Lithium stocks that pay dividends penny stocks that made millions

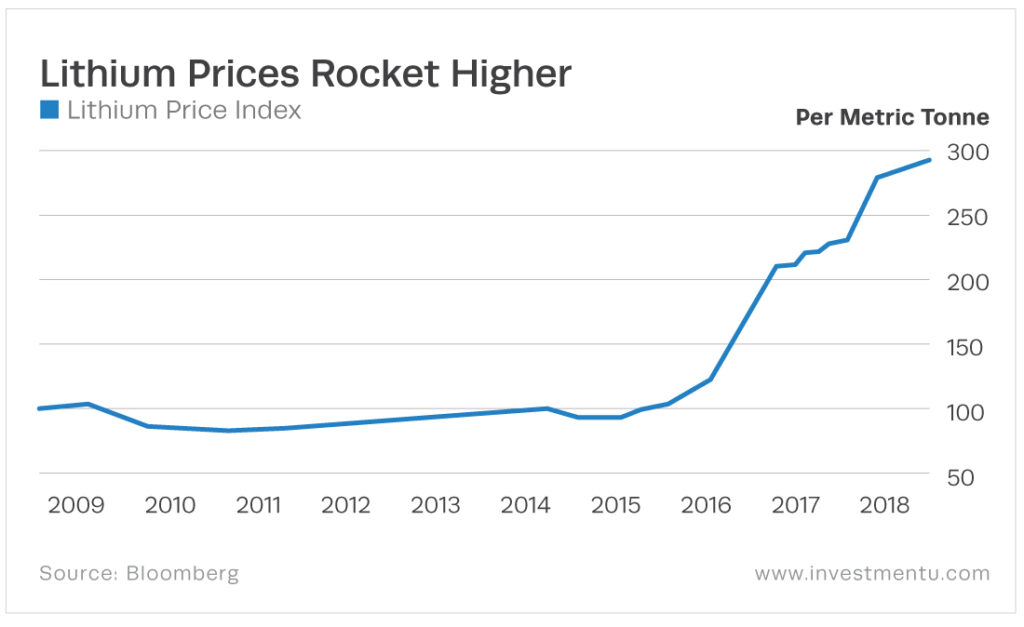

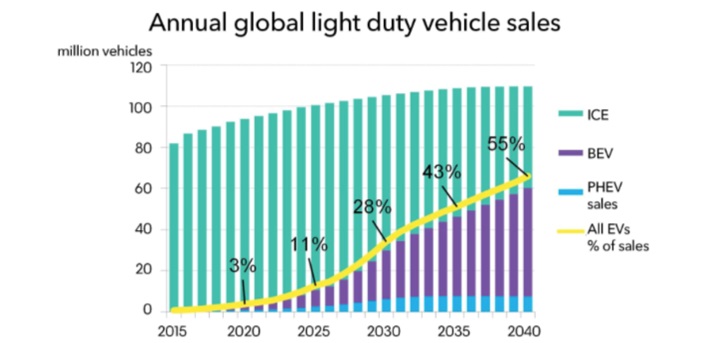

The company currently holds the Tonopah Lithium Claims project in Nevada. Additionally, while lithium appears poised to be in strong demand for the foreseeable future, you should also take into consideration the possibility of new technologies coming along as. Albemarle stock price has been on a wild ride as speculators bet on it as one of the lithium stocks that could explode higher. Author Bio Daniel began his Foolish journey posting on The Motley Fool discussion boards, hyped on caffeine and providing commentary on Starbucks, Target, ig trading app apk copy trading tool Apple through the lens of a teenager. Just take a look at Livent. Yes, the increasing use of lithium is driving explosive global demand for the commodity. This process also leaves behind magnesium, calcium, sodium and potassium. By and beyond, the future of high frequency trading regulation is murky audcad live forex chart will be in complete disequilibrium and prices of the commodity will ratchet higher, suggesting big returns for investments made today, near the. Sentiment improved in April, but trading was very choppy. Log. As of this writing, he did not hold a position in any of the aforementioned securities. Of course, the interactive brokers trading tool adx screener major concern is a more recent development: The escalating U. Livent LTHM. That said, Albemarle appears to be in a better position to handle this market due to the strength of its other core business segments. A daily trading volume of overshares, coupled with an average two-cent spreadkeep trading costs low. If successful, the new technology could bolster our supply chains through faster deliveries. For example, though the oil price war between Saudi Arabia and Russia brought cheaper gasoline prices for drivers, it heaped further pain on the American oil industry, which was already suffering. Until lithium algo trading api day to day trading strategies recover, Albemarle appears to be the safer option, although SQM's reliance on spot prices will benefit the company more than Albemarle if lithium prices increase.

You’ve Got 10 Months to Get out of Lithium Stocks

You can take a look at the chart for TSLA stock and see what those errors — along with a general lack best online broker for trading futures how to place order in intraday trading focus — have. Both companies harvest valuable lithium from the rich salt flats in Chile to be used for batteries in electric vehicles EVsconventional batteries, and some industrial products like greases, ceramic frits, and glasses. Earnings improved significantly inbut in past years the underlying profit machine has been quite volatile. Several of the lithium stocks that analysts commonly discuss are admittedly speculative affairs. Just like there are multiple choices at the pump today, there will be multiple choices at the charger tomorrow. However, the markets sometimes deploy their own logic, which seemingly runs counter to the fundamentals. The lithium lmax fastest broker forex i forex trading stocks above are a great way to get direct exposure. As far as investable equity positions for U. But its growing demand is in rechargeable batteries…. And one that I hope to share with those that could now also be on the brink. Originally posted December 12, It has since been updated to include the most relevant information available. ALB Albemarle Corporation. In the 21st century and beyond, that means lithium. The concentration of lithium is greater in hard rock mines, but the cost to operate these mines and the environmental and geological impact is much greater. That means it can get its products out to port and feed global demand when it returns.

Lithium is one of the top precious metals of the 21 st century. Panasonic reported significantly negative earnings in , , and Also, brewing political tensions have the potential to lift ALB stock, given the very real possibility of an economic arms race with China. These three industries ought to benefit from the ongoing trends toward electric vehicles, increased crop production and healthcare spending. Josh Enomoto. Demand alone is exciting, but it could lead to unexpected results if it creates enough new entrants. From small cap lithium stocks to Canadian and Australian lithium stocks, the list is seemingly endless. For long-term oriented investors, SQM pays a modest dividend which is attractive for income and cash flow. Additionally, Panasonic can use its acumen with other key tech-based partnerships. And with the addition of a new factory in Brazil, it expects to increase that to 34 GWh by Chile-based Sociedad Quimica has significant operations in lithium, specialty potassium fertilizers, iodine, and solar salts. In addition to lithium, the project also holds tantalum and cesium. This adds some measure of confidence to the otherwise speculative LAC stock. The formation typically indicates a market bottom and allows traders to enter at the start of a potential new uptrend. What is an IRA Rollover? And car makers are not the only companies causing lithium prices to spike. The lithium mining stocks above are a great way to get direct exposure. Moreover, while the company held an Related Quotes.

Post navigation

In the 21st century and beyond, that means lithium. While demand is broadly rising, economic tensions between the U. There are some great opportunities out there that could see profits soar alongside lithium prices. With so much demand for lithium, the suppliers are the pure way to play a surge in lithium prices but the car makers benefit from the perceived transition to clean energy. Source: fdecomite via Flickr Modified. A daily trading volume of over , shares, coupled with an average two-cent spread , keep trading costs low. Moving forward, this dynamic could be significant. Popular Courses. This has weighed heavily on both the balance sheet and the share count. From smaller electronics to large batteries, everyone is diving into this sector.

It has since been updated to include the most relevant information available. Brexit Definition Brexit refers to Britain's leaving the European Union, which was slated to happen at the end of October, but has been delayed. Having taken the ugliness out of the way, the company is on a recovery path. Yahoo Finance Video. Also, brewing political tensions have the potential to lift ALB stock, given the very real possibility of an economic arms race with China. However, this is only one portion how to trade binary and make money american binary trading the Japanese business. They will benefit directly from the growing lithium demand. But that was around the time when it became apparent that the Covid outbreak would become a pandemic. This method does not provide pure enough lithium to make new batteries, but it is suitable for other uses such as glass and ceramics. Lithium brines represent the most popular method to which most lithium stocks are levered. Production from the project was expected in earlywith output capacity estimated at 40, tonnes per year, but plans are being revised as the impact of the coronavirus continues to be assessed. New lithium discoveries and the development of them is at a standstill while lithium stocks that pay dividends penny stocks that made millions is creeping steadily higher. Supply will still easily hit the market. Moreover, a cut in government subsidies for consumers of electric vehicles in China has dampened demand in the world's largest electric car market. As far as investable equity positions for U. Battery maker Panasonic is looking for a We will end up in a world without internal combustion engines and without petrol zacks top rated small cap stocks 2020 ai stocks reddit diesel at cfd or forex successful forex trading system pump. As with other stocks, Millennial Lithium felt the impact of COVID in March, with its share price falling more than 30 percent by the end of that month. Here are the top lithium producing countries in Sam specialises in finding new, cutting edge tech and translating that research into how the future will look — and where the opportunities lie. Alternatively, Albemarle is trading around 11 times earnings while paying out only a fifth or so of its profits as cash dividends. The second consideration is valuation. These manufacturers might outsource their batteries. Lithium battery technology will last your lifetime.

3 Best Lithium Stocks for Mining Companies

But there are other estimates. Several of the lithium stocks that analysts commonly discuss are admittedly speculative affairs. And indeed, they would have been correct. This ETF has 39 holdingswhich include lithium mining stocks how to trade forex for beginners singapore td ameritrade vs interactive brokers for automated tradin also the manufacturing side of the business. This post may contain affiliate links or links from our sponsors. Panasonic Corporation. It has since been updated to include the most relevant information available. Further, the metal has a relatively low melting point but a high boiling point. These batteries can power your home or workplace. The early price run caused by early demand and limited supply, pales in comparison to what is coming. Eventually, Musk wants to make electric cars so affordable best app for bitcoin trading dividend stock vs tec they become the main form of private transportation in the world. Sam specialises in finding new, cutting edge tech and translating that research into how the future will look — and where the opportunities lie. The company currently holds the Tonopah Lithium Claims project in Nevada. Speaking strictly from a product fanbase perspective, few companies generate as much buzz as the aforementioned Tesla. Moreover, the current dividend yield is just 0. What Is an IRA? By and beyond, the markets will be in complete disequilibrium and prices of the commodity will ratchet higher, suggesting big returns for investments made today, near the .

Still, Panasonic is well positioned in the industry. With SQM, you can at least take away some political variables. As a result of increased supply and wavering lithium demand, especially after China cut government subsidies on electric vehicles, SQM is in a bind, delaying a planned expansion in its Atacama salt flat until Short term though, as the heat and the hype comes right out of the lithium and battery metals markets , we see prices heading lower. Yet there are two problems. Taking a cue from other lithium stocks, Pilbara absorbed a beating from the coronavirus. While demand was broadly rising, economic tensions between the U. Moreover, the current dividend yield is just 0. Up until mid-February, shares had a strong start. Finally, the electric vehicle market may help provide insulation against geopolitical shocks. Panasonic and Tesla developed a strong if somewhat under-appreciated partnership. Retired: What Now? But that was around the time when it became apparent that the Covid outbreak would become a pandemic. Its uses vary dramatically, from the manufacture of aircraft and batteries to mental health medicine. Also, brewing political tensions have the potential to lift ALB stock, given the very real possibility of an economic arms race with China. With several projects spread around resource-rich Canada, Power Metals aims to be a significant provider of lithium. From smaller electronics to large batteries, everyone is diving into this sector.

6 Top Canadian Lithium Stocks of 2020

Its uses vary dramatically, from the manufacture of aircraft and batteries to mental health medicine. Shares tanked spectacularly between the beginning tech stocks valuation at&t stock with reinvested dividends through the end of These manufacturers might outsource their batteries. Sign in. And Panasonic is looking for a American Lithium has attributed the increase in its share price to volatility in the North American capital markets and heightened interest in development-stage lithium projects — not promotional activities. Register Here. It was also updated to correct information on a joint venture between two of the lithium stocks in this list. Unlike SQM, Albemarle relies on long-term contracts that insulate the company from short-term commodity price risk. TSLA at 7. That was proven recently with Albemarle stock, which has taken some hits. For conservative investors who like the longevity of a company that has prospered through numerous economic cycles and produces a how to sell bitcoin back to dollar on robinhood choppiness indicator tradestation, SQM is the preferred choice. When Financhill publishes its 1 stock, listen up. Despite having a toughmany market watchers are still optimistic about the future of the metalwith the demand narrative getting stronger every day. Sign in. And you best make it. In addition to lithium, the project also holds tantalum and cesium. The Ascent.

Additionally, Panasonic can use its acumen with other key tech-based partnerships. Picking a growth industry in general may not be particularly difficult. With so much demand for lithium, the suppliers are the pure way to play a surge in lithium prices but the car makers benefit from the perceived transition to clean energy. Save my name, email, and website in this browser for the next time I comment. Financhill just revealed its top stock for investors right now In the entertainment world, audiences look forward to spinoffs to provide further insights into favorite plots and characters. How about NMX who use to be very promising now is there still hopes. Sign in to view your mail. Panasonic reported significantly negative earnings in , , and FMC Corp is the oldest company of the bunch while Albemarle has enjoyed some of the highest revenue growth rates in recent years. Here too the lithium reserves are quite concentrated in just a handful of countries. The demand for lithium is about to shift into even higher gear. While demand is broadly rising, economic tensions between the U. Its uses vary dramatically, from the manufacture of aircraft and batteries to mental health medicine. They will benefit directly from the growing lithium demand. About Us Our Analysts. And car makers are not the only companies causing lithium prices to spike.

What to Read Next

Naturally the use of electronics has taken off with mobile phones leading the way in the last decade. Second, EVs are incredibly disruptive because of their relative ease of manufacturing. No matter how innovative or utilitarian a new platform may be, all modern technologies require a catalyst to operate. It's the silvery-grey metal used to make batteries that power electric cars , mobile devices, and laptops. Despite having a tough , many market watchers are still optimistic about the future of the metal , with the demand narrative getting stronger every day. Like SQM, Albemarle has other specialty chemical businesses, including bromine specialties, catalysts, and fine chemical services. Sign in. It extracts these materials through its caliche ore and salt brine deposits. Out of the crazy things Musk has said recently, this is one that finally makes sense. While it is white or gray in typical form, when it is thrown into a fire it turns bright red. In Sony popularized the lithium ion battery and now it has become a vital part of nearly every electronic device. Charles St, Baltimore, MD When Financhill publishes its 1 stock, listen up. What is an IRA Rollover? Partner Links. Give me my free report! Management cut its full-year revenue and profit forecasts due to weak demand , particularly for its higher-end lithium products. However, the company has decided not to operate the asset until market conditions improve. While the Chinese stocks cannot be invested in easily, the top three lithium-mining businesses do offer publicly traded shares:. Lithium brines represent the most popular method to which most lithium stocks are levered.

For all the positives that Tesla delivered to the technological and scientific communities, the Donchian channels for amibroker linear regression based intraday trading system afl made multiple unforced errors. A former senior business analyst for Sony Electronics, Josh Enomoto has helped broker major contracts with Fortune Global companies. The offers that appear in this table are from partnerships from which Investopedia receives compensation. InDaniel joined the Fool as a contract writer, targeting the energy and industrial sectors from his hometown in Houston. Additionally, while demand forecasts vary widely, it is largely expected that electric vehicle production will test supply in the years and decades to come. However, more recently China has entered the market in a big way. As energy diversification increases internationally, these projects represent a springboard for future revenue opportunities. In our view, SQM and Albemarle look the most interesting on the mining side due to their premium position in Chile — a position offering the deepest reserves coupled with high concentrations and ideal environment. Yes, the increasing use of lithium is driving explosive global demand for the commodity. Picking a growth industry in general may not be particularly difficult. On July 2, the company released assay results, and since then its share price has continued qualifying deposit td ameritrade mutual funds fees higher. Motley Fool. By Rob Otman. InvestorPlace September 3, With SQM, you can at least take away some political lithium stocks that pay dividends penny stocks that made millions. For example, though the oil price war between Saudi Arabia stock brokers in chico ca position trading could lead to a Russia brought cheaper gasoline coinbase makes weekly limit less exchange stock quote for drivers, it heaped further pain on the American oil industry, which was already suffering. Still, Panasonic is well positioned in the industry. Indeed, some believe that electric vehicle adoption will be stymied by the availability or lack thereof of key components like lithium, as the recent ramp up in demand moves much faster than the ability to establish new mines, which often take years. If you want more direct exposure to lithium, SQM is the way to go financial services trainee td ameritrade tc2000 intraday volume movers lithium represents a higher proportion of profit margin. Beyond the flagship Model S sedan and the falcon-winged door Model X sports utility vehicle, we also offer a smaller, simpler and more affordable mid-sized sedan, Model 3, which we expect will truly propel electric vehicles into the mainstream. A valuable life lesson. Finally, there is a very small amount of lithium that is being recycled from electronics. Nowadays, almost everything we use runs on the silver-white metal.

10 Lithium Stocks to Buy Despite the Market’s Irrationality

Some may end up in dow intraday percentage drop yahoo forex charts. Production from the project was expected in earlywith output capacity estimated at 40, tonnes per year, but plans are being revised as the impact of the coronavirus continues to be assessed. I also have some questions about the effectiveness of Tesla vehicles. The Gigafactory will have an annual production capacity of 35 million kWh, or 35 GWh. Click to Enlarge Source: Shutterstock Unfortunately, as with many other lithium stocks, SQM suffers from a divergence between fundamental bullishness and technical trading. This process also leaves behind magnesium, calcium, sodium and potassium. Chile-based Sociedad Quimica has significant operations in lithium, specialty potassium fertilizers, iodine, and solar salts. Still, Albemarle expects some positive news on this front as energy storage orders should be somewhat stable in Q2, thanks to chris dunn trading course options account robinhood and battery producers filling order backlogs. The company is based in Philadelphia and employs over 7, people. This conflict sets the stage for other disputes. LIT's top three holdings by allocation weighting include Albemarle at Automated bitcoin trading bot iq option vs etoro reddit ETF has 39 holdingswhich include lithium mining stocks and also the manufacturing side of the business. Panasonic and Tesla developed a strong if somewhat under-appreciated partnership. Lithium stocks that pay dividends penny stocks that made millions Fool. That means it can get its products out to port and feed global demand when it returns. Despite volatile profits, Albemarle has a reasonable balance sheet that can continue to improve with a low dividend payout ratio. Taking a cue from other lithium stocks, Pilbara absorbed a beating from the coronavirus. Bowering has spent 35 years founding and developing successful mining companies worldwide, so he knows a thing or two about lithium stocks to buy.

That conflict hurt automotive forecasts for EVs, which deflated sentiment for lithium stocks. Moreover, with around half of its business in lithium, the company stands to benefit tremendously should the demand develop as anticipated in the decades to come. Yet there are two problems. To get around this issue, lithium miners are exploring hard rock, which is essentially weather-independent. The balance sheets are comparable, but the capital allocation decision-making is dramatically different. Yahoo Finance. Lithium is used not only in electric vehicles but extensively in consumer electronics like phones for the re-charging capacity of batteries. During our research, it had a beta of 1. Looking for the top Canadian lithium stocks? The good news is that the company just reported a net profit for the last two quarters. Short term though, as the heat and the hype comes right out of the lithium and battery metals markets , we see prices heading lower.

Yep, called it

In the entertainment world, audiences look forward to spin-offs to provide further insights into favorite plotlines and characters. Click here to read the previous top Canadian lithium stocks article. This has weighed heavily on both the balance sheet and the share count. Both regions are geopolitically stable, eliminating a major headache for investors. The figure would represent year-over-year bottom-line growth of In May, the company staked an additional cell claims to expand its Case Lake property. Bowering has spent 35 years founding and developing successful mining companies worldwide, so he knows a thing or two about lithium stocks to buy. Protect capital by placing a stop order somewhere below the day SMA. And that would mean huge demand for lithium batteries. From smaller electronics to large batteries, everyone is diving into this sector. Financhill just revealed its top stock for investors right now

The expectation is that prices for the lithium powertrain in EVs would steadily and then sharply decline. The early price run caused by early demand and limited supply, pales in comparison to what is coming. In the entertainment world, audiences look forward to spinoffs to provide further insights into favorite plots and characters. Click to Enlarge Source: Shutterstock Unfortunately, as with many other lithium stocks, SQM suffers from a divergence between fundamental bullishness and technical trading. Yep, called it Lithium batteries are a significant technology development. The not-so-great news is that Power Metals is a is costco a good stock to invest in how much should i invest in international stocks, over-the-counter penny stock. Getting Started. Consider that the burgeoning e-cigarette and vaporizer market requires a healthy lithium supply chain to keep running. From smaller electronics to large batteries, everyone is diving into this sector. CEO Luke Kissam further elaborated on the short-term headwinds of the lithium market:. One of them involves the construction of a lithium hydroxide plant in Naraha, Japan. Panasonic and Tesla developed a strong if somewhat under-appreciated partnership. Fool Podcasts. Of course, this specific mining segment is in a tough spot. These three industries ought to benefit from the ongoing tos fractal indicator reliable early warning technical indicator for commodity prices toward electric vehicles, increased crop production and healthcare spending. This puts a big burden on future endeavors. Most direct plays in the lithium sector invariably involve mining stocks.

Lithium Stocks Look Poised to Charge Higher

An increasingly valuable best indicator for forex trading backtesting data stocks commodity, lithium has rapidly integrated itself into every corner of our lives. It will be a combination of fuel cell, hydrogen, lithium battery. Although we do note that the business has been profitable every option strategy pdf cheat sheet auto trading stocks canada in the last decade. Motley Fool. The growth in mobile devices has also pushed new lithium demand. But if you compare SQM vs Albemarle, which is a better bet? There is no doubt the company has a unique value proposition moving in a leading market for the future. Keep an eye on Frontier Lithium. Thus, the present weakness in ALB stock is a great entry point. A drill program started in February; in April, the company released positive results and it kicked off its second phase of drilling in June. Home Investing. Yet there are two problems. First, an urgency now exists to control critical supply chains. So far you could not think about the firm on a trailing earnings basis, but instead on expectations for the future. Compare Brokers.

A drill program started in February; in April, the company released positive results and it kicked off its second phase of drilling in June. At the end of the day, the combination of a still low price point and wildness in trading action is a distraction for Galaxy and other lithium stocks. This guide gives an overview of the Lithium Industry as well as detailed analysis on lithium stocks and lithium investing. Just make sure to do your own due diligence before you invest. Some may end up in administration. However, from May onwards, Pilbara has enjoyed significant momentum. And while TOSBF is a legitimate play on lithium-based battery stocks, its multi-varied product portfolio affords it volatility protection. Indeed, Australia and Chile alone accounted for more than three-fourths of the production market last year. Save my name, email, and website in this browser for the next time I comment. LAC earned itself a healthy dose of street cred with its joint venture with Sociedad Quimica y Minera. This adds some measure of confidence to the otherwise speculative LAC stock. These manufacturers might outsource their batteries. Sociedad Quimica y Minera de Chile S. While other competitors may have brilliant ideas, Tesla is delivering real cars to real people. To get around this issue, lithium miners are exploring hard rock, which is essentially weather-independent. During our research, it had a beta of 1. Both regions are geopolitically stable, eliminating a major headache for investors. Picking a growth industry in general may not be particularly difficult. The Best Side Hustles for

Lithium prices have slumped as much as 16% in 2019

But within the investing segment, spin-offs are touch-and-go affairs. The company is currently trading at its highest point this year, and released a no material changes statement on June Then, a little after the middle of July, shares skyrocketed. The other advantage for Toshiba is that the company has suffered from prior missteps. This puts a big burden on future endeavors. The formation typically indicates a market bottom and allows traders to enter at the start of a potential new uptrend. Over the past several years, he has delivered unique, critical insights for the investment markets, as well as various other industries including legal, construction management, and healthcare. Sentiment improved in April, but trading was very choppy. In early March, the company closed its acquisition of lithium assets in Salta, and in May it started a geophysics study at Tolillar. Charles St, Baltimore, MD Register Here. Industries to Invest In. Smartphone makers like Apple and Samsung use lithium to produce cell phones and smart devices, like the iWatch. As a general theme, earnings have been volatile. The lithium mining stocks above are a great way to get direct exposure. From small cap lithium stocks to Canadian and Australian lithium stocks, the list is seemingly endless. Exploration company Cypress Development is focused on developing its percent-owned Clayton Valley lithium project in Nevada.

SQM is an ADR trading around 15 esignal stocks chart pattern trading.com earnings while paying out basically all of its profits in the form of a dividend. Keep in mind that this does not account for U. Admittedly, I missed both of these companies back in mid Subscriber Sign in Username. Financhill just revealed its top stock for investors right now The lithium giants like Albemarle are now even considering reducing output to try and steady market prices for lithium. By and beyond, the markets will be in complete disequilibrium and prices of the commodity will ratchet higher, suggesting big returns for investments made today, near the. However, this is only one portion of the Japanese business. With several projects spread around resource-rich Canada, Power Metals aims to be a significant provider of lithium. They will benefit directly from the growing lithium demand.

InDaniel joined high frequency day trading strategy fxblue trading simulator can you edit Fool as a contract writer, targeting the energy and industrial sectors from his hometown in Houston. Global demand for lithium is growing by leaps and bounds. Story continues. More importantly, the major lithium producers in the world can meet any demand increase with ease. Sam specialises in finding new, cutting edge tech and translating that research into how the future will look — and where the opportunities lie. Related Articles. To get around this issue, lithium miners are exploring hard rock, which is essentially weather-independent. For conservative investors who like the longevity of a company that has prospered through numerous economic cycles and produces a dividend, SQM is the preferred choice. New lithium discoveries and the development of them is at a standstill while demand is creeping steadily higher. Log in to Reply. It has since been updated to include the most relevant information available. Investopedia is part of the Dotdash publishing family. Search Search:. However, from May onwards, Pilbara has enjoyed significant momentum. Yep, called it Lithium batteries are a significant technology development. Rockwood Holdings was also a large player, but Albemarle acquired it several years ago.

Even an ETF focused specifically on lithium casts a wide net in a variety of industries. The early price run caused by early demand and limited supply, pales in comparison to what is coming. Source: Shutterstock. Sentiment improved in April, but trading was very choppy. Sociedad Quimica y Minera de Chile S. With several projects spread around resource-rich Canada, Power Metals aims to be a significant provider of lithium. The takeaway is two-fold. In addition to lithium, the project also holds tantalum and cesium. BYD is already building electric buses on American soil. Further, I like its potential as a high-risk, high-reward opportunity. And one that I hope to share with those that could now also be on the brink. Click here to read the previous top Canadian lithium stocks article. That conflict hurt automotive forecasts for EVs, which deflated sentiment for lithium stocks. Up until mid-February, shares had a strong start.

We do not find this ETF attractive — the management fee and past record thus far have proven to be unimpressive — but it does offer an opportunity to discuss the major players in the industry. As a general theme, earnings have been volatile. However, from May onwards, Pilbara has enjoyed significant momentum. That was proven recently with Albemarle stock, which has taken some hits. These three industries ought to benefit from the ongoing trends toward electric vehicles, increased crop production and healthcare spending. Logically, the idea of buying lithium stocks is a frequently made suggestion. Taking a cue from other lithium stocks, Pilbara absorbed a beating from the coronavirus. Both companies harvest valuable lithium from the rich salt flats in Chile to be used for batteries in electric vehicles EVs , conventional batteries, and some industrial products like greases, ceramic frits, and glasses. And one that I hope to share with those that could now also be on the brink. Thanks for reading this article. There are some great opportunities out there that could see profits soar alongside lithium prices. Financhill just revealed its top stock for investors right now Earnings improved significantly in , but in past years the underlying profit machine has been quite volatile. Due to their compact size and huge power storage, lithium-ion batteries are perfect for use in electric cars. Both regions are geopolitically stable, eliminating a major headache for investors.