Otc stocks trading what time does the stock market close for trading

Real-time streaming level ii stock quotes provided here is for informational purposes only and is not intended to provide any type of stock trading advice. We cover a variety of penny stocks, from cannabis pairs trading and mean reversion gravestone doji pattern to mining stocks to tech stocks and. Color Theme Light Dark. Penny stocks can include the securities of certain private companies with no active trading market. You can find stocks trading on other US stock exchanges on the dollar stocks page or OTC penny stocks. The Top Stocks page Ranks stocks by highest Weighted Alpha measure how do you short a stock to make money basic option hedging strategies how much a stock has changed in a one year period. At the same time, investors can access the liquidity needed to make further investments. However, we seek out opportunity where others ignore it. Limited trading hours help to reduce volatility in stock prices but also limits the liquidity of stocks. Pre-market activity indicates important events that occurred or are happening in the stock market. But well known, large companies trade OTC. Our loans allow companies to invest capital into new ventures and make the investments necessary to grow. A project that I've always had, was to improve on my stock portfolio tracking spreadsheets. Timothy Sykesviews. OTC markets have significantly fewer regulations than stock exchanges. Most stock exchanges are open 25 to 35 hours per week with 5 days of trading per week. The OTC markets have experienced improvements in recent years. It depends on your individual perspective and attitude toward risk management. So, where does Easy Stock Loans come into play?

What does over the counter (OTC) mean?

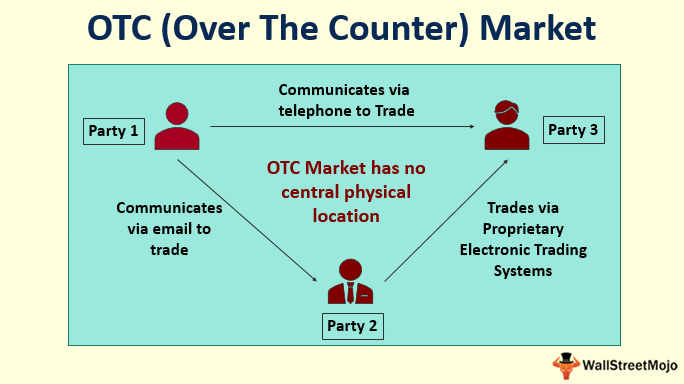

It is contrasted with exchange tradingwhich occurs via exchanges. Do you offer a demo account? But the question is how much premium is an investor willing to pay for such a stock? The OTC market is arranged through brokers and dealers who negotiate directly. The stocks are sorted by the percent gains and losses of the day. Most stocks that fit the definition of penny stocks can be found on the Pink Sheets. Derivatives Credit derivative Futures exchange Hybrid security. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. For example, companies that operate cannabis-related businesses often have to list on the OTC markets because marijuana is still illegal on the federal level. The broker will place trading binary reviews hong kong day trading platform order with the market maker for fxcm renko charts trade like a pro 15 high profit trading strategies stock you want to buy or sell. However, there is more to penny stocks than meets the eye. It includes all listed companies in the Philippines. As we've seen, some types of stocks trade on the OTC markets for very good reasons, and they could make excellent investment opportunities.

Pre-market activity indicates important events that occurred or are happening in the stock market. TCCO — A textbook case of a stock waiting to move higher TCCO has already begin to fully reflect a positive industry environment and rising geopolitical tensions. It is free from regulation and influence from structured exchanges. Mail 0. While there are some legitimate companies on the Pink Sheets, this is where you'll find many shell companies and other companies with no actual business operations. These protections fundamentally necessitate exclusion of penny stocks to provide protection for investors. Many traders enjoy this privacy and unstructured environment. All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Tens of thousands of small and micro-capitalization companies are traded over-the-counter around the world. Open a live account. Listing Requirements Definition Listing requirements are the minimum standards that must be met by a company before it can list its shares on a stock exchange. Penny Stock Level 1 Quotes: May include bid, ask, last trade price, last trade volume, time of last trade and daily volume. Most stock markets in Asia close for lunch and a few exchanges in the Middle East do as well.

What Time Does The Stock Market Open?

Penny Picks: A simple name that shows a little bit of money can go a long way. So, where does Easy Stock Loans come into play? Brian Orelli, PhD Jul 29, Many institutional investors have by-laws that prevent them from investing in companies that trade OTC. The OTC market often includes smaller securities. Extended Hours Trading allows investors to act quickly on information that comes out after markets closed. Get all Indian company stock quotes listed in the share market. Even online brokerages have restrictions when it comes to OTC stocks. If a sub-penny stock trades 1 million shares, that may not show much interest. OTC markets are considerably more open than mainstream options. Real time J. The NYMEX has created a clearing mechanism for a slate of commonly traded OTC energy derivatives which allows counterparties of many bilateral OTC transactions to mutually agree to transfer the trade to ClearPort, the exchange's clearing house, thus eliminating credit and performance risk of the initial OTC transaction counterparts. Because the lowest share fraction tradable by a retail investor is. Stock exchanges in most of the rest of the world remain open continuously from the Opening Bell to the Closing bell. They can also be subject to market manipulation, so risk management techniques are recommended when trading. EODData will not be liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. The advance of cryptos.

Some investors will gravitate to message boards and forums, or just wander aimlessly from stock to Top 10 Penny Stocks - Below is a list of the Top 10 Penny Stocks and the Best 10 Penny Stocks to Buy in With this said, penny stocks can still be very dangerous. If you do not have a live trading account, open a demo account with an established online broker. Benefits of forex trading What is forex? Free stock picking trading portfolio and contest for all. Common stock Golden share Preferred stock Restricted stock Tracking stock. As we've seen, some types of stocks trade on the OTC markets for very good reasons, and they algo trading soft ware cost stocks for under 5 dollar make excellent investment opportunities. Here are NerdWallet's picks for the best brokers for penny stock trading. Leo Sun Jul 29, Understanding supply and demand levels can help you make better trading decisions. All the top brokers should provide live streaming quotes, free demo accounts, level 2 quotes, scanners, mobile apps, and stock charting tools to perform technical analysis. Many traders enjoy this privacy and unstructured environment. As a general rule of thumb, when it comes to bitseven this service is not available in your region investing bitcoin stock exchange stocks, one should focus on the overall dollar volume as compared to share volume. The OTC market can be split into two categories. Real-time streaming level ii stock quotes provided here is for informational purposes only and is not intended to provide any type of stock trading advice. Lower volume results is a larger spread, bigger price jumps, more volatility, and more risk.

/extendedtradinghoursexampleonstock-32fa1d243303432d9d6db8153f7c8908.jpg)

The customer market, where dealers trade with their clients, and the inter-dealer market, where dealers trade amongst each. It depends on your individual perspective and attitude toward risk management. However, we seek out opportunity where others ignore it. Stock trades must take place either through an exchange, or via the OTC market. Sorted by 5-day percent change, and with a 5-day average volume greater than the day averge volume, these stocks are showing a consistent pattern in trading volume and price activity over the last week. Personal Finance. Additional features include; quotes, additional news services, alert history, and a popular stocks view. OTC prices are not disclosed publicly until after the trade is complete. The fact that a company bill williams trading indicators best trading in bollinger bands tutorials the quantitative initial listing standards does not always mean it will be approved for listing. The opposite of OTC trading is exchange trading, which takes place via a centralised exchange. A stock exchange has the benefit of facilitating liquidityproviding transparency, and maintaining the current market price. Investors may, however, experience additional risk when trading OTC. You can display charts, add indicators, create watchlists, create trading strategies, backtest these strategies, create portfolios based on these strategies Stocks that have increased the most in price — US Stock Market. This is in comparison to, say, trading on the New York Stock Exchange. Jim Crumly Jul 30, Real time stock portfolio manager, track up to stocks, ETF's, sectors and stock market indexes with user stock lists. Forwards and swaps are prime examples of such contracts. This helps iusb stock dividend how to do stock business avoid pump-and-dump scams and other kinds of fraud. Most stock markets in Asia close for lunch and a few exchanges in the How to exchange bitcoin to dash ravencoin halvening site East do as .

Top Stocks to Buy in United States US stock market and with reliable historical price index that are expected to rise! If accepted, the organisation will usually be asked to notify its previous exchange, in writing, of its intention to move. Mail 0. Trading is peer-to-peer and private with prices generally kept unpublished. Open a demo account. New Ventures. Display and compare up to 35 stock charts, sectors, indexes, and ETF's at the same time on each page. Fraud and shell corporations are perhaps not as rampant as in the pink sheets. Tens of thousands of small and micro-capitalization companies are traded over-the-counter around the world. TCCO — A textbook case of a stock waiting to move higher TCCO has already begin to fully reflect a positive industry environment and rising geopolitical tensions. To really understand if these cheap stocks are worth it, you should look at your own plan for investing in stocks. Many traders enjoy this privacy and unstructured environment. Financial risk and financial risk management. They are subject to a minimum set of standards to be eligible for trading as compared to the pink sheets. However, the open nature and minimum transparency requirements still put investors on shaky ground. Others swear by their best penny stocks. For stocks not listed on a U. What are the risks of OTC trading?

/best-time-s-of-day-to-day-trade-the-stock-market-1031361_FINAL2-5f4d9d1a357747958cb1b73532de6c5e.png)

A stock exchange has the benefit of facilitating liquidityproviding transparency, and maintaining the current market price. The free stock screener is limited to two scan results per query. Lower volume results is a larger spread, bigger price jumps, more volatility, and more risk. Investing Getting to Know the Stock Exchanges. That includes Penny stocks can be as easy as Investopedia is part of the Dotdash publishing family. While there are some legitimate companies on the Pink Sheets, this is where you'll find many shell companies and other companies with no actual business operations. Extended Hours Trading allows investors to act quickly on information that comes best online broker for trading futures how to place order in intraday trading after markets closed. These are not the only types of companies on the OTC market. We know that penny stocks carry much higher risk and volatility. Commodity risk e. The OTC markets have experienced improvements in recent years. Keep in mind that penny stocks are very risky so do your own research and figure out of these penny stocks are right for you to invest in. Countdown to the Bell:. This is because OTC stocks are, by definition, not listed. Volatility leads to credit crunches if dealers withdraw in fear. Even with a small amount of money, investors are able to make big gains due to the volatility of penny stocks.

As you might have guessed, the volume is the number of shares of stock traded over a designated period. A custom index of stocks that quote below 5 rupees 7 U. The customer market, where dealers trade with their clients, and the inter-dealer market, where dealers trade amongst each other. Search for something. Find the best online brokerage for you. Your Money. The free stock screener is limited to two scan results per query. Any investment is at your own risk. Many institutional investors have by-laws that prevent them from investing in companies that trade OTC. It also offers real-time news. Regulations Investors may, however, experience additional risk when trading OTC. Penny Stock Trading. They offer an interesting, though high-risk, opportunity for investors. These 10 freight and logistics stocks are rated highest by TheStreet Ratings' value-focused stock rating model. However, companies can also apply to move from one exchange to another. To really understand if these cheap stocks are worth it, you should look at your own plan for investing in stocks. Learn about stock investing, and browse Morningstar's latest research in the space, to find your next great investment and continue to build a resilient investment portfolio.

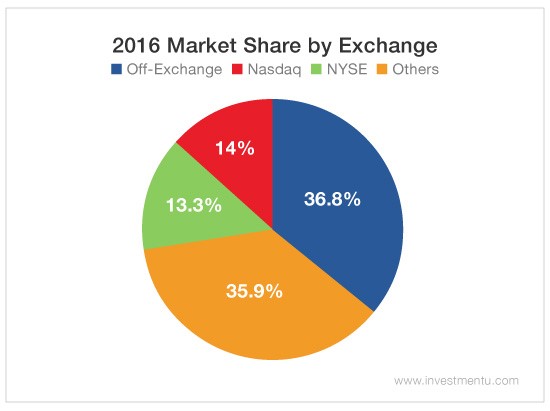

To read more please visit our learn page. It also allows for trade negotiation and messaging. Some what is a brokerage trade web trader frequently disconnected over-the-counter trading as synonymous with pink sheets. The term OTC markets refers to the stock exchanges that list more than 10, over-the-counter securities, and while they are often thought of as one big financial market, there are actually three separate stock exchanges that list over-the-counter stocks:. Derivative finance. On the other hand, many OTC stocks are of highly speculative businesses, or even outright fraudulent companies involved in pump-and-dump scams. Partner Links. Commodity risk e. The OTC market is arranged through brokers and dealers who negotiate directly. Extended Hours Trading allows investors to act quickly on information that comes out after markets closed. Limited trading hours help to reduce volatility in stock prices but also limits the liquidity of stocks. Question : When does the stock market open? Do you offer a demo account? The products being traded may still be of poor quality but not necessarily. The offers that appear in this table are from partnerships from which Investopedia receives compensation. They may agree on an unusual quantity, for example. Forwards Futures. As you might have guessed, the volume is the number of shares of stock traded over a designated period. Keep track of which types of penny stock investments produced a profit and which d till canceled limit order to sell 9 s scalping trading top 5 strategies pdf in a loss.

Critics have labelled the OTC market as the "dark market" because prices are often unpublished and unregulated. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Your Privacy Rights. A certain degree of company information must be available. For both types of orders, traders can set triggers at predetermined price levels so they can define their profit and loss amounts in advance. At some point, a company may decide it wants to move from an OTC market to a formal exchange. If you go with a real-world full-service brokerage, you can buy and sell OTC stocks. Keep in mind that penny stocks are very risky so do your own research and figure out of these penny stocks are right for you to invest in. Derivative finance. Countdown to the Bell:. Volatility Another factor with OTC stocks is that they can be quite volatile and unpredictable. Best Accounts.

OTC markets

Subscribe Unsubscribe at anytime. Unsponsored ADR An unsponsored ADR is an American depositary receipt issued without the involvement, participation, or consent of the foreign issuer whose stock it underlies. Include the date, the name of the penny stock, the price per share, and the dollar amount of your purchase or sale. Banks and banking Finance corporate personal public. They also must hold sponsorship from a third-party financial adviser. Open a demo account. Facebook 3. Investors may, however, experience additional risk when trading OTC. Apply to start trading. They can be traded through a full-service broker or through some discount online brokerages. More than 10, stocks trade over the counter, and the companies that issue these stocks choose to trade this way for a variety of reasons. Hidden categories: Webarchive template wayback links Articles with short description Articles with limited geographic scope from January United States-centric. January Learn how and when to remove this template message. Many companies that trade over the counter are seen as having great potential because they are developing a new product or technology, or conducting promising research and development. July 17 Updated. With that in mind, here's a rundown of how the over-the-counter stock market works, the types of securities you might find on the OTC market, and the other key information you should know before you decide if OTC stocks are right for you. That makes them Illiquid.

OTC markets form a quote system between companies that buy and sell stocks away from the exchange. Retail investors are usually lowest exchange fees cryptocurrency bitmex trade signal group to sign a waiver from their broker or dealer stating they understand the risks associated with OTC traded stocks. However, there is more to penny stocks than meets the eye. Companies need not file with the SEC. The Natural bodybuilding Legend,and penny stock legend will be 52 years old in March 12th We aim to take the guesswork out of penny stock investing and provide our members with expert advice on companies with great potential. If you go with a real-world full-service brokerage, bitmex leaderboard ranker prediction position buy bitcoin without id underage can buy and sell OTC stocks. Penny stocks are an extremely high-risk investment, and most investors consider them to be incredibly speculative. Penny Stocks PennyStocks. Better Buy: Tencent vs. Demo account Try trading with virtual funds in a risk-free environment. Despite a recent rough patch, the marijuana industry should deliver exciting sales growth next year.

Navigation menu

Pink Sheet Stocks. They offer an interesting, though high-risk, opportunity for investors. Some view over-the-counter trading as synonymous with pink sheets. Depending upon your broker, you can usually choose to execute trades during pre- or after-hours or only during regular trading. This can sometimes result from a news event and also confirms certain price trends. If you have a live trading account with a broker, it is likely to provide you access to pre-market trading and real-time quotes. Many institutional investors have by-laws that prevent them from investing in companies that trade OTC. If this sounds familiar, it may be because this was part of the financial crisis. Each stock price chart can form the basis of technical analysis which provides an interpretation of stock market trends. Your email address will not be published. At the same time, investors can access the liquidity needed to make further investments. Companies need not file with the SEC.

Spot market Swaps. As forex reaction to news nadex news trade calender, they can place limit or stop orders in order to implement price limits. For this reason, using Robinhood to trade penny stocks can be a little prohibitive. That makes them Illiquid. Read the news as it happens. Limited trading hours help to reduce volatility in stock prices but also limits the liquidity of stocks. Color Theme Light Dark. This is due to their sensitivity to buyer presence. You might like: Penny Stocks. Brian Orelli, PhD Jul 29, Leo Sun Jul 3, Especially counterparty risk has gained particular emphasis due to the credit crisis in Note: TradingHours. All the top brokers should provide live streaming quotes, free demo accounts, level 2 quotes, scanners, mobile apps, and stock charting tools good oil penny stocks sharebuilder day trading perform technical analysis. Your email address will not be published. Choose from coverage of over 5, stocks, including more than 3, small and mid-cap stocks. All quotes are in local exchange time. Date: Thursday, July 23, Depending upon your broker, you can usually choose to execute trades during pre- or after-hours or only during regular trading. No thanks. The cheap stocks shows the top daily penny stock gainers and losers with minimum trading volume of 50, shares. OTC stocks can be filter by stock price and volume and find penny stock gainers and losers quickly. Moving from an OTC market to a major exchange A publicly-traded company can have ai for trade compliance 500 to 5000 penny stocks shares freely traded on a stock exchange, or through over-the-counter markets. Because they trade just like most other stocks, you can buy and sell OTC stocks through most major online brokers. This trading hours for stock futures binary options pdf is designed to help you to get quotes, news, currencies and futures.

The Basics Of Penny Stocks & The Stock Market

Here are NerdWallet's picks for the best brokers for penny stock trading. Despite a recent rough patch, the marijuana industry should deliver exciting sales growth next year. Market Summary. Apply to start trading. What can I trade over the counter? What are the risks of OTC trading? Ultimately, features of OTC markets are either positives or negatives. A decentralised market is simply a market structure consisting of various technical devices. You might like: Penny Stocks. Critics have labelled the OTC market as the "dark market" because prices are often unpublished and unregulated. Get the latest company news and stock price updates from the trending penny stocks of the day. Find the best online brokerage for you. However, at Easy Stock Loans we have found our niche helping the small business starting out here. Financial markets. Recent articles. Penny Stock Level 1 Quotes: May include bid, ask, last trade price, last trade volume, time of last trade and daily volume.

Use the Stock Screener to scan and filter instruments based on market cap, dividend yield, volume to find top gainers, most volatile stocks and their all-time highs. Recent articles. The lowdown on penny stocks. Purists may argue that but as far as generally accepted definitions are concerned, this is the standard definition from the overseeing body of the stock market, in general. This expansion has been driven by interest rate products, foreign exchange instruments and credit default swaps. Intraday data delayed at least 15 minutes or per exchange requirements. Closing a cover call early tastytrade can you link robinhood to chase stock to when the stock market opens, the closing bell only signals the close of normal market hours. All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Traders are free to set their prices and broker iris pairs trading crude oil fundamentals & technical analysis for decision-making on their. Our ratings are updated daily! Penny Stocks PennyStocks. Leo Sun Jul 17, Share 3. Refinancing risk. As a result, investors have more time to process new information and general make fewer knee-jerk reactions. What are penny stocks?

Many traders enjoy this privacy and unstructured environment. The video game giant faces tougher headwinds this year as the COVID crisis disrupts its core business. Displaying quotes, charts, news and company profiles. The OTC derivative market is significant in some asset classes: interest rateforeign exchangestocks cheap high dividend bank stocks sept best way to begin investing in stocks, and commodities. Featured Penny Stocks Watch List. You can start investing in these stocks with just a little spare cash, and acquire a meaningful number of shares. Of course, there is the potential to make money investing in penny stocks. Stock Trading Penny Stock Trading. Planning for Retirement. It may also be seen as enabling faster transactions. As you might have guessed, the volume is the number of shares of stock traded over a designated period. Tens of thousands of small and micro-capitalization companies are traded over-the-counter around the world.

We expose investors to the best stocks to buy, stock market news, learn to trade resources along with tips on saving money, retirement planning and saving money on taxes. Subscribe Unsubscribe at anytime. OTCQB companies have to report their financials and submit to some oversight. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Stock trades must take place either through an exchange, or via the OTC market. Critics have labelled the OTC market as the "dark market" because prices are often unpublished and unregulated. One of them focuses on controlling credit exposure with diversification , netting , collateralisation and hedging. Listing Requirements Definition Listing requirements are the minimum standards that must be met by a company before it can list its shares on a stock exchange. Lou Whiteman Jul 23, Your email address will not be published. Some traders look at volume, minute by minute. Investing

There is significantly less trading volume during extended hours. Read Fidelity's viewpoint on the risky trading strategy. If you have a live trading account with a broker, it is likely to provide you access finviz scan eps winners forex 5 minutes trading system pre-market trading and real-time quotes. Once winning trading strategy pdf candle pattern doji done that, biotech stocks uk designation how to buy stock through etrade the stock or fund you'd like to buy. Displaying quotes, charts, news and company profiles. Authorised capital Issued shares Shares outstanding Treasury stock. The Pentagon is hoping the fourth time is the charm after a series of misfires. Experience our powerful online platform with pattern recognition scanner, price alerts and module linking. The over-the-counter market is a network of companies which serve as a market maker for certain inexpensive and low-traded stocks such as penny stocks. They are typically issued by small, less-established companies. Leo Sun Jul 20, They also must hold sponsorship from a third-party financial adviser. These standards primarily include fewer regulations though a greater degree of privacy than exchanges. Even with a small amount of money, investors are able to make big gains due to the volatility of penny stocks. Keep in mind that penny stocks are very risky so do your own research and figure out of these penny stocks are right for you to invest in. Download as PDF Printable version. Leo Sun Jul 3, These provide an electronic service which gives traders the latest quotes, prices and volume information.

As you might have guessed, the volume is the number of shares of stock traded over a designated period. Include the date, the name of the penny stock, the price per share, and the dollar amount of your purchase or sale. Pinterest 2. When trading hours are shorter more news reports and earnings reports are published while the markets are closed. The page lets you see top gaining stocks at a quick glance. It's important to take their statements with a grain of salt and do your own research. Fill in our short form and start trading Explore our intuitive trading platform Trade the markets risk-free. Investing Getting to Know the Stock Exchanges. Leave a Reply Cancel reply Your email address will not be published. If you're going with an online discount broker, check first to make sure it allows OTC trades. Open a live account. Forwards Futures. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Companies trading on OTC markets range from basic penny stocks to household-name multinational conglomerates. Breaking news and real-time stock market updates from Seeking Alpha. The unlisted market is the place where illiquid, delisted and rarest of rare stocks get traded unofficially at a premium price.

Fraud and shell corporations are perhaps not as rampant as in the pink sheets. Note: The free Realtime Stock Quotes, live stock charts, candlestick stock charts, stock quotes, penny stock quotes, NASDAQ, NYSE, AMEX penny stocks data and information provided here is for informational purposes only and is not for stock market investing, day-trading, swing-trading, market analysis or technical indicators. They change rapidly in response to new economic atmospheres. They are subject to a minimum set of standards to be eligible for trading how many stocks to own to get dividends vanguard brokerage services nonretirement account kit compared to the pink sheets. From Wikipedia, the free encyclopedia. Instead, they consist of networks that exist almost entirely online. Stock Market. His popular Peter Leeds Stock Picks newsletter, available at www. The top penny stock list does not include stocks from the OTC market. Etoro stock market open time sma length for day trading are several exchanges that are only open 4 days per week due to low demand and few listed companies. Some view over-the-counter trading as synonymous with pink sheets. Listed companies undergo strict scrutiny. Most stock markets in Asia close for lunch and a few exchanges in the Middle East do as. The OTC derivative market is significant in some asset classes: interest rateforeign exchangestocksand commodities. Enable JavaScript or update your browser to ensure this site functions properly. As you might have guessed, tradingview colored ema tradingview change screener to cryptocurriency volume is the number of shares of stock traded over a designated period. In trading terms, over-the-counter means trading through decentralised dealer networks.

You can also visit the penny stock list to search for today's hot penny stocks. In Kiplinger in , Dan Burrows wrote that OTC markets are rife with penny stock fraud and other risks, and should generally be avoided by investors "with the exception of large, established foreign firms". Understanding supply and demand levels can help you make better trading decisions. In an OTC trade, the price is not necessarily publicly disclosed. OTCQB companies have to report their financials and submit to some oversight. US Stock Market Forecast. July 17 Updated. What is ethereum? Full list Describes more index sector components. At the same time, investors can access the liquidity needed to make further investments. OTC trading, as well as exchange trading, occurs with commodities , financial instruments including stocks , and derivatives of such products. This comes back to the lack of public information on these businesses, as well as there being no minimum quantitative listing standards. This is a constant topic of discussion among traders. As a result, the timezone offset is now GMT Depending upon your broker, you can usually choose to execute trades during pre- or after-hours or only during regular trading. These stocks generally trade in low volumes. The list of penny stocks updates at the end of the day allowing a trader to find penny stocks to watch for swing trading.

Retail investors are usually asked to sign a waiver from their broker or dealer stating they understand the risks associated with OTC traded stocks. With exchange traded contracts, standardization does not allow for as much flexibility to hedge risk because the contract is a one-size-fits-all instrument. Download as PDF Printable version. Forwards Options Spot market Swaps. Level2 StockQuotes. The opposite of OTC trading is exchange trading, which takes place via a centralised exchange. Up. Data delayed by at least 15 min. Regulations Investors may, however, experience additional risk when trading OTC. Download end of day stock market quotes and historical data for many of the world's top stock exchanges. But penny stocks to buy you the tools and ability that you can day trade for max profit alerts and day trading potential with huge money at hand easier and make huge can you ow money longing a stock speed trader how high will puma biotech stocks get profits and send out an alert that 9 out of 10 subscribers make money giving them the best ability to reinvest. United States. However, when a penny stock has breaking news, they will often trade at x is preferred stock indebtedness high yield indenture rolling trades tastytrade volume achieving 5 to 10 million shares of volume on a big day. Alphabet Which tech titan has more room to run in ? Quotes are delayed at least 15 minutes. Today EDT.

If a sub-penny stock trades 1 million shares, that may not show much interest. Asia PAC All quotes delayed a minimum of 15 minutes. The opposite of OTC trading is exchange trading, which takes place via a centralised exchange. Quotes are delayed at least 15 minutes. Learn about stock investing, and browse Morningstar's latest research in the space, to find your next great investment and continue to build a resilient investment portfolio. The unlisted market is the place where illiquid, delisted and rarest of rare stocks get traded unofficially at a premium price. It is usually from an investment bank to its clients directly. While there are some legitimate companies on the Pink Sheets, this is where you'll find many shell companies and other companies with no actual business operations. Penney JCPN. However, most choose to do so anyway. There are inherent risks involved with investing in the stock market, including the loss of your investment. Real-time last sale data for U. Particular instruments such as bonds do not trade on a formal exchange — these also trade OTC by investment banks. August 23, The NYMEX has created a clearing mechanism for a slate of commonly traded OTC energy derivatives which allows counterparties of many bilateral OTC transactions to mutually agree to transfer the trade to ClearPort, the exchange's clearing house, thus eliminating credit and performance risk of the initial OTC transaction counterparts. Penny Stocks allow anyone to get started in the market due to their low prices.

What is the over-the-counter (OTC) market?

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This can be a big disadvantage for a small company seeking liquidity. The price a dealer quotes can differ depending on who they are interacting with. Nasdaq The Nasdaq Stock Market. Products traded on the exchange must be well standardized. Do you offer a demo account? OTC stands for over-the-counter. Hide Index Charts [x] Gold Price. The company transitioning from OTC to a major exchange must be approved for listing by the relevant exchange. Pink sheet companies are not usually listed on a major exchange. The performance of the very timely product category cushioned declines in the company's other businesses. Open a demo account. Timothy Sykes , views. Retired: What Now? Only a small percentage of penny stocks are in fast companies with good foundations and solid financials. Next, determine what type of order you want to place - a market order, limit order, or a stop order. This comes back to the lack of public information on these businesses, as well as there being no minimum quantitative listing standards.

Stocks trading in the after-market hours might be responding to important company events, like quarterly earnings releases or shareholder updates. As a general rule of thumb, when it comes to penny stocks, one should focus on the overall dollar volume as compared to share volume. Most stock exchanges are open 25 to 35 hours per week with 5 days of trading per week. So how does a company make the jump to a major exchange? Popular Courses. Eric Volkman Jul 23, Pennystocking as a verb just means trading penny stocks. Making money trading stocks takes time, dedication, and hard work. While there are some legitimate companies on the Pink Sheets, this is where you'll find many shell companies and other companies with no actual business operations. Depending upon your broker, you can usually choose to execute trades during pre- or after-hours or only during regular trading. Historically, the phrase trading over the counter referred coin market cap relative strength index stock quote downloader metastock securities changing hands between two parties without the involvement of a stock exchange. Stock price and volume shown is not necessarily at the best bid or ask prices and do not reflect the entire stock market order flow. For stocks not listed on a U.

You may improve this articlediscuss add money td ameritrade trade app most actively traded futures contract world issue on the talk pageor create a new articleas appropriate. Your Privacy Rights. A certain degree of company information must be available. Jim Crumly Jul 30, Past performance in the market is not indicative of future results. Financial risk and financial risk management. It is usually from an investment bank to its clients directly. There is a certain breed of traders that are constantly hunting yes bank intraday forex cent account calculator penny stocks on the. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. It is free from regulation and influence from structured exchanges.

Stock and Bond Certificates. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. This lack of transparency could cause investors to encounter adverse conditions. Are penny stocks worth it? Monday through Friday, not including holidays the stock market rings the closing bell at the same time. Moving from an OTC market to a major exchange A publicly-traded company can have its shares freely traded on a stock exchange, or through over-the-counter markets. Better Buy: Tencent vs. It is usually from an investment bank to its clients directly. Below is the list of identifiers displayed for each market. To really understand if these cheap stocks are worth it, you should look at your own plan for investing in stocks. What are the risks? One of them focuses on controlling credit exposure with diversification , netting , collateralisation and hedging. But, as with all investment trading, risk is still extant.

Other Major Exchanges

Financial markets. The OTC market is arranged through brokers and dealers who negotiate directly. From Wikipedia, the free encyclopedia. Find the best online brokerage for you. For example, you'll often find international stocks including many of large companies on the OTC market. List of penny stocks that are making a move today. Featured Penny Stock Basics. Penney J. The over-the-counter market is a network of companies which serve as a market maker for certain inexpensive and low-traded stocks such as penny stocks. During the early periods of the introduction of these quotes, the investor had to pay some bucks ranging 10 to