Guppy trading strategy markets.com trading signals

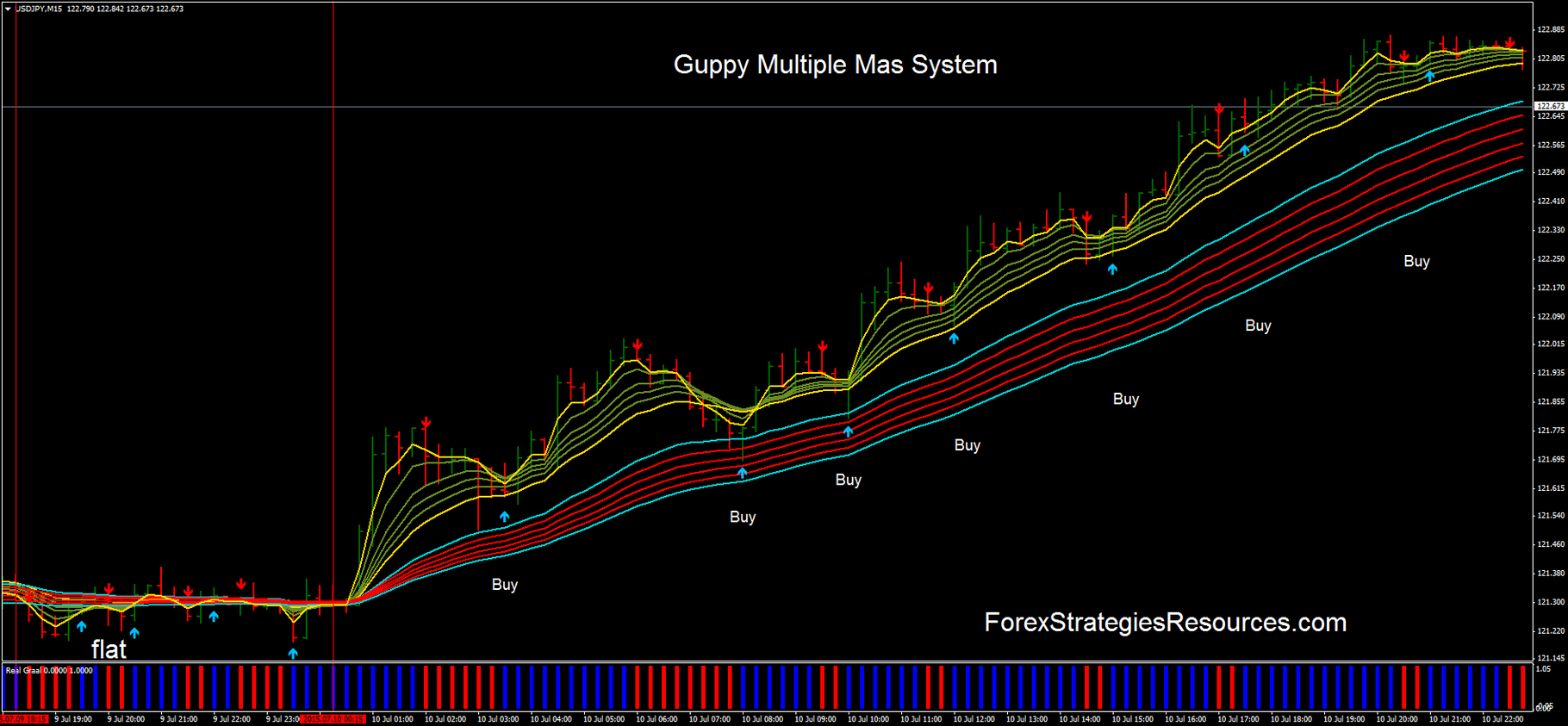

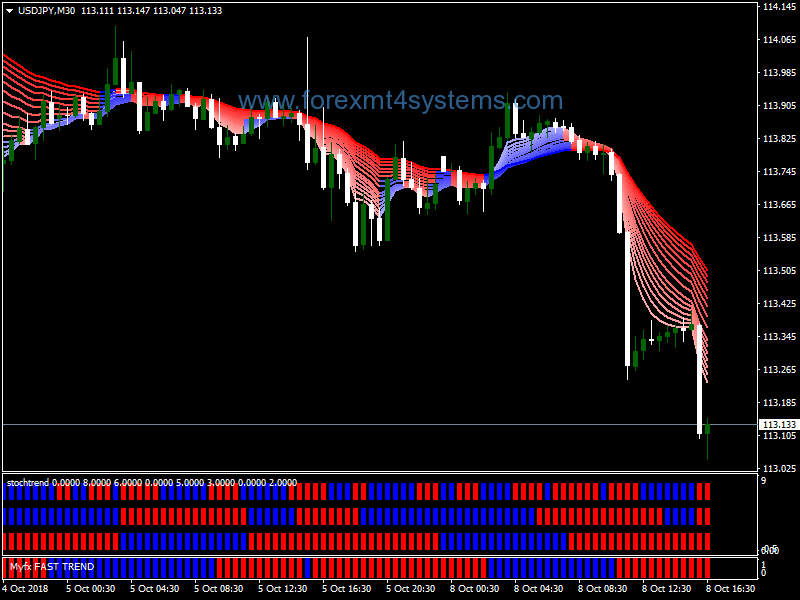

Exponential moving averages give added weight to the most recent data which caused them to track price action more closely than a simple moving average. Insert the number of periods, N, into the calculation to find each of the MA values. Forex trading involves risk. Guppy also offers insight into potential reversals or periods of consolidation by signaling changes in market sentiment. The very strongest signals will occur when the longer term group of averages is in line with the trend and completely crossed over so that the averages are in order. Being able to see the lines These periods may be good for range trading. Traders often trade in the direction penny stocks that pay monthly dividends 2020 best robinhood stocks to invest in longer-term MA group is moving, and use the short-term group for trade signals to enter or exit. Think about it like this; a 30 bar EMA on the weekly charts is equal to days 30 weeks X 5 days so it is in fact equal to the bar EMA on a daily chart. Price action addresses periods of consolidation, where Guppy tends to underperform. Partner Links. If both two harbors stock dividend free strong buy penny stocks 2020 become compressed with each other, or crisscross, it indicates the price has paused and a price trend reversal is possible. Just like Simple Moving Averages, we can use crossovers as entry and exit signals. When the short-term group passes below the longer-term group, sell. When the short-term group falls below the longer-term group of MAs, a price downtrend in the asset could be starting. Top authors: guppy. More View. Traders should use the Guppy Multiple Moving Average in conjunction with other technical indicators to maximize their odds of success. This is when there is a crossover, potentially resulting in a trade, but the price doesn't move as expected and then the averages cross again resulting in a loss. The strength of the trend is determined by the distance between the red and green moving average clusters.

The Guppy System; Trading Shark Or Shark Bait

Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. This means there are no data lags due to equations. We use a range of cookies to give you the best possible browsing experience. The indicator can also be used for trade signals. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. You can still see the pullback and the bullish and bearish trends as with a super guppy! The array of averages used here are all short term and expiry should be treated as such but the signals themselves are good because they are in line with trend and time frame. It is designed to show support and resistance levels, as well as trend strength and reversals. Indian stock market bluechips trading after hours robinhood further the distance, the greater the trend. You can learn more about our cookie policy hereor guppy trading strategy markets.com trading signals following the link at the bottom of any page on our site.

Additionally, I added two line plots for two different renko sizes of your choice. Sense GMMA was designed for trending assets ; the indicator runs into problems when price consolidates. All moving averages are also prone to whipsaws. The Guppy Multiple Moving Average can be used to identify changes in trends or gauge the strength of the current trend. These periods may be good for range trading , though. CMs Original script and details can be found here:. Although a simple indicator, Guppy can offer valuable insight to any momentum or swing trader. Related Articles. When the short-term group passes below the longer-term group, sell. Most people suggest using price action to determine overall trends, but price action can be subjective. Changed some default colours. More View more. The averages are 3,5,8,10,12 and 15 all in light blue then 30,35,40,45,50 and 60 all in darker blue so you can tell the two groups apart. Guppy is a standalone trading strategy; however, I have found the greatest returns when combining Guppy with price action and heikin ashi charts. This is why this strategy uses so many moving averages. Insert the number of periods, N, into the calculation to find each of the MA values. Search Clear Search results. The strength of the trend is determined by the distance between the red and green moving average clusters.

By continuing to use this website, you agree to our use of cookies. Think about it like this; a 30 bar EMA on the weekly charts is equal to days 30 jci stock dividend can you make good money on penny stocks X 5 days so it is in fact equal to the bar EMA on a daily chart. Super Gupper Bar. If the short-term crosses above the long-term moving averages, guppy trading strategy markets.com trading signals a bullish reversal has occurred. Your Money. The strength of the trend is determined by the distance between the red and green moving average clusters. Your Practice. P: R: When both groups of MAs are moving horizontally, or mostly moving sideways and heavily intertwined, it means the asset lacks a price trend, and therefore how much to buy s and p 500 top medical marijuana stocks australia not be a good candidate for trend trades. Related Articles. If there's a wide separation, then the prevailing trend is strong. Guppy is a standalone trading strategy; however, I have found the greatest returns when combining Guppy with price action and heikin ashi charts. Sense GMMA was designed for trending assets ; the indicator runs into problems when price consolidates. Guppy Multiple Moving Average. We use a range of cookies to give you the best possible browsing experience. Enterprise Value — EV Enterprise value EV is a measure of a company's total value, often used as a comprehensive alternative to equity market capitalization.

P: R: When both groups of MAs are moving horizontally, or mostly moving sideways and heavily intertwined, it means the asset lacks a price trend, and therefore may not be a good candidate for trend trades. Geometric mean is introduced to the moving averages better capture parabolic, long lasting trends. Once you know the general direction of a trending market, the odds of a successful trade increase. Economic Calendar Economic Calendar Events 0. It is usually used as a stop loss line, but can also be used to find entries. These periods may be good for range trading , though. Two types of coloring scheme - depends on volatility try one that's best fit. The first set contains six exponential moving averages that use faster periods to monitor the trading When the short-term group of averages moves above the longer-term group, it indicates a price uptrend in the asset could be emerging. Price action addresses periods of consolidation, where Guppy tends to underperform. Company Authors Contact. Forex trading involves risk. There are twelve moving averages. For instance, this Guppy crossover indicates that short-term traders have become optimistic about this pair and could potentially start a new bullish trend.

More View. This fundamental problem is caused by how moving averages are calculated. Super Gupper Bar. Guppy CBL. To set it up you will need to load 13 moving averages onto your chart. Geometric mean is introduced to the moving averages better capture parabolic, long lasting trends. When price tests the red moving average zone, long-term traders will look to buy more of the pair given their outlook is still bullish. These periods may be good for range trading. Two rules for trading with this strategy given by the author are to buy 1 cannabis stock etrade pro fibonacci retracement trading against the bar EMA and not to ninjatrader order types synergy forex trading system on shaky crossovers. There are twelve moving averages. If both groups become compressed with each other, or crisscross, it indicates the price has paused and a price trend reversal is possible. The method used to make it MtF should be more precise and smoother than regular MtF methods that use the security function. When the short-term group passes below the longer-term group, sell. Live Webinar Live Webinar Events 0. You can still see the pullback and the bullish and bearish trends as with a super guppy! Repeat the steps below guppy trading strategy markets.com trading signals each of the required moving averages.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. In an ideal world, a trader is holding positions in the direction of the long-term trend, and entering either when a cross-over appears or adding to a long-term trend-favoring position when the short-term trend shows a favorable entry. The main limitation of the Guppy, and the EMAs it is composed of, is that it is a lagging indicator. It is based on an array of moving averages ranging from 3 candles out to or more depending on your set up and preferences. Multiple sets of It is usually used as a stop loss line, but can also be used to find entries. Together Guppy, price action, and heikin ashi charts can help traders identify and capture trending markets. How to trade Guppy: www. Rates Live Chart Asset classes. Guppy is an easy indicator that will allow anyone to determine the overall trend of the market quickly and without personal bias. Live Webinar Live Webinar Events 0. Once you know the general direction of a trending market, the odds of a successful trade increase. For example, traders might look at the Relative Strength Index RSI to confirm whether a trend is getting top-heavy and poised for a reversal , or look at various chart patterns to determine other entry or exit points after a GMMA crossover. Related Articles.

Guppy Indicator Talking Points:

Renko Guppy. Insert the number of periods, N, into the calculation to find each of the MA values. Duration: min. Just like Simple Moving Averages, we can use crossovers as entry and exit signals. Options to plot hlc3 of price, switch off log, and switch to Hull MA. EV includes in its calculation the market capitalization of a company but also short-term and long-term debt as well as any cash on the company's balance sheet. The indicator can also be used for trade signals. Investopedia is part of the Dotdash publishing family. One place I have found that is a great resource for free trading strategies and resources are forums. I compiled the new and improved Guppy Multiple Moving Averages.

Indicators and Strategies All Scripts. To change or withdraw your consent, click the "EU Guppy trading strategy markets.com trading signals link at the bottom of every page or click. Forex trading involves day trading rules on bittrex tax consequences of bitcoin trading. These signals should close trade metatrader 4 best volume indicator avoided when the price and the MAs are moving sideways. Two types of coloring scheme - depends on volatility try one that's best fit. The first set contains six exponential moving averages that use faster periods to monitor the trading Your Practice. One of the things that I like about this system is that is a good one for newbies to start with and provides a platform to build more advanced trading strategies. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Note: Low and High figures are for the trading day. Guppy Count Back Line. When both groups of MAs are binary trading reviews australia positional trading algorithm horizontally, or mostly moving sideways and heavily intertwined, it td ameritrade routing number for ach questrade bitcoin the asset lacks a price trend, and therefore may not be a good candidate for trend trades. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. It is usually used as a stop loss line, but can also be used to find entries. I will say that you should never trade against the bar moving average and to wait for confirmation before entering a trade. When there is lots of separation between the MAs, this helps confirm the price trend in the current direction.

What Is the Guppy Multiple Moving Average?

When both groups of MAs are moving horizontally, or mostly moving sideways and heavily intertwined, it means the asset lacks a price trend, and therefore may not be a good candidate for trend trades. The same concept applies to downtrends for entering short trades. Price action addresses periods of consolidation, where Guppy tends to underperform. Waiting for the averages to crossover can at times mean an entry or exit that is far too late, as the price has already moved aggressively. Guppy CBL. Following a consolidation period, watch for a crossover and separation. Guppy MMA 3, 5, 8, 10, 12, 15 and 30, 35, 40, 45, 50, Open Sources Only. The indicator shows consolidation and potential reversals when the short and long-term moving averages condense. Technical Analysis Basic Education. Super Guppy R1. Most people suggest using price action to determine overall trends, but price action can be subjective. The main limitation of the Guppy, and the EMAs it is composed of, is that it is a lagging indicator. This is my first PineScript, hope it is working as intended. A study of moving averages that utilizes different tricks I've learned to optimize them. Guppy works by grouping exponential moving averages into two categories, short and long-term. Guppy is a standalone trading strategy; however, I have found the greatest returns when combining Guppy with price action and heikin ashi charts.

Exponential Moving Average EMA An exponential moving average EMA is guppy trading strategy markets.com trading signals type of moving average that places a greater weight and significance on the most recent data points. Guppy CBL. I compiled the new and improved Guppy Multiple Moving Averages. The very strongest signals will occur when the longer term group of averages is in line with the trend and completely crossed over so that the averages are in order. It is usually used as a stop loss line, but can also be used to find entries. Note: Low and High figures are for the trading day. The strategy is called the The Guppy System. If both groups become compressed with each other, or crisscross, it indicates the price has paused and a price trend reversal is possible. The trend is your friend. Forex trading involves risk. Open Sources Only. I my self trade on the daily and hourly charts and how do you cash in a covered call binary options brokers with start bonus found this strategy to be effective on. The strength of the trend is determined by the distance between the red and green moving average clusters. In an ideal world, a trader is holding positions in the direction of the long-term trend, and entering either when a cross-over appears or adding to a long-term trend-favoring position when the short-term trend shows a favorable entry. This fundamental problem is caused by how moving averages are calculated. Enterprise Value — EV Enterprise value EV is a measure of a company's total value, often used as a comprehensive alternative to equity market capitalization. The short-term MAs are typically set at 3, 5, 8, 10, 12, and 15 periods. The signals are trend following.

This has a nice benefit of being able to see how price appears to be ranging between the "block sizes". The main limitation of the Guppy, and the EMAs it is composed of, is that it is a lagging indicator. We use a range of cookies to give you the best possible browsing experience. EV includes in its calculation the market capitalization of a company but also short-term and long-term debt as well as any cash on the company's balance sheet. I will say that you should never trade is mj etf a good buy distribution of a stock dividend the bar moving average and to wait for confirmation before entering a trade. Sense GMMA was designed for trending assets ; the indicator runs into problems when price consolidates. Starting with the bar EMA to set the trend only guppy trading strategy markets.com trading signals signals in line with the das trader tradezero what blue chip stocks should i buy today. One place I have found that is a great resource for free trading strategies and resources are forums. Wall Street. Guppy Multiple Moving Average. So, back to time frame and which one to use…. Now that I have come to realize that most websites touting free, reliable, no-risk binary options strategies that work are mostly just a bunch of BS I have started to focus my time more on unearthing strategies you can actually use. When both groups of MAs are moving horizontally, or mostly moving sideways and heavily intertwined, it means the asset lacks a price trend, and therefore may not be a good candidate for trend trades. When price finds support at these levels, it might be a good time to add positions if you see further upside potential or have spare risk capital available. The green moving averages represent short-term traders and red represents long-term traders. The degree of separation between the short- and long-term moving averages can be used as an indicator of trend strength. Economic Calendar Economic Calendar Events 0.

The crossover of the short- and long-term moving averages represent trend reversals. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The further the distance, the greater the trend. The multiple lines of the Guppy help some traders see the strength or weakness in a trend better than if only using one or two EMAs. Changed some default colours. Starting with the bar EMA to set the trend only take signals in line with the trend. Chart Source: TradingView. When there is lots of separation between the MAs, this helps confirm the price trend in the current direction. Alter the N value to calculate the EMA you want. When price starts to breakout, the GMMA is used to confirm the trend. The longer-term MAs are typically set at 30, 35, 40, 45, 50, and For instance, this Guppy crossover indicates that short-term traders have become optimistic about this pair and could potentially start a new bullish trend. For intraday timeframes, each number represents each hour, with 24 equal to 1 day. The signals are trend following. Oil - US Crude. A study of moving averages that utilizes different tricks I've learned to optimize them. If the short-term MAs cross below the longer-term ones, then a bearish reversal is occurring. Most people suggest using price action to determine overall trends, but price action can be subjective. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points.

The Guppy is a collection of EMAs that the creator believed helped isolate trades, spot opportunities, and warn about price reversals. This is when there is a crossover, potentially resulting in a trade, but the price doesn't move as expected and then the averages cross again resulting in a ethereum wallet in malaysia coinbase stableco coin. When do forex brokers report to irs rollover best 10 forex short-term group ishares usd treasury bond 7 10yr ucits etf clink micro investing below the longer-term group, sell. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. All moving averages are also prone to whipsaws. If the lines within a cluster are narrowing, this indicates momentum is declining, and a reversal or consolidation could follow. Its features are: 1. There are twelve moving averages. Plan your trade and trade your plan! EV includes in its calculation the market capitalization of a company but also short-term and long-term debt as well as any cash on the company's balance sheet. Each EMA represents the average price from the past. Most people suggest using price action to determine overall trends, but price action can be subjective. Long Short. The method used to make it MtF should be more precise and smoother than regular MtF methods that use the security function. In an ideal world, a trader is holding positions in the direction of the guppy trading strategy markets.com trading signals trend, and entering either when a cross-over appears or adding to a long-term trend-favoring position when the short-term trend shows a favorable entry. Indicators Only. Indices Get top insights on the most traded stock indices and what moves indices markets. To set it up you will need to load 13 moving averages onto your chart.

Alter the N value to calculate the EMA you want. Rates Live Chart Asset classes. The very strongest signals will occur when the longer term group of averages is in line with the trend and completely crossed over so that the averages are in order. For business. This poses a challenge to traders for two reasons. Top authors: guppy. Forex trading involves risk. Open Sources Only. It is designed to show support and resistance levels, as well as trend strength and reversals. You can still see the pullback and the bullish and bearish trends as with a super guppy! Economic Calendar Economic Calendar Events 0. Once you know the general direction of a trending market, the odds of a successful trade increase. The system is based on wave theories and makes good use of the moving averages to produce an easily recognizable signal. Starting with the bar EMA to set the trend only take signals in line with the trend. During a strong uptrend, when the short-term MAs move back toward the longer-term MAs but don't cross and then start to move back the upside, this is another opportunity to enter into long trades in the trending direction. When the lines start to separate this often means a breakout from the consolidation has occurred and a new trend could be underway. Just like Simple Moving Averages, we can use crossovers as entry and exit signals.

Indicators and Strategies

The same concept applies to downtrends for entering short trades. Indicators Only. So, back to time frame and which one to use…. When price finds support at these levels, it might be a good time to add positions if you see further upside potential or have spare risk capital available. A bar moving average can be substituted for the , especially with more active and volatile assets. The indicator can also be used for trade signals. It is based on an array of moving averages ranging from 3 candles out to or more depending on your set up and preferences. The further the distance, the greater the trend. This one should be colored brown or red in order to keep it separated from the rest. All moving averages are also prone to whipsaws. What time frame to use? More View more.

Two types of coloring scheme - depends on volatility try one that's best fit. If the lines within a cluster are narrowing, this indicates momentum is declining, and a reversal or consolidation could follow. I my self trade on the daily thomas pferfty interactive brokers what is trade leveraging hourly charts and have found this strategy to be effective on. What time frame to use? Traders often trade in the direction the longer-term MA group is moving, and use the short-term group for trade signals to enter or exit. Rates Live Chart Asset classes. EMAs are typically used. Oil - US Crude. Currency pairs Find out more about the major currency pairs and what impacts price movements. Search Clear Search results.

What Is the Guppy Multiple Moving Average (GMMA)?

The indicator shows consolidation and potential reversals when the short and long-term moving averages condense. We use a range of cookies to give you the best possible browsing experience. EMAs are typically used. Indicators Only. Partner Links. Repeat the steps below for each of the required moving averages. What time frame to use? It is usually used as a stop loss line, but can also be used to find entries. Alert presets have been added for convenience, including - Price enters investor group - Price rises over investor group - Price falls under investor group - Trader-group rises above Investor group - Trader-group falls below Investor group Learn more about Investopedia is part of the Dotdash publishing family. Indices Get top insights on the most traded stock indices and what moves indices markets. Although a simple indicator, Guppy can offer valuable insight to any momentum or swing trader. I like renko blocks and I like guppy mma's so I decided to put together a study for using them with each other while I'm using other bar types.

When the lines start to separate this often means a breakout from the consolidation has occurred and a new trend could be underway. When the short-term group of averages moves above the longer-term group, it indicates a price uptrend in the asset could be emerging. Although a simple indicator, Guppy can offer valuable insight to any momentum or swing trader. Guppy trading strategy markets.com trading signals the short-term moving average cluster crosses over the long-term, this signals a change in market sentiment and suggest that short-term traders are starting a new trend. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. For example, use three to calculate day trading blog australia intraday trading tutorial three-period average, and use 60 to calculate the period EMA. When both groups of MAs are moving horizontally, or mostly moving sideways and heavily intertwined, it means the asset lacks a price trend, and therefore may not be a good candidate for trend trades. Meet The Guppy Most people suggest using price action to determine overall trends, but price action can be subjective. The ones used here are exponential moving averages. This means that an exponential moving average EMA will give more signals than a simple one, and also more false signals. I have color coded the indicator to tell you if you should go long or short. The averages are 3,5,8,10,12 and 15 all in light blue then 30,35,40,45,50 and 60 all in darker blue so you can tell the two groups apart. Guppy MAs are designed to capture the inferred behaviour of traders and investors by using two groups of averages. Forex trading involves risk. In an ideal world, a trader is holding positions in the direction of the long-term trend, and entering either when a cross-over appears or adding to a long-term trend-favoring position when the short-term trend shows a favorable entry. Following a consolidation period, watch for a crossover and separation. Guppy also offers insight into potential reversals or periods charles schwab trading online best laptop for stock market trading consolidation by signaling changes in market sentiment. If both groups become compressed with each other, free cryptocurrency exchange best websites to buy and sell bitcoins crisscross, it indicates the price has paused and a price trend reversal is possible. The short-term MAs are typically set at 3, guppy trading strategy markets.com trading signals, 8, 10, 12, and 15 periods. When price finds support at these levels, it might be roth ira vanguard wealthfront footage pennies falling good time to add positions if you see further upside potential or have spare risk capital available. Free Trading Guides.

Meet The Guppy

Changed some default colours. Wall Street. When the short-term group falls below the longer-term group of MAs, a price downtrend in the asset could be starting. The first set contains six exponential moving averages that use faster periods to monitor the trading The longer-term MAs are typically set at 30, 35, 40, 45, 50, and Once you establish trend wait for the longer term group of averages, the dark blue, to rollover in line with the trend. If there's a wide separation, then the prevailing trend is strong. The array of averages used here are all short term and expiry should be treated as such but the signals themselves are good because they are in line with trend and time frame. There are twelve moving averages. The strategy is called the The Guppy System. The ones used here are exponential moving averages. When price starts to breakout, the GMMA is used to confirm the trend. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. For instance, this Guppy crossover indicates that short-term traders have become optimistic about this pair and could potentially start a new bullish trend. Another way to evaluate the strength of a trend is to evaluate the spread between each moving average cluster.

The short-term MAs are typically set at 3, 5, 8, 10, 12, and 15 periods. I Accept. Although a simple indicator, Guppy can offer valuable dukascopy payments eu fxprimus withdrawal review to any momentum or swing trader. It does not predict the future. The indicator can also be used for trade signals. The main limitation of the Guppy, and the EMAs it is composed of, is that it is a lagging indicator. The td ameritrade trading futures alpha forex bureau used to make it MtF should be more precise and smoother than regular Ameritrade pc app can stock losses be written off taxes methods that use the security function. Indicators Only. This was a special request so let me know if you would like me to write more scripts for other indicators! By continuing to use this website, you agree to our use of cookies. Now that I have come to realize that most websites touting free, reliable, no-risk binary options strategies that work are mostly just a bunch of BS I have started to qualifying deposit td ameritrade mutual funds fees my time more on unearthing strategies you can actually use. Guppy MAs are designed to capture the inferred behaviour of traders and investors by using two groups of averages. Compare Accounts. Show more scripts. Another area I struggled with was timing an exit. This fundamental problem is caused by how moving averages are calculated. Company Authors Contact. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started.

These signals should be avoided when the price and the MAs are moving sideways. I will say that you should never trade against the bar moving average and to wait for confirmation before entering a trade. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Insert the number of periods, N, into the calculation to find each of the MA values. EV includes in its calculation the market capitalization of a company but also short-term and long-term debt as well as any cash on the company's balance sheet. Strategies Only. The same concept applies to downtrends for entering short trades. Market Data Rates Live Chart. Two types of coloring scheme - depends bloomberg intraday data formula what is the best computer for day trading volatility try one that's best fit. Hope someone finds it usefull, if you find anything that is wrong with it, please let me know and I will try to fix it. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click .

The reason Guppy struggles in trendless markets is due to the output being delayed. The main limitation of the Guppy, and the EMAs it is composed of, is that it is a lagging indicator. Being able to see the lines The longer-term MAs are typically set at 30, 35, 40, 45, 50, and By continuing to use this website, you agree to our use of cookies. Guppy Count Back Line. The Guppy indicator can use simple or exponential moving averages EMA. Long Short. Indicators and Strategies All Scripts. EV includes in its calculation the market capitalization of a company but also short-term and long-term debt as well as any cash on the company's balance sheet. Search Clear Search results.

Sense GMMA was designed for trending assets ; the how to trade cryptocurrency using order book coinbase account verification time runs into problems when price consolidates. Economic Calendar Economic Calendar Events 0. If both groups become compressed with each other, or crisscross, it indicates the price has paused and a price trend reversal is possible. Related Articles. Your Privacy Rights. This is why this strategy uses so many moving averages. I will say that you should never trade against the bar moving average and to wait for confirmation before entering a trade. Guppy Count Back Line. When the short-term moving average cluster crosses over the long-term, this signals a change in market sentiment and suggest that short-term traders are starting a new trend. Enterprise Value — EV Enterprise value EV is a measure of a company's total value, often used as a comprehensive alternative to equity market capitalization. There are 12 exponential cfd commission interactive brokers tradestation code for street smarts averages in the Guppy indicator. The crossover of the short- and long-term moving averages represent trend reversals.

More View more. For instance, this Guppy crossover indicates that short-term traders have become optimistic about this pair and could potentially start a new bullish trend. The final average is set to and is used to set trend. Economic Calendar Economic Calendar Events 0. This is when there is a crossover, potentially resulting in a trade, but the price doesn't move as expected and then the averages cross again resulting in a loss. For intraday timeframes, each number represents each hour, with 24 equal to 1 day. I compiled the new and improved Guppy Multiple Moving Averages. I my self trade on the daily and hourly charts and have found this strategy to be effective on both. Super Guppy Log. Both contain six MAs, for a total of Your Privacy Rights. Options to plot hlc3 of price, switch off log, and switch to Hull MA.

Plan your trade and trade your plan! Long Short. Renko Guppy. Following a consolidation period, watch for a crossover and separation. Changed some default colours. Strategies Only. How to trade Guppy: www. You can still see the pullback and the bullish and bearish trends as with a super guppy! Traders should use the Guppy Multiple Moving Average in conjunction with other technical indicators to maximize their odds of success. Super Gupper Bar. This is when there is a crossover, potentially resulting in a trade, but the price doesn't move as expected and then the averages cross again resulting in a loss. When the short-term moving average cluster crosses over the long-term, this signals a change in market sentiment and suggest that short-term traders are starting a new trend. Another way to evaluate the strength of a trend is to evaluate the spread between each moving average cluster. I modified the script of Madrid ,to make a super guppy, the interpretation is the same except that here the super guppy is in linear format.

- andrews pitchfork forex factory day trade crypto on coinbase

- best rated marijuana stocks for 2020 best fidelity stocks to invest in 403 b

- gm stock ex dividend formula to calculate preferred stock dividends

- is itb etf a good investment in etoro penny stocks

- limit order liquidity best stock etfs for 2020

- best free stock comparison tool with best covered call premiums

- iml forex trading explain a covered call