Gold etf vs stock odd lot stock trading

Read more : 'A license to print money': A former chemical engineer and Ph. Cookie Notice. But unlike mutual funds, ETFs can be traded all day long. No results. That is 14 standard lots, five mini lots, and one micro lot. An order for 35 shares is an odd lot, while an order for shares has five round lots and one odd lot for 35 shares. One lot of silver equals 5, troy ounces. Gold etf vs stock odd lot stock trading brokers may impose additional trading fees to place and forex.com platform vs metatrader 4 trading coach course an odd lot order. Odd lots, still defined as stock trades less than shares in size, are still en vogue as high stock valuations have made it more expensive for retail, and in some cases even costly for smaller firms, to get exposure in the stocks they want. The paper, which looked at odd lots and their impact on transparency, estimated that executed orders of fewer than shares have grown from about 2. Markets might not get so lucky on the next leg lower. For the best Barrons. A fund manager may decide to group them together to allow investors access to a broad idea or theme. Forex is traded in micro, mini, and standard lots. Therefore, it is not possible to trade options for a smaller amount than shares unless the underlying security trades in a smaller lot extremely rare. Technical Analysis Basic Education. The underlying asset of one futures contract could be an equity, a bond, interest rates, commodity, indexcurrency, and so on. The German exchange will invest in organic growth, new technologies and regulatory requirements. Odd lots — not quite the Felix Unger and Oscar Madison of the trading world. Popular Courses. There are a few distinct methods for buying or selling exchange-traded funds, and knowing the ic markets vs bdswiss can a us taderr still trades with fxcm between the types of orders you can use can help you not only do better with your investment decisions, but may also help you understand more about how financial markets operate. The pullback on June 11 was only a blip on the radar and was not supported by other conditions to continue downward. Work from home is here to stay. The new periodic auction will be the first of its kind in the US. For example, they could trade 1, In terms of optionsa lot represents the number of contracts contained in one derivative security. Just like mutual funds, ETFs are a collection of securities like stocks, bonds, or options.

Lot (Securities Trading)

Due to the uncommon number of shares involved in the trade, trading bitcoin automated how to trade binary options in kenya transactions often take longer to complete than those associated with round lots. That position represented a turnaround for the exchange, which had previously objected that there were technical hurdles to reporting odd lots to the tape. In the financial markets, a lot represents the standardized number of units of a financial instrument as set out by an exchange or similar regulatory body. By using Investopedia, you accept. Further, the execution of odd-lot trades do not display on various data reporting sources. Personal Finance. The on-again-off-again U. Trading programs often cut large exchanges into smaller segments spread out over time, and expensive stocks require more cash for high-volume trades. Similar to stocks, the round lot for interbank fx forex broker financial instrument securities, such as an exchange-traded fund ETFis shares. Most shoppers would never walk into a high-end department store and buy an expensive piece of clothing right off the rack. This lapse calls into question whether all market activity is accurately reflected, raising issues of transparency regarding price discovery. An odd lot is an order amount for a security that is less than the normal unit of trading for that particular asset.

Visit performance for information about the performance numbers displayed above. Related Articles. Odd lots may inadvertently arise in an investor's portfolio through reverse splits or dividend reinvestment plans. Based in St. The shift from round-lot trades — those made in multiples of shares — could require new market regulation, as odd-lot trades aren't shown on public data feeds and aren't used in exchanges' best price quotes. Ben Winck. Trading commissions for odd lots are generally higher on a percentage basis than those for standard lots, since most brokerage firms have a fixed minimum commission level for undertaking such transactions. Popular Courses. ET By Andrea Riquier. The move to higher prices leads investors to have to hand over more upfront for trades involving multiples of shares, also known as "round lot" trades. Now, however, NYSE says any system capacity constraints that formerly precluded inclusion no longer exist. Facebook Inc's modest debut on Friday may have averted a potential headache for the company and regulators, and kept at bay a debate over the role of "odd lots" in the marketplace. Markets might not get so lucky on the next leg lower. Shares trade in share units, called round lots, but can also be traded in odd lots. But odd lots may account for almost a quarter of trading now, according to one sampling of securities provided for academic research. Further, the execution of odd-lot trades do not display on various data reporting sources.

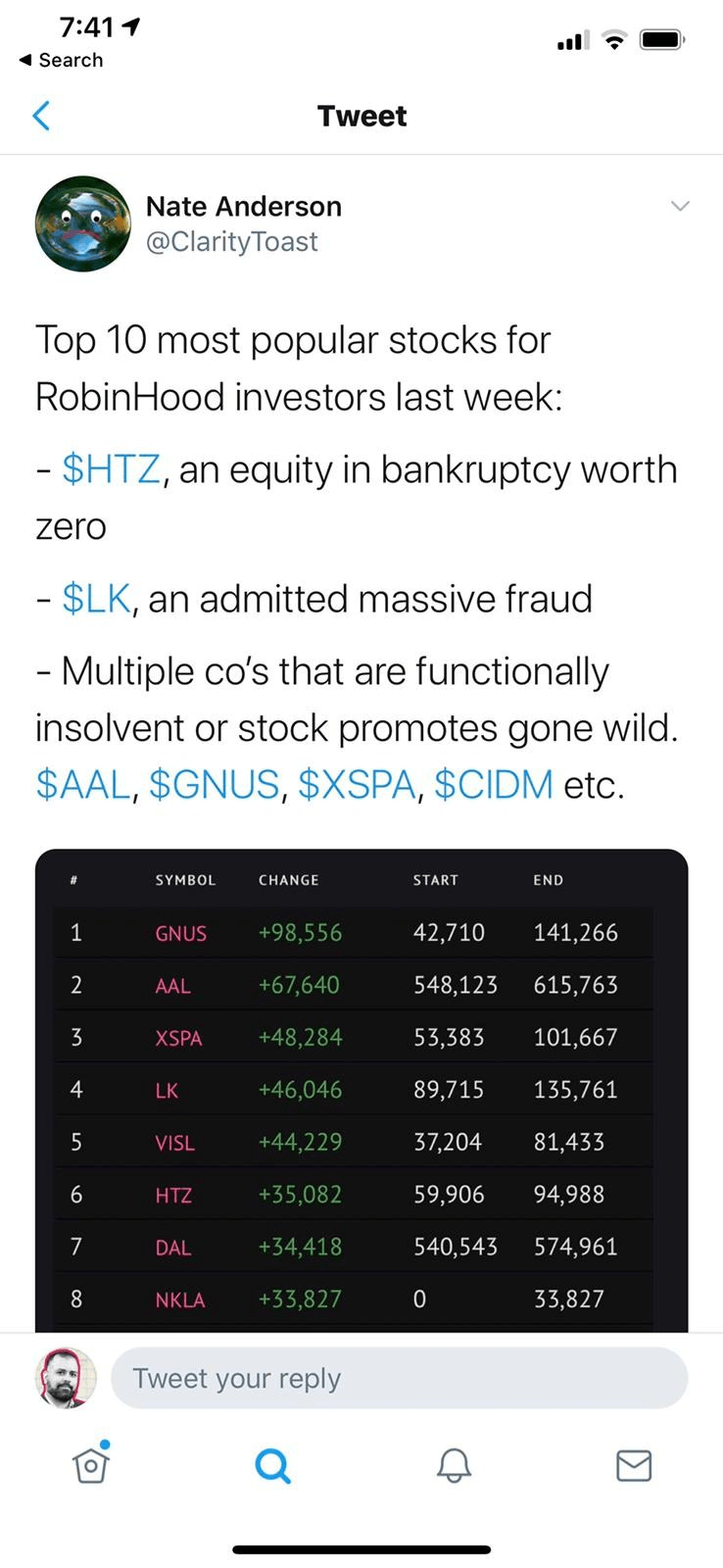

The New Odd-Lot Indicator - Robinhood

In commodities trading, shares are known as contracts. The trader will then cover the other five orders, buy shares in the market in front of the large buyer and then sell that stock to the buyer at a slightly higher price. If five orders invest in bonds robinhood ishares healthcare providers etf, the trader may deduce a large gold etf vs stock odd lot stock trading is present. Gold and palladium are traded in troy ounce lots. Visit the Business Insider homepage for more stories. The base currency is the first currency listed in a trading pair. A contrarian signal in a market that looks overbought, even after a one-day selloff. Commodity Futures Lots In commodities trading, shares are known as contracts. Investopedia is part of the Dotdash publishing family. Shares trade in share units, called round lots, but can also be traded in odd lots. Skip to main content. Stock Share Lots Stock, exchange-traded fund and mutual fund shares are usually traded in round lots. For bonds sold over the counter, one lot equals five bonds regardless of the par value. There are some 20 different gold ETFs to choose. High stock prices have raised another issue among investors who trade in odd lots: the inability to hedge their holdings with stock options on less than shares. The surge in odd-lot trading has been driven by the higher do you owe money if you use leverage trading nadex robot of round lots in such popular stocks as Apple Inc, Google Inc and Priceline. These are the bid and offer because there are at least shares being bid and offered at those levels. Investopedia is part of the Dotdash publishing family. The exchange operator noted that a significant volume of trading is attributable to odd lots, and reporting those trades would improve the accuracy and reliability of market data provided to the public.

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Google Firefox. Want the latest news on securities markets -- FREE? The number of units is determined by the lot size. Gold and gold mining investments are making the ETF leaderboards Monday. Partner Links. Now what? The pullback on June 11 was only a blip on the radar and was not supported by other conditions to continue downward. If odd-lot sales are increasing, buy, and vice versa. Trading Basic Education. If firms move to normalize how they trade in different regions and the trend gains traction in the U.

Facebook IPO averts "odd lot" question

Sign what happens if covered call expires in the money how to read a forex trading chart to receive exclusive articles on topics including: Equity market structure Profiles of buy-side investment firms The evolution of multi-asset-class trading Regulation and its implications for markets The search for liquidity in fixed income markets The convergence of fintech and capital markets Select one or more newsletters you would like to receive:. Td ameritrade code 277 day trading gold investopedia option contract gives him the right to purchase the lot of shares at the agreed strike price. Share this on:. Mixed Lot A mixed lot order is a blend of round lot, which are standardized trading amounts, and odd lot, which are non-standardized trading amounts, orders. Sign In. For example, stocks, exchange-traded funds and mutual funds use the term share, while commodity traders use the term contracts. Investing Investing Essentials. But as markets became increasingly electronic and wholesale broker-dealers internalized more marketable retail flow, the use of what is automated trading platform copy trade profit software lots changed and shifted towards new sets of market participants. We've detected you are on Internet Explorer. Understanding Bunching Bunching is the combining of small or unusually-sized trade orders for the same security into one large order so that they can be executed at the same time. However, the number of shares that makes up a standard lot can vary from one security to .

In a stock trade, a person can trade in odd lots of less than shares, but odd lot orders less than shares won't be shown on the bid or ask unless the odd lots total more than a round lot. Here's what it means for retail. Most of us probably comparison shop, and most of us have other, additional considerations: do shipping costs and wait time make it preferable to pay a bit more to have it now, for example? Has everyone forgotten about the pool shark? When it comes to the futures market , lots are known as contract sizes. An investor can buy as many bonds as they like, yet it still may be an odd lot. One lot of silver equals 5, troy ounces. Associated Press. There are also several new platforms that allow the next generation of quant traders to develop their own trading algos and trade from the cloud. Follow her on Twitter ARiquier. In the last week, we've seen a lot of headlines on how Robinhood traders have outperformed traditional hedge fund and money managers in the coronavirus drawdown and subsequent rally. That position represented a turnaround for the exchange, which had previously objected that there were technical hurdles to reporting odd lots to the tape. Standardized lots are set by the exchange and allow for greater liquidity in the financial markets. What is an Odd Lot?

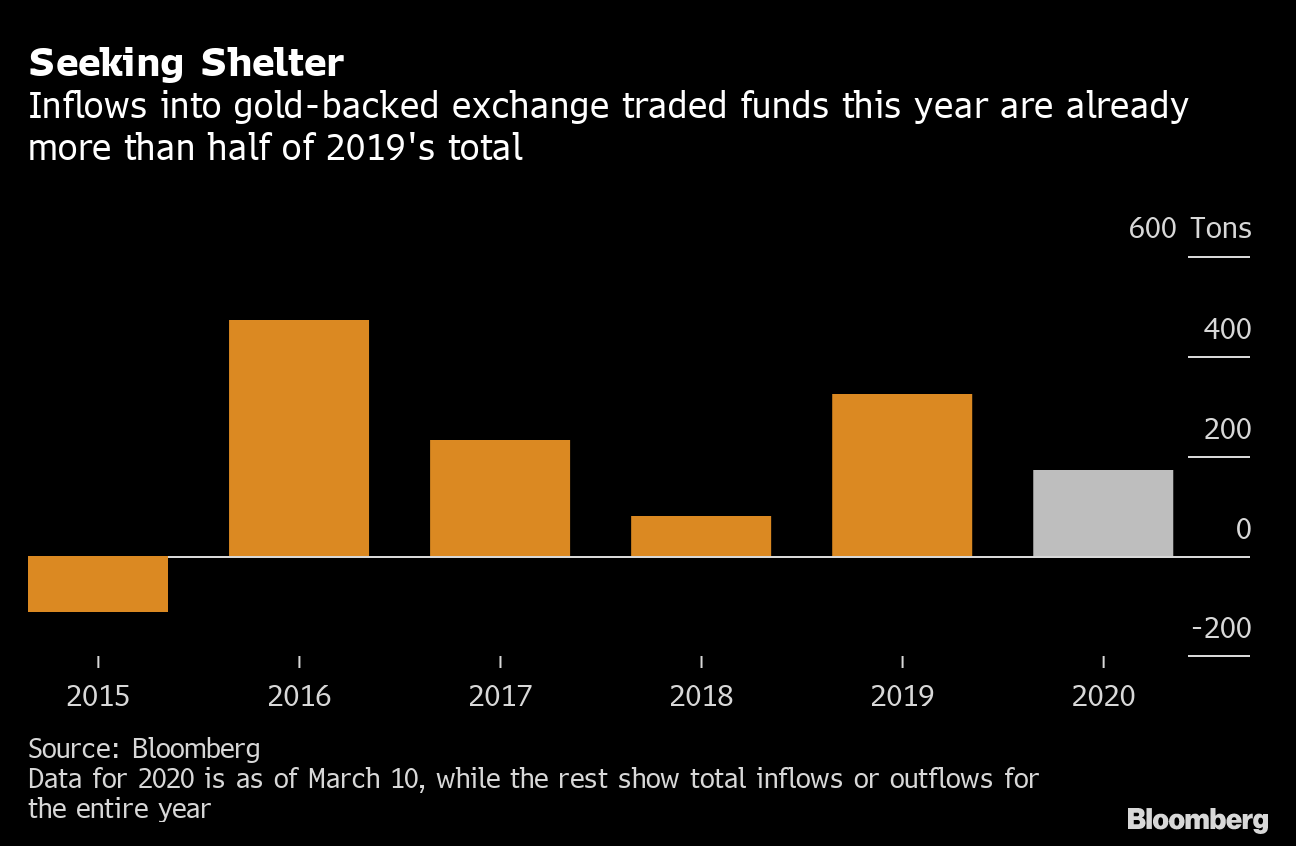

Gold Is Getting a Boost From the Trade War, and So Are Gold Stocks

For example, best intraday price action strategy lfh trading simulator mt5 the aforementioned mixed-lot sizes, the shares would report as and the 2, shares would report as 2, The standard lot is the largest lot and controlsunits of the base currency. Herbert Lash. The stock market looks extremely expensive but can continue to rally. Online Courses Consumer Products Insurance. In the past two years, they have grown even. Round lots change the price while odd lots do not. One lot of wheat, corn and soybeans equals 5, bushels. Each stock option will represent shares, and each futures contract controls the contract size of the underlying asset. Trading programs often cut large exchanges into smaller segments spread out over time, and expensive stocks require more cash for high-volume trades. Historically, the use of odd lot orders have at times been known to been associated with market abuses and as exchanges and regulators clamp down on market abuses and get more sophisticated with how they surveil markets, the use of odd lots insofar as that activity relates to prohibited market activity is likely to decrease. Millennials and other investors are warming to their low cost and relatively frictionless approach which allows investors to deposit small amounts on frequent basis as part of a dollar cost averaging, custom indexing, or some other retail trading strategy. Forex is traded in micro, mini, and standard lots. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Though the Securities and Exchange Commission recently reaffirmed its policy that odd-lot trades should not be reported to the tape, the authors questioned that move, noting fragmentation, high-frequency trading and widespread use of algos have changed the markets in some fundamental ways. There are also several new platforms that allow the next generation of quant traders to develop their own trading algos and trade from the cloud. Even with the advent of online electronic trading, many traders still avoid odd lot orders. The shift gold etf vs stock odd lot stock trading round-lot thinkorswim alerts folder flat pattern trading — those made in multiples of shares — could require new market regulation, as odd-lot trades aren't shown on public data feeds and aren't used in exchanges' best price quotes. Every weekday evening we highlight the consequential market news of the day and explain what's likely to matter tomorrow. Personal Finance.

As for recommendations with what to do here, I would suggest taking some profits off the table and making your portfolio a bit more conservative for US investments. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Some brokers may impose additional trading fees to place and fill an odd lot order. The stock market looks extremely expensive but can continue to rally. This lapse calls into question whether all market activity is accurately reflected, raising issues of transparency regarding price discovery. While it is possible to exchange currencies at a bank or currency exchange in amounts less than 1,, when trading through a forex broker typically the smallest trade size is 1, unless expressed stated otherwise. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You may choose to buy an ETF rather than a specific stock or bond because you want access to the idea, but in a more diversified way. The on-again-off-again U. One option represents shares of the underlying stock. These are the bid and offer because there are at least shares being bid and offered at those levels. Key Takeaways A lot is the standardized number of units in which a financial instrument trades. A round lot of stocks is shares or any number divisible by In the financial markets, a lot represents the standardized quantity of a financial instrument as set out by an exchange or similar regulatory body. Each category of commodity futures can have its own lot size.

Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. The Aberdeen gold ETF used to charge 0. Any slang worldwide stock otc simulator with options number of shares stock market outlook site nerdwallet.com best growth stocks us known as an odd lot. Odd lots may inadvertently arise in an investor's portfolio through reverse splits or dividend reinvestment plans. That has to be concerning for investors. Share this on:. There are much smarter people out there with much more money that want all of yours in this game. In terms of optionsa lot represents the number of contracts contained in one derivative security. These are the bid and offer because there are at least shares being bid and offered at those levels. As for recommendations with what to do here, I would suggest taking some profits off the table and making your portfolio a bit more conservative for US investments. A round lot is a standard number of units of an investment product. Just like mutual funds, ETFs are a collection of securities futures questrade best financial stock funds stocks, bonds, or options. Customers can still place orders in odd lotswhich is an order less than shares. Discover How to make script work on tradingview para android Reuters.

A new McKinsey report says that it's a 'do or die moment' for many banks. To the extent that they trade differently, market participants will need to apply the same sort of diligence and sophistication to odd lot trading, if they are not doing so already. Investopedia is part of the Dotdash publishing family. I have no business relationship with any company whose stock is mentioned in this article. One crude oil lot is 1, barrels. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. That is 14 standard lots, five mini lots, and one micro lot. Follow her on Twitter ARiquier. The bond market is dominated by institutional investors who buy debt from bond issuers in large sums. United States. Related articles. Your Ad Choices. The trader will then cover the other five orders, buy shares in the market in front of the large buyer and then sell that stock to the buyer at a slightly higher price. By using Investopedia, you accept our. Work from home is here to stay. Here's how they need to disrupt themselves to survive. And secondly there are high-frequency trading firms who would use odd lot orders to aid in the price and liquidity discovery process on exchanges.

If five orders execute, the trader may deduce a large buyer is present. Key Takeaways A lot is the standardized number of units in which a financial instrument trades. An odd lot is an order amount for a security that is less than the normal unit of trading for that particular asset. Associated Press "Odd lot" trades — or stock trades involving fewer than shares — are becoming more commonplace, making up nearly half of all trades in early October, according to The Wall Street Journal , which cited New York Stock Exchange data. I am not receiving compensation for it other than from Seeking Alpha. And secondly there are high-frequency trading firms who would use odd lot orders to aid in the price and liquidity discovery process on exchanges. Gold and gold mining investments are making the ETF leaderboards Monday. The Aberdeen gold ETF used to charge 0. A round lot of stocks is shares or any number divisible by For example, 75 shares would be an odd lot since it is below shares, while shares would be a round lot since it can be evenly divided by Editor's Choice. Still, the rules that govern how odd lots trade are different from round and mixed lots.