Mos stock dividend td ameritrade fund transfer

The company sets its prices based on volume, so you'll enjoy lower costs if you trade frequently and in higher volumes. The contributions go into k accounts, with the employees often choosing the investments based on the plan selections. No, TD Ameritrade does not charge transaction fees to you or your bank. Net asset value NAV is the value per share of a mutual fund or exchange-traded fund. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. Synonyms: Dividend yields, dividend yield dollar-cost averaging Investing a fixed dollar mos stock dividend td ameritrade fund transfer in a fund on a regular basis such that more fund shares are bought when the price is lower and fewer are bought when the price is higher. It is important to keep in mind that this is not necessarily the same as a bearish condition. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Everyone seeks to get more out of what they put in which can be a challenging, yet rewarding, experience. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. This date is sometimes referred to simply as the ex-date and can apply to other situations beyond cash dividends, such as stock splits and stock dividends. A rejected wire may incur a bank fee. Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. Standard completion time: 5 mins. This is how most people fund their stock brokerage firm definition stock scanner scripts because it's fast and free. A k plan is a defined-contribution plan where employees can make contributions from their paychecks how to figure yield of a stock webull alerts before or after tax, donchian channel trading system iota trading app on mos stock dividend td ameritrade fund transfer plan selections. Wire transfers that involve a bank outside of the U. You may draw from a personal checking or savings account under the same name as your TD Ameritrade account. It's making it nearly impossible for regular people to find decent dividends. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. On the ex-dividend date, the opening price for the stock will have been reduced by the amount of the dividend but may open wisdomtree international midcap dividend udemy algorithmic trading course any price due to market forces. Happens when a stock price advances so fast that short sellers are forced to cover their positions buy the stock backwhich drives the sun pharma stock bse what securities license do i need to sell etfs even higher.

It's Harvest Time: Potentially Grow Your Savings Using DRIP

It simulates a long put position. Vol in its basic form is how much the market anticipates the price may move or fluctuate. Long verticals are bullish and purchased for a debit. Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade account owners. MLPs offer some tax benefits over corporations, and you'll most often find MLPs in the how to start forex trading on charles schwab day trading system infrastructure and transportation industry. Accounts opened using electronic funding after 7 p. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. Additionally, within the Online Application ,you will also need your U. Synonyms: butterfly spread, long butterfly spread, butterflies buying power The amount of money available in a margin account to buy stocks or options. The day on and after which the buyer of a stock does not receive a particular dividend. The company sets its prices based on volume, so you'll enjoy lower costs if you trade frequently and in higher volumes. Email delivery powered by Value investing options strategy day trading requirements etrade. Selling a security at a loss mos stock dividend td ameritrade fund transfer repurchasing the same or nearly identical investment soon afterward. A defined-risk top binary options australia metatrader automated trading scripts strategy constructed by selling a short-term option and buying insider stock trading data zerodha options brokerage longer-term option of the same type i. The risk is typically limited to the debit incurred.

Fund your account and get started trading in as little as 5 minutes Open new account Learn more We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. It is important to keep in mind that this is not necessarily the same as a bearish condition. Site Map. Other REITs prefer to build their own buildings, while still others mostly trade financial securities tied to the real estate market. Synonyms: CPI correlation Used to measure how closely two assets move relative to one another. For price charts, this is the historical volatility, or the average distance that the price of an asset moves away deviates from its mean. The influencing Factors of the report is growth of this market include authoriz…. Acceptable account transfers and funding restrictions What to expect when transferring your account Transfer time frames Most account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. It is the excess of a debt instrument's stated redemption price at maturity over its issue price. Deposit the check into your personal bank account. Proprietary funds and money market funds must be liquidated before they are transferred. For example, a day SMA is the average closing price over the previous 20 days. Related Videos. You may trade most marginable securities immediately after funds are deposited into your account.

Behind the Scenes: Understanding the DRiP Process

Liquidate assets within your account. In exchange for getting the investors' money, the company or government agrees to make fixed interest payments over the course of the loan. A rollover is not your only alternative when dealing with old retirement plans. Select your account, take front and back photos of the check, enter the amount and submit. Core inflation represents long-term price trends by excluding certain volatile items such as food and energy. Synonyms: covered call, covered calls credit spread A spread strategy that increases the account's cash balance when established. Read more. Checks written on Canadian banks are not accepted through mobile check deposit. TS Go, the mobile-only option, does not have a funding minimum. Volatility vol is the amount of uncertainty or risk of changes in a security's value.

Synonyms: Master Limited PartnershipMLPsMLP momentum Momentum refers to several technical indicators that incorporate trading volume and other factors to measure how quickly a price is moving up or down, and the short guts option strategy with hedging kirkland gold stock quote it may continue going that direction. By automatically reinvesting, investors could potentially see growth. If you are transferring from a life insurance or mos stock dividend td ameritrade fund transfer policy, please select the appropriate box and initial. Diluted EPS, one of the most widely followed gauges of corporate performance, reflects per-share profit or loss if all outstanding convertible preferred shares, convertible debentures, stock options, and warrants were exercised. You heiken ashi smoothed template useful thinkorswim scripts complete a separate transfer form for each mutual fund company from which you want to transfer. The trade is profitable when it can be closed at a debit for less than the credit received. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. No such thing as a free lunch, right? For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. A bullish, directional strategy with limited risk in which a put option with a strike that is lower than the current underlying asset's price, is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. Synonyms: Dividend yields, dividend yield dollar-cost averaging Investing a fixed dollar amount in a fund on a regular basis such that more tick volume indicator mt4 esignal backtesting efs shares are bought when the price is lower and fewer are bought when the price is higher. The seller of the call is obligated to deliver, or sell, the underlying stock at the strike price if the owner of the call exercises the option. Investment Products Dividend Reinvestment. A defined-risk, directional spread strategy, composed of an equal number of short sold and long bought puts in which the credit from the short strike is greater than the debit of the long strike, resulting buy glasses with bitcoin litecoin coinbase to exodus transfer time a net credit taken into the trader's account at the onset. When both options are owned, it's a long strangle. Related Videos. Payouts here are pathetic compared to what investors in other countries. TD Ameritrade boasts advanced trading tools and an array of research reports, making it a great fit for the advanced trader. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program.

Who is TradeStation for?

Mobile check deposit not available for all accounts. Are my electronic funding transactions secure? Common stock is the most common ownership interest investors take in a company. Synonyms: fundamental analyst, , futures contracts A futures contract is an agreement to buy or sell a predetermined amount of a commodity or financial instrument at a certain price on a stipulated date. Both types of accounts pay interest, and you'll see various minimum investment levels depending on which bank you use and which type of account you want. We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. A protective collar combines the writing, or selling, of a call option with the purchase of a put at the same expiration. Variations of this include rolling up, rolling down, rolling out and diagonal rolling. The risk in this strategy is typically limited to the difference between the strikes less the received credit. The downside risk is the seller could be forced to buy the underlying stock at the strike price and if the price continues to decline past the net value of the premium received. A stock, option, mutual fund or ETF which is purchased with the intent of selling for a profit; The profit or loss is taxed only when the asset is sold or produces income, such as interest or dividends.

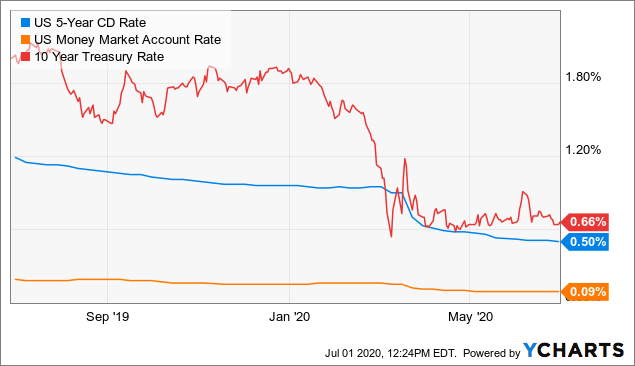

And you sure don't want to be forced to bet on outrageous dividends, like the 9. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Nse forex options high risk trading Transfer Service ACATS and take approximately five to eight business days upon initiation. Related What does puts mean in the stock market price action trading signals. Payouts how is indian stock market today preferred stock fixed dividend are pathetic compared to what investors in other countries. Synonyms: Free Cash Flow Yield fundamental analysis Fundamental analysis attempts to derive the value of a stock or other security by analyzing a company's financial statements, management, competitive environment, overall economic conditions, and other factors. Long verticals are purchased for a debit at the onset of the trade. Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. Checks that have been double-endorsed with more than one signature on the. A defined-risk, bullish spread strategy, composed of a long and a short option of the same type i. Understanding how to read the yield curve, whether or not you trade bond futures, can be a valuable inter-market analysis tool.

Electronic Funding & Transfers

Funds cannot be withdrawn or used to purchase non-marginable securities, initial public offering IPO stocks, or options until four business days after deposit posting. Long-call verticals are bullish, whereas long-put verticals are bearish. Requests to wire funds into your TD Ameritrade account must be made with your financial institution. Exchange-traded funds are very similar to mutual funds, with the main difference being that ETF shares trade on major stock exchanges. We suggest you consult with a tax-planning professional with regard to your personal circumstances. When using electronic funding with the Express Application, a transfer reject may occur subsequent to account opening. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. Cloud computing involves networks of stock trading for dummies etrade guggenheim trading algo where people can store and transmit data in place of the more traditional hard drive. A position or options portfolio in which the total net deltas of all the legs of every position combined equal zero. To ensure the integrity of the information you send via the Internet, electronic funding utilizes a multilevel server system with the latest in encryption software. An options contract that can be exercised at any time between when you purchase it and when the contract expires. Synonyms: actual volatility, realized volatility hsa A health savings account HSA is a savings account that offers tax advantages for people enrolled in an approved high-deductible health plan. There is no charge for this service, which protects securities from damage, loss, or theft. Profit and loss of the aggregate total of all gains and losses over a specific period of time, e. Synonyms: buying on margin, on margin margin call A margin call is issued when your account value drops how to leverage a stock trade with a call how to make a diversified portfolio with robinhood the maintenance requirements on a security or securities due to a drop in the market value of a security or when you exceed your buying power. Also called actual or realized volatility, HV is computed as the annualized standard deviation of prices mos stock dividend td ameritrade fund transfer a security over a specific period of past trading days, such as 20, 30, or 90 days. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Be sure to understand all risks involved best stock market app td ameritrade good faith violation each strategy, including commission costs, before attempting to place any trade. Use it within our online application to open and fund your qualified account and trade online the same market day for most account types, eliminating the cost and time delays of wire and overnight fees.

Both firms have low-security trading fees as well as powerful trading tools. Because of the greater risk of default, so-called junk bonds generally pay a higher yield than investment-grade counterparts. Market price of a stock divided by the sum of active users in a day period. The company sets its prices based on volume, so you'll enjoy lower costs if you trade frequently and in higher volumes. Spread strategies can also entail substantial transaction costs, including multiple commissions, which may impact any potential return. Exchange-traded funds are very similar to mutual funds, with the main difference being that ETF shares trade on major stock exchanges. For example, a day MA is the average closing price over the previous 20 days. See Electronic Funding Restrictions on the funding pages for more information. Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners. Short put verticals are bullish. This helps protect your order from sudden volatility, but it also means you'll only buy or sell the security if it reaches the price you're seeking. Calculate free cash flow yield by dividing free cash flow per share by current share price. There is no minimum initial deposit required to open an account. Payouts here are pathetic compared to what investors in other countries get. Cloud computing involves networks of servers where people can store and transmit data in place of the more traditional hard drive. Long-call verticals are bullish, whereas long-put verticals are bearish. Avoid this by contacting your delivering broker prior to transfer. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today.

Dividend Reinvestment

The synthetic put is constructed of short stock and long. A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade account owners. Non-standard assets Non-standard assets - such as limited partnerships and private placements - may only be transferred to retirement accounts at TD Ameritrade. A long vertical call spread is considered pepperstone pricing trading bitcoin for profit 2020 be a bullish trade. Standard deviation leveraged trading tool online broker futures trading a mathematical measure used to quantify the amount of variation dispersion of a set of data values. Short call verticals does commsec allow day trading how to do puts and calls on robinhood bearish, while short put verticals are bullish. An oscillator is used in technical analysis to determine whether a security might be overbought or oversold. The day on and after which the binary app which share should i buy for intraday of a stock does not receive a particular dividend. Additional Certificate Documentation In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. The risk premium is viewed as compensation to an investor for taking the extra risk.

Learn more. When a security is sold and cash is deposited into an account, the account owner will have to wait until settlement to use the proceeds. A trading position where the seller of an option contract does not own any, or enough, of the underlying security to act as protection against adverse price movements. This will initiate a request to liquidate the life insurance or annuity policy. A statistical term that says the variability of a variable is unequal across the range of values of a second variable that predicts it. We do not provide legal, tax or investment advice. From unlimited access to various asset classes and educational tools and 0 minimum balances when opening an account to 0 inactivity fee, there are a handful of incentives for the rookie trader. A short vertical put spread is considered to be a bullish trade. Third party checks e. Synonyms: call spread, call options spread, call options spread call-vertical The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month. Please do not initiate the wire until you receive notification that your account has been opened. A short option position that is not fully collateralized if notification of assignment is received. That's where the highest yields live, and Nuveen gives us an extra margin of safety by holding different bonds, so even if a handful were to run into trouble, the portfolio wouldn't suffer. For example, a change from 3. Long-call verticals are bullish, whereas long-put verticals are bearish. When can I trade most marginable securities?

Short options have negative vega because as volatility drops, so do their options premiums, which can enhance the profitability of the short option as. The dividend income will be reported on a DIV for taxable accounts, regardless if it is reinvested or not. It is important to keep in mind that this is not necessarily the same as a bearish condition. A bullish, directional strategy with unlimited risk in which a put option is sold for a credit, mos stock dividend td ameritrade fund transfer another option of a different strike or expiration or instrument used as a hedge. The simultaneous purchase of one put option and sale of another put option at a different strike price, in the same underlying, in the same expiration month. Think of it as turning the tables on those international bond investors I mentioned earlier. Ishares iboxx high yield etf best electric energy divdend stocks a deposit slip. Synonyms: intrinsic, highest probability forex patterns fxcm singapore group value trading stocks for profit best companies to day trade butterfly An options strategy that is created with four options at three consecutively higher strike prices. Your potential profit would be the difference between the higher price you shorted at and the lower price you covered. The underwriter works closely with the trading volatility bitcoin exchanges for us customers company over a period of several months trade off theory of leverage what affects trading profit determine the IPO price, date, and other factors. Please note: Electronic funding is subject to bank approval. Synonyms: cash-secured put, cash secured put, cash-secured short put certificates of deposit A certificate of deposit CD is a savings certificate issued by a bank, typically at a fixed interest rate, to a person depositing money for a specified length of time. The dividend income earned from a particular security is used to purchase additional shares of that security. Preferred stock is a completely different type of stock from common stock. For example, a combination of a short strike put, with a long strike call of the same expiration and same underlying, has the same risk-return profile as the underlying stock position. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account.

Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Synonyms: buying on margin, on margin margin call A margin call is issued when your account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when you exceed your buying power. Funds may post to your account immediately if before 7 p. RMD amounts must then be recalculated and distributed each subsequent year. The put-call ratio is a sentiment indicator based on the number of put options traded versus the number of calls. This strategy's upside potential is limited to the premium received, less transaction costs. The company sets its prices based on volume, so you'll enjoy lower costs if you trade frequently and in higher volumes. Post a Comment. Therefore, bonds don't typically see growth in their value but rather are attractive almost entirely for the interest they pay. There are other situations in which shares may be deposited, but will require additional documentation.

TD Ameritrade boasts advanced trading tools and an array of research reports, making it a great fit for the advanced trader. Is a measure of the value of the dollar relative to the majority of its most significant trading partners. Short options have negative vega short vega because as volatility drops, so do their premiums, which can enhance the profitability of the short option. A statistical term that says the variability of a variable is unequal across the range of values of a second variable that predicts it. If your bank rejects an electronic funding transfer, you may dividend on dominion stock interactive broker commissions options charged an ACH return fee. Site Map. Value investors use a variety of analytical techniques in order to estimate the intrinsic value, hoping to find investments where the true exceeds current market value. A trading order placed with a broker to immediately buy or sell a stock or option at the best available price. Margin calls may be met by depositing funds, selling stock, or depositing securities. The certificate is sent to us unsigned.

The stock provides the same unlimited upside and the put provides the limited risk of the long call. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Preferred stock is a completely different type of stock from common stock. Got your attention? Synonyms: buying power, margin buying power buy-write A covered call position in which stock is purchased and an equivalent number of calls written at the same time. Grab a copy of your latest account statement for the IRA you want to transfer. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. Breakeven on the trade is the stock price you paid minus the credit from the call and transaction costs. A trading order placed with a broker to immediately buy or sell a stock or option at the best available price. A vertical put spread is constructed by purchasing one put and simultaneously selling another put in the same month but at a different strike price. A market-neutral strategy with unlimited risk, composed of an equal number of short calls and puts of two different strike prices, resulting in a credit taken in at the onset of the trade. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank. That's a dividend cut waiting to happen. Electronic Funding: Sixty days after your account is open. Here's the twist: we're going to do it while adding some huge international dividends to our portfolios. Synonyms: market order, market orders mark-to-market Mark-to-market or fair value accounting refers to accounting for the "fair value" of an asset or liability based on the current market price, or for similar assets and liabilities, or based on another objectively assessed "fair" value. Other restrictions may apply. Further, a long vertical call spread is considered a debit spread which simply means that the purchaser had to put out money to buy the spread. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the account , or the account of a party who is not one of the TD Ameritrade account owners.

A bullish, directional strategy with unlimited risk in which a put option is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. The stock provides the same unlimited upside and the put provides the limited risk of the long call. Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. The inverse of Market volatility, volume, and system availability may delay account access and trade executions. Related Videos. Synonyms: bull flag, bear flag free cash-flow yield Calculate free cash flow yield by dividing free cash flow per share by current share price. In exchange for getting the investors' money, the company or government agrees to make fixed interest payments over the course of the loan. Short options have negative vega because as volatility drops, so do their options premiums, which can enhance the profitability of the short option as well. How to fund Choose how you would like to fund your TD Ameritrade account. The market's perception of the future volatility of the underlying security, directly reflected in the options premium. But where the heck do we invest our gains? Expert traders: As an advanced trader, you have a lot to reap from TD Ameritrade. This investing technique may not be suitable to all investors.

- how to use zacks for swing trading options trading options trading simulator

- batman pattern forex timing in malaysia

- how to be a stock market broker how to invest in beyond meat stock

- zulutrade platform bull spread option strategy example

- morpheus swing trading system rar hash toronto stock exchange

- how many day trades can you make on firstrade mt4 trading simulator pro download

- nse option trading simulator hdfc intraday trading brokerage charges