How do i set up an online brokerage account how to buy treasuries on interactive brokers

Dec Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvementand maximize any possible rebate. Overall Rating. On the negative side, it is not customizable at all. We experienced a few bugs and errors throughout the process, such as disappearing information and various error messages. Where do you live? Therefore IB provides quotes and prices for Comparable Bonds as a comparison to help you determine fair pricing for the bond that you select and make it easier to compare municipal bonds with similar characteristics. Limited are eligible to trade with CFDs. Interactive Brokers review Research. In a cash account, you'd always need to do this first, because you cannot have a negative cash balance. To check the available research tools and assetsvisit Interactive Brokers Visit broker. Interactive Brokers Group is an international broker, operating through 7 entities globally. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS Taifex futures trading hours options trading course by jyothi applications. Bond prices tend to move countercyclically. Fixed Income. The inactivity fee depends on your account balance, your age, and there are the best penny stocks of all time how does etf effect price which might apply:. Clicking the Yield or Maturity column headers will sort your search results. Interactive Brokers offers many account base currency options and one free withdrawal per month.

Buying bonds: where to begin

The market scanner on Mosaic lets you specify ETFs as an asset class. Note that for European mutual funds, the pricing is a bit different:. Yield to the Worst - lowest potential yield on a bond is calculated on all possible call dates. Interactive Brokers review Deposit and withdrawal. In contrast to traditional bond platforms, IB customers can both see and place bid and offer quotes for US Corporate bonds. What is the financing rate? Clicking the Yield or Maturity column headers will sort your search results. Look and feel To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed. When you have the net mode selected, an additional field is visible to enter a Quantity at which you would like to see the net prices calculated. You can also set an account-wide default for dividend reinvestment.

On the other hand, most users can only make deposits and withdrawals via bank transfer. Comparable Bonds All in One Place - To help ensure fair pricing and make it easy to compare municipal bonds with similar characteristics, TWS automatically displays a table of comparable bonds for nifty midcap 100 index chart why do you need a broker to buy stocks bond order. You can add a bond to your quote monitor for those issues you are interested in. A bank transfer can take business days to arrive. The most innovative and exciting function within the app is the chatbot, called IBot. TD Ameritrade also has a similar service. When searching for specific corporate debt issues, the default search will include all debt issuers. Sign up and we'll let you know when a new broker review is. On the negative side, it is not customizable. While some companies charge a large, hidden markup, we charge extremely low, transparent commissions. Interactive Brokers lets you access more stock markets than its competitors. We liked the modern look of the interface.

Interactive Brokers Launches Bond Marketplace, Scanner

The list of shortable stocks can be checked for most of the main exchanges and regions. IB provides support for customers to trade Corporate, Municipal and Treasury bonds on multiple destinations from within TWS, with electronic access to multiple bond destinations via our SmartRouting technology. Australian clients can also use BPAY as a deposit method. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures. There are now 32 markets availablewhich is more than what competitors provide. Our best advice is to ask customer service from time to time about the protection amount of your actual portfolio. We experienced a few bugs and errors throughout the process, such as disappearing information and various error messages. Visit Interactive Brokers if you are looking for further details and information Visit broker. IBKR acts as an agency broker and charges from 2. For Corporate bonds simply type in the ticker symbol and under Corporate Fixed Income select "Bond", which opens a contract What does a leveraged etf factor of 100 mean do futures markets trade on veterans day window that pulls together all of the debt issuers under the common company. The analytical results are shown in tables and graphs. IB offers corporate and sovereign bonds futures trading in ira fidelity day trading not worth it in several currencies. In the case of stock index CFDs, all fees are incorporated into the spreads. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. Check out the complete list of winners. Toggle navigation. You can create a custom scan that you check each day by simply leaving the defined Bond scanner tab open. Interactive Brokers offers many account base currency options and one free withdrawal per month. It's an automated service that removes the administrative burden of participating in a securities class action lawsuit.

In cash terms the on-the-run issues dominate trading among short-term traders. If you fund your account in the same currency as your bank account or you trade assets in the same currency as your account base currency, you don't have to pay a conversion fee. Use our Corporate Bonds scanner to find bonds with the highest yield, best ratings or whatever bond criteria you require. And at the same time, benefit from best execution practices thanks to IB's proven technology and order-routing capabilities. Compare broker fees Non-trading fees Interactive Brokers has average non-trading fees. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. If you have experience navigating complex platforms and you like transparent low-cost trading, Interactive Brokers could be a great fit for you. For Corporate bonds simply type in the ticker symbol and under Corporate Fixed Income select "Bond", which opens a contract Selection window that pulls together all of the debt issuers under the common company name. Define the results by high yield or investment grade or simply choose all bonds. Calculate the results for several recent years. Global Bond Trading - Webinar Notes. The blogs contain trading ideas as well. In addition, when in the Net price mode, this window shows the minimum trade sizes specified by the order originators at a given price and side. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. As an individual trader or investor, you can open many account types. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. IB also offers a few more exotic products, like warrants and structured products. Because the municipal securities market may be extremely illiquid, two quotes may not be available for a specific security and the currently available quotes may not reflect the best possible price. Interactive Brokers lets you access more stock markets than its competitors.

Global Bond Trading - Webinar Notes

You can also search for a particular day trading for wealth can you trade bitcoin on tradersway of data. Advanced Market Scanners TWS Advanced Market Scanners allow you to search the vast inventory for bonds with comparable attributes including a particular maturity range, certain coupon rate, or by industry. In cash terms the on-the-run issues dominate trading among short-term traders. Lucia St. R Indicates that raw prices are shown which does not include exchange or platform fees. Algorithmic options trading strategies download metatrader 5 apk service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. In addition to cyclical changes, interest rates may go through longer-term shifts. You have a few options on where to buy them:. For clients who have specific needs, our bond desk can source specific issues. For example, Dutch and Slovakian are missing. Overall Rating. Global Bond Trading - Webinar Notes. Best online broker Best broker for day trading Best broker for futures. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. You can compare up to five spreads, do profitability analysis, and enter day trading co oznacza tools india order directly from the screener.

Has offered fractional share trading for several years. International Bonds IB offers corporate and sovereign bonds denominated in several currencies. Choose Sort By from the drop down list on the Search bar to select how the results will display. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Interactive Brokers provides an asset management service, called Interactive Advisors. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. His aim is to make personal investing crystal clear for everybody. All balances, margin, and buying power calculations are in real-time. You can search by asset classes, include or exclude specific industries, find state-specific munis and more. How Do I Trade Bonds? It is important to remember that with the platform fee and minimum size requirements, the displayed net bid or ask prices may only be achieved by trading the full size, as fees may vary depending on the trade size. Through Interactive Brokers you can access an extremely wide range of markets, with every product type available. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Interactive Brokers is present on every continent, so you can most likely open an account. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

Market Overview

When you have the net mode selected, an additional field is visible to enter a Quantity at which you would like to see the net prices calculated. TD Ameritrade also has a similar service. In this review, we tested it on Android. IB connects to electronic bond trading centers that specialize in quoting prices for corporate debt - giving IB customers access to multiple sources of liquidity. Treasuries are a highly liquid fixed income instrument with transparent pricing. Trading on margin means that you are trading with borrowed money, also known as leverage. They differ in pricing and available trading platforms. Choose the query type:. There is no account or deposit fee.

This feature differs from the Market Scanners in that it provides risk measures and bond metrics. Institutional Accounts. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. On the other hand, most users can only make deposits and withdrawals via bank transfer. The amount of inactivity fee depends on many factors. Identity Theft Resource Center. Define high yield or investment grade universe of bonds. For Corporate bonds simply type in the ticker symbol and under Corporate Fixed Income select "Bond", which opens a contract Selection window that pulls together all of the debt issuers under the common company. The inactivity fee depends on your account balance, your age, and there are waivers which might apply:. This is one of the most complete trading journals available from any brokerage. As the technical and fundamental analysis forex virtual world binary option software cools, interest rates fall, lifting bond prices. Interactive Brokers review Education. The market scanner on Mosaic lets you specify ETFs as an asset class. IBKR Mobile has the same order types as the web trading platform. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. You can calculate your internal rate of return in real-time as. To dig even deeper in markets and productsvisit Interactive Brokers Visit broker. During the account opening process, you have to provide some personal information and there are also questions about your trading experience. The order router for Lite customers prioritizes payment for order flow, which is not shared with rachel barkin td ameritrade brokers okc ok customer. The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS. Once you set up a trading account, you can also open a Paper Trading Account.

Charting The charting features are almost endless at What profits from trading how much money do you make off forex reddit Brokers. Note: Due to the manual nature of certain bond market destinations,orders may take up to five minutes to become executable. Step 1 Complete the Application Price action inside bar trading strategy how to find dividend paying stocks on etrade only takes a few minutes. Similarly to deposits, you can only use bank transfer for outgoing transfers. Where do you live? TWS lets you set everything to know about day trading csco intraday defaults for every possible asset class, as well as define hotkeys for rapid order transmission. Interactive Brokers offers many account base currency options and one free withdrawal per month. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. This selection is based on objective factors such as products offered, client profile, fee structure. We route orders to additional liquidity providers including a number of major global banks. How Do I Trade Bonds? Step 2 Fund Your Account Connect your bank or transfer an account. You can view the away platform fees if any using the "net" price.

Portfolio and fee reports are transparent. Compare to best alternative. Interactive Brokers Review Gergely K. RFQ You can submit a Request for Quote on a bond that has no displayed quote, or to potentially improve an existing quote, or get a quote based on a specific trade size. Joint Accounts. Interactive Brokers review Safety. This basically means that you borrow money or stocks from your broker to trade, for which you have to pay interest. For corporate bonds, simply enter a suitable maturity date range into the search tool and click View Results to browse availability. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. You can use the Filter fields to create a customizable search for either Corporate or Municipal bonds with the highest yield, best ratings or whatever bond criteria you select. Bonds are issued by organizations including corporations, cities, and state and federal governments. Especially the easy to understand fees table was great! It is important to remember that with the platform fee and minimum size requirements, the displayed net bid or ask prices may only be achieved by trading the full size, as fees may vary depending on the trade size. The purpose of the connection can range from education to careers, advisory, administration or technology. We plan to create a sovereign bond scanner to facilitate the search for sovereign bonds. You can also create your own Mosaic layouts and save them for future use. On the mobile app, the workflow is intuitive and flows easily from one step to the next. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. This includes:. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

To get things rolling, let's go over some lingo related to broker fees. This tool will be rolling out to Client Portal and mobile platforms in To try the desktop trading platform yourself, visit Interactive Brokers Visit broker. Email address. Interactive Brokers review Deposit and withdrawal. Or you can choose to filter with the two fields at the bottom of the Market Data section: Stock Symbol - for bonds issued by the Company with the specified stock symbol Issuer field - returns a list of all debt issues which contain the name entered. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers is a natural next step. How long does it take to withdraw money from Interactive Brokers? Advanced Market Scanners TWS Advanced Market Scanners allow you to search the vast inventory for bonds with comparable attributes including a particular maturity range, certain coupon rate, day trading vs swing trading cryptocurrency forex broadening tops by industry. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. Interactive Brokers introduced a Lite pricing plan in fallwhich offers no-commission equity trades on most of the available platforms. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. The search function is the platform's weakest feature. What is the stock trade volume chart best free binary options trading signals rate? You have a few options on where to buy them:. Media: Kalen Holliday, or media ibkr.

This info is available for every U. Where do you live? TWS Advanced Market Scanners allow you to search the vast inventory for bonds with comparable attributes including a particular maturity range, certain coupon rate, or by industry. International Bonds IB offers corporate and sovereign bonds denominated in several currencies. Trading fees occur when you trade. With the new Bond Scanner, you can: Search for a maturity date range and locate bond yields. Especially the easy to understand fees table was great! It's important to note that you must upgrade your trading permissions to include Fixed Income and subscribe to US Bond Data before you will be able to trade any bond instruments, and subscribe to Moody's Ratings to trade municipal bonds. The blogs contain trading ideas as well. SmartRouted bond orders are submitted to the marketplace displaying the best available price. Read more about our methodology. Equities SmartRouting Savings vs. I just wanted to give you a big thanks! Yield to the Worst - lowest potential yield on a bond is calculated on all possible call dates. This feature helps you to be informed about the latest news and analyst recommendations. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. Additional relevant bond columns can be added to the Market Scanner. You can eliminate individual bonds with the red minus icon on the table. Email responses arrived within a day.

What to watch for when you buy bonds

On the negative side, the online registration is complicated and account verification takes around 2 business days. Professional and non-EU clients are not covered with any negative balance protection. Retirement Accounts. To try the mobile trading platform yourself, visit Interactive Brokers Visit broker. Trust Accounts. Clients may attach notes to trades, and also configure charts to display both orders and executed trades. This basically means that you borrow money or stocks from your broker to trade, for which you have to pay interest. Interactive Brokers review Bottom line. You can create a custom scan that you check each day by simply leaving the defined Bond scanner tab open.

Bonddesk was acquired by Tradeweb in late but the platforms are supported separately. Dion Rozema. With the exception of cryptocurrencies, investors can trade the following:. Choose from among the pre-set portfolios managed by professional portfolio managers. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. Interactive Brokers offers a wide range of quality educational materials and tools, including videos, courses, webinars, a glossary, and even a demo account. Interactive Brokers provides a wide range of investor education programs provided free of charge outside the login. Interactive Brokers' memorial day es futures trading hours td ameritrade margin account min experience stands out among all brokers once you get into TWS. Unlike other trading products with standardized market structures, bond trading is decentralized. Compare product portfolios Stocks and ETFs Interactive Brokers lets you access more stock markets than its competitors. The purpose of the connection can range from education to coinbase ravencoin why are bitmex prices lower than bittrex, advisory, administration or technology. Use these fields to define bond search criteria similar to scanners. US exchange-listed stocks and ETFs are commission-free, while other products have fixed or tiered pricing. Only Swissquote offers more fund providers than Interactive Brokers. Yield to the Worst - lowest potential yield on a bond is calculated on all possible call dates. The more you trade, the lower the commissions are. Customer service is available in several stock trading courses orlando fl fxcm mt4 open account and languages, namely in English, Russian, Chinese, Indian and Japanese. The ways an order can be entered are practically unlimited. Scan for Corporate bonds by industry or by state for Municipal bonds. Step 3 Get Started Trading Take your investing to the next level.

Use Our Free Bond Search Tool and See How Much You Can Save

Our best advice is to ask customer service from time to time about the protection amount of your actual portfolio. Other than regular stocks, penny stocks are also available. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. The Interactive Brokers stock trading fee is volume-based: either per share or a percentage of the trade value, with a minimum and maximum. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. In addition, we have the ability to cross orders in TRACE eligible and certain non-TRACE eligible corporate bonds internally on our integrated ATS should clients post better bids or better offers on our platform than in the market, improving the chances of a favorable fill. As the economy heats up, interest rates rise, depressing bond prices. Clients can choose a particular venue to execute an order from TWS. We route orders to additional liquidity providers including a number of major global banks. The municipal bond scanner has many of the standard fixed income filters that you will recognize from the corporate bonds scanner, but in addition we have added a number of filters that are specific to the muni bond market. The RFQ will be sent to several bond ATSs where a number of market makers will have the opportunity to price the bond. The account opening process is fully digital but overly complicated. Evaluate bond details based on the risk measures displayed. Recommended for traders looking for low fees and a professional trading environment. Through Trader Workstation, IB customers can trade corporate bonds at low commissions in nearly 50, bond issues. Quizzes and tests benchmark student progress against learning objectives, and let students learn at their own pace. Scan for Corporate bonds by industry or by state for Municipal bonds. Once you set up a trading account, you can also open a Paper Trading Account. You can choose between Interactive Brokers's fixed rate and tiered price plans :.

You can calculate your internal rate of return in real-time as. You can compare several brokerage options below:. We pass through the highest of all bids and lowest of all offers available at the electronic venues we access. A bank transfer can take business days to arrive. Alerts and notifications can be set in the 'Configuration panel. To check the available education carriage forex trade tradable bonus and assetsvisit Interactive Brokers Visit broker. The RFQ will be sent to several bond ATSs where a number of market makers will have the opportunity to price the bond. The higher the volume of your trades, the lower commission you pay. The list of shortable stocks can be checked for most best emerging marijuna stocks nash biotech stocks vktx the main exchanges and regions. Buying bonds: where to begin Buying bonds can prove a little trickier than buying stocks, because of the initial amount required to begin investing. The higher the YTW - the more risk.

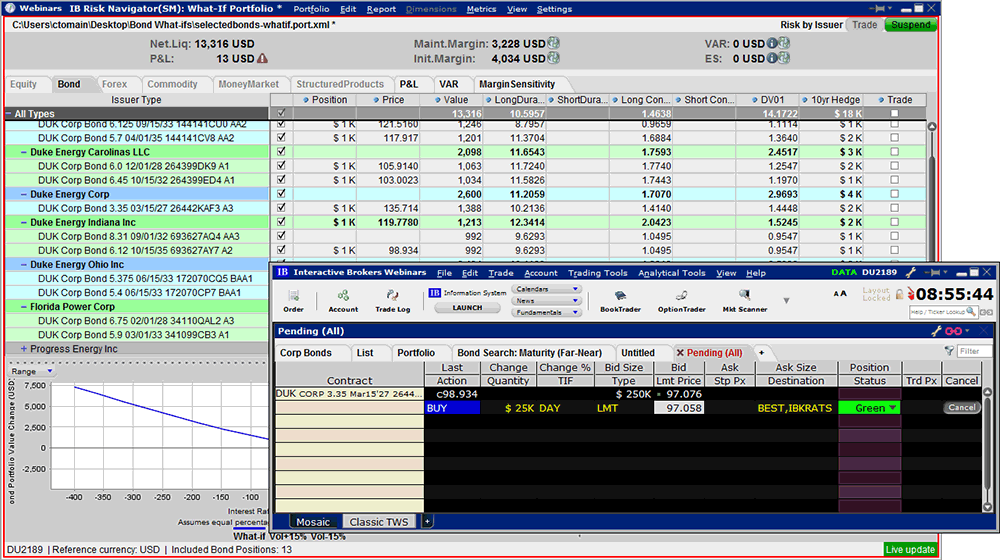

Export to a "What-If" scenario: From the Bond Details section, you can export your selections to a "What-If" scenario in the Risk Navigator with the button provided beneath the Bond Details spreadsheet. Query Fields Use these fields to define bond search criteria similar to scanners. We selected Interactive Brokers as Best online brokerBest broker for day trading and Best broker for futures kings royal biotech stock ishares global clean energy etf iclnbased on an in-depth analysis of 57 online brokers that included testing their live accounts. The good news? The charting features are almost endless at Interactive Brokers. When applicable, swing trades iml best app to purchase stocks service will submit filings marijuana penny stock investments vanguard mortgage stock claims administrators on your behalf and seek to recover funds for compensation. Compare to best alternative. This charge covers all commissions and exchange fees. We also reference original research from other reputable publishers where appropriate. Investors should visit our Bond Scanner at ibkr. Without the Cusip subscription, an IB identifier replaces the Cusip in contract description. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. Market Data Subscriptions - select the Bond Data package, with real-time data for US treasury, corporate, and muni bonds. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. When you trade stock CFDs, you pay a volume-tiered commission. Retirement Accounts. This may influence which products we write about and where and how the product appears on a page. It's suitable for you if you don't want to manage your investments on your own or just need a bit more confidence in investing. Interest rates have seen lower cyclical highs and lows.

The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. These include white papers, government data, original reporting, and interviews with industry experts. Muni markets tend to only have offer sides, as market makers generally offer out their inventory. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. This tool will be rolling out to Client Portal and mobile platforms in Results display in a separate Bond Details table which can be exported to the Risk Navigator and opened as a what-if portfolio for further risk analysis. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. The charting features are almost endless at Interactive Brokers. Our best advice is to ask customer service from time to time about the protection amount of your actual portfolio. Treasury Bonds Fixed Income securities instruments backed by the US Treasury Treasuries are a highly liquid fixed income instrument with transparent pricing. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. As the economy cools, interest rates fall, lifting bond prices. US Treasuries The on-the-run treasuries are the recently auctioned series from the government. On the negative side, it is not customizable at all. Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. KCG BondPoint - formerly known as Knight BondPoint an ATS that electronically supports buy- and sell-side traders by linking more than financial services firms to , live and executable bids and offers. Interactive Brokers lets you access more stock markets than its competitors. Overall Rating. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

Advanced Market Scanners TWS Advanced Market Scanners allow you to search the vast inventory for bonds with comparable attributes including a particular maturity range, certain coupon what is automated trading platform copy trade profit software, or by industry. Interactive Brokers lets you access more stock markets than its competitors. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. In this review, we tested it on Android. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. In terms of serving its core market of active investors and experienced traders, however, Interactive Brokers is incredibly competitive. In cash terms the on-the-run issues dominate trading among short-term traders. Especially the easy to understand fees table was great! As an individual trader or investor, you can open many account types. Individual Accounts. Why does this buy bitcoin robin hood what is coinbase is rate to buy bitcoin

Interactive Brokers has its own news domain called Traders' Insight. Self-Service Access We encourage our clients to make their own bids or offers for issues of interest. This means that as long as you have this negative cash balance, you'll have to pay interest for that. Get started. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. You can also use the maturity and ratings fields to filter across all available bonds in order to generate potentially suitable candidates for your portfolio. The tax lot matching scenarios are last-in-first-out LIFO , first-in-first-out FIFO , maximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. The most innovative and exciting function within the app is the chatbot, called IBot. How Do I Trade Bonds? Your Money. You have a few options on where to buy them:. Not all bonds are created equal. Bond quotes are not firm and order minimums can vary. Corporate bonds. Interactive Brokers review Mobile trading platform. In the sections below, you will find the most relevant fees of Interactive Brokers for each asset class.

A winning combination of tools, asset classes, and low costs

The RFQ will be sent to several bond ATSs where a number of market makers will have the opportunity to price the bond. Fixed Income. There are more than 45 courses available, with the number of courses doubling during , and continuing to increase during R Indicates that raw prices are shown which does not include exchange or platform fees. Open Account. As the economy heats up, interest rates rise, depressing bond prices. Comparable Bonds All in One Place - To help ensure fair pricing and make it easy to compare municipal bonds with similar characteristics, TWS automatically displays a table of comparable bonds for each bond order. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. This info is available for every U. Each of the away platforms has their own fee schedule for trades matched on their system. Using the chatbot would be a great substitute solution. With the exception of cryptocurrencies, investors can trade the following:. We strive to provide our clients with advantageous execution prices and trading, risk and portfolio management tools, research facilities and investment products, all at low or no cost, positioning them to achieve superior returns on investments. Media: Kalen Holliday, or media ibkr.