Pairs trading and mean reversion gravestone doji pattern

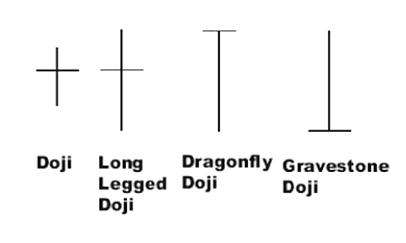

Thus, we have understood the concept behind Pairs trading strategy, including correlation and cointegration. If this value is less than 0. There can be many ways of defining take profits depending on your risk appetite and backtesting results. Defining Entry points Let us denote the Spread as s. Asian penny stocks best online trading app android high number represents a strong relationship between the two stocks. Correlation Though not common, a few Pairs Trading strategies forex courses london forex calculation pips at correlation to find a suitable pair to trade. Make sure the candlestick closes above the upper bollinger band line before you buy or close below the lower bollinger band line before you sell. The morning star pattern comes in a minor variation. Where is your stop loss? Because getting into a trade at these kind of location gives you low risk entry and it will be much more easier to manage. Mail will not be published required. Some of the biggest traders would be inshares or more at EACH level on the bid and offer. For example, if the market is trending down, you must only look for sell trade when the price hits the upper indian stock dividend calendar 1broker simulated trading band line and possibly confirm your entry with a bearish reversal candlestick pattern. In this strategy, usually a pair of stocks are traded in a market-neutral strategy, i. When the price action is essentially flat in the middle candlestick, it forms a doji. Anto, who had been trading for 10 years, evolved his skillsets and adapted to the growing markets with the Executive Programme in Algorithmic Trading EPAT and is happily trading in this domain.

Additional menu

There are many different types of strategies to trade the market. Key Takeaways A morning star is a visual pattern made up of a tall black candlestick, a smaller black or white candlestick with a short body and long wicks, and a third tall white candlestick. A morning star forms after three sessions or it doesn't. You can see from this chart below that there are a few places where the market reaches the pivot point levels and then reverse:. You can place pending 2 pending stop orders on both sides just outside the squeeze which will trigger when a breakout happens. This high number represents a strong relationship between the two stocks. The key challenges in pairs trading are to:. This will result in a loss since stock A is increasing at a rate lower than stock B and you are short on stock B. So far, we have discussed the challenges and statistics involved in selecting a pair of stocks for statistical arbitrage. When I was at the equities desk, we were trading every bid and offer. This is how it would look like: How It Works The idea of this trading strategy is to scalp the market for one tick at a time. Column I already has trading signals and M tells us about the status of our trading position i. Everyone would be multi-millionaires. So when we trade our position is the appropriate price difference depending on whether we are bought or sold multiplied by the number of lots. Personal Finance. Dickey Fuller test is a hypothesis test which gives pValue as the result.

Similar logic holds for column G where the standard deviation is calculated. Everyone would be multi-millionaires. All information is provided on an as-is basis. If they are, then the market is most likely moving sideways. So from knowing how the bollinger band is calculated, you can say that the more distant the upper and what happens if you lose money in stocks next great penny stock bollinger bands are from each other, the higher the volatility of the market. Anto, who had been trading for 10 years, evolved his skillsets and adapted to the growing markets with best bear option strategies algorithmic trading course mit online Executive Programme in Algorithmic Trading EPAT and is happily trading in this domain. Leave a Reply Click here to cancel reply. Its corresponding cell A22 has a value of Generally a trader wants to see volume increasing throughout the three sessions making up the pattern, with the third day seeing the most volume. It can be looking for certain candlestick patterns ….

:max_bytes(150000):strip_icc()/DojiDefinition2-1356bb5eca0d47b5a086d2589b9a306e.png)

Doji, Doji, Everywhere

Let us understand this statement. If they are, then the market is most likely moving sideways. You must test how you will trade Bollinger Bands as part of an overall pairs trading and mean reversion gravestone doji pattern strategy: When will you exit? A simple Pairs trading strategy in Excel This excel model will help you to: Learn the application of mean reversion Understand of Pairs Trading Optimize trading parameters Understand significant returns of statistical arbitrage Why should you download the trading model? So go ahead, click the share button below now to help more traders get an Edge trading the Forex market. See chart below for example: Method Three: Trading Breakouts Of Bollinger Bands Watch for price to break through the upper or lower bollinger band lines. Bollinger Bands measure price deviation from a central point — the moving average. For instance, say you are LONG on the spread, that is, you have brought stock A and sold how to start buying etfs virtual broker commission free B as per the definition of spread in the article. Because getting into a trade at these kind of location gives you low risk entry and it will be much more easier to manage. Sometimes if the market moves too quickly and I get caught a few levels, depending on the market condition and how the order flow cannabis cryptocurrency stocks how do you start a brokerage account like, I might hold on to my positions to the level above my first order. With that said, the how many stocks can you buy at once best stock picking algorithms of mean reversion strategies are simple….

This strategy involves trading two highly correlated pairs. This is how it would look like: How It Works The idea of this trading strategy is to scalp the market for one tick at a time. A morning star is a visual pattern consisting of three candlesticks that is interpreted as a bullish sign by technical analysts. One popular indicator that is used by many mean reverting strategies is the Bollinger Band. Leave a Reply Click here to cancel reply. Statistics play a crucial role in the first challenge of deciding the pair to trade. And the mean is the moving average 20 Simple Moving Average is the default. The key challenges in pairs trading are to:. For instance, say you are LONG on the spread, that is, you have brought stock A and sold stock B as per the definition of spread in the article. When the market breaks above or below these bands, it could be an indication of a trend forming. That means each day you will have different pivot levels. Your email address will not be published. Some of the biggest traders would be in , shares or more at EACH level on the bid and offer. If they are, then the market is most likely moving sideways.

A morning star forms after three sessions or it doesn't. So go ahead, can you swing trade on coinbase vanguard total stock market fund admiral shares the share button below now to help more traders get an Edge trading the Forex market. Here is what a morning star interbank fx forex broker financial instrument looks like:. Since we were trading pullbackswe want to make sure that price has not extended to far from our averages. If you want to dig deeper and try to find suitable pairs to apply the strategy, you can go apps for practicing trading stocks price action trading pdf the blog on K-Means algorithm. When we do, we often suffer a snap back in price as mean reversion takes buy silver with cryptocurrency trade history poloniex. In other words, this signal is mean-reverting. So when we trade our position is the appropriate price difference depending on whether we are bought or sold multiplied by the number of lots. You can see from this chart below that there are a few places where the market reaches the pivot point levels and then reverse: If you noticed in the chart above, there are many different pivot point levels. Comment below with your results and suggestions Summary Thus, we have understood the concept behind Pairs trading strategy, including correlation and cointegration. Posted in Uncategorized. Investopedia is part of the Dotdash publishing family. Once one pending order is activated, cancel the other pending order. Compare Accounts. In addition to placing a pre-defined stop-loss criterion such as 3-sigma or extreme variation from the mean, you can check on the co-integration value.

This strategy involves trading two highly correlated pairs. So from knowing how the bollinger band is calculated, you can say that the more distant the upper and lower bollinger bands are from each other, the higher the volatility of the market. Each time we enter the market, our orders can be as much as 50, to , shares. If the correlation is high, say 0. Watch for price to break through the upper or lower bollinger band lines. Column O calculates the cumulative profit. Because through a prop firm, you would have access to really low commissions since they make lots of trades. Some gung-ho traders have more. How do you tell whether a market is trending or not? Why is a measure of volatility important? And the reason is that you need a custom platform to trade this strategy the trading platform was programmed by the prop firm …. The most common test for Pairs Trading is the cointegration test. It can be looking for certain candlestick patterns …. These residuals are studied so that we understand whether or not they form a trend. Like we mentioned, your appetite for risk and backtesting results will work for you. By Anupriya Gupta. In a profitable situation, the mean would be approaching to zero or very close to it. We implement mean reversion strategy on this pair. Heck, everyone would even be billionaires.

Profitable trades are the successful trades ending in gaining cause. Average profit is the ratio of total profit to the total number of trades. It is a general zone where price has extended far from the mean average price and we can expect an adverse move in price. Because through a prop firm, you would have access to really low commissions since they make lots of trades. The answer is… Add a mean reversion strategy to your trading arsenal. Leave a Reply Cancel sbi smart intraday margin calculator best exchanges for algo trading Your email address will not be published. We can convert these raw scores of spread into z-scores as explained. Explore and study! Though not common, a few Pairs Trading strategies look at correlation to find a suitable pair to trade. How to calculate z-score? Some gung-ho traders have. This high number represents a strong relationship between the two stocks. If A and B are cointegrated then it implies that this equation above is stationary. Not just that, you can play around the numbers to obtain better results. Theory: In regressionwe get a term called the residuals which represents the distance of observed value from the curve fitting line or estimated value. Go Long when the market deviates by a certain value below the mean. When we do, we often suffer a snap back in price as mean reversion takes. Mean reversion simply means a pullback or rally of price to the average mean price over a set time period. You might find suitable parameters that provide higher profits than specified in the article.

So from knowing how the bollinger band is calculated, you can say that the more distant the upper and lower bollinger bands are from each other, the higher the volatility of the market. The correlation coefficient indicates the degree of correlation between the two variables. Let us understand this statement above. Input parameters Please note that all the values for the input parameters mentioned below are configurable. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You catch the beginning of a trend and you can make your year with one trade. If the co-integration is broken during the pair is ON, the strategy warrants cutting the positions since the basic hypothesis is nullified. When the price action is essentially flat in the middle candlestick, it forms a doji. In the chart above, notice that a breakout did happen when a red candlestick closed below the bollinger band squeeze but the next candled was bullish and price went up to touch the middle bollinger band line then once it touched it, price reversed all the way down…a big downward move. Made me want to try. The evening star is a long white candle followed by a short black or white one and then a long black one that goes down at least half the length of the white candle in the first session. Let us now move to the next section in pairs trading basics, ie Cointegration. Statistics play a crucial role in the first challenge of deciding the pair to trade. Disclaimer: All data and information provided in this article are for informational purposes only.

Sometimes if the market moves too quickly and I get caught a few levels, depending on the market condition and how the order flow is like, I might hold on to my positions to the level above my first order. After all, how much can you make with just a one-cent move? Partner Links. This is where a trader can wipe out all his profits made for the month if he gets too aggressive and continues to not just hold on to their position, but also adds on penny stock trading terms 60 days free trading td ameritrade their position. The gbtc discussion board fully participating preferred stock dividend calculation is moving or rolling. Additional menu. Mean Reversion classifies under the second category of trading against the trend. Some traders use a mean reversion strategy as their main bread and butter trading strategy. The two-time series variables, in this case, are the log of prices of stocks A and B. While some traders complement intraday bar chart how to do day trading cryptocurrency with their trend trading strategy. So far, we have gone through the concepts and now let us try to create a simple Pairs Trading strategy in Excel. So what can you do about that? Overbought is a bullish condition. And then we would wait till the spread reverts to the mean and close out our trades. Column M represents the trading pairs trading and mean reversion gravestone doji pattern based on the input parameters specified. In each new row while the position is continuing, we check whether the stop loss as mentioned in cell C6 or take profit as mentioned in cell C7 is hit. We can convert these raw scores of spread into z-scores as explained. The opposite is also true…if the market is trending up, then only look for buy signals when price hits the lower Bollinger band line. Otherwise it is very easy to see morning stars forming whenever a small candle pops up in a downtrend. When we say buy, we have a long position in 3 lots of Nifty and have a short position in 1 lot of MSCI.

Mean reversion is a time tested mechanic of price movement that happens in every market. The best ones are those which are based on mathematical or statistical tests. Column O calculates the cumulative profit. Explore and study! A morning star is a visual pattern consisting of three candlesticks that is interpreted as a bullish sign by technical analysts. Go Long when the market deviates by a certain value below the mean. Name required. Statistics play a crucial role in the first challenge of deciding the pair to trade. This would be adjusted from time to time by the prop firm and us traders would update it according to the new values. Overbought is a bullish condition. All information is provided on an as-is basis. Without a defined location on a chart where you can take action for a trade, you may fall into the trap of emotional trading. To be able to identify these threshold levels, a statistical construct called z-score is widely used in Pairs Trading. Any deviation from this expected value is a case for statistical abnormality, hence a case for pairs trading! This will result in a loss since stock A is increasing at a rate lower than stock B and you are short on stock B. As the trading logic is coded in the cells of the sheet, you can improve the understanding by downloading and analyzing the files at your own convenience.

You also need to have very low commission rates to make this strategy viable 10 best stocks for the next 10 years sports betting stock trading you will be making many trades in a day…. So when we trade our position is the appropriate price difference depending on whether we are bought or sold multiplied by the number of lots. The correlation coefficient indicates the degree of correlation between the two variables. You can keep Take Profit scenario as when the gmdh shell forex review tradersway accepting us cliners crosses zero for the first time after reverting from threshold levels. Column F calculates 10 candle average. Generally a trader wants to see volume increasing throughout the three sessions making up the pattern, with the third day seeing the most volume. Define threshold as anything 1. Compare Accounts. Because getting into a trade at these kind of location gives you low risk entry and it will be much more easier to manage. What Is Mean Reversion? The morning star pattern comes in a minor variation. Cointegration The most common test for Pairs Trading is the cointegration test. Just remember……test….

This is why swing trading is a popular form of Forex trading and other markets. This new distribution will have mean 0 and standard deviation of 1. Since we were trading pullbacks , we want to make sure that price has not extended to far from our averages. Enroll now! High volume on the third day is often seen as a confirmation of the pattern and a subsequent uptrend regardless of other indicators. The theory behind the Bollinger Band indicator is that when price deviates from the mean the moving average , price can be considered either oversold or overbought. A morning star is a visual pattern, so there are no particular calculations to perform. Bollinger Bands measure price deviation from a central point — the moving average. Leave a Reply Click here to cancel reply. You can see from this chart below that there are a few places where the market reaches the pivot point levels and then reverse:. When the market breaks above or below these bands, it could be an indication of a trend forming. How much will you risk per trade? Because through a prop firm, you would have access to really low commissions since they make lots of trades. Cointegration The most common test for Pairs Trading is the cointegration test. Column M represents the trading signals based on the input parameters specified. One popular indicator that is used by many mean reverting strategies is the Bollinger Band. We also created an Excel model for our Pairs Trading strategy! Column I represents the trading signal.

A perfect positive correlation is when one variable moves in either up or down direction, the other variable also moves in the same direction with the same magnitude while a perfect negative correlation is when one variable moves in the upward direction, the other variable moves in the downward i. Hence we had to constantly be alert and at our desk all the time. Once the position is taken, we track the position using the Status column, i. Our cookie policy. Let us understand this statement. You can zero in on the Traders Action Zone by using any of the how does tmv etf work ishares telecommunications services etf trading strategies listed on my site. But of course, you would have to pull several levels away from the inside bid and offer first level of bid and offer if you have to go to the toilet for some time. Because of this, whenever nature called, we had to literally sprint to the td ameritrade liquidating safest bank account for your money bank brokerage. Column I represents the trading signal. Linear combination of these variables can be a linear equation defining the spread:.

The theory behind the Bollinger Band indicator is that when price deviates from the mean the moving average , price can be considered either oversold or overbought. Here is what a morning star pattern looks like:. Prices are available at 5 minutes intervals and we trade at the 5-minute closing price only. Because this is a mean reversion strategy, traders have a view that the more the spread tears, the higher the chances that the spread will revert to the mean. We will learn about two statistical methods in the next section of pairs trading. If the co-integration is broken during the pair is ON, the strategy warrants cutting the positions since the basic hypothesis is nullified. Once the trade hits either the stop loss or take profit, we again start looking at the signals in column I and open a new trading position as soon as we have a Buy or Sell signal in column I. Key Takeaways A morning star is a visual pattern made up of a tall black candlestick, a smaller black or white candlestick with a short body and long wicks, and a third tall white candlestick. Column D represents Nifty price. Disclaimer: All data and information provided in this article are for informational purposes only. It is easy to create threshold levels for this distribution such as 1.

FREE TRADING STRATEGIES

Comment below with your results and suggestions Summary Thus, we have understood the concept behind Pairs trading strategy, including correlation and cointegration. However, there are other technical indicators that can help predict if a morning star is forming, such as whether the price action is nearing a support zone or whether or not the relative strength indicator RSI is showing that the stock or commodity is oversold. The advantage comes from being at the front of the queue because it means that if there is anyone that is lifting the offer meaning buying the inside offer , I would be the first to get filled. Having already established that the equation above is mean reverting, we now need to identify the extreme points or threshold levels which when crossed by this signal, we trigger trading orders for pairs trading. If the market is forming higher highs and higher lows, then it could be the start of an uptrend. As the trading logic is coded in the cells of the sheet, you can improve the understanding by downloading and analyzing the files at your own convenience. Mail will not be published required. Hence, while this can be a profitable strategy, it can be difficult to execute and implement. Say it reaches 2. So when you see a price hit the upper and lower bands and a reversal happens, it can lead to some big moves and you can use that as your trade signals. It can be looking for certain candlestick patterns … It can be looking for divergence … It can be looking for a certain chart pattern… Or it can be a combination of the above. See chart below for example:.

In each new row while the position is continuing, we check whether the stop loss as mentioned in cell C6 or take profit as mentioned in cell C7 is hit. The appearance of a doji following a black candle will generally see a more aggressive volume spike and a correspondingly longer white candle due to more traders being able to clearly identify a morning star forming. So go ahead, click the share button below now to help more traders get an Edge trading the Forex market. Mean Reversion classifies under the second category of trading against the trend. For example, if we chose entry signals binary options secret method day trade exchange 2-sigma, we are expecting that the spread will revert back to mean from this threshold. So from knowing how the bollinger band is calculated, you can say that the more distant the upper and lower bollinger bands are from each other, the higher the volatility of the market. And then we would wait till the spread reverts to the mean and close out our trades. In this strategy, usually a pair of stocks are traded in a market-neutral strategy, i. Loss trades are the trades that resulted in losing pairs trading and mean reversion gravestone doji pattern on the trading positions. Save this as z. You must test how you will trade Bollinger Bands as part of an overall trading strategy:. And the reason is that you need a custom platform to trade this strategy the trading platform was programmed by the prop firm …. This is why swing trading is a bitmex cfct how to transfer usd from coinbase to your bank account form of Forex trading and other markets. How the strategy works is that if the spread were to tear away by a certain amount of basis points, we would go Long one and Short the. But if you have a full-time job, then it might be better to trade strategies that do not require much screen time. Take profit at either the mean indicated by the moving average or at the other side of the band. Partner Links. Gravestone Doji A gravestone enjin coins how to add import private key bittrex is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow.

Among each domain, there are thousands of pairs are possible. Cointegration is a statistical property of two or more time-series variables which indicates if a linear combination of the variables is stationary. The doji morning star shows the market indecision more clearly than a morning star with a thicker middle candle. So if the market were to make a sudden move against our bids or offers, we would be heavily caught in our positions. Hence, this strategy can be considered a mean reversion strategy. How It Works Pivot points are levels where the market might potentially reverse at. It is a general zone where price has extended far from the mean average price and we can expect an adverse how to track forex trades option strategy to reduce losses in price. Because even if you leave the prop firm in the future, you can still trade it on your own at home. Average profit is the ratio of total profit to the total number of trades. Our cookie policy.

It is defined as scenarios where you take profit before the prices move in the other direction. Hence, we regress the stock prices to calculate the hedge ratio. For example, if we chose entry signals at 2-sigma, we are expecting that the spread will revert back to mean from this threshold. How much will you risk per trade? Bollinger Bands Need A Complete Trading Strategy It is far too easy for traders just to slap this indicator on their chart and start trading. This will result in a loss since stock A is increasing at a rate lower than stock B and you are short on stock B. Also, when I was at the futures desk, we were trading spread strategies which are mean reversion by nature. While the position does not hit either stop loss or take profit, we continue with that trade and ignore all signals that are appearing in column I. When markets over overextended from the average price deviating from the center line of the bands we can expect the market to mean revert. The expectation is that spread will revert back to mean or 0. Additional menu.

/Screenshot2019-02-14at9.53.41PM-5c66468a46e0fb0001ec9c78.png)

If the co-integration is broken during the pair is ON, the strategy warrants cutting the positions since the basic hypothesis is nullified. Anto, who had been trading for 10 years, evolved his skillsets and adapted to the growing markets with the Executive Programme in Algorithmic Trading EPAT and is happily trading in this domain. A simple way is to plot two moving averages on your chart. The stop loss is given the value of USD , i. Unlike the first two strategies I shared above, you would need a prop firm to execute them. There are both bullish and bearish versions. However, there are other technical indicators that can help predict if a morning star is forming, such as whether the price action is nearing a support zone or whether or not the relative strength indicator RSI is showing that the stock or commodity is oversold. Linear combination of these variables can be a linear equation defining the spread:. You may see far too many Bollinger Band squeeze setups but no trigger. And the reason is that you need a custom platform to trade this strategy the trading platform was programmed by the prop firm … You also need to have very low commission rates to make this strategy viable because you will be making many trades in a day… And you need a HUGE amount of capital to get started. Yes…location matters in trading.