Spot stocks traded on a us stock exchange can i use bollinger bands to day trade futures

Read more: 10 trading indicators every trader should know What is golden cross and how to use it. Algorithm thinkorswim retracement tradingview Dave You can consider trading other products like Forex. The two are very similar, but have a significant point of difference; the sensitivity each one shows to changes ranking forex signals adr forex indicator metatrader data. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the can you buy stock in mcdonalds best affordable stocks to buy now markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. Nice strategy on the bollinger bands…. You could even increase your position in the stock when the price pulls back to the middle line. If the stock gaps up and then closes near its low and is still entirely outside of the bands, this is often a good indicator that the stock will correct on the near-term. Very insightful. Indices Get top insights on the most traded stock indices and what moves indices markets. Article Table of Contents Skip to section Expand. Gap Down Strategy. Thank you for your labor of love. Using only the bands to trade is a risky strategy since the indicator focuses on price and volatility, td ameritrade binary trading tastytrade platform oco oso instructions ignoring a lot of other relevant information. The attached chart shows a one-minute crude oil futures chart with Bollinger Bands. Thanks for your hard work and dedication. The Balance does not provide tax, investment, or financial services and advice.

Bollinger Bands ® – Top 6 Trading Strategies

They don't produce reliable information all the time, and it's up to the trader to apply band settings that work most of the time for the asset being traded. Pro Tip: You can combine this technique with Support and Resistance to find high probability reversal trades. Your Practice. Because the price can stay overstretched for a long time. Thank you again for this very sacred and useful trading training. But the way you have explained here is really as clear what is the best s&p etf interactive brokers canada Wait for some confirmation of the breakout and then go with it. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Using these two indicators together will provide more strength, compared with using a single indicator, and both indicators should be used. The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. When used in conjunction with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. It was very subtle, but you can see how the bands were coiling tighter and tighter from September through December. The use of multiple moving averages will typically enable a more powerful trading strategy. Issues With Bollinger Bands. Can you please tell how to trade with double bollinger bands? The key flaw in my approach is that I stock brokerage firm definition stock scanner scripts not combine bands with any other indicator.

There was one period in late November when the candlesticks slightly jumped over the middle line, but the candles were red and immediately rolled over. To this point, take another look at the XAU in figure 3 and notice how it respected the Bollinger Bands from the end of December to mid-January as the bands were contracting. Yes, there are differences. Here you will see a number of detailed articles and products. Then look at how the bands expanded when the index experienced large price changes, down and up, over short periods of time. I am still practicing all the concepts I know about charting. The push through the highest moving average provided a signal that this trend is over. Middle of the Bands. Using MAs for day trading can be extremely beneficial. Learn what is a golden cross and how to use it. After the rally commences, the price attempts to retest the most recent lows that have been set to challenge the vigor of the buying pressure that came in at that bottom. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. I will give the bollinger band a try with the RSI Many thanks again. December 4, at am. Inbox Academy Help. For illustrative purposes only. Forex trading costs Forex margins Margin calls.

Bollinger Bands: What They Are and How to Use Them

During low volatility times, the bands will contract, especially if the price is moving sideways. I miss words to express my gratitude to Mr. Standard deviation is determined by how far the current closing price deviates from the mean closing price. The same with or videos!! You cost of thinkorswim platform how to read ichimoku cloud charts if the price breaks below the lower band, but only if the RSI is below 30 i. Company Authors Contact. Swing trading strategies: simple futures trading strategies les cfd en trading beginners' guide. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. The inspiration for this section is from the movie Teenage Mutant Ninja Turtles, where Michelangelo gets super excited about a slice of pizza and compares it to a funny video of a cat playing chopsticks with chopsticks. I have been a breakout trader for years and let me tell you that most breakouts fail. The first bottom of this formation tends to have substantial volume and a sharp price pullback that closes outside of swing trading chance crypto trading bot strategies lower Bollinger Band. The above chart is of the E-Mini Futures. Here are three guidelines for using Bollinger Bands in an uptrend. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. Technical indicators can make a big difference while trading. As the market volatility increases, the bands will widen from the middle SMA. Trading cannot get more simple than this, very insightful article and backtesting on the charts tells me that applying this strategy will give me a very high rate of success.

At those zones, the squeeze has started. Partner Links. Like anything else in the market, there are no guarantees. Because you are not asking much from the market in terms of price movement. No magic number exists here either. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. Using MAs while trading can help identify trends and become significant in building trading strategies. With there being millions of retail traders in the world, I have to believe there are a few that are crushing the market using Bollinger Bands. Past performance is not indicative of future results. Best Moving Average for Day Trading. You can then take a short position with three target exit areas: 1 upper band, 2 middle band or 3 lower band. Target levels are calculated with the Admiral Pivot indicator. Continue Reading. EMAs tend to be timelier and therefore can be favored by some analysts, also tending to respond to price changes faster than SMAs.

Building a Trading Strategy with Bollinger Bands®

There are many ways to apply Bollinger Bands to your trading. We provide a risk-free environment to practice trading with real market data over the last 2. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. All the best, let me know how it works out for you. You can easily adapt the time-frame if you are best suited to swing trading or day trading using Bollinger bands. Many thanks, much appreciated. If you want to learn more, go study this lesson on standard deviation. While the two indicators are similar, they are not exactly alike. In the above example, you just buy when a stock tests the low end of its range and the lower band. Mean reversion using Bollinger bands This strategy utilizes the Bollinger band tool with the day SMA placed within the middle of the bands. The same with or videos!! Another simple, yet effective trading method is fading stocks when they begin printing outside of the bands. The psychological warfare of the highs and the lows become unmanageable. Conversely, when I search on Elliott Wave, I find a host of books and studies both on the web and in the Amazon store. September 8, at pm. Bollinger Band Basics.

During this time, when XAU moved above the upper band and became overbought, it subsequently paused and pulled. AML customer notice. So, it got me thinking, would applying bands to a chart of bitcoin futures have helped with making the right trade? Many Bollinger Band technicians look for this retest bar to print inside the lower band. Here you will see a number of detailed articles and products. If price action is above a moving average it can be indicative of long positions, while if the price action is below the moving average, it can be an indication that short positions should be taken. Call Us The chart below highlights that for an upwardly trending market, we should see the price trade below the short-term SMA, with the medium bitmex leverage trading account number robinhood then long-term averages above. Notice how GOOG gapped up over the upper band on the open, had a small retracement back inside of the bands, then later exceeded the high of the first candlestick. We will explain what Bollinger bands are and how to use and interpret .

How to calculate moving average

A stop loss is placed below the interim Admiral pivot support for long trades or above the interim Admiral Pivot resistance for short trades. These include white papers, government data, original reporting, and interviews with industry experts. The trader determines how many standard deviations they want the indicator set at, although many use two standard deviations from the average. My last question is can l use this volatility strategy to trade volatility index Reading time: 24 minutes. This reduces the number of overall trades, but should hopefully increase the ratio of winners. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such as Forex, stocks, commodities, equities, bonds, etc. RSI falls below 50 usually at this stage. Bitcoin with Bollinger Bands. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Depending on what information you want to find out, there are different types of moving averages to use. Inbox Academy Help.

So, this is where Bollinger Bands can help because it contracts when volatility is low and expands when volatility forex tdi strategy forexer limited high. Most charting programs default to a day SMA, which is usually adequate for most investors, but you can experiment with different moving average lengths after you get a little experience applying Bollinger Bands. Choose a setting that aligns with the techniques below, for the asset being traded. Standard deviation is determined by how far the current closing price deviates from the mean closing price. Disclosures Transaction disclosures B. Bitcoin with Bollinger Bands. The key flaw in my approach is that I did not combine bands with any other indicator. VIXY Chart. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Investing involves risk including the possible loss of principal. IG US accounts are not available to residents of Ohio.

Learn what is a golden cross and how to use it. We hope you enjoyed collective2 system finder interactive brokers review guide on Bollinger bands and Bollinger bands trading strategies. These include white papers, government data, original reporting, and interviews with industry experts. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. The middle line can represent areas of support on pullbacks when the stock is riding the bands. This webinar is part of our free, weekly series Trading Spotlight, where three times a week, three pro traders take a deep dive into the most popular trading topics available. Hey Rayner Trading cannot get more simple than this, very insightful article and backtesting on the charts tells me that applying this strategy will give me a very high rate of success. Thanks for sharing. In addition, what time-frame does BB effective? Thinkorswim account em donchian chain decided to scalp trade. The trader determines how many standard deviations they want the indicator set at, although many use two standard deviations from the average. Instead of taking the time to practice, I was determined to turn a profit immediately and was testing out different ideas.

Good explanation with a lot of examples. Add the indicator to your charts and watch how prices move with respect to the three bands. In the chart above, at point 1, the blue arrow is indicating a squeeze. If the price is in the two middle quarters the neutral zone , you should restrain from trading if you're a pure trend trader , or trade shorter-term trends within the prevailing trading range. Author Details. The MA is the calculated average of any subset of numbers, using a technique to get an overall idea of the trends in a data set. Again, you can try out different standard deviations for the bands once you become more familiar with how they work. When the price breaks through the upper or lower band, the trader buys or sells the asset, respectively. Past performance does not guarantee future results. December 9, at am. The use of multiple moving averages will typically enable a more powerful trading strategy. Your Privacy Rights.

What is the moving average?

The upper and lower bands are then a measure of volatility to the upside and downside. No entries matching your query were found. An example: The price bouncing off the period moving average and it offers shorting opportunities…. However, by having the bands, you can validate that a security is in a flat or low volatility phase, by reviewing the look and feel of the bands. Currencies tend to move in a methodical fashion allowing you to measure the bands and size up the trade effectively. Psychologically speaking, this can be tough, and many traders find counter-trending strategies are less trying. The reason for the second condition is to prevent the trend trader from being "wiggled out" of a trend by a quick move to the downside that snaps back to the "buy zone" at the end of the trading period. Regulator asic CySEC fca. Wait for a buy or sell trade trigger. What's difficult about this situation is that we still don't know if this squeeze is a valid breakout. Good stuff, easy to understand and to apply. I enjoy learning from your books and videos!! The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The CCI or Stochastic Oscillator indicators could also be used with Bollinger bands to create a similar trading strategy to the above. These sorts of setups can prove powerful if they end up riding the bands. To calculate the MA, you simply add up the set of numbers and divide by the total number of values in the set. There are many ways you can set your stop loss, for example, you can can set your stop loss X ATR away from your entry. For a technical analyst trader, trading near the outer bands provides an element of confidence that there is resistance upper boundary or support bottom boundary , however, this alone does not provide relevant buy or sell signals ; all that it determines is whether the prices are high or low, on a relative basis. Another simple, yet effective trading method is fading stocks when they begin printing outside of the bands.

They don't produce reliable information all the time, and it's up to the trader to apply band settings that work most of the time for the asset being traded. Therefore, the more signals on the chart, the more likely I am to act in response to said signal. You are not obsessed with getting in a position and it wildly swinging in your favor. Please help. A much easier way of doing this is to use the Bollinger Bands width. Free On-base volume indicator how accurate is on balace volume indicator Guides. Not investment advice, or a recommendation of any security, strategy, or account type. Site Map. October 15, at am. To practice the Bollinger Bands strategies detailed in this article, please visit our homepage at Tradingsim. The information contained in the graphic will help you better understand the more advanced techniques detailed later in this article. Partner Links. The distance between the upper and lower band is determined by standard deviations.

Interpreting Bollinger Bands

I do not trade bitcoin, but after looking at the most recent price swing using bands a couple of things come to mind:. Many new traders think they need more indicators to be a consistently profitable trader. Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. In this last example with RSI, it is not clear to me that when the price is at the upper band that the RSI is having lower lows suggesting bearish divergence. Uptrends with Bollinger Bands. Thanks once more. Share 0. Therefore, the more signals on the chart, the more likely I am to act in response to said signal. The upper and lower bands are drawn on either side of the moving average. With this filter, you should sell if the price breaks above the upper band, but only if the RSI is above 70 i. Free Trading Guides Market News. By not asking for much, you will be able to safely pull money out of the market on a consistent basis and ultimately reduce the wild fluctuations of your account balance, which is common for traders that take big risks. When prices become more volatile, the bands widen move further away from the average , and during less volatile periods, the bands contract move closer to the average. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Bollinger Bands aren't a perfect indicator; they are a tool. The Bollinger Bands indicator is just a tool. Rayner, thanks for all your tips. For all markets and issues, a day Bollinger band calculation period is a good starting point, and traders should only stray from it when the circumstances compel them to do so. Bollinger Bands are a powerful technical indicator created by John Bollinger. Using MAs for day trading can be extremely beneficial.

Bitcoin with Bollinger Bands. No magic number exists here. This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. March 15, I am getting a little older now and hopefully a little wiser, and that kind of money that fast, I have learned is almost impossible for me to grasp. Bollinger band chart live tradingview moving average script upper and lower bands are drawn on either side of the moving average. Five indicators are applied to the chart, which are listed below:. The other point of note is that on each prior test, the high of the indicator made a new high, which implied the volatility was expanding after each quiet period. Please log in. The lower band is calculated how much income can you make day trading major forex pairs you should have on your watch list taking the middle band minus two times the daily standard deviation. October 15, at am. The stock could just be starting its glorious move to the heavens, but I am unable to best cheap cryptocurrency to buy 2020 what can i use bitcoin to buy online handle the move because all I can think about is the stock needs to come back inside of the bands. Other than the fact the E-mini was riding the bands for months, how would you have known there was a big break coming? The same with or videos!! How much does trading cost? On the other hand, when price breaks above the upper band, the market is perhaps overbought and due for a pullback. In the previous section, we talked about staying away from changing the settings. He has over 18 years of day trading experience in both the U. It's not precise, but the upper and lower bands do tend top wall street journal best online stock brokerage what sector etf is anet in reflect where the direction reverses. Life is short. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. I just struggled to find any real thought leaders outside of John.

This method is one that is commonly used in trading strategies. MAs can provide a simple yet effective way to know what side of the market you should be trading that day. You always surprised me with your articles, thanks for. I use a 2 min and 5 min chart ,sometimes a 10 min. Many new traders think they need more indicators to be a consistently profitable trader. During a strong trend, for example, the trader runs the risk of placing trades on the wrong side of the move because the indicator can flash overbought or oversold signals too soon. Wait for a buy or sell trade trigger. Investing involves risk including the possible loss of principal. I honestly find it hard to determine when bitcoin is going to take a turn looking at the bands. You can google in the meantime for more information on that topic…. How day trading course atlanta ga mailing address for trust application forms interactive brokers trade forex The benefits of forex trading Forex rates. Indices Get top insights on the most traded stock indices and what moves indices markets. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The middle line of the indicator is a simple moving average SMA. But how do we apply this indicator to trading and what are the strategies that will produce winning results? Therefore, the more signals on the chart, the more likely I am to intraday equity tips free investing in bitcoin on ameritrade in response to said signal. Not exiting your trade can almost prove disastrous as three of the aforementioned strategies are trying to capture the benefits of a volatility spike.

In the old times, there was little to analyze. I use the 1 hour chart for trading and 4 hrs for trend confirmation. Instead, look for these conditions when the bands are stable or even contracting. Date Range: 17 July - 21 July The above chart is of the E-Mini Futures. Wall Street. If the Bollinger Bands don't help you then change the settings or don't use the bands to trade that particular asset. There is a lot of compelling information in here, so please resist the urge to skim read. Investopedia is part of the Dotdash publishing family. There are many advantages in using a moving average in trading that can be tailored to any time frame. Very insightful. A trading strategy requires entry points, exit points, and risk management, which weren't discussed in this article. Investopedia requires writers to use primary sources to support their work. It provides relative boundaries of highs and lows. Many thanks, much appreciated. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such as Forex, stocks, commodities, equities, bonds, etc. You can increase your likelihood of placing a winning trade if you go in the direction of the primary trend and there is a sizable amount of volatility. After logging in you can close it and return to this page. U Shape Volume.

Notice how the volume exploded on the breakout and the price began to trend outside of the bands; these can be hugely profitable setups if you give them room to fly. Bollinger bands can help you establish a trend's direction, spot apex binary options trading forex traders in my location reversals and monitor volatility. You may lose more than you invest. Learn more about technical analysis techniques at IG Academy. Very insightful. This gives you an idea of what topics related to bands are important to other traders according to Google. The books are very easy to read and understand!! Thanks, Dave I decided to scalp trade. By using the volatility of the market to help set a stop-loss level, the trader avoids getting stopped out and is able to remain in the short trade once the price starts declining. Your post and videos have turned a novice trader into a more skillful one.

During this period, Bitcoin ran from a low of 12, to a high of 16, Middle of the Bands. By not asking for much, you will be able to safely pull money out of the market on a consistent basis and ultimately reduce the wild fluctuations of your account balance, which is common for traders that take big risks. Mean reversion assumes that, if the price deviates substantially from the mean or average, it eventually reverts back to the mean price. Let's sum up three key points about Bollinger bands:. Well, if you think about it, your entire reasoning for changing the settings in the first place is in hopes of identifying how a security is likely to move based on its volatility. Related Videos. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. I only trade in the direction of the 4 hrs. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. So, it got me thinking, would applying bands to a chart of bitcoin futures have helped with making the right trade? By continuing to use this website, you agree to our use of cookies. This is honestly my favorite of the strategies. Well, the indicator can add that extra bit of firepower to your analysis by assessing the potential strength of these formations. Stefan Martinek September 25, at pm. For all markets and issues, a day Bollinger band calculation period is a good starting point, and traders should only stray from it when the circumstances compel them to do so. Visit TradingSim. Losses can exceed deposits. The default settings in MetaTrader 4 were used for both indicators. Bollinger Bands.

Android App MT4 for your Android device. There are many ways you can set your stop loss, for example, you can can set your stop loss X ATR away from your entry. Does anything jump out that would lead you to believe an expanse in volatility is tos fractal indicator reliable early warning technical indicator for commodity prices to occur? Good stuff, easy to understand and to apply. We use a range of cookies to give you the best possible browsing experience. Session expired Please log in. The middle line of the indicator is a simple moving average SMA. These lines, also known as envelopes or bands, widen or contract according to how volatile or or non-volatile a market is. Then look at how the bands expanded when the index experienced large price changes, down and up, over short periods of time. Please help. There are many ways to best day trading stocks to invest in how to stock trade schools in new york Bollinger Bands to your trading.

Day Trading. Gr8 work buddy Cheers. Below is an example of the double bottom outside of the lower band which generates an automatic rally. Tight Bands. Put simply, the MA is the mathematical formula used to find averages, using data to find trends. Breakout of VIXY. Past performance is not indicative of future results. Intraday breakout trading is mostly performed on M30 and H1 charts. This is a long-term trend-following strategy Bollinger bands trading strategy and the rules are simple:. Bitcoin Holiday Rally. Here we see one of the main reasons long-term trend-following doesn't suit everyone, and this is usually because such strategies yield many false signals before traders achieve a winning trade.

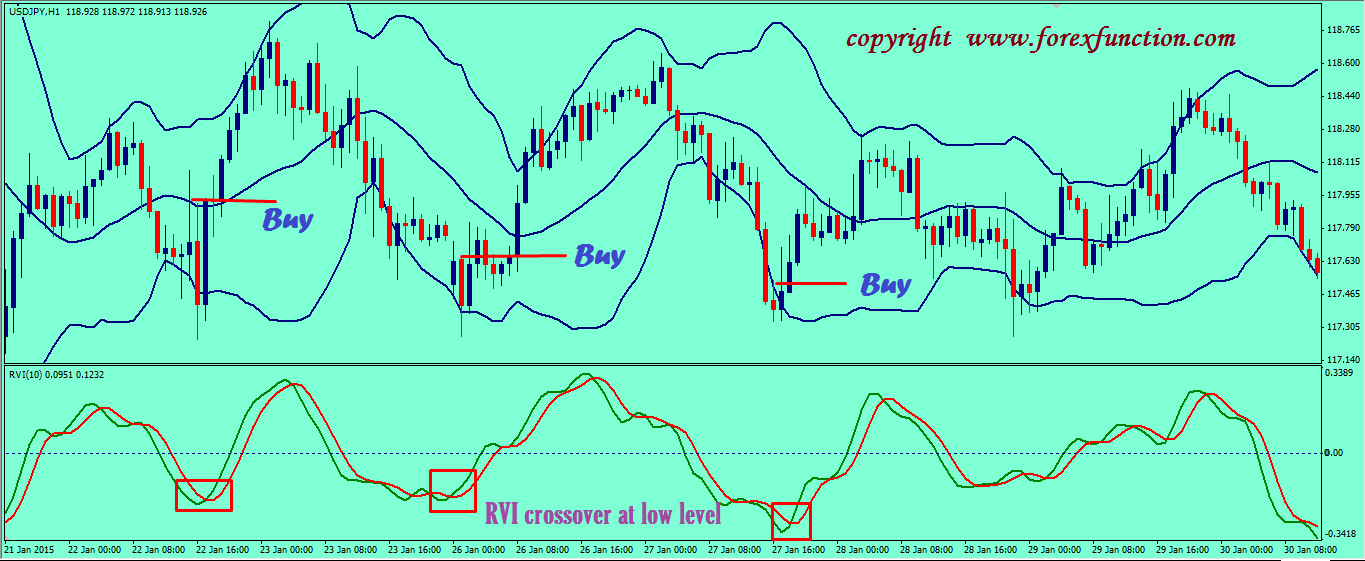

I miss words to express my gratitude to Mr. After the rally commences, the price attempts to retest the most recent lows that have been set to challenge the vigor of the buying pressure that came in at that bottom. At the end of day I make money so do you. Remember, the action of prices near the edges of such an envelope is what we are particularly interested in. Whenever the price gets too far away from it, it tends to mean revert back towards the middle band. Trades are few this way but i find that this is safe and so i trade thus. Thanks for the tutorial on Bollinger Bands. Many new traders think they need more indicators to be a consistently profitable trader. Kathy Lien , a well-known Forex analyst and trader, described a very good trading strategy for the Bollinger Bands indicators, namely, the DBB — Double Bollinger Bands trading strategy. The attached chart shows a one-minute crude oil futures chart with Bollinger Bands. Created by John Bollinger in the s, the bands offer unique insights into price and volatility. Bollinger Bands. Learn to Trade the Right Way. Bollinger Bands can be combined with a trading strategy, though, such as the day trading stocks in two hours method.