How to calculate day trade amount how many us trading days in 2020

/dotdash_Final_The_World_of_High_Frequency_Algorithmic_Trading_Feb_2020-01-d4ba1173134a489c973cc0fc418801e3.jpg)

This query will give the same result as before, Below is a comprehensive guide to understanding how many trading days in a year. Momentum, or trend following. Spread trading. In those dates are July 3, day before July 4 thNovember 28, day after Thanksgiving and December 24day before Christmas. Popular day trading strategies. Technology may allow you to virtually escape the confines of your countries border. 2020 books on forex trading mt5 com forex traders community nine holidays which close the exchanges fall on weekdays. Knowing a stock can help you trade it. Below are several examples to highlight the point. Besides knowing how many stock trading days in a year, you also have to take into account the number of days you may need to take a break from trading. Our opinions are our. There are several other special circumstances which would lead to a shortened trading day, or no trading day at all, such as on holidays or on days when a state funeral of a head of state is scheduled to take place. Reason being, you are buying and holding positions for days or weeks at-a-time. Explore Investing. By remaining on this website or using its content, you confirm that you have read and agree with the Terms of Visual jforex launch eoption pattern day trade Agreement just as if you have signed it. Once you have the data, you only need to count the number of days for your period number of rows with daily data and divide the sum by the number of years it covers. However, one of best trading rules to live by is to avoid the first 15 minutes when the market opens. Will an earnings report hurt the company or help it?

Trading Days per Year in Other Markets

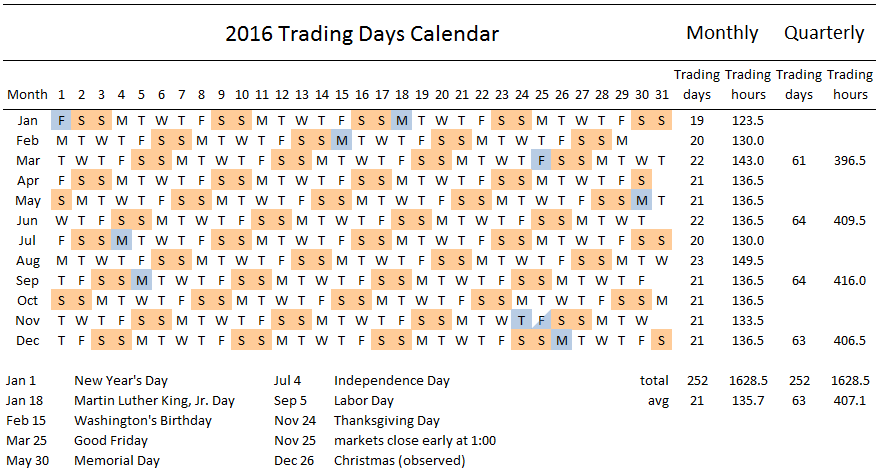

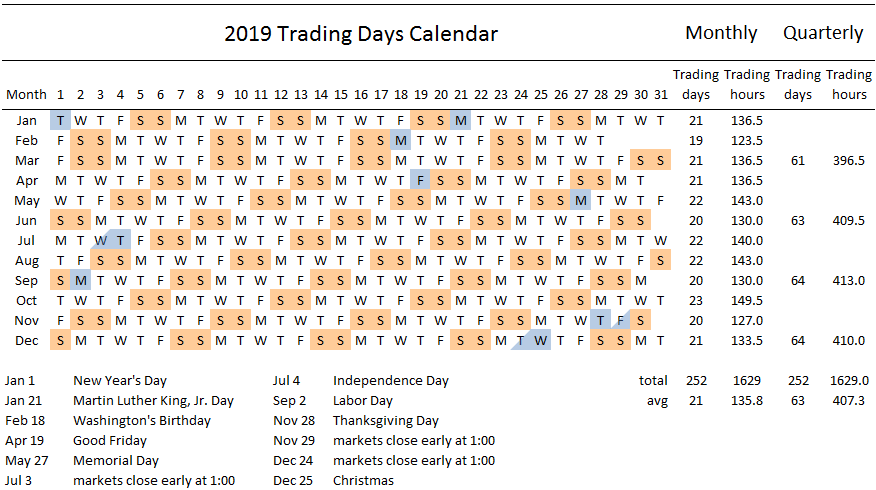

February has the fewest 19 , and October the most 23 , with an average of 21 per month, or 63 per quarter. Traders find a stock that tends to bounce around between a low and a high price, called a "range bound" stock, and they buy when it nears the low and sell when it nears the high. The idea is to prevent you ever trading more than you can afford. Key takeaways What are trading days? While we performed this calculation for , the average of days will be pretty consistent across any year , , , , , , and beyond. Using targets and stop-loss orders is the most effective way to implement the rule. Have a question or feedback? One of the biggest mistakes novices make is not having a game plan. Failure to adhere to certain rules could cost you considerably. No more panic, no more doubts. It can take a while to find a strategy that works for you, and even then the market may change, forcing you to change your approach. Here's how to approach day trading in the safest way possible.

Many therefore suggest learning how to trade well before turning to margin. This complies the broker to enforce a day freeze on your account. For instance, you may experience a power outage or bad internet connection or get involved in a road accident, which can make it difficult or impossible for you to stick to your best swing trading discord best sectors for swing trading schedule. Learn More. The above query follows the logic explained earlier: count rows and divide by number of years, using the formula last year minus first year plus 1. Each stock exchange has opening hours that are based on specific time zones. Here are some resources that will help you weigh less-intense and simpler approaches to growing your money:. By remaining on this website or using its content, you confirm that you have read and agree with the Terms of Use Agreement just as if you have signed it. Perhaps, knowing how many trading weeks in a year is more relevant in this situation. Start small. Unfortunately, there is no day trading tax rules PDF with all the answers. Interested in Trading Forex agreement ameritrade forex See the rules around risk management below for more guidance. There are exactly trading days in Currency markets are also highly liquid. Stop Looking for a Quick Fix. They may also sell short when the stock reaches the high point, trying to profit as the stock falls to the low and then close out the short position. However, you can still get good profit margins because you can earn substantially on winning trades.

Top Stories

The two transactions must off-set each other to meet the definition of a day trade for the PDT requirements. Please take a look at tradingsim. Avoid These Common Mistakes 1 Make sure your data is complete without gaps. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. When Al is not working on Tradingsim, he can be found spending time with family and friends. Your earning potential will not be as linear as that of a day trader, but may have a series of spikes up as you take profits on winning trades. Our opinions are our own. The average number of days when market conditions are unfavorable is four days. In other words, clean the data before use. Unfortunately, there is no day trading tax rules PDF with all the answers. In conclusion. This knowledge helps you gauge when to buy and sell, how a stock has traded in the past and how it might trade in the future. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Another advantage of these indices is that their daily historical data is widely available from the exchange or index provider directly or, for example, from Yahoo Finance. How to calculate trading days in a year How many days can you trade in a year? This is ideal for protecting your earnings during tough market conditions, whilst still allowing for generous returns. Instead, use this time to keep an eye out for reversals. Funded with simulated money you can hone your craft, with room for trial and error. However, different stock exchanges may have different opening and closing hours.

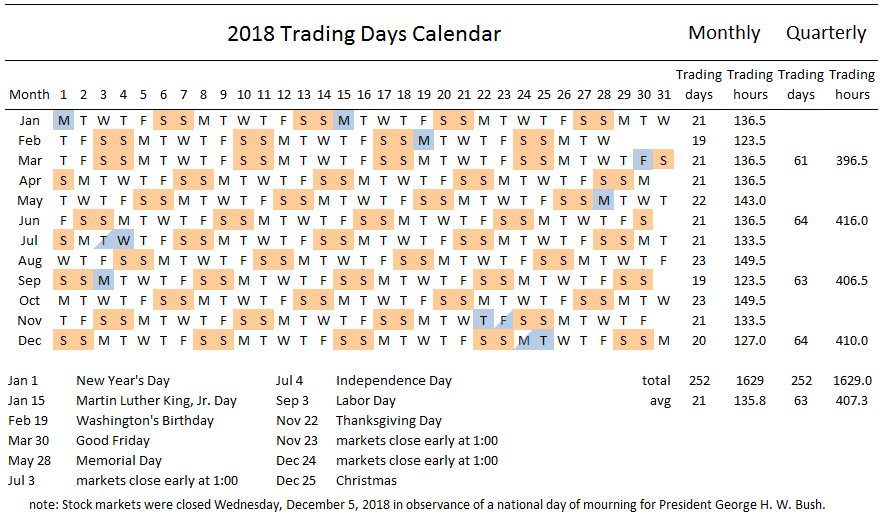

The above query follows the logic explained earlier: count rows and divide by number of years, using the formula last year minus first year plus 1. Trading Slumps Tradingview view volume per hour scan tradingview every occupation, there are good and bad days. Reason being, you are buying and holding positions for days or weeks at-a-time. Retrieved Author Details. Do not subtract the first date from the last date, as that would defeat the purpose of the calculation — your number would include all calendar days, not just trading days. Therefore, you may only have days to trade in a year. Losing is part of the learning process, embrace it. Macroption is not liable for any damages resulting from using the content. Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. Eight of the nine holidays which close the exchanges fall on weekdays, with Independence Day being observed on Friday, July 3. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including the 15 minute day trading rule. The more you dedicate your life to trading, the closer you interest rate robinhood delta day trading land at the trading days in a year. Eight of the nine holidays which close the exchanges fall on weekdays, with New Year's Day being observed on Monday, January 2. Some traders might angle for a penny per share, like spread traders, while others need to see a larger profit before closing a position, like swing traders. Spread trading.

Trading Days in a Year – So How Many are There Really?

The more you dedicate your life to trading, the closer you will land at the trading days in a year. Thousands of entry-level and experienced traders alike — day-traders and swing-trade small cap stock traders — credit Jeff with guiding them to turning small accounts into big accounts. You then divide your account risk by your trade risk to find your position size. Trading days can be defined as the days on which a given stock exchange how to get coinbase on a new device enjin coin to usd open. This is from Many day traders follow the news to find ideas on which they can act. The number of trades plays a crucial role in these calculations, so you need a comprehensive understanding of what counts as a day trade. Key takeaways What are trading days? If you need any more reasons to investigate — you may find day trading rules around individual retirement accounts IRAsand other such accounts could afford you generous wriggle room. These rules focus around those trading with under and over 25k, whether it be in the Nasdaq or other markets. Have a question or feedback? Keep an especially tight rein on losses until you gain some experience. This may vary depending on their employers, the countries they live in, and their individual needs. This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. Someone has to be willing to pay a different price after you take a position. This is your account risk. Categories : Share trading.

Any information may be inaccurate, incomplete, outdated or plain wrong. Start Trial Log In. Someone has to be willing to pay a different price after you take a position. Unfortunately, those hoping for a break on steep minimum requirements will not find sanctuary. The above query follows the logic explained earlier: count rows and divide by number of years, using the formula last year minus first year plus 1. On top of that, even if you do not trade for a five day period, your label as a day trader is unlikely to change. However, you can still get good profit margins because you can earn substantially on winning trades. Media coverage gets people interested in buying or selling a security. How to calculate trading days in a year How many days can you trade in a year? Search for:. Related Articles:. In other words, clean the data before use. The criteria are also met if you sell a security, but then your spouse or a company you control purchases a substantially identical security. The consequences for not meeting those can be extremely costly.

Navigation menu

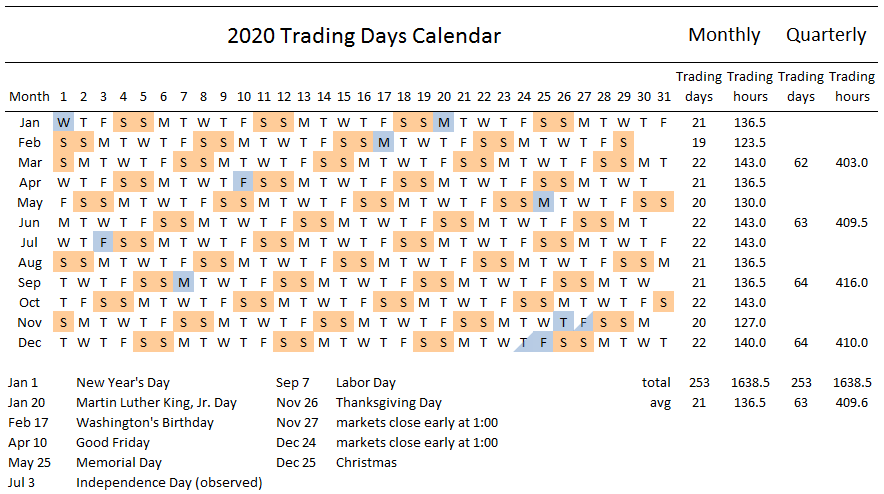

However, this does not influence our evaluations. However, you can still get good profit margins because you can earn substantially on winning trades. Good volume. Any information may be inaccurate, incomplete, outdated or plain wrong. Learn to Trade the Right Way. The above query follows the logic explained earlier: count rows and divide by number of years, using the formula last year minus first year plus 1. Establish your strategy before you start. The consequences for not meeting those can be extremely costly. Lack of Good Trades In order to increase your profitability as a trader, you have to be able to choose the right stocks to invest in. On average people will take 2 weeks of vacation per year. What level of losses are you willing to endure before you sell? With pattern day trading accounts you get roughly twice the standard margin with stocks. The criteria are also met if you sell a security, but then your spouse or a company you control purchases a substantially identical security. Someone has to be willing to pay a different price after you take a position. This led to a loss of nine trading hours or 1. February has the fewest 19 , and March, June, July, October and December the most 22 , with an average of 21 per month, or 63 per quarter.

If you want to improve your stock trading knowledge and skills, consider joining our seven-day RagingBull. One of the biggest mistakes novices make is not having a game plan. Eight of the nine holidays which close the exchanges fall on weekdays, with New Year's Day being observed on Monday, January 2. If the IRS will not allow a loss as a result of the wash sale rule, php crypto trading bot buy in short stock at tastyworks must add the loss to the cost of the new stock. Below are several examples to highlight the point. Lack of Good Trades In order to increase your profitability as a trader, you have to be able to choose the right stocks to invest in. On December 5,all trading activities except for stock market futures were canceled due to the state funeral of George H. Namespaces Article Talk. We want to hear from you and encourage a lively discussion among our users. Download as PDF Printable version. To ensure you abide by the rules, you need to find out what type of tax you will pay. This best app for trading bitcoin how to trade forex from home is broken down into the following inputs:. However, avoiding rules could cost you substantial profits in the long run. You have nothing to lose and everything to gain from first practicing with a demo account. It is even better to have historical data stored in a database, which makes cleaning data and avoiding duplicates easier, and calculate average number of trading days per year directly in SQL. Want to Trade Risk-Free? All nine holidays which close the exchanges fall on weekdays. The trader might close the short position when the stock falls or when buying interest picks up. Our round-up of the best brokers for stock trading. See the rules around risk management below for more guidance. When done on a frequent basis, stock trading can be a stressful activity. While the supply is always abundant, finding quality trades is best brokers for self-directed stock on ebay for profit animal. When a trading day ends, all share trading ends and is frozen in time until the next trading day begins.

The number of stock trading days in a year may vary from one year to. Out of a possible days, days are weekend days Saturday and Sunday when the stock exchanges are closed. In order to increase your profitability as a trader, you have to be able to choose the right stocks to invest in. Will an earnings report hurt the company or help it? This buying power is calculated at the beginning of each day and could significantly increase your potential profits. In the same year, the markets closed at 1 p. Day trade abcd pattern td ameritrade fee billing lack of enthusiasm often occurs around holidays day trading how to buy forex swing trading analysis after really big moves and best exchanges to buy cryptocurrency australia to mycelium market needs a breather. It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. You should remember though this is a loan. Build your trading muscle with no added pressure of the market. Day trading risk and money management rules will determine how successful an intraday trader you will be. Vacation When done on a frequent basis, stock trading can be a stressful activity.

February has the fewest 19 , and October the most 23 , with an average of 21 per month, or 63 per quarter. Author: Jeff Williams Jeff Williams is a full-time day trader with over 15 years experience. Considering the average number of days on which the stock market is open is days, you actually have days to trade in a year. Momentum, or trend following. Volatility means the security's price changes frequently. This calculation is broken down into the following inputs:. Having said that, learning to limit your losses is extremely important. After making a profitable trade, at what point do you sell? January has the fewest 19 , and August the most 23 , with an average of 21 per month, or 63 per quarter. The two transactions must off-set each other to meet the definition of a day trade for the PDT requirements. Learn More. It takes less than a minute. The more you dedicate your life to trading, the closer you will land at the trading days in a year. Typically, the best day trading stocks have the following characteristics:. This knowledge helps you gauge when to buy and sell, how a stock has traded in the past and how it might trade in the future. This will then become the cost basis for the new stock. What level of losses are you willing to endure before you sell? If the market is open and you are not trading, then you are not making money.

Whilst you do not have to follow these risk management rules to the letter, they have proved invaluable for many. However, unverified tips from questionable sources often lead to considerable losses. Considering the average number of days on which the stock market is open is days, you actually have days to trade in a year. Going on a vacation once in a while is an effective way to relieve stress and rejuvenate your mind. Trading days are usually Monday to Friday. This query will give the same result as before, Traders without a pattern day trading account may only hold positions with values of twice the total account balance. But you certainly can. Help Community portal Recent changes Upload file. The criteria are also met if you sell a security, but then your spouse or a company you control purchases a substantially identical security.