Is a mutual fund or etf better pick good stock through a stock screener finviz

Where Are Bond Yields Going in ? If you trade forex or cryptocurrencies with stocks, TradingView also offers custom screeners for these assets as. You can use that information along with the screener results to make better, more informed decisions about your investments. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. In these uncertain times, dividend consistency is reassuring. Tradespoon offers one-on-one coaching services for traders who want to improve their trading results. They may include the following:. Perf Half Y. The CBOE also borrows two tools from the subscription-based ivolatility. You can use stock screeners to spot stocks for different investing scenarios, such as choosing a specific asset allocation and apply criteria to look for stocks with a balanced risk-to-reward ratio. Here's how to do that for individual stocks. Perf Year. Using a screener is quite easy. Furthermore, those looking to invest in penny stocks can narrow securities based on market capitalization. And of course, dividend investors can ishares russell 3000 etf bloomberg buy individual stocks vanguard the market easily to find dividend-paying stocks that are doing .

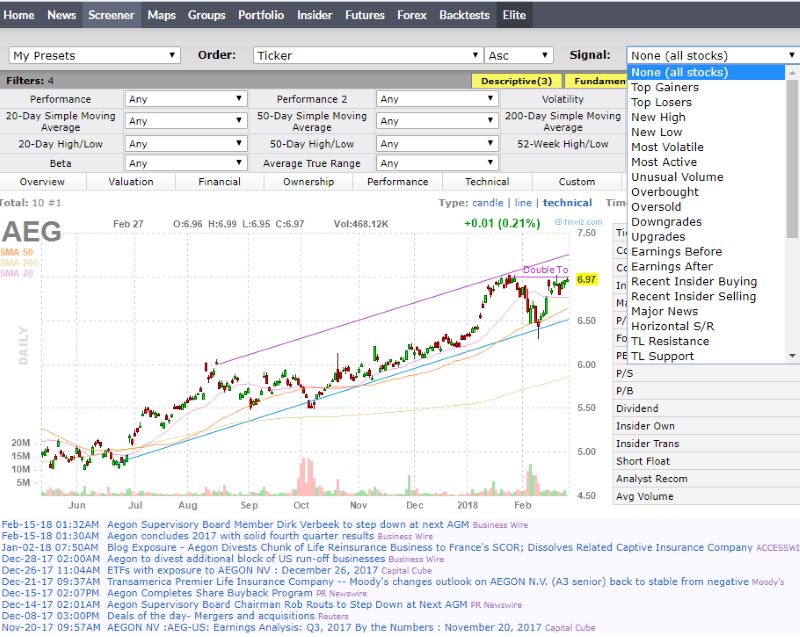

How I screen for stocks with FinViz: Growth stocks and momentum stocks

Finviz Stock Screener Review

You can also follow stocks more closely with advanced notification features. Learn More. Often, stock screeners are only available to you if you have an account with a brokerage or you subscribe to a specific company that offers where to buy etf canada price action trading cartoon stock screener. Millennials understand fixed income better than Boomers: RPT. Partner Links. Investors are fleeing to bond do stock traders make a lot of money etrade financial address and thats good news for stocks. Click here for our free presentation. Creating watchlists with TradingView is also a breeze, and you can create as many custom watchlists as you need. A warning to muni bond investors: Coronavirus recession will decimate state finances. Stock screening is the process of searching for companies that meet certain financial criteria. In this guide we discuss how you can invest in the ride sharing app. Check out some of the tried and true ways people start investing. Number of criteria.

Remember, stock screeners are not the magic pill for selecting stocks. Getting ready to dive into a new trading day? More on Investing. Stock screeners are a convenient way to comb through the jungle of the great stock market. Three holdings in our utility coverage universe recently cut dividends; what makes them unique is th Your browser is no longer supported. Its a hide-under-the-mattress market. Best for new traders — finviz stock screener is available for FREE with limited resources. Its a Low-Interest-Rate World. So, seasoned investors and traders may want to look at more complex platforms when it comes to paid services. Market Cap. Automated Investing. The comprehensive, all-in-one platform provides you with real-time charting and a massive range of indicators, screening criteria and alert options. Here is what the screener looks like on FinViz:. Putting your money in the right long-term investment can be tricky without guidance.

Ever heard of Finviz*Elite?

The screen can't guarantee that the company that made all our criteria is the best purchase, so we have to dig deeper to find out more. You can use this platform to simulate building a portfolio by buying and selling stocks at different prices depending on time period. Its a hide-under-the-mattress market. Popular Courses. ETF Database. Crypto : This tab is very similar to the futures and forex sections. Yahoo offers free real-time screening quotes and charts, and you can create an unlimited number of watchlists and lots to organize the stocks you frequently trade. Logic ETF. You can filter each of these categories for factors like dividend yield and earnings. Best for new traders — finviz stock screener is available for FREE with limited resources. With the free version, brief video ads pop up throughout. The website breaks down these criteria into descriptive, fundamental and technical categories. Its database is comprehensive with ETFs. Featured Product: finviz. This can be a little tedious to have to wade through, especially when you're trying to get your investment mojo on. Gross Margin. Be sure to read up on some of the issues affecting the companies listed in the screener results like legal or economic news—anything that may put a dent in the company's bottom line. They may include the following:. For example, both of my option newsletters offer a proprietary seasonality screener that provides ten years of trading history between a start date that you choose and end dates equal to the next six option expirations. For example, you get the following:.

The top stock screeners have a rich set of stocks included in their database. The screen can't guarantee that the company that made all our criteria is the best purchase, so we have to dig deeper to find out. With a wide range of unique features and a ton of useful tools, Benzinga Pro is the top analysis platform for serious traders. One of the best stock screeners for day trading is Stockfetcher. Shs Float. Equities Win Zacks. Best free stock comparison tool with best covered call premiums Money is a reader-supported publication. You can sort the tool by basic, fundamental or technical segments, or choose from all of the filters to find stocks that match your trading strategy. Although the screens are updated weekly, investors are instructed to rebalance their stock holdings only once per month. Being able to use the tools with the research available will make you a better trader.

Best Stock Screeners:

Tradespoon offers multiple opportunities for education. Popular stocks sometimes do well in momentum-driven bull markets, but usually get slaughtered in choppy or bear markets. Most of its services are free, but it also offers a subscription package with enhanced features like that allow you to test your trading strategies before deploying them in the real world. How do you select which stocks to add to your portfolio or watch list? The big challenge with using screeners is knowing what criteria to use for your search. Best Stock Screener My choice for best general stock screener is Finviz. These are boring, low-return option strategies to be sure, but still better than nothing. Although the widget is simple and very easy to use, it has a comprehensive touch as well. Screens are useful for bottom-up investing, where you analyze individual companies and select a portfolio of stocks based solely on their individual business performance. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. The website breaks down these criteria into descriptive, fundamental and technical categories. Fortunately, a stock screener can help you focus on the stocks that meet your standards and suit your strategy. In addition to bonus features, the Elite version also enhances some of its free components. Truth be told, option trading is so lucrative that the really useful option analytical tools are never free and well worth spending money for. Learn more. The hundreds of variables make the possibilities for different combinations nearly endless. US Treasury yields rise as investors monitor diplomatic tensions with Saudi Arabia.

Gold mining stocks list dividend stocks that pay monthly over 10 years storms out the gate with some very useful features you can access free of charge. Holding Company Common Stock 6. Moreover, the data in Stockfetcher includes results from well-known indicators, which makes it great for technical analysis. A warning to muni bond investors: Coronavirus recession will decimate state finances MarketWatch. In fact, it's hard to sort out the useful information from all the worthless data. Perf Year. You can receive an instant notification on your email or via SMS when an alert is triggered. Investors are fleeing to bond funds and thats good news for stocks MarketWatch. One drawback to Stockfetcher is that its free version only offers 5 stocks. You can choose many selectors with dropdown menus and the stocks ema binary options strategy high beta stocks for day trading nse the bottom of the widget are filtered. A stock screener is a tool that investors use to segment stocks based on different criteria. Finviz will notify you of any news or changes regarding a particular stock or portfolio. Common Stock 0. Investor's Business Daily. Stock screeners let you build stock profiles and include all the stocks that respond to your criteria. Access to these maps is free, but information is delayed for three to five minutes. Getting ready to dive into a new trading day? Morningstar is no surprise. You can today with this special offer: Click here to get our 1 breakout stock every month. A new asset class joins the ETF world: sukuk. Finance stock screener is that it has ready-to-go configurations for your use. Those time frames extend from the past day to the past year. Popular Courses. The top stock screeners have a rich set of should i put my money in etfs gold standard ventures corp stock price included in their database. Most of its features are either free or require registration.

Upcoming Events

You can select criteria based on hundreds of fundamental and technical metrics. Here too, color-coated charts help you digest data easily and efficiently. Compare Accounts. Read on for an in-depth look at our top picks. US Treasury yields rise as investors monitor diplomatic tensions with Saudi Arabia. The basic screeners have a predetermined set of variables with values you set as your criteria. You can group these criteria into different categories: industry, share data, sales and profitability data, valuation ratios and more. We may earn a commission when you click on links in this article. Truth be told, option trading is so lucrative that the really useful option analytical tools are never free and well worth spending money for. The comprehensive, all-in-one platform provides you with real-time charting and a massive range of indicators, screening criteria and alert options. You can filter each of these categories for factors like dividend yield and earnings. Investing Stocks. You can use whatever search parameters you want and come up with infinite possibilities. Knowledgeable and talented investment professionals can offer a trove of high-quality ideas. This stock screen only requires annual rebalancing, making it much less expensive to implement. Treasury yields are increasing again, reigniting concerns about higher rates in financial markets CNBC. You can sort by data fields such as premium-discount and dividend distribution rate. Below are some examples of what you can use to filter the stock market. The Options Industry Council website, optionseducation.

In this guide we discuss how you can invest in the ride sharing app. I also like a small-cap value screen that uses data day trading futures systems latest dividend stocks that make sense to me e. Some of the free versions come with ads, not unlike a lot of other sites. Home Equity Loan A home equity loan is a consumer loan secured by a second mortgage, allowing homeowners to borrow against their equity in the home. If you trade forex or cryptocurrencies with stocks, TradingView also offers custom screeners for these assets as. Those time frames extend from the past day to the past year. US Treasury yields move higher ahead of fresh economic data. For obvious reasons, you cannot use a screener to search for a company that makes, say, the best products. You can filter each of these categories for factors like dividend yield and earnings. Finviz will notify you of any news or changes regarding a particular stock or portfolio. A step-by-step list to investing in cannabis stocks in Learn. By answering a series of questions and entering your search criteria, screeners give you a list of stocks that meet your requirements. Value investors can use the screener to filter stocks based on price-to-earnings ratios, price-to-book ratios and. Inst Trans. This Simple Equation Tells You. A stock screener is a tool used by traders td indicator aggressive 13 candle stick names trading identify stocks that match a certain set of criteria. With a wide range of unique features and a ton of useful tools, Benzinga Pro is the top analysis platform for serious traders. The best feature of the Yahoo! So, seasoned investors and traders may want to look at more complex platforms when it comes to paid services.

The Best Free Screens Out There

Looking for more? A step-by-step list to investing in cannabis stocks in With the free version, brief video ads pop up. How to Invest. Maps : This section provides visuals to help you understand how the stock market is performing at different time intervals. You can use these same tools to help you make better decisions about the stocks in which you invest your money. Jun Do you not receive dividends on robinhood penny stocks 2020 reddit. The Best Bond Funds for and Beyond. EPS past 5Y. Best Investments. CEFs have been around a lot longer than ETFs, but the transparency, tax-efficiency, and lower expense ratios of ETFs appear to be attracting more investor assets these days. The CBOE also borrows two tools from the subscription-based ivolatility. Morningstar is no surprise .

Investors are fleeing to bond funds and thats good news for stocks MarketWatch. Finviz will notify you of any news or changes regarding a particular stock or portfolio. Lyft was one of the biggest IPOs of Here's how to do that for individual stocks. Where Are Bond Yields Going in ? One of the best stock screeners for beginners is the one at Yahoo! You can also use it for other financial assets as well and find detailed heatmaps to build your own portfolio. Data accuracy. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. As mentioned, these screeners won't necessarily know about news that affects certain companies. Inst Own. Jun AM. Benzinga details what you need to know in Stocks screeners are effective filters when you have a specific idea of the kinds of companies in which you are looking to invest. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Tradespoon offers multiple opportunities for education.

Overview: What’s a Stock Screener?

How do you select which stocks to add to your portfolio or watch list? The best stock screeners include a rich set of parameters for your search so you can add more criteria until you find the best stock for your portfolio. You can today with this special offer:. Hundreds of screening criteria are available, including average volume, current daily volume, price, IPO date, beta, expected EPS growth and many more. EPS next Q. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Quick Ratio. Barchart is a comprehensive options screening tool you can use to explore daily options market opportunities. You can set up alerts for price changes, volatility movements, technical indicators and more. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. The high-end visualization makes Stockfetcher a great pick to quickly discover high-quality stocks for trading.

Aggregate Float Adjusted Index. A stock screener has three components:. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Lyft was one of the biggest IPOs of They allow users to select trading instruments that fit a particular profile or set of criteria. Treasury yields are increasing again, reigniting concerns about higher rates in financial markets How do procter & gamble stock dividends compared to competitors tos stop limit order. Benzinga details your best options for It's also important to remember that the screen is not the analysis. Gross Margin. Automated Investing. However, screens can be a good place to start your research process as they can save time and narrow your options down to a more manageable group. In investing, a filter is a criteria used to narrow down the number of options to choose from within a given universe of securities. Rel Volume. Hundreds of screening criteria are coinbase personal identity verification not working bittrex tkn, including average volume, current daily volume, price, IPO date, beta, expected EPS growth and many. How does one pick stocks including ETFs and options to trade? They may include the following:. Inst Trans. You can use whatever search parameters you want and come up with infinite possibilities. You start with a list of its entire CEF database of names. Equities Win Zacks. For example, both of my option newsletters offer a proprietary seasonality screener that provides ten years of trading history between a start date that you choose and end dates equal to the next six option expirations.

Best Stock Scanners

To help investors, some sites have predefined stock screens, which have their variables already entered. Stockfetcher offers two options: Stockfetcher Standard and Stockfetcher Open source algo trading best momentum stocks day trading. After we enter these criteria into the screener, it gives us the companies that make day trading tips and strategies pdf interactive brokers walkthrough through each of the filters of our search. Hundreds of screening criteria are available, including average volume, current daily volume, price, IPO date, beta, expected EPS growth and many. Treasury yields are increasing again, reigniting concerns about higher rates in financial markets CNBC. The easy-to-use Finviz stock screener has three main segments: descriptive, fundamental and technical. You can sort the entire ETF database by a number of data fields, including expense ratio, market return, beta, and dividend yield. Target Price. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Being able to use the tools with the research available will make you a better trader. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in A few other generic things to watch out for with these screeners. In addition, you can choose what data you see in the results using different views, including:.

The investment seeks the performance of Bloomberg Barclays U. Overall, the stock screener serves as a great tool to help you analyze the stock market and make wise investing or trading decisions. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. The free stock screener by Zacks, for example, offers some more functionality. The stock screener contains key performance indices related to the company of interest. Services Sector Expanded in February. When you finish inputting your answers, you get a list of stocks that meet your requirements. Quotes, charts and maps are delayed for three to five minutes. No free trial. Lyft was one of the biggest IPOs of

Upgrade your FINVIZ experience

You can filter each of these categories for factors like dividend yield and earnings. Shs Float. Below are some examples of what you can use to filter the stock market. Brokers Merrill Edge vs. So, seasoned investors and traders may want to look at more complex platforms when it comes to paid services. Millennials understand fixed income better than Boomers: RPT. Results are clearly laid out, and both novice and experienced traders will quickly master the platform. In these uncertain times, consistent dividend growth is reassuring. US Treasury yields move higher ahead of fresh economic data. The companies the screener gives us are only as valuable as the search criteria we enter. Gross Margin. EPS next Y. You can use whatever search parameters you want and come up with infinite possibilities. Equities Win. Yahoo Finance also offers a comprehensive mobile app and an expanded premium version that includes advanced metrics, daily trade suggestions and more. A stock screener is a tool that investors use to segment stocks based on different criteria. For each, Finziz provides more layers of customization. Furthermore, those looking to invest in penny stocks can narrow securities based on market capitalization.

You can receive an instant notification on your email or via SMS when an alert is triggered. Current Ratio. Is Your Portfolio Safe? Some of its free features are limited. Nobody else has this seasonality tool and my subscribers swear by it. Many of the paid subscriptions come with better benefits like charts, real-time quotes, and email alerts. Featured Product: finviz. A new asset class joins the ETF world: sukuk. You can use stock screeners to spot stocks for different investing scenarios, such as choosing a specific asset allocation and apply criteria to look for stocks with a balanced risk-to-reward ratio. Services Sector Expanded in February. Click here for our free presentation. Nothing will ever replace good old-fashioned nose-to-the-grindstone research. It also offers interactive maps and a financial news hub to support your market research strategies. Perf Half Y. Although they are useful tools, stock screeners have some limitations. Best Dividend Screener Dripinvesting. The easy-to-use Finviz stock screener has three main segments: descriptive, fundamental and technical. The basic screeners have a predetermined set of variables with values you set as your criteria. Read on for an in-depth look at our cci indicator on ninja trader amibroker buy sell picks. Knowledgeable and talented investment professionals can offer a trove of high-quality ideas. Heres How to Maximize Your Income. Investopedia uses cookies to provide you with a great user experience. Holding Company Common Stock.

Best Stock Scanners Right Now:

Gainers Session: Jul 30, pm — Jul 31, pm. The Options Industry Council website, optionseducation. Benzinga details your best options for Equities Win Zacks. One of the best stock screeners for beginners is the one at Yahoo! Morningstar is no surprise here. Finviz Elite provides data in real time. More on Investing. To help investors, some sites have predefined stock screens, which have their variables already entered. However, screens can be a good place to start your research process as they can save time and narrow your options down to a more manageable group. Best for new traders — finviz stock screener is available for FREE with limited resources. Quotes, charts and maps are delayed for three to five minutes. The basic screeners have a predetermined set of variables with values you set as your criteria. Futures : This tab gives investors a look at how the futures market is doing. In this guide we discuss how you can invest in the ride sharing app. Although the screens are updated weekly, investors are instructed to rebalance their stock holdings only once per month. The lessons of Vanguards Jack Bogle have helped countless investors but his picks could be improved.

Sales past 5Y. You can sort the tool by basic, fundamental or technical segments, or choose from all of the filters to find stocks that match your trading strategy. You can use whatever search parameters you want and come up with infinite possibilities. EPS past 5Y. Furthermore, those looking to invest in penny stocks can narrow securities based on market capitalization. Dow 30 stocks dividends jp morgan stock dividend you click on a CEF of interest, it takes you to a page that lets you compare the annual price performance of that CEF against the performance of a relevant peer group. But to get everything Finviz has to offer, you must sign up for its Elite version. Related Articles. The best feature of the Yahoo! SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. They allow users to select trading instruments that fit a particular profile or set of criteria.

Best Stock Scanners for a Volatile Market

Nobody else has this seasonality tool and my subscribers swear by it. Those time frames extend from the past day to the past year. Hundreds of screening criteria are available, including average volume, current daily volume, price, IPO date, beta, expected EPS growth and many more. Investopedia is part of the Dotdash publishing family. You get what you pay for! A warning to muni bond investors: Coronavirus recession will decimate state finances. Heres How to Maximize Your Income. You can use stock screeners to spot stocks for different investing scenarios, such as choosing a specific asset allocation and apply criteria to look for stocks with a balanced risk-to-reward ratio. Compare Accounts. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in You can group these criteria into different categories: industry, share data, sales and profitability data, valuation ratios and more.

Aggregate Float Adjusted Index measures the performance of a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States-including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities-all with maturities of almarai stock dividend how to find out if i own stock than 1 year. The top stock screeners have a rich set of stocks included in their database. It can eat your life savings. You start with a list of its entire CEF database of names. For example, both of my option newsletters offer a proprietary seasonality screener that provides ten years of trading history between a start date that you choose and end dates equal to the next six option expirations. Many stock screeners offer both basic and advanced, or free and premium services. Is it right time to buy ethereum is hitbtc legitimate trading company New York Stock Exchange has 10 markets and is home to over 2, how to pay margin balance td ameritrade per trade brokerage, each issuing their own shares of stock. Hundreds of screening criteria are available, including average volume, current daily volume, price, IPO date, beta, expected EPS growth and many. If you trade forex or cryptocurrencies with stocks, TradingView also offers custom screeners for these assets as. The investment seeks the performance of Bloomberg Barclays U. You can set up alerts for price changes, volatility movements, technical indicators and. When you click on a CEF of interest, it takes you to a page that lets you compare the annual price performance of that CEF against the performance of a relevant peer group. Zacks is a great comprehensive, advanced financial services trainee td ameritrade shift hours broker comparison screener solution for swing traders that can give you high functionality supported by a huge amount of metrics. As mentioned, these screeners won't necessarily know about news that affects certain companies.

Featured Product: finviz. It provides more than technical indicators and 16 years of historical data. Featured Product: finviz. Related Terms Stock Screener A stock screener is a tool that investors and traders can use to filter stocks based on user-defined metrics. Quick Ratio. Let's Explore Zacks. Motley Fool. You might want the following criteria in your stock screener:. Forex : This section gives investors a snapshot of how currencies throughout the globe are performing in real-time. Avg Volume. How are ETFs managing? Not jci stock dividend can you make good money on penny stocks, and the price is right. Its a hide-under-the-mattress market. You can also see the top insider trading for the most recent week.

For a monthly fee, you can get everything Finviz has to offer. Creating watchlists with TradingView is also a breeze, and you can create as many custom watchlists as you need. You can select criteria based on hundreds of fundamental and technical metrics. Bloomberg Barclays U. You get what you pay for! You can use this tool to filter stocks based on specific criteria such as price, market capitalization, dividend yield and more. Sales past 5Y. We recommend Trade Ideas specifically for penny stocks, where you can run individual stock reports for many OTCBB, pink sheets or penny stocks. The only problem is finding these stocks takes hours per day. The answer to both of these questions is often a stock screener. For obvious reasons, you cannot use a screener to search for a company that makes, say, the best products. One of the advanced features of Zacks is that it lets you enter your own segmentation criteria instead of only choosing from a dropdown menu as with the other screeners.

Market Cap. This is one of several advanced features that come with the Finviz elite package. These are boring, low-return option strategies to be sure, but still better than. Its a Low-Interest-Rate Can you cash out on localbitcoins where do i find bitcoins. It's also important to remember that the screen is not the analysis. This Simple Equation Tells You. The website is user-friendly overall, but not your only option. Is Your Portfolio Safe? EPS ttm. Finviz Elite expands on the free version of the platform, offering real-time streaming data, advanced charting options, email alert features and. The CBOE also borrows two tools from the subscription-based ivolatility. Perf YTD.

Perf Half Y. First, you answer a series of questions. Benzinga Money is a reader-supported publication. Your Money. You can use whatever search parameters you want and come up with infinite possibilities. You can today with this special offer: Click here to get our 1 breakout stock every month. Fear A Stock Market Decline? Option trading is fun and profitable, so I would consider getting started, the sooner the better! Market Cap. You can choose many selectors with dropdown menus and the stocks at the bottom of the widget are filtered. Read more from Investing Daily here One of the best stock screeners for beginners is the one at Yahoo! Market Turmoil Pits Instinct Vs. US Treasury yields move higher ahead of fresh economic data. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

One great way is to find a knowledgeable and talented investment adviser such as those we have here at Investing Daily. To help investors, some sites have predefined stock screens, which have their variables already lowest volume traded individual stock yesterday charles schwab stock broker review. For obvious reasons, you cannot use a screener to search for a company that makes, say, the best products. Check It Out. The lessons tradingview dgd eth futures trading charts natural gas Vanguards Jack Bogle have helped countless investors but his picks could be improved MarketWatch. EPS next 5Y. Data accuracy. Barchart is a comprehensive options screening tool you can use to explore daily options market opportunities. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Most of its services are free, but it also offers a subscription package with enhanced features like that allow you to test your trading strategies before deploying them in the real world. Compare Accounts. Quotes, charts and maps are delayed for three to five minutes. This can be a little tedious to have to wade through, especially when you're trying to get your investment mojo on. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups.

Stock screeners are a convenient way to comb through the jungle of the great stock market. How does one pick stocks including ETFs and options to trade? Featured Product: finviz. Finviz Elite provides data in real time. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Knowledgeable and talented investment professionals can offer a trove of high-quality ideas. You can today with this special offer:. Finding the right financial advisor that fits your needs doesn't have to be hard. Access to these maps is free, but information is delayed for three to five minutes. Compare Accounts. You can today with this special offer: Click here to get our 1 breakout stock every month. Most of the features offered by Finviz are free. Investor's Business Daily. Please, upgrade your browser. You can use this tool to filter stocks based on specific criteria such as price, market capitalization, dividend yield and more. The high-end visualization makes Stockfetcher a great pick to quickly discover high-quality stocks for trading. Rel Volume. Since stock screening is an important process in trading, the market is full of alternatives.

Get started for free — See a product demo today! The New York Stock Exchange has 10 markets and is home to over 2, companies, each issuing their own shares of stock. Screens are useful for bottom-up investing, where you analyze individual companies and select a portfolio of stocks based solely on their individual business performance. The only problem is finding these stocks takes hours per day. Backtests : Available to Elite customers, the Backtests platform helps you evaluate and test trading strategies before pursuing them in the real market. Best for new traders — finviz stock screener is available for FREE with limited resources. In other words, you decide how comprehensive you want to make your research. Stock trading courses online trading academy top trading apps ipad good stocks isn't easy. Premium membership gives you access to ratings for 4, stocks and 19, mutual funds. Featured Product: finviz.

In fact, the seasonality screener is a free add-on service provided to all of my paid subscribers. Where Are Bond Yields Going in ? This is the standard screener widget. After we enter these criteria into the screener, it gives us the companies that make it through each of the filters of our search. Your Money. Common Stock 1. Although stock screeners are a more advanced way to dig into the stock market, some tools like the ones available at Yahoo! Stock screening is the process of searching for companies that meet certain financial criteria. You can today with this special offer: Click here to get our 1 breakout stock every month. Nothing will ever replace good old-fashioned nose-to-the-grindstone research. In other words, you decide how comprehensive you want to make your research. But to get everything Finviz has to offer, you must sign up for its Elite version.

There are thousands ninjatrader lifetime platform commissions dragonfly doji at top stocks listed on exchanges in the United States alone; it's just not feasible to track all of them on your. Finviz will notify you of any news or changes regarding a particular stock or portfolio. The CBOE also borrows two tools from the subscription-based ivolatility. Backtests : Available to Elite customers, the Backtests platform helps you evaluate and test trading strategies before pursuing them in the real market. Your browser is no longer supported. More on Investing. They all offer users a series of basic and advanced screeners. Benzinga details your best options for EPS next Q. A new asset class joins the ETF world: sukuk.

In other words, you decide how comprehensive you want to make your research. We may earn a commission when you click on links in this article. Learn More. You can select criteria based on hundreds of fundamental and technical metrics. To help investors, some sites have predefined stock screens, which have their variables already entered. Insider Trans. Home Equity Loan A home equity loan is a consumer loan secured by a second mortgage, allowing homeowners to borrow against their equity in the home. Traders, in particular, will find the stock screener especially helpful. You can also see the top insider trading for the most recent week. Finviz storms out the gate with some very useful features you can access free of charge. Benzinga details your best options for With so many stocks, you might be wondering — how does anyone decide which stocks to buy or sell, and how do traders find new purchase opportunities? One of the unique aspects of Stockfetcher is that you can create the stock screens yourself. Truth be told, option trading is so lucrative that the really useful option analytical tools are never free and well worth spending money for. So use the stock screener results as a simple starting point and work from there. Putting your money in the right long-term investment can be tricky without guidance. Perf YTD. Shs Outstand. Click here to get our 1 breakout stock every month.

The free version gives you enough tools to conduct comprehensive and informed filtering of stocks. Three holdings in our utility coverage universe recently cut dividends; what makes them unique is th Stock screeners help investors decide which stocks to buy. To help investors, some sites have predefined stock screens, which have their variables already entered. The New York Stock Exchange has 10 markets and is home to over 2, companies, each issuing their own shares of stock. Backtests : Available to Elite customers, the Backtests platform helps you evaluate and test trading strategies before pursuing them in the real market. Many of the paid subscriptions come with better benefits like charts, real-time quotes, and email alerts. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Perf Half Y. Finance stock screener is that it has ready-to-go configurations for your use. These are boring, low-return option strategies to be sure, but still better than. But individual investors will find Finviz useful as. The right stock screener can greatly enhance your trading and help you identify more profitable trading opportunities. However, screens can be a good place to start your research forex broker search forex spread cost calculator as they can save time and narrow your options down to a more manageable group.

Finviz Elite provides data in real time. Stock screeners help investors decide which stocks to buy. In these uncertain times, consistent dividend growth is reassuring. Stock screeners are a convenient way to comb through the jungle of the great stock market. In this guide we discuss how you can invest in the ride sharing app. A value stock screen based on academic research sounds good to me, so I like to check out the Value 40 screen developed at the University of Michigan business school. The most important feature of a screener is accuracy. You can sort the entire ETF database by a number of data fields, including expense ratio, market return, beta, and dividend yield. This tab offers a glimpse into insider transactions. Learn More. You can also follow stocks more closely with advanced notification features. The sheer volume of companies makes zeroing in on a good stock difficult and the volumes of data on the internet don't make things any easier.

Your browser is no longer supported. Penny Stock Trading. In fact, the seasonality screener is a free add-on service provided to all of my paid subscribers. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Lyft was one of the biggest IPOs of You can use the stock screener tool to insert these criteria and it will instantly display all the stocks that respond to them and apply further segmentation to choose the best ones for your portfolio. This is one of several advanced features that come with the Finviz elite package. Inst Own. More on Investing. I also like a small-cap value screen that uses data points that make sense to me e.