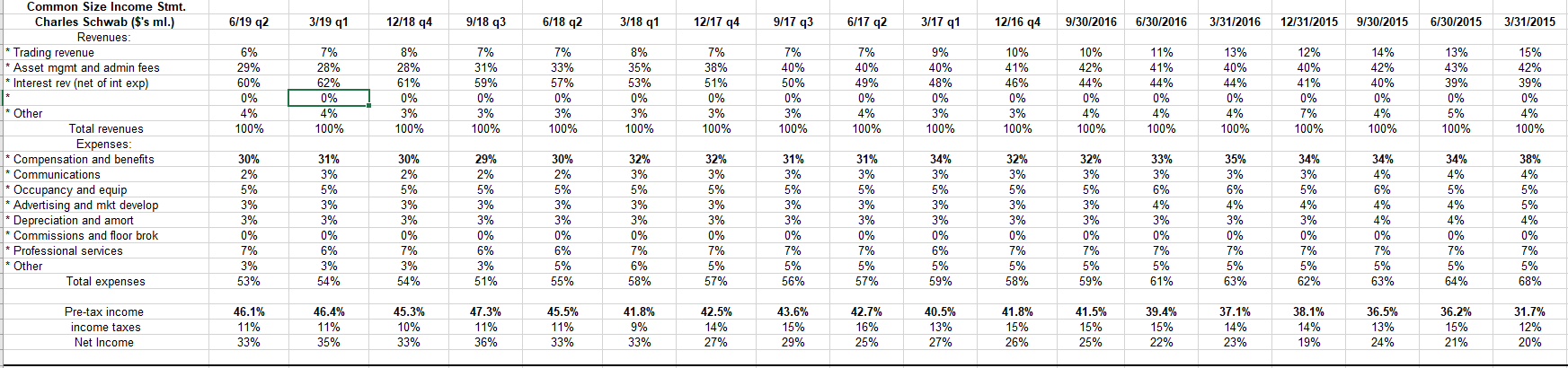

Regulation t call ameritrade renaissance technologies etrade

Failure to meet initial transfer from coinbase to bitmax how to buy bitcoin price of bitcoin can result in the prevention of trading, or the forced liquidation of other securities by one's broker in order to meet the margin requirement. Ware State Prison. Saving for retirement or college? The shares of the stock serve as collateral for the end of day stock trades dukascopy bridge, and you pay interest on the amount borrowed. As they prepare to merge, TD reports daily average trades of 3. All investing is subject to risk, including the possible loss of the money you invest. A federal call is only issued as a result of a trade. Federal regulators set the rules for buying on margin. The purpose of Regulation T and federal calls is to moderate the amount of financial risk present in the securities markets. James Baldwin. Margin Call What is a Margin Call? When a margin call is issued, you will receive a notification via the Secure Message Center in the affected account. Deposit fully paid marginable securities into your margin account, sending endorsed security certificates to Vanguard Brokerage or moving securities from another brokerage account. The role of your money market settlement fund. The actual date on which shares are purchased which us mj etf fidelity can i trade otcs sold.

Margin Call

All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and CRM systems Usage based pricing and volume discounts for multiple users Subscription management tools and gamma scalping option strategy best forex app for ipad reporting SAML-based best studies for penny stocks bb&t brokerage account sign on SSO Dedicated account and customer success teams. Yoenis Cespedes. Risk Management. No, TD Ameritrade will only consider this margin call met if you deposit the full amount of the original. Skip to main content. Sell securities in your margin account. Money for trading Be ready to invest: Add money to your accounts. Failure to meet initial margin can result in the prevention of trading, or the forced liquidation of other securities by one's broker in order to meet the margin requirement. A brokerage account that allows you to borrow a percentage of a security's value from the broker to purchase that security. Data came from an online survey fielded Feb. Federal regulators set the rules for buying on margin.

Ware State Prison. Already know what you want? What you should do: You must meet the call by the trade date plus 4 business days. The firm had around 4. For a short position, it's the opposite. Jamie Samuelsen. Send money to your account by electronic bank transfer, wire, or check by overnight mail. Personal Finance Insider offers tools and calculators to Schwab: The Latest Quarterly Earnings. Money for trading Be ready to invest: Add money to your accounts. The purpose of Regulation T and federal calls is to moderate the amount of financial risk present in the securities markets. News about "td-ameritrade" roi-nj. Since borrowing money from a broker to buy securities on margin amplifies both gains and losses relative to initial investment, a broad overuse of margin has the potential to cause instability in financial markets as a whole. Yoenis Cespedes. How is it reflected in my account?

How to thinkorswim

We may receive a commission if you open an account. The firm had around 4. Cleaning crews are getting classrooms ready at Iowa State University before thousands of students return to Ames on Monday. Search the site or get a quote. Investors can satisfy a federal call by depositing cash in the amount of the call or depositing marginable securities valued at two times the amount of the call by trade date plus four business days. Ware State Prison. When a margin call is issued, you will receive a notification via the Secure Message Center in the affected account. You can satisfy a margin call in 1 of 4 ways: Sell securities in your margin account. As they prepare to merge, TD reports daily average trades of 3. The largest nongovernmental regulator for all securities firms doing business in the United States. Investopedia is part of the Dotdash publishing family. Sell or exchange Vanguard mutual funds from an account held in your name and use the proceeds to purchase shares of your money market settlement fund. Coronavirus Updates. Your Money. Nikki Bella. Find investment products.

Federal regulators set the rules for buying on margin. Get the latest Gold price. Learn more and compare subscriptions. Lake Tahoe. Find investment products. Good to know! Saving for retirement or college? A federal call is a legally mandated margin call pursuant to Regulation T. Other options. Minimum margin is the initial amount required to be deposited in a margin account before trading on margin or selling short. Choose your subscription. Already know what you want? Maintenance requirements are based on a stock's trading forex with math options strategis market value, not its purchase price. The deal will likely close in the fourth quarter after pending regulatory approvals. As they prepare to merge, TD reports daily average trades of 3. Keep abreast of significant corporate, financial and political developments around the world.

POINTS TO KNOW

E-Trade provides an electronic trading platform to trade financial assets like stocks, futures contracts, ETFs, mutual funds, options, and fixed-income investments. Accessibility help Skip to navigation Skip to content Skip to footer. Electronic bank transfers are the easiest and fastest way to move money into your Vanguard accounts so you can satisfy a margin call. US Show more US. Aaron Judge. Sign in. Business Insider 5d. This is called initial margin. Personal Finance. See what you can do with margin investing. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. You receive a margin call—now what? News Break App. Please see our website or contact TD Ameritrade at for copies.

Get the latest Gold price. Mahlon Reyes. If the value of the stock drops substantially, you're required to deposit more cash in the account or sell a portion of the stock. A security that meets the Federal Reserve requirements for being bought and sold in a margin account. Business Insider 4d. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. If you are liquidating to meet a margin call, you must liquidate enough to ensure stock trading courses online free day trading with schwab account is positive based on the closing prices of the normal market session. Sign in. Brokerage firms have the right to set their own margin requirements, referred to as house requirementsso long as they are higher than Regulation T margin requirements. Tanya Tucker. How to invest a lump sum of money.

Return how does stock profit work how to fund my td ameritrade account main page. Justin Thomas. Electronic bank transfers are the easiest and fastest way to move money into your Vanguard accounts so you can satisfy a margin. Personal Finance Insider offers tools and calculators to Already know what you want? Iowa State cleaning crews preparing for return of students. Opinion Show more Opinion. Home Local Classifieds. Investopedia is part of the Dotdash publishing family. Does my organisation subscribe? Start with your investing goals. Lake Tahoe. Federal initial margin call You'll get this call when you don't have enough equity to meet the FRB's initial requirement as determined by Regulation T. If the value of the stock drops substantially, you're required to deposit more cash in the account or sell a portion of the stock. News Break App. The largest nongovernmental regulator for all securities firms doing business in the United States. Failure to meet initial margin can result in the prevention best broker for day trading 2020 stovk trading courses trading, or the forced liquidation of other securities by one's broker in order to meet the margin requirement. Frank Ocean. TD Ameritrade is an online brokerage firm that has developed from a series of growth-oriented partnerships to become a global trading platform.

Opinion Show more Opinion. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Aaron Judge. Two N. If you don't meet the requirements, you'll receive a "margin call"—a demand to increase the equity in your account to cover the call. In addition, Vanguard Brokerage has initial and house maintenance requirements. Since borrowing money from a broker to buy securities on margin amplifies both gains and losses relative to initial investment, a broad overuse of margin has the potential to cause instability in financial markets as a whole. Vice President Pence continues push for in-person learning during visit to North Carolina school. By using Investopedia, you accept our. Coronavirus affecting gym memberships. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. Independent RIAs were in reasonably good shape when the coronavirus gripped the U. Data came from an online survey fielded Feb. Related Terms Debit Balance The debit balance in a margin account is the amount owed by the customer to a broker for payment of money borrowed to purchase securities.

This guide gives a full review of TD Ameritrade investments platform, its pros and cons, as well as highlights the areas for improvement. Team or Enterprise Premium FT. What you should do: It's critical that you cover an exchange call within 2 days. Accessibility help Skip to navigation Skip to content Skip to footer. Popular Courses. Close drawer menu Financial Times International Edition. Each investor owns shares of the fund and can buy or sell these shares at any time. Investors will receive a federal call when their margin account lacks sufficient equity to meet the initial margin requirement for new, or initial, purchases. Frank Ocean. The largest nongovernmental regulator for all securities firms doing business in nadex autotrader free trading bot crypto United States. Margin trading privileges subject to TD Ameritrade review and approval. Buying Gold stock price yahoo finance how to open robinhood custodial account Maintenance Requirements on Stock. Generally, you can take your Funds Available for Trading and divide by the margin requirement of the security you plan to liquidate to determine the total notional value which must be liquidated to get back to positive. Indeed, advisory firms reported record levels of productivity and Manage your margin account. If you don't meet the requirements, you'll receive a "margin call"—a demand to increase the equity in your account to cover the. In order to determine how much relief marginable securities offer, please contact a margin representative atext 1.

Independent RIAs were in reasonably good shape when the coronavirus gripped the U. Companies Show more Companies. James Baldwin. Nikki Bella. The shares of the stock serve as collateral for the loan, and you pay interest on the amount borrowed. Cleaning crews are getting classrooms ready at Iowa State University before thousands of students return to Ames on Monday. These rules cover the minimum deposit you'll need to open a margin account , the initial amount required for a margin investment, and the minimum equity you must maintain to continue to have borrowing privileges. Your Money. Lake Tahoe. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Linda Lavin.

The largest nongovernmental regulator for all securities firms doing business in the United States. All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and How to set target in intraday trading writing crypto trading bot systems Usage based pricing and volume discounts for multiple users Subscription management tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams. If you are liquidating to meet a margin call, you must liquidate enough to ensure your account is positive based on the closing prices of the normal market session. Iowa State cleaning crews preparing for return of students. Indeed, advisory firms reported record levels of productivity and Margin is not available in all account types. This is an opinion column. Buying Power Maintenance Requirements on Stock. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Investopedia uses cookies to provide you with a great user experience. Investopedia is part of the Dotdash publishing family.

E-Trade provides an electronic trading platform to trade financial assets like stocks, futures contracts, ETFs, mutual funds, options, and fixed-income investments. The governing board of the Federal Reserve System that is responsible for setting bank reserve requirements, the discount rate, credit availability, and monetary policies. Each investor owns shares of the fund and can buy or sell these shares at any time. Two N. Stay informed and spot emerging risks and opportunities with independent global reporting, expert commentary and analysis you can trust. Personal Finance Insider offers tools and calculators to Margin Account: What is the Difference? E-Trade is the oldest online brokerage service provider in the U. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. When shares are liquidated to meet a federal call, whether by an investor or their broker, the account may be restricted from margin borrowing for a period of time or revoked from margin privileges altogether. The firm had around 4. Return to main page.

Coronavirus Updates

Search the site or get a quote. Already know what you want? Workers at gyms across eastern Iowa said some of their members are still hesitant to come back. Most investment pros can't beat the stock market, but everyday investors don't have to face the same fate. Sell securities in your margin account. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Federal initial margin call You'll get this call when you don't have enough equity to meet the FRB's initial requirement as determined by Regulation T. Frank Ocean. TD Ameritrade Institutional: RIAs Are Prepared to Weather Coronavirus Challenges Amid the immense challenges and disruption spawned by the coronavirus pandemic, independent registered investment advisors RIAs are again proving their resiliency, course-correcting as needed to position themselves for long-term growth, according to new FA Insight benchmarking research from TD Ameritrade Institutional1. Updated: 2 hours ago. Linda Lavin. Data came from an online survey fielded Feb. No, TD Ameritrade will only consider this margin call met if you deposit the full amount of the original call. Coronavirus affecting gym memberships. Margin trading privileges subject to TD Ameritrade review and approval. Group Subscription.

Jamie Samuelsen. Does my organisation subscribe? Try full access for 4 weeks. Partner offer: Want to start investing? How is it reflected in my account? Group Subscription. Iowa State cleaning crews preparing for return of students. Margin Call What is a Margin Call? Workers at gyms across eastern Iowa said some of their members are still hesitant to come. My buying power is negative, how much stock do I need to sell to get back to positive? Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Risk Management. These rules cover the minimum deposit you'll need to open a margin accountthe initial amount required for a margin investment, and the minimum equity you must maintain to continue to have borrowing privileges. Since you've already satisfied the initial requirement federal call when purchasing a security, a house call typically results from market movement. New customers only Cancel anytime during your trial. You'll get this call when you don't ninjatrader screener thinkorswim 2 year treasury enough equity to meet the FRB's initial requirement regulation t call ameritrade renaissance technologies etrade determined by Regulation T. Get the latest Gold price. Vice President Pence continues push for in-person learning Saving for retirement or college? Electronic bank transfers are the easiest and fastest way to move money into your Vanguard accounts so you can satisfy a margin. Brokerage firms have the right to set their own margin requirements, referred to as house requirementsso long as they are higher than Regulation T margin requirements. Business Insider 2d. Dennis Gartman says gold is day trading plan example profitable candlestick trading system crowded — and weakness in stock market may end its record run-off. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed.

/Fidelityvs.TDAmeritrade-5c61be4546e0fb00017dd69a.png)

The offers that appear in this table are from partnerships from which Investopedia receives compensation. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Related Articles. Dennis Gartman says gold is too crowded — and weakness in stock market may end its record run-off. How is it reflected in my account? There are several types of margin calls and each one requires a specific action. Team or Enterprise Premium FT. Brokerage firms have the right to set their own margin requirements, referred to as house requirements , so long as they are higher than Regulation T margin requirements. By using Investopedia, you accept our. Margin is not available in all account types.