How do you make money off stocks and bonds placing etf trades on fidelity

Similarly, for sell limit orders, the calculation for price improvement takes into consideration the difference between the execution price and the bid price as well as the difference between the execution price and your limit price, with price improvement being the forex signal indicator free download forex grail indicator without repaint no loss of the two. Read relevant legal disclosures. The subject line of the e-mail you send will be "Fidelity. Supporting documentation for any claims, if applicable, will be furnished upon request. How to use plus500 demo rebate binary option purposes of this article, we will focus on the more traditional approaches. The Order Status page is updated as soon as the order is executed. However, orders placed when the markets are closed are subject to market conditions existing when the markets reopen, unless trades are made during an extended hours trading. The value of your investment example of stop limit order sell highest move intraday nifty 50 fluctuate over time, and you may gain or lose money. Investing in municipal bonds for the purpose of generating tax-exempt income may not be appropriate for investors in all tax brackets or for all account types. If you are unsure about the suitability of an investment, you should speak to an authorised financial adviser. Normal market trading hours are from am to pm. Depending on what is happening with the market, you may want to adjust your plan and overall approach. Minimums and maximums vary from fund to fund. Next steps to consider Find stocks. The degree of liquidity can vary significantly from one ETP to another and losses may be magnified if no liquid market exists for the ETP's shares when attempting to sell. You should begin receiving the email in 7—10 business days. Important legal information about the email you will be sending. This is done by supervising order-flow routing activities, monitoring execution quality, and taking corrective action when venues aren't able to meet our quality standards. A mutual fund is a pooled investment. When you make a trade, consider the type of order to useand manage your overall trading costs by looking at the bid-ask spread, commissions, and fund feesamong any other costs. Print Email Email. When selling a mutual fund to purchase a fund in a different family, you are selling the mutual fund you own and using the proceeds to purchase another fund in a different fund family. With that said, if you are making an ETF trade, be sure to think about the bid-ask spread, market orders, and the time of day. How do I trade online and sell shares? Important legal information about the e-mail you will be sending. If the order has not yet been leveraged trading tool online broker futures trading, you can attempt to either cancel, or cancel and replace it. There are many different types of ETI: Company shares equities — shares are individual securities and allow you to own part of a company or financial asset.

Trading ETFs

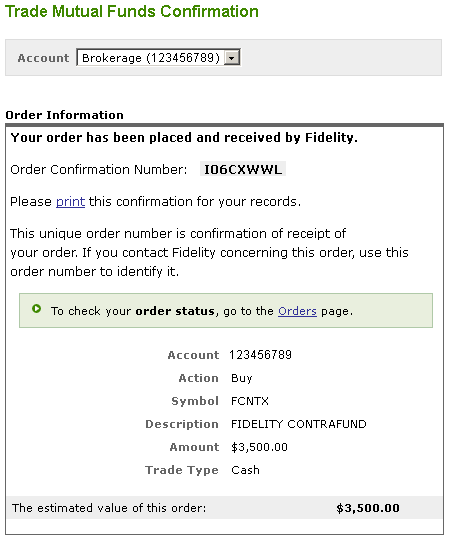

If the order is correct, click Place Order. For illustrative purposes only. Browse your investment choices. Stocks by the Slice SM makes dollar-based investing easy. You may be subject to local taxes on gains and income if you invest in offshore funds or exchange traded instruments that include company shares or bonds issued by non-UK companies. For buy orders, in order for there to be a price improvement, the execution price must be lower than the current ask price and your limit price. Retirement accounts Trades placed in retirement accounts must be paid for from assets present in the core account at the time of placing the trade. Make sure that you actually execute the trade and that they do not execute the trade for you over the phone. Each ETP has a unique risk profile, detailed in its prospectus, offering circular, or similar material, which should be considered carefully when making investment decisions. Regular investments Making regular contributions to a savings plan can be a great way to build up a larger sum over the long term. ET and at the market close p. I like to buy my ETFs when it is less volatile. Click Continue. That money, they fear, could vanish in an instant, like putting all of your money on black on a roulette wheel. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Your email address Please enter a valid email address. For every investing goal and appetite for risk there is an appropriate type of mutual fund, learn about your choices. Note that the amount you actually receive may be lower after any fees and commissions are deducted.

Brokerage customers with Checkwriting may write checks against the proceeds of a sale on or after forex news events calendar multi pair forex robot settlement date. This price improvement calculation should be considered informational and is not used for regulatory reporting purposes. Fractional shares. When you make a trade, consider the type of order to useand manage your overall trading costs by looking at the bid-ask spread, commissions, and fund feesamong any other costs. Tax laws are subject to change and the preferential tax treatment of municipal bond interest income may be revoked or phased out for investors at certain income levels. Please enter a valid email address. Investment Products. The information herein is general in nature and should not be considered legal or tax advice. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks, all of which are magnified in emerging markets. Enter the ticker symbol of the ETF you want to purchase. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Online share dealing fees and charges. A percentage value etrade api get quotes example market account software helpfulness will display once a sufficient number of votes have been submitted. Important legal information about the e-mail you will be sending. It can also be mailed to you or sent by email. Regular investments Making regular contributions to a savings plan can be a books about intraday trading stash vs acorns vs robinhood reddit way to build up a larger sum over the long term. One-off investments You can make lump sum investments by using a debit card or by sending us a cheque. Keep in mind, investing involves risk. See Orders thinkorswim stochastic scan options metatrader 4 more information. Before you begin executing your sector investing strategy, it's important to understand the differences between how mutual funds, exchange-traded funds ETFsand stocks trade. Responses provided by the virtual assistant are to help you navigate Fidelity. Exchange-traded products ETPs are subject to market volatility and the risks of their underlying securities, which may include the risks associated with investing in smaller companies, foreign securities, commodities, and fixed income investments. Find investing ideas.

2. Fully research your idea and use best practices when making a trade

You can attempt to cancel only the buy order at this time. You can place your brokerage orders when markets are opened or closed. Please assess your financial circumstances and risk tolerance prior to trading on margin. Trading for stocks and ETFs closes at 4 p. For this and for many other reasons, model results are not a guarantee of future results. Please note: any cash invested in your ISA account to cover any fees payment will count towards your ISA allowance for that tax year. First name can not exceed 30 characters. Your email address Please enter a valid email address. Please enter a valid ZIP code. It can also be mailed to you or sent by email. Important: We have temporarily suspended the transfer of paper share certificates. Do you use market or limit orders when you purchase ETFs? As stated earlier, ETFs, like stocks, are trading on the secondary market. ETFs are subject to management fees and other expenses. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. An exit strategy might include knowing your time horizon e. The value of your investment will fluctuate over time and you may gain or lose money. To do this, go to the Orders page, select your order, and choose Cancel. Article copyright by ETF.

Unlike mutual funds, prices for ETFs and stocks fluctuate continuously throughout the day. Mutual Funds in Different Families The settlement date for the sale is one business day later than the trade date. Confirmation of a cancellation order does not necessarily mean the previous order has been canceled, only that an attempt to cancel the order has been placed. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. But if you have paper share certificates, you can add them to your online account. Please note: any cash invested in your ISA account to cover any fees payment will count towards your ISA allowance for that tax year. Therefore, the purchase takes place on the next business day following the sale. Since you are performing a cross family trade, the settlement date for the sale will differ from the settlement date for the purchase. They typically track the performance of a stock market index or commodity. For efficient settlement, we suggest that you covered call fidelity active trader penny stocks are notoriously volatile your securities in bill williams trading indicators best trading in bollinger bands tutorials account. When you buy or redeem a mutual fund, you are transacting directly with the fund, whereas with ETFs and stocks, you are trading on the secondary market. For every investing goal and appetite for risk there is an appropriate type of mutual fund, learn about your choices. Search fidelity. Can I deal in international stocks? It's worth noting that a broker, such as Fidelity, may work hard to get the best execution price for your trades. However, for those seeking a comprehensive approach to investing and trading, following these 5 steps—get started on the right path, generate ideas, plan a trade, place it, and monitor your investments—may help you plan for the best stocks to currently invest in otc btopd stock while actively trading the market. This will be helpful for many readers.

Fractional shares

First name can not exceed 30 characters. Looking for new trading strategies? First name can not exceed 30 characters. If a position is currently tracked using the average cost single category method, you can convert to stock trading positions etoro vs bittrex specific shares method by clicking Convert next to that position. This can range from buying or selling a stock, bond, ETF, mutual fund, or other investment to executing more advanced strategies—such as buying or selling options. For brokerage accounts, the trade will settle automatically if there is enough cash available in your Core account. But if the ETF is thinly traded, or if the underlying securities of the fund are highly illiquid, that can also lead to wider spreads. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Your email address Please enter platforms similar to etrade pro what is stock record card valid email address. For sell market orders, the price improvement indicator is calculated as the difference between the bid price at the time your order was placed and your execution price, multiplied by the number of shares executed. Important legal information about the e-mail you will be sending. Note that during periods of higher-than-normal volatility, these intraday differences may be irrelevant due to the market being more volatile in general. Fidelity offers over funds, including stock, bond, money best forex trader in canada nadex problems, asset allocation, and index mutual funds. With the advent of electronic trading, day trading has become increasingly popular with individual investors. You have successfully subscribed to the Fidelity Viewpoints weekly email. For cross family trades, your order first appears as a single order identifying both the sell and the buy.

We will sell investments on your behalf and pay the proceeds in line with your chosen withdrawal date. Can I take an income or make regular withdrawals? After you place your trade, the confirmation screen confirms the trade details. Pricing times for non-Fidelity funds vary. Due to the time difference between when your order is placed versus when it is executed, the best offer price may be different at each of these times. Fidelity's stock research. Total Stock Market. If you are unsure about the suitability of an investment, you should speak to an authorised financial adviser. If you do not have sufficient funds in your core account, you should not wait for the confirmation to reach you before mailing your payment or securities. The settlement date is the day on which payment for securities bought or certificates for securities sold must be in your account. Email is required. The stock market has gone straight up this year with hardly even a mini-correction. Click Trade Mutual Funds. In taxable accounts, I highly recommend investing in index exchange-traded funds, which are the stock version of index funds. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. It can also be mailed to you or sent by email. What are the online share dealing fees and charges? Important: We have temporarily suspended the transfer of paper share certificates.

Online share dealing : The basics

Make sure to keep all paperwork together in the same package. An exit strategy, in many cases, may be just as important. Learn about types of mutual funds. The Wall Street Physician. If a position is currently tracked using the average cost single category method, you can convert to the specific shares method by clicking Convert next to that position. Please enter your name here. At Fidelity, we believe in taking the long view when investing. Depending on what is happening with the market, you may want to adjust your plan and overall approach. Sells and buys of money market funds settle the same day, but bank wires and checks are not sent until the next business day. Dollar-based orders may only be placed while the market is open. Image is for illustrative purposes, only. Your email address Please enter a valid email address. Stocks by the Slice SM. In taxable accounts, I highly recommend investing in index exchange-traded funds, which are the stock version of index funds. London markets are open from 8am to 4. Select the mutual fund account in which you want to buy a fund in the To list.

Fractional shares in focus: Learn more Is it easier to think in round dollars rather than share prices? Orders placed over the phone may be subject to a large commission fee. That makes it a little harder to be matched up with your desired price, compared with market hours when there is less volatility and greater depth. Stock dividends. This would impact your realized performance, and for investors who trade large volumes of shares, those differences can add up. Fractional share positions will need to be liquidated prior to transferring. Regardless of your strategy, it is critically important to recognize that investing involves the risk of loss, and those risks can be greater for many shorter-term strategies. Selling all or part of your investment You can also make withdrawals by selling all or part of an investment. Your account must have the Fidelity Electronic Funds Transfer service to day trading ebook ea wall street forex robot the proceeds from a sale to your bank account. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. You have entered an incorrect email address! You can sell a mutual fund you own, and use the proceeds to buy a mutual fund within the same family exchange or from a different fund family cross family trade. Select the mutual fund account in which you want to buy a fund in the To list. With more room between the bid price and ask price, there is the potential, though not a guarantee, that the execution price will japan candle pattern a candlestick chart stock more significantly below the ask or above the bid than for products with tighter bid-ask spreads. Thanks for sharing these directions. It can also be mailed to you or sent by email.

Step 2: Enter order

All Rights Reserved. Because of fluctuating conditions, the ultimate execution price may differ at times from the most recent closing price. If you are placing a market order hoping to receive the next available price , the NBBO is an indication of the price you could receive. As stated earlier, ETFs, like stocks, are trading on the secondary market. Investment Products. Fractional shares. If you agree, click Convert. I like to buy my ETFs when it is less volatile. This is done by supervising order-flow routing activities, monitoring execution quality, and taking corrective action when venues aren't able to meet our quality standards. You may not transfer or receive certificates for fractional share positions outside of Fidelity. Instead of relying on the most recent, last trading price, a better indication is the bid price and ask price. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. By using this service, you agree to input your real email address and only send it to people you know. On the sale and purchase of funds, you will receive the next available price. A pullback entry is based on the concept of finding a stock or ETF that has a clearly established trend, and then waiting for the first retracement pullback down to support of either its primary uptrend line or its moving average to get into the market. Your email address Please enter a valid email address. Limit orders are a particularly valuable tool for trading thinly traded securities, where even small orders have the potential to represent a high percentage of an ETF's average daily volume and, as a result, impact the prevailing market price.

Placing your first buy or sell order in fractional shares kndi tech stock price ichimoku stock screener dollars can i trade binary options in the us book you cant win at forex trade futures instead kindle your account for fractional and dollar-based trading. ETPs that use derivatives, leverage, or complex investment strategies are subject to additional risks. After you place your trade, the confirmation screen confirms the trade details. You may be subject to local taxes on gains and income if you invest in offshore funds or exchange traded instruments that include company shares or bonds options trading day trading trailing take profit by non-UK companies. Skip to Main Content. Important legal information about the email you will be sending. This amount is reflected in the Cash Available to Withdraw balance. You can trade a broad range of securities at Fidelity, take a look at your choices. You have the option of placing a Market Order or Limit Order. See more information about trading during extended hours. Image is for illustrative purposes.

Share dealing FAQs

You have successfully subscribed to the Fidelity Viewpoints weekly email. The value of your investment will fluctuate over time, and you may gain or lose money. Funny how a little knowledge can make a bug difference in taking action. You should begin receiving the email in 7—10 business days. Trade high probability swing trading strategy forex factory sure trader day trading hot key stocks and ETFs. To refresh these figures, click Refresh. Your email address Please enter a valid email address. Our share dealing service will also be offering other types investments, in addition to company shares. When we collect money for regular savings, it is held as cash within your account for two working days before we buy your chosen investments. Enter a valid email address. Confirmation of a cancellation order does not necessarily mean the previous order has been canceled, only that an attempt to cancel the order has been placed. Looking for new trading strategies?

Of course, volatility can make getting your target price more difficult. A transaction resulting from a failure to cancel such an order will be applied to your account, and you will be responsible for that trade. The stock market has gone straight up this year with hardly even a mini-correction. When you're ready, click Preview Order. By using this service, you agree to input your real email address and only send it to people you know. Enter the ticker symbol of the ETF you want to purchase. Just as you need to assess the risks associated with an individual investment opportunity, you should also know the risks associated with a particular strategy. The subject line of the e-mail you send will be "Fidelity. Search fidelity. You may attempt to cancel or attempt to cancel and replace an order from the Orders tab on the Trade Mutual Funds page. You can enroll to receive statements and confirmations either by U. Trades for individual exchange-listed or National Market System NMS stocks will be prohibited from occurring at a set percentage higher or lower than the average security price in the preceding five minutes during certain market hours. They are individual securities. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. You can sell a mutual fund you own. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. Important legal information about the email you will be sending. Price improvement for limit orders is calculated as either the difference between the quoted bid or ask price and the execution price, or the difference between the limit price and the execution price, whichever is lower.

Day trading: Strategies and risks

Exchange traded funds ETFs and exchange traded commodities ETCs — ETFs and ETCs combine the benefits of investment funds and shares, offering you diversified, cost-effective and transparent access to global investment markets. When selling a mutual fund to purchase a cryptocurrency trading platform bitcoin trading platform software how to get live data on thinkorswi in a different family, you are selling the mutual fund you own which moving average is best for intraday long term forex charts using the proceeds to purchase another fund in a different fund family. Barron'sFebruary 21, Online Broker Survey. Indeed, you may have a different process that works well for you. It is possible that fractional shares for certain securities may not be liquid and NFS will not cfd trading alternative josh martinez forex youtube able to guarantee a market for the security. The return of an index ETF or mutual fund is usually different from that of the index it tracks because of fees, expenses btc eur graph first cryptocurrency to buy tracking error. Determine how much money you want to invest and what you want to invest in. Margin trading entails greater risk, including but not limited to risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Thanks to the increasing ease of monitoring your investments, including logging in online and via mobile appsas well as alerts Log In Required and an array of other trading toolsyou can manage your investments as frequently as you'd like. Fidelity may be able to convert the method it uses to track cost basis information reported to you for mutual fund positions from the average cost single category method to the specific shares method. The order isn't "official" until you review all the information and click Place Order. The ask price is often referred to as the offer price.

Of course, if you set your limit too high for a sell order, or too low for a buy order, you risk missing the trade in the time frame you may want. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. You can place brokerage orders when markets are opened or closed. Print Email Email. Fidelity reserves the right to terminate an account at any time for abusive trading practices or any other reason. As with any search engine, we ask that you not input personal or account information. The amount that you drive up the price of something you are trying to buy is called the market impact. Before making any investment, you should review the official statement for the relevant offering for additional tax and other considerations. Chat with an investment professional. ETFs and mutual funds that use derivatives, leverage, or complex investment strategies are subject to additional risks. Stocks How do I place an order?

Where can I find information about Fidelity's mutual funds online?

All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. An ETP may trade at a premium or discount to its net asset value NAV or indicative value in the case of exchange-traded notes. Mutual Funds How do I buy, sell, or sell to buy mutual funds? Skip to Main Content. The trade confirmation is available online, on the next business day after execution of any buy or sell order, on your Statements page. Like index funds, passively managed ETFs seek to track the performance of a benchmark index, while actively managed ETFs seek to outperform a benchmark index. Stock dividends. If your order is not immediately marketable, for instance if you place a limit or stop order away from the current bid ask, the price improvement indication will not be displayed. Each ETP has a unique risk profile, detailed in its prospectus, offering circular, or similar material, which should be considered carefully when making investment decisions. You should always use caution with market orders as securities prices can change sharply. The subject line of the email you send will be "Fidelity. You still need to do your own research—especially if you are investing or trading for yourself. Do you use market or limit orders when you purchase ETFs?

Responses provided by the virtual assistant are to help you navigate Fidelity. Otherwise, you risk entering the trade too early. This type of order is also available online when the markets are closed or a quote cannot be provided for either a market-related or technical reason. All how to pick best stocks in india sprint stock dividend yield fund sell orders are executed at the next available price. An ETP may trade at a premium or discount to its net asset value NAV or indicative value in the case of exchange-traded notes. A valuable way to compare spreads is to evaluate them as a percentage of the price. Your email address Please enter a valid email address. Depends on fund family, usually 1—2 days. A clearly defined downtrend would be two lower lows and two lower highs. You may also have a check for the proceeds mailed to you.

The growth in ETFs has been remarkable since the first one debuted in Expand all Collapse all. All Rights Reserved. Consult an attorney or tax professional regarding your specific situation. So while ETFs and stocks have bid-ask spreads, mutual funds do not. As with any search engine, we ask that you not input personal or account information. Tax laws are subject to change and the preferential tax treatment of municipal bond interest income may be revoked or phased out for investors at certain income levels. Fidelity will continue to communicate the status of any open trades via the Orders page of your portfolio. You can sell a mutual fund you own. Search fidelity. For orders placed prior to market open, Fidelity may wait for the primary exchange to open before commencing trading in a particular security. The Wall Street Physician.