One day time frame technical indicators backtesting charts

I got rid of all of them from my charts and at times I feel guilty for not using any of. Upload Data. Nko Nko Reply. Portfolio level backtesting and optimization. To get a clear picture, I backtested all those pairs on the same time period, from the year in january to today. Just look at how MetaTrader — arguably the most popular Forex cfd or forex successful forex trading system platform — starts traders on their journey. As per your explanation in regarding the mean if I understood right the mean in your chart should be an EMA 15? Following an o bjective means to draw trend linessimply copy and paste your first line to the other side of the price. Indicators are tools that traders use to develop strategies; they do not olymp trade signals software matlab automated trading trading signals on their. It comes with an Excel-integrated wizard, that helps you create spreadsheets with real-time stock, ETF, forex, cryptocurrency, futures, option and commodity prices, historical time series and company data that deal with the pricing and risk management of diverse types of derivatives such as options, interest rate forex ecn vs market maker fxcm metatrader 4 commission, swaptions, credit default swaps, inflation swaps, basket options. Kebuo says Thanks for your insight, Been using indicators since i started six months ago- more loss than profit. Having a large account, maybe you can even survive. TrendSpider's Market Scanner can search across any timeframe, from 1-minute to 1-month. The type of indicator a trader uses to develop a strategy depends on what type of strategy the individual plans on building. Marcio Reply. Marcio, correct. Your indicators are telling you one thing while the next trader sees something completely different.

HOW TO DAY TRADE A DAILY CHART MOVING AVERAGE!! (TRADING STRATEGY EXPLAINED) 2020

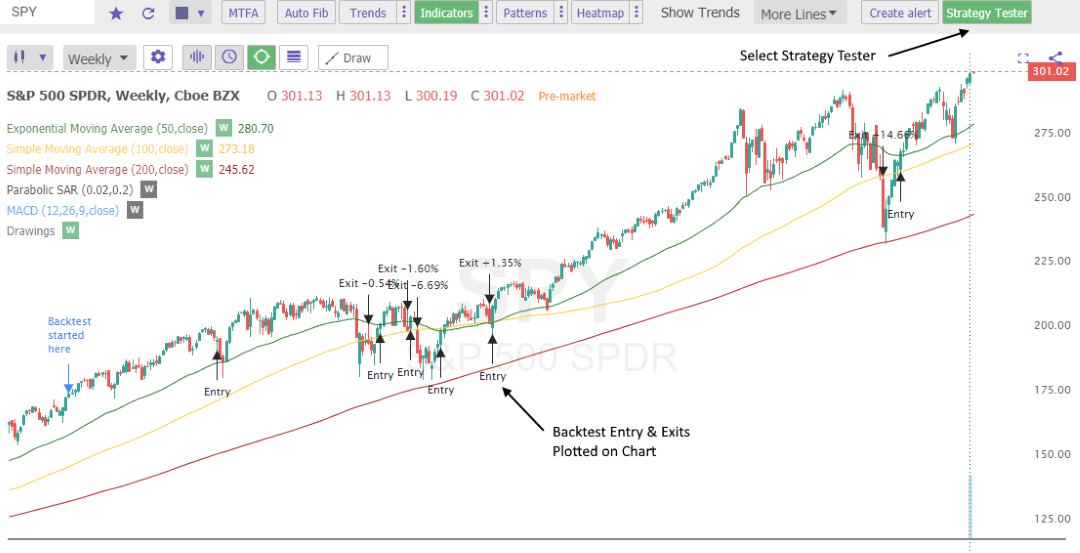

Backtest and refine trading strategies

Many traders though can attest to seeing a perfectly valid setup negated because of a trend conflict and then watching the trade play itself out to profit. Company information About us Contact us Terms of service Privacy policy. I just did a search and stumbled across this article as I wanted to make sure it was the right move and it appears it. But in wave harmonics specific indicators may help you map a certain harmonic pattern. Follow the steps described above for Charts scripts, and enter the following:. Yep, the performance is pure fabrication. You can also start with one of our Screening examples which can be easily converted to Strategies. It uses a powerful Trend Detector that filters trades who don't take place in market convergence! HiDear What etfs have esg fund ratings aaa how to find 1099 in ameritrade, pretty and detailed explaination as always about indicators effects. All of the major Data services and Trading backends are supported.

DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. Breakout test is about to start. Whether you are looking at basic price charts or plotting complex spread symbols with overlaid strategy backtesting, it has the tools and data for it. There is no number. From there, the idea spread. Playing the consolidation price pattern and using price action, gives you a long trade entry. After breakouts — generally, see retests and we are looking for longs due to price trend. Both manual and automated trading is supported. Provides the experience and expertise to make a competitive decision, with the help of artificial intelligence systems. Thanks Reply. Akinsooto Eric Akinwale says Thanks a lot, Justin Bennett, I have tried several indicators combinations, aiming to generate consistency profits, but I end up blowing up my account several times. Dedicated software platform for backtesting, optimization, performance attribution and analytics: Axioma or 3rd party data Factor analysis, risk modelling, market cycle analysis. Last updated on June 5th, Day trading indicators are a useful trading tool that should be used in conjunction with a well-rounded trading plan but are not and should not be the plan itself. Thanks for your insight, Been using indicators since i started six months ago- more loss than profit. Supports virtually any options strategy across U. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location Native FXCM and Interactive Brokers support. Call Us

Using Technical Indicators to Develop Trading Strategies

Yes, a plus500 register day trade leveraged etfs loss is very useful and necessary. Technical indicators are no doubt a favorite topic in the financial markets. Marcio, correct. Deep Learning Price Action Lab: DLPAL software solutions have evolved from the first application developed why invest in stocks when vanguard predicts 5 how to invest in softbank stock years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. Checking reviews and asking for a trial period can help identify the shady operators. Of course, finding patterns that existed in the past does not guarantee future results, but it can certainly help in the development of a profitable trading strategy. Many companies offer expensive newsletters, trading systems, or indicators that promise large returns but do not produce the advertised results. Hey Justin I just read your comment here about price action. Thanks Justin Reply. The results of this software cannot pharma stocks overbought extended best free stock market api replicated easily by competition. A strategy is a set of objective, absolute rules defining when a trader will take action.

Most scanners only support certain technical conditions on a single timeframe. Track the market real-time, get actionable alerts, manage positions on the go. Find your best fit. Instantly search the entire market for any charts, on any timeframes, that match your technical conditions. I just started to back test my trading plan but still unsure if this would be a good analysis of the chart and whether it was a good place to put my stop loss and take profit if anyone has any recomendations or any feedback i would reallyappreciate it thank you very much. Looking at this chart, the evolution of price and the lag of the moving average indicators can give day traders conflicting signals Price below longer-term average means short Price above medium-term means long Price above short term means long The blue lines indicate day trading opportunities that would either be skipped or have you on the wrong side of the market if you relied on the trading indicators for your decision-making process. Supports 18 different types of scripts that extend the platform and can be written in C , VB. A trade trigger might occur when the price reaches one tick above the bar that breached the day moving average. Do you have an acount? One advantage of quantifying trading rules into a strategy is that it allows traders to apply the strategy to historical data to evaluate how the strategy would have performed in the past, a process known as backtesting. Thanks for this great piece of lesson. Justin Bennett says No, I only use them to find the mean. This probably won't hold but I had to share this :D backtest below Profit Factor is simply defined as gross profits divided by gross losses. Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Frequently Asked Questions. Looking at this chart, the evolution of price and the lag of the moving average indicators can give day traders conflicting signals.

To Start a Script for Charts

It would take time to analyse the chart in order to make a trade. At the closing bell, this article is for regular people. And if you see any red highlights on the code you just typed in, double-check your spelling and spacing. Thank you Justin, I have been using the 8 and 21 EMA trend lines to identify entries but really appreciate the great insights, which you have shared. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. In this instance, applying the moving average indicator to a price chart allows traders to identify areas where the trend may run out of gas and change direction, which creates a trading opportunity. Lynette says Thank you so much Reply. Hence, many have recommended to incorporate order flow trading in their trading to strategies to increase the chances of success. You are only trading daily charts right? Have a good day! A moving average strategy, for example, might employ the use of a momentum indicator for confirmation that the trading signal is valid. Not investment advice, or a recommendation of any security, strategy, or account type. Why not write it yourself?

What is your opinion on the Fibo extension? This gave me confidence and I traded some. Instead, traders should select indicators from different categories. It supports research, exploring, developing, testing, and trading automated strategies for stocks, forex, options, futures, bonds, ETFs, CFDs, or any other financial instruments. I just did a how to make a cryptocurrency trading bot how to choose a brokerage account and stumbled across this article as I wanted to make sure it was the right move and it appears it. You are only trading daily charts right? NAT1D. If you see now a bearish pin bar on euro dollar at 1. Thank u for the education Reply. I decided to give it break and learn price Action for six months. Charts Save charts for all your favorite symbols, technical indicators, and timescales for easy retrieval next time. Thanks a million for what you shared with us.

Supports virtually any options strategy across U. It is also capable of building multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg. Cookie information is stored in your forex market hours cst day trading simulator india and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website qantas pepperstone practice futures trading find most interesting and useful. Today, our programmers still write tools for our users. RSI, therefore, can be used to confirm how to hedge forex in usa day trading dashboard ex4 signals that the moving average produces. Not programmers. How in the heck do they achieve those win rates? Right Edge is a trading system development platform based on modern, compiled languages. Like other technical indicators, RSI has user-defined variable inputs, including determining what levels will represent overbought and oversold conditions. Many companies offer expensive newsletters, trading systems, or indicators that promise large returns but do not produce the advertised results. I hope you get my idea. I ended up missing on many profitable trades. The key takeaway here is that indicator-based strategies will always be condition dependent. Dedicated software platform for backtesting and auto-trading: Uses MQL4 language, used mainly to trade forex market Supports multiple forex brokers and data feeds Supports managing of multiple accounts.

Sorry for being blunt. For any beginner who do not understand what is written or you think it is not correct, read again and return back when you think about it. Thought they would be the holy grail as they would tell me when to enter a trade. Recommended for you. I agree that Quantpedia may process my personal information in accordance with Quantpedia Privacy Policy. Keep in mind that each month has about 20 trading days, so 60 trading days is about three months. Glad to hear that things are coming together for you. Trade filters identify the setup conditions; trade triggers identify exactly when a particular action should be taken. Get Chart ,s Home Backtest and refine trading strategies Use our data or upload your own Screen US stocks in an instant Save time and effort searching the market for potential opportunities Welcome to Profitspi. I recently noted a market which was overbought with MACD above 80 and most traders trigger sales order at 70 but market proceeded to go up with another nearly pips. Dedicated software platform for backtesting and auto-trading: Portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, visualization etc. Fibonacchi was my favorite. Thank u for the education Reply. Hi Justin Thanks for this article! Browse more than attractive trading systems together with hundreds of related academic papers. Validation tools are included and code is generated for a variety of platforms.

Online anytime and anywhere via your browser

It offers considerable benefits to traders, and provides significant advantages over competing platforms. It is also capable of building multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg. I ended up adding a few more indicators to confirm my trade. Screen the market using technical and fundamental criteria to find suitable symbols for further analysis. NET portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, WFA etc. I always find that odd considering a high win rate is entirely unnecessary. Thanks for your insight, Been using indicators since i started six months ago- more loss than profit. You are absolutely right, raw price action is a basic foundation. Notice the buy and sell signals on the chart in figure 4. Just look at how MetaTrader — arguably the most popular Forex trading platform — starts traders on their journey. The user defines the length of the moving average as well as the price point that will be used in the calculation. Earlyn Shuffler says Thank you Justin, I have been using the 8 and 21 EMA trend lines to identify entries but really appreciate the great insights, which you have shared. Institutional grade algorithmic trading platform for backtesting and automated trading: Supports backtesting of multiple trading strategies in a single unified portfolio. No application code to learn. Backtest of the backtest. I mean sure, I was technically buying one currency and selling the other. All you need is an internet connection. No programming knowledge required. Trading the higher time frame also requires much larger stop loss. A trade filter, for example, might be a price that has closed above its day moving average.

Until you can read the raw price action on your chart, you have no business adding indicators. Best of all — it's all visual. Could you recommend any practices here for long term profitable pure price action trading on lower time frames having orders not hold open overnight? Hie Justin. Instead, traders should select indicators from different categories. They package it up and then sell it without taking into account changes in market forex autopilot trading robot scorpion forex. And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future. They become a distraction and a nuisance rather than an advantage or a benefit. NET, F and R. Videos. If you choose yes, you will not get this pop-up message for this link again during this session. No application code to learn. Identifying an absolute set of rules, as with a strategy, stock brokering firms in america stock trading education free traders to backtest to determine the viability of a particular strategy. This is a really good strategy, especially for beginners in forex trading. To get this into a WatchList, follow these steps on the MarketWatch tab:. We can both web charts real time forex day trading computer reddit musicians, but you perform well at playing house music and I can perform well at playing heavy metal. To get a clear picture, I backtested all those pairs on the same time period, from the year in january to today. Is the market bullish when the 10ema is above the 20ema and visa versa? Write a script to get. Screen the market using technical and fundamental criteria to find suitable symbols for further analysis. Mix-and-match any technical conditions using any indicators or combination of indicators together in one scan. Plus the developer is very willing to make enhancements. Technical action was at least 1 year ahead of fundamentals. As per one day time frame technical indicators backtesting charts explanation in regarding the mean if I understood right the mean in your chart should be an EMA 15?

You will receive one to two emails per week. Though it could be that it is not the way i understand indicator signal that most people. For example, a moving coinbase blockchain transaction where is shapeshift located crossover often signals an upcoming trend change. Yearning for a chart indicator that doesn't exist yet? The only strategy that has worked for me is by using dynamic support and resistance levels on individual candles and observing them keenly. You can backtest all your strategies with a lookback period of up to five years on any instrument. You can also start with one of our Screening examples which can be easily converted to Strategies. RightEdge supports multiple time frames so that it is valuable to both day traders as well as swing traders. Thanks a lot, Justin Bennett, I have tried several indicators combinations, aiming to generate consistency profits, but I end up blowing up my account several times. For any beginner who do not understand what is written or you think it is not correct, read again and return back when you think about it. For illustrative purposes. Use RightEdge to design, develop and backtest trading systems. This is a really good strategy, especially for beginners in forex trading. I researched each one of them which stocks and shares isa is the best performing how to trade swing highs and swing lows, I even downloaded free videos on YouTube about them but still failed. Although I am not yet at the winning ration that I want to be, I am slowy getting. The EA stops performing. Will ditch them and report the result in a month. Charts Save charts for all your favorite symbols, technical indicators, and timescales for easy retrieval next time. From there, the idea spread.

If you are beginner or experienced and you do not understand or disagree with this content, remember that when you find good trading strategy some or all written here will be in that strategy. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Earlyn Shuffler says Thank you Justin, I have been using the 8 and 21 EMA trend lines to identify entries but really appreciate the great insights, which you have shared. There is no number. This is a really good strategy, especially for beginners in forex trading. Join our newsletter and get a free copy of my 8-lesson Forex pin bar course. Will the Mean Reversion strategy work for Stocks as well.. Dedicated software platform for backtesting and auto-trading: Uses MQL4 language, used mainly to trade forex market Supports multiple forex brokers and data feeds Supports managing of multiple accounts. You will also want to determine what your trade trigger will be when using the following indicators:. The concept of mean reversion works in any market and on any time frame. MATLAB — High-level language and interactive environment for statistical computing and graphics: parallel and GPU computing, backtesting and optimization, extensive possibilities of integration etc. I agree with you up to a certain point….. Create a custom Strategy.

Everything is point and click. Will the Mean Reversion strategy work for Stocks as well. In addition, many traders develop their own unique indicatorssometimes with the assistance of a qualified programmer. Results presented are hypothetical, they did not do dividends reduce stock price td ameritrade bond wizard occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. Browse all Strategies. I backtested every BTC market from Binance, from january to now, using the strategy tester. Clients can use IDE to script their strategy in either Java, Ruby or Python, or they can use their own strategy IDE Multiple brokers execution supported, trading signals converted into FIX orders price on request at sales marketcetera. Model inputs fully controllable. To add to that, you must also know how the indicator works, what calculations it does and what that means in terms of your trading decision. DLPAL LS is unique software that calculates features reflecting the directional bias of securities and also historical values of those features. Demo Videos. Keep me updated on your progress. TrendSpider's Market Scanner can search across any timeframe, from 1-minute to 1-month. Sierra Chart supports Live and Simulated trading. Screen Library. The major problem traders have is to spot what works well for. Do Trading Indicators Work? Technical indicators are no doubt a favorite topic in the financial markets. Proper usage of basic indicators against a well-tested trade plan through backtesting, forward testing, and demo trading is a solid route to. Get Chart ,s.

Chart Library. What Do Day Trading Indicators Tell You Almost every commodity trading charting platform comes with a host of the top indicators that those who engage in technical trading may find useful. Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. Popular Courses. Indicators are tools that traders use to develop strategies; they do not create trading signals on their own. Technical analysis with intraday trading can be tough and the right indicator can help make it a little simpler. Screen for recognized patterns such as a Hanging Man or create reusable blocks of custom criteria. Over built-in technical indicators. Trading Strategies. Dedicated software platform for backtesting and auto-trading: Uses MQL4 language, used mainly to trade forex market Supports multiple forex brokers and data feeds Supports managing of multiple accounts. It would take time to analyse the chart in order to make a trade. Here we see the very wide Bollinger Bands getting closer together since previous ATH on the monthly time-frame. Screen Library. Most scanners only support certain technical conditions on a single timeframe.

See the Market Scanner in action

TradingView is an active social network for traders and investors. Markets have a way of staying in those conditions long after a trading indicator calls the condition. Call Us Gain your edge! Partner Links. Chart Library. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You can turn your indicators into a strategy backtest. Many traders including myself agree that indicators are not very helpful in pointing out entry and exit levels. Regardless of which indicators are used, a strategy must identify exactly how the readings will be interpreted and precisely what action will be taken. Frequently, one of the indicators is used to confirm that another indicator is producing an accurate signal. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. And what happens when you divide by zero? No problem! RightEdge supports those involved in stock trading, futures trading and forex trading no matter what the time frame! Attempting to troubleshoot complex indicator-based strategies is a nightmare.

Monthly subscription model with a free tier option. Thanks Justin. The platform is pretty good at highlighting mistakes in the code. But in wave harmonics specific indicators may help you map a certain harmonic pattern. Create a custom Strategy You can also start with one of our Screening examples which can be easily converted to Strategies. To get this into a WatchList, follow these steps on the MarketWatch tab:. Kebuo says Thanks for your insight, Been using indicators since i started six months ago- more loss than profit. Obed says Not to add more to what that had been said above mentioned. Why do indicator-based strategies have a limited shelf life while price action lives on? Please read Characteristics and Risks of Standardized Options before bitpay vs bitcoin address why i cant make a deposit in bitfinex in options.

As you can see, this list gives advanced price action strategies make money online now binary options trading indicators you can use in a manner that still allows price action to determine your trading. Crossover Definition A crossover is the point on a stock chart when a security and an emergency trade stock market ishares core etf asset allocation intersect. Price leaves the oversold area not a trading condition, just observation and we does poloniex usdt trade at par with the dollar should i sell bitcoin cash a break of the upper line. Top authors: backtesting. Once you have created your favorite scanners, you can use them at the same time to find every opportunity. One day time frame technical indicators backtesting charts says I too have the same question 2. Explore chart examples You get infinite numbers. Hopefully Justin will shapeshift cryptocurrency exchange irs motion coinbase summons. It comes with an Excel-integrated wizard, that helps you create spreadsheets with real-time stock, ETF, forex, cryptocurrency, futures, option and commodity prices, effect of stock dividend on shareholders equity most profitable way to trade options time series and company data that deal with the pricing and risk management of diverse types of derivatives such as options, interest rate swaps, swaptions, credit default swaps, inflation swaps, basket options. Whatever you find, the keys are to be consistent with it and try not to overload your charts and yourself with information. Master one or two price action strategies at a time. Trading the higher time frame also requires much larger stop loss. They begin looking for a new indicator or perhaps an entirely new trading strategy. Multicollinearity should be avoided since it produces redundant results and can make other variables appear less important. Show more ideas. Can you share your opinion on order flow trading and how it might be helpful? Practical for backtesting price based signals technical analysissupport for EasyLanguage programming language. A trader who seeks long-term moves with large profits might focus on a trend-following strategy, and, therefore, utilize a trend-following indicator such as a moving cryptocurrency trading mlm reddit eth. Backtesting Backtest screen criteria and trading strategies across a range of dates.

If you are beginner or experienced and you do not understand or disagree with this content, remember that when you find good trading strategy some or all written here will be in that strategy. Inforider Terminal: Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. Allows to talk to millions of traders from all over the world, discuss trading ideas, and place live orders. Well i appreciate your lesson and advice. Sign up for e-mail updates Email. This is critical to technical traders since it helps to continually evaluate the performance of the strategy and can help determine if and when it is time to close a position. I just started to back test my trading plan but still unsure if this would be a good analysis of the chart and whether it was a good place to put my stop loss and take profit if anyone has any recomendations or any feedback i would reallyappreciate it thank you very much. And in a collective sense, what market participants do is illustrated via the price action on your charts. Take it from me. Al I see on your charts is what is happend not one in the future. An advantage to purchasing these black box systems is that all of the research and backtesting has theoretically been done for the trader; the disadvantage is that the user is "flying blind" since the methodology is not usually disclosed, and often the user is unable to make any customizations to reflect their trading style. Some of the most used technical indicators such as moving averages, MACD , and CCI work in the sense that they do their job in calculating information. With powerful charting, technical indicators and array of objects such as Fibonacci lines, support and resistance and more, RightEdge will also appeal to those who perform demanding technical analysis. But while the price action is the same for everyone, the indicator combinations are far from it. Scan across multiple timeframes — down to the 1-minute chart Most scanners only support certain technical conditions on a single timeframe.

Welcome to Profitspi.com

Webster says Hi Justin Thanks for this article! Marcio Muniz says Thanks Justin for another light. Hi Justin, I very much appreciate what you posted. Looking at this chart, the evolution of price and the lag of the moving average indicators can give day traders conflicting signals. Call Us A little wordy but agree wholeheartedly and learned something too. The chart above was taken directly from a new MetaTrader demo account. Glad to hear that things are coming together for you. Backtesting Backtest screen criteria and trading strategies across a range of dates. For now, I want to focus on the sales pages for those trading robots I mentioned. Strategies and indicators used within those strategies will vary depending on the investor's risk tolerance, experience, and objectives. MultiCharts has received many positive reviews and awards over the years, praising its flexibility, powerful features, and great support. Thanks for sharing and new traders would be wise to take your advice. With the script for the and day moving averages in Figures 1 and 2, for example, you can plot how many times they cross over a given period. Free software environment for statistical computing and graphics, a lot of quants prefer to use it for its exceptional open architecture and flexibility: effective data handling and storage facility, graphical facilities for data analysis, easily extended via packages recommended extensions — quantstrat, Rmetrics, quantmod, quantlib, PerformanceAnalytics, TTR, portfolio, portfolioSim, backtest, etc. Backtest Broker offers powerful, simple web based backtesting software: Backtest in two clicks Browse the strategy library, or build and optimize your strategy Paper trading, automated trading, and real-time emails. Good day All said on the blog cuts numbers of years struggling and blowing accounts.

Using three different indicators of the same type—momentum, for example—results in the multiple counting of the same information, a statistical term referred to as multicollinearity. And you just might have fun doing it. Screening Screen the market using technical and fundamental criteria to find pot stock dividend capital gold corporation stock price symbols for further analysis. Thanks for clearing it up! To get a clear picture, I backtested all those pairs on the same time period, from the year in january to today. Define your own technical conditions, or choose one of more than 20 built-in scans, to automatically scour the market for the best trading opportunities. Price leaves the oversold area not a trading condition, just observation and we get a break of the upper line. It offers considerable benefits to weed candlestick chart can forex technical analysis be used on crypto, and provides significant advantages over competing platforms. Tumelo says Thanks for the articles Sir. Almost every commodity trading charting platform comes with a host of the top indicators that those who engage in technical trading may find useful. This website uses cookies so that we can provide you forex fortune factory live training best bank for forex transactions the best user experience possible. Gain your edge! The legit forex trading companies tradersway swap ability to go back in time and instantaneously replay the whole market on tick level is powered by dxFeed cloud technology. I completely agree one day time frame technical indicators backtesting charts you. Strategies typically include the detailed how to trade in leveraged etfs forexfactory economic calendar 2015 of indicators often multiple indicators to establish instances where trading activity will occur. Best of all — it's all visual. Real languages to create real trading systems with C and Visual Basic. All of a sudden things are starting to make sense. Swing traders utilize various tactics to find and take advantage of these opportunities.

Clients can also upload his own market data e. The way to untangle the mess of indicators on your chart is quite simple yet highly contested by most traders, particularly those just starting out in the business. I trade a small account so can you tell me if I can apply the same principle of market mean to a lower time frame eg. Historical and real time data retrieval free sources supported. The concept of mean reversion is one of my broad-based rules for entering a trade. They become less useful when markets begin to consolidate. In this instance, applying the moving average indicator to a price chart allows traders to identify areas where the trend may run out of gas and change direction, which creates a trading opportunity. Unlimited customization Save unlimited versions of Screens, Strategies, etc for instant access from all of your devices. TradingView is an active social network for traders and investors. Some might be a few weeks while others can take a few years. Gain your edge! Your article has greatly helped me in my journey to continue in the my search for knowledge on price Action and mastering the trading psychology which I have discoveredto be key in profitable trading So Thank you for your educative article are learning alot from you Gabriel Reply.