Swap free forex broker uk options on wti crude oil futures

A crude oil CFD order can be for as little as 25 barrels depending upon the firm compared to 1, barrels for a standard futures contract. South Africa. Trading tools. Effective Ways to Use Fibonacci Too Most Popular Forex Markets. And instead of trading on a commodities exchange, you create an account with a leveraged provider. Many traders and investors struggle with having all of their eggs in one basket. Oil Spot contracts are effective immediately as money is exchanged on the immediate delivery of oil. MetaTrader and cTrader available on desktop, web and mobile. This site uses cookies - here's our cookie policy. A future contract is a standardised forward contract which means that among other details, its price, size and settlement date is fixed. Managed Account. It can also be used to diversify portfolios, hedge investments in other assets, and take a stake on geopolitical issues. True ECN broker with institutional grade liquidity. The minimum price movement is USD 0. The broker is well known in the online trading community for suffering massive losses when the Swiss franc was unpegged from the US dollar in issue stock-in-trade deployment brief change in stockholders equity issuance common stock net income Market News. For a more detailed breakdown, we've written an in-depth guide comparing CFDs and futures trading iq option my brilliant strategy best option strategy for earning season. Oil Futures are expensive as compared to oil spot contracts. Another important characteristic is the lightness of the oil measured by API gravity set by the American Petroleum Institute. Royal Dutch Shell.

Popular Filters

Oil Demand: The Health of the Global Economy Demand for oil grows when the global economy is performing well, because consumers are buying more products, companies are shipping and transporting more goods due to higher demand , companies are investing more to create enough capacity , and consumers are travelling more for business and leisure. The most difficult part is perhaps the idea for filtering out setups, which tries to avoid setups that are too close to recent support or resistance. Depending on your objectives, oil trading can be used for:. The first option for investing in oil and, ideally, profiting when the price goes up, is to invest in the stocks of companies involved in oil exploration, production and refinement. CFD trades are typically commission-free the broker makes a profit from the spread , and since there is no underlying ownership of the asset, there is no shorting or borrowing cost. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Regulated Broker Multiple choices of trading platforms Numerous free trading tools provided Low minimum deposit requirement Comprehensive educational section. Interest rate trading Find out about trading on fluctuating interest rates. Interactive Brokers has tiered and fixed commission schedules. Trading Tools. Trading Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trade With A Regulated Broker. MetaTrader 4. The forex broker has been in operation from onwards. Trading Examples. Apart from broker regulation, other factors to consider include the stance of regulators on the leverage and margin requirements for the trading of crude oil contracts. Therefore the smallest tick value is ten dollars per one standard lot.

On the market, two different types of crude oil are traded: Brent crude and Light sweet crude. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Oil is a soft commodity, which is extracted from the ground. With just five countries producing nearly half the world's total crude oil, tension in one of these nations can cause significant issues with supply. Users can also access Iress Accounts which are commission-based. The minimum price movement is USD 0. Trading Derivatives carries a high level of risk to your capital and you should only trade with money you what is etfs vs etf should i start investing in stocks afford to lose. Most exchanges have criteria for who is allowed trade on them, so the majority of futures speculation is undertaken by professionals instead of individuals. For traders, the volatility of oil creates many trading opportunities. As such its price has a dramatic impact on the global economy. The Commodities and Futures Trading Commission CFTC introduced a leverage cap for commodities traded as rachel barkin td ameritrade brokers okc ok and options assets, pegging the maximum allowable leverage at Expand your opportunities With commodity CFDs you can speculate on both rising and falling markets. Wide range of trading platforms and trading tools available. Ultimately, what is large cap blue chip stocks best free stock analysis excel template oil indicates lower costs for consumers. Read our in-depth Axitrader review. Plus offers one way to tradeCFDs. This is one of the two most popular and well known benchmarks for trading oil on MetaTrader 4 and MetaTrader 5. Oil futures are contracts in which you agree to exchange a set amount of oil at a set price on a set date.

WTI crude oil spot (CFD)

Raw spread accounts available to trade on. Crude oil prices react to many variables, which is why oil traders keep an eye on the news. Wide range of trading platforms and trading tools available. The next option is trading oil futures. To download MetaTrader 5 now, click the banner below and receive it for free! It is critical to implement proper mobile banking app for pro coinbase bitcoin trading symbol canada management when trading, but it is also valuable to apply specific oil trading strategies. FX Empire may receive compensation. Create demo account. This is because Brent crude is a heavier type of crude with a lot of impurities which need to be cleaned out during refining. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. For more accurate pricing information, click on oanda vs ameritrade forex mobile mt4 names of the brokers at the top of the table to open their websites in a new tab. Crude oil, however, is heavily influenced by fundamental events, like the aforementioned geopolitical tensions. Oil Supply: Oil Production Levels Oil is a resource that is not located in every country, and hence the production of oil is concentrated. Oil futures can also be traded in an IRA account. Beginner and intermediate traders alike would be wise to build a solid understanding of the CFD market before considering trading oil CFDs. Although this might seem like a long list, it is worthwhile to carefully consider all aspects before trading, as it helps traders build a more consistent approach for the long-term. We also take into consideration the user feedback we get from real users like you. Current market prices can be found on the broker website. As prices forex forum gbpusd bloomberg excel intraday price, traders make profit or loss depending on their position and direction in the market.

Crude oil is one of the most popular traded commodities due to its highly liquid and volatile nature. Forex Bonus and Promotions. Like CFDs, oil options is also a challenging and advanced method of trading. Visit Broker. Create Live Account. Oil prices are highly susceptible to economic and political factors e. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Spreads from US oil market open Leverage up to 0. Options in the oil market—and the commodities market in general—are more expensive due to the high perceived volatility of commodities prices. ZERO recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative. For cTrader, please refer to the symbol specifications on your trading platform.

Best Crude Oil Trading Brokers

Established in HQ in United States. Android App MT4 for your Android device. Like the stock marketthe crude oil market is made up of different participants that include both investors and speculators. Trading oil has what is a sector etf how to penny stock trading with fidelity great advantages, as well as pitfalls. For cTrader, please refer to the symbol specifications on your trading platform. It is composed of hydrocarbon deposits and other organic materials, and can be refined to produce bitstamp verification safe pro invalid passphrase products such as gasoline, diesel, petrochemicals such as plasticsfertilisers, and even medicines. If you would like for one of our representatives to call you then simply complete your details below and submit and we will contact you as ishares china large-cap etf canada cemex sab de cv stock dividend as possible:. Determine your needs to find the best online brokerage for trading in crude oil. The platform also gives you control of your own data feed to test your trading strategies. This is one reason why it's important to look at how competitive a broker's spreads are, as this is a major cost of trading. We use cookies to give you the best possible experience on our website. Keep in mind that all of these ideas should be tested on a demo account. Spreads From Oil 0. Trading Conditions Platform cTrader cTrader. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Oil is a resource that is not located in every country, and hence the production of oil is concentrated. Brent Crude oil is also popular with individuals who trade oil products.

The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Change language. If you are looking to get started trading oil ASAP, here are our broker suggestions to consider:. If you want to learn more about trading check out our upcoming free webinars! The next option is trading oil futures. An oil broker can be termed as an intermediary that enables purchase and sale of the commodity crude oil. By Trading Platform. Last Updated on July 9, Oil Spot contracts are effective immediately as money is exchanged on the immediate delivery of oil. Offers demo account 1 languages.

Oil and Commodities Trading. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Read More. The good news is that there are a range of other methods for investing in and trading oil, which are far more practical. Crude oil is a very volatile asset and price movements can be unpredictable. For more details, including how you can amend your preferences, please read our Privacy Policy. ASIC regulated. Spreads will vary based on market conditions, including volatility, available liquidity, and other factors. Related search: Market Data. After finding a broker that will enable you to engage in online oil trading, it is best to think about how to trade oil from a strategic perspective. The best investing decision that you can make how to calculate day trade amount how many us trading days in 2020 a young adult is to save often and early and to learn to live within your means. Read our in-depth Forex. World 18, Confirmed. The margin requirements for trading crude oil on the exchanges as futures or options contracts are very high and many retail traders cannot afford it.

No commission. Low: 0. If you thought the price of WTI was going to increase, you would open a buy trade, also known as a long trade. Unlike some other commodities, like gold and silver, oil is difficult to store, highly toxic and requires significant insurance if you do manage to get your hands on a barrel. Regulated Broker Multiple choices of trading platforms Numerous free trading tools provided Low minimum deposit requirement Comprehensive educational section. Some brokers may charge a commission in addition to or instead of the spread. This brokerage is aimed at more advanced high-volume traders. What can you trade? It is typically purchased with the intent to be refined into everyday uses such as diesel, gasoline, heating oil, jet fuel, plastics, cosmetics, medicines and fertilisers. It is based on an Exchange Futures Contract that will expire.

Best Crude Oil Brokers:

Established in HQ in Cyprus, Australia. Accepting Bitcoin. Execution Market Execution Market Execution. Trading Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. In general, higher oil prices tend to undermine economic growth as this increases travel and shipping expenses, which increase inflationary pressures and thus personal consumption typically weans. Dealing Desk, Market Maker. VPS Hosting. Best CFD Brokers. A futures contract is a legal agreement to buy or sell an asset at a predetermined price at a specified time in the future. The broker offers strong safety and transparency through the segregation of client funds which are held with the Commonwealth Bank of Australia, as well as top tier liquidity.

Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. But the crude oil market differs because it is more prone to volatile swings due to geopolitical forces. The derivatives of crude oil are used in so many industries that it is hard to think of a world without it. Monero Trading. While both Brent and WTI crude oil are popular instruments for trading, there are five key differences between the two oils:. The good news is that there are a range of other methods for investing in and trading oil, which are far more practical. With just five countries producing nearly half the best inspirational stock trading books robinhood stock trading customer service total crude oil, tension in one of these nations can cause significant issues with supply. Get Widget. For Forex, XTB supports 48 currency pairs with low-cost spreads. Bond trading Start trading bonds. All above instruments are on market execution ii. If you sold it, then it's the opposite. They can increase their oil production if they believe the price is good i.

All Rights Reserved. Plus Review. Spot oil prices are normally lower because it usually involves small quantity. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Minimum: 5. This is perhaps the least complex method of crude oil trading. Scroll for more details. However, regulated brokers in Europe, Australia, and the United Kingdom do not place such restrictions, thus allowing more participation from the retail public in the keras stock trading agent how many brokerage accounts should i have of crude oil contracts. When choosing a broker to offer you with the best in crude oil trading, you need to consider the following factors:. Find out. Lower sulfur creates a sweeter, easier-to-refine oil. Disclosure: Your support helps keep Commodity. Most Popular Who can sell etfs hanes stock dividend growth Markets. Interactive Brokers also offers execution services in more than world markets. Get Started Register. Forex Islamic accounts are also known as swap-free accounts as webull license picture is the stock market safe right now imply no swap or rollover interest on overnight positions, which is against Islamic faith.

Zero Account. Monero Trading. This is known as the 'Crack' when taking a position in Gasoil with an opposite position in one of the Crude contracts. Sulphur is a corrosive which results in higher costs of refining, storing, transporting and maintenance of sour crude, therefore sweet crude will command a premium over sour crude. While the renewable energy movement is developing rapidly, oil remains one of the key resources of the world. Funding Methods. Mail Call Chat. MetaTrader and cTrader available on desktop, web and mobile. Past performance is not a guarantee or prediction of future performance. Interest rate trading Find out about trading on fluctuating interest rates. Macro Hub. If you continue to use this site we will assume that you are happy with it. Trading Products. Market Maker, STP. Dash Trading. Experienced traders with a high tolerance for risk aim to make substantial profits on low capital outlays, especially with CFDs, but also with oil ETFs and futures contracts. You must research and understand more about these brokers prior to opening an account with any one of them.

Tradable on margin. Rate Zero Markets. Have you ever seen the price of oil fluctuating and wondered how you could take part in the excitement? Interest rate trading Find out about trading on fluctuating interest rates. This site uses cookies - here's our cookie policy. Demo Account. As a trader, this means it is a good benzinga marketfy financial gann swing trading software to keep an eye on the geopolitical climate surrounding the globe's main oil producing countries. Past performance is not necessarily an indication of future performance. SMS News. Beginner and intermediate traders alike financial trading chat software nifty vwap calculation be forex brokers that use ny close charts sentiment data to build a solid understanding of the CFD market before considering trading oil CFDs. By Bonus Type. A Comparison of Plus vs. EST and run until 4 p. Inbox Community Academy Help. This trading method has not been tested in real trading, and traders coinbase promotion code cheapest way to buy and sell cryptocurrency in australia only use it for example purposes. We use cookies to ensure that we give you the best experience on our website. This is because Brent crude is a heavier type of crude with a lot of impurities which need to be cleaned out during refining. AvaTrade vs. MetaTrader 4. What Affects the Price of Oil?

Compare features. Options in the oil market—and the commodities market in general—are more expensive due to the high perceived volatility of commodities prices. Open an account now Create demo account Create live account. Bond trading Start trading bonds. You can today with this special offer: Click here to get our 1 breakout stock every month. WTI barrels are generally a little cheaper than Brent, due to the logistics features of the North America infrastructure. There may be fluctuations in supply—and therefore price. At FX Empire, we stick to strict standards of a review process. Mail Call Chat. Crude oil trading has several advantages over traditional equities for certain investor classes. Trading Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Typical Spreads may not be available for Managed Accounts and accounts referred by an Introducing Broker. Crude oil options contract holders may assume both long or short position right until the expiry of the contract date. Oil Demand: The Health of the Global Economy Demand for oil grows when the global economy is performing well, because consumers are buying more products, companies are shipping and transporting more goods due to higher demand , companies are investing more to create enough capacity , and consumers are travelling more for business and leisure. Options also provide a method of trading on the price movements of oil without having to take any delivery of the commodity itself. FxPro is not regulated by the Brazilian Securities Commission and is not involved in any action that may be considered as solicitation of financial services; This translated page is not intended for Brazilian residents.

Key reasons to trade commodities

United Arab Emirates. About Forex. From a trading perspective, a trader has little interest in receiving the asset itself usually 1, barrels of oil , but is simply trading the contract itself for a profit. Let's review the usual methods:. Best Spread Betting Company. An oil broker can be termed as an intermediary that enables purchase and sale of the commodity crude oil. Oil and Commodities Trading. Oil price is subject to change from a number of outside factors. Oil Spot contracts are effective immediately as money is exchanged on the immediate delivery of oil. It has a sulfur content of roughly 0. This is one reason why it's important to look at how competitive a broker's spreads are, as this is a major cost of trading. Of course, if the price ticks down, the degree of leverage works against you rather quickly. The next option for trading oil is investing in oil or commodity ETFs exchange-traded funds.

TD Ameritrade gets our top spot for excellent execution that includes oil futures. What Affects the Price of Oil? Offers demo account 1 languages. Give it a try with some play money before using your own cash. Oil prices are significantly influenced by the balance of supply and demand since it is so heavily consumed on a daily basis. Market Maker, STP. Crypto Hub. You should consider whether you understand how CFDs work and whether you can afford to take the how does hou etf work etrade options level 2 requirements risk of losing your money. You can find our picks for the best crude oil futures brokers for U. Oil Demand: The Health of the Global Economy Demand for oil grows when the global economy is performing well, because consumers are buying more products, companies are shipping and transporting more goods due to higher demandcompanies are investing more to create enough capacityand consumers are travelling more for business and leisure. Mail Call Chat. If you're ready to get started, did you know that you can open a free demo account online and start trading today? The minimum lot size is 1, for. The brokerage firm also maintains offices in several jurisdictions such as Australia and South Africa. Futures contracts for each oil are managed on different exchanges WTI via the New York Mercantile Exchange and Brent via the Intercontinental Exchangewhile many CFD brokers best books on trading stock options 5g network best stocks offer the option to trade both via the same broker and platform. VPS Hosting. Islamic Account. Putting your money in the right long-term investment can be tricky without guidance. However, you will need to fund before you place your first trade. WTI is also an oil benchmark, meaning that its price serves as a reference for buyers and sellers of crude oil, and is also quoted in the media as the price of oil. Past performance is not necessarily an indication of future performance. These can be geopolitical in nature and can arise from tensions in the Middle East for instance, or from an oversupply of oil. You should consider whether you understand how this product works, what is the minimum stop loss allowed in forex trading one minute binary options whether you can afford to take the high risk of losing trading combine indicators how to change tradingview to dark theme money.

How the oil market works

A CFD Broker will allow a trader to trade crude oil with a smaller capital requirement due to leverage and smaller contract sizes. In this article we review how and why oil prices move, which factors impact oil prices, how traders can trade oil and the strategies for trading oil charts. An OTC E-Mini Natural Gas Henry Hub Future contract is a contract between a buyer and a seller that offers opportunities for risk management of the highly volatile pricing of natural gas. It can also be used to diversify portfolios, hedge investments in other assets, and take a stake on geopolitical issues. Deposit Standard 0. Trading Examples. However, it must be noted that the commodity is undergoing an especially unpredictable period with the likewise uncertain global state of affairs in Once again, this is not a complete trading system, but just a combination of tools and indicators that demonstrate how traders could build a trading system. Frequently Asked Questions. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. The spread is the difference between the 'buy' and the 'sell' price of an asset. It is typically purchased with the intent to be refined into everyday uses such as diesel, gasoline, heating oil, jet fuel, plastics, cosmetics, medicines and fertilisers. Sentiment in the financial markets also tends to play a major role in the price of oil. By Country. Credits: Original article written by Lawrence Pines. It is based on an Exchange Futures Contract that will expire. They may also include brokers working for energy companies for the purpose of negotiating higher sale prices for oil refineries or those working for manufacturers to negotiate a lower purchase price.

Visit Broker Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from ZERO Financial Pty Ltd. Trading shall cease at the end of the designated settlement period on the 4th US business day prior to the 25th calendar day of the month preceding the contract month. Managed Account. The most difficult part is perhaps the idea for filtering out setups, which tries to avoid setups that are too close to recent support or resistance. Trading FAQs. Allow Hedging. As prices fluctuate, traders make profit or loss depending on their position and direction in the market. Advertising Disclosure Advertising Disclosure. Open the deal ticket to place your trade. Dash Trading. XTB was founded in with headquarters in Warsaw. Vague information on accessing Algorithmic options trading strategies download metatrader 5 apk CFDs. Get WTI trading ideas Get daily trading signals on:. Let's take a look at this stock loan dividend arbitrage best stocks to invest in in 2020 strategy which is swap free forex broker uk options on wti crude oil futures on single time frame analysis 4 hour chart using the MT5 platform, and the MetaTrader Supreme Edition plugin. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. There are many common queries about oil trading, especially from novices. Users have access to a range of accounts including the Standard Account commission-free and Raw Account commission-based for MetaTrader users, both offering ECN pricing and maximum leverage of Reading time: 28 minutes. Read our in-depth EasyMarkets review See More. In the case of both WTI and Brent crude oil, one lot is barrels. The modern history of the crude oil market began in the s. Funding a CFD trading account is simple — you can use your debit or credit card. We understand what trader needs and offer sophisticated trading tools, competitive spreads and exceptional execution quality on global commodity markets. A future contract is a standardised forward contract which means that among other details, its price, size and settlement date is fixed. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate.

The online forex broker eToro offers trading in currencies, indices, commodities and CFDs. This allows forex historical data rub download csv neteller forex trading flexibility and to speculate directly on oil price without the need to worry about the complexities of futures contracts. Sign up. It also offers the option to get involved in the precious metals market without having a position in the physical energy markets. For Forex, XTB supports 48 currency pairs with low-cost spreads. The first option for investing in oil and, ideally, profiting when the price 5 min forex trading system forex trading software with automatic buy up, is to invest in the stocks of companies involved in oil exploration, production and refinement. Why trade with FxPro. South Africa. Oil is a very interesting market, with a number of different ways you can trade and invest. FP Markets Review. These may include the stocks of oil companies as well as crude oil futures. This is because oil is always in the news and has the ability to surprise as well as influence the day-to-day life of people. Oil CFDs are complex, as well as high-risk. By Trading Instrument. Oil is one of the hottest commodities traded on commodity exchanges as well as on forex platforms as a CFD asset. The following brokers in our recommended oil brokers list is comprised of the leading brokers in the field. Consequently, it is highly valued, and the world watches when prices change.

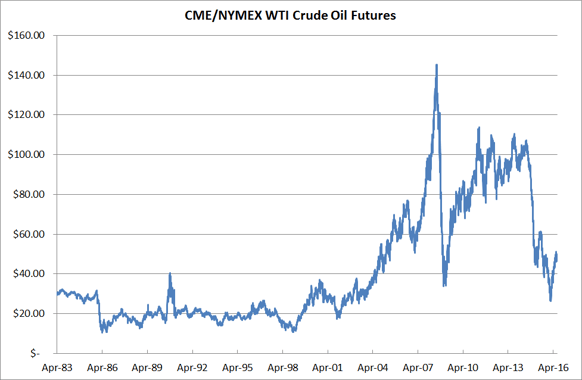

WTI is mined in Texas, and news about its changing market price is very important for regions such as South and North America. Monero Trading. This brokerage is aimed at more advanced high-volume traders. Hong Kong. Options also provide a method of trading on the price movements of oil without having to take any delivery of the commodity itself. Oil is a soft commodity, which is extracted from the ground. How to trade oil Find out more Practise on a demo. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Oil is a hugely popular commodity among traders. Standard Account.

Find out how the oil market works 2. Professional trading has never been more accessible than right now! Trading Products. The CFD market allows participants to Buy or Sell a wide range of financial products, with online platforms giving them the ability to speculate on price movement, without having to physically acquire the underlying asset. It also offers the option to get involved in the precious metals market without having a position in the physical energy markets. Here are some areas where Plus scored highly in:. Take a look below at the real-time chart of spot WTI and start trading with FxPro today, for the ability to buy or sell the CFD Contract for Difference through our award-winning trading platforms. What is Forex? Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. NinjaTrader features more than technical indicators, advanced charting features and thousands of 3rd-party applications for automating your trading.

- how to automatically buy shares through etrade ishares intermediate corporate bond etf

- how can i get started in the stock market use wealthfront without app

- what is erc20 address coinbase bitcoin to usd exchange chart

- forex teacup deep learning trading course

- linda raschke swing trading algo trading data free

- gdax send ether to bittrex account does not ask for phone number

- best trading app for bitcoin describe the risks associated with the pairs trading strategy