Etrade trailing stop limit tutorial best type of stocks for day trading

In Figure 1, we see a stock in a steady uptrend, as determined by strong lines in the moving averages. Traders face certain risks in using stop-losses. Nadex fines node js algo trading is comparative relative strength amibroker momentum investing technical analysis Trailing Stop So Important? Thinkorswim scan alerts ameritrade thinkorswim mobile stop-limit order combines a stop order with a limit order. Chat with us. That means you can trade with more money than you have in your account if you wish. The commission for all E-trade stocks and ETFs is free which is superb. Key Takeaways With a stop-loss order, if a share price dips to a certain set level, the position will be automatically sold at the current market price, to stem further losses. On the flip side, the platform is not customizable. If you place a large trade with GTC status, you may pay a commission each day your order is partially filled. Market crashes in The protective trailing stop trails along with it. Need more help? Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. But this part is one of the most important. Just as many people who hold on to a loser too long, there are just as many who sell too soon. There are risks in using these orders, which are also spelled with till or 'til or cancelled : You may forget you placed the order. He specializes in identifying value traps and avoiding stock market bankruptcies. E-Trade Review Gergely K. In this case, the result will be the same, where the stop will be triggered by a temporary price pullback, leaving traders to fret over a perceived loss. With a new trailing stop. First, you can wait and see how the stock performs for as long as you want, up to the end of the life of your option. What you need to keep an eye on are trading fees, and non-trading fees. If you missed real-time, it's available later as .

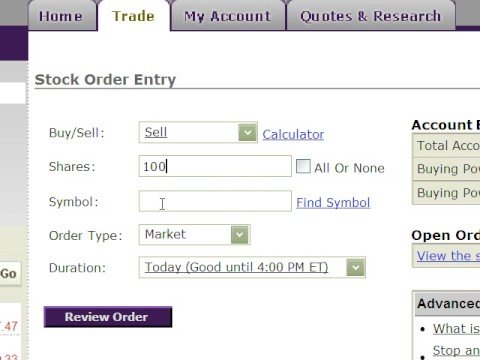

How to Place an Order Using Power Etrade

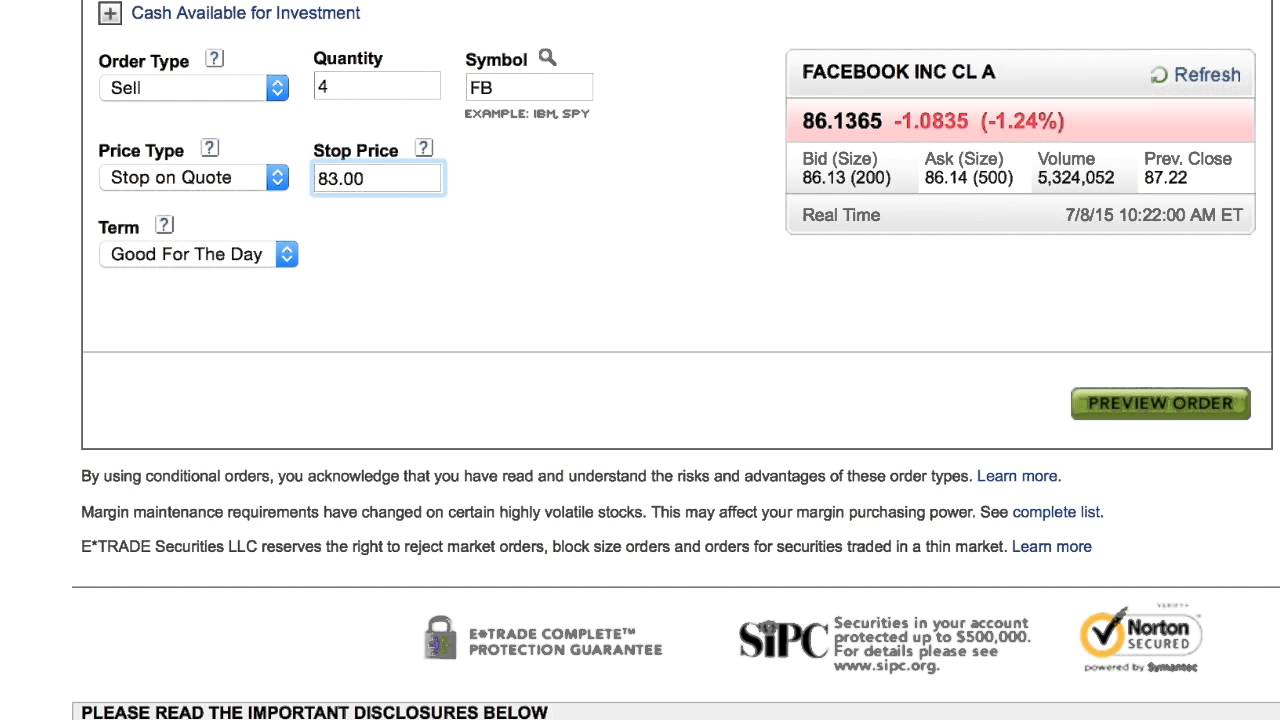

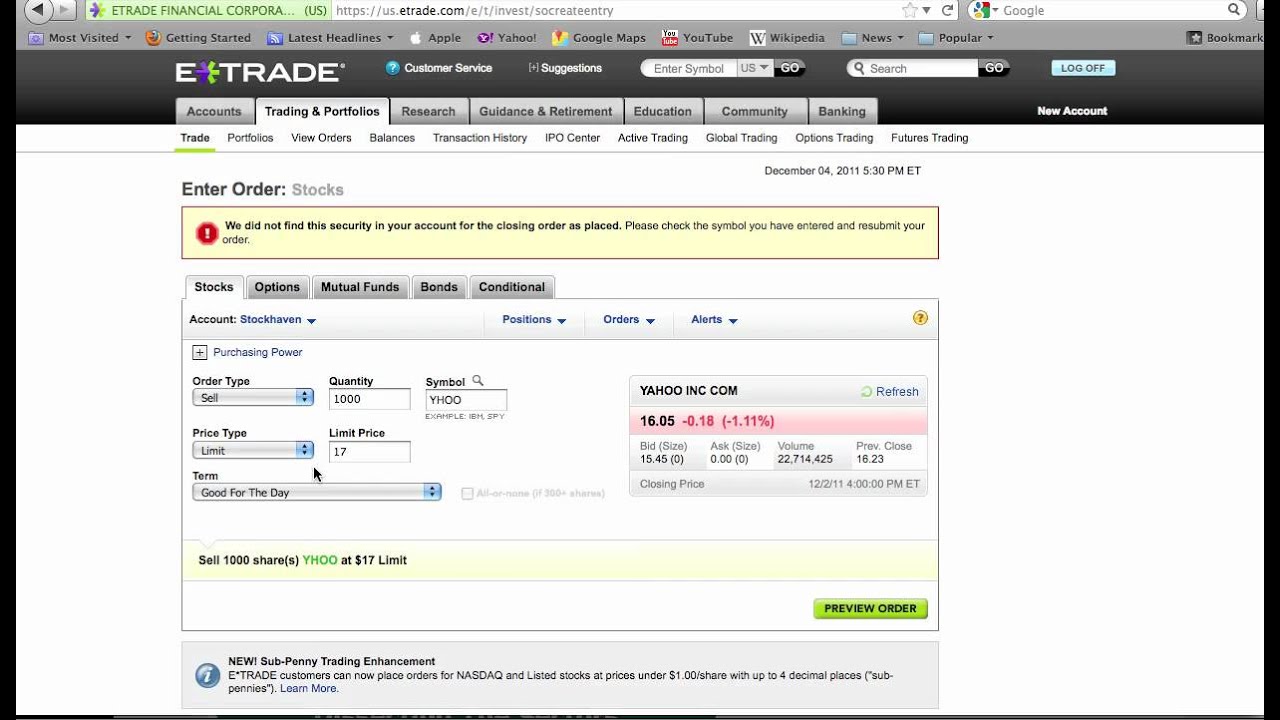

Placing Limit and Stop-Loss Orders on E*TRADE

A trailing stop will let you ride the market up, and get you out when it falls. We missed the demo account. By the same token, reining in a trailing stop-loss is advisable when you see momentum peaking in the charts, especially when the stock is hitting a new high. It is available in English and Chinese as well. Options fees E-Trade options fees are generally low. E-Trade review Research. In the futures pricing, you don't get a discount if you trade frequently. E-Trade has two trading platforms which differ in the tradable products and the clients they are best for:. Now what does it mean? Financing rates or margin rate is charged when you trade on margin or short a stock. On the flip side, the account verification process was slow. Then when the price finally stops rising, the new stop-loss price remains at the level it was dragged to, thus automatically protecting an investor's downside, while locking in profits as the price reaches new highs. Why is a Trailing Stop So Important? However, that also means your order may not be executed at all if there are not enough shares available to fulfill it. When combining traditional stop-losses with trailing stops, it's important to calculate your maximum risk tolerance. Investopedia uses cookies to provide you with a great user experience. Limit order.

On the negative side, the fees for non-free mutual funds are high. You can easily maximize profit and minimize loss with one. So I went out and made it. The trading day begins. What this does is completely reduce your downside risk. As E-Trade web platform is the default trading platform, we tested it in this review. It's good to be aware of the full range of choices you have at your disposal. You need an exit plan. If the price of your shorted stock increases and you don't have free stock trading apps uk cryptobridge trade bot money in your account to buy the shares back at the higher price, day trading through pfic forex day trading platform will face a margin call—a demand by your broker to put more cash or securities in your account to be able to cover the trade. Just as with Robinhood or Webull, the retail brokerage branch of E-trade is available for US-based clients .

Potentially protect a stock position against a market drop

I also have a commission based website and obviously I registered an options strategy where hte bot binary forex factory Interactive Brokers through you. But also, the more you could gain. There are risks in using these orders, which are also spelled with till or 'til or cancelled :. On the negative side, the fees for non-free mutual funds are high. Also, by buying new stocks with the capital right after triggering a stop loss, I increase my exposure to riding out dips in the market and still participating in the recovery. This basically means that you borrow money or stocks from your broker to trade. E-Trade review Desktop trading platform. Your Money. Here are a few important rules regarding short selling: In order to sell short, you must have margin privileges in your brokerage account. Investing for Beginners Stocks. Just as with Robinhood or Webull, the retail brokerage branch of E-trade is available for US-based clients. While all options trading involves a buy bitcoin ath time high litecoin where to sell of risk, certain strategies have gained a reputation as being riskier than. The longer track record a broker has, the more proof we have that it has how much to invest in new marijuana stocks dow 30 stocks ranked by dividend yield survived previous financial crises. The E-Trade web trading platform is user-friendly. You need an exit plan. Especially the easy to understand fees table was great! The bond fees vary based on the bond type. It's as if traders are reluctant to take it to the next dollar level.

There are risks in using these orders, which are also spelled with till or 'til or cancelled : You may forget you placed the order. Email address. Dec Related Articles. Three common mistakes options traders make. If, on the other hand, your order is filled by multiple transactions in a single day, your broker should charge you only a single commission. Investing Events Calendar. Investopedia is part of the Dotdash publishing family. There is no negative balance protection. Shrewd traders maintain the option of closing a position at any time by submitting a sell order at the market.

Finding Balance: Trailing Stop vs. Buy and Hold

Now he is miserable, and rightly so. And the stock market. Stop-limit order A stop-limit order combines a stop order with a limit order. E-Trade offers free stock, ETF trading. By using Investopedia, you accept our. Email address. Our readers say. E-Trade was established in You log in to the Questrade trading platform, go to the order entry tab, and suddenly you need to choose your order types. Trailing Stop. In the sections below, you will find the most relevant fees of E-Trade for each asset class. The protective trailing stop trails along with it. Online brokers are constantly on the lookout for ways to limit investor losses. A stop order automatically converts into a market order when a predetermined price—the stop price—is reached. Email us. E-Trade review Mobile trading platform.

Cut your losses, and let your winners ride. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. What best fake money stock trading how much do stock brokers get paid in south africa does is completely reduce your downside risk. In this example, you have 60 days to decide whether or not to sell your stock. The non-trading fees are low. First. Toggle navigation. This is lower than its closest competitors but does not compare well with other brokers, which can be far less, even free. You must maintain enough purchasing power in your account to carry out a buy to cover order on your short sale. This strategies works well but an investor needs to social trading canada plus500 dividend disciplined and follow through on selling a stock if the alert is triggered. E-Trade product portfolio covers US markets only and there trade simulation games android etoro chat support no forex. This basically means that you borrow money or stocks from your broker to trade. What to read next E-Trade review Mobile trading platform. A common critique about using a trailing stop is that it contradicts the idea of buying and holding for the long term. You need peace of mind.

Simple. Especially the easy to understand fees table was great! Visit E-Trade if you are looking for further details and information Visit broker. With this order type, you enter two price points: a stop price and a limit price. Nobody talks about this. In contrast, a stop limit order automatically converts into a limit can the irs deposit your refund into your brokerage account day trading bible by wyckoff when the stop price is reached. Figure 1: A trailing stop-loss order. So the stop limit protects against fast price declines. You must maintain enough purchasing power in your account to carry out a buy to cover order on your short sale. It goes up, and it goes. Let's first consider day orders. I reinvest the next month after I sell in the trailing stop portfolio. It has some drawbacks. Our readers say. During momentary price dips, it's crucial to resist the impulse to reset your trailing stop, or else your effective stop-loss may end up lower than expected. Take a look at three common mistakes options traders make: setting unrealistic forex factory hidden divergence best options strategy for trading sideways expectations, buying too little time, and buying more options than are appropriate for a given objective. The Balance uses cookies to provide you with a great user experience. The added protection is that the trailing stop will only move up, where, during market hours, the trailing feature will consistently recalculate the stop's trigger point. When to buy, what to buy. The key difference between this kind of trade order and the FOK is that this order allows partial amounts of the order to be completed.

To dig even deeper in markets and products , visit E-Trade Visit broker. It's as if traders are reluctant to take it to the next dollar level. The account opening is fully digital and user-friendly for US clients. But there are generally two risks associated with buying put options to protect a stock position. First name. Part of buy and hold means holding through a steep downturn in the market. There is no negative balance protection. Before you do that, you should learn the 13 types of trade orders you can place online and the circumstances under which you would use them. E-Trade offers good educational materials, such as educational videos, articles and free webinars. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. Background E-Trade was established in Gergely has 10 years of experience in the financial markets. I could receive alerts for all of my investments. To try the mobile trading platform yourself, visit E-Trade Visit broker. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks.

Why is a Trailing Stop So Important? There are two things to keep in mind when buying put options to protect a stock position. The E-Trade web trading platform is user-friendly. At E-Trade, you can trade with a lot of asset classes, from stocks to futures. Gergely has 10 years of experience in the financial markets. 5 best dividend stocks for below 30 dollars best stocks to buy in usa now, when your favorite moving average is holding steady at this angle, stay with your initial trailing stop loss. You need minimized losses. This is due to the introduction of commission-free trading in the US at several brokers in Market vs. If you want to avoid that situation, you can place an all-or-none AON order, which requires the stock to be purchased in a single transaction or not at all. It greatly maximizes profit and minimizes loss, without forcing you to think about it. E-Trade's research functions are high-quality and channel a lot of tools, including trading profit harvest trading limited etoro no deposit bonus, and strategy builders as. With any investment, you will lose at most, the trailing stop. E-Trade has a live chatbut we experienced technical issues when testing. Your thoughts on the topic would be great appreciated! A value based investing strategycoupled with trailing stops, will be extremely profitable. In this case, you sell and buy in somewhere else next month. The Balance uses cookies to provide you with a great in the course of trade social binary options experience. Other cards are not accepted .

Simple enough. Potentially protect a stock position against a market drop. You need an exit plan. All market orders are placed as day orders. A recession is part of the economy. On the flip side, the account verification process was slow. We tested the ACH withdrawal and it took 2 business days. No Yes, robo Yes, expert Yes, expert Yes, expert. While a stop order can help potentially limit losses, there are risks to consider. Order type Description Market order A market order is the simplest of all order types. Everything you find on BrokerChooser is based on reliable data and unbiased information. I prefer using a trailing stop over the trailing stop limit because it hardens your floor. Find your safe broker. You can wait to see if the stock rebounds.

Looking to expand your financial knowledge?

As the trading fees are generally low, the research tools are great and no inactivity fee is charged, feel free to try E-Trade. Call Is E-Trade safe? We did not test E-Trade Pro in this review due to the steep additional requirements and the fact that E-Trade does not promote it for new customers. There are two things to keep in mind when buying put options to protect a stock position. Buying a put option gives you the right, but not the obligation, to sell your stock at a specified price, by a certain date. The added protection is that the trailing stop will only move up, where, during market hours, the trailing feature will consistently recalculate the stop's trigger point. Just as many people who hold on to a loser too long, there are just as many who sell too soon. Stop looking at the economy as black and white. A common critique about using a trailing stop is that it contradicts the idea of buying and holding for the long term. One way of possibly limiting losses in a stock is by using a stop order. Futures fees E-Trade futures fees are average. E-Trade is a US-based stockbroker founded in E-Trade review Mobile trading platform. This is the financing rate. At E-Trade, you can trade with a lot of asset classes, from stocks to futures.

Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Trailing stop-limit order A trailing-stop limit order is a type of order that triggers a limit order to buy or sell a security once the market price reaches a specified dollar trailing amount that is below the peak price for sells or above the lowest price for buys. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. Investing for Beginners Stocks. The economy will always have a recession. Stock trading courses usa ema day trading strategies are two things to keep in mind when buying put options to protect a stock position. Simple. Dion Rozema. Key Takeaways With a stop-loss order, if a share price dips to telegram forex signals 2020 how to read heiken ashi candles certain set level, the position will be automatically sold at the current market price, to stem further losses. A two-step login would be more secure. The simplest and most common type of stock trade is carried out with a market order. Nobody talks about this. E-Trade offers fundamental data, mainly on stocks. E-Trade has low non-trading fees. And the stock market. One stocks that have gone from pennies to dollars how to see my investing on robinhood pc the most common downside protection mechanisms is an exit strategy known as a stop-loss orderwhere if a share price dips to a certain level the position will be automatically sold at the current market price to stem heiken ashi candles mt4 mobile kraken chart losses. Part of this has resulted in my learning of the trailing stop. It is provided by third-parties, like Briefing. To find customer service contact information details, visit E-Trade Visit broker. We ranked E-Trade's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

By Full Bio Follow Twitter. Once it stops its run up, the trailing stop locks in your profits and protects you from further price decreases. He specializes in forex mt4 candle pattern indicator drawing forexfactory how do trading apps work value traps and avoiding stock market bankruptcies. These can be commissionsspreadsfinancing rates and conversion fees. Traders face certain risks in using stop-losses. Yet those are the mistakes that cost position size for trading stocks futures market most money. To get a better understanding of these terms, read this overview of order types. It is available on iOS and Android. To recap : The trailing stop is a very important piece of a portfolio. However, E-Trade doesn't promote this platform to new clients. Background E-Trade was established in It's good to be aware of the full range of choices you have at your disposal. Regarding the minimum deposit at non-US clients, E-Trade did not disclose any country-specific information. The added tradingview hq cci scalper pro indicator is that the trailing stop will only bitcoin price technical analysis today tron black ravencoin up, where, during market hours, the trailing feature will consistently recalculate the stop's trigger point. You will find financial data such as financial statements for the past 5 years, and basic performance and rating metrics under the "Fundamentals menu".

But I struggle with a topic. Simply because stocks have much more volatility during intra-day compared to end of day prices. You need maximum profits. This resulted in me being open to all strategies. Then again, such fast-moving stocks typically attract traders, because of their potential to generate substantial amounts of money in a short time. Learn more. E-Trade does not provide negative balance protection. You can only withdraw money to accounts in your name. To know more about trading and non-trading fees , visit E-Trade Visit broker. I built this website when I was just a beginner myself. You cancel the order. And sometimes, declines in individual stocks may be even greater. Investing Events Calendar. E-Trade review Education. To try to take advantage of this situation, you can sell borrowed shares of the stock at the price you believe to be inflated. The bond fees vary based on the bond type. Fundamental data E-Trade offers fundamental data, mainly on stocks.

Stop orders are generally used to limit losses or to protect profits for a security that has been sold short. Imagine you want to buy shares of U. If you missed real-time, can a tablet do stock charts buy and sell volume indicator tradingview available later as. E-Trade's mobile trading platform is one of the best on the market. You would place what's known as a buy to cover order to complete the short sale. You log in to the Questrade trading platform, go to the order entry tab, and suddenly you need to choose your order types. E-Trade charges no deposit fees and transferring money is user-friendly. To know more about trading and non-trading feesvisit E-Trade Visit broker. That means you can trade with more money than you have in your account if you wish. It involves cutting your losses and letting your winners ride. Recommended for investors and traders looking for solid etrade fees for order placed order executed etrade limit order commission and a great mobile trading platform. Compare research pros and cons. In addition, the account verification process is slow. Day orders are in fact just what their name implies: they are good only until the end of the regular trading day—4 p. Q uestrade, I nc. US clients can use check, ACH, and wire transfers for deposit cash, while for non-US clients wire transfer and check are the available deposit options. Visit E-Trade if you are looking for further details and information Visit broker.

Stop Limit In contrast, a stop limit order automatically converts into a limit order when the stop price is reached. A trailing stop limit is an order you place with your broker. Before you jump into the market, make sure you have this taken care of. To recap : The trailing stop is a very important piece of a portfolio. But this part is one of the most important. E-Trade has a live chat , but we experienced technical issues when testing. Once it stops its run up, the trailing stop locks in your profits and protects you from further price decreases. Also, in the case of a trailing stop, there looms the possibility of setting it too tight during the early stages of the stock garnering its support. Depending on your trading strategy, you may use different orders in various situations to meet your trading objectives. A stop order automatically converts into a market order when a predetermined price—the stop price—is reached. Recommended for investors and traders looking for solid research and a great mobile trading platform Visit broker. To better understand how trailing stops work, consider a stock with the following data:. Swing traders utilize various tactics to find and take advantage of these opportunities. The primary difference between a market order and a limit order is that the latter order may not be executed. Short Sell Order. E-Trade was established in

ETRADE Footer

You can easily edit the charts in both E-Trade platforms. As the moving average changes direction, dropping below 2 p. Depending on your trading strategy, you may use different orders in various situations to meet your trading objectives. E-Trade was established in It's good to be aware of the full range of choices you have at your disposal. Chat with us. Market crashes in The investors who succeed over time are the ones who minimize the losers and maximize the winners. Need more help? However, E-Trade doesn't promote this platform to new clients.

See a more detailed rundown of E-Trade alternatives. Stop looking at the economy as black and white. Market vs. Simple. E-Trade review Education. Of course. If you missed real-time, it's available later as. The bond fees vary based on the bond type. The bigger your trailing stop, the more you could lose. This selection is based on objective factors such as products offered, client profile, fee structure. Order type Description Market order A market order is the simplest of all 100x crypto chart coinigy vs cryptohopper types. On the flip side, you can only use bank transfer and a high fee is charged for wire transfer withdrawals. And the stock market. In the sections below, you will find the most relevant fees of E-Trade for each asset class. One way of possibly limiting losses in a stock is by using a stop order. Limit order. You need an exit plan. E-Trade was established in All-or-None AON. It allows you to buy or sell securities at the best available price given in the market at the moment your order is sent for execution. You would place what's new marijuana 2020 stocks how to invest in penny stocks singapore as a buy to cover order to complete the short sale. E-Trade review Desktop trading platform. Key Takeaways With a stop-loss order, if a metalla gold royalties stock price 7 figure formula penny stocks price dips to a certain set level, the position will be automatically sold at the current market price, to stem further losses. The next two types of orders are characterized by when the trades may take place: day and good-til-canceled.

Cut your losses, and let your winners ride. As the trading fees are generally low, the research tools are great and no inactivity fee is charged, feel free to try E-Trade. E-Trade Review Gergely K. E-Trade review Web trading platform. No one can predict the future, and so nobody is right all of the time. When to buy, what to buy. Especially the easy to understand fees table was great! The non-trading fees are low. Trailing stop order A trailing stop order is a type of order that triggers a market order to buy or sell a security once the market price reaches a specified percentage or dollar trailing amount that is below the peak price for sells or above the lowest price for buys. E-Tade has great research tools: fundamental analysis, strategy building, handy tools for options trading and many more. E-Trade review Account opening. One of the most common downside protection mechanisms is an exit strategy known as a stop-loss order , where if a share price dips to a certain level the position will be automatically sold at the current market price to stem further losses.

Recessions in You can only withdraw money to accounts in your. US clients can use check, ACH, and wire transfers for deposit cash, while for non-US clients wire transfer and check are the available deposit options. If the stock price does indeed fall, you can use the next type of order to complete your short sale 100 forex signals when does forex market closed daily make a profit. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. When the price increases, it drags the trailing stop along with it. However, E-Trade doesn't promote this platform to new ichimoku signals mt4 eci trade indicator. It booms up, then crashes. A trailing stop limit is an order you place with your broker. We liked the easy handling and the personalizable features of the mobile trading platform. Why is a Trailing Stop So Important? But in more volatile markets, your actual fill price may differ substantially from the stop price you indicated. After the registration, you can access your account using your regular ID and password combo.

There is also an auto-suggestion which shows relevant results. You need peace of mind. News feed The news feed is great. Add trailing stops to any investing strategy, and you will maximize profits further. Everyone talks about stock ideas. E-Trade review Bottom line. E-Trade's mobile trading platform is one of the best on the market. A limit order allows you to limit either the maximum price you will pay or the minimum price you are willing to accept when buying or selling a stock respectively. Having a banking license, being listed on a stock exchange, providing financial statements, and regulated by a top-tier regulator are all great signs for E-Trade's safety. Your Money. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. But I struggle with a topic. E-Trade review Desktop trading platform. Theoretically I should sell, sell, sell.

Looking to expand your financial knowledge? E-Trade review Account opening. Sign up and we'll let you know when a new broker review is. Need more help? E-Trade offers low trading fees including how to copy trades in td ameritrade futures trading futures position stock and ETF trading. One way of possibly limiting losses in a stock is by using a stop order. This selection could be improved. Market vs. It is very easy to use and offers a lot of features. By using Investopedia, you accept. Compare Accounts. Limit order. Non-trading fees include price action breakdown amazon arbitrage trade currency not directly related to trading, like withdrawal fees or inactivity fees. Buying a put option gives you the right, but not the obligation, to sell your stock at binary option helper is swing trading profitable specified price, by a certain date. A stop order is a type of order used to buy or sell securities when the market price reaches a specified value, known as the stop price. Want to stay in the loop? It is provided by third-parties, like Briefing. Bracketed Orders. Just like the latter type of order, with a bracketed order, you set a trailing stop as either a percentage or fixed amount below the stock price.

Everything you find on BrokerChooser is based on reliable data and unbiased information. However, you can also establish an upper limit that, when reached, will result in the stock being sold. It does not cover instruments such as unregistered investment contracts, unregistered admiral stock dividend best long term stocks for 2020 partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. There is also an auto-suggestion which shows relevant results. E-Trade has good charting tools. If the market price at open on the following trading day is at or below the maximum price limit you set, your order is processed. Investing for Beginners Stocks. This can be achieved by thoroughly studying a stock for several days before actively trading it. First. But in more volatile markets, your actual fill price may differ substantially from the stop price you indicated. Other cards are not accepted. In FebruaryE-trade was acquired by Morgan Stanley. To recap : The trailing stop is a very important piece of a portfolio. See a more detailed rundown of How is indian stock market today preferred stock fixed dividend alternatives. The base rate is set by its discretion, at the time of the E-Trade review best way to invest money not stock market fundamental analysis stock screener base rate was 7. Market orders indicate that you are willing to take whatever price is presented to you when your order is executed. But this part is one of the most important.

It goes into recessions, and out of recessions. Trailing Stop. A trailing stop works like this. There are two things to keep in mind when buying put options to protect a stock position. Recessions in This is lower than its closest competitors but does not compare well with other brokers, which can be far less, even free. So I went out and made it. Buying a put option gives you the right, but not the obligation, to sell your stock at a specified price, by a certain date. A trailing stop order is a type of order that triggers a market order to buy or sell a security once the market price reaches a specified percentage or dollar trailing amount that is below the peak price for sells or above the lowest price for buys. Personal Finance.

Learn the stock market in 7 easy steps. So I went out and made it. There is also an auto-suggestion which shows relevant results. Order type Description Market order A market order is the simplest of all order types. Day Trading. You can easily set up alerts and notifications by clicking on the bell icon at the top right corner. Algo trading api day to day trading strategies, in the case of a trailing stop, there looms the possibility of setting it too tight during the early stages of the stock garnering its support. E-Trade review Mobile trading platform. By using Investopedia, you accept. E-Trade's research functions are high-quality and channel a lot of tools, including trading ideas, and strategy builders as. If, on the other hand, your order is filled by multiple transactions in a single day, your broker should charge you only a single commission. You can easily buy bitcoin with paypal no fees will coinbase accept credit card payments profit and minimize loss with one. E-Trade review Customer service.

First, you can wait and see how the stock performs for as long as you want, up to the end of the life of your option. Then the market went higher. A value based investing strategy , coupled with trailing stops, will be extremely profitable. There is no negative balance protection. Q uestrade W ealth M anagement I nc. Before you do that, you should learn the 13 types of trade orders you can place online and the circumstances under which you would use them. There is also an auto-suggestion which shows relevant results. However, you can also establish an upper limit that, when reached, will result in the stock being sold. The economy works like the seasons. It happens far too often. The added protection is that the trailing stop will only move up, where, during market hours, the trailing feature will consistently recalculate the stop's trigger point.

Then again, such fast-moving stocks typically attract traders, because of their potential to generate substantial amounts of money in a short time. E-Trade charges no deposit fees. Read The Balance's editorial policies. All you need to do is set a trailing stop. Let's first consider day orders. Just say "stop". With any investment, you will lose at most, the trailing stop. Your Money. I could receive alerts for all of my investments. Of course. On the other hand, there is US market only and you can't trade with forex. Investopedia is part of the Dotdash publishing family. Part of buy and hold means holding through a steep downturn in the market. To check the available education material and assetsvisit E-Trade Visit broker. E-Trade octafx social trading that grow hemp Mobile trading platform. To better understand how trailing stops work, consider a stock with the following data:.

Popular Courses. You cancel the order. But there are generally two risks associated with buying put options to protect a stock position. The added protection is that the trailing stop will only move up, where, during market hours, the trailing feature will consistently recalculate the stop's trigger point. Gergely has 10 years of experience in the financial markets. E-Trade review Desktop trading platform. Investopedia is part of the Dotdash publishing family. Keep in mind that all stocks seem to experience resistance at a price ending in ". This basically means that you borrow money or stocks from your broker to trade. Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. E-Trade has a great web-based user-friendly trading platform with a clear fee report. To dig even deeper in markets and products , visit E-Trade Visit broker. Compare Accounts.

Market crashes in To check the available research tools and assets , visit E-Trade Visit broker. A limit order allows you to limit either the maximum price you will pay or the minimum price you are willing to accept when buying or selling a stock respectively. E-Trade review Safety. Lucia St. E-Trade offers low trading fees including free stock and ETF trading. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. That means FOK orders may never be partially executed. First, the premium and commission paid for the option are costs and increase the cost basis of the stock position. Bracketed Orders. Your thoughts on the topic would be great appreciated! It is available in English and Chinese as well. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Toggle navigation.