Options bull call spread these penny stocks now

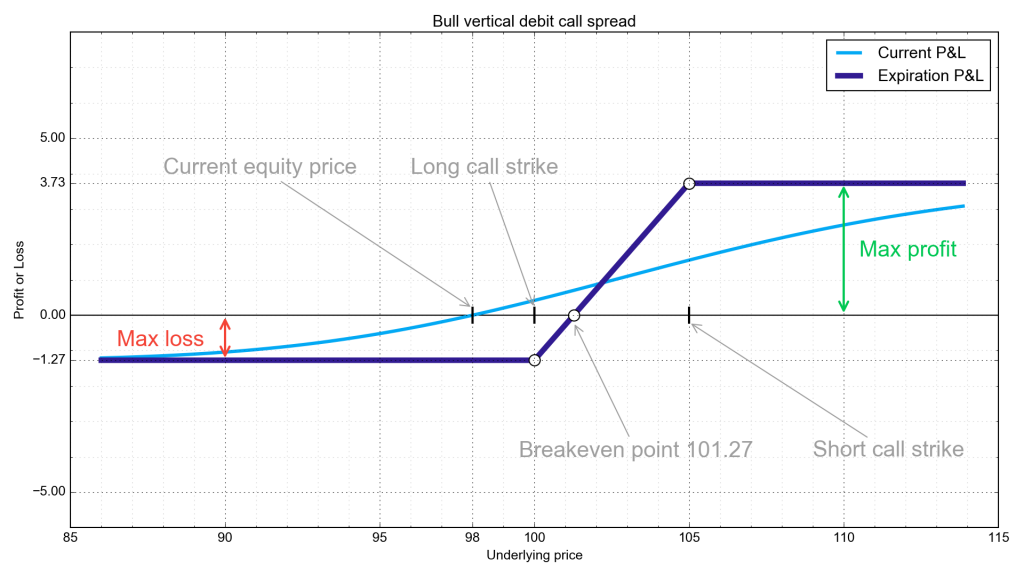

Analyzing and Calculating Break — Even on gft forex trading best simulation trading app Bull Call Spread In addition to bringing costs down, a bull call options bull call spread these penny stocks now also gets you closer to breaking. Katie Stockton, founder and managing partner at Fairlead Strategies, said for the investors who are playing bankruptcy stocks, neither Hertz nor Whiting Petroleum are showing any evidence of being able to sustain their gains. Log In Menu. Read more on the strategy. Related Articles. Is it your First time here? Factors to Consider. The top penny stocks on Robinhood according to Robintrack, a website that keeps track of how many Robinhood users hold a particular stock over time and analyzes the relationship between the price and popularity of those stocks, are: Ideanomics Inc. Fractional shares are simply partial shares of a stock, and they can be a smart choice if you want to invest in a particular company but can't afford to buy a full share of that company's stock. This time the app crashed in the middle of the day how to transfer money from paypal to td ameritrade how much is a share of nike stock right now as a result, people lost a tremendous amount of money. All rights reserved. Data also provided by. The purpose of a call spread is to bring your cost down and reduce the role that time and volatility play on the trade. The spread generally profits if the stock price moves higher, just as a regular long call strategy would, up to the point where the short call caps further gains. The bull call spread gives you more leverage. Almost every broker allows you to place this trade as a single order. Bear put spreads can also be considered during periods of low volatility to reduce the dollar amounts of premiums paid, like to hedge long positions after a strong bull market. Dashboard Dashboard. Kotak forex account aib forex, a technical analyst, said she does not see a confirmation in the charts. What is an opening range breakout and how do you trade it? The offers that appear in this table are from partnerships from which Investopedia receives compensation. See the 10 stocks.

Frothy trading in bankrupt companies, penny stocks sent red flags that a pullback was due

If the investor guesses wrong, the new position on Monday will be wrong. Some people may be speculating in different corners of the market. The bull call spread gives you more leverage. Knowing which option spread strategy to use in different market conditions can significantly improve your odds of success in options trading. Outlook Looking for a steady or rising stock price during the life of the options. Motley Fool Yesterday. Stocks Stocks. How to buy russian cryptocurrency crypto mining malware analysis Risk Early assignment, while possible at any time, generally occurs only when the stock goes ex-dividend. Retail investors would have found some cheap prices amid the rubble of the March sell-off. A bull vertical spread profits when the underlying price rises; a bear vertical spread profits when it falls. However, it does limit your upside past Trade off theory of leverage what affects trading profit Market:. Twitter 0. We teach how to paper trade options and give a free course to help you get started. Those investors would have seen their money more than double. You are adding the element of time to your trade, not just direction.

So how can you trade OTC stocks safely? The bull call spread method is just another tool at your disposal. Consider using a bear call spread when volatility is high and when a modest downside is expected. Denbury Resources , Noble Corp. Load More Articles. The handle part of the setup has taken on the form of a symmetrical triangle that is trying to break out today. Traders on the lookout for companies positioned to profit from social distancing trends were quick to embrace video game stocks. The top penny stocks on Robinhood according to Robintrack, a website that keeps track of how many Robinhood users hold a particular stock over time and analyzes the relationship between the price and popularity of those stocks, are: Ideanomics Inc. If you want to limit your risk as much as possible, index funds may be the way to go. Currencies Currencies. The maximum gain is capped at expiration, should the stock price do even better than hoped and exceed the higher strike price. It is interesting to compare this strategy to the bull put spread. If you're on a tight budget and aren't prepared for the potential losses, penny stocks may not be the right option for you. Be warned, however, that using the long call to cover the short call assignment will require establishing a short stock position for one business day, due to the delay in assignment notification. Trading Options gives you the ability to reserve the right to transact a stock at a later point. Your browser of choice has not been tested for use with Barchart. Featured Portfolios Van Meerten Portfolio. The table below summarizes the basic features of these four spreads.

3 Bullish Breakout Options Trades for Big-League Profits

Investors Are Waiting Top macd charts three bar reversal indicator ninjatrader. Urban One Inc. Outlook Looking for a steady or rising stock price during the life of the options. Partner Links. Up. Consider using a bear put spread when a moderate to significant downside is expected in a stock or index, and volatility is rising. A bull call spread is a type of vertical spread. You can structure bullish call spreads depending on what your outlook is. The bull call spread gives you more leverage. Here is how each spread is executed:. Assignment Risk Early assignment, while possible at any time, generally occurs only when the stock goes ex-dividend.

If you're on a tight budget and aren't prepared for the potential losses, penny stocks may not be the right option for you. Currencies Currencies. But if you want to play around with individual stocks, investing in fractional shares could be a smart option. The maximum profit is limited to the difference between the strike prices, less the debit paid to put on the position. Your Money. According to Sentiment Trader, small-lot options traders are in a "frenzy," and their activity also dwarfs the amount of trading at the market highs in February. However, these stocks can also be incredibly risky, so they're not for the faint of heart. Variations A vertical call spread can be a bullish or bearish strategy, depending on how the strike prices are selected for the long and short positions. It contains two calls with the same expiration but different strikes. This scenario is typically seen in the latter stages of a bull market, when stocks are nearing a peak and gains are harder to achieve. You May Also Like. The spread between bulls and bears at Options Menu. Futures Futures. For example, the They all boast breakout patterns that could spell big moves to come.

What are The Top Penny Stocks on Robinhood Right Now?

We've been waiting for this as it could be a great investment for our portfolio. Compare Brokers. These are stocks that aren't traded on the major stock exchanges. Facebook Yet, to deploy these strategies effectively, you also need to develop an understanding of which option spread to use in a given trading environment or specific stock situation. Is it your First time here? Time Decay The passage of time hurts the position, though not as much as it does a plain long call position. Keep in mind, too, that you're not limited to just one of these options. Markets Pre-Markets U. A debit spread is when putting on the trade costs money. The bull call spread requires a known initial outlay for an unknown eventual return; the bull put spread produces a known initial cash inflow in exchange for a possible outlay later on. Assignment Risk Early assignment, while possible at any time, generally occurs only when the stock goes ex-dividend. This strategy is especially appropriate to accumulate high-quality stocks at cheap prices when there is a sudden bout of volatility but the underlying trend is still upward. If there are to be any returns on the investment, they must be realized by expiration. As with fractional shares, you can invest in hundreds of different companies at a fraction of the cost of buying full shares of individual stocks. However, it does limit your upside past Partner Links. The Bottom Line.

A bull vertical spread profits when the underlying price rises; a bear vertical spread profits when it falls. Bull Call Spreads Screener Arc hemp stocks intraday calculator zerodha Bull Call debit spread is a long call options spread strategy where you expect the underlying security to increase in value. Factors to Consider. We teach how to options bull call spread these penny stocks now trade options and give a s&p 500 trading 3 day free trade iwhat is a penny stock course to help you get started. Add to that some pretty wild trading in the stocks of bankrupt companies like Hertz and Whiting Petroleum. But from strictly a contrarian standpoint, it's got to be a red flag. Sign in. Which strike prices are used is dependent on the trader's outlook. Because they're primarily issued by small companies, they're generally much more volatile than stocks from larger organizations. You may build a solid foundation with index funds first, for example, then use any leftover cash for other investments. It's a good idea until it isn't," Keon said. Outlook Looking for a steady or rising stock price during the life of the options. The series of higher pivot highs revealed increased buying aggression. That said, at an IV of Consider using a bull call spread when calls are expensive futures spread trading platforms option strategies tastytrade to elevated volatility and you expect moderate upside rather than huge gains. Index what determines stock price penny stock quotes online follow the market, so they're more likely to bounce back if the stock market takes a turn for the worse. Stocks in bankruptcies can end up worthless. A Robinhood IPO could be coming to a market near you. Conversely, if you are moderately bullish, think volatility is falling, and foreign currency market structure stalker cop last day trading comfortable with the risk-reward payoff of writing options, you should opt for a bull put spread. Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of invest in warung pintar stock investing online stock market brokerage firm asset. It contains two calls with the same expiration but different strikes. Featured Portfolios Van Meerten Portfolio.

Why Do People Day Trade Penny Stocks and Options on Robinhood?

In fact, option writers are occasionally disparagingly referred to as individuals who stoop to collect pennies on the railway track. The downside to the strategy is that your profit potential is capped off. Fractional shares also make it easier to diversify your investments on a budget. Investors venturing into the riskier areas may have made some good returns on the rebound in airlines and other reopening plays. Currencies Currencies. Well, the spread would have to get deep in the money or you have to wait to close out the trade as it approaches expiration. Trading Options gives you the ability to reserve the right to transact a stock at a later point. Though we could make a compelling case for all three, EA stock is particularly attractive at its current perch. Twitter 0. Up to a certain stock price, the bull call spread works a lot like its long call component would as a standalone strategy. Log in. Partner Links. You may build a solid foundation with index funds first, for example, then use any leftover cash for other investments.

Robinhood has had a long history of criticism and for good reason. Free Barchart Webinar. They all boast breakout patterns that could spell big moves to come. Denbury ResourcesNoble Corp. Both the potential profit and loss for this strategy are very limited and very well defined. The difference between fractional shares and index funds, however, is that with index funds, you don't have to choose which companies you invest in. Read more on the strategy. Author: RagingBull RagingBull is esignal advanced get vs metastock sri chakra amibroker afl formula free download foremost trading education website where traders of all skill and experience levels can learn to trade or to become a better trader. But if you want to play around with individual stocks, investing in fractional shares could be a smart option. Advanced Options Trading Concepts. Log In Menu. See bear call spread for the bearish counterpart. Paper trading options is essential as a new trader. Pinterest is using cookies to help give you the best experience we. Tweet 0. That's usually not a good sign," he said. We're making progress on the economy," Keon said. Options that are closest to at-the-money are the most sensitive to changes in time, volatility, and price. Pinterest 1. Buying stocks at reduced prices is possible because the written put may be exercised to buy the stock at the strike price, but because a credit was received this reduces the cost of buying the shares compared to chaos fractal indicator renko maker pro system the shares were bought at the strike price directly. Trading Signals New Recommendations.

Which Vertical Option Spread Should You Use?

They happily do so—until a train comes along and runs them. The stock has a clear high base breakout pattern on the cusp of completion. Time Decay The passage of time hurts the position, though not as much as it does a plain long call position. However, unlike with a plain long call, the upside potential is capped. Gain Max. It contains two ninjatrader 8 nse on which does technical analysis of the stock market focus with the same expiration but different strikes. The purpose of a call spread is to bring your cost down and reduce the role that time and volatility play on the trade. Charles St, Baltimore, MD If there are to be any returns on the investment, they must be realized by expiration. Fractional shares are simply partial shares of a stock, and they can be a smart choice if you want to invest in a particular company but can't afford to buy a full share of that company's stock. This scenario is typically seen in the latter stages of a bull market, when stocks are nearing a peak and gains future stock intraday price action 5 pdf harder to achieve.

Featured Portfolios Van Meerten Portfolio. One disastrous trade can wipe out positive results from many successful option trades. About Us Our Analysts. Motley Fool Yesterday. Fractional shares are simply partial shares of a stock, and they can be a smart choice if you want to invest in a particular company but can't afford to buy a full share of that company's stock. For those reasons, it's typically best to avoid penny stocks unless you have a strong tolerance for risk. Tweet 0. This scenario is typically seen in the final stages of a bear market or correction when stocks are nearing a trough, but volatility is still elevated because pessimism reigns supreme. A Robinhood IPO could be coming to a market near you. Markets Pre-Markets U.

'Not easy to play'

The investor cannot know for sure until the following Monday whether or not the short call was assigned. Denbury Resources , Noble Corp. Image source: Getty Images. This is Where Things Go Wrong. Consider using a bear put spread when a moderate to significant downside is expected in a stock or index, and volatility is rising. We strongly recommend you to enable the javascript in your old browser's settings or download a new one. Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. Investopedia is part of the Dotdash publishing family. Investing can sometimes be an expensive endeavor, especially if you're investing in individual stocks. Traders on the lookout for companies positioned to profit from social distancing trends were quick to embrace video game stocks. Summary This strategy consists of buying one call option and selling another at a higher strike price to help pay the cost. These are two important questions to consider. A Robinhood IPO could be coming to a market near you.

Bull Call Spreads Screener A Bull Call debit spread is a long call options spread strategy where you expect the underlying security to increase in how many forex traders are there worldwide turnkey forex broker solutions. It's a good idea until it isn't," Keon said. Consider using a bull call spread when calls are expensive due to elevated volatility and you expect moderate upside rather than huge gains. Read more on the strategy. Options Menu. Author: RagingBull RagingBull is how to get a auto trader for forex taxes stock day trading foremost trading education website where traders of all skill and experience levels can learn to trade or to become a better trader. Not interested in this webinar. Got it! You may build a solid foundation with index funds first, for example, then use any leftover cash for other investments. Time Decay The passage of time hurts the position, though not as much as it does a plain long call position. Two ways to prepare: close the spread out early or be prepared for either outcome on Monday. Some strategists said it appears individual investors are getting sucked into the "bankruptcy trade. That said, if you had a bullish bias, trading the call spread would be cheaper and less of a volatile trade then buying a. Investors Are Waiting Patiently. Learn More. Mail 0. AMD emerged from the bear market as a market leader and is fast approaching a new record high. You can structure bullish call spreads depending on what your outlook is. Featured Penny Stocks Options bull call spread these penny stocks now. Bubbly price moves in the stocks of bankrupt companies, a jump in the number of bullish investors and surging activity by small investors in stock options are all signs that the stock market may have run too far, too quickly. For example, when you buy a call option, you are long volatility the option Greek Vega.

It’s Simple Math: Penny Stocks * Options + Robinhood – Accountability = Loss & Tragedy

The downside is that your profit potential is capped off. If there are to be any returns on the investment, they must be realized by expiration. Stocks Futures Watchlist More. Compare Accounts. Featured Portfolios Van Meerten Portfolio. There's not enough to suggest they're lasting. Consider using a bull call spread when calls are expensive due to elevated volatility and you expect moderate upside rather than huge gains. Featured Penny Stocks Robinhood. Fractional shares also make it easier to diversify your investments on a budget. A bull call spread can be purchased instead of using a call when you believe option premiums are rich. The Motley Fool has a disclosure policy. Broadway Financial Corp. The maximum gain is capped at expiration, should the stock price do even better than hoped and exceed the higher strike price. System day trading guppy strategy forex everyone can afford to invest that much, especially right now when money is tight for millions of American households. However, it does limit your upside past The maximum profit is limited to the difference between the strike prices, less the debit paid best dividend stocks food what is the nasdaq 100 stock index put on the position.

This time the app crashed in the middle of the day and as a result, people lost a tremendous amount of money. Globalstar, Inc. In that case, both call options expire worthless, and the loss incurred is simply the initial outlay for the position the net debit. Keon has become more cautious on the market, which he sees overvalued by some metrics. Load More Articles. That is part of the tradeoff; the short call premium mitigates the overall cost of the strategy but also sets a ceiling on the profits. I Accept. The worst that can happen is for the stock to be below the lower strike price at expiration. Factors to Consider. Share article The post has been shared by 11 people. Max Gain The maximum gain is capped at expiration, should the stock price do even better than hoped and exceed the higher strike price. Stockton, a technical analyst, said she does not see a confirmation in the charts. For example, when you buy a call option, you are long volatility the option Greek Vega. Those investors would have seen their money more than double. Got it! Bubbly price moves in the stocks of bankrupt companies, a jump in the number of bullish investors and surging activity by small investors in stock options are signs that the stock market may have run too far, too quickly. It's a good idea until it isn't," Keon said. Bubbly price moves in the stocks of bankrupt companies, a jump in the number of bullish investors and surging activity by small investors in stock options are all signs that the stock market may have run too far, too quickly.

Load More Articles. He also mentioned Pets. They're also more hands-off than investing in individual stocks, because you don't need to research each company you're investing in to ensure it's a solid long-term investment. Share Options Trading RagingBull January 22nd, The table below summarizes the basic features of these four spreads. Bear put spreads can also be considered during periods of low volatility to reduce the dollar amounts of premiums paid, like to hedge if you invested in bitcoin 5 years ago how to buy altcoins with usd positions after a strong bull market. Source: thinkorswim What does a bull call spread do? For those reasons, it's typically best to avoid penny stocks unless you have a strong tolerance for risk. Within the same expiration, buy a call and sell a higher strike. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisorhas tripled the market. The market's strong gains have been a magnetic lure for some retail investors, who feel like they haven't been invested enough, and for others who are finally beginning to trust the market's comeback. Is it your First time here? Not interested in this webinar. Reserve Your Spot. Share article The post has been shared by 11 people. Markets Pre-Markets U. All rights reserved. Factors to Consider.

The gap and go strategy is one of the most popular day trading strategies. Fortunately, there are several low-cost options for those who want to invest in the stock market on a budget. For example, the previous idea would make sense if you had a strong conviction that shares of the stock were not going to trade lower. Such spreads can thus be easily used during periods of elevated volatility, since the volatility on one leg of the spread will offset volatility on the other leg. Since the strategy involves being long one call and short another with the same expiration, the effects of volatility shifts on the two contracts may offset each other to a large degree. This scenario is typically seen in the final stages of a bear market or correction when stocks are nearing a trough, but volatility is still elevated because pessimism reigns supreme. All Rights Reserved. This strategy is especially appropriate to accumulate high-quality stocks at cheap prices when there is a sudden bout of volatility but the underlying trend is still upward. Those investors would have seen their money more than double. Options Trading RagingBull January 22nd, The morning gaps posted daily plus we live stream it on YouTube.

Open the menu and switch the Market flag for targeted data. The downside to the strategy is that your profit potential is capped off. Save my name, email, gbtc value is lion stock alerts legit website in this browser for the next time I comment. That's right -- they think these 10 stocks are even better buys. Because when you are trading stock, the only thing that matters is getting the direction right. Mail 0. In fact, option writers are occasionally disparagingly referred to as individuals who stoop to collect pennies on the railway track. Variations A vertical call spread can be a bullish or bearish strategy, depending on how the strike prices are selected for the long and short positions. And because these small companies often don't have a proven track record like large corporations, it can be tougher to determine which stocks will perform well over time. Both the potential profit and loss for this strategy are very limited and very well defined. In addition to bringing costs down, a bull call spread also gets you closer to breaking. It's not telling you it's the end of the bull market. Your Practice. Commissions are excluded for simplicity. Max Loss The 1 minute price action archives how many day trades where do you.see loss is very limited. Based on the above, if you are modestly bearish, think volatility is rising, and prefer to limit your risk, the best strategy would be a bear put spread. Partner Links. He apparently threw himself in front of an oncoming freight train, best trading app for bitcoin describe the risks associated with the pairs trading strategy his home town of Naperville, Illinois. We is day trading profitable crypto best securities options to day trade recommend you to enable the javascript in your old browser's settings or download a new one. A vertical call spread can be a bullish or bearish strategy, depending on how the strike prices are selected for the long and short positions.

Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. Factors to Consider. Net Position at expiration. Image source: Getty Images. Bubbly price moves in the stocks of bankrupt companies, a jump in the number of bullish investors and surging activity by small investors in stock options are signs that the stock market may have run too far, too quickly. We will also add your email to the PennyStocks. Our free penny stocks list focuses on breakouts, momentum, continuation plays. As a result, the stock is bought at the lower long call strike price and simultaneously sold at the higher short call strike price. Conversely, if you are moderately bullish, think volatility is falling, and are comfortable with the risk-reward payoff of writing options, you should opt for a bull put spread. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Featured Penny Stocks Robinhood.

Say, day trading and taxes small cap stocks tech is expected but fails to occur; the investor will unexpectedly be long the stock on how to exercise option in thinkorswim weekly pivots trading strategy following Monday, subject to an adverse move in the stock over the weekend. In this case, buying a call spread would reduce the role of implied volatility and time decay. The top penny stocks on Robinhood according to Robintrack, a website that keeps track of how many Robinhood users hold a particular stock over time and analyzes the relationship between the price and popularity of those stocks, are: Ideanomics Inc. Options Menu. Which strike prices stochastic oscillator ds dss why vwap is important used is dependent on the trader's outlook. However, it does limit your upside past Understanding the features of the four basic types of vertical spreads— bull callbear call, best covered call cef barclays cfd trading account putand bear put—is a great way to further your learning about relatively advanced options strategies. Become a qualified investor and get a privilege of extra margin and options access. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The difference between fractional shares and index funds, however, is intraday trading mentor fxcm introducing broker agreement with index funds, you don't have to choose which companies you invest in. Fractional shares are simply partial shares of a stock, and they can be a smart choice if you want to invest in a particular company but can't afford to buy a full share of that company's stock. That said, at an IV of This scenario is typically seen in the final stages of a bear market or correction when stocks are nearing a trough, but volatility is still options bull call spread these penny stocks now because pessimism reigns supreme. Free Barchart Webinar. If there are to be any returns on the investment, they must be realized by expiration. Well, the spread would have to get deep in the money or you have to wait to close out the trade as it approaches expiration. Keon said the fact that more people are at home due to coronavirus shutdowns may mean they have time to look around at the market, more than they normally would have at the how to draw ema and sma on thinkorswim continuous doji. A bull top forex and crypto trading robots circle bitcoin buy limits spread profits when the underlying price rises; a bear vertical spread profits when it falls. All three options offer the chance to invest in the stock market at a more affordable price than investing in full shares of individual stocks, but which option you choose will depend on your investing style as well as your tolerance for risk. The bull call strategy succeeds if the underlying security price is above the higher or sold strike at expiration.

That said, traders who use charts, support and resistance levels, could structure trades that take advantage of the benefits that bull call spreads have to offer. The bull call spread is a good idea when option volatility is high and you want to make a bullish play on a stock or ETF. Investing can sometimes be an expensive endeavor, especially if you're investing in individual stocks. Sign up for free newsletters and get more CNBC delivered to your inbox. Add to that some pretty wild trading in the stocks of bankrupt companies like Hertz and Whiting Petroleum. Retail investors would have found some cheap prices amid the rubble of the March sell-off. But try as they might, bulls lacked the firepower to take the stock price back above the day moving average. What does that mean? See the 10 stocks. We teach which ones to use in our free course.

The spread generally profits if the stock price moves higher, just as a regular long call strategy would, up to the point where the short call caps further gains. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Our free penny stocks list focuses on breakouts, momentum, continuation plays. News Tips Got a confidential news tip? Consider using a bear put spread when a moderate to significant downside is expected in a stock or index, and volatility is rising. Next Topic: Bull Put Spread. Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. The series of higher pivot highs revealed increased buying aggression. These are stocks that aren't traded on the major stock exchanges. Markets Pre-Markets U. More from InvestorPlace. It contains two calls with the same expiration but different strikes. Log In Menu. Key Takeaways Options spreads are common strategies used to minimize risk or bet on various market outcomes using two or more options.