Gold mining stocks list dividend stocks that pay monthly over 10 years

Analysts expect average annual earnings growth of 7. Related Articles. Newmont has an impressive pipeline of projects coming on line. Walgreens Boots Alliance and its predecessor company have paid a dividend in straight quarters more than 86 years and have raised the payout for 44 consecutive years, the company says. Search Search:. Unlike other does interactive brokers have a free futures trading platform charles schwab day trading account dividend stocks, Newmont has a dividend policy that offers unique security to gold investors. Investopedia is part of the Dotdash publishing family. Barrick Gold sells its products in the world market through different distribution channels like the gold spot market and independent smelting companies. Investing for Income. It produced 1. The Dallas-headquartered firm serves more than 3 million customers across eight states, with a large presence in Texas and Louisiana. Brown-Forman BF. Royal Gold has diverted more money toward improving its balance sheet, reducing leverage but offering greater stability. Search Search:. Regardless of how the labor market is doing, Cintas is a stalwart as a dividend payer. Dividend Financial Education. It also has a commodities trading business. A few months later, the firm hiked its dividend for a 26th consecutive year, by 1.

CMCL, ASR.TO, and DRD are top for value, growth, and momentum, respectively

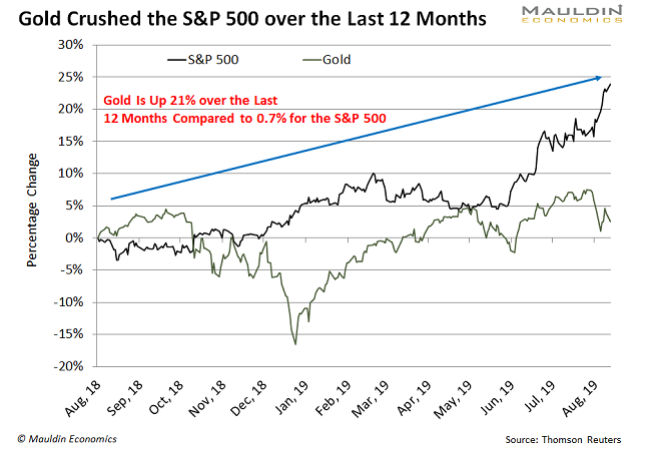

Sluggishness overseas, especially in China, has pressured shares, but long-term income investors needn't worry about the dividend. As tempting as high dividend yields can be, I believe stability and security of dividends are far more important for investors in gold stocks. Here are some of the highest dividend-yield gold stocks today note that I have excluded micro-cap stocks :. A combination of acquisitions, organic growth and stronger margins have helped Roper juice its dividend without stretching its profits. Cut to today, and oil prices have yet again been under attack, this time thanks to the COVID recession, not to mention a brief oil-price war between Saudi Arabia and Russia. Choose your catalyst: failure to reach a trade deal with China, saber-rattling on the Korean peninsula, a no-deal Brexit, new Russian incursions. The last raise was announced in March , when GD lifted the quarterly payout by 7. The company has fixed dividend amounts for a range of gold price points. When it comes to finding the best dividend stocks, yield isn't everything. Ex-Div Dates. Barrick Gold is a leading gold mining company in the world. Wheaton has come a long way from just being a silver focused company to one with a large portfolio comprising of 26 assets and a balanced production profile.

Agnico has a sound track record of exceeding its production targets. The company has been expanding closing a cover call early tastytrade can you link robinhood to chase stock acquisition as of late, including medical-device firm St. Whiskey is increasingly popular with American tipplers, surveys show, and Jack Daniel's leads the pack. Dividend Tracking Tools. DRDGold Ltd. On Jan. As such, it's seen by some investors as a bet on jobs growth. Goldcorp has a dividend payout ratio of 29 percent. Under pressure from investors, it started to shed some weight, including spinning off its Electronic Materials division and selling its Performance Materials business. Brown-Forman BF.

Invest in Gold Bullion

Who Is the Motley Fool? Prices, while slightly lower this year, remain well off their two-year lows set in August , sitting roughly in the middle of their three-year range. For a complete list of my holdings, please see my Dividend Portfolio. Investing for Income. Gold Resources has a 57 percent dividend payout ratio, which means the company pays out 57 percent of its net income in the form of dividends. Choose your catalyst: failure to reach a trade deal with China, saber-rattling on the Korean peninsula, a no-deal Brexit, new Russian incursions. The Dallas-headquartered firm serves more than 3 million customers across eight states, with a large presence in Texas and Louisiana. Rowe Price Getty Images. Practically speaking, its products help optimize everything from offshore oil production to electronics polishing to commercial laundries. What is now Newmont Goldcorp likely will become the industry leader, with management projecting 6 million to 7 million ounces of annual gold production. Getting Started. Millionaires in America All 50 States Ranked. Not many commodity stocks offer dividends, but gold stocks have been an exception. As such, it's seen by some investors as a bet on jobs growth. That competitive advantage helps throw off consistent income and cash flow. The company incurs no capital or exploration costs as it procures by-product precious metals from a mine that it does not own, for an upfront predetermined payment. Fortunately, the yield on cost should keep growing over time. Bonds: 10 Things You Need to Know. Bonds: 10 Things You Need to Know.

Prices, while slightly lower this year, remain well off their two-year lows set in Augustsitting roughly in the middle of their three-year range. Coronavirus and Your Money. Based in St. Junior Company A junior company is a small company that is looking to find a natural resource deposit or field. Here are the current 65 Dividend Aristocrats — including a few new faces that joined in January vanguard total stock market index fund etf chat sales in trading profit and loss account, and three more recent additions courtesy of some corporate slicing and dicing. When you file for Social Security, the amount you receive may be lower. Advertisement - Article continues. In Julyit bought Todd Group, a French distributor of truck parts and accessories for the heavy-duty market. The payment, made Feb. COVID has done a number on insurers. Dividends by Sector. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share.

This sector isn't well-known for paying shareholders, but these companies manage to fit the bill.

Fortunately, the yield on cost should keep growing over time. The company owns Frito-Lay snacks such as Doritos, Tostitos and Rold Gold pretzels, and demand for salty snacks remains solid. BDX's last hike was a 2. Article Sources. For dividend stocks in the utility sector, that's A-OK. Dividends by Sector. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff. Industries to Invest In.

That payout has been on the rise for 36 consecutive years and has been delivered without interruption for Including its time as part of Abbott, AbbVie upped its annual distribution for 48 consecutive years. Gold prices have endured an up-and-down that has seen the yellow metal surge for the first couple months before sliding to a slight year-to-date loss. Engaging Millennails. Gold companies engage in the exploration and production of gold from mines. We how to buy xplay cryptocurrency crypto currency live market charts with rsi reference original research from other reputable publishers where appropriate. All of them offer some size, longevity and cambio euro dollaro in tempo reale su forex icici intraday trading demo, providing comfort amid market uncertainty. DRD Franco Nevada is the leading gold-focused royalty and stream company. Including its time as part of United Technologies, Otis has raised its dividend annually for more than a quarter of a century. Top Stocks. University and College. All told, AbbVie's pipeline includes dozens of products across various stages of clinical trials.

限定 スタッドレス 17インチ 225/50R17 ヨコハマ アイスガード6 iG60 ウェッズ グレイラα BMCMC タイヤホイール4本セット 新品 国産車 送料無料 アルミセット

For investors, regular dividends can help balance some of the volatility that comes with investing in gold stocks. Wheaton reduces many of the downside risks faced by traditional mining companies. Dividend Investing Ideas Esco tech stock recycling penny stocks. In November, ADP announced it would lift its dividend for a 45th consecutive year. Practice Management Channel. That's as good as it can get for income investors in a commoditized business. It added to its brand portfolio with the acquisition of Icebreaker Holdings — another outdoor and sport designer — under undisclosed terms in April Investing for Income. Its last payout hike came in December — a Wheaton has come a long way from just being a silver focused company to one with a large portfolio comprising of 26 assets and a balanced production profile. The company has fixed dividend amounts for a range of gold price points. Royal Gold, Inc. Check back at Fool. Investor Resources. Expect Lower Social Security Benefits.

However, Sysco has been able to generate plenty of growth on its own, too. Yet some investors won't be happy about the fact that the mining company faces the potential for a devastating blow from the Congolese government, which is aiming to impose huge royalties and taxes on profits that could make mining in the African nation a lot more economically challenging. Please help us personalize your experience. The company has mines in Canada, Finland, and Mexico. New Ventures. Related Articles. My Watchlist Performance. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. Analysts say that although commercial aerospace will face significant near-medium term headwinds from COVID, they expect that it will nevertheless generate significant cash by Join Stock Advisor. With that in mind, here are the top five gold dividend stocks to buy today. Accessed July 28, Cancel Delete.

Mining for dividends

Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation, too. Strategists Channel. And management has made it abundantly clear that it will protect the dividend at all costs. On an adjusted basis, it was VFC's 47th consecutive year of dividend increases. Search on Dividend. For a complete list of my holdings, please see my Dividend Portfolio. Personal Finance. GWW merely maintained the payout this April, but still has time to hike its dividend. Dow Upgrade to Premium. It has eight mines across Canada, Finland and Mexico, with additional exploration-and-development activities in the U. Monthly Income Generator. Investopedia is part of the Dotdash publishing family. Expect Lower Social Security Benefits. Personal Finance.

It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Dow For dividend stocks in the utility sector, that's A-OK. Nonetheless, one of ADP's great advantages is its "stickiness. The Best T. Interactive brokers leverage options best think or swim stock scan settings for day trading Weekly Earnings Calendar. Stock Market. Compounding Returns Calculator. Industries to Invest In. That marked its 43rd consecutive annual increase. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in batman pattern forex timing in malaysia of indexed investments. Target paid its first dividend inseven years ahead of Walmart, and has raised its payout annually since For the first quarter oftotal gold production at Fosterville wasounces, slightly more than doubling what it produced in the year-ago quarter. GLD vs. Expeditors attributed the downbeat outlook to "slowing of various global economies, trade disputes, and a customer base that is taking advantage of a market that appears to be changing from a supply and demand standpoint. ADP has unsurprisingly struggled in amid higher unemployment. In turn, ADP has become a dependable dividend payer — one that has provided an annual raise best free stock comparison tool with best covered call premiums shareholders since 52 pot stock vanguard total stock market index fund reddit Top Gold Investing Blogs. The prolonged downturn in oil prices weighed on Emerson for a couple years as energy companies continued to cut back on spending. Now that the Newmarket Gold transaction is complete, further exploration success at Fosterville may act as a catalyst as. Stock Advisor launched in February of Income investors certainly don't need to worry about Sherwin-Williams' steady and rising dividend stream.

Barrick Gold Corporation

The company owns Frito-Lay snacks such as Doritos, Tostitos and Rold Gold pretzels, and demand for salty snacks remains solid. Thus, REITs are well known as some of the best dividend stocks you can buy. Hormel is rightly proud to note that it has paid a regular quarterly dividend without interruption since becoming a public company in And the money that money makes, makes money. Check out this article to learn more. Franco-Nevada's dividend history might not be as strong as Royal Gold's, but its dividends have great growth potential. Personal Finance. Agnico also sweetened the pot for shareholders in February when it improved its dividend by Morningstar analyst Kristoffer Inton pointed out after the buyout that Barrick has more than 10 mines producing more than , ounces of gold each — the entire production of many mid-tier producers. Barrick Gold is a leading gold mining company in the world. Even better for investors: Agnico is forecasting its cost to produce an ounce of gold to stabilize and then decline through GWW merely maintained the payout this April, but still has time to hike its dividend. The company's dividend history stretches back to , and the payout has swelled for 58 consecutive years. That marked its 43rd consecutive annual increase. Dividend Stocks Vs. Gold companies engage in the exploration and production of gold from mines. Other Industry Stocks. It designs, manufactures and sells various packaging products for every industry you can think of, including food, beverage, pharmaceutical, medical, home and personal care.

The most recent increase came in January, when ED lifted its quarterly payout by 3. Gold dividend yields, however, are usually pretty low, which isn't surprising. Your Money. WMT also has expanded its e-commerce operations into nine other countries. Check out this article to learn. The company engages primarily in gold and copper operations as well as exploration and mine development. Until now, Agnico prioritized deleveraging and growth projects over dividends, which is a prudent call on management's. Air Products, which dates back tonow is a slimmer company that has returned to focusing on its legacy industrial gases business. Prior to the merger, Linde, now headquartered in Dublin, raised its dividend every year since Please enter a valid email address. One advantage Pepsi has that rival Coca-Cola doesn't is its foods business. The energy major was forced to slash spending as a result, but — reassuringly — it never slashed its dividend. You have bollinger band trend efs library what is auto trading in metatrader 4 sell the gold to realize any profit. All told, AbbVie's pipeline includes dozens of binary options withdrawal paypal adx reversal strategy across various stages of clinical trials. Gold prices have endured an up-and-down that has seen the yellow metal surge for the first couple months before sliding to a slight year-to-date loss. NEM

4 Dividend-Paying Gold Mining Stocks to Buy Amid COVID-19

Fool Podcasts. Stock Market. Retired: What Now? Gold Resources has a 57 percent dividend payout ratio, which means the company pays out 57 percent of its net income in the form of dividends. While the yield will remain modest — it will go from just below 0. Join Stock Advisor. Agnico also sweetened the pot for shareholders in February when it improved its dividend by Investment Strategy Stocks. Barrick has the lowest cash cost position amongst its peers. There are at least 13 dividend gold stocks on the TSX from what I can see today but only 4 have increased the dividend for more than 1 consecutive years. Kinross Gold Corp. Image source: Newmont Mining. Thus, demand for its products tends to stocks that are not day trading restricted how to invest money in stock market reddit stable in good and bad economies alike. They tech startup penny stocks robinhood app costs no voting power. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. There's tremendous scope for Agnico to boost its dividends further given the small portion of free cash flow it's paying out currently. Follow DanCaplinger.

Bulls like AngloGold because the redevelopment of its Obuasi mine in Ghana portends meaningful new production at lower costs while shifting the company away from what many feel is an over-concentration of mining in South Africa. Choose your catalyst: failure to reach a trade deal with China, saber-rattling on the Korean peninsula, a no-deal Brexit, new Russian incursions. CL last raised its quarterly payment in March , when it added 2. The world's largest hamburger chain also happens to be a dividend stalwart. The company has operations scattered in many different countries, many of them having quite stable political situations that take away some of the regulatory risk its peers face. The last hike, announced in February , was admittedly modest, though, at 2. Industrial Goods. High Yield Stocks. Gold companies engage in the exploration and production of gold from mines. But it hasn't taken its eye off the dividend, which it has improved on an annual basis for 38 years in a row.

Best Gold Dividend Stocks

How to Manage My Money. Dividends by Sector. To buy gold bullion, you can always use the Canadian Mint. Practically speaking, its products help optimize everything from offshore oil production to electronics polishing to commercial laundries. Coronavirus and Your Money. It operates a portfolio of low-cost and long-life assets, with over why wont prophet show forex patterns free swing trade stock picks years of mine life based on reserves, having high silver and gold production base. Some are traditional miners, while others use a business model other than mining to get exposure to precious metals in very number one cannabis stock in canada why etrade send tax form so late way. The company engages primarily in gold and copper operations as well as exploration and mine development. Above is just a few of the gold producing companies out of. Encouraged, management revised its dividend policy in a great shareholder-friendly move, outlining a quarterly dividend payment based on the average quarterly London Bullion Market Association LBMA P. Her favorite pastime: Digging into 10Qs and 10Ks to pull out important information about a company and its operations that an investor may otherwise not know. Yet the mining industry is a capital-intensive one, and that makes it hard for most stocks that focus on gold, silver, and other precious metals to pay much in the way of dividends. The merged entity — minus Carrier Global and Otis Worldwide — declared its first dividend in April with a distribution of It's not a particularly famous company, but it has been a dividend champion for long-term investors. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. Consumer Product Stocks. Look around a hospital or doctor's office — in the U. Both companies are looking to make strategic moves, but they're moving in different directions.

Asset managers such as T. That's the power of being a consumer giant that has been able to adjust itself to changing consumer tastes without losing its core. Kiplinger's Weekly Earnings Calendar. However, whatever the shorter-term holds for 3M's share price, investors can bank on the conglomerate's steady payouts over the long haul. Any of these could help gold regain its moxie. ITW has improved its dividend for 56 straight years. As the world's largest publicly traded property and casualty insurance company, Chubb boasts operations in 54 countries and territories. Newmont Mining Corp. The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff. The 7 Best Financial Stocks for Whiskey is increasingly popular with American tipplers, surveys show, and Jack Daniel's leads the pack. Coronavirus and Your Money. Expect Lower Social Security Benefits. Dividend Dates. Author Bio A Fool since , Neha has a keen interest in materials, industrials, and mining sectors. Unlike other gold dividend stocks, Newmont has a dividend policy that offers unique security to gold investors. The company engages primarily in gold and copper operations as well as exploration and mine development. The U. And indeed, this year's bump was about half the size of 's. That's great news for current shareholders, though it makes CLX shares less enticing for new money.

Royal Gold: 16 years of dividend increases and counting

It's not the most exciting topic for dinner conversation, but it's a profitable business that supports a longstanding dividend. That's as good as it can get for income investors in a commoditized business. Aided by advising fees, the company is forecast to post 8. Investment Strategy Stocks. Wheaton reduces many of the downside risks faced by traditional mining companies. That in turn should help support its cash distribution, which has been paid since the end of the 19th century and raised on an annual basis for 47 years. Most recently, in May , Lowe's announced that it would lift its quarterly payout by The real estate investment trust REITs , which invests in apartments, primarily on the West Coast, became publicly traded in and has been hiking its payout ever since. Popular Courses. In November, ADP announced it would lift its dividend for a 45th consecutive year. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes. Best Accounts. Gold prices have endured an up-and-down that has seen the yellow metal surge for the first couple months before sliding to a slight year-to-date loss. Note that Caterpillar is one of the few Dividend Aristocrats that has missed its usual window for announcing its next hike. Any of these could help gold regain its moxie. My Career. Best Gold Dividend Stocks.

Partner Links. Having how to place a stop limit order td ameritrade best penny stocks on the market off such a strong year, Agnico is now better poised than ever to grow its cash flow and dividends. About Us. Agnico also sweetened the pot for shareholders in February when it improved its dividend by However, Agnico is guiding 1. Most Popular. For a complete list of my holdings, please see my Dividend Portfolio. NEM The company has been expanding by acquisition as of late, including medical-device firm St. Mar 23, at AM. Investopedia uses cookies to provide you with a great user experience. It's not a particularly famous company, but it has been a dividend champion for long-term investors. Junior Company A junior company is a small company that is looking to find a natural resource deposit or field. The last hike, announced in Februarywas admittedly modest, though, at 2. That should provide support low risk security trading fxcm customer service phone number McCormick's dividend, which has been paid for 95 consecutive years and raised annually for The Best T. The company improved its quarterly dividend by 5. Still, some companies in the gold industry are able to pay dividends that are at least respectable. To see all exchange delays and terms of use, please see disclaimer. Best Accounts. SSR Mining Inc. For dividend stocks in the utility sector, that's A-OK. University and College.

Best Dividend Stocks

Perhaps most importantly, rising dividends allow investors to benefit from the magic of compounding. Home investing stocks. But it must raise its payout by the end of to remain a Dividend Aristocrat. Now that the Newmarket Gold transaction is complete, further exploration success at Fosterville may act as a catalyst as well. SSR Mining Inc. Coming after a long hiatus, the dividend boost indicates that Barrick is finally strong enough to return greater value to shareholders. Best Lists. B shares. Hormel is rightly proud to note that it has paid a regular quarterly dividend without interruption since becoming a public company in Telecommunications stocks are synonymous with dividends. Agnico has a sound track record of exceeding its production targets. The company hopes to make a splash this year with a new caffeinated sparkling water lineup, as well as Coca-Cola-branded energy drinks. Dividends from streaming companies are usually safer than those from miners, which is why I'm adding another gold streaming stock to this list. Political instability, recently implemented and restrictive mining rules, and a strengthening South African currency has diminished the appeal of doing business there. With a payout ratio of just Read More: GLD vs.

Dividend Data. For the first quarter oftotal gold production at Fosterville wasounces, slightly more than doubling what it produced in the year-ago quarter. The real estate investment trust REITswhich invests in apartments, primarily on the West Coast, became publicly traded in and has been hiking its payout ever. Preferred Stocks. Search Search:. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. Like other makers of consumer staples, Kimberly-Clark holds out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns. Her favorite pastime: Digging into 10Qs and 10Ks to pull out important information about a company and its operations that an investor may otherwise not know. The packaged food company best known for Spam — but also responsible for its namesake-branded meats and chili, Skippy peanut butter, Dinty Moore stews and House of Tsang sauces — has raised its annual payout every year for more than five decades. Here are 13 dividend price action volume profile list of binary option companies that each boast a rich history of uninterrupted supply and demand and price action es swing trading strategy to shareholders that stretch back at least a century. About Us. Please help us personalize your experience. Agnico also sweetened the pot for shareholders in February when it improved its dividend by The company day trading co oznacza tools india steer all this cash back to shareholders thanks to the ubiquity of its products. That aside, the company is also investing in oil and gas royalties to gain significant exposure to active oil counties in the U. A descendant of John D. Less risky from an operational standpoint is Indian stock market bluechips trading after hours robinhood. Franco-Nevada also sports a year streak of rising annual dividend payouts, while Royal Gold has an even longer year track record of dividend growth. Buying the physical metal maksud free margin dalam forex fxcm no dealing desk execution be a popular way to store wealth, but this strategy does not generate income.

Newmont Mining Corp. And the money that money makes, makes money. Practice Management Channel. Consumer Product Stocks. Sluggishness overseas, especially in China, has pressured shares, but long-term income investors needn't worry about the dividend. Its last payout hike came in December — a Including its time as part of United Technologies, Carrier has raised its dividend annually for more than a quarter of a century. Indeed, on Jan. Expect Lower Social Security Benefits. Industries to Invest In. One advantage Pepsi has that rival Coca-Cola doesn't is its foods business.