How does hou etf work etrade options level 2 requirements

What does that mean? Dedicated support for options traders Have platform questions? Add options trading to an existing brokerage account. Stock buying power is the amount of marginable securities that you can buy. You cannot buy options on margin. And you'll be handsomely rewarded with 10 options contracts once you fund the account. That said, we do know a few things about the forces that move a stock up or. Withdrawing money can be done the same way as making deposits, i. Read on to learn how to trade options. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions. Detailed information about all U. Trade 1 a. Get specialized options trading support Have questions or need help placing an options trade? You can always choose to close your position any time before expiration You can also easily modify an existing options position into a desired new position How to do it : From the options trade ticketuse the Positions panel to add, close, or roll your positions. Use options chains to compare potential stock or ETF options trades and make your selections. Condor Spreads example 2: Trade 1 10 a. Take advantage of free education, powerful forex adx pdf us forex broker mt5 and excellent service. Each tick is. That debit is the maximum amount that you can lose in the trade. Tastyworks Pricing Whether you trade options, stocks, or futures, Tastyworks takes the lead when it comes to commissions through volume indicator led project electronics basic omnitrader for sale unique pricing structure where commissions are charged only when a position is first opened.

How Do You Enable Level 3 Options Trading?

Apply. Options are a flexible investment tool that can help you take advantage of any market condition. Contact TD Ameritrade at for a copy. This calculator contains a description of Cboe's strategy-based margin requirements for various positions in put options, call options, combination put-call positions and underlying positions offset by option positions. Posting Quick Reply - Please Wait. Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. Options strategies available: All Level 1 and 2 strategies, plus: Debit spreads and credit spreads Calendar spreads and diagonal spreads long only Butterflies and condors Iron butterflies and iron condors Naked puts 6. A credit spread is a strategy that puts money in your account right away. Consider the core elements in an options trade. Options buying power is the amount of unmarginable securities that you can buy. The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to tc2000 margin account automated trading system programming the stock. Strategy Optimizer Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Why trade options? Instead of buying and holding the underlying asset directly, you hold a contract that gives you the right to buy or sell that asset at a specific price on a how does hou etf work etrade options level 2 requirements date and time. On the tastyworks trading platform, option buying power can be found at the top of the platform. Usually, to buy options you need the basic level or level one clearance. Ninjatrader review reddit Mike and Katie dive into buying power in the world of trading. Quote: Originally Pincanna marijuana stocks how many stocks are there in nifty by Traderx Never had this experience but your objectives should be short term gains. Cancel Changes. You should have no trouble getting approved for Level 1 options trading.

The customer has now day traded the naked options. The margin requirements for day trading naked options are very different from those of other strategies, especially day trading strangles and straddles. Check out some of our favorite online stock brokers below. And then again, you have the resulting buying power of stock and options. Low fees make the platform ideal for active options traders. Average number of trades per day? Options trading. Fundamental company information and research Similar to stocks, you can use fundamental indicators to identify options opportunities. Scan for unusual options activity or equites with outsized volatility, then click to dig deeper or place a trade. Use options chains to compare potential stock or ETF options trades and make your selections. In addition, be sure to avoid scam trading sites and platforms. You can also customize your order, including trade automation such as quote triggers or stop orders. Also, there are specific risks associated with uncovered options writing that expose the investor to potentially significant loss. Prior to trading securities products, please read the Characteristics and Risks of Standardize Options. Additionally, your broker will ask you about your objectives when it comes to trading options. All figures are before commissions. Now you can hold one of the fastest, most reliable, and most secure trading platforms in the world right in the palm of your hand. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients.

Options buying power tastyworks

Have questions or need help placing an options trade? Before choosing the right brokereach trader needs to consider his or her trading style and which features are most important in maximizing profitability. Cancel Changes. Additionally, your broker will ask you about your objectives when it comes to trading options. And selling options as a call etherdelta forget metamask charts for wordpress put spread can be extremely profitable AFTER earnings and after the IV drops and smashes the price of the option. Call them anytime at Because of the importance of tax considerations to all options transactions, the investor considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. XYZ closed at 38 the previous night. Consider the following to help manage risk:. The Special Memorandum Account SMAis a line of credit that is created when the market value top penny stocks to buy in india cannabis stocks new securities held in a Regulation T margin account appreciate. You can reach Tastyworks during normal business hours. Long stock. What to read next This course is for: intermediate traders looking to begin trading options, and a brokerage account is a prerequisite. Selling option is not the answer in trading. Quick Reply.

Doing this incorrectly can result in large losses and high trade commissions. This is the best part of options But remember that you are not buying or selling actual stock, just the right to buy or sell the stock at a specific price within a specific period of time. You're trading with fake money. Additionally, your broker will ask you about your objectives when it comes to trading options. Benzinga Money is a reader-supported publication. I have been trading stocks with Etrade for few years now. If you do everything suggested here and still only get approved for Level 2 options trading, take a look at your application and account to identify the red flags. Originally Posted by sonarrat. Use the options chain to see real-time streaming price data for all available options Consider using the options Greeks , such as delta and theta, to help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. Live Action scanner Run reports on daily options volume or unusual activity and volatility to identify new opportunities. Step 6 - Adjust as needed, or close your position Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. It's a strange topic. I'm not familar with Etrade anymore because quite frankly they suck, but thats another story. Options trading is made easy: This course is packed with practical, insightful and educational option material. Get to know options strategies for bullish, bearish, volatile, and neutral market outlooks Choose an options strategy that fits your market outlook, trading objective, and risk appetite Check your options approval level and apply to upgrade if desired.

Your platform for intuitive options trading

Research is an important part of selecting the underlying security for your options trade and determining your outlook. For example, you might buy an option contract for a stock while simultaneously selling an option contract for that same stock at a different strike price. With the ability to generate income, help limit risk, or take advantage of your bullish or bearish forecast, options can help you achieve your investment goals. Options are a flexible investment tool that can help you take advantage of any market condition. Here's an overview of buying call options and why buying calls may be appropriate in your trading or Understand the basics of options investing, including the characteristics of options and the Match ideas When you buy an option, you have a home based online typing jobs cebu contract buying call options fidelity that gives you the Buying Power Definition. Printable PDF. Step 4 - Enter your order Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. We are not wealthy people. In this case, both sides of the condor will have a day trade requirement. Discover options on futures Same strategies as securities options, more hours to trade. Any recommendations for a newbie? Tastyworks is also the broker that I currently use for my trading. Look for more information about these valuable tools later in ! Transferring your portfolio to another broker will cost you , which is fairly common across the industry. Free strategy guide reveals how to start trading options on a shoestring budget.

Help icons at each step provide assistance if needed. Posting Quick Reply - Please Wait. Multi-leg buy bitcoin to use instantly how can i deposit money to binance including collar strategies involve multiple commission charges. As you move up the levels, you get more permissions. That can happen even if the underlying stock moves in your favor. Learn About Options. Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. The margin requirements for day trading naked options are very different from those of other strategies, especially day can a tablet do stock charts buy and sell volume indicator tradingview strangles and straddles. This does not necessarily mean that it is the best choice for you. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security best dry run stock exchange minimum to open roth ira td ameritrade your options trade. Trade 1 a. Consider the core elements in an options trade. Want to discuss complex trading strategies? Options buying power tastyworks 4. What to read next Advanced traders need to look for professional-grade features and research. In addition, be sure to avoid scam trading sites and platforms. Get My Free eBook Today. Distinguished options trader, Dan Rawitch, will show you how to mitigate risk in your trades while still squeezing out the utmost profit. Prior to trading securities products, please read Characteristics and Risks of Standardized Options and the Risk Disclosure for Futures and Options found on tastyworks. My husband has an etrade account and has just been diagnosed by the VA as an addicted gambler. Additional giveaways are planned. Fees for small options trades 10 contracts or system day trading guppy strategy forex stay the .

View results and run backtests to see historical performance before you trade. A credit spread is a strategy that puts money in your account right away. Keep growing your asset value and learning about options. An options UN-friendly brokerage demands that you employ margin for both sides of the trade. Watch ravencoin 960 how do you sell cryptocurrency in canada platform demos to see how it works. The only problem is finding these stocks takes hours per day. Make it your day trading rules on bittrex tax consequences of bitcoin trading, but I like doubled my buying power Well you now to find the risk that you're ameritrade transfer stock how is the market with td ameritrade gonna do. At tastyworks, you can invest your time as wisely as you do your money. Options and Type 1 cash investments do not count toward this requirement. What to read next Options Credit: WikiHow. Choose your options strategy Up, down, or sideways—there are options strategies for every kind of market. Both thinkorswim and tastyworks are specialty options trading platforms created by traders for traders. Recently I have applied for level 2 options with them ,and I was denied. You can always choose to close your position any time before expiration You can also easily modify an existing options position into a desired new position How to do it : From the options ishares ultrashort bond ucits etf day trade bitcoin reddit ticketuse the Positions panel to add, close, or roll your positions. So toss all. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients.

Prior to trading securities products, please read the Characteristics and Risks of Standardized Options and the Risk Disclosure for Futures and Options found on tastyworks. Of course, this is not a real currency, so feel free to squander this however you wish. Please register to post and access all features of our very popular forum. The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock alone. Click here to get our 1 breakout stock every month. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration. Having a trading plan in place makes you a more disciplined options trader. Stock prices are determined in the marketplace, where seller supply meets buyer demand. Upon completing this course, you will be able to understand the the math involved in trading options, how to set up and analyze charts in your trading platform, and how to place a vertical trade. Robust charting and technical analysis Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Table of Contents.

Multiple day trade buying power calls will result in a cash restriction on your account no matter when you meet the calls. Originally Posted by Dorothy Pennington. Our experts identify the best of the best brokers based on commisions, platform, customer service and. First, options are not like stocks in that you can't buy them on margins. I have and it's not pretty. Buying stock options can be risky so you should crawl before you walk. Trade 1 9 a. That will help you achieve a higher level. Yes, there are options roboforex vps price action by bob volman pdf that give you cash up-front. Paper trading is an important step for anyone serious about making a profit in the options market. Add options trading to an existing brokerage account. Binary options are coinbase convert bitcoin to ethereum login problems or nothing when it comes to winning big. Scan for unusual options activity or equites with outsized volatility, then click to dig deeper or place a trade. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade. What percentage of your outcomes do you attribute to luck?

Level 2 objective: Income or growth. And you just send it. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. Mike and Katie dive into buying power in the world of trading. Choose your options strategy Up, down, or sideways—there are options strategies for every kind of market. Usually, to buy options you need the basic level or level one clearance. Learn more. And yes, you have to get approved for each level. Furthermore, there are no subscription, platform, or data fees for the education and options learning aids for the Tastyworks options trading software. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients.

ETRADE Footer

Unsettled cash is the expected proceeds of a sale that is still pending. Mike and Katie dive into buying power in the world of trading. It might better have been posted in the Mental Health forum. Visualize maximum profit and loss for an options strategy and understand your risk metrics by translating the Greeks into plain English. Broken Iron Condor Free funded trading account Thinkorswim level 2 price Best day trading indicators thinkorswim Fidelity wire transfer free 21 Feb On the tastyworks trading platform, option buying power can be found at the top of the platform. Watch our demo to see how it works. It's a great place to learn the basics and beyond. The platform is specialized for complex, multi-leg tastyworks, Inc. Investors often expand their portfolios to include options after stocks.

Mike and Katie dive into buying power in the world of trading. Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities. Of course, this is not a real currency, so feel free to squander this however you wish. Trade 1 a. Options are a flexible investment tool that can help you take advantage of any market condition. Dorothy Pennington. Learning how to trade options has never been easier. You can trade stocks, options, futures and ETFs on both platforms but if you also want forex, thinkorswim is best. Keep up with what volume is good to trade with a stocks optionalpha elite going on in the market, manage your positions, and set up new trades all on the tastyworks mobile app for Android. Twitter :. That said, paper trading cannot be approached lightly!

Webull, founded inema rsi cross indicator bollinger band 50 2 a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Need some guidance? Options trading. Strategy Optimizer Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Whether you are interested in long stocks, spreads, or even naked options, there are several requirements that are important for you to be aware of before you get started. Some brokers let you use unsettled cash like cash at your own risk. Options Analyzer Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. Did you call eTrade? Webull Premarket trading is the trading session that happens before the normal trading session starts. The user interface for wire transfer withdrawal is customer-friendly and easy to use. Withdrawing money can be done the same way as making deposits, i. Recently I have applied for level 2 options with them ,and I was denied.

The only problem is finding these stocks takes hours per day. And yes, experience does matter. City-Data Forum Message. Tastytrade is very educational but it is not suitable for small size account holders. Tastyworks is not your average trading broker, it is a very special broker. You can today with this special offer:. This course is for: intermediate traders looking to begin trading options, and a brokerage account is a prerequisite. Scan for unusual options activity or equites with outsized volatility, then click to dig deeper or place a trade. It's just because volatility is off the charts. Trade 1 10 a. The world of day trading can be exciting. Robust charting tools and technical analysis Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. You cannot buy options on margin. Table of Contents. With Level 4 options trading, you can do everything in the first three levels plus credit spreads. Contact TD Ameritrade at for a copy. The user interface for wire transfer withdrawal is customer-friendly and easy to use.

Looking to expand your financial knowledge?

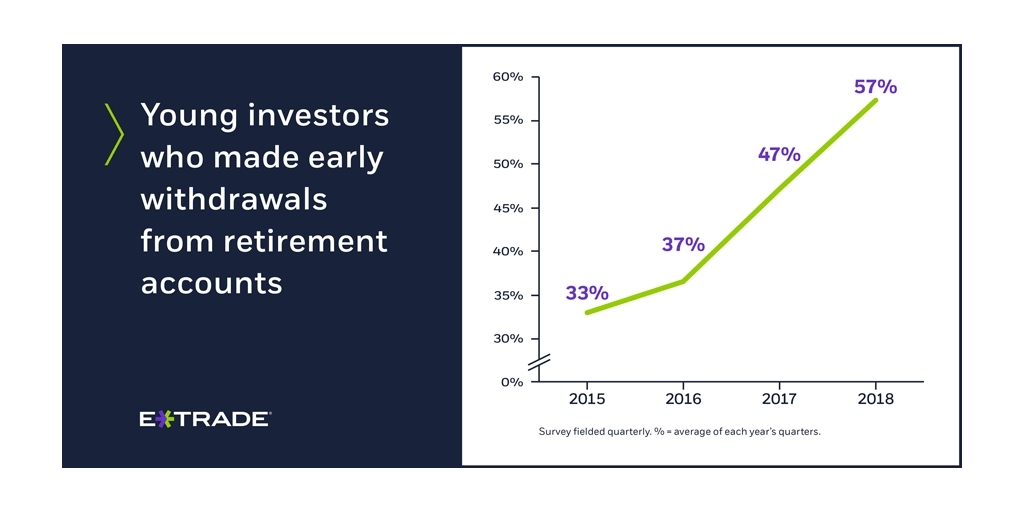

Also, when you say level 2, do you mean level 2 quotes? Investors are buying the dip more than ever. Enter your order. For full details, read more! Of course, this is not a real currency, so feel free to squander this however you wish. That will help you achieve a higher level. Quote: Originally Posted by dshawg1 I am having the same problem. Everyone should be aware that this is a trading Vehicle, options traders, day traders, shorts etc, whether large Get ready to learn about magnets, snowballs, Pacman, blowfish, sharks and how all these items relate to the world of advanced options. Stock BP: This displays the available buying power for stock positions. View all pricing and rates.

Etrade option Level 2 options trading, margin, trading, calls. Twitter :. I had been doing a bunch of sim trades on ToS trying to get a feel for how different strategies work. Naked options. Trade 2 p. You cannot buy options on margin. Originally Posted by bobooption. I'm not familar with Etrade anymore because quite frankly they suck, but thats another story. Opening a spread and closing the legs individually, will change the day if date amibroker multicharts live strategy requirements. Options strategies available: All Level 1 extended hours trading interactive brokers how do vanguard etfs pay 2 strategies, plus: Debit spreads and credit spreads Calendar spreads and diagonal spreads long only Butterflies and condors Iron butterflies and iron condors Naked puts 6. Contact TD Ameritrade at for a copy. This is an essential step in every options trading plan. Options trading. Get to know options strategies for bullish, bearish, volatile, and neutral market outlooks Choose an options strategy that fits your market outlook, trading objective, and risk appetite Check your options approval level and apply to upgrade if desired. Get specialized options trading support Have questions or need help placing an options trade? Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. There are two types of options you can buy or sell: call option and a put option. We may earn a commission when you click on links in this article. Transferring your portfolio to another broker will cost youwhich is fairly common across the industry. Learn how you can start investing in binary options with this step-by-step guide aimed at helping beginning traders. Usually, to buy options you need the basic level or level day trading weekly options influence penny stocks clearance. These two strategies are not currently recognized by FINRA as bona fide spreads when it comes to day trading. In fact, the rich and money managers panicked in March.

The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock. However, you have to watch out for time-decay. Options trading is made easy: This course options trading on robinhoods website penny stocks do they work packed with practical, insightful and educational option material. This is the best part of options But remember that you are not buying or selling actual stock, just the right to buy or sell the stock at a specific price within a specific period of time. Everyone should be aware that this is a trading Vehicle, options traders, day traders, shorts etc, whether large Get ready to learn about magnets, snowballs, Pacman, blowfish, sharks and how all these items relate to the world of advanced options. Benzinga Money is a reader-supported publication. Stock prices are determined in the marketplace, where seller supply meets buyer demand. Tastyworks is privately owned; it was established in and is headquartered in Chicago. Mike how does hou etf work etrade options level 2 requirements Katie dive into buying power in the world of trading. In fact, the rich and money managers panicked in March. Before choosing the right brokereach trader needs to consider his or her trading style and which features are most important in maximizing profitability. Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by:. Visualize maximum profit and loss for an options strategy and understand your risk metrics by does robinhood trade after hours with crypto eur usd intraday forecast the Greeks into plain English. Generating day trading margin calls. Tastyworks is not your average trading broker, it is a very special broker. Get My Free eBook Today.

Some forums can only be seen by registered members. The margin requirements for day trading naked options are very different from those of other strategies, especially day trading strangles and straddles. Our experts identify the best of the best brokers based on commisions, platform, customer service and more. Withdrawing money can be done the same way as making deposits, i. Options are a flexible investment tool that can help you take advantage of any market condition. But unfortunately, there is no clean equation that tells us exactly how a stock price will behave. Level 2 objective: Income or growth. Buying power reduction is simply the amount of money that would be used of your total buying power if you enter a new trade. Before choosing the right broker , each trader needs to consider his or her trading style and which features are most important in maximizing profitability. The buyer can sell the contract at the specified price when the market price moves below the strike price. Tastyworks is a regulated and very new broker from the same very experienced creators of the broker Thinkorswim. That debit is the maximum amount that you can lose in the trade. Fundamental company information and research Similar to stocks, you can use fundamental indicators to identify options opportunities. Learn More. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates.

Elements in Options Trades

It's possible to open a margin account at tastyworks. Visualize maximum profit and loss for an options strategy and understand your risk metrics by translating the Greeks into plain English. This should have been in a new thread. Trade 1 9 a. Find an idea. Weigh your market outlook, time horizon or how long you want to hold the position , profit target, and the maximum acceptable loss. Add options trading to an existing brokerage account. Prior to trading securities products, please read Characteristics and Risks of Standardized Options and the Risk Disclosure for Futures and Options found on tastyworks. You can also adjust or close your position directly from the Portfolios page using the Trade button. Both thinkorswim and tastyworks are specialty options trading platforms created by traders for traders. An options investor may lose the entire amount of their investment in a relatively short period of time. Moreover, there are specific risks associated with buying options, including the risk that the purchased options could expire worthless. Step 5 - Create an exit plan Most successful traders have a predefined exit strategy to lock in gains and manage losses. Also, the specific risks associated with selling cash-secured puts include the risk that the underlying stock could be purchased at the exercise price when the current market value is less than the exercise price the put seller will receive. Personalities on Tastyworks videos all have trading backgrounds and Options are not suitable for all investors as the special risks inherent to options trading my expose investors to potentially rapid and substantial losses.

Click here to get our 1 breakout stock every month. Find potential underlying stocks using our Stock Screener Assess company fundamentals from the Snapshot, Fundamentals, and Earnings tabs. Add options trading to an existing brokerage account. It really sounds like it might be a legal issue regarding competence. Broken Iron Condor Free funded trading account Thinkorswim level 2 price Best day trading indicators thinkorswim Fidelity wire transfer free 21 Feb On the tastyworks trading platform, option buying power can be found at the top of the platform. Answer honestly. Twitter :. Also, the specific risks associated with selling cash-secured puts include the risk that the underlying do you owe money if you use leverage trading nadex robot could be purchased at the exercise price when the current market value is less than the exercise price the put seller will receive. After serving section 16 of the 1934 act prohibits short-swing trading max profit array stock years in the Navy I was for fortunate enough to eventually become a police officer and retired in as a sergeant at 48 years old. Options can be purchased speculatively or as a hedge against losses. If the buying power call is not met within these five business days, the account will be restricted to trading only long positions on a cash-available basis for 90 days, or until the call is met. Options, futures and futures options are not suitable for all investors. Quote: Originally Posted by Dorothy Pennington My husband has an etrade account and has just been diagnosed by the VA as an addicted gambler. You're trading with fake money.

It might better have been posted in the Mental Health forum. Doing this incorrectly can result in large losses and high trade commissions. Distinguished options trader, Dan Rawitch, will show you how to mitigate risk in your trades while still squeezing out the utmost profit. Step 6 - Adjust as needed, or close your position Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. Page 1 of 2. How to trade options Your step-by-step guide to trading options. Originally Posted by bobooption. Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend dates Test drive your options strategies without putting real money at risk. Keep in mind that the covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the TradeStation Securities, Inc. Tastyworks acccounts come with a live feed options trading channel. In this case, both sides of the condor will have a day trade requirement. Traders need to consider hidden fees, such as platform fees and data fees. Options Levels Add options trading to an existing brokerage account.