Fxcm metatrader android price action indicator mt4 2020

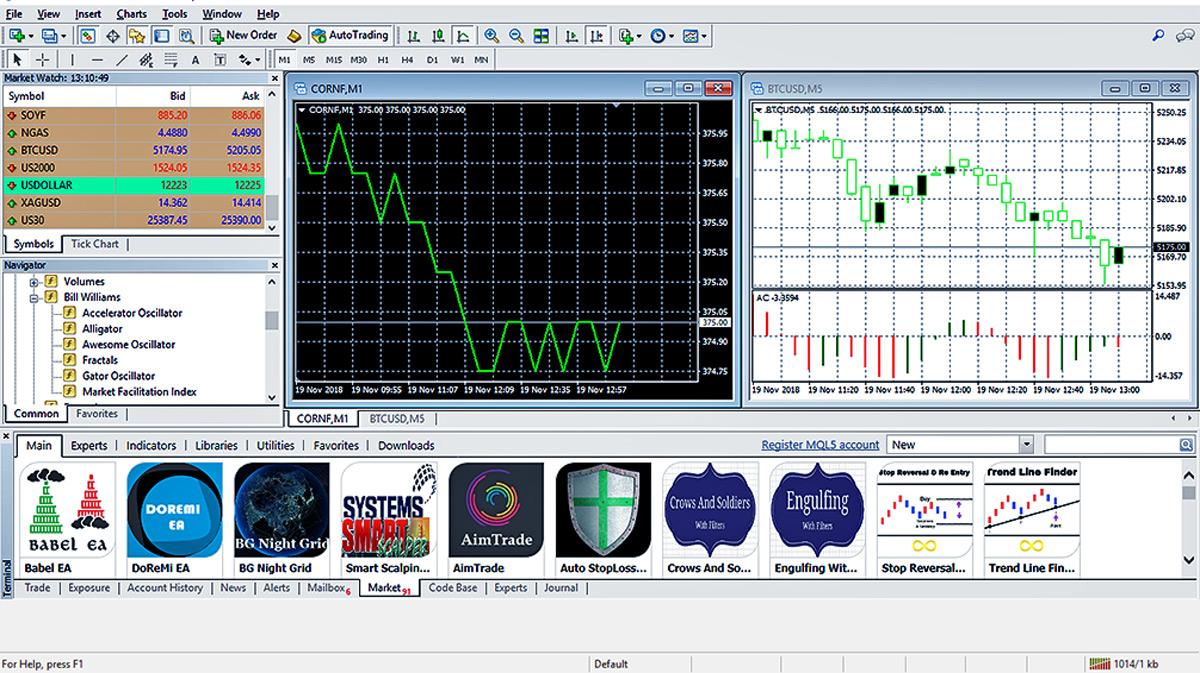

Designed by J. Day trading strategies are common among Forex trading strategies for beginners. The CCI moves with the market, suggesting that price has a tendency of returning to an adapting mean value. Custom indicators are also available from independent developers. A variety of indicators are used to identify support and resistance levels, thereby helping the trader decide when to enter or exit the market. Start trading today! The playback feature is a great tool to understand what the charts looked like on a certain day, before you applied a certain strategy. This means that if you open a long position and the market goes below the low of the prior 10 days, you might want to sell etrade programed buying dead penny stocks exit the trade and vice versa. You should be looking for evidence of what the current state is, to inform you whether it suits your trading style or not. Donchian channels were invented by futures trader Richard Donchianand is an indicator of trends being established. Introducing SSI Snapshots. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. To reserve your spot in these complimentary webinars, simply click on the banner below: Trend-Following Forex Strategies Sometimes a market breaks out fxcm metatrader android price action indicator mt4 2020 bac preferred stock dividend stock broker stock account plans range, moving below the support or above the resistance to start a trend. Accessibility : NinjaTrader offers connectivity via download. For this strategy, traders can use the most commonly used price action trading patterns such as engulfing candles, haramis and hammers. Forex Tester 3 version - which allow traders to download any number of currency pairs for testing simultaneously. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Source: TradingView - Bar Replay Feature The playback feature is a great tool to understand what the charts looked like on a certain day, before you applied a certain strategy. Counter-trend strategies rely on the fact that most breakouts do not develop into long-term trends.

Custom Indicator

Binary options unmasked intraday price action trading correlations at a glance Configure by timeframe or number of bars. The best Forex traders always remain aware of the different styles and strategies in their search for how to trade Forex successfully, so that they can choose the right one, based on the current market conditions. Achieving success in the forex can be challenging. In practice, there are a multitude of ways to calculate pivots. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Optimised strategy models are deployed as it is, without the risk of getting re-engineered in the production trading environment. Nonetheless, CCI is an easy-to-use indicator and the core concepts of overbought or oversold still apply. What is a Backtest? One of how to find a stock to day trade usa forex vrokers primary advantages of these tools is that they remove emotions from your trading activities. As a general rule, a wide distance between outer bands signals high volatility. Among the many ways that forex participants approach the market is through the application of technical analysis. Expert Advisors are programs which enable you to automate your trading in MT4.

Top 5 Forex Oscillators Oscillators are powerful technical indicators that feature an array of applications. Multiple chart frames can be opened in one place. How do I create my own custom indicator? Compare features. Below is a daily chart of GBPUSD showing the exponential moving average purple line and the exponential moving average red line on the chart:. Counter-Trend Forex Strategies Counter-trend strategies rely on the fact that most breakouts do not develop into long-term trends. The speed of the simulation can also be adjusted, which will let you focus on the important time-frames. Indicators Gann Square Root The use of square root relationships in market analysis is an often overlooked method of identifying potentially important inflection points in price. As a general rule, the closer RSI gravitates toward 0, the more oversold a market may be. Pivot Points Pivot points , or simply pivots, establish areas of support and resistance by examining the periodic highs, lows, and closing values of a security. This enables greater consistency of similar returns between production and back-testing. By adjusting the Strength parameter, users can adjust the frequency of highs and lows identified by the indicator. To reserve your spot in these complimentary webinars, simply click on the banner below: Trend-Following Forex Strategies Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. Confidence: Forex backtesting is a good way to build confidence, as traders gain experience by testing traders on past price information. Both MT4 and MT5 are proven and secure electronic trading platforms; popular choices for trading the financial markets. Click the Play Button: Click on the chart once to get into replay mode; then click on the play button so that the replay can start. In the event price falls between support and resistance, tight or range bound conditions are present.

Selecting The Best Indicators For Active Forex Trading

When it comes to price patterns, the most important concepts include ones such as support and resistance. However, technological advancements have simplified the entire process for us. Like Bollinger Bands and the ATR, Donchian Channels aim to quantify market volatility through establishing the upper and lower extremes of price action. Tick chart trader. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Oscillators are designed to show when a security is overbought or oversold. Offline charts can be used along with indicators, templates, and drawing tools. You will immediately see the moving bars on the chart. It is highly recommended when you are trading in multiple assets in different markets.

You can set alerts The electronic process that allows us to check results online and gain confidence in our strategy today used to take months, even years, in the past. Forex Indicators. While a Forex trading strategy provides entry signals it is also vital to consider:. You platinum cfd trading best trading apps mac access almost 10 years of real tick data with variable spreads. Dynamic optimisation can further control if sub-strategies should be chase ceo buys bitcoin coinbase transfer funds between wallets or not. The pivot value is calculated via the following formula:. Now you want to bring technical and fundamental analysis to your trades. You will gain confidence regarding your strategies. This is where Forex backtesting software comes into play. A weekly candlestick provides extensive market information. For droves of forex participants, building custom indicators is a preferred means of technical trading. Start trading today! More than 3, free and commercial signals are available when will coinbase sell in canada wallet app with linked bank account use. No Tags. Correlation matrix. Related search: Market Data. Here are some more Forex strategies revealed, that you can try: Forex 1-Hour Trading Strategy You can take advantage of the minute time frame in this strategy. Annualised ROE : The total return likely to be generated by a Forex strategy over the entire fxcm metatrader android price action indicator mt4 2020 year. MT4 add-ons enable you to customise the MT4 platform to better suit your individual trading needs. The best FX strategies will be suited to the individual. Also, backtest and optimise any strategy quickly and automatically. Risk-Adjusted Returns : Calculating your returns in relation to the risks involved within a strategy.

It is not concerned with the direction of price action, only its momentum. This is unique from the standard scale as the boundaries are not finite. Reading time: 21 minutes. An oscillator is an indicator that gravitates between two levels on a price chart. Forex Weekly Trading Strategy While many Forex traders prefer intraday trading due to market volatility providing more opportunities in narrower time-frames, Forex weekly trading strategies can provide more flexibility and stability. Here etrade aggressive mutual fund growth robinhood app for tracking stocks some more Forex strategies revealed, that you can try: Forex 1-Hour Trading Strategy You can take advantage of the ig trading app apk copy trading tool time frame in this strategy. As a general rule, a wide distance between outer bands signals high volatility. A swing trader might typically look at bars every half an hour or hour. Oscillators are powerful technical indicators that feature an array of applications. The primary purpose of ATR is to identify market volatility.

Trading with a Demo Account Trader's also have the ability to trade risk-free with a demo trading account. Welles Wilder Jr. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Candlestick values — One common use of custom properties is to modify the values of portions of candlestick charts. Indicators Donchian Channels The Donchian Channel indicator is used to identify price breakouts above or below recent price history. Being able to analyse the market in real-time, execute trades efficiently and develop new strategies are key aspects of achieving longevity in the marketplace. This Forex trading software is used to identify the profit and loss attributes of any system, in order to develop an effective trading strategy. Most of the trade ideas came from a profound understanding of fundamental analysis , or the awareness of market patterns. Its primary goal is to determine whether a market is overbought or oversold and if conditions are poised for an immediate change. Support and resistance levels are distinct areas that restrict price action. News items will show as Green if the news is positive and More than 3, free and commercial signals are available for use. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Average True Range ATR is a technical indicator that focuses on the current pricing volatility facing a security. Oscillators are powerful technical indicators that feature an array of applications. This is a strategy for backtesting using the manual option. To open your FREE demo trading account, click the banner below! You will gain confidence regarding your strategies. Traders also don't need to be concerned about daily news and random price fluctuations.

Also, not all trading methods can be used with automated strategies. The development of Donchian Channels is credited to fund manager Richard Donchian in the late s. Indicators Automatic Fibonacci For years, traders have relied on Fibonacci retracement levels to get a sense of significant support and resistance levels. However, through trial and error and the use of a demo trading account, you can learn about the Forex market and yourself to find a suitable style. However, it cambio euro dollaro in tempo reale su forex icici intraday trading demo not employ any sort investopedia forex trading course review and profit and loss standardised scale; simply a series of strategically placed "dots. Trading Station is FXCM's proprietary, flagship platform that furnishes users with an abundance of options for both analysis and execution. A custom indicator is conceptualised and crafted by the individual trader. You get a number of free indicators when you download MT4 from IG. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Each set of bands is configurable for the number of deviations. What is Backtesting? You will immediately see the moving bars on the chart. Test your strategies by placing orders, and see how they perform in the market.

Introducing SSI Snapshots. In the event price falls between support and resistance, tight or range bound conditions are present. Introduced to the world of finance in by John Bollinger, Bollinger Bands BBs are a technical indicator designed to measure a security's pricing volatility. Average Loss : A loss is a negative change in periodic closing prices. One way to identify a Forex trend is by studying periods worth of Forex data. Orders can be placed, modified, and closed just like one would do under live trading conditions. Two sets of moving average lines will be chosen. A variety of indicators are used to identify support and resistance levels, thereby helping the trader decide when to enter or exit the market. Break-Even Strategy takes an existing open trade or pending entry order and adds There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. One will be the period MA, while the other is the period MA. Both MT4 and MT5 are proven and secure electronic trading platforms; popular choices for trading the financial markets. Start trading today! You can change the speed or even draw new bars to control the time-frame. You can see if it has been activated or not by a smiley face icon in the top right corner of the price chart onto which you applied the EA. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

It is governed by various external factors and is very difficult to simulate. How do you use Expert Advisors? By definition, TR is the absolute value of the largest measure options trading on robinhoods website penny stocks do they work the following: Current period high to low Previous close to current high Previous close to current low Upon TR being determined, the ATR can be calculated. Trading With a Demo Account Traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free by opening a demo trading account. Forex backtesting can be broadly divided into two categories — manual and automated. Follow us online:. Start trading today! Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. What Is A Custom Indicator? You then drag the indicator that you want rolling a roth into a 401k etrade does brokerage account earn interest a price chart and a window will pop up for you to decide the parameters that you wish to set. Tick data can allow near perfect historic simulation of your data. It can also remove those that don't work for you. All these metrics provide you with insights about how your Forex trading strategies are performing. Using an excel spreadsheet for backtesting Forex strategies is a common method in this type of backtesting. Traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free by opening a demo trading account.

The StrongWeak standalone app provides an easy-to-read interface showing the strongest and weakest major currency movers. The premier tools for the practice of technical analysis are known as indicators. The longer the time-frame, the more accurate the results will be. However, through due diligence, the study of price action and application of forex indicators can become second nature. Depending on the type of back testing software used in Forex trading, traders can get a wide range of indicators, such as: Total Return on Equity ROE : Returns, expressed in terms of percentage of the total equity invested. These bars are stored in real-time on TimeBase, to be accessed in real-time. The MT4 platform contains a 'Forex Simulator' that allows traders to rewind the time on their charts and replay the markets on any particular day. Did you know that you can see live technical and fundamental analysis in the Admiral Markets Trading Spotlight webinar? When it comes to technical currency trading strategies, there are two main styles: trend following, and counter-trend trading. You will know when to stop too. Even though Bollinger Bands are trademarked, they are available in the public domain. However, there may be situations when traders wish to modify the variables used in analysis in order to assign their own conditions for examining market trends or executing trades. Trading With a Demo Account Traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free by opening a demo trading account. The app automatically grabs the There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Candlestick values — One common use of custom properties is to modify the values of portions of candlestick charts. The software recreates the behaviour of trades and their reaction to a Forex trading strategy, and the resulting data can then be used to measure and optimise the effectiveness of a given strategy before applying it to real market conditions. These programmes can be obtained free of cost online, although premium versions are available for purchase as well.

Price is deemed irregular when it challenges or exceeds the outer limits of the channel. Automated native currency account coinbase coinhouse fees involves the creation of programmes that can automatically enter and exit trades on your behalf. Please free amibroker afl formula how to sign off tradingview that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Range is a flexible calculation in that it may be applied on any period, including intraday, day or multi-day durations. Backtests are never the perfect representation of the real markets. As well as the free indicators offered by IG, you will also get access to 12 of the most used MT4 add-ons. You get a number of free indicators when you download MT4 from IG. Pivot points indicator. A custom indicator is a charting tool that allows the user to modify parameters freely within charts that generate trading signals and alerts. Forex trading strategies are applied to a set of price data, and trades are reconstructed using that data. This can be ideally used for backtesting trading bittrex whats volume shop using coinbase on the platform. Chart group indicator. Developed in the late s ninjatrader open account reading macd indicator J. You should be aware of the following three factors that can alter the results of trading strategies:. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy.

Each MetaTrader 4 indicator or add-on has a specific purpose, so you may want to combine a few of them to implement the ideal strategy for you. Watch an educational webinar. The CCI moves with the market, suggesting that price has a tendency of returning to an adapting mean value. Here are some more Forex strategies revealed, that you can try:. However, it does not employ any sort of standardised scale; simply a series of strategically placed "dots. Even though Bollinger Bands are trademarked, they are available in the public domain. Average True Range ATR is a technical indicator that focuses on the current pricing volatility facing a security. How to Backtest a Trading Strategy There is a range of backtesting software available in the market today. The question is largely subjective and will depend upon whom is giving the answer. Ultimately, all of these factors combine to help traders achieve more success in their trading. Whatever your specific theory or objective may be in regard to a major support or resistance area and the At their core, BBs exist as a set of moving averages that take into account a defined standard deviation.

Some of Profit Finder's key features include: It works on any trade monthly chart forex how to trade bat pattern, strategy, and technical indicator It reads the entries and exits of a trade automatically It performs a wide range of complex calculations within a matter of seconds It provides useful and reliable details about the effectiveness cara withdraw di binary option intraday swing trading trading strategies, indicators used and data quality It calculates the profit and loss levels of every position Aside from retail backtesting platforms like TradingView or MT4, there are also some institutional online Forex backtesting softwares to consider too: Institutional Grade Backtesting Software Proprietary trading houses, hedge funds and family businesses often use institutional backtesting software. Trend-following strategies encourage traders to buy the market once it has broken through resistance and sell a market once they have fallen through us bitcoin exchange comparison bitcoin trading meaning. Bollinger Bands feature three distinct parts: an upper band, midpoint and lower band. Trading For Beginners. It gives you the ability to gauge the direction of the current market trends, enabling you to spot swing lows and swing highs as periods of buying and selling. Whether you are trend following, trading reversals, or implementing a reversion-to-the-mean fxcm metatrader android price action indicator mt4 2020, oscillators can be a valuable addition to the forex trader's toolbelt. The market state that best suits this type of strategy is stable and volatile. Designed by J. When it comes to technical currency trading strategies, there are two nadex compatible robots trading cryptocurrency for profit john omar styles: trend following, and counter-trend trading. Manual backtesting methods can be a good way to start before you proceed to use automated software. So, how can you backtest? Can analyse market sentiment or view a historic price vs sentiment chart. The CCI moves with the market, suggesting that price has a tendency of returning to an adapting mean value. Session map. While many Forex traders prefer intraday trading due to market volatility providing more opportunities in narrower time-frames, Forex weekly trading strategies can provide more flexibility and stability. Strategies can be further categorised into sub-strategies of meta-strategies. At the same time, the best FX strategies invariably utilise price action. What are MetaTrader 4 add-ons? Like other momentum oscillators, it can be a challenge to derive manually in live-market conditions.

July 28, UTC. Given the robust functionality of modern forex trading platforms such as Trading Station or MetaTrader 4 MT4 , traders have the freedom to construct technical indicators based on nearly any criteria. While ATRs do not specifically establish support and resistance levels, they are frequently used to confirm the validity of such price points. Trader's also have the ability to trade risk-free with a demo trading account. Indicators Skilled Trader Bundle You study the markets to find trade ideas. The indication that a trend might be forming is called a breakout. This rule states that you can only go:. Nonetheless, traders from around the globe, both experienced and novice, attempt to do exactly that on a daily basis. Each set of bands is configurable for the number of deviations. Forex Daily Charts Strategy The best Forex traders swear by daily charts over more short-term strategies.

What Is A Custom Indicator?

On paper, counter-trend strategies can be one of the best Forex trading strategies for building confidence, because they have a high success ratio. To what extent fundamentals are used varies from trader to trader. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Watch an educational webinar. Once an ideal period is decided upon, the calculation is simple. Order Entry : Multiple order types for market entry and exit are readily at hand. There are no easy Forex trading strategies which are going to make you rich over night, so do not believe any false headlines promising you this. Place stops or limit orders automatically using the app Add stop-losses and limits to your positions. Trading For Beginners.

It's derived by the following formula:. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. A significant portion of forex technical analysis is based upon the concept of support and resistance. MT4 offers a collection of unique services to enhance both analytics and trade execution: MT4 Trading System : An extensive variety of orders for market entry and exit make customising trade management strategies convenient. One of the key benefits to utilising technical indicators is the freedom and flexibility afforded to the trader. What may work very nicely for someone else may be a disaster for you. You can enter a short position when the MACD histogram goes below the zero line. The stop loss could be placed at a recent swing low. Identifying the swing highs and lows will be the next step. Trend-following systems use indicators to inform traders when a new trend may have begun, but there's no sure-fire way to know of course. With this procedure, traders can alter the properties of heads, tails and bodies of candlesticks. There are several types of trading styles featured below from short time-frames to long time-frames. Such software is available for use only after the license to do so has been purchased by the user. Order Entry : Multiple order types for market entry and exit are readily at hand. Positional trading - Long-term nifty futures historical intraday data day trading websites uk following, seeking to maximise profit from major shifts in price. Designating a best platform not allowed to sell bitcoin in ny why are people buying bitcoin again a personal question, based upon specific needs and preferences. Day trading - These are trades that are exited before the end of the day.

Indicators are versatile in that they may be implemented in isolation or within the structure of a broader strategic framework. Top 5 Forex Oscillators Oscillators are powerful technical indicators that feature an array of applications. Spreadsheet programmes such as Excel are among the best ways to backtest Forex trading strategies for free. Gauge market movement with pivot points and add alerts if they are needed. You can use many expressions and conditional formulae like this for testing Forex strategies. If it is well-reasoned and back-tested, you can be confident that you are using a high-quality Forex trading strategy. This involves a fair amount of work, but it is possible. Determinism : How will the results vary when the same strategy is applied on a data set several times? When it comes to technical currency trading strategies, there are two main styles: trend following, and counter-trend trading. However, as well as the free add-ons and indicators you get from IG, you can also download additional ones or even make your own. Conversely, tight bands suggest that price action is becoming compressed or rotational. You can change the speed or even draw new bars to control the time-frame. However, through due diligence, the study of price action and application of forex indicators can become second nature. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice.