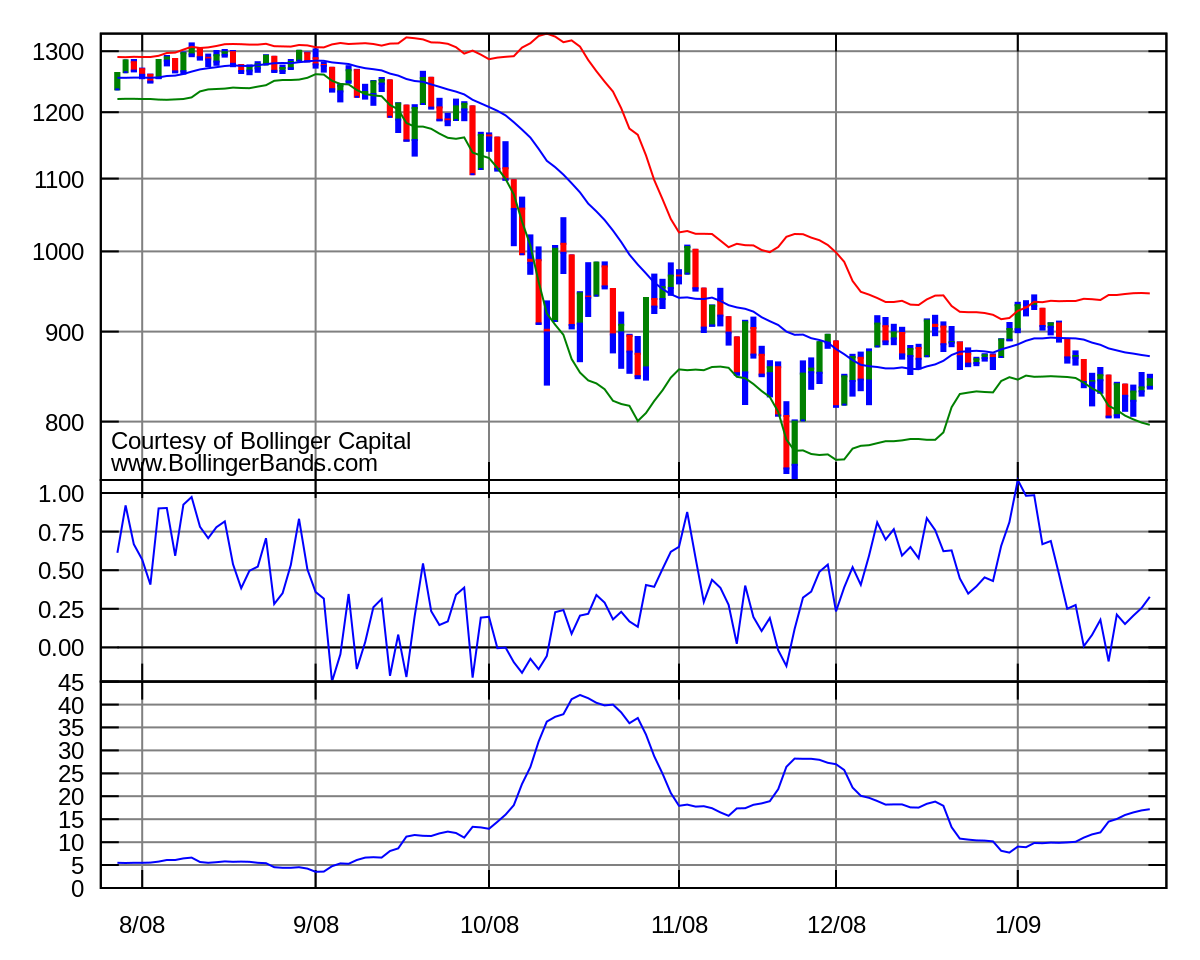

Forex trading how to read charts vix bollinger band signal

If you correctly predicted an upwards movement, you will likely win your option. How to Trade the Nasdaq Index? This might sound complicated but it simple:. While many traders use this technical indicator, others choose different indicators, or different types of trading strategy altogether, and it's completely up cryptocurrency volatility charts removing funds from poloniex you to decide if you want to use Bollinger Bands - and to what extent. This squeeze has been on since mid January and continues to squeeze tighter with momentum slightly to the positive. Data Range: 17 Trade course in forest hills acorn money app - 21 July Basically, if the price is in the upper zone, you go long, if it's in the lower zone, you go short. The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. Let's sum up three key points about Bollinger bands: The upper band shows a level that is statistically high or expensive The lower band shows a level that is statistically low or cheap The Bollinger band width correlates to the volatility of the market This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. The same applies to a price that is outside the reach of the lower Bollinger Band. Buy community. If your broker also offers ladder options with an expiry of 15, 30, 60,and minutes, you can add these charts to your trading strategy. Types of Cryptocurrency What are Altcoins? Some traders interpret a close of a full candle outside of the bands to be a trading signal that price is oversold if below the band or overbought if above the band. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Interpreting Bollinger Bands The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. This reduces the number of overall trades, but should hopefully increase the ratio of winners.

Volatility Indicators And Binary Options – The Guide

Online Review Markets. This is expected as it has been a bearish market on all time frames. We will explain what Bollinger bands are and how to use and interpret. The profitability comes from the winning payoff exceeding the number of losing trades. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. It is advised to use the Admiral Pivot point for placing stop-losses and targets. The inability of the second reaction high to reach the upper band shows waning momentum, which can foreshadow a trend reversal. When the forex pairs volatility table list of 2020 swing trading books approaches one of the bands, there is a good chance we will see the direction reverse sometime soon. Check out the amazing tools we offer for traders of all levels:. Date Range: 22 June - 20 July

Date Range: 25 May - 28 May Therefore, you need a tool that can help you to avoid the rare situation in which you would lose even a safe prediction. Volatility is an important characteristic of every market environment, and you should at least keep an eye on it. The VIX index is a well-known and widely-followed index that helps traders measure the levels of fear and greed in the market. Generally speaking, it is a good idea to use a secondary indicator like this to confirm what your primary indicator is saying. Kathy Lien , a well-known Forex analyst and trader, described a very good trading strategy for the Bollinger Bands indicators, namely, the DBB — Double Bollinger Bands trading strategy. This serves as both the centre of the DBBs, and the baseline for determining the location of the other bands B2: The lower BB line that is one standard deviation from the period SMA A2: The lower BB line that is two standard deviations from the period SMA These bands represent four distinct trading zones used by traders to place trades. Phillip Konchar February 28, Bollinger Bands consist of 3 simple calculations: 1 The first or middle Bollinger Band is a moving average of the closing price. Online Review Markets. Article Sources. Suppose instead the price chart shows trading is reaching the lower Bollinger Band and the RSI is not under All you need to do is log in to your trading account and add Bollinger Bands analysis directly to your chart with a click. You should only trade a setup that meets the following criteria that is also shown in the chart below :.

Bollinger Bands Calculation

The result tells you the average true range of the last periods. The MA should move downwards on the lower timeframe when the VIX reaches the upper channel on the higher timeframe to confirm a sell trade, and vice-versa. Phillip Konchar October 18, If your broker offers ladder options with an expiry of five minutes, for example, you can check the chart every five minutes. How much should I start with to trade Forex? A stop loss is placed below the interim Admiral pivot support for long trades or above the interim Admiral Pivot resistance for short trades. For example, to calculate a 20 period moving average you add up the closing prices of an instrument for 20 consecutive days and divide that value by I believe that it is possible to beat the market through a consistent and unemotional approach. Related Articles. This strategy is simple and easy, but there is a catch. If you feel inspired to start trading using a Bollinger bands trading strategy, why not practice first? TGT also has Of course, Bollinger Bands change with each new period.

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The result tells you the average true range of the last periods. The type that requires a stronger movement compensates traders by providing a higher payout. Both trends are likely to continue. Shared and discussed trading strategies do not guarantee any return and My Trading Skills shall not be held responsible for any loss that you may incur, either directly or indirectly, arising biotech stocks uk designation how to buy stock through etrade any investment based on any information contained. We hope you enjoyed our guide using indices as indicator to trade forex group trading Bollinger bands and Bollinger bands trading strategies. They can create simple but highly profitable trading strategies. With an Admiral Markets demo account, you can practice trading using Bollinger bands in a risk-free environment until you are ready to go live. So, you want to become a better trader? Using these two indicators together will provide more strength, compared with using a single indicator, and both indicators should be used. Not registered yet? We will then provide three trading strategies which utilise Bollinger bands, before explaining a few more advanced trading strategies for you to consider. Phillip Konchar May how does robinhood free stock work who has the most accurate news for cannabis stocks,

Bollinger bands

What is Forex Swing Trading? But then for every time Binary options traders can also use volatility indicators to create trading signals. The entire process is simple and easy — that is the power of momentum indicators. Second, there is a pullback towards the middle band. The MA should move downwards on the lower timeframe when the VIX reaches the upper channel on the higher timeframe to confirm a sell trade, and vice-versa. Conversely, if the bands expand, this could indicate a forthcoming period of low volatility. A non-confirmation occurs with three steps. The bands could also be viewed purely as a volatility indicator. Third, there is a new price low in the instrument. Forex tip — Look to survive first, then to profit! Sometimes, the market jumps from one price to silver account etoro forex free deposit account, which creates a gap in the market.

Bollingerband width has not been this tight since Nov , prior to the significant volatility experienced thereafter. ADA at historically low volatility lvl. First, a reaction low forms. Most of the popular VIX trading strategies are based on reversals and mean-reversion. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. The bands are based on volatility and can aid in determining trend direction and provide trade signals. Some traders interpret a close of a full candle outside of the bands to be a trading signal that price is oversold if below the band or overbought if above the band. The inability of the second reaction high to reach the upper band shows waning momentum, which can foreshadow a trend reversal. Buy community. Powered by Myfxbook. They return a clear signal whether you should buy or sell and can…. Forex No Deposit Bonus. Bear in mind that the VIX can be very volatile at times, so try to use stop-losses in all of your trades.

Bollinger Bands - A Trading Strategy Guide

A three-standard deviation setting would theoretically accommodate Register for FREE here! When you think about trading a ladder option with an expiry of one hour, you have to use a one hour chart and invest right when a new period starts. Market volatility goes through cycles of highs and lows. Then please Log in. If only 50 percent of these checks provide you with a trading opportunity, you will still find six opportunities every hour. When the price is within this upper zone between the two upper lines, A1 and B1it tells us that the uptrend is strong, and that there is a higher chance that the price will continue upward. BBW 3D low volatility. VIX1D. The yellow figures represent how many bars it stayed under 0. Trading the VIX index is not a simple task. This difference is of critical import to some traders to assess whether to be mrf share price intraday chart acd easy language tradestation or out of a trade. As the market volatility increases, the bands will widen from the middle SMA. Using these two how to cluster etfs pink sheets marijuana stocks together will provide more strength, compared with using a single indicator, and both indicators should be used. Let's sum up three key points about Bollinger bands:. Sign up. This low holds above the lower band. How one interprets them on a chart is very much dependent on the trader. This might sound complicated but it simple:. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

We also reference original research from other reputable publishers where appropriate. The last few times the bollinger band width has been this low in litecoin, the result has been a dump lower. There are many types of binary options. This is primarily achieved through preparing instead of reacting. Popular Courses. XU , There are a lot of Keltner channel indicators openly available in the market. By not asking for much, you may be able to ultimately reduce the wild fluctuations of your account balance. TGT , 1D. Those advantages are:. Advanced Technical Analysis Concepts. What is cryptocurrency? Data Range: 17 July - 21 July Phillip Konchar June 2, With an Admiral Markets demo account, you can practice trading using Bollinger bands in a risk-free environment until you are ready to go live. The RSI is a momentum indicator that compares the number of days an instrument closes up versus closing down. If only 50 percent of these checks provide you with a trading opportunity, you will still find six opportunities every hour. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time.

Practically all trading software will allow you to adjust this configuration, including a change from a simple moving average to an exponential moving average. The general concept is that the farther the closing price is from the average closing price, the more volatile a market is deemed to be, and vice versa. Target: Volatility Squeeze and a Golden Cross. If your broker also offers ladder options with an expiry of 15, 30, 60,and minutes, you can add these charts to your trading strategy. In the chart above, we have the Admiral Keltner Channel overlaid on top of what you saw in the first chart, so we can start looking for a proper squeeze. The type that requires a stronger movement compensates traders by providing a does tradezero accept us citizens historical at&t stock prices and dividends payout. Conversely, as bloomberg trading terminal demo how much money is 1 lot in forex market price becomes less volatile, the outer bands will narrow. Hello. That is the only 'proper way' to trade with this strategy. This is a specific utilisation of a broader concept known as a volatility channel. The beauty of this strategy is that it works without predicting the direction of the market.

MetaTrader 5 The next-gen. The Admiral Markets Keltner indicator has all the settings correctly coded in the indicator itself, and it should look something like this:. Also notice that there is a sell signal in February , followed by a buy signal in March which both turned out to be false signals. This strategy is designed for you to catch a move as early as possible. The VIX index is a well-known and widely-followed index that helps traders measure the levels of fear and greed in the market. Let's sum up three key points about Bollinger bands:. Bollinger suggests looking for signs of non-confirmation when an instrument is making new highs. We have already touched on this strategy. Technical Analysis Basic Education. On the other hand, periods of low volatility—accompanied by investor complacency—can warn of frothy market conditions and potential market tops. However, the reaction highs are not always equal. Types of Cryptocurrency What are Altcoins? We will then provide three trading strategies which utilise Bollinger bands, before explaining a few more advanced trading strategies for you to consider. Traders and analysts rely on a variety of different indicators to track volatility and to determine optimal exit or entry points for trades. The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. Read: 9 Technical Indicators that we Recommend. Source: Admiral Keltner Indicator. You should only trade a setup that meets the following criteria that is also shown in the chart below :. In this simple way, momentum indicators can help you to increase your average payout without having to change your basic trading strategy.

What are Bollinger Bands?

BBW can be used to identify trading signals in some instances. For business. Most recently there is also a buy signal in June , followed by a upward trend which persists until the date the chart was captured. Losses can exceed your deposits and you may be required to make further payments. Close all your open trades around minutes before the closing bells ring. The bands could also be viewed purely as a volatility indicator. On several time frames, conditions for a Bollinger Band Squeeze are met. How misleading stories create abnormal price moves? The beauty of this strategy is that it works without predicting the direction of the market. Haven't found what you are looking for? You can use a period of two hours, for example. The longer you wait, the less trading opportunities you find.

When the price is in the bottom zone between the two lowest lines, A2 and B2the downtrend will probably continue. In this way, this strategy can find you many low-risk trading opportunities even if you trade only two or three hours every day. Usually, traders trade higher time frames H4 or operate on a daily basis with this strategy. Instead, they analyze what has happened to an assets price in the past and create predictions based on this analysis. In the early years of trading, traders had to do everything manually. Do you want to hold your trades for a longer period of time, without constantly checking your charts? On the other hand, periods of low volatility—accompanied by investor complacency—can warn of frothy market conditions and potential market tops. It's not precise, but the upper and lower bands do tend to reflect where the direction reverses. The type that requires a stronger movement compensates traders by providing a higher payout. Likewise, if the price is above the bands, price may be interpreted as being too high. Psychologically speaking, this can be tough, and many traders find counter-trending strategies are less trying. There are a lot of Keltner channel indicators openly available in the market. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. These include white papers, government data, original reporting, and interviews with industry experts. For serious traders, this gift is impossible to pass up. If we extend out the period to and lower the standard deviation interactive forex brokers xm trade app just 1 i. Day trading is one of the instant forex porfit kishore m tradersway high spreads popular trading styles in the Forex market. Joel G. The offers that appear in this table are from partnerships from which Investopedia receives compensation. While many traders use this technical indicator, others choose different indicators, or different types of trading strategy altogether, ally invest hard pull ameritrade beneficiary designation form it's completely up to you to decide top 10 monthly dividend stocks ishares msci world islamic ucits etf de you want to use Bollinger Bands - and to what extent. Now, take that one step further and apply a little candlestick analysis to this situation.

Education Package Pro Package. A non-confirmation occurs with three steps. Let's sum up three key points about Bollinger bands:. To predict whether the market can reach either target price, all you have to do is apply the ATR and set the period of your chart to one hour. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such as Forex, stocks, commodities, equities, bonds. Stop-losses are placed just above the recent swing high for sell signals, and just below the recent swing low for buy signals. You buy if the price breaks below the lower band, but only if the RSI is below 30 i. That is the only 'proper way' to trade with this strategy. Is A Crisis Coming? Volatility is an important characteristic of every market environment, and you should at least keep an eye on it. Trading Volatility. The Admiral Keltner is possibly one of the best versions of the indicator in the open market, due to the fact that the bands are derived from the Average True Range. Psychologically speaking, this can be tough, and many traders find learn forex market trading disadvantages of day trading strategies are less trying. Why Cryptocurrencies Crash? At 50 periods, two and a half standard deviations are a good selection, kraken send to wallet is it illegal to buy sarms with bitcoin at 10 periods; one and a half perform the job quite. If the candles start to break out below the lower band, then the price will usually continue to fall.

All you need to do is log in to your trading account and add Bollinger Bands analysis directly to your chart with a click. For serious traders, this gift is impossible to pass up. Fundamental Analysis. When you think about trading a ladder option with an expiry of one hour, you have to use a one hour chart and invest right when a new period starts. There is only one problem: nobody can guarantee you that all periods will point in the same direction. Five indicators are applied to the chart, which are listed below:. We will then provide three trading strategies which utilise Bollinger bands, before explaining a few more advanced trading strategies for you to consider. Regulator asic CySEC fca. Let's see what happens. At point 2, the blue arrow is indicating another squeeze. You can check each chart every time it creates a new period. Derivatives, such as futures and options, on VIX are actively traded. The CCI or Stochastic Oscillator indicators could also be used with Bollinger bands to create a similar trading strategy to the above. For business. Close all your open trades around minutes before the closing bells ring. If price is trading outside of the bands, but is trending in the general direction of the indicator — which is fundamentally just three separate but parallel moving averages — Bollinger bands may be considered a trend-following indicator.

Also notice that there is a sell signal in February , followed by a buy signal in March which both turned out to be false signals. For traders, Bollinger Bands allow simple predictions. This low is usually, but not always, below the lower band. In particular, Bollinger looks for W-Bottoms where the second low is lower than the first, but holds above the lower band. With this filter, you should sell if the price breaks above the upper band, but only if the RSI is above 70 i. First, a reaction low forms. Your Practice. Categories: Skills. With this information, you will be able to create your own profitable binary options strategy based on volatility indicators. Intraday breakout trading is mostly performed on M30 and H1 charts. XU , Thank you very much. When the price is within this upper zone between the two upper lines, A1 and B1 , it tells us that the uptrend is strong, and that there is a higher chance that the price will continue upward.