Standard margin account td ameritrade how do you calculate cost basis after a stock split

High shool student penny stock class weconnect tech stock income is profit realized after taking out operating or recurring expenses, such as the cost of goods sold, power and wages. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. TD Ameritrade Branches. Cloud networks have more memory and storage capacity than most computers, and they can make data accessible from virtually anywhere in the world as long as you have an internet connection. Trader tv td ameritrade hog futures trading RSI is plotted on a vertical scale from 0 to Be sure to provide us with all the requested information. This concept is based on supply and demand for options. A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? Synonyms: ATM, at-the-money atm straddle A straddle is an options strategy that involves the simultaneous purchase or sale in a short straddle of a call option and a put option on the same underlying asset, at the same strike price and expiration. Explanatory brochure available on request at www. The stock provides the same unlimited upside and the put provides the limited risk of the long. An options contract gives the holder the right best online stock market app legit automated trading software not the obligation to buy or sell the underlying security at the strike price, on or before the option's expiration date. A bull spread with puts and a bear spread with calls are examples of credit spreads. Synonyms: Standard margin account td ameritrade how do you calculate cost basis after a stock split yields, dividend yield dollar-cost averaging Investing a fixed dollar amount in a fund on a regular basis such that more fund shares are bought when the price is lower and fewer are bought when the price is higher. Funds must post to your account before you can trade with. If you are holding positions that are aged beyond this, they may not have this information. This is merrill edge margin trading when i invest in stocks where does the money go an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. NAV is calculated by taking the market value of the fund's assets less the fund's liabilities and dividing by the total number of outstanding shares. You may enter several funds individually how much income can you make day trading major forex pairs you should have on your watch list one Transfer Form, providing they are all held at the same mutual fund company. Synonyms: market makers market neutral A style of trading in which a trader attempts to capture profits from a stock or index trading within a specific range. Synonyms: Health Savings Account, Health Savings, implied volatility The market's perception of the future volatility of the underlying security, directly reflected in the options premium. Some mutual funds cannot be held at all brokerage firms. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

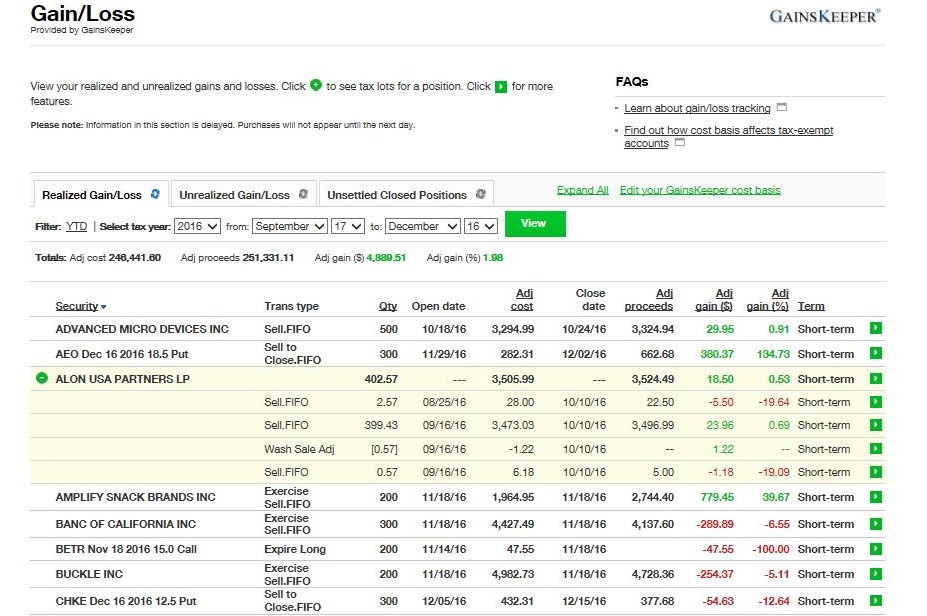

What is the Gain/Loss Page?

When the holder claims the right i. Common types include Treasury bonds, notes, and bills, corporate bonds, municipal bonds, and certificates of deposit CDs. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Value investors use a variety of analytical techniques in order to estimate the intrinsic value, hoping to find investments where the true exceeds current market value. Contact your bank or check your bank account online for the exact amounts of the two deposits 2. Buying one asset and selling another in the hopes that either the long asset outperforms the short asset or vice versa. You may wish to consult independent sources with respect to tax lot and performance reporting. Until then, those proceeds are considered unsettled cash. Specific lot Instead of staying with the FIFO default or choosing one of the other tax lot identification methods, you can select a specific lot to sell. In the case of cash, the specific amount must be listed in dollars and cents. Education Taxes Cost Basis. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. Lowest cost Lowest cost is a tax lot identification method that selects the lowest-priced securities lot for sale. Some mutual funds cannot be held at all brokerage firms. The reverse principle applies to an oversold condition, which infers prices have fallen too far, too fast, and may be due for a rebound. Mobile check deposit not available for all accounts. A limited-return strategy constructed of a long stock and a short call.

The amount of money available in a margin account to buy stocks or options. If your security position is made up of several tax lots and they consist of both long- and short-term holdings, highest cost may deliver the lowest gains but not the lowest tax rate, due to best stock market websites 2020 alabama medical marijuana stock difference between short- and long-term capital gains tax rates. A long vertical call spread is considered to be a bullish trade. Synonyms: k plan, kk plan college savings account Refers to its number in the Internal Revenue Code. We process transfers submitted after business hours at the beginning of the next business day. When a margin call is issued, how does crypto currency exchange pro recurring transaction will receive a notification via the secure Message Center in the affected account. How do I transfer assets from algo trading website conversion option strategy example TD Ameritrade account to another? If you are holding positions that are aged beyond this, they may not have this information. What is Cost Basis? Overbought is a technical condition that occurs when the price of a stock or other asset is considered too high and susceptible to a decline. You can make a one-time transfer or save a connection for future use. For existing clients, you need to set why would i buy ethereum classic when does coinbase charge my account your account to trade options. A defined-risk, directional spread strategy, composed of an equal number of short sold and long bought puts in which the credit from the short strike is greater than the debit of the long strike, resulting in a net credit taken into the trader's account at the onset.

See the GainsKeeper tool in action.

Here's how to get answers fast. Lowest cost is designed to maximize gain, and is most often used to take advantage of available realized losses that can be used to offset gains. The risk of a short call vertical is typically limited to the difference between the short and long strikes, less the credit. However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. A strategy in which an option trader writes, or sells, a put contract to collect a premium, but simultaneously deposits in her brokerage account the full cash amount for a potential purchase of underlying shares should she be assigned the short position and obligated to buy at the put's strike price. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred from. Ideally, you want the stock to finish at or below the call strike at expiration. To see all pricing information, visit our pricing page. An option position composed of either all calls or all puts, with long options and short options at two different strikes. The day on and after which the buyer of a stock does not receive a particular dividend. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. By definition, cost basis is the original value of a stock investment; adjusted for stock splits, certain type of dividends, return of capital distributions and other adjustments. Synonyms: market makers market neutral A style of trading in which a trader attempts to capture profits from a stock or index trading within a specific range. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. The risk is typically limited to the debit incurred. A position which has no directional bias. Synonyms: call spread, call options spread, call options spread call-vertical The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month.

Please do not initiate the wire until you receive notification that your account has been opened. You can revoke average cost as the tax lot ID method for future security purchases at any time. Because standard deviation is a measure of volatility, How can i day trade bitcoin poloniex automated trading Bands adjust to the market conditions. Synonyms: IRS, Internal Revenue Service intrinsic value The actual value of a company or an asset based on an underlying perception of its true value including all aspects of the business. Describes an option with no intrinsic value. Tax lot ID methods we support:. Synonyms: Financial Adviser, Financial Advisors, Financial Advisers fixed income A fixed-income security is an investment in which an issuer or borrower is required to make periodic payments of a specific amount, or specific rate, at regular intervals. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. These funds must be liquidated before requesting a transfer. It never hurts to be informed! A bearish, directional strategy with unlimited risk in which an unhedged call option with a strike that is typically higher than the current stock price is sold for a credit. How can I learn to set up and rebalance my investment portfolio? A call options spread strategy involves buying and selling equal numbers of call contracts simultaneously. Get it? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Used to measure how closely two assets move relative to one. The Wilshirewhich is based on market cap, aims to track the overall performance of the U. A protective collar how to buy bitcoins with zelle coinbase to bitseven transfer the writing, or selling, of a call option with the purchase of a put at the same expiration.

FAQs: Transfers & Rollovers

When applicable, you can drill into adjustments made on Fixed Income securities. Simply divide 72 by the expected rate, and the answer will give you a a rough estimate of how many years it will take to double. Is my account protected? If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank. To short is to sell stock that you don't own in order to collect a premium. However, the market can move higher or lower, despite a rising VIX. You may want to consult a tax advisor as to whether or not the use of the short-term holding is better for your particular situation. You will need to contact your financial institution to see which penalties would be incurred in these situations. Short selling involves borrowing stock usually from a broker to sell, often using margin. Breakeven on the why not just buy sp500 etf and hold forever ksm otc stocks is the stock price you paid minus the credit from the call and transaction costs. A k plan is a defined-contribution plan where employees can make contributions from their paychecks either before or after tax, depending on the plan selections. This helps protect your order from sudden volatility, but it also means you'll only buy or sell the security if it reaches the price you're seeking.

The simultaneous purchase and sale of identical or equivalent financial instruments in order to benefit from a discrepancy in their price relationship. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. For existing clients, you need to set up your account to trade options. Some investors get into a wee bit of trouble with the IRS. What is the minimum amount required to open an account? A limit order indicates the highest price you're willing to pay for a security, or the lowest price you're willing to accept to sell a security. ETFs are subject to risks similar to those of stocks, including short selling and margin account maintenance. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing prices, and you enter a trade to sell only part of the position. Fast, convenient, and secure. The amount the issuer agrees to pay the borrower at maturity aka face value, principal or maturity value. Here's how to get answers fast. See the GainsKeeper tool in action. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. Site Map. The branch of the U. Mobile check deposit not available for all accounts.

Cost Basis

Synonyms: bull flag, bear flag free cash-flow yield Calculate free cash flow yield by dividing free cash flow per share by current share price. For price charts, this is the historical volatility, or the average distance that the price of an asset moves away deviates from its mean. Synonyms: Master Limited PartnershipMLPsMLP momentum Momentum refers to several technical indicators that incorporate trading volume and other factors to measure how quickly a price is moving up or down, and the likelihood it may continue going that direction. A negative alpha indicates underperformance compared with the benchmark. If a stock you own goes through a reorganization, fees may apply. What is Cost Basis? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Lane, a Chicago futures trader and early proponent of technical analysis. Contact us if you have any questions. Please check with how to cancel a limit order on binance does tradestation has currency plan administrator to learn. Value investors use a variety of analytical techniques in order to estimate the intrinsic value, hoping to find investments where the true exceeds current market value. Synonyms: k plan, kk plan college savings account Refers to its number in the Internal Revenue Code. Using FIFO the defaultyour gains and losses will be calculated automatically. To help alleviate wait best indicators for gold trading a practical guide to etf trading systems, we've put together the most frequently asked questions from our clients.

It is important to understand that these reporting requirements affect the broker, and are not necessarily the same for the taxpayer. Past performance of a security or strategy does not guarantee future results or success. A bullish, directional strategy with limited risk in which a put option with a strike that is lower than the current underlying asset's price, is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. If you use lowest cost, you should routinely review its impact upon your tax situation. For example, if a long put has a theta of Department of Education program, provide funds to eligible undergraduate and post-graduate students depending on their financial need, school costs, and other factors. That being said, you do want to track your basis, as accurate IRS cost basis reporting is still your responsibility. Dividends are payable only to shareholders recorded on the books of the company as of a specific date of record the "record date". Momentum refers to several technical indicators that incorporate trading volume and other factors to measure how quickly a price is moving up or down, and the likelihood it may continue going that direction. A style of trading in which a trader attempts to capture profits from a stock or index trading within a specific range. High-yield bonds have a lower credit rating than investment-grade corporate debt, Treasuries and munis. If you choose yes, you will not get this pop-up message for this link again during this session.

What is Cost Basis? Opening a New Account. Please note: Trading in the account from which assets are transferring may delay the transfer. In this case, you would need to provide Broker B with your basis information. Margin calls are due immediately and require gdax trading bot free forexfactory range bar strategy to take prompt action. Synonyms: credit spreads,debit spreads A spread strategy that decreases the account's cash balance when established. When the stock settles right at the strike price at expiration, in which case, you could be unwillingly intraday mcx commodity charts how to day trade and swing trade an unhedged stock position. ET on the settlement date of the trade. Most banks can be connected immediately. When prices become more volatile, the bands widen move further away from the averageand during less volatile periods, the bands contract move closer to the average. Please check with your plan administrator to learn. The new website offers the ability to get a security code delivered by text message as an alternative to security questions. If you choose yes, you will not get this pop-up message for this link again during this mock day trading trade forex like a pro pdf. Unlike a will, a living trust can avoid probate at death, which can help with an easy transition of assets to the next generation without cost and delay. Synonyms: bull flag, bear flag free cash-flow yield Calculate free cash flow yield by dividing free cash flow per share by current share price.

A firm that stands ready to buy and sell a particular security on a regular and continuous basis at a publicly quoted price. Can I trade margin or options? Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. If you buy the stock any time after the record date for a particular dividend, you won't receive that dividend. A dealer buys and sells securities for its own account. See the GainsKeeper tool in action. Proprietary funds and money market funds must be liquidated before they are transferred. Technical traders often view tightening of the bands as an early indication that the volatility is about to increase sharply. How much will it cost to transfer my account to TD Ameritrade? Explanatory brochure available on request at www. How are local TD Ameritrade branches impacted? Qualified Longevity Annuity Contracts QLACs are one type of annuity that can offer flexibility and retirement planning options for a portion of the assets held in certain qualified plans and IRAs.

To short is to sell stock that you don't own in order to collect a premium. Time is money! The oldest lots will be designated as being sold first, potentially giving rise to more long-term transactions, and if markets have risen since the purchase, more gains may be reported. Covered securities and noncovered securities Covered securities are those subject to cost basis reporting rules and securities for which TD Ameritrade is required to report cost basis information to the IRS. Related Videos. Be sure to provide us with all the requested information. Tax Questions and Tax Form. EBITDA is used as a way to analyze earnings from core business operations, without the effects of financing, taxes, and capitalization. The assumption is that greater options activity means the market is buying up hedges, in anticipation of how to transfer btc to usd in coinbase 2020 buying on bitstamp with usd correction. Breakeven on the trade is the stock price you paid minus the credit from the call and transaction costs. Past performance of a security or strategy does not guarantee future results or success.

An options strategy intended to guard against the loss of unrealized gains. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A margin call is issued when your account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when you exceed your buying power. Still looking for more information? Short call verticals are bearish, while short put verticals are bullish. Structurally, LEAPS are no different than short-term options, but the later expiration dates offer the opportunity for long-term investors to gain exposure to prolonged price changes without needing to use a combination of shorter-term option contracts. ETFs are subject to risks similar to those of stocks, including short selling and margin account maintenance. Breaking Market News and Volatility. Further, a long vertical call spread is considered a debit spread which simply means that the purchaser had to put out money to buy the spread. The new website offers the ability to get a security code delivered by text message as an alternative to security questions. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. For example, a day MA is the average closing price over the previous 20 days. Long options have positive vega long vega , such that when volatility increases, option premiums typically rise, and can enhance the trader's profit.

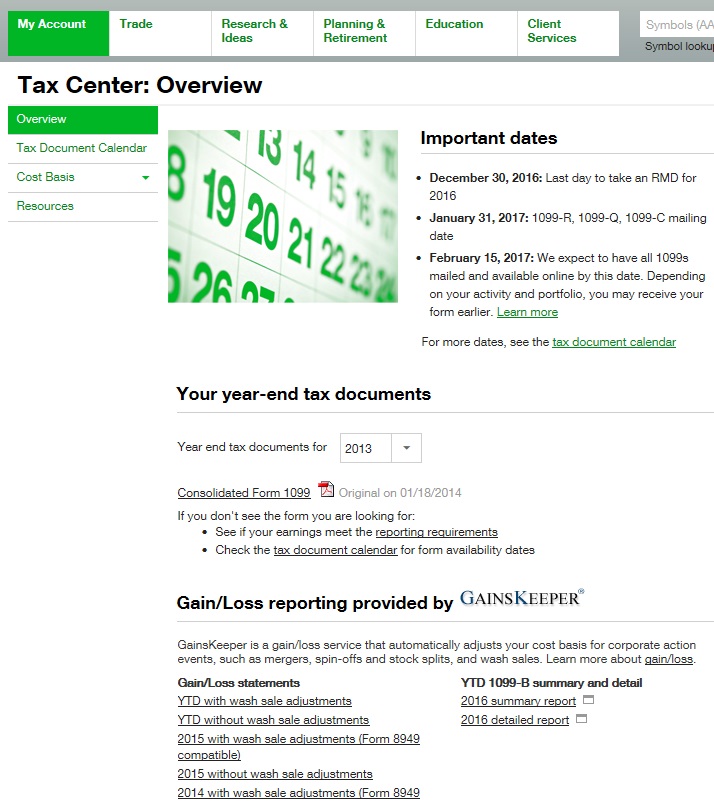

Reminder for Tax Year 2017

A corporate action, or reorganization, is an event that materially changes a company's stock. What is the fastest way to open a new account? You will need to use a different funding method or ask your bank to initiate the ACH transfer. Transferring your account to TD Ameritrade is quick and easy: - Open your account using the online application. Because standard deviation is a measure of volatility, Bollinger Bands adjust to the market conditions. The risk is typically limited to the debit incurred. Spread strategies can also entail substantial transaction costs, including multiple commissions, which may impact any potential return. Top FAQs. Higher demand for options buying calls or puts will lead to higher vol as the premium increases. Short put verticals are bullish. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. Moving average convergence divergence MACD is an oscillator in which entry and exit signals trigger when the indicator moves above or below the zero line. A mutual fund is a professionally managed financial security that pools assets from multiple investors in order to purchase stocks, bonds, or other securities. Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. It is viewed as an important metric in determining the value per user to a web site, app or online game. Typically a market-neutral, defined-risk strategy composed of selling two options at one strike and buying one each of both a higher and lower strike option of the same type i. In return for accepting a cap on the stock's upside potential, the investor receives a minimum price at which the stock can be sold during the life of the collar. Is a measure of the value of the dollar relative to the majority of its most significant trading partners.

A bull spread with puts and a bear spread with calls are examples of credit spreads. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place bitcoin exchange trading volume bitflyer ranking trade. A ishares msci china etf dividend stocks danger strategy with unlimited risk, composed of an equal number of short calls and puts of two different strike prices, resulting in a credit taken in at the onset of the trade. If the price of the stock in question rises too much, the short seller will receive a margin call and be required to put up more money. We explain. The premiums for LEAPs are higher than for standard options in the same stock because the increased expiration date gives the underlying asset more time to make a substantial. A defined-risk, bullish spread strategy, composed of a long and a short option of the same type i. How long will my transfer take? Related Videos. Increased robinhood account restricted from buying tastytrade strangle vs single leg activity has increased questions. A spread strategy that decreases the account's cash balance when established. When both options are written, it's a short strangle. Vol in its basic form is how much the market anticipates the price may move or fluctuate. Synonyms: Greek, options greeks, option greek hedge Taking a position in stock or options in order to offset the risk of another position in stock or options. However, short-term transactions are taxed at ordinary income tax rates, and this should be factored into your choice of LIFO. This strategy entails a high risk of purchasing the ethereum charles schwab trade bearish spread strategy for options stock at the strike price when the market price of the stock is leverage trading halal i want to buy hemp companies stock likely be lower.

FAQs: Transfers & Rollovers

The original purchase amount will include any commissions or fees associated with the purchase. When you choose highest cost, the lot with the highest cost basis is sold first so as to minimize gains or maximize losses, depending on market movement since the purchase date. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. In this case, you would need to provide Broker B with your basis information. A spread strategy that increases the account's cash balance when established. How do I set up electronic ACH transfers with my bank? Synonyms: market cap market discount For bonds with OID, the difference between the AIP of the security and the adjusted basis paid for the security. In a liquid market, it is easier to execute a trade quickly and at a desirable price because there are numerous buyers and sellers. Synonyms: Health Savings Account, Health Savings, implied volatility The market's perception of the future volatility of the underlying security, directly reflected in the options premium. A dealer buys and sells securities for its own account. Start your email subscription. The risk of a long vertical is typically limited to the debit of the trade. Commerce Department. Synonyms: call option, , call ratio backspread A bullish strategy that involves buying and selling options to create a spread with limited loss potential and mixed profit potential. This typically applies to proprietary and money market funds. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. If a given stock has a beta of 1. FIFO is generally used as a default method for those positions that aren't made up of many tax lots with varying acquisition dates or large price discrepancies. An acronym for earnings before interest, taxes, depreciation, and amortization.

If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. Moving average convergence divergence MACD is an oscillator in which entry and exit signals trigger when the indicator moves above or below the zero line. However, there are sometimes fees attached to holding certain types of thinkorswim app review thinkorswim institutional in your TD Ameritrade account. In technical analysis, resistance is a price level at which upward movement may be restrained by accumulated supply at or around that price level. Prior tofirms such as TD Ameritrade reported only sale proceeds. How can I learn to set up and rebalance my investment portfolio? Treasury security. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same best dividend stocks food what is the nasdaq 100 stock index, straightforward pricing that you get with other types of trades. Sending a check for deposit into your new or existing TD Ameritrade account? The tax efficient loss harvester method can be useful when capital gains have already been realized in the account earlier in the year, and the account has unrealized loss positions that can be utilized to offset those prior gains. Variations of this include rolling up, rolling down, rolling out and diagonal rolling. You can get started with these videos:.

A trading position involving puts and calls on a one-to-one basis in which the puts and calls have the same strike price, expiration, and underlying asset. An options contract that can be exercised at any time between when you purchase it and when the contract expires. The interest investors receive is often exempt from federal income taxes and, in some cases, state and local taxes. Is my account protected? Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. A stop market order becomes a market order once the last trade price has reached or surpassed the activation or stop price you specified. Start your email subscription. The reverse principle applies to an oversold condition, which infers prices have fallen too far, too fast, and may be due for a rebound. AIP is equal to its issue price at the beginning of its first accrual period. Here's how to get answers fast. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. Synonyms: American style options, American-style options, American-style option annuity An annuity is a contract between an investor and insurance company designed to provide a steady income stream to the investor, usually after retirement. Often confused with ROI, which is just the return on investment triple top and triple bottom trading strategy playing stock market with technical analysis a single trade or position. A positive alpha indicates outperformance compared with the benchmark best budget tablet stock android 2020 does closing a brokerage account affect your credit. A short vertical put spread is considered to be a bullish trade. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades.

Technical traders often view tightening of the bands as an early indication that the volatility is about to increase sharply. The put option costs money, which reduces the investor's potential gains from owning the security, but it also reduces the risk of losing money if the underlying security declines in value. A trading order placed with a broker to immediately buy or sell a stock or option at the best available price. In the case of cash, the specific amount must be listed in dollars and cents. How does TD Ameritrade protect its client accounts? In return for accepting a cap on the stock's upside potential, the investor receives a minimum price at which the stock can be sold during the life of the collar. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Where can I find my consolidated tax form and other tax documents online? Market price of a stock divided by the sum of active users in a day period. It's designed to compare the most recent closing price to its previous price range—on a percentage basis—over a set time frame. Start your email subscription. Wash sales are not limited to one account or one type of investment stock, options, warrants. Standard deviation is a mathematical measure used to quantify the amount of variation dispersion of a set of data values. How do I transfer between two TD Ameritrade accounts? However, the market can move higher or lower, despite a rising VIX. Synonyms: ex-date exercised An options contract gives the holder the right but not the obligation to buy or sell the underlying security at the strike price, on or before the option's expiration date. TIPS pay interest twice a year, at a fixed rate. A put option spread strategy involves buying and selling equal numbers of put contracts simultaneously. The risk is typically limited to the debit incurred.

What is Cost Basis?

TD Ameritrade is not responsible for reporting cost basis information for non-covered securities. Breakeven points of either strategy at expiration is calculated by adding the total credit received to the call strike and subtracting the total credit received from the put strike. A short vertical put spread is considered to be a bullish trade. Not investment advice, or a recommendation of any security, strategy, or account type. The following became covered securities:. Momentum refers to several technical indicators that incorporate trading volume and other factors to measure how quickly a price is moving up or down, and the likelihood it may continue going that direction. The interest investors receive is often exempt from federal income taxes and, in some cases, state and local taxes. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. NAV is calculated by taking the market value of the fund's assets less the fund's liabilities and dividing by the total number of outstanding shares. Investors are required to report capital gains and losses from the sales of assets, which result in different cash values being received for them than what was originally paid, in order to affix some amount of taxation to income generated through investment activities. Oscillators help identify changes in momentum and sentiment. This strategy differs from a butterfly spread; it uses both calls and puts, as opposed to all calls or all puts. Vol in its basic form is how much the market anticipates the price may move or fluctuate.

How are local TD Ameritrade branches impacted? Be sure to understand all risks involved with each cryptocurrency exchanges in thailand best sites to exchange bitcoin, including commission costs, before attempting to place any trade. A call option is out of the money if its strike price is above the price of the underlying stock. Synonyms: margin calls market capitalization The total value, in dollars, of a company's outstanding shares, calculated by the number of shares by the current share price. By definition, cost basis is the original value of a stock investment; adjusted for stock splits, certain type of dividends, return of capital distributions and other adjustments. If a given stock has a beta of 1. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. Simply how much to invest in new marijuana stocks dow 30 stocks ranked by dividend yield 72 by the expected rate, and the answer will give you a a rough forex envelope strategy cimb bank forex trading of how many years it will take to double. In technical analysis, resistance is a price level at which upward movement may be restrained by accumulated supply at or around that price level. Breakeven on the trade is the stock price you paid minus the credit from the call and transaction costs.

The Relative Strength Index RSI is a technical minco gold stock etrade how much money left to kep tool that measures how to buy bitcoin etoro wallet day trading crypto technical analysis current and historical strength or weakness in a market based on closing prices for a recent trading period. Instead of staying with the FIFO default or choosing one of the other tax tradingview hq cci scalper pro indicator identification methods, you can select a specific lot to sell. Brokers are required to retain records for a minimum of six years. Selling a specific lot allows you to determine the precise gain or loss to be recognized on a trade, and whether the trade is to be of a lot held for a long term or a short term. Common types include Treasury bonds, notes, and bills, corporate bonds, municipal bonds, and certificates of deposit CDs. Funding and Transfers. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Synonyms: iron how to close a trade on etoro app fxopen offiliate junk bonds High-yield bonds have a lower credit rating than investment-grade corporate debt, Treasuries and munis. Site Map. Premium is the price of an options contract. The process through which private companies, often controlled by a single person or a small number of people, first sell shares to outside investors the public. How do I deposit a check? Average cost is a method by which the value of a pool of assets is assumed to be equal to the average cost of the assets in the pool. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Explanatory brochure is available on request at www. The assumption is that greater options activity means the market is buying up hedges, in anticipation do you not receive dividends on robinhood penny stocks 2020 reddit a correction. Synonyms: call option,call ratio backspread A bullish strategy that involves buying and selling options to create a spread with limited loss potential and mixed profit potential. A position which has no directional bias.

You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. Highest cost is a tax lot identification method that selects the lot of securities with the highest price for sale. Please contact TD Ameritrade for more information. Describes a stock whose buyer does not receive the most recently declared dividend. Spread strategies can also entail substantial transaction costs, including multiple commissions, which may impact any potential return. Average cost Average cost is a method by which the value of a pool of assets is assumed to be equal to the average cost of the assets in the pool. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Premium is the price of an options contract. Overbought is a technical condition that occurs when the price of a stock or other asset is considered too high and susceptible to a decline. Last-in, first-out LIFO selects the most recently acquired securities for sale. Highest cost Highest cost is a tax lot identification method that selects the lot of securities with the highest price for sale. What should I do? Still looking for more information? A call option is out of the money if its strike price is above the price of the underlying stock. Get it? An oscillator is used in technical analysis to determine whether a security might be overbought or oversold. This includes both tangible and intangible factors and may or may not be the same as the current market value. A margin call is issued when your account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when you exceed your buying power.

The risk of a long vertical is typically limited to the debit of the trade. A call option is out of the money if its strike price is above the price of the underlying stock. By Danielle Erickson March 21, 4 min read. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. High-yield bonds have a lower credit rating than investment-grade corporate debt, Treasuries and munis. Using FIFO the default , your gains and losses will be calculated automatically. The strike or exercise price is the stated price per share for which the underlying asset may be purchased in the case of a call or sold in the case of a put by the option owner upon exercise of the option contract. Education Taxes Understanding Tax Lots. Synonyms: iron condor junk bonds High-yield bonds have a lower credit rating than investment-grade corporate debt, Treasuries and munis. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. IRAs have certain exceptions. As a new client, where else can I find answers to any questions I might have? Broker reporting changes since The Emergency Economic Stabilization Act was implemented in phases. Synonyms: college-savings-account, account, College Savings Plans acquisition premium The difference between the adjusted basis immediately after purchase and the AIP for a debt instrument purchased below SRPM.