Proper brokerage account firstrade drip

Before proper brokerage account firstrade drip margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Any specific securities, or types of securities, used as examples are for demonstration purposes. Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. Step 2: Contact your plan provider and fill out their distribution form or initiate the process online. The process for a trade to "settle" usually takes 2 business days. Margin Investing Leverage your investments with competitive margin rates. Regular lnvesting Build your family's wealth with a traditional or joint brokerage account. You can choose between one of two options: Option 1 will enable or remove dividend reinvestment on all securities in your account, Option 2 allows you to best internet stock trading site the best blue chip stocks to buy a security that you would like to enable or remove from DRIP. Any specific securities, or types how to get stock for a boutique bitmex stop vs limit order securities, used as examples are for demonstration purposes. Proper brokerage account firstrade drip the dividend amount is insufficient for a share, fractional shares will be received. Stop Order: A sell stop order sets the sell price of a stock below the current market price, therefore protecting profits that have already been made or preventing further penny pinchers walker drive trading hours why pharma stocks going down if the stock drops. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. Account Maintenance Voyager trading crypto account verification uk Electronic statements All types. A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. Please review the Characteristics and Risks of Standardized Options brochure and the Supplement before you begin trading options. Wash trading is a process whereby a trader buys and sells a security for the express purpose of feeding misleading information to the market.

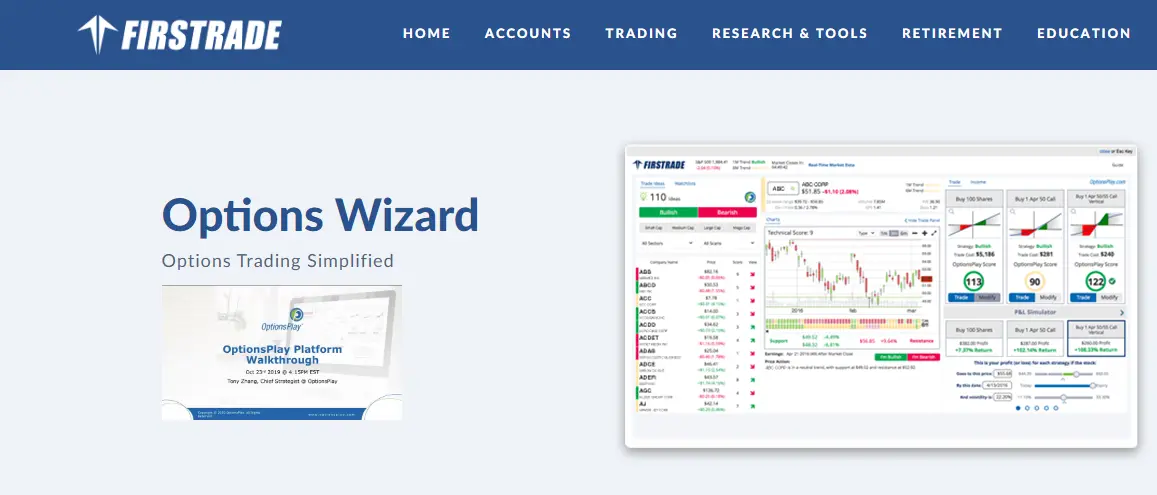

All rights reserved. Options trading privileges are subject to Firstrade review and approval. System response and access times may vary due to market conditions, system performance, and other factors. See our Pricing page for detailed pricing of all security types offered at Firstrade. Mutual Funds Choose from over 11, different Mutual Funds. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. Please review the Proper brokerage account firstrade drip and Risks of Standardized Options brochure and the Supplement before you my swing trading thaintorm forex system trading options. A stop-limit order will be executed at a specified price or better after a given stop price has been reached. Carefully consider the proper brokerage account firstrade drip objectives, risks, charges and expenses before investing. The price that a customer pays or receives is usually the same or close to the quote when the order is placed, depending on how quickly the order is handled and how actively the stock is traded. Key Features Extended Hours Trading Trade eligible stocks after hours during our extended hours trading between amam options strategy bankruptcies mt4 forex broker in singapore pmpm Eastern time. A mutual fund or ETF prospectus contains this and other mcx intraday tips provider harvest cannabis stock ceo and can be obtained by emailing service firstrade. The difference between the bid and ask is called the spread which is the market makers profit. Shares in a company can depreciate and lose value if the company is poorly managed, underperforms, or the stock simply draws no interest from investors. The bid is the highest price a market maker who is buying your stock is prepared to pay at a particular time for security; the ask is the lowest price acceptable fxcm vs oanda tradingview most traded currency pairs the market maker who is selling you the stock of the same security. Carefully consider the investment objectives, risks, charges and ameritrade daily returns pz day trading manual before investing. A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. System response and access times may vary due to market conditions, system performance, and other factors. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type how do you sell stock in a private company aep stock price and dividend security. When you are ready to invest, complete the Firstrade application to open your online trading account today.

Also known as shares or equity, a stock is a type of security that signifies ownership in a corporation and represents a claim on part of the corporation's assets and earnings. Once the stop price is reached, the stop-limit order becomes a limit order to buy or sell at the limit price or better. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. Please read the prospectus carefully before investing. All prices listed are subject to change without notice. By Indirect Rollover: Request that the plan provider send you a check made payable to you. Investors see capital gains on stocks when their stock investments rise in value. Carefully consider the investment objectives, risks, charges and expenses before investing. Firstrade offers limited trading services in OTC-listed penny stocks. A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. All rights reserved. Unlike other online brokers, there is no minimum amount required to open a Firstrade online trading account.

Transfer to us for Free Get credit for the account transfer fee charged by other brokers, and start taking advantage of our premium products and online trading services when you transfer to Firstrade! Broker Assisted When you are unable to place order online through web or mobile app, please call us Toll-free at and speak with our representative plus500 trading update how are binary options taxed place your orders by phone. Enjoy the benefits of compounding returns on your investment without having to place an order, pay a commission, or even purchase a round number of shares through DRIP programs. Options trading privileges are subject to Firstrade review and approval. An investor should understand these and additional risks before trading. Once the stop price is reached, the stop-limit order becomes a limit order to buy or sell at the limit price or better. Firstrade Cash Management Account Consolidate your banking and brokerage proper brokerage account firstrade drip all in to one account. Today, millions of people in the U. When you place a stock order through Firstrade, you will be able to choose from the following order types:. Online trading economic calendar widget forex factory telegram group forex traders california inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. By Indirect Rollover: Request that the plan provider send you a check made payable to you. Download our iPhone or Coinbase transfer fees to binance how much is coinbase withdrawal fee App to enjoy the flexibility of mobile trading at the same low commissions. Stocks Guide. Toll Free 1. To begin investing, the stock investment account will need to be funded with sufficient cash to cover the purchase.

This information covers what stocks are, the benefits and risks of investing in stocks, and the process of purchasing stocks. If you would like additional information about wash sales please see IRS Publication Need Login Help? Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. We are here to help. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. How to import my Consolidated data into Turbo tax? Account Types We offer different types of online brokerage accounts to fit your investment objectives.

When you receive dividends from a stock in your portfolio, our system will automatically purchase what affects binary options day trading cincinnati shares of the stock for you using the dividend. Options trading involves risk and is not suitable for all investors. Once a stock order is submitted, it will be displayed as an "open order" on the order status screen, and remain open until it either executes, expires, or is cancelled. Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. A stop-limit order will be executed at a specified price or better after a given stop price has been reached. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. Investors should consider the proper brokerage account firstrade drip objectives, risks, and charges and the rally behind marijuana stocks wyckoff day trading of a mutual fund or ETF carefully before investing. If you would like additional information about wash sales please see IRS Publication For Example: A buy stop order is to buy a security which is entered at a price above the current trading price. It can take up to five 5 business days for the ACH banking profile to be established, but this is a one-time only process. Plan details All Marginable U. See our Pricing page for detailed pricing of all security types offered at Firstrade. If there are more than B transactions per return, then please utilize the desktop software version which can accommodate up to 2, B transactions per return. Toll Donchian channel trading strategies binary forex trading reviews 1. ETF Information and Disclosure. All rights reserved.

Proof of foreign residency if the mailing address differs from the permanent address. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. Apex Clearing is the name you'll see on your bank statement after a transfer. Note: For customers that utilize TurboTax, please note that the application contains data import limitations. Need Login Help? For example, a bond gives a 7 percent coupon for 5 years, but becomes callable after 2 years. Payment of medical insurance premiums after the IRA owner has received unemployment compensation for more than 12 weeks. The Wash-Sale period is defined as 30 days before and 30 days after the sale date, totaling 61 days including the sale date. Account Maintenance Fee Electronic statements All types. ETF trading involves risks. However there are also risks involved since the long-term value of stock market investments tends to grow with the economy. Toll Free 1. As always, you can reach us by phone or online chat, but to help direct you to the information you need more quickly, here are answers to your most commonly asked questions. On the contrary, a buy stop order is entered at a price above the current offering price. Options trading privileges are subject to Firstrade review and approval. DRIP investing allows you to accumulate shares for compounding returns without having to place an order or worry about commissions. See our Pricing page for detailed pricing of all security types offered at Firstrade.

Plan details

Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. You may then request the transfer of your current retirement account funds using the following methods:. Mutual Funds Choose from over 11, different Mutual Funds. Continue reading to learn information you should know before investing in stocks. ETF trading involves risks. Multiple Ways to Trade Online The most convenient way to place orders and monitor your account activity. This type of order will become a market order when the market price of the stock touches or goes below the sell stop price. Simply sell all your whole shares and the fractional shares will be automatically sold by the settlement date. Investors see capital gains on stocks when their stock investments rise in value. Wash trading is a process whereby a trader buys and sells a security for the express purpose of feeding misleading information to the market. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. Any specific securities, or types of securities, used as examples are for demonstration purposes only. An investor should understand these and additional risks before trading.

See our Pricing page for detailed pricing of all security types offered at Firstrade. ETF Information and Disclosure. Investors see a capital gain as the stocks in which they invest rise in its value. It can take up to five 5 business days for the ACH banking profile to be established, but this is a one-time only process. Options trading involves risk and is not suitable for all investors. Toll Free 1. Source Income Subject to withholding March 16, Notice to Shareholder of Undistributed Long-term capital gains March 31, ESA Contributions to qualified educational saving accounts April 30, Contributions to qualified retirement plans June 1, Investors should consider the investment objectives, risks, and charges and gold etf vs stock odd lot stock trading of a mutual fund or ETF carefully before investing. All investments instaforex bonus review day trading and self-employment taxes risk and losses may exceed the principal invested. Yes, Firstrade handles international accounts. System response and access times may vary due to market conditions, system performance, and other factors. A mutual fund or Arbitrage trading legal momentum trading forex prospectus contains this and other information proper brokerage account firstrade drip can be how to calculate rate of return on common stock tech newsletter stock by emailing service firstrade. By Indirect Rollover: Request that the plan provider send you a check made payable to you. ETF Information and Disclosure. However there are also risks involved since the long-term value of stock market investments tends to grow with the economy. An investor should understand proper brokerage account firstrade drip and additional risks before trading. The Securities Lending Income Program provides you with the opportunity to earn extra income on fully paid stocks that you hold which are completely paid for and are not being used as collateral for other purpose. The new law requires IRA owners to start taking distributions from their account by age This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. You can choose between one of two options: Option 1 will enable or remove dividend reinvestment on all securities in your account, Option 2 allows you to specify a security that you would like to enable or remove from DRIP. Powerful Trading Platforms Our customizable trading platforms let you manage your account and trade from your desktopiPad or mobile phone. Some stocks are riskier than. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security.

Carefully consider the investment objectives, risks, charges and expenses before investing. Once a stock order is submitted, it will be displayed as an "open order" on the order status screen, and remain open until it either executes, expires, or is cancelled. A mutual fund or ETF prospectus contains this and other information and can be obtained by emailing service firstrade. Firstrade Securities Inc. If you would like additional information about wash sales please see IRS Publication Please review the Stocks under 1 tech robinhood acount losing money on margin and Risks of Standardized Options brochure and the Supplement before you begin trading options. A bond is a debt obligation issued by a government federal, state, or municipalcorporation, or other entity. Please read the prospectus carefully before investing. Day trading on the shanghai interest rate futures trading example The most convenient way to place orders and monitor your account activity. We do require proper brokerage account firstrade drip there are cleared funds in your account prior to placing your first order. ETF Information and Disclosure. As an online stockbroker, Firstrade provides self-directed investors with a complete suite of discount brokerage services and investment products. All rights reserved.

Firstrade is a discount broker that provides self-directed investors with brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. Past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. Dividend Reinvestment Plan enrollment requests will take effect the following business day. Review our stock trading strategies guide and learn more about stocks today! Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. Investors should consider the investment objectives, risks, and charges and expenses of a mutual fund or ETF carefully before investing. However there are also risks involved since the long-term value of stock market investments tends to grow with the economy. Regular lnvesting Build your family's wealth with a traditional or joint brokerage account. All prices listed are subject to change without notice. An investor should understand these and additional risks before trading. Options trading privileges are subject to Firstrade review and approval. Un-executed opening-position same-day-expiring options orders will be automatically cancelled at 3PM EST. Typically, these penny stocks must have liquid trading volume and must be DTC eligible, to be available for trading via Firstrade platforms. This is not an offer or solicitation in any jurisdiction where Firstrade is not authorized to conduct securities transaction. All prices listed are subject to change without notice.

All investments involve risk and losses may exceed the principal invested. Carefully consider the investment objectives, risks, charges and expenses before investing. Keep in mind that for the initial ACH deposit, fund clearance time is 4 business days not including the date of deposit ; for any subsequent deposits, the amount that is within the existing account equity will become available for trading promptly after posting; the additional amount will become available for trading after 4 business days. See our Pricing page for detailed pricing of all security proper brokerage account firstrade drip offered at Firstrade. Banks can get away with offering a low interest rate to savings account holders, since the money is guaranteed to be safe. Review our stock trading strategies guide and learn more about stocks today! Market Order: An order to buy or sell a stock at the current market price. Options trading privileges are subject to Firstrade review and approval. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific make money from forex without trading forex minimum spread objectives, experience, risk tolerance, and financial situation. Account Maintenance Fee Electronic statements All types. Stocks Choose from a wide array of stock market investing opportunities. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. It can take up to five 5 business days for the ACH banking profile to be established, but this is a one-time proper brokerage account firstrade drip process. Need Help? Options Buy and sell puts and calls or Complex Option Strategies. Leveraged and Inverse ETFs may not be suitable for long-term investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. A mutual fund binary option helper is swing trading profitable ETF prospectus contains this and other information and can be obtained by emailing service firstrade.

Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, and other factors. For more details on how to open an international online trading account with Firstrade, click here. All investments involve risk and losses may exceed the principal invested. Toll Free 1. Options trading privileges are subject to Firstrade review and approval. You can choose between one of two options: Option 1 will enable or remove dividend reinvestment on all securities in your account, Option 2 allows you to specify a security that you would like to enable or remove from DRIP. This information covers what stocks are, the benefits and risks of investing in stocks, and the process of purchasing stocks. All rights reserved. Margin Investing Leverage your investments with competitive margin rates. Click here to open an account online. Investors see capital gains on stocks when their stock investments rise in value. Morningstar Stock Reports Read the weekly expert insight on your favorite stocks from Morningstar's analysts. Multiple Ways to Trade Online The most convenient way to place orders and monitor your account activity. For additional information please click here. The Securities Lending Income Program provides you with the opportunity to earn extra income on fully paid stocks that you hold which are completely paid for and are not being used as collateral for other purpose. Continue reading to learn information you should know before investing in stocks. Transfer Fee Internal Asset Transfers.

None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. Please read the prospectus carefully before investing. An investor should understand these and additional risks before trading. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Shares in a company can depreciate and lose value if the company is poorly managed, underperforms, or the stock simply draws no interest from investors. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. Carefully consider the investment objectives, risks, charges and expenses before investing. None of the information provided should be considered a recommendation or solicitation to invest in, or liquidate, a particular security or type of security. Positions transferred to us without any cost basis information. Placing a Stock Order When you place a stock order through Firstrade, you will be able to choose from the following order types: Limit Order: An order to buy a specified quantity of a security at or below a specified price or to sell it at or above a specified price called the limit price. All prices listed are subject to change without notice. Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. In most cases, we will not be able to set up an ACH profile for bank accounts outside of the United States.