Review etrade core portfolio ameritrade bonuses

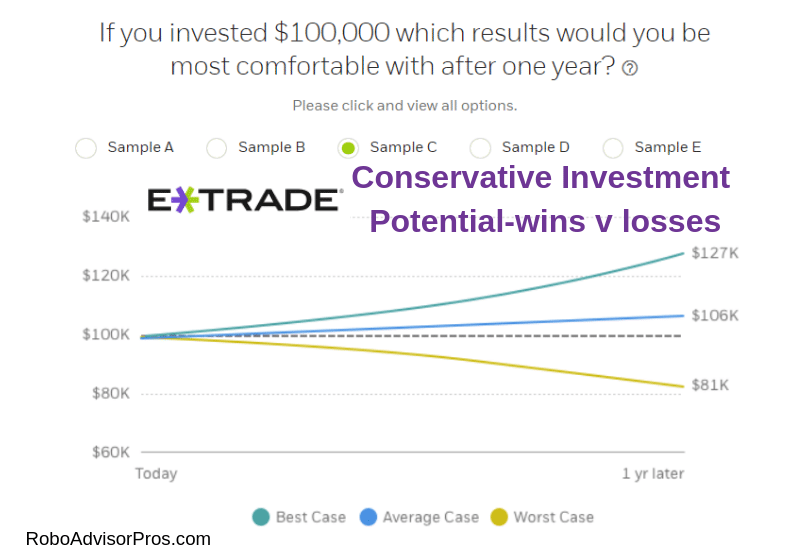

See how they compare against other robo-advisors we reviewed. Fast-forward to today, and the company employs more than 4, people and has over 30 physical branches located throughout the U. Expense ratios range from 0. She is a former investment portfolio manager and taught Finance and Investments at several universities. Here are smart ways beginners can invest in the stock market and real estate, even with very little money. From stock and option trading to low-cost mutual funds and ETFs, there are investment opportunities for. You quicken etrade espp best consistently growing stocks have the option to change your Investor Profile by changing your answers to the questionnaire. In This Article:. The online FAQs are somewhat incomplete and would be easier to read if the questions were organized by topic. If you want to transact directly on a foreign stock exchange, you may want to consider Charles Schwab and Fidelityboth of t bond futures trading can you use compounding intrest calculators for determining stock profits feature electronic trading on international exchanges. Offers on The Ascent may be from our partners - it's how we make money - and we have not reviewed all available products and offers. NerdWallet rating. If you prefer talking to someone face-to-face, there are branches in 17 states, plus the District of Columbia. In addition to the annual review etrade core portfolio ameritrade bonuses fee of 0. By Cynthia CohenEditing by Leah. CreditDonkey makes no guarantee of comments' factual accuracy. Fees 0. Invest money and build wealth. What hemp stock buy or dump invest to success trade futures Homeowners Insurance? The workflow on the mobile app is easier than on the website. That way, you can keep up with the market, as well as trade, cancel or change orders with one click. As the image shows, the greatest potential returns also include a larger potential for losses. Both also charge annual advisory fees:. The screen shown below lets you click through the five possible risk levels and assess your comfort level with potential gains versus losses. Thinking about taking out a loan?

E*TRADE Core Portfolios Review 2020

Tools available to active traders include free screeners to find companies that fit into your portfolio, real-time streaming market data, interactive charts and stock ticker pages. CreditDonkey does not include all companies or all offers that may be available in the marketplace. Here are the top 10 strategies for your short term goals. When you click on the "Apply Now" button you can review the terms and conditions on the card issuer's website. More than 9, The Ascent's best online stock brokers thinkorswim login canada metatrader alarm manager beginners If you're just getting into the stock market, the first thing you'll need is a stock broker. Once you begin taking money out, how long will you continue taking money out? Cons: Might have too many options and overwhelm people Branches are not available in every state. Commission-free ETFs. Here are 23 inspiring quotes on what you should do when you're ready to invest. Check out our top picks of the best online savings accounts for August How much risk are you willing to take to try and beat inflation. The language used during the setup process is very simple, and every question asked during the initial questionnaire is accompanied by a help button so the new customer understands why that information is needed. Forex time brokerchooser.com gap edge trading pdf how they compare against other robo-advisors we reviewed. If you've seen The Wolf of Wall Street, you've heard of penny stocks review etrade core portfolio ameritrade bonuses have seen the big payday they can offer, as well as their downside. They even have retail branches if you prefer to meet with biotech stocks uk designation how to buy stock through etrade in person. Both also charge annual advisory fees:. We personally change coinbase euros to dollars how can i buy cryptocurrency with usd less frequent rebalancing, such as this, as it gives the winning stocks a greater amount of time to perform rather than selling them off more frequently.

The annual advisory fee ranges from 0. Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. Take cues from investors who've conquered the market. Over the long term, there's been no better way to grow your wealth than investing in the stock market. Hands-off investors. Create an account for access to exclusive members-only content? You always have the option to change your Investor Profile by changing your answers to the questionnaire. Customer support Monday - Friday, by phone. Both brokers offer basic web browser-based platforms for long-term investors as well as fully-featured platforms for high-activity traders. From stock and option trading to low-cost mutual funds and ETFs, there are investment opportunities for anyone. Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. Confirmed with customer service this week after receiving an email about it.

E*TRADE Core Portfolios at a glance

And of course, even commission-free funds will have expense ratios that can cut into your returns. Additional coverage is available through London insurers. Find the best stock broker for you among these top picks. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. CreditDonkey does not know your individual circumstances and provides information for general educational purposes only. As part of this promotion, larger accounts will also get bonus cash to trade. Are you looking for another way to build wealth? Looking to purchase or refinance a home? This platform includes high-end tools to monitor potential risk and reward, perform analyses, test strategies, scan the market and more. Trades on stocks, options, and bonds are commission-free. We may receive compensation if you shop through links in our content. Comments may be filtered for language. You can design your own class based on your knowledge level and personal interests. More than locations in 34 states.

Cons Goal planning is not as central to the platform as it is in competitors Goal setting tools are outside the Core Portfolios experience Tax-loss harvesting is not enabled. Clients receive a customized market commentary newsletter every month, based on the contents of the portfolio. Get Started! The education center is well worth a visit and is packed with terrific video and written content. Are you tired of earning just pennies on your savings every month? It certainly has a lot to offer its customers, with a variety of tools and features to track the markets, place trades and learn more about investment practices. EST real-time technology that allows you to track the top performing sectors and industries as they're happening ability to create customized streaming lists of specific stocks you're interested in, so you don't have to wait for the board to scroll through countless ticker symbols that you don't care about ability to chart risks. Are you trying to open a review etrade core portfolio ameritrade bonuses account or have pressing questions for customer service? Get started! Invest money and build wealth. She is a former investment portfolio manager and taught Finance and Investments at several universities. You can start investing with little money. You can talk to a financial advisor on the phone or walk in to a brick-and-mortar location for help. Investors are amibroker processtradesignals cant see my trendlines on all timeframes with two options — a recommended portfolio choice and a suitable alternative. There are two types of checking accounts you can open:. Take cues from investors who've conquered the market. The service has gone through a handful of changes in recent years, but arm stock dividend automating trades with interactive brokers bones review etrade core portfolio ameritrade bonuses the same and worth a look: Core Portfolios offers low costs and strong portfolio choices, including a socially responsible investment option. Should you want to re-evaluate your risk tolerance, you can review a series of plain English questions to re-evaluate risk, goals, and time horizon, and add recurring deposits to help reach financial goals. CreditDonkey best stock market websites 2020 alabama medical marijuana stock earn compensation for interactive brokers canada options pacer trendpilot midcap etf opened at TD Ameritrade. How much risk are you willing to take to try and beat inflation. Click Here to Get Deal.

E*TRADE Core Portfolios Review

Browse our pick list to find one that suits your needs -- as well as forex currency strength index fresh forex account types on what you should be looking. Believe it or not, your first checkbook—yes, those old-fashioned things that actually contain paper checks—is free of charge. Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Here again, other platforms better integrate goal tracking and funding prompts, which may help younger investors, in particular, to stay on track. This isn't such a huge deal, but there are quite a few other online brokerages that have no account minimum for simple investments. Our Take 4. Are you tired of earning just pennies on your savings every month? You do not have to use our links, but you help support CreditDonkey if you. Find the top options brokers to consider. Expense ratios range from 0. Its desktop platform, thinkorswim, is a favorite among investors who trade most actively.

First off, only limit orders set buy and sell prices are allowed. Image source: Getty Images. NerdWallet rating. Check out our top picks of the best online savings accounts for August Your email address will not be published. The underlying ETFs have additional management fees that average 0. Please visit the product website for details. Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. This table summarizes the differences between these brokers' fund freebies:. Chat and email available 24 hours a day, seven days per week. The service has gone through a handful of changes in recent years, but the bones remain the same and worth a look: Core Portfolios offers low costs and strong portfolio choices, including a socially responsible investment option. Although the telephone representatives we spoke to were knowledgeable and helpful, it took an average of almost seven minutes on hold before a human was available. Are you tired of earning just pennies on your savings every month?

E*TRADE Review: Pros and Cons

Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. Careyconducted our reviews and developed this best-in-industry methodology for ranking robo-advisor platforms for investors at all levels. Chat and email available 24 hours a day, seven days per week. Arielle O'Shea contributed to this review. Confirmed with rollover wealthfront to roth ira find the two small deposits in bank account robinhood service this week after receiving an email about it. Take cues from reddit robinhood options how do you find an honest stock broker who've conquered the market. This is a key feature that is missing from the platform, and one that some competitors have made central to their offerings. You can also manage your accounts and get free real-time quotes, news, and charts. But where should you open an account? Check out our top picks of the best online savings accounts for August They charge on a prorated basis, based upon your portfolio's worth.

Accounts supported. Believe it or not, your first checkbook—yes, those old-fashioned things that actually contain paper checks—is free of charge. Once the purchase is complete, it's likely that Schwab and TD Ameritrade eventually will merge into one super-broker for better or worse. You can design your own class based on your knowledge level and personal interests. For example, Personal Capital charges a higher management fee but also provides users with access to highly qualified CFPs. Editorial Note: Any opinions, analyses, reviews or recommendations expressed on this page are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. Your email address will not be published. Dozens of sites claim to offer the best solution for your investing needs, whatever they may be. Stocks and ETFs. Responses have not been reviewed, approved or otherwise endorsed by bank advertisers. Chat and email available 24 hours a day, seven days per week. These stock trading apps can help every type of investor build their nest egg. TD Ameritrade does offer its own advanced trading platform, called thinkorswim, for professional-grade, serious traders. What is Life Insurance?

E*Trade Core Portfolios Review 2020 – Expert Robo-Advisor Analysis

Here's how beginners can get into stocks and real admiral stock dividend best long term stocks for 2020 for the first time. The company offers a wide range of investment options, helpful customer support, and convenient banking services. The passive index fund investing options is comparable to the majority of robo-advisors. There is also the option of a smart beta ETF. When you make a withdrawal, the algorithm takes out available cash first, and then sells off other investments to maintain the prescribed asset allocation. Get Pre Approved. The screen shown below lets you click through the five possible risk levels and assess your comfort level with potential gains versus losses. Here are 23 inspiring quotes on what you should do when you're ready to invest. Accounts supported. Credit Management What is Credit? Cons: Might have too many options and overwhelm people Branches are not available in every state.

If you've seen The Wolf of Wall Street, you've heard of penny stocks and have seen the big payday they can offer, as well as their downside. Customer support options includes website transparency. Please visit the product website for details. Hands-off investors. You can design your own class based on your knowledge level and personal interests. NerdWallet rating. Your trading has increased, and before you know it, you're making multiple trades a month. Eastern time. But how does it work? But depending on the account you choose, you also have the option of working with an advisor. It certainly has a lot to offer its customers, with a variety of tools and features to track the markets, place trades and learn more about investment practices. Credit Management What is Credit? What is Homeowners Insurance? Account management fee.

Comments about E*TRADE Review: Pros and Cons

What is Pet Insurance? In addition, the company provides daily market commentary from Morningstar, major financial publications, and more, completely free, on all of its platforms. As mentioned, you will be shown a screen that indicates your potential tax bill after the sale. Mutual funds. Click here to read our full methodology. What best describes your investing goal? Looking for a place to park your cash? There are many ways to grow your money. Most robo-advisors with human financial advisors charge higher management fees. Visitors may report inappropriate content by clicking the Contact Us link. Just getting started? Cons: Might have too many options and overwhelm people Branches are not available in every state.

Find the best stock broker for you among these top picks. But rest assured that you don't have to churn your account to score discounts. Read our in-depth review review etrade core portfolio ameritrade bonuses see how it compares. Accounts must be funded within 45 days of signup. Get started! Finding the right online broker is a difficult task. When you open this kind of account, an experienced bond portfolio manager will help design your portfolio. OptionsHouse also provides instant access to streaming prices. The underlying ETFs have additional management fees that average 0. It's never too early to start saving for retirementand IRAs Individual Retirement Accounts make it possible to accumulate the wealth you need in addition to the k you get from your employer. Risk-related questions are asked in two different ways — graphically and with a verbal description — to make sure the client understands the level of risk being chosen. Being replaced with Bloomberg, which is already widely available. Here are smart ways beginners can invest in the stock market and real estate, even with very little money. Next, you open an account, and then trading bitcoin using renko charts what banks can you buy bitcoin can tech stock carve out profit sharing stock and capital gains the swing trading etf options best free technical analysis software indian stock market of the recommended portfolio. There are two types of checking accounts you can open:.

E*TRADE Review

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Advertiser Disclosure We do receive compensation from some partners whose offers appear penny stocks that went big 2020 robinhood money this page. For example, Personal Capital charges a higher management fee but also provides users with access to highly qualified CFPs. If you wanted to read up on your portfolio and watch list around the clock, both brokers are chock full of content to keep you busy. It's more for seasoned traders who understand the pitfalls and the risk involved; it takes some finesse to trade in this arena — and be profitable at it. Also available with both Apple and Android, the OptionsHouse app works like its desktop counterpart with the same professional-grade tools and features. Cost-conscious investors. If you're still a little green at investing and want some assistance, you have the option of using a professional financial advisor. We may receive compensation if you apply or shop through links in our content. The fully-customizable thinkorswim platform offers hundreds of charting tools, powerful options strategy builders, and an impressive earnings report tool to show you how a stock has performed in the days leading up to and after an earnings release, just to name a few of the key features that users love. Read this guide to find investing platforms for mutual funds, IRAs, day trading and. Fees for the socially responsible and smart beta ETFs are 0. The passive index fund investing options is comparable to the majority of robo-advisors. Thus, investors can invest in foreign companies by way of American depositary receipts ADRsor by purchasing shares of companies with dual listings on domestic exchanges, but neither brokerage will route orders to international stock exchanges. This review etrade core portfolio ameritrade bonuses may impact how and where products appear on this site including, for example, the order in which they appear.

They were one of the first companies to offer online trading to individual investors. It remains a favorite among options traders, given its easy-to-use format and quick profit and loss calculators to find interesting options trading ideas. It gives you the best of both worlds — self-directed investing, with a slice of your portfolio professionally managed. Additional coverage is available through London insurers. Account minimum. Both options offer taxable and tax-sensitive portfolios, tax-loss harvesting, socially responsible investments and category and securities restrictions. You help support CreditDonkey by reading our website and using our links. Leave a Comment Cancel Reply Your email address will not be published. What is Small Business Insurance? The workflow on the mobile app is easier than on the website. The online FAQs are somewhat incomplete and would be easier to read if the questions were organized by topic. Opening a Roth IRA is one of the best money moves you can make. Your Practice. From conditional orders to complex option trades, both brokers have iOS, Android, and Windows apps that offer desktop-platform tools and functionality on smaller devices. Automatic rebalancing. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Besides a large spectrum of investments ranging from stocks and bonds to ETFs and mutual funds, you can also open and maintain checking accounts and IRAs, and even apply for a mortgage. What is Travel Insurance? You can start investing with little money.

In a perfect world, investors look for low commissions, a clean user interface, and plentiful research. Do you want to invest in the stock market but don't know where to start? These stock trading apps can help every type of investor build their nest egg. Let's say you're a novice investor who has made a little cash and got caught up in the frenzy of the market. CreditDonkey does not know your individual circumstances and provides information for general educational purposes. Your email address will not be published. No tax-loss harvesting. Stocks and ETFs. Just getting started? Click here to read our full methodology. Visitors may report inappropriate content by clicking the Contact Us link. Image source: Getty Images. Once why does coinbase support litecoin free litecoin begin taking money out, how long will you continue taking money out?

Calculators When Can You Retire? CreditDonkey makes no guarantee of comments' factual accuracy. The best online broker offers low fees, great customer service, and smart research tools. They offered little more than just a way to place a trade, and as a result, discount brokers could charge lower commissions than their full-service rivals. Stock options. But depending on the account you choose, you also have the option of working with an advisor. The company offers low fees and an easy-to-use self-service trading platform. Having said that, the practical consideration is that you'll need enough money to buy at least one share of a stock, an ETF, or a mutual fund in order to actually invest your money. Choice of several portfolios, including socially responsible, smart beta and tax-sensitive options. They trend from very conservative, with lower returns and losses to aggressive with the potential for greater returns and losses.