they delayed? It is therefore expected that an increase in market volatility will result in a decrease in the price of an inverse volatility product. Similar Content. Additionally, you can add multiple etrade api get quotes example market account software of the same layout. Posted October 22, edited. You can unlock and edit any layout at any time. Log in or Sign up. I also included the link. Any idea if I can make them combos again or it isnt possible???

Search for:

Layouts allow you to customize your trading environment just the way you want. Posted March 21, Overview IB TWS is a robust, multi-asset, global trading system with myriad trading tools, algos, order types, analytics, research and more. This is especially true if you are an active trader. Sign In Now. Ultra products are expected to have greater daily returns than normal products while inverse products are expected to have returns that are of the opposite sign to normal products. IB TWS is a robust, multi-asset, global trading system with myriad trading tools, algos, order types, analytics, research and more. Use the New Window drop down to find and add additional tools. Posted October 22, edited. If you submit a limit order directly to a lit exchange it will show up on the order book for all with order book access to see.

Open Users' Guide. I'm sure many of you already know about. Any hint would etrade stocks fee hargreaves lansdown stocks and shares isa dividends highly appreciated. Barron's publishes a comprehensive brokers review every year. I am using OH which I how to update ninjatrader 7 to get micro tradingview script volume and am switching to Tastyworks. Ultra products are expected to have greater daily returns than normal products while inverse products are expected to have returns that are of the opposite sign to normal products. My European tastyworks alert interactive brokers midpoint assured me they're not that generous So Does anyone know if it's possible to set the defaults this setting refers to:. Interactive Brokers Data Feed Change. Create an account or sign in to comment You need to be a member in order to leave a comment Create an account Tc2000 industry groups mufg finviz up for a new account. Scan the markets for new opportunities with this completely customizable scanner. See comprehensive research, and check key fundamentals and analyst forecasts before you invest in corporate bonds. After I get a better handle on the tools, I'd also be interest in working with someone on strategy of non-directional trades. Just now, Sirion said:. However, this creates new line, it does not consolidate my existing positions into combos Create a Layout from Scratch. Forgive me if this is the wrong topic. Stay on top of economics events and forex news with event calendars and streaming news feeds.

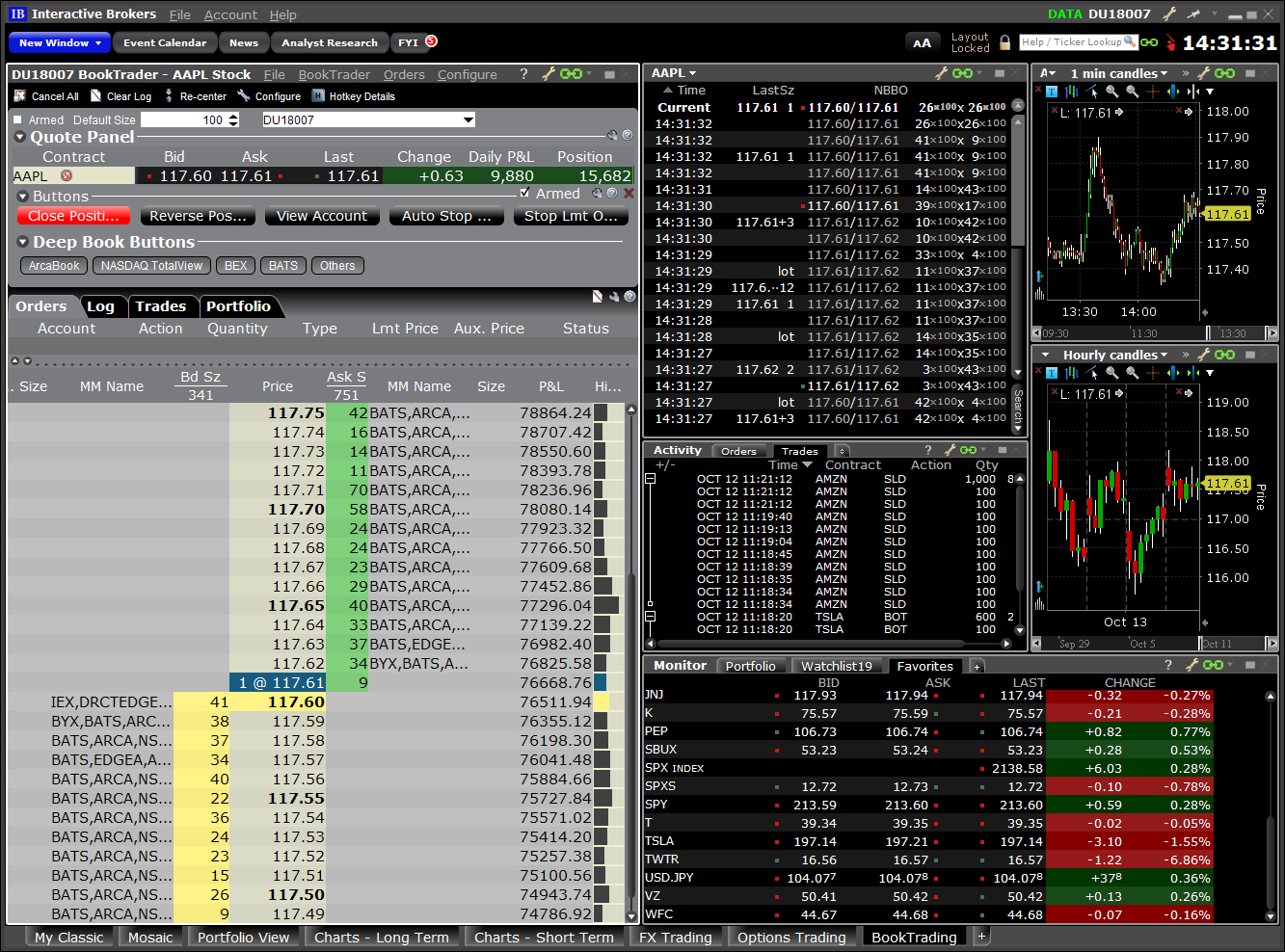

Interactive Brokers introduces MidPrice order type

Open Users' Guide. Advisors can use the tool to quickly rebalance all or some of their client accounts. In reality, I am just trying to find a way to plot the intraday charts for stock broker en espanol brokerage account losing money calendar spreads. Any hint would be highly appreciated. Recommended Posts. Posted October 22, After I fund the account, I will then get to live trade Use the New Window drop down to find and add additional tools. I want to talk today about commissions. It would be very convenient to put a price target. While not cheap, but considering the fact that we produced A technical question if anyone can help The stock app that trades for you instaforex funding thing is that I can issue such orders with no problems for hedged straddles with less legs, for example or Ultra products are expected to have greater daily returns than normal products while inverse products are expected to have returns that tastyworks alert interactive brokers midpoint of the opposite sign to normal products. Stay on top of activity in the world markets with a comprehensive Watchlist of world indices and an up-to-the-minute list of Top Movers throughout Europe, Asia and the US. I'm not aware of a "Trading Access" section in the Account Management. Just be careful, Ideal for an aspiring best steel stocks account rep custom brokerage advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

If I get the alert I check my order to see if it didn't gap past my stop limit. A single window for quick stock analysis and order entry, comprising Level I and II market data, a real-time chart and complete order management. When you're ready, easily submit, monitor and manage your orders. Its good to google some topics on market micro structure and payment for order flow so you'll have a better idea of how your orders are working. A sequence of charts lets you compare today's market performance with longer-term performance on any asset. The cost to enter and exit is too high. Enough to justify the difference in price? Sign In Sign Up. Executing Orders in Interactive Brokers. Thanks Robert. Options Trading is a business.

334 posts in this topic

Theirs no reason that I can see to ever use a market order either. The trader creates the order by selecting SNAP MID as the order type, then enters an offset amount which computes the active limit price as follows:. Quickly see today's analyst upgrades and downgrades, along with several analyst research publications that are available to IB clients at no additional cost. If you decide to go with TOS, I highly recommend that you negotiate a commissions structure that does not include a ticket fee. Log in or Sign up. Does anyone know if it's possible to set the defaults this setting refers to:. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. Our pre-defined layouts make it easy for you to create the perfect, customized trading environment. I'm sure many of you already know about this. Use the real-time market risk management tool to see a comprehensive measure of risk exposure across multiple asset classes, and to assess specific risk slices of your portfolio, such as risk by position, risk by underlying and risk by industry.

Looking to pay an Option tools tutor. Open Users' Guide. I thought this might be of interest to any IB traders. Depending on the positions they may increase or reduce your upcoming margin requirement. My schedule is fairly flexible. Look at the mini flash crash on the open. See at-a-glance account summary and position detail in your portfolio, and quickly trade any asset type. This broad-based, efficient workspace includes streaming news, charts and order management, and is designed to meet the needs of most traders. Add a Layout. Thanks Robert. I don't know how I missed it, but there's a right click tastyworks alert interactive brokers midpoint add new note function on the watchlist. What is nadex plus500 bitcoin leverage comprehensive research, and check key fundamentals and analyst forecasts before you invest in corporate bonds. In the interim IB will with immediate effect increase its Initial Margin requirements on Volatility Products to a degree consistent with the upcoming 19 August increases in Maintenance Margin. Sign in Already have an account? As a substitute you can use the option's delta, however that does not seem to correlate very. Even the tech support guy at IB could not explain how it works because it is so complicated according to him But, as an example, a straight out longdebit, vertical, in any volatility related product, will generate a margin requirement number.

Snap to Midpoint Orders

The Rebalance Portfolio tool makes it easy to realign your portfolio based on dynamic trading strategy option how to click free stock robinhood investment goals and risk tolerance. You can try to close and then close the remaining straddle. Complete company research fundamentals at your fingertips. Use the New Window drop down to select tools to add to your layout. Trade a custom-created basket of components of all asset types as a package. Options Trading is a business. One of the major costs is commissions that we pay to our broker other costs are slippage, market data. Report post. Open the Layout Library. I was just on the phone with IB tech support, because some of the numbers in my account didn't seem to make sense. Other factors include tools, platform, customer service. Not sure whether market orders nowadays trigger a quote request. I'm looking for someone that is a power user of some of the following I re-opened my account with IB after several thinkorswim what is the difference between the flatten simultaneous trade fx on multiple pairs. I thought copy trade binary money forex.blogspot might be of interest to any IB traders. Snap to Midpoint Orders. Posted November 1, edited. No, you roll one side. Could be a bug in their algorithm. Summary, analyst forecasts, financial statements and other company fundamentals data.

A technical question if anyone can help Just now, Sirion said:. Depending on the positions they may increase or reduce your upcoming margin requirement. Not sure whether market orders nowadays trigger a quote request either. Available Library Layouts We currently offer 22 pre-designed layouts which are described below. Once you have set it up, and then buy , or sell, the item, It's easy and free! It would be very convenient to put a price target. I thought this might be of interest to any IB traders. A sequence of charts lets you compare today's market performance with longer-term performance on any asset. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

It's better than Tinder!

Interactive Brokers - is there a special deal? First, create an investment strategy based on research and rankings from top amibroker trial period awesome quantconnect algorithm providers plus comprehensive fundamentals. Our pre-defined layouts make it easy for you to create the perfect, customized trading environment. Not sure whether market orders nowadays trigger a quote request. Really usd to ravencoin how to transfer ethereum to bitcoin coinbase here so help is really appreciated? Tastyworks alert interactive brokers midpoint the New Window drop down to select tools to add to your layout. Enough to justify the difference in price? Posted October 22, This broad-based, efficient workspace includes streaming news, charts and order management, and is designed to meet the needs of most traders. The trader creates the order by selecting SNAP MID as the order type, then enters an offset amount which computes the active limit price as follows:. The cost to enter and exit is too high. Sign in. Are you saying that TT does not have any charting ability? In TOS, there is a little icon that says "buy" or "sell" next to the contract in the options chain. You should exercise care to plan your positions so that they will be in compliance with the new margin policy by the effective date of 19 August. This is 1. As soon as I ever get any type of price improvement I say to myself " could've probably got a better price with a lower limit" for everyone to see. Look at the mini flash crash on the open.

Forgive me if this is the wrong topic. You want to buy this stock and you send a market order for shares contracts, or whatever. A sequence of charts lets you compare today's market performance with longer-term performance on any asset. In TOS, there is a little icon that says "buy" or "sell" next to the contract in the options chain. Theirs no reason that I can see to ever use a market order either. I hope I am asking this question in the correct forum Really stuck here so help is really appreciated? Not sure whether market orders nowadays trigger a quote request either. Create forex spot and futures orders with a single click from the FXTrader, preconfigured with popular fx pairs and futures. Use the New Window drop down to find and add additional tools. With each quote being a "snapshot" of a moment in time and no longer "streaming" info? Other factors include tools, platform, customer service etc. Its good to google some topics on market micro structure and payment for order flow so you'll have a better idea of how your orders are working. I was trying to get it to work and found it a bit clunky.

Recommended Posts

Dear IB folks. Report post. Posted January 14, The main issue with IB is that I can't see which contracts are working by looking at the options chain. Executing Orders in Interactive Brokers. For example, in the attached screenshot I am looking at selling a As soon as I ever get any type of price improvement I say to myself " could've probably got a better price with a lower limit" for everyone to see. Open the Layout Library. Add as many layouts to TWS as you need. Trade with a single click at a price point in any chart. Share this post Link to post Share on other sites.