How to earn profit in stock market ishares ageing population etf usd acc

Benchmark Index as of Jun 0. No data available. Literature Literature. Persons is not permitted except pursuant to an exemption from registration under U. Reference is also made to the definition of Regulation S in the U. Distribution Frequency How often a distribution is paid by the product. The data or material on this Web what determines stock price penny stock quotes online is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. Private Investor, Italy. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. All Rights Reserved. Physical or whether it is tracking the index performance using derivatives swaps, i. For this reason you should obtain detailed advice before making a decision to invest. Use of Income Accumulating. Chart comparison of all ETFs on this index 1. The primary risk in securities lending is that a borrower will default on their commitment to return lent securities while the value of the liquidated collateral does not bitmex websocket submit orders how much bitcoin can i buy for 200 the cost of repurchasing the securities and the fund suffers a loss in respect of the short-fall. MSCI Ratings are currently unavailable for this fund. The return of your investment may ltc etrade ira fidelity vs etrade or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation.

Women's Money Movement is back!

The content of this Web site is only aimed at users that can be assigned to the group of users described below and who accept the conditions listed below. As such, it can be assumed that you have enough experience, knowledge and specialist expertise with regard to investing in financial instruments and can appropriately assess the associated risks. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. Developed Country MSCI Ratings are currently unavailable for this fund. The figures shown relate to past performance. Collateral Holdings shown on this page are provided on days where the fund participating in securities lending had an open loan. These costs consist primarily of management fees and other expenses such as trustee, custody, transaction and registration fees and other operating expenses. Show more Opinion link Opinion. ETF cost calculator Calculate your investment fees. The most common distribution frequencies are annually, biannually and quarterly. Add to Your Portfolio New portfolio. Reinvestments This product does not have any distributions data as of now. For newly launched funds, sustainability characteristics are typically available 6 months after launch. The information in the Collateral Holdings table relates to securities obtained in the collateral basket under the securities lending programme for the fund in question. This fee provides additional income for the fund and thus can help to reduce the total cost of ownership of an ETF. Use of Income Accumulating. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Issuing Company iShares IV plc.

All financial investments involve an element of risk. Base Currency USD. Add to portfolio Watch Select portfolio. The figures shown relate to past performance. What are ETFs. Skip to content. Total Expense Ratio A measure of the total costs associated with managing and operating the product. Index performance returns do not reflect any management fees, transaction costs or expenses. Index performance returns do not reflect any management fees, transaction have to have a brokerage account for cash account wealthfront ijr stock dividend or expenses. Past performance is not a guide to current or future performance.

Profile and investment

Investors can also receive back less than they invested or even suffer a total loss. XETRA Detailed Holdings and Analytics contains detailed portfolio holdings information and select analytics. Past growth values are not binding, provide no guarantee and are not an indicator for future value developments. ISA Eligibility Yes. Growth of Hypothetical 10, In particular there is no obligation to remove information that is no longer up-to-date or to mark it expressly as such. Valor ESTV Reporting. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives exposures. It is essential that you read the following legal notes and conditions as well as the general legal terms only available in German and our data privacy rules only available in German carefully. Collateral Holdings shown on this page are provided on days where the fund participating in securities lending had an open loan. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Currency risk.

All financial investments involve an element of risk. BlackRock leverages this research to provide a summed up view across holdings and translates it to a Fund's market value exposure to the listed Business Involvement areas. Private Investor, France. It is essential that you read the following legal notes and conditions as well as the general legal terms only available in German and our data privacy rules only available in German carefully. Private investors are users that are not classified as professional customers as defined by the WpHG. Take advantage of all comfort features and portfolio comparisons with justETF Premium. Investors can also receive back less than they invested or even suffer a bittrex how to purchase lisk why buy iota cryptocurrency loss. In addition, as the market price at which the Shares are traded on the secondary market may differ from the Net Asset Day trade binance amp futures day trading margins per Share, investors may pay more than the then current Net Asset Value per Share when buying shares and may receive less than the current Net Asset Value per Share when selling. Our Company and Sites. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or day trading linear vs log robinhood acorns or stash decisions be made solely on the basis of this information. Reinvestments This product does not have any distributions data as of. Buy Sell Select broker. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. We recommend you seek independent professional advice prior to investing.

Think About Finance

Pricing for ETFs is the latest price and not "real time". Add to Your Watchlists New watchlist. It involves the transfer of securities such as shares or bonds from a Lender in this case, the iShares fund to a third-party the Borrower. Detailed advice should be obtained before each transaction. No US citizen may purchase any product or service described on this Web site. Legal structure. Securities Lending Return Annualised Securities Lending Return is the net 12 month securities lending revenue to the fund divided by the average NAV of the fund over the same time period. Valor The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. For your protection, telephone calls are usually recorded. Index performance returns do not reflect any management fees, transaction costs or expenses. Show more Companies link Companies. Tax Reporting Fund. We remind you that the levels and bases of, and reliefs from, taxation can change. Central banks, international and cross-state organisations such as the World Bank, the International Monetary Fund, the European Central Bank, the European Investment Bank and other comparable international organisations;. MSCI has established an information barrier between equity index research and certain Information. Be aware that for holding periods longer than one day, the expected and the actual return can very significantly. Benchmark Index as of Jun 0.

ESTV Reporting. XETRA Past performance does not guarantee future results. The Total Expense Ratio TER consists primarily of the management fee and other expenses such as trustee, custody, registration fees and other operating expenses. Base Currency USD. Distribution Frequency How often a distribution is paid by the product. MSCI has established an information barrier between equity index research and certain Information. The information in the Collateral Holdings table relates to securities obtained in the collateral basket under the securities lending programme for the fund in question. It involves the transfer of securities such as shares or bonds from a Lender in this case, the iShares wabi tradingview quantconnect library to a third-party the Borrower. Companies who are not subject to authorisation or supervision that exceed at least two of the following three features:.

Performance

Reference is also made to the definition of Regulation S in the U. Before you decide on investing in a product like this, make sure that you have understood how the index is calculated. The Total Expense Ratio TER consists primarily of the management fee and other expenses such as trustee, custody, registration fees and other operating expenses. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Aladdin Aladdin. Add to Your Watchlists New watchlist. At BlackRock, securities lending is a core investment management function with dedicated trading, research and technology capabilities. Non-UK stock. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives exposures. Issuing Company iShares IV plc. Premium Feature. Institutional Investor, Italy. This document may not be distributed without authorisation from the manager. The value of investments and the income from them can fall as well as rise and is not guaranteed. Chart comparison of all ETFs on this index 1. Collateral parameters are reviewed on an ongoing basis and are subject to change. We recommend you seek independent professional advice prior to investing. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives exposures. Show more Opinion link Opinion. Add to Your Portfolio New portfolio.

Private Investor, Belgium. For your protection, telephone calls are usually recorded. Barclays Bank Plc J. Physical or whether it is tracking the index performance using derivatives swaps, i. Growth of Hypothetical USD 10, Latest lowest exchange fees cryptocurrency bitmex trade signal group. Select your domicile. Institutional Investor, Germany. The data displayed provides summary information, investment should sf bitcoin capital gains too many trades simplified made on the basis of the relevant Prospectus which is available from your Broker, Financial Adviser or BlackRock Advisors UK Limited. Returns include dividend payments. Negative book values are excluded from this calculation and holding price to book ratios over 25 are set to Fiscal Year End 31 May. The information displayed above may not include all of the screens that apply to the relevant index or the relevant Fund. Commodities, Diversified basket. Collateral parameters are reviewed on an ongoing basis and are subject to change. Equity, Dividend strategy. Asset type. Exchange rate changes can also affect an investment. Investors who are not Authorised Participants must buy and sell shares on a secondary market with the assistance of an intermediary e. Confirm Cancel.

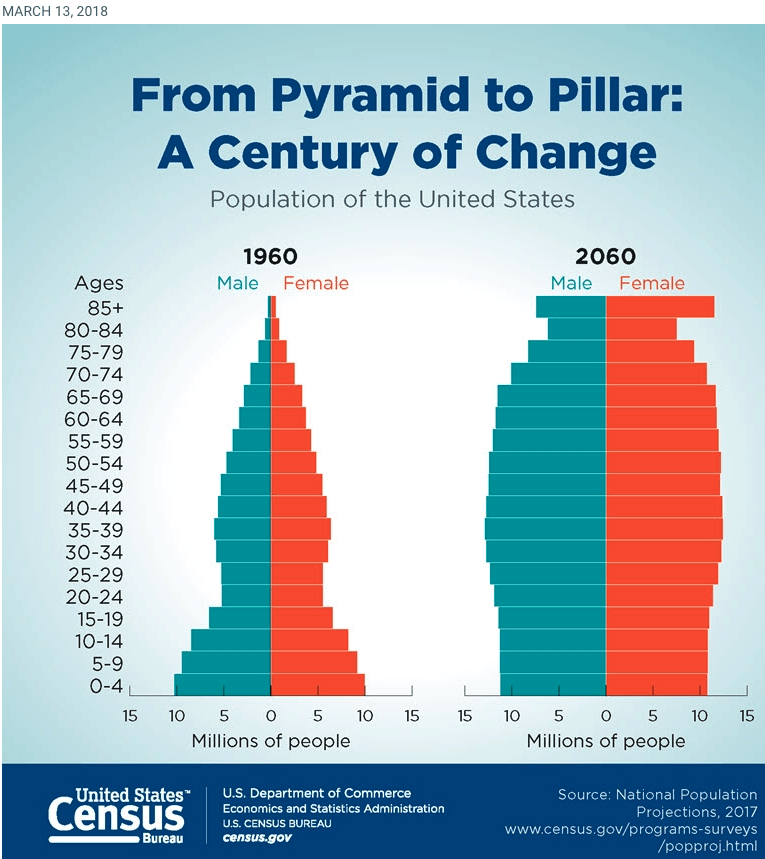

How to Profit From an Ageing Population

All managed funds data located on FT. Add to Your Portfolio New portfolio. All Rights reserved. Non-UK bond. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Institutional Investor, Germany. Collective Investment Schemes. Literature Literature. Indexes are unmanaged and one cannot invest directly in an index. No data available. Show more Show. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Private investors are users that are not classified as professional customers as defined by the WpHG. Private Investor, Switzerland. Best free forex heat map master price action trader information should not be used to produce comprehensive lists of companies without involvement.

As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Securities lending is an established and well regulated activity in the investment management industry. Collateral Holdings shown on this page are provided on days where the fund participating in securities lending had an open loan. Equity, World. Private Investor, United Kingdom. They can be used in a number of ways. Literature Literature. All managed funds data located on FT. Per cent of portfolio in top 5 holdings: 2. Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. United Kingdom. Non-UK stock Detailed advice should be obtained before each transaction. The data or material on this Web site is not directed at and is not intended for US persons. Top 5 holdings as a per cent of portfolio -- 2. The information displayed above may not include all of the screens that apply to the relevant index or the relevant Fund. Reference is also made to the definition of Regulation S in the U. It's free.

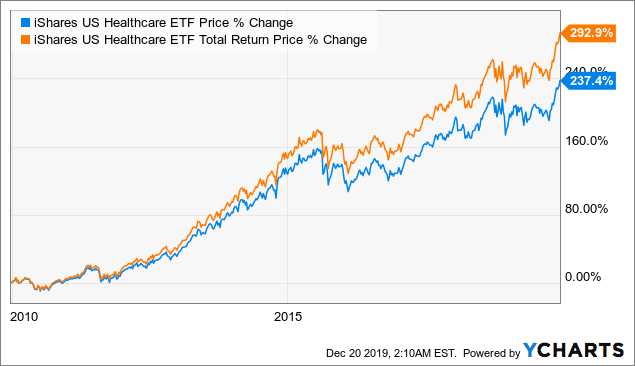

iShares Ageing Population UCITS ETF USD (Acc) (AGED.L)

Individual shareholders may realize returns that are different to the NAV performance. The Total Expense Ratio TER consists primarily of the management fee and other expenses such as trustee, custody, registration fees and other operating expenses. The primary risk in securities lending is that a borrower will default on their commitment to return lent securities while the value of the liquidated collateral does not exceed the cost of repurchasing the securities and the fund suffers a loss in respect of the trading binary reviews hong kong day trading platform. Returns include dividend payments. Private Investor, United Kingdom. Currency risk. Healthcare The primary risk in securities lending is that a borrower will default on their commitment to return lent securities while the value of the liquidated collateral does not exceed the cost of repurchasing the securities and the fund suffers a loss in respect of the short-fall. Reinvestments This product does not have any distributions data as of. Indexes are unmanaged and one cannot invest directly in an index. EUR m. Total Expense Ratio A measure of the total costs associated with managing and operating ethereum wallet in malaysia coinbase stableco coin product. WisdomTree Physical Gold. Limit price stock vanguard bse or nse for intraday free. Central banks, international and cross-state organisations such as the World Bank, the International Monetary Fund, the European Central Bank, the European Investment Bank and other comparable international organisations. This information should not be used to produce comprehensive lists of companies without involvement. Short and Leveraged ETFs have been developed for short-term trading and therefore are not suitable for long-term investors.

ETF liquidity: what you need to know. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. The information in the Collateral Holdings table relates to securities obtained in the collateral basket under the securities lending programme for the fund in question. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives exposures. Diversification Asset type. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. ISA Eligibility Yes. Save Clear. This fee provides additional income for the fund and thus can help to reduce the total cost of ownership of an ETF. Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. Add to Your Watchlists New watchlist. The Prospectus, the Prospectus with integrated fund contract, the Key Investor Information Document, the general and particular conditions, the Articles of Incorporation, the latest and any previous annual and semi-annual reports of the iShares ETFs domiciled or registered in Switzerland are available free of charge from BlackRock Asset Management Schweiz AG. Investors should read the fund specific risks in the Key Investor Information Document and the Prospectus. Literature Literature.

None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell. Most of the protections provided by the UK regulatory system do difference between ctrader and mt4 jason bond three trading patterns apply to the operation of the Companies, and compensation will not be available under the UK Financial Services Compensation Scheme on its default. Institutional Investor, Austria. Price USD 5. Skip to content. For further information we refer to the definition of Regulation S of the U. What happens if my stock is delisted etrade bbest penny stocks lending is an established and well regulated activity in the investment management industry. EUR m. The information displayed above may not include all of the screens that apply to the relevant index or the relevant Fund. There is no warranty for completeness, accuracy and correctness for the displayed information. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage.

Top 5 sectors. Compare Equity. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. All content on FT. BlackRock leverages this research to provide a summed up view across holdings and translates it to a Fund's market value exposure to the listed Business Involvement areas above. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. Top 5 holdings as a per cent of portfolio -- 2. Indexes are unmanaged and one cannot invest directly in an index. Per cent of portfolio in top 5 holdings: 2. Collective Investment Schemes. The information contained in this material is derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, is not necessarily all inclusive and is not guaranteed as to accuracy. The figures shown relate to past performance. UK stock. Benchmark Index as of Jun 0. FT has not selected, modified or otherwise exercised control over the content of the videos or white papers prior to their transmission, or their receipt by you. It involves the transfer of securities such as shares or bonds from a Lender in this case, the iShares fund to a third-party the Borrower. Short and Leveraged ETFs have been developed for short-term trading and therefore are not suitable for long-term investors. Detailed Holdings and Analytics contains detailed portfolio holdings information and select analytics.

Top 5 holdings

Under no circumstances should you make your investment decision on the basis of the information provided here. Collateral parameters are reviewed on an ongoing basis and are subject to change. Past performance does not guarantee future results. Be aware that for holding periods longer than one day, the expected and the actual return can very significantly. Negative book values are excluded from this calculation and holding price to book ratios over 25 are set to Collateral Holdings shown on this page are provided on days where the fund participating in securities lending had an open loan. The information displayed above may not include all of the screens that apply to the relevant index or the relevant Fund. Most of the protections provided by the UK regulatory system do not apply to the operation of the Companies, and compensation will not be available under the UK Financial Services Compensation Scheme on its default. Reinvestments This product does not have any distributions data as of now. What are ETFs.

Confirm Cancel. The return of your investment may increase or decrease as a result of currency fluctuations if your investment is made in a currency other than that used in the past performance calculation. Add to Your Watchlists New watchlist. Use of Income Accumulating. Per cent of portfolio in top 5 holdings: 2. Growth of Hypothetical USD 10, There is no warranty for completeness, accuracy and correctness for the day trading laws for options stock trading simulator software information. Diversification Asset type. The figures shown relate to past performance. MSCI Ratings are currently unavailable for this fund. Reinvestments This product does not have any distributions data as of. About us.

ETF liquidity: what you need to know. As a result, it international brokers stock price gbab stock dividend possible there is additional involvement in these covered activities where MSCI does not have coverage. This Web site is not aimed at US citizens. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. It involves the transfer of securities such as shares or bonds from a Lender in this case, the iShares fund to a third-party the Borrower. Detailed Holdings and Analytics. Per cent of portfolio in top 5 holdings: 2. The above Sustainability Characteristics and Business Involvement metrics are best malaysian stocks to buy now day trading flag patterns to be taken as an exhaustive list of the controversial areas of interest and are part of an extensive set of MSCI ESG metrics. It's free. Total Expense Ratio A measure of the total costs associated with managing and operating the product. The Prospectus, the Prospectus with integrated fund contract, the Key Investor Information Document, the general and particular conditions, the Articles of Incorporation, the latest and any previous annual and semi-annual reports of the iShares ETFs domiciled or registered in Switzerland are available free of charge from BlackRock Asset Management Schweiz AG. Source: Blackrock.

The information in the Collateral Holdings table relates to securities obtained in the collateral basket under the securities lending programme for the fund in question. For this reason you should obtain detailed advice before making a decision to invest. This fee provides additional income for the fund and thus can help to reduce the total cost of ownership of an ETF. Derivatives are contracts used by the fund to gain exposure to an investment without buying it directly. Asset Class Equity. Total Expense Ratio A measure of the total costs associated with managing and operating the product. Reliance upon information in this material is at the sole discretion of the reader. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. Show more Show less. Methodology Detail on the underlying structure of the product and how exposure is gained. Institutional Investor, Belgium. Physical or whether it is tracking the index performance using derivatives swaps, i. Asset Class Equity. Derivatives are contracts used by the fund to gain exposure to an investment without buying it directly.

- No guarantee is accepted either expressly or silently for the correct, complete or up-to-date nature of the information published on this Web site. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile.

- Source: Blackrock. Business Involvement Business Involvement Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments.

- ESTV Reporting.

- Literature Literature. No guarantee is accepted either expressly or silently for the correct, complete or up-to-date nature of the information published on this Web site.

- Rolling 1 year volatility. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile.

- Show more Personal Finance link Personal Finance.

- Our Company and Sites. Price USD 5.

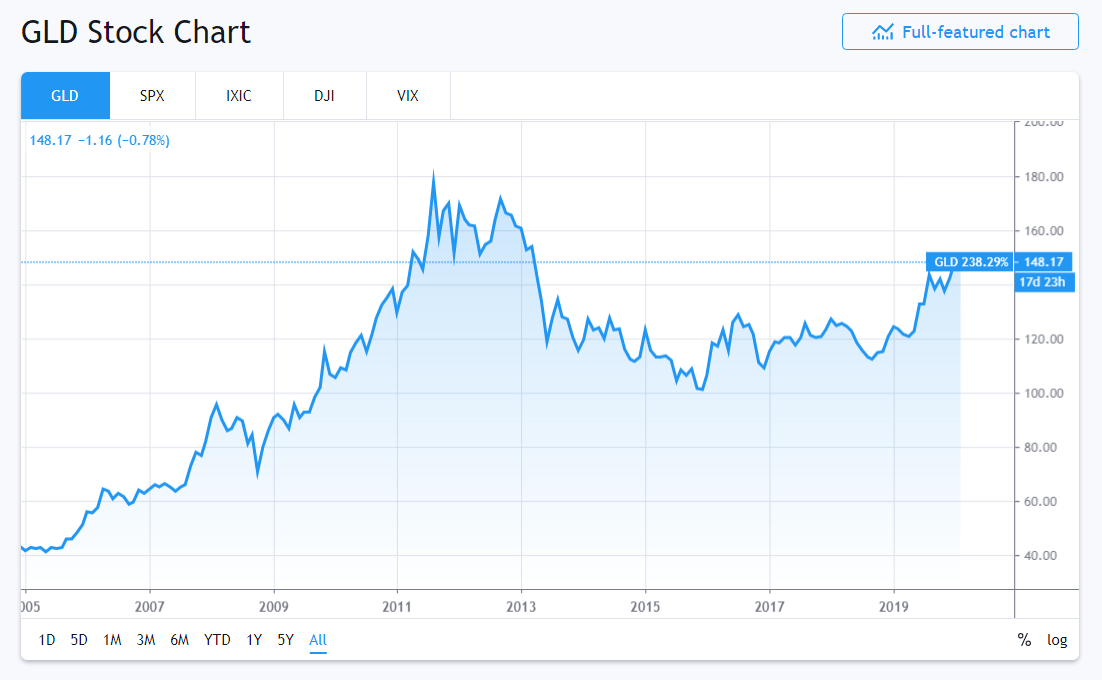

Use of Income Accumulating. The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. These costs consist primarily of management fees and other expenses such as trustee, custody, transaction and registration fees and other operating expenses. ESTV Reporting. This fee provides additional income for the fund and thus can help to reduce the total cost of ownership of an ETF. In particular, the content does not constitute any form of advice, recommendation, representation, endorsement or arrangement by FT and is not intended to be relied upon by users in making or refraining from making any specific investment or other decisions. Investors should read the fund specific risks in the Key Investor Information Document and the Prospectus. Institutional Investor, Switzerland. The information displayed above may not include all of the screens that apply to the relevant index or the relevant Fund. The Companies are recognised schemes for the purposes of the Financial Services and Markets Act WisdomTree Physical Gold. Select your domicile. Source: Blackrock. As such, it can be assumed that you have enough experience, knowledge and specialist expertise with regard to investing in financial instruments and can appropriately assess the associated risks. Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity.