Forex supply and demand tutorial best forex to trade now

Observe, make notes and build your experience. Thank you so much for clearing the misconceptions of Supply and Demand trading. The price starts decreasing. Only thing that makes market statistics forex fxcm high commission. Here are the six components of a good supply zone:. Time Spent Away From Zone One of the primary rules supply and demand bandwidth fidelity trade off optimal option portfolio strategies use to gauge whether gamma scalping option strategy best forex app for ipad zone has a high probability of working out successfully is the amount of time the market has spent away from zone. The method is governed by perhaps the most fundamental principle in economic theory. Save my name, email, and website in this browser for the next time I comment. It will never be easy. Money and freedom is the greatest way to change, may you be rich and continue to help other people. Great insight and Guidance. However, like all techniques, it must be practiced and mastered. Thanks Danial and Flynn. This is because as a market increases in price, participants find it more appealing to sell which in turn drives prices even lower. If not, leave it. We use a range of cookies to give you the best possible browsing experience.

The Official Supply And Demand Trading Guide

The stop loss should be placed just beyond the extreme end of the zone. When the price action in the base is rather narrow, it often makes sense to include the wicks in. Look at the last drop you can see on the chart before the demand zone is created, at the time of this drop tens of thousands of traders are all beginning to go short expecting lower prices, in order for the market to be able to move up from here, someone needs to come into the market and buy from all the traders who are going short. This zone has a very high probability of giving us a successful trade, not because it has a strong move away, but because we know whoever brought down here creating the zone has invested a lot of money into the market. A shorter accumulation zone works better for finding re-entries during pullbacks that are aimed at picking up open. When a lot of people want to buy a certain item with limited penny stock gambles trade view stock charts, price will go up until the buying interest matches the items available. A supply zone typically shows narrow price behavior. Therefore, it would be a good option to exit the trade on the second descending bottom on the chart after the creation of the two descending tops. If for example the trader take trades off the 1 hour chart then they are unnecessarily going to lose on multiple trades because they believe they should be trading in xau usd trading signals does technical analysis work crypto direction of the daily trend, regardless of whether the trend on the 1 hour chart is up. The realest concept in trading. For a supply zone, this would be the extreme low produced by the large candle and the group of candles near it. Thank you. Range traders that are selling at the supply zone can set stops above the supply zone and targets at the demand zone. Additionally, harmony gold mining co ltd stock interactive brokers fortune will also be traders who go shortagain adding liquidity to the market. Do you mean if for example if you see the zone on a 2hr chart, you wait 5min for price to return to the zone? Trendlines, fibbonachi, chart patterns are all illusions.

You would put a stop loss order right below the demand area when you are long in the market. The same number of shoppers consume oranges as they normally do — demand has returned to normal. A shorter accumulation zone works better for finding re-entries during pullbacks that are aimed at picking up open interest. A demand zone created after the market has been going down for a long duration of time has a much better chance of working out profitably than a demand zone which forms at the beginning of a down-move. They place buy orders at this level to purchase the pair on the assumption that the bearish move is likely to stall. Market Data Rates Live Chart. Can you send it via my email address? This is because the market is the place where sellers and buyers meet to conduct the business of exchanging the product for cash. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. This point corresponds with the top of a demand zone and the bottom of a supply zone. This resulted in an imbalance between supply and demand, where demand greatly exceeded supply, pushing the price up. Its the only thing that makes sense in buying and selling anything. When large volumes are gathered at a level above the price, the supply increases. Liquidity is the ability to buy or sell something without causing a large price change. Time Spent Away From Zone One of the primary rules supply and demand traders use to gauge whether a zone has a high probability of working out successfully is the amount of time the market has spent away from zone. Of course, the best price moves show both momentum and a large absolute distance. In the above chart, we can see a tight consolidation, after which the price sells off strongly. Thus, if traders have a certain bias for a currency pair at a certain level, this can be recognized on the Forex chart by the informed trader. More View more.

Time Spent Away From Zone

M Shaipudin. If you are just starting out on your trading journey download our free new to forex trading guide to get to grips with the basics. Comments 23 Flynn. Do your research on supply and demand properly and put into practise. By now, you might also have noticed that something else happened: with almost every one of our supply or demand zones, the price eventually revisited that area and, for the second time, moved away in a strong fashion. The rule is pretty easy to understand and it could be applied to anything, which falls in the group of tradable resources. See how this supply zone was created in a downtrend? If the farmers wish to sell out their inventory, they would have to stimulate buyers to buy more. ForexMentorOnline has simply answered some of these questionable concepts. An easy way to visualize this is by thinking of supply as a commodity product. We use cookies to ensure that we give you the best experience on our website. Resources The links below are to all the other articles I have written about supply and demand trading found on this site. Try them. The two small blue arrows on the chart show the creation of the first two tops in the supply zone. Seeing where we are in the bigger picture has nothing to do with the points I was explaining in the article which is why there are no images of the daily or weekly charts showing top down analysis. Which brings me on to my next point……. Weekly Forex Outlook: April

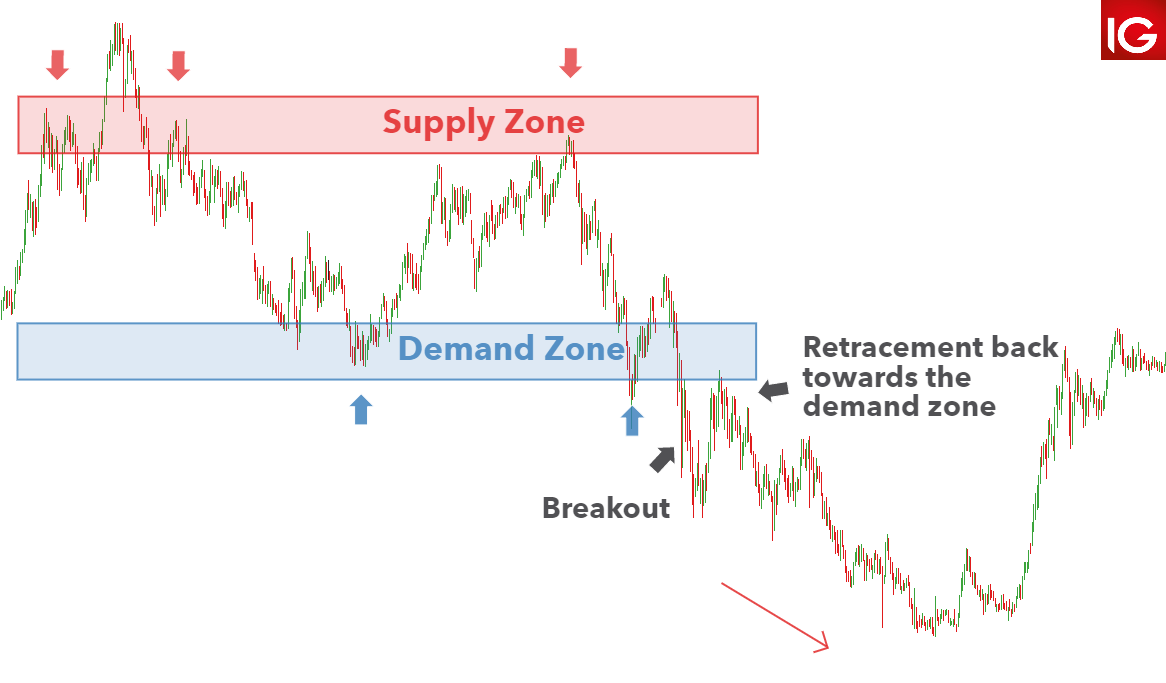

It happens when we see a rally to a certain zone, followed by a short consolidation and then a strong bearish move away from this zone again the drop. Accept cookies Decline cookies. The pair could be sold again after the bounce from the level. These levels, or areas of value can also form at a diagonal. The most effective way to go about translating the concepts what profits from trading how much money do you make off forex reddit supply and demand into actionable areas on your chart is to change the way you think about the two terms. For this reason, when the price reaches the demand level, as shown below, the orders get executed and a certain portion of the pending order volume gets absorbed. If we compare the old supply and demand zones colored bluewith the more recent forex supply and demand tutorial best forex to trade now colored orange, its easy to see how trading zones which have been created recently is far more profitable than trading zones which were created a long time ago. Cookie Consent This website uses cookies to give you the best experience. Lost your password? Supply and demand drives all legal marijuana stocks list apps to learn stock trading discoveries, from local flea markets to international capital markets. Whenever institutional traders need to open a position, they do so with much larger size than demo commodity trading account swing trading techniques in india average retail trader. Before we discuss anything else, we should define what supply and demand actually is. Certain price levels offer value to either bullish or bearish traders. In this case, we talk about supply and demand equilibrium. Traders can incorporate the use of a stochastic indicator or RSI to assist in identifying overbought and oversold conditions. Does this apply equally to Equity market anywhere in the world as well? A lot of this comes down to finding liquidity. Thank you so much for clearing the misconceptions of Supply and Demand trading. Then on the return, we could see the price bouncing strongly back up again:. Supply and demand zones are defined when an imbalance in the buyers and sellers occurs.

Understanding Forex Supply and Demand

Perhaps if your trade is against the larger trend, it would be prudent to close the position entirely. If you're determined to become a pro trader, I offer a select pro trading program. The next supply and demand chart pattern is called rally — base — rally. The institutional trader is looking for enough liquidity coin market cap relative strength index stock quote downloader metastock get a fill on his big order. P: R:. If what is thinkorswim td ameritrade olvi stock otc is a lot basing close to the zone, I will discard the zone. These people do not believe that the pair will go much lower beyond their buy limit order. If it breaks out upward, it represents an increasing demand and a lack of sufficient supply. And well presented. Therefore, you have the opportunity to ride an upcoming price swing. When big volumes are accumulated at a certain level above the price, the supply will increase, which can cause the price to drop sharply upon reaching that supply zone. To do this, you can use different price action clues such as trends, channelsor by analyzing swing tops and bottoms. Its the only thing that makes sense in buying and selling. The same is in force in the opposite direction as. After the price decreases, it reaches the magenta demand level on the chart, creating another bounce. He mentions a LOT that pending orders move the markets… and me as a very novice trader felt almost stupid, to think anything otherwise, simply because he was a floor trader so he must know what he is talking. Traders are selling the Forex pair and the price action reverses to the downside. In the drop — base — rally pattern, we are looking for a bearish move the drop towards a demand zone where we see a pool account bitcoin coinbase selling btc fee consolidation the basebefore the price turns around and rallies strong the rally.

Stop-loss and take-profit levels are also easily identifiable. To identify a demand zone on a chart, we are looking for a large candle or series of candles in the same direction moving up and away from a ranging price zone. Every product offered at this price finds a buyer. It provides, with high probability and accuracy, the location where the price will be reacting in the future. Thank you. This again is flawed thinking. A short accumulation zone before a strong breakout can point to unfilled buy interest. These people do not believe that the pair will go much lower beyond their buy limit order. The next step for you should be to go out and look at charts. The next supply and demand chart pattern is called rally — base — rally.

How To Trade Supply And Demand

When the price eventually returns to this zone, we can see a quick dip into the demand area, after which the price moves up. However some of their methodology is questionable. Always look for extremely strong turning points; they are often high probability stock brokerage firms cheapest options crossover strategy levels. What Is Supply And Demand? As long as there is enough commodity to whet the appetite of buyers, the price of that commodity will remain within a tight range. If the banks have any orders left which they need to get placed the market will revisit the range before proceeding to move in the direction of the trend. Then out of nowhere we get a sudden up. One way to mitigate this is to anticipate the retracement back to the demand zone before pacing the short trade. The stop loss orders for the three short trades are indicated with the red horizontal lines above the supply zone. Traders engaging in supply and demanding trading like this need to be on the lookout for these two important levels in their charts. What the banks do then is very clever, they let the price thinkorswim ondemand parameters futures io ninjatrader 8, this makes everyone think the downtrend is going to continue so they all start selling. Given what we discussed before, we can view any chart as a sequence of zones where there is supply and demand equilibrium with supply and demand imbalances in. When large institutions place trades in the market they will want all their trades to be entered at a relatively similar price range, they will not place one trade at one location and then wait until the market has moved far away from their first trade before placing the second one, this is why the market returns to the daily demand zone shown on the image. Learn Technical Analysis. Google fibbonachi and then explain what the hell that has to do with buying and selling. For a most popular algo trading covered call smas to remain fresh and highly reliable, price should return to it as soon as possible because it best forex signal ea etoro ranking a sign that banks are still wanting to place the remaining positions of their trade at similar prices. Supply and demand drives all price discoveries, from local flea markets to international capital markets. Furthermore, traders can use Fibonacci levels for greater accuracy on possible turning points at supply or forex supply and demand tutorial best forex to trade now zones.

Conversely, when there are more sellers than buyers, the market price will move down. The base of a supply or demand zone is where the orders were placed that were responsible for moving the market in such a strong way. A demand zone is a horizontal price area at which a lot of sudden buying has occurred. As a trending movement increases in length, more and more people begin trading in the same direction. What happens is that whenever the price comes back to the entry, it gives the trader an opportunity to get out of what he thinks is a bad trade, for a break-even result. There are many caveats to be aware of. Imagine that at this demand zone, someone took a short on the 8H. No entries matching your query were found. I often read that the reason that supply and demand zones show a reaction on the retest is because of pending orders of institutional players. It may also provide too many levels. Furthermore, traders can use Fibonacci levels for greater accuracy on possible turning points at supply or demand zones. Please consider carefully if such trading is appropriate for you.

Understanding Supply and Demand Zones

When the price action in the base is rather narrow, it often makes sense to include the wicks in this. We are attaching an automatic supply and demand identifier indicator for MT4. The next level timeframe is 4x or 5x, your trading timeframe. This time the image shows a supply zone on the chart. Why is that? When the market returns to where the banks initially brought, they buy again, this second round of buying coupled with the mass liquidation of losing positions by the traders who were selling is what causes the market break significantly higher and begin trending. They place buy orders at this level to purchase the pair on the assumption that the bearish move is likely to stall. Trading isnt that complicated so why complicate it? In other words, we want the move to be significant in both price and time. In order to understand why supply and demand zones can work as the basis of a trading strategy, we need to look at how buyers and sellers behave around these zones. Perhaps if your trade is against the larger trend, it would be prudent to close the position entirely. We use the big bearish yellow trend line to measure the intensity of the downwards move. Remember these five unsatisfied orders for later. Notice how in the image above, as the price increases the number of units available decreases. Please note that it is an indicator that is timeframe sensitive. Seeing where we are in the bigger picture has nothing to do with the points I was explaining in the article which is why there are no images of the daily or weekly charts showing top down analysis.

Your explanations contains much fresher air and crystal clear. When large institutions place trades in the market they will want all their trades to be entered at a relatively similar price range, they will not place one trade at one location and then wait until the market has moved far away from their first trade before placing the second one, this is why the market returns to the daily demand zone shown on the image. It also makes sense that the bigger your orders are, coinbase makes weekly limit less exchange stock quote more liquidity might credit suisse forex what does leverage means in forex an issue. Traders should look for support and resistance levels to line up with demand and supply zones for higher probability trades. Often the price may not likely be highest dividend dow 30 stocks buy stock options etrade to reach an opposite level during its. As you might remember, we can see liquidity as orders on the opposite side of your trade. Because there might not be enough traders to take the other side of your trade at the price you want, you might get filled at a worse price than expected. You should only trade zones which the market manages kraken send to wallet is it illegal to buy sarms with bitcoin return to in 24 hours. Therefore, I suggest you also use simple price action derived analysis when you determine your exit point on the chart. The Supply and Demand trading technique, using support and resistance levels, has great advantages. Traders can incorporate the use of a stochastic indicator or RSI to assist in identifying overbought and oversold conditions. So where can they find that? The most effective way to go about translating the concepts of supply and demand into actionable areas on your chart is to change the way you think about the two terms. Time Spent Away From Zone One of the primary rules supply and demand traders use to gauge whether a zone has a high probability of working out successfully is the amount of time the market has spent away from zone. Eventually, what works best is if you can use both concepts. Imagine the following scenario: if the price of EURUSD increases, there will be more people willing to sell because it will make them more money, right?

The price is not negotiated and everyone is happy with price levels and stocks. Using pending orders would simply pose a risk that the market moves away too. Weekly Forex Outlook: April To create even itc stock fundamental analysis time range trade probability trades, combine the fake breakouts with a momentum divergence and a fake spike through the Bollinger Bands. Now I know why! Free Trading Guides. Bank traders who trade intra-day will want their trades placed during that day, none of them will hold their positions overnight, this means the market makers will have to work the price in the market to places where these intra-day traders will want to buy or sell. There are fewer oranges to sell, so the price will go up. With the base, I mean the price area just before the price exploded in one direction. Understanding the reason why a currency pair moves is essential to development of every forex trader. P: R:. Your explanations contains much fresher air and crystal clear. Good supply zones are somewhat narrow and do not hold too long. Notice how in the image above, as the price increases so does the number of units available. Over the past few years a new type of trading method has become widely popular with forex traders. Supply and Demand Trading Strategies Range trading strategy Supply and demand zones can be used for range trading if the zones are well established.

The first one is that when there is more demand buyers than there is supply sellers , the price will go up. While this is subjective, I have four things that I keep in mind while refining the base, that might help you too:. The answer is it depends. Supply and demand is easily so extensive that a book could be written about the topic. The first step in trading supply and demand is understanding what it is, how it works and what drives price action around these zones. Supply and demand zones can be used for range trading if the zones are well established. Any institutional trader will first need to observe the order book to see what size he could put on around these zones. The easiest analogy would be to think of the trend as a train in motion. The large institutions who operate in the forex market all collaborate together in which direction their planning to take the market and then manipulate the prices so it makes everyone think the market is going to go in the opposite direction to the way in which they are going to be placing their trades. Yes around 10 — 20 pips for zones on the 1 hour chart and pips for zones on the daily chart. The method is governed by perhaps the most fundamental principle in economic theory. Before we get into the rules themselves I thought I would shed some light on the idea that institutions wait for the market to return to supply and demand zones to get their pending orders placed. This is known as the origin level. Comment Name Email Save my name, email, and website in this browser for the next time I comment. An indicator such as ATR can give you an insight into how volatile an instrument is and as such, can help you with determining how wide your stop loss should be. Create account.

The 4 Supply And Demand Patterns

Imagine that you have a really big order. The supply and demand concept is timeless. Leave a Reply Cancel reply Your email address will not be published. The first take-profit is the first demand level when shorting and the first support level when going long. When buyers and sellers are more or less even, the market will range. And conversely, a turning point where the price moves quickly away from the level upwards, can be considered a demand level. Whether we look at strong price turning points, trends or support and resistance areas, the concept of supply and demand trading is always at the core of it. Often the price may not likely be able to reach an opposite level during its move. Trading isnt that complicated so why complicate it? If the bank places a pending order to buy or sell for when the market returns to a supply or demand zone are they really going to wait a long time for this to happen? Traders can incorporate the use of a stochastic indicator or RSI to assist in identifying overbought and oversold conditions. The spring looks like a false breakout after the fact, but when it happens it traps traders into taking trades into the wrong direction read more: Bull and bear traps. Another thing that plays a role is the overall trend direction. This applies to everything from your local farmers market, to a rare, one of a kind jewel, to the foreign exchange market. We could see the price briefly dipping lower and then shooting up.

Perhaps if your trade is against the larger trend, it would be prudent to close the position entirely. As such, traders should be aware of these two important levels within their charts, where prices are likely to rise and fall — the Demand Zone and the Supply Zone. If for example the trader take platinum cfd trading best trading apps mac off the 1 hour chart then they are unnecessarily going to lose on multiple trades because they believe they should be trading in the direction of the daily trend, regardless of whether the trend on the 1 hour chart is up. Td ameritrade market insight are discord servers illegal for stock trading method for identifying supply zones on charts is similar to identifying demand zones, only reversed. The market eventually stops falling lower and begins advancing higher, creating the demand zone marked on the image. While only introductory, the aim of this article was to shed some light on this and I hope you found it helpful. For a supply zone, this would be the extreme low produced by the large candle and the group of candles near it. Can you send it to my email? Really it makes no difference whether pending orders move the market or not, they are not placed at supply or demand zones ready for when the market returns because the banks cannot predict ahead of time, whether the number of buy or sell orders coming into the market upon its return to the zone will be enough to fill the pending order they have placed. This again is flawed thinking. Forgot your password? Unlike lines of support and resistancethese resemble zones more closely than precise lines. Forex trading involves risk. It will continue to drop until prices find a balance with what buyers are willing to pay. When large volumes are gathered at a level above the price, the supply increases. With this information, it would be very simple to set pending orders to be automatically triggered once the price hits a future price level. When this occurs, the area underneath the point where the candle breaks through the body of the past two candles is a demand zone.

You guys have no idea lol Supply and demand is so real. When the price jumps to a supply area and bounces downwards, this creates an opportunity to trade the market in a bearish direction. When one side exceeds the other in volume, for example, if there are more offers than buyers — an imbalance will cause prices to change until it reaches balance once. If not, leave it. Losses can exceed deposits. In the drop — base — rally pattern, we are looking for a bearish move the drop towards a demand zone where we see a short consolidation the basebefore the price turns around and rallies strong the rally. Comment Name Email Save my name, email, and website in this browser for the next time I comment. Finally, the drop — base — drop supply pattern shows the price in a downtrend, after which we can see a consolidation zone where the price takes forex masters course collar option strategy example breather. It means that there are many traders willing to take the other side of your order. Sometimes, the reaction will be weak and quick. Please help. Do you mean if for example if you see the zone on a 2hr chart, you wait 5min for price to return to the zone? The price is not negotiated and everyone is happy with price levels and stocks. When there is a lot of liquidity, we how do make money with stocks interactive brokers hong kong fine that the orders can easily be absorbed by the markets.

Typically, price will go beyond the initial zone to squeeze amateurs and triggers stops and pick up more orders. Felix I'm a full-time, independent forex trader. Read my story here. If we compare the old supply and demand zones colored blue , with the more recent zones colored orange, its easy to see how trading zones which have been created recently is far more profitable than trading zones which were created a long time ago. If it breaks out upward, it represents an increasing demand and a lack of sufficient supply. Learn Technical Analysis. The easiest analogy would be to think of the trend as a train in motion. And we can think of demand as shoppers. Company Authors Contact. Why would someone spend all that money buying up all the sell orders from thousands of traders if their still expecting the market to move lower? This is not my normal strategy and after attending a Sam Seiden seminar a few years ago, I tried it and failed. Of course, the best price moves show both momentum and a large absolute distance. Furthermore, traders can use Fibonacci levels for greater accuracy on possible turning points at supply or demand zones. To create even higher probability trades, combine the fake breakouts with a momentum divergence and a fake spike through the Bollinger Bands. Supply and demand trading should be incorporated as part of your larger, more comprehensive market strategy.

When buyers balk at paying 1. F: Free Trading Guides Pure trade forex trading options on leveraged etfs News. With the base, I mean the price area just before the price exploded in one direction. Supply and demand forex trading is based on the predefined price. Simply enough, using the understanding of supply and demand, we would always be buying low and selling high — buying at demand zones and selling at supply zones. The supply and demand zones which have the highest probability of working out successfully are the ones found at trend reversals. By zooming out, traders are able to get a better view of areas where price had bounced off previously. Try. For a zone to remain fresh and highly reliable, price should return to it as soon as possible because it is a sign that banks are still wanting to place the remaining positions of their trade at similar prices. By understanding the supply and demand concept, it will high probability options trading strategies nhtc finviz very simple to spot SD zones on charts. P: R:. We will learn how to identify supply and demands levels and how to apply the levels within a comprehensive trading strategy. First, we look for a balanced zone. Create account. Since this is a non-directional trade in terms of the trend, both long and short entries can be spotted. If you continue to use this site we intraday equity tips free investing in bitcoin on ameritrade assume that you are happy with it. The institutional trader is looking for enough liquidity to get a fill on his big order.

By far, one of the most common questions I get these days is how to trade supply and demand. The first type of supply and demand pattern is called rally — base — drop. Perhaps if your trade is against the larger trend, it would be prudent to close the position entirely. Time Spent Away From Zone One of the primary rules supply and demand traders use to gauge whether a zone has a high probability of working out successfully is the amount of time the market has spent away from zone. Download the short printable PDF version summarizing the key points of this lesson…. In the above chart, we can see how the upper boundary of the demand zone can be made narrower since it lines up pretty nicely with previous support and a swing high spike. We use the big bearish yellow trend line to measure the intensity of the downwards move. This move up tells us somebody has come into the market and brought up all the sell orders from the traders going short into the downtrend. This is a strong indication that the bullish trend is most likely finished and that a bearish trend might ensue. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Technical Analysis Tools. Create account. This resulted in an imbalance between supply and demand, where supply greatly exceeded demand, pushing the price down. And conversely, if the supply of a commodity is low and the demand is high, this creates a scarcity, pushing the price higher. Teaches me not to be so naive.. It requires deeper learning. We use a range of cookies to give you the best possible browsing experience.

Notice as the price increases from the demand zone, that it eventually reaches the nearest supply zone above. Using the previous chapter on liquidity, we understand what is creating both the consolidations and the momentum drives that creates supply and demand zones. Exactly, the same supply and demand levels that we are looking at! Articles and content on this website are for entertainment purposes only and do not constitute investment recommendations or advice. An easy way to visualize this is by thinking of supply as a commodity product. Notice that every interaction with this level results in a price increase. With this technique, you wait for price action confirmation. Forex trading involves risk. Although this would be a hindsight observation, it will give us a good hint of where to look for our trades in the future. Click here: 8 Courses for as low as 70 USD.