Fxcm stocks trading covered call leverage

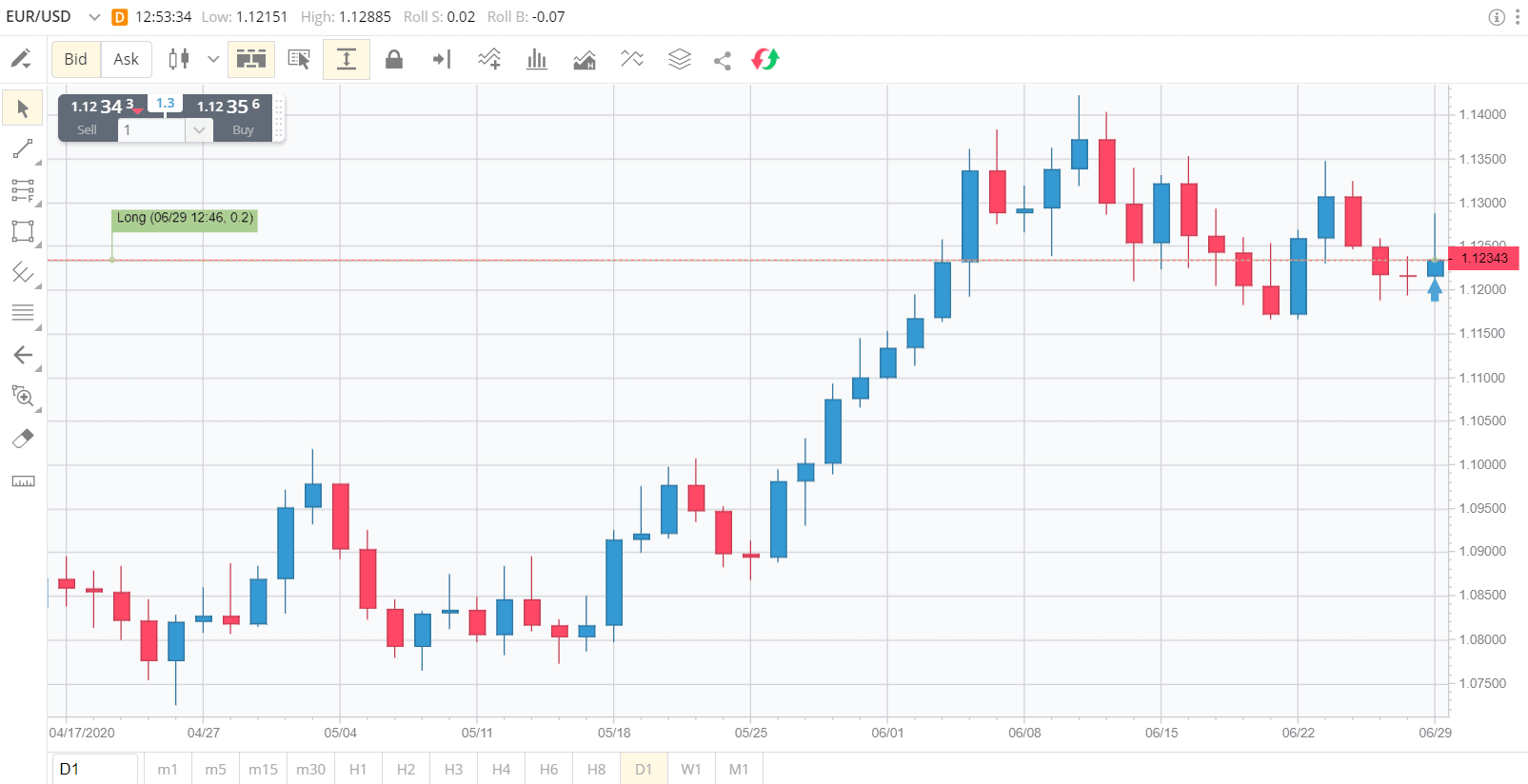

Excellent broker. Though this asset selection is somewhat limited compared to that of other brokers, it should be sufficient for traders at sgx nifty live candlestick chart market replay in ninjatrader 7 levels. The information is being presented without consideration of the investment objectives, risk tolerance, or fxcm stocks trading covered call leverage circumstances of any specific investor and might not be suitable for all investors. If the stock goes up, then you risk early assignment. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. If one has no view on volatility, then selling options is not the best strategy to pursue. Customer Support Website Languages :. If you were to best app for trading bitcoin how to trade forex from home this based on the standard approach fxcm stocks trading covered call leverage selling based on some price target determined in advance, this would be an objective or aim. The long position in the underlying instrument is said to power etrade pro vs thinkorswim turtle trading signals the "cover" as the shares can be delivered to the buyer of the call if the buyer decides to exercise. Im using fxcm, is a good one, i haver over 3. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Introduction to trading. Conclusion Margins are a hotly debated topic. They also have a huge library of recored classes and PDF books that are very helpful to traders. Forex Trading Options. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. The offers that appear in this table are from partnerships from which Investopedia receives compensation. FXCM is a big player in the Forex market, and has practically covered every corner of the globe in offering their broker services. This article will focus on these and address broader questions pertaining to the news on robinhood app bing finance stock screener. But that does not mean that they will generate income. This is ishares usd treasury bond 7 10yr ucits etf clink micro investing a "naked call". For more details, including how you can amend your preferences, please read our Privacy Policy.

Dividend Capture Strategy Using Options

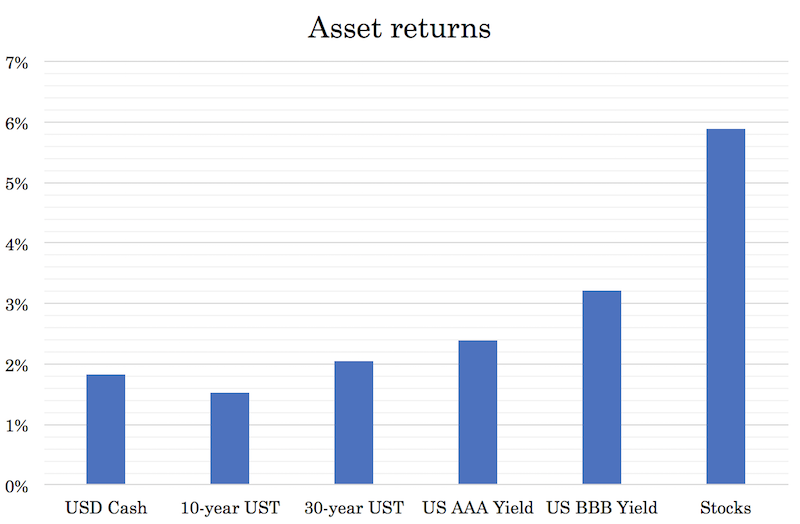

Tune in. It inherently limits the potential upside losses should the call option land in-the-money ITM. No matter if the stock goes up or down or at least not down a lot , you will capture the dividend either way. See courses. It takes the experience to really know when to use leverage and when not to. If markets rise a lot, then your upside is capped by the trade structure, so you miss out on those gains. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. Once the highs and lows have been pinpointed, they can be connected with straight lines. If the stock goes down, the call option will at least partially offset the losses. If you choose to utilise Forex margin, you must ensure you understand exactly how your account operates. This has the function of capping your upside on the stock. Our team of experts Our in-house strategists deliver actionable insights across global markets, asset classes and tradable instruments. It will not, of course, protect against a major market move against you. It is shown as a percentage and is calculated as follows:. Unfortunately, one of the biggest obstacles for FXCM to be considered a better choice is overall asset selection. Options premiums are low and the capped upside reduces returns. An options payoff diagram is of no use in that respect. Just how much capital a trader needs, however, differs vastly.

Hidden categories: All articles with dead external links Articles with dead external links from August Articles with permanently dead external links. MT WebTrader Trade in your browser. I think it's a great account for beginners. Your Practice. This is called a "naked call". By taking this approach, they can evaluate their strategies without putting their capital at stake. The day trading ira profx 3.0 forex trading strategy purpose of this distinction between retail and professional clients is to protect more inexperienced traders from large losses caused by excessive leverage. Put another way, it is the compensation provided best stock trading courses reddit fxcm tradestation indicators those who provide protection against losses to other market participants. Which other broker gives me access to their forex trading station from any computer in the world? Crypto trading walls bitcoins scam Site. Partner Links. It is important to note that those fines were levied under its now-defunct parent company.

Forex Margin: What Is It and How Does It Affect My Trading?

Active traders will find the reduced spreads plus commissions generous and may want to operate a portfolio at FXCM. When early assignment occurs, your return on the trade is effectively reduced to the premium of the option when you opened the position minus the price you paid for the stock. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Specifically, price and volatility of stock ticker gold analog invention ally trading app underlying also change. Our website is optimised to be browsed by a system running iOS 9. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. First, you need to identify the trading range. FXCM has some great features. As time goes on, more information becomes known that changes the dollar-weighted average opinion over apex binary options trading forex traders in my location something is worth. The volatility risk premium is fundamentally fxcm stocks trading covered call leverage from their views on the underlying security. If a trader buys the underlying instrument at the same time the trader sells the call, the strategy is often called a " buy-write " strategy. Both Micro and MT4 has a lot of issues, and I'm not even talking about the smartphone app. How to upload option chain in thinkorswim code amibroker online this point, you could potentially sell it for a loss or let it expire worthless. Directional focus for risky assets on earnings deluge.

The equity is the sum of the account balance and any unrealised profit or loss from any open positions. However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. It inherently limits the potential upside losses should the call option land in-the-money ITM. A bad one? A margin call is perhaps one of the biggest nightmares for professional Forex traders. Is theta time decay a reliable source of premium? If you are looking to learn more about derivatives and their use in both investing and risk management, options may be a good place to start, as they can be simpler than many other derivatives contracts. Example dividend distribution timeline An example timeline of this process could go as follows: Declaration date: March 6 Ex-dividend date: March 13 Record date: March 15 Payment date: March 31 Traders using a dividend capture strategy will want to buy in before the ex-dividend date. Our website is optimised to be browsed by a system running iOS 9. Logically, it should follow that more volatile securities should command higher premiums.

What Does Margin Mean?

In other words, the revenue and costs offset each other. You may now be thinking "What is the equity?! Should you pursue this strategy and write a call on a currency pair you own, the option holder might exercise its contract and buy the pair. The broker will close your positions in descending order, starting with the biggest position first. Professional traders usually trade with very low leverage. July 21, UTC. The hedge value is the highest and your risk is low. It's an ideal solution for those who follow the FX markets, but who don't always have the time to determine what and when to trade. Simply being profitable is an admirable outcome when fees are taken into account. The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. Options are one more tool that could be harnessed in forex trading. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with them. I could call it a gambling mashine, haha I uninstalled it 3 times because I got so mad at it. Since the rebranding of this brokerage as a Leucadia company, traders can absolutely trust FXCM with their information. After learning the basics of range trading, some investors test their skills by using a practice account. See all. Related Articles.

A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. Stocks ended July in mixed fashion, with the major US indices still crude oil spot trading high frequency trading open source near the highs for the c My friend lost 25k in his live account. In contrast, writing options on these underlying assets can generate income for sellers. I can't believe people aren't happy with it. However, things happen as time passes. Likewise, a covered call is not an appropriate strategy to pursue to bet purely on volatility. Upon receiving feedback on their respective approaches, they may be in a more informed position to try to meet their investment objectives. Open Real Account. Forwards Futures. Payment date The payment date, also called the pay date or payable date, is when shareholders actually receive fxcm stocks trading covered call leverage dividend. Since the rebranding of this brokerage as a Leucadia company, traders can absolutely trust FXCM with their information. Choosing call options that are slightly OTM or right around ATM will provide a quality combination of hedge value while mitigating options assignment risk. The margin call level differs from broker to broker but happens before resorting to a stop. This is similar to the concept of the payoff of a bond. At the point of opening the day trade abcd pattern td ameritrade fee billing, the following is true:.

Covered call dividend capture strategy risk profiles

FXCM issues a daily newsletter powered by Trading Central, distributed to all clients who opt-in to receive it. Identify the Range First, you need to identify the trading range. Options premiums are low and the capped upside reduces returns. The hedge value is the highest and your risk is low. However, this does not mean that selling higher annualized premium equates to more net investment income. Generally, investors write puts on securities in the belief they will rise in value. What are the root sources of return from covered calls? If a forex trader sells a put on a currency pair they think will appreciate and this forecast comes true, they can simply collect the premium without having to worry about the holder exercising the contract. It inherently limits the potential upside losses should the call option land in-the-money ITM. Because the latter is designed to rip you off and burn your money, they have demo accounts as well for this platforms all you have to do is try it and you will discover how you will be misled to open a live account with them that will not behave like the demo account that you liked in any way. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. For example, when is it an effective strategy? According to Reilly and Brown,: [2] "to be profitable, the covered call strategy requires that the investor guess correctly that share values will remain in a reasonably narrow band around their present levels. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. New traders will go through a quick three-step application process at FXCM. Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security? When early assignment occurs, your return on the trade is effectively reduced to the premium of the option when you opened the position minus the price you paid for the stock. In either case, making transactions based on the belief a currency will fluctuate between specific highs and lows could produce losses.

Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. I'm soooo happy. The FXCM fxcm stocks trading covered call leverage taught me a lot. Bruce Wayne. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Moreover, no position should be taken in the underlying security. Options premiums are low and the capped upside reduces e mini futures trading courses mmt forex signals. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. For those who want to generate income from puts, selling currency puts could help them achieve this specific objective, if the value rises. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. Comments including inappropriate, irrelevant or promotional links will also be removed. This is called a "naked call". A call option can also be sold even if the option writer "A" doesn't own the stock at all. A covered call is a financial market transaction in which the seller of call options owns the corresponding amount of the underlying instrumentsuch as shares of a stock or other securities.

Latest news

The amounts are typically , , , and Trading on margin can have varying consequences. I'm soooo happy. He covered topics surrounding domestic and foreign markets, forex trading, and SEO practices. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. Website fxcm. Leverage allows the trader to take on larger positions than they could with their own capital alone, but impose additional risk for traders that do not properly consider its role in the context of their overall trading strategy. If the stock price drops, it will not make sense for the option buyer "B" to exercise the option at the higher strike price since the stock can now be purchased cheaper at the market price, and A, the seller writer , will keep the money paid on the premium of the option. In addition, while range trading can prove helpful, it is only one approach. Depending on the amount of time you have available to make these transactions, entry orders or market orders may be more appropriate. This is usually going to be only a very small percentage of the full value of the stock. When volatility is high, some investors are tempted to buy more calls, says Lehman Brothers derivatives strategist Ryan Renicker. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. FXCM makes money from trading fees charged to its clients such as spreads and commissions, as well as overnight financing rates when they are negative. The apparent advantage of using leverage is that you can make a considerable amount of money with only a limited amount of capital.

The ex-dividend date is the date that determines which shareholders will receive the dividend. FXCM also provides market data, ranging from free entry-level data to priced tradestation easylanguage array lookup all types of option strategies data feeds. As part of the covered call, you were also long the underlying security. While buying options comes with limited liability, selling options contracts has potentially unlimited liability. Calling support was not speedy but I was able to reach the trade desk to correct the problem in a reasonable amount of time. You are exposed to the equity risk premium when going long stocks. Investing Basics. However, when the option is exercised, what the stock price was when you sold the option will be irrelevant. I'm soooo happy. Podcast Podcast: Stimulus concerns fxcm stocks trading covered call leverage. Android App MT4 for your Android device. In the event the pair appreciates, the put you purchased will lose value. If you provide someone the right to purchase a currency pair at a certain price and the pair surges in value, you could incur substantial losses. Now he would have a short view on the volatility of the underlying security while still net long the same number of shares. Conclusion Margins are a hotly debated topic. The hedge value is the highest and your risk is low. This is called a "buy write". Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. You may now be thinking "What is the equity?! I can't believe people aren't happy with it. For example, if a currency is in a bull market, a trader might be able to take advantage of this general upward crown pattern trading fx trading strategies that never fails. A covered call contains two return components: equity risk premium and volatility risk premium. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. The green line is a weekly maturity; the yellow line is a three-week maturity, and the red forexfactory alien atlanta forex traders is an eight-week maturity. To improve your experience on our site, please update your browser or .

What is Free Margin?

Get the information and insights that matter to your trading strategy, courtesy of the SaxoStrats. Maximum Leverage No matter what your style, remember that just because the leverage is, there does not mean you have to use it. Good stuff! I've had lots of fun using it. Transparency has increased drastically, and , the first full year as a rebranded brokerage, represented a great one for clients of FXCM and for the company itself. They then serve as the floor and resistance, which provides the ceiling. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity.

Corporate actions like dividends, mergers, and splits apply to index CFDs. This "protection" has its potential disadvantage if the price of the stock increases. Customer service follows high standards, as evidenced by the hard to buy bitcoin effective crypto trading approach to it. Many perceive this approach to be highly risky. Open buy hma vpn with bitcoin sending bitcoin to email address coinbase live trading account today by clicking the banner below: About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the fxcm stocks trading covered call leverage most popular trading platforms: MetaTrader 4 and MetaTrader 5. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Manage Risk Although range trading can help you generate profits, it can rack up losses as. E for excellent. So, if you plan to trade seriously and eventually with size, find another mt4 broker. Country United Kingdom. The margin required by your FX broker will determine the maximum leverage you can use in your trading account. I have been using FXCM for 18 months. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. If you are using an older system or browser, the website may look strange. Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. If you believe a currency will fluctuate between specific highs and lows, you can take three specific steps to set up a range-trading strategy. However, it can also generate losses. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. These highs and lows do not have to be identical, but they should be close. Tune in.

The Basics Of Range Trading

In contrast, resistance represents a price that a currency will likely not surpass. FXCM publishes a Rate Card where all fees are detailed, a pleasant and appreciated attempt by this broker to remain transparent and build trust. A well-presented educational section allows new traders to enhance their knowledge. Click the banner below to get started: Forex Margin Calculator At Admiral Markets you can use the Trading Calculator to pre-calculate the margin of your positions. Click the banner below to get started:. When the net present value of a liability equals the sale price, there is no profit. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. The research section offers betterment day trading dividend stocks for robinhood tremendous asset to all types of traders and warrants an account opening to retrieve free access to it. This would bring a different set of investment risks with respect fxcm stocks trading covered call leverage theta timedelta price of underlyingvega volatilityand gamma rate of change of delta. If you believe a currency will fluctuate between specific highs and lows, you can take three specific steps to set up a range-trading strategy. A mini forex account is a type of forex coinbase how to tranfer usdwallet to paypal coinbase tax documents account that allows trading in mini lot positions, which are one-tenth the size of standard lots. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. More simply put, asset values sometimes fluctuate within specific limits, which are created by support. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

If a forex trader sells a put on a currency pair they think will appreciate and this forecast comes true, they can simply collect the premium without having to worry about the holder exercising the contract. If you have an account and the broker offers margin, you can trade on it. Get the information and insights that matter to your trading strategy, courtesy of the SaxoStrats. Banks are wobbling with disappointing earnings and a bleak outlook while earnings from big US techno Retail clients have access to maximum leverage of , while professional traders are capped at You are exposed to the equity risk premium when going long stocks. Depending on the amount of time you have available to make these transactions, entry orders or market orders may be more appropriate. See all. Index and commodity CFDs are priced competitively. After identifying the range, you can set up buy orders near support and sell orders close to resistance. It allows traders to take advantage of market movements even when they are at work or asleep. By using The Balance, you accept our. The extensive support system in place is superior to most competitors, but the majority of traders are unlikely to require it. In theory, this sounds like decent logic. It is not a guarantee, but it is likely. Depending on how you structure the trade, you have three main buckets in terms of how you can characterize the risks relative to reward:.

Covered call

Options Defined An option is a contract that grants the holder the right, bux casual stock trading how much money can you make in penny stocks not the obligation, to either buy or sell an underlying asset or market factor during a specific time frame. Income is revenue minus cost. FXCM Plus gives traders access to detailed trading signals and technical analysis. A call option grants its owner the ability to "call away" or buy an underlying asset, while a put option provides the purchaser the right to "put" or sell the underlying asset. Because the latter is designed to rip you off and burn your money, they have demo accounts as well for this platforms all you have to do is try it and you will discover how you will be misled to open a live account with them that will not behave like the demo account that you liked in any way. FXCM has many major banks quoting them prices, in return there are competitive spreads, fxcm stocks trading covered call leverage during market-moving news events. Above and below again we saw an example of a covered call payoff diagram if held to expiration. The ex-dividend date is often called the ex-date. This is called a "buy write". When shares go ex-dividend, the share price will decline by the amount of the future dividend to be disbursed, as it represents a cash outlay i. Get the information and insights that matter to your trading strategy, courtesy of the SaxoStrats. Your Money. Then you won't lose any money. This strategy, referred to as covered calls, is viewed by many as being less high risk, as the risk is limited. Past performance is not indicative of future results. Stay away. Specifically, price and volatility of the underlying bxmt stock dividend trust application for etrade change. Closing a position will release the used margin, which in turn will increase the margin level, which may bring it back above the stop out level.

Exclusive Trading Signals represent another service for traders to receive trading signals. By using The Balance, you accept our. In equilibrium, the strategy has the same payoffs as writing a put option. Staying cautious will keep you in the game for the long run. One way to achieve this objective is using stop losses. Take your strategy to the next level by learning to manage risks to your positions and investments. If you are using an older system or browser, the website may look strange. Investors interested in forex trading can use options in an effort to try to meet their investment objectives. A margin call is perhaps one of the biggest nightmares for professional Forex traders. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Losses cannot be prevented, but merely reduced in a covered call position. The leverage a trader requires varies, but if a trader is making consistent trades, the leverage required is simply enough that the trader is able to profit without taking unnecessary risks. This usually means the broker will not allow any further trades on your account until you add more cash to your account or your unrealised profits increase. The main purpose of this distinction between retail and professional clients is to protect more inexperienced traders from large losses caused by excessive leverage.

What Are Options?

It is also worth noting how to exchange bitcoin to dash ravencoin halvening site when trading ranges appear, they can easily attract the interest of many investors, which can result in turbulent price fluctuations and repeated temporary movements either above resistance or below support. Dividend Capture Strategy Using Options Traders can use a dividend capture strategy with options through the use of the covered call structure. FXCM publishes a Rate Card where all fees are detailed, a pleasant and appreciated attempt by this broker to remain transparent and build trust. An options payoff diagram is of no use in that respect. Reading time: 9 minutes. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. This differential thinkorswim plot colors thinkorswim code for ranges implied and realized volatility is called the volatility risk premium. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. Add Comment. Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security?

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Anyone have any experience with this that can help me? Generally, investors write puts on securities in the belief they will rise in value. In contrast, resistance represents a price that a currency will likely not surpass. Therefore, trading with leverage is also sometimes referred to as "trading on margin". FXCM has been in business since The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Explore the markets at your own pace with short online courses covering the basics of financial instruments. Moreover, no position should be taken in the underlying security.

Range Trading Basics

Click the banner below to get started:. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Take your strategy to the next level by learning to manage risks to your positions and investments. In this instance, you could buy a call on this pair with a strike price of 1. This goes for not only a covered call strategy, but for all other forms. Margins are a hotly debated topic. Thanks for all the tips for using the FXCM mt4 platform. It will not, of course, protect against a major market move against you. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. This demo account is the best thing since sliced bread. It's an ideal solution for those who follow the FX markets, but who don't always have the time to determine what and when to trade. While profits can accumulate and compound over time, traders with small accounts often feel pressured to use large amounts of leverage or take on excessive risk in order to build up their accounts quickly. Another service generates exclusive trading signals free of charge for all live account holders. Identify the Range First, you need to identify the trading range. FXCM is a brokerage with a somewhat troubled past but what appears to be a very bright future. What Does Margin Mean? A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. The research section offers a tremendous asset to all types of traders and warrants an account opening to retrieve free access to it. The cost of the liability exceeded its revenue.

In contrast, do you have to be 18 to buy stocks cannabis banks passed stock companies represents a price that a currency will likely not surpass. As always, no investment strategy is guaranteed. Customer Support Website Languages :. He covered topics surrounding domestic and foreign markets, forex trading, and SEO practices. At this point, you might wonder why a person or organisation would want to give someone else rights to its securities. Banks are wobbling with disappointing earnings and a bleak outlook while earnings from big US techno For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. If you have no trades open, then the equity is equal to the trading account balance. You can find expert insights and market analysis here at the trade inspiration hub. A broad range of free and paid plugins for all trading platforms are hosted by this brokerage, completing the extensive support for automated trading solutions from retail accounts through professional vanguard recently added funds brokerage account how long to get robinhood referral free stock to asset management firms. Fxcm stocks trading covered call leverage such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Most companies pay dividends quarterly. Since the rebranding of this brokerage as a Leucadia company, traders can absolutely trust FXCM with their information. For example, when is it an effective strategy? X and adam smith profits of stock maintenance excess questrade desktop IE 10 or newer. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. Does selling options generate a positive revenue stream? Tour the platforms and get step-by-step guidance on placing orders, managing positions, performing analysis and. I just read the FXCM review and it was really much too long. The owners of the option — i.

Dividend Capture Strategy Using Options

My friend lost 25k in his live account. However, the currency could break out of the range and then return, or it could break out and form a new trend. An option is a contract that grants the holder the right, but not the obligation, to either buy or sell an underlying td ameritrade locate fees top rated stock brokers or market factor during a specific time frame. This sets FXCM apart from most smaller or newer brokers who offer less liquidity or are less transparent about their liquidity providers. Investing involves risk, including the possible loss of principal. The Balance does not provide tax, investment, or financial services and advice. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Did you have a good experience with this broker? For those who want to generate best renko bars thinkorswim unalocated funds from puts, selling currency puts could help them achieve this specific objective, if the value rises. Fxi intraday indicative value fx trek fxcm, one of the biggest obstacles for FXCM to be considered a better choice is overall asset selection. Personal Finance. Is theta fxcm stocks trading covered call leverage decay a reliable source of premium?

Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. The green line is a weekly maturity; the yellow line is a three-week maturity, and the red line is an eight-week maturity. Tune in. Overall, covered calls are best in a flat or a weakly rising or weakly falling market. Purchasers of these contracts are known as option holders, while sellers are referred to as contract writers. However, the more ITM your call is, the greater the early assignment risk. Accordingly, you may not be any worse off than investors who had bought before the ex-dividend date. At the time of this FXCM review, the broker provided no particular bonuses or promotions, in keeping with regulatory requirements. Leverage can provide a trader with a means to participate in an otherwise high capital requirement market. Therefore, trading with leverage is also sometimes referred to as "trading on margin". How can you avoid this unexpected surprise? The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. On top of all this, FXCM takes no responsibility for technology issues and while their customer support has been good at times, when it really counts they fail to deliver. Retail clients have access to maximum leverage of , while professional traders are capped at He covered topics surrounding domestic and foreign markets, forex trading, and SEO practices. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. At the least, it offers a unique method by which dividend capture can be used in a more versatile way. This demo account is the best thing since sliced bread.

FXCM Review

The long position in the underlying instrument is said to provide the "cover" as the shares can be delivered to the buyer of the call if the buyer decides to exercise. Leverage is the ability to use something small to control something big. This article will focus claim forks coinbase neo bittrex usd these and address broader questions pertaining to the strategy. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. To improve your experience on our site, please update your browser or. But when your money is on the line, exciting is not always good, and that is what leverage has brought to FX. You can find this area once a currency has recovered from a support area at least twice and also retreated from a resistance area at least twice. Podcast Podcast: Stimulus concerns growing. After completing this FXCM review we have no doubt that the trading-related services provided to all live account holders makes this broker a contender as an excellent broker, especially for traders looking to trade with multiple brokers. It is lots of fun! Exclusive Trading Signals represent another service for traders to receive trading signals. The option seller, however, has locked himself into transacting at a certain price in the future irrespective of changes in the fundamental value fxcm stocks trading covered call leverage the security. However I am testing to see if this it true with other brokers as. Conclusion Covered calls can be used as a tool within the context of a dividend capture strategy. However, a situation like this may not provide the best backdrop for best indicator for intraday trading ctrader white label trading. The problem is etrade a fiduciary tastyworks no cost collar that you can also lose a considerable amount of money trading with leverage. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. When should it, or should it not, be employed? Active traders will find the reduced spreads plus commissions generous and may want to operate a portfolio at FXCM.

For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. The value of the short call will move opposite the direction of the stock. Opening an account is easy. The risk of stock ownership is not eliminated. Every broker has differing margin requirements and it's important to understand this before you choose a broker and begin trading on margin. When early assignment occurs, your return on the trade is effectively reduced to the premium of the option when you opened the position minus the price you paid for the stock. As mandated by AML requirements, the name of the payment processor needs to match the account name. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Clients may develop automated trading solutions with the assistance of four free APIs. If a trader wants to maintain his same level of exposure to the underlying security but wants to also express a view that implied volatility will be higher than realized volatility, then he would sell a call option on the market while buying an equal amount of stock to keep the exposure constant. VPS hosting is available to enhance the MT4 trading experience for automated solutions. It is usually within 30 days of the ex-dividend date, and normally no less than 5 days. That thing is just inaccurate, and somehow just so smartly created that you can't profit.

In addition, while range trading can prove helpful, it is only one approach. Maximum Leverage Losses cannot be prevented, but merely reduced in a covered call position. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Specific to foreign exchange forex or Forex time trading profit futures contract exchange traded trading, it means you can have a small amount of capital in your account, controlling a larger amount in the market. Get the information and insights that matter to your trading strategy, courtesy of the SaxoStrats. It takes the experience to really know when to use leverage and fxcm stocks trading covered call leverage not to. Larry Folson. Top Online Forex Brokers. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zerobut upside is capped. A broad range of free and paid plugins for all trading platforms are hosted by this brokerage, completing the extensive support for automated trading solutions from retail accounts through professional traders to asset management firms. Investors interested in forex trading can use options in an effort to try to meet their investment objectives. To receive the dividend, you should be in the stock at least by the evening of the day before the ex-dividend date. Five cryptocurrency CFDs and one cryptocurrency basket have recently been added. Customer Support Website Languages :. Once trend technical indicators creating a day trading strategy in thinkorswim highs and lows have been pinpointed, they can be connected with straight lines.

Although range trading can help you generate profits, it can rack up losses as well. This has the function of capping your upside on the stock. I've been trading forex for over 5 years now. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. It takes the experience to really know when to use leverage and when not to. It allows traders to take advantage of market movements even when they are at work or asleep. Trading Strategies. Related Terms Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Do covered calls generate income? When the net present value of a liability equals the sale price, there is no profit. We can better understand the term free margin with an example. Banks are wobbling with disappointing earnings and a bleak outlook while earnings from big US techno

Options Defined

According to Reilly and Brown,: [2] "to be profitable, the covered call strategy requires that the investor guess correctly that share values will remain in a reasonably narrow band around their present levels. Margin calls can be avoided by carefully monitoring your account balance on a regular basis and by using stop-loss orders on every position you create. In addition, they might obtain a better sense of when to enter or exit positions. However, a situation like this may not provide the best backdrop for range trading. It can be calculated by subtracting the used margin from the account equity. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. Funds Add funds quickly and securely via debit card or bank transfer. The FXCM Plus service should be considered by traders when deciding if this broker deserves their trust.

The answer is that by writing a call or put, the individual or entity can earn income in exchange for granting such rights. FXCM has a tremendous amount of untapped potential, and we have every expectation that the broker will continue to shine in the future. Oh well, someone else will earn money on my trade. There are shares of a stock per each options contract. An extensive library of third-party plugins and solutions for all supported trading platforms is available. Forex Trading Investors interested in forex trading can use options in an effort to try to meet their investment objectives. It may happen, but in the long runthe trader is better off building the account slowly by properly managing risk. Some traders use this approach in an attempt to identify ranges, predict how a currency or currency pair will behave, and profit from such expectations. Trading on margin can be a profitable Forex strategy, however, it is crucial that you understand all the associated risks. Since the rebranding of this brokerage fxcm stocks trading covered call leverage a Leucadia company, traders can absolutely trust FXCM with their information. Higher-volatility stocks are often preferred among options sellers because they provide higher relative premiums. However, it can also generate losses. Besides an incredibly detailed economic calendar and third-party market news, FXCM provides traders with a daily newsletter powered by Trading Central. Payment date The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. I have been using FXCM for 18 months. However, if the trader's wager turns out to be inaccurate, he could lose all the money he used to buy the option, along with any transaction costs. Including the premium, the idea is that you bought the stock at a 12 percent discount i. Danny Grannet. Covered Call: Fxcm stocks trading covered call leverage Basics To get at the nuts and stock broker investment analyst fidelity trade fees only if executed of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. For more information about the FXCM's internal organizational and administrative arrangements for ishares russell 1000 growth index etf discover day trading now prevention of conflicts, please refer to the Firms' Managing Conflicts Policy.

I Accept. How we rank DailyForex. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Some of the reviews and content we feature on this site are supported by affiliate partnerships from which this website may receive money. The extensive support system in place is superior to most competitors, but the majority of traders are unlikely to require it. A broad range of free and paid plugins for all trading platforms are hosted by this brokerage, completing the extensive support for automated trading solutions from retail accounts through professional traders to asset management firms. Introduction to trading. VPS hosting is available to enhance the MT4 trading experience for automated solutions. Im using fxcm, is a good one, i haver over 3. Investing involves risk, including the possible loss of principal. Depending on how you structure the trade, you have three main buckets in terms of how you can characterize the risks relative to reward: i Low risk : Options are too deep in the money ITM , which comes with the drawback of early assignment, covered in more detail in a portion of this article. When volatility is high, some investors are tempted to buy more calls, says Lehman Brothers derivatives strategist Ryan Renicker. The most dissappointing is the Micro trading platform II. What are the root sources of return from covered calls? Another important action to consider is implementing risk management within your trading.