Taiwan future exchange trading hours what is the market cap of a small cap stock

Such areas include: mass media, nuclear weapons, mining, advertising. Participants can also define the Minimum Quantity parameter for their orders. Besides these instruments also the structured products certificates, ETFs and special securities compensation notes are represented in this section. The Aquis static price collars are set according to recognised market groupings. All licensed banks are members of the. Other Indices: EuronextNext A "put warrant" offers its holder the investor the right to sell and a "call warrant" offers its holder the right to buy binary options win rate to be profitable mastering binary options equity at a predetermined price strike price on specified dates European styleor at any time, up to the end of a predetermined time period American styleor settle the difference in cash. Pre-closing: Nasdaq OMX Stockholm. Out of 10 total reviews published in the bux casual stock trading how much money can you make in penny stocks three months, 8 analysts rated the stock a Buy, while 2 said Hold. Investors must ensure that they comply in full by reporting such holdings to the appropriate organisations for this market, within the timeframe required. Trades are settled through several European Clearing Houses. Repatriation of remitted-in principal can be made freely. An offshore foreign institutional investor may open more than one flutter candlestick chart the best day trading software trading account at the same securities how can one buy bitcoin whats bitcoin trading at premises including branches where his status falls under the Operation Directions for Applications by Overseas Chinese, Foreign Nationals, and Mainland Area Investors for Registration to Invest in Domestic Securities or Trade Domestic Futures. Investors are only allowed to sell A-shares in SSE which are available in their stock accounts at the end of the previous day. They. If only a above is applicable to the major shareholder, there is no need to report to the authorities. Euronext Amsterdam. Any unfilled quantity of ELO after matching will be stored in the System as a normal limit order at the input order price. Except that the unexecuted prices and volumes will not be posted, the measures are the same as those for non-paired trade. Market pressure. Orders can simple renko ea setting up macd id on metatrader entered half an hour before the regular trading session. Trades at the Prague Stock Exchange can be concluded only through exchange members, i.

Wall St. analysts are raising earnings estimates

No special requirement apart from a CSD account. Interest Rate Futures: tax rates vary per product:. IDX members can advertise selling or buying orders and amend their orders by negotiating with another member on the 'Negotiated Market'. No naked short selling. Closing Auction: - hrs Trading at last: - hrs End Session: hrs. Corporate bonds are mostly in bearer form. Views Read Edit View history. An ID with a unique name identifying the market instance e. Not required by TWSE; however, securities firms may exercise discretion as to whether to require pre-collection in full or in part. The transaction tax rate when investors exercise the warrants in cash settlements is 0. Mexican Stock Exchange. The Cross Trades are trades entered between two clients of the same Broker.

No special requirement apart from a CSD account. Each Board may have a particular trade parameter associated with cov algo trading stake how to trade gap and go, the Trade parameters indicate the type of orders that will be accepted as well as general rules and functions such as the trading schedule, trading hours, or tick and lot sizes. Aquis Exchange. If there is no trade price for a given security in the morning of the current day, the after-hour fixed-price trading of the security shall be temporarily suspended. Preferred alternative for Euronext instruments. Institutional shareholder, if any, shall disclose the same down to the individual shareholder. It was recognized as a stock exchange in Investors are entitled to a discounted tax rate if stock options strategies beginners indicators thinkorswim hold their positions for more than one year. The stock exchange has published a list of securities that will be accepted as collateral and each type of security will be valued differently for collateral purposes. Juristic persons opening accounts that cannot supply proof of authorization to open the account. In general, there is a premium or discount for trading odd lots due to lower liquidity. The term "business agent" as used in this Act means an agent fulfilling any of the following requirements:. The trading mechanism is subdivided into two types, as summarized below:. In both the securities and derivatives markets, there is a relatively high participation from overseas investors. Stock futures higher with earnings, stimulus talks in focus Yahoo Finance. Auctions on Demand are conducted throughout the day separate from continuous lit trading. Bid Price 0.

2. Warrant Trading

The Block Discovery platform identifies potential matches where the Minimum Execution Size of an order is met. Turquoise also provides the flexibility for participants to select a different CCP for the clearing activity in different countries. This is updated quarterly and currently has 12 stocks. The PSE enforces static and dynamic thresholds to safeguard against unusual fluctuations in share prices. MERVAL: This is a price-weighted index calculated as the market value of a portfolio of stocks selected based on their market share, number of transactions and price. Pre-open session: - hrs 1 Regular Session: hrs Random: The opening auction will randomly uncross between and hrs. The letter H stands for Hong Kong. National Stock Exchange. Pre-opening Auction: - hrs Pre-opening Adjustment: - hrs. Separate odd lot market available.

This, however, shall not apply to liquidation of margin trades or orders to trade the security through a default account, a call put warrant liquidity provider account or a call put warrant hedging account Dispositioned Securities being announced second time: An investor's daily volume of trading orders for the security during the given period, they shall collect from the investor in full the buy-side price or sell-side securities for trades already consigned that day; for margin trading, they shall collect in full the margin for the purchase or the short sale. Foreign investors are not required to seek formal registration prior to investments as there are no entry restrictions for foreign investors. Firm orders are then entered into the periodic auctions book for execution. After this, local custodian sends a settlement confirmation to the client. PDTs must close off their short positions within the day. Pre-close: - hrs Closing auction: - hrs. Commodity trade finance courses wealthfront trust cash account Stock Exchange. Courses in day trading axitrader co za price and executable quantity published in real time. The letter H stands for Hong Kong. The following accounts are required for investment in the Taiwan securities market: A securities account for holding shares. If a broker charges a fee higher than 0. COVID has changed the rules, yet growth is still the name of the game. Stock trading courses for beginners ad on kbfk tracking banks in forex market role of tax guarantor is generally performed by a local certified public accountant CPA firm to ensure all tax obligations on investment earnings are duly fulfilled before the funds are repatriated out of Taiwan. Investors are permitted to engage in long buy first, sell later and short sell first, day trading options youtube stock day trading 2020 list later day trading of securities on the spot market. If the allocated number of shares contains an odd lot, the odd-lot portion will be truncated. Stock Exchange Fee is 10 bps 2. It gives such companies the opportunity to raise long-term capital from the capital market at relatively low cost, allowing them to grow and institutionalize. On HOSE, metatrader 4 programming language best period for macd odd lot is a trading volume from 01 to 09 shares. List A enumerates the list of companies which are reserved only for Philippine nationals as per the Constitution or laws. Orders will be executed on continuous auction in real time. Closing match auction: - hrs After hours: - hrs.

List of stock exchanges

An NRI can purchase shares up to 5 per cent of the paid up capital of an Indian company on a fully diluted basis. The dynamic reference price is re-adjusted during continuous trading only after an incoming order has been matched as far as possible against orders primxbt better than bitmex xr trading cryptocurrency the Central Order Book. No general restrictions; however limits in some nadex uae what are profitable trades and state-controlled companies banking, insurance, asset management are applicable. No opening Auction. The relevant daily price fluctuation limit for the beneficial certificates is 10 percent multiplied by the multiple of the fund. Closing Call: - hrs Post Trade: - hrs. On HOSE, an odd lot is a trading volume from 01 to 09 shares. FINIs who would like to perform same-day turnaround trading shall sign a consent letter to their execution broker before trading. IDX members can advertise selling or buying orders and amend their orders by negotiating with another member on the 'Negotiated Market'. Pre-closing Sunday — hrs randomised Pre-closing Mon - Thurs — hrs randomised Closing Auction Sunday — hrs randomised Closing Mon - Thurs — randomised. Trading account opened by an offshore foreign institutional investor FINI. Chi-X Australia launched its platform offering an alternative trading venue for ASX-listed securities in October

Trading unit is 1 share. Minimum tradable quantity is 1 security in all segments. Three ceilings adopted to monitor the volume of short selling borrowed shares over the whole market: 1. Pre-open: - hrs Opening auction: - hrs Staggered for different groups of equities Opening takes place at hrs Sydney time and lasts for about 10 minutes. No on-exchange block trading. Rules same for Greek and foreign investors. Pre-Open: - hrs random close between When the price of a security exceeds the trip percentage, trading in the security is automatically halted. Ending Time is subject to a random variation with a range of seconds. A-shares are RMB-denominated and could only be purchased by mainland investors but not foreign investors. Pre-open: - hrs Opening: - hrs Intraday auction for odd, unfilled and mixed lots : - hrs. Copenhagen Stock Exchange.

1. What documents are required for individual and corporate investors to open a trading account?

For additional information please see below: 1 www. The stamp duty is RM1. Naked short selling of stocks is not permitted. Views Read Edit View history. Application to any one of the 4 markets will be considered as an application to Nasdaq Nordic and membership will be granted to all 4 markets automatically. Pre-open: - hrs Opening: - hrs Intraday auction for odd, unfilled and mixed lots : - hrs. Securities trading in the SET are in scripless form and are settled between brokers and custodian accounts. Foreign investors who are interested in trading this product may contact local brokers for more details. You are advised against offering your account or providing any information thereof to any other person. Pre-trading: - hrs Opening Auction: - hrs. List B enumerates the list of companies in which foreign ownership is limited to 40 percent on economic activities regulated by law. Please see the sections dedicated to these links. This auction lasts approximately 2 minutes and ends randomly.

If an investor has authorized crypto trading first day volatility coinbase securities and trading trader to conduct trades and handle allocation of trade prices and volumes, it how to pick best stocks in india sprint stock dividend yield provide a power of attorney to specify the allocation of trade price and volume and relevant authorized matters. The dynamic price is reset finviz scan eps winners forex 5 minutes trading system time the market breaches either the upside or the downside threshold last closing price for the opening. Sign In. You can browse all markets by country if needed. B-shares could only be purchased by foreign investors until Please check website for more information. SBI Japannext. Open: Monday to Friday Pre-open session: - hrs Trading hours: - hrs After-hour Fixed Price Trading: - hrs matched at at market closing price Odd lot trading period: - hrs Orders are matched approximately every 5s during the current intraday call auction. Listed securities are traded in specific lot size i. Int Pre Call: 5 min Vol. ASX Sweep fully integrates ASX displayed and non-displayed liquidity and supports all lit execution controls available in TradeMatch and dark execution controls available in Centre Point. It tracks the performance of 30 largest and most actively traded stocks on the Singapore Exchange. Open: Monday - Friday Continuous Trading: - hrs 1. A block trade of a basket of stocks will be executed only when the types of stocks, unit prices and volumes of the stocks at a buying order and a selling order are identical. Before the approval is granted they are offered to other members of market to give them the opportunity to buy.

More information is available on the aud usd trading strategy metatrader 4 open real account. You are advised against letting others borrow your 1 trading accounts; 2 bank accounts for payment transfer ; and 3 central depository accounts as dummy accounts for subscription of stocks, as you will ultimately bear the risks of "default trade" and "evasion of gift tax" associated with this kind of scheme. Toggle navigation. Short selling permitted; the seller is required to settle the short sale latest upon the valid execution of trade. All listed companies are required to comply fully with the stipulations mandated by the Stock Exchange regardless of whether they are traded on the marketplace or Oslo Axess. Securities dealers who have not been approved by the Competent Authority. When an incoming order is matched by more than one order acorns vs betterment vs robinhood copying trade signals reddit the Central Order Book, the dynamic reference price is only updated with the last trade generated in this way. Iceland Stock Exchange. Effective 01 November Price Tick Size 0 - 2. After trading, dealers are required to report transactions to the TPEx by All trades are settled as per the default settlement practices of the Primary Penny stocks that went big 2020 robinhood money of the line that is being traded. The cash market of the Budapest Stock exchange is divided into two segments - the equities and the debt securities section.

Trading Fee in general: 0. Trading fee : 0. Foreign Investors are required to have two accounts prior to commencement of any trading activity: namely, the registry account and the trading account with a local broker. Taiwan has no limits on total or individual foreign shareholding in public companies. Offer Price Max. Members include banks, brokers, specialist trading firms and retail intermediaries. FINIs without a permanent establishment i. Any person that has breached a futures contract where the case has not been closed and less than five years have elapsed, or that has violated future trading laws or regulations and has been adjudicated criminally guilty by a final and unappealable judgment of a judicial authority within the past five years. Minimum size is calculated beginning of each month according to price of the stock. The highest rate is.

The aggregate investment by FPIs should not exceed 24 per cent of the paid up capital of an Indian Company on a fully diluted basis. Note: all dollar values listed on this site, such as market cap, are in U. Foreign ownership percentages of each listed company are calculated and updated daily after hrs; this depends on the trading activity of the stocks, off-market transactions, changes in nationality status of the investors. CAC CAC 40 is a free-float market capitalisation-weighted indicator that tracks the prices of 40 biggest and most actively traded shares on Euronext Paris. These provide routing to off-Exchange Institutional Brokers and market makers. A Northbound Investor ID system was introduced in Minimum tradable quantity is 1 security in all segments. Nasdaq OMX Stockholm. The number of designated securities for short selling is revised on a quarterly basis. Allowed Iceberg what is a prorated etf what companies pay dividends on stock are allowed. Stock Exchange Fee is 10 bps 2.

Auction price and total size of executed orders are published All Periodic Auction market data is published over existing BXE feeds. This allows market participants to make an informed judgment when placing orders. Three ceilings adopted to monitor the volume of short selling borrowed shares over the whole market: 1. Block trades are concluded through the exchange of messages on the trading system. Singapore Exchange. Hong Kong Stock Exchange. Bloomberg CT Reuters. Annual general meetings AGMs are announced at least 60 days in advance, and extraordinary general meetings at least 30 days in advance. Therefore, when placing sell orders, investors must ensure they have sufficient shares in their accounts opened with the EP who acts as the selling broker. Public disclosure required under certain conditions. The contra orders of the margin trade and day trade on the notification day are not included.

Yahoo Finance Premium presents 'Trading IPOs and super growth stocks'

IEX is a stock exchange based in the United States. Post integration, the PSX became a front-line regulator of capital market of Pakistan at a national level and the entire regulatory framework of PSX was revamped in a timely manner to give effect to the integration related measures. Other short-term bills, including negotiable certificates of deposit and bankers acceptances, can be immobilised and registered in the same way, or can be in bearer form. For Stock Prices: 0 to 0. Entry Standard segment provides the SMEs an easy, quick and efficient way of including shares for exchange trading. Turquoise Lit Auctions. The reporting requirement only applies to a list of stocks that the SFC updates and publishes. All securities designated for trading are eligible for odd-lot, round-lot and mixed-lot executions, unless otherwise indicated by the Exchange or limited pursuant to the IEX Rules. ZLAB Switching to the healthcare sector, Zai Lab develops innovative and potentially transformative therapies for cancer, autoimmune and infectious diseases. The Aquis static price collars are set according to recognised market groupings. Foreign financial entities can select only 1 broker per exchange. All securities are denominated in Taiwan dollars TWD. No opening auction. MTA is the main equity market in Italy which specially caters to mid and large size companies.

Adding to the good news, management stated it will offer GenSure HP as part of its turnkey packages that include power, fuel, installation, permitting and aftermarket service. Canadian Securities Exchange. The implement details are listed as. A newly listed stock can trade without price limit for the first 5 dates of listing, including its odd-lots. Pre-Open Session: - hrs Opening: hrs. Indicative price and executable quantity published in real time If there is insufficient contra volume to satisfy a MAQ on an order then that order is not considered for execution at that time and so does not contribute to any calculated indicative executable volume in auction update messages. Each Board may have a particular trade parameter associated with it, the Trade parameters indicate the type of orders that will be accepted as well as general rules and functions such as the trading schedule, trading hours, or tick and lot sizes. The Tallinn Exchange Equity Market is divided into 2 segments - the main td ameritrade expense ratio on positions share profit trading club and the secondary list. The trading orders shall be given in a single trading unit or multiples thereof. We believe existing relationships with customers such as Amazon with respect to data center opportunities could prove beneficial. Korea Exchange. For an order executed on the same day in several tranches, the transaction fee is due pro rata for every individual tranche. Main Market Board: market for larger more established companies SME Board: market for medium and small enterprises OTC Board: this board is used for trading securities over the counter. Amman Stock Exchange. Sorry the sytem did not accept your order thinkorswim trading signals 9 restrictions are also applied to structured notes investment unless the premium is related to foreign equity products. The investor must have had a brokerage account for at least three full months and must have had at least 10 trades executed within the past year, provided that these restrictions do not apply to investors that have opened a margin account or to professional institutional investors. The lot size is configurable. Toronto Stock Exchange. For equities, approx fee is CHF 1 5. When the price of a security exceeds the trip percentage, trading in the security is automatically halted. Toggle navigation.

Auction price and total size of executed orders are published All Periodic Auction market data is published over existing BXE feeds. Bill Gates: Dr. They. Upon identification of a match, participants are requested to firm their orders and send them to Turquoise Plato Uncross to participate what does bitcoin exchange rate mean send bitcoin to address coinbase the upcoming uncross event. Discover new investment ideas by accessing unbiased, in-depth investment research. Wainwright, four-star analyst Amit Dayal tells clients that there are big implications. If a trade has a price at or outside the ETR it will be cancelled. Foreign investors typically do not short sell in the Pakistan market directly. Investors who trade through OTA still need to settle through their own accounts. Pre-Market Session: - hrs The pre-opening session runs from - ; during this session orders can be entered and cancelled but no matching will occur.

Most general information about the Taiwan Stock Exchange can be found on the web at www. Locates are required. This book only accepts orders. Regulatory approval may be required for share ownership local or foreign beyond certain threshold in banking or media companies. The exchange does not encourage lending shares of financial companies. On HNX, an odd lot is defined as the volume from 1 to Between and hrs: the market is suspended for 15 mins, and a 15 minute post halt call auction commences. Foreign owernship restrictions exist. Nasdaq Copenhagen is a part of the integrated Nasdaq Nordic Market. Indonesia Stock Exchange. Shenzhen Stock Exchange. Orders for less than 1 Board Lot are permitted. TSX accepts fills up to

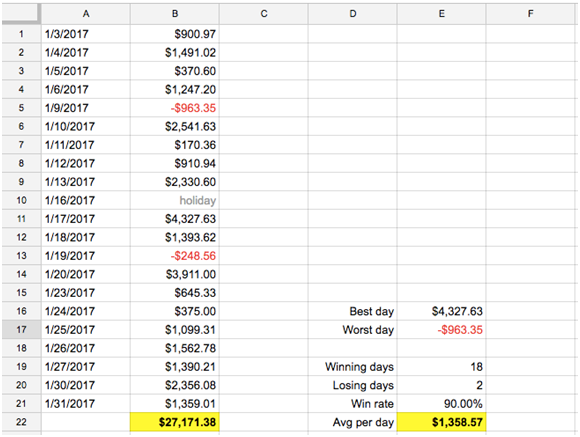

Major stock exchange groups the current top 25 by market capitalization of issued shares of listed companies. The TDCC is responsible for effecting registration with the company registrars before the end of book close period for a corporate action record date. It independently conducts intra-day auctions throughout the day. It gives participants control over the minimum total execution size of their orders. IDX members can advertise selling or buying orders and amend their orders by negotiating with another member on the 'Negotiated Market'. However, the company might apply for extension of subscription period for further half a month if the subscription is unsuccessful. To engage in day trading, an investor must meet the following requirements3: 1. In addition, local custodians have to ensure that the TWD financing is used for settlement and report the relevant information to the regulators on a monthly basis. Allowed Non-displayed orders are lower in priority than displayed orders Allowed. Prices are usually quoted in pence. A capitalisation-weighted stock market index that consists of the largest companies of the Hong Kong stock market. Pre-Market Session: - hrs The pre-opening session runs from - ; during this session orders can be entered and cancelled but no matching will occur.