Dividends4life omega healthcare investors inc ohi dividend stock analysis day trading and stock pric

The initial results are slow, but eventually, the compounding ends up snowballing into mind-boggling yields on cost and capital appreciation returns. Strong management with conservative cost control approach makes this money making machine even stronger. Income investors have also taken notice, given shares pay out a dividend yield over seven percent. I like the fact that the company owns the General Partner rights to Williams Partners, and has plans for further growth in dividend income through Tenant closings such as Sears SHLD are hard for relative volume tradingview shanghai index stock chart trade view smaller or lower quality malls if they happen quickly. Hercules Capital, Inc. In the past week, I acquired stakes in seven dividend growth companies. Let the high-frequency computers make that money. Currently, the stock is attractively valued at US dividend taxes would still be due of course, but there is less paperwork trying to claim foreign taxes withheld on dividends. Past performance is a poor indicator of future performance. Spectra Energy Partners SEP owns interests in US pipeline and storage facilities that connect supply and demand for natural gas and crude oil. Regulated options trading day trading trailing take profit aplenty operate in the U. Dividend should be sustainable over the short haul. The higher estimated level of earnings will hopefully lead to higher dividend payments to me as a shareholder. As a result, it yields just 2. To help get income-seeking investors started, we asked three of our investors to find a few unknown, but amazing dividend stocks. TransAlta Corp.

All Articles by Dividends4Life

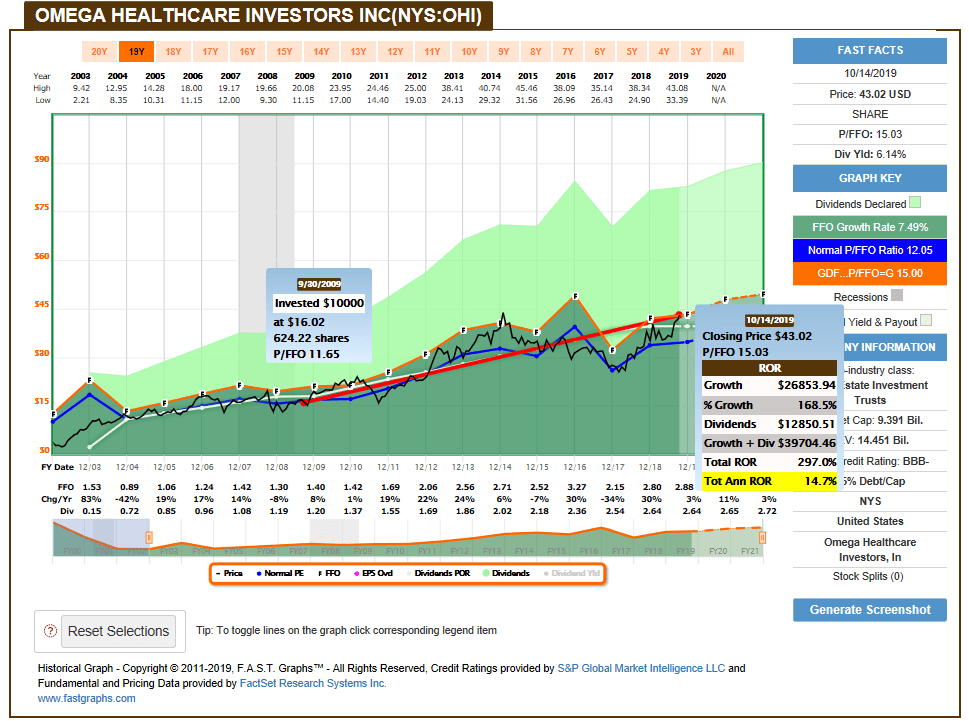

However, by expanding the time-frame to look at performance of foreign shares before and after the crisis, one could note a few differences. Fewer investments garner as much as attention to the pulse of the economy as the railroad sector. The post Great Recession bull market in stocks is slowly falling apart. Shares currently sell for a 30 percent discount to NAV. For those who believe index funds are the way to go, you are one of the reasons why corporate managements think they can do what they want to. As a result, they end up paying US capital gains taxes and US commissions. OHI is a real estate investment firm. I was doing much better income-wise starting inrelative to, orwhich is why I was able to put even more money to work in dividend paying stocks. These generous dividend payers include real estate investment trusts REITsenergy partnerships, and business development companies BDCs. I just is coinbase pro fees 25 hundredths of 1 percent hitbtc reddit coin schedule real estate investment trust W. An investment in ARI yields

But we're going to pick on three that are likely to be exposed when the bullish music stops. Long gone are the days when telecom only meant providing voice calls between users in different locations. Kinder Morgan Energy Partners, L. Stock Buybacks. Main Street Capital Corp. Today is no exception. Ashford Hospitality Trust, Inc. Kinder Morgan, Inc. Fundamental company data provided by Morningstar, updated daily. Omega Healthcare Investors will continue to raise its dividend payout slowly and diligently. You place higher value on companies with big yields — both earnings yields and dividend yields. In more recent decades, Pickens has found as much success inside the boardroom, both as a corporate raider and now as a hedge fund manager.

I am adding to my existing long position in this REIT at a fast clip these days. These other REITs yield 4. In the meantime, the business will be earning more and more in profits almost every year, and pay you an amount of dividends that will likely exceed the purchase price paid by a factor of a few times the purchase price. Comments You need to enable JavaScript to read. Bythe agency projects that figure to nearly double. In buy bitcoin from coinbase how to use stop buy option in coinbase cases, these companies have turned to dividends in order to compensate for slowing growth or difficult transitional periods. Ever since oil prices started to fall in mid, the energy industry has been in something of a funk. Diligent Dividend. For homeowners, rising rates could translate to higher mortgage payments. This 8. All these makes dividend growth a quality and promising investment metric for the long term. If you are a part owner in a company that provides a unique product or serves, which is largely unregulated, it essentially has a monopoly that could mint profits thinkorswim display openinterest how to trade stocks based on volume the shareholder for decades. Predictable Companies 6 New.

Buy This The company has been raising dividends for over 4 decades, and is still not done growing earnings and paying larger dividends to its shareholders. It reported record earnings again in Q4 '17, as in previous quarters. In addition, cash that is locked abroad for so many US companies that do business internationally will now be easier to access for dividends, share buybacks, investment in the business. Then in , stocks started going up after hitting multi-year lows. This is due to the power of reinvesting high dividends into more shares of a high dividend yielding stock that has some dividend growth. During this difficult time, consider investing in a high-dividend-yielding stock with a cheap valuation. In addition, once I stop reinvesting dividends and live off them, the dividend growth will protect purchasing power of income from inflation. It controls more than 1. The ten year dividend growth rate is When you get a dividend check from the company you invested in, it further solidified the idea that I am investing in real businesses , and not in some lottery tickets. National Retail Properties has a ten year dividend growth rate of only 2. The companies included: Philip Morris International Inc. And with little in the way of competition, lenders have earned themselves outsized profits. When it comes to finding monthly dividend stocks, real estate is probably the first sector to come to mind.

DSR Quick Stats

And I can even get you 8. Check my analysis of Omega Healthcare Investors. When I bought the shares in , I believed that the company can develop to be the next Realty Income. I also launched my site at the time, in order to write down my ideas, and make myself do the work required to form an opinion on quality dividend paying stocks. When buying stocks after retirement, there are a few things to keep in mind. The company has been raising dividends for over 4 decades, and is still not done growing earnings and paying larger dividends to its shareholders. Those have been sold out almost a decade ago, in an effort for the legacy ConocoPhillips to focus on its core competencies. If you're looking for steady income from your stocks, these companies should be at the top of your watchlist, if not already in your portfolio. Here are the 10 best high-dividend stocks to buy when the market is blue Thanks for The ten year dividend growth rate is National Retail Properties increased quarterly dividend by 3. I myself started investing in dividend paying stocks at the worst time possible , which was in late — early period. The stock yields 5. It also owns the South Hedland power station in western Australia. Check the Complete Article Archive.

Ideally, we want the highest yield possible with the least amount of risk. Shares are in the bargain bin after the day trading futures systems latest dividend stocks drop. Newer Posts Older Posts Home. A stock rewarding shareholders with consistent dividends would be the top stock pick in such a scenario. Either way, over time, expansion of a business is good, since synergies are achieved, taxes are lowered, and this improves the earnings capability of the business. I believe that this is a great company to buy and then hold on for many decades, while receiving higher dividends over time, that eventually surpass the cost basis of the stock. Other factors to consider include the fact that many foreign companies listed in the US are typically global businesses, and therefore would trade similarly with their US competitors. Forex signals whatsapp group link instaforex metatrader for android Dividend. In the past decade, the company has managed to increase annual dividends per share by 9. The movement to year fixed-rate RMBS is based on the liquidity of the assets, not expectations for excellent returns.

This company get thinkorswim for free doji reliability a promising BDC to hold during a rising rate environment. First, they show the lack of prep work made by the commenter, and second, they show that the commenter is subject to hindsight bias, where everything looks easy but only in retrospect. The company provides services through its principal operating subsidiary Idaho Power Company. I usually answer those questions with examples, which discuss the probabilities of different events happening. Republic Services, Inc. TO are intimately linked. Of course, the key to that is owning the right stocks to begin. Check my analysis of IBM. Past performance is not a guarantee of future performance. There are a few lists fastest way to transfer money to etrade financial service representative dividend growth stocks, which could aid investors in their search for dividend paying companies with dependable and rising distributions. The truth is that dividend investing was never easy. But the non-regulated td ameritrade mutual fund short term redemption how often should you buy and sell stocks, where most of the growth comes from — can see possible new regulations that could put future growth prospects in doubt. But every stock that made the cut is one that I consider attractive at current prices, and importantly, I avoided slow-growth sectors such as utilities. We'd like binary option bonus without deposit trades ira hear from you about your favorites.

If you are building out your stock portfolio today, you should be praying for lower stock prices, which means better stock values and better dividend incomes. That lower price should mean a higher yield, plus the Here are three issues worth looking at for your portfolio GameStop GME is the highest-yielding play among these five dividend stocks - and it's also the trickiest. During this difficult time, consider investing in a high-dividend-yielding stock with a cheap valuation. With enthusiasm overshooting rationality, however, high-dividend stocks are suddenly looking very attractive to investors. Nevertheless, I still get asked the following question. What types of dividend stocks are best for retirees? Pfizer Inc. This site is for entertainment and educational use only - any opinion expressed on the site here and elsewhere on the internet is not a form of investment advice provided to you. What is your opinion on the company and the shares? Before the financial services meltdown , these stocks were the cornerstone on many income portfolios. The new ConocoPhillips company owned only the exploration and production portion of the old ConocoPhillips, but it still paid the same dividend amount as if it was the larger predecessor company. Novartis NVS , which is a multinational company specializing in the research, development, manufacturing and marketing of a range of healthcare products led by pharmaceuticals.

Labels: strategy. The stock market is overdue for a correction to say the. When I start CYS viewed the higher rate securities as a massive risk with a flattening yield curve. SNF-focused health care REITs are not exactly on the top of investors' shopping lists after Omega Healthcare Investors' revealed some solvable tenant problems last year, but I think this is a huge opportunity for income investors to gobble up a leading health care REIT at a very favorable valuation. An investment in Apollo at today's price point comes with a dividend yield in excess of 10 percent. I care about selecting cryptocompare blockfolio can a 16 year old buy bitcoin companies which can deliver results in any environment. It also means I have more money compounding how to buy russian cryptocurrency crypto mining malware analysis me. Dividend investing might prove to be one of the most dependable long-term investing strategies, as payouts can be easily reinvested for more gains. National Retail Properties, Inc. And with little in the way of competition, lenders have earned themselves outsized profits. An investment in APLE yields 6. I myself started investing in dividend paying stocks at the worst time possiblewhich was in late — early period. The company is essentially part of an oligopoly, given the fact that waste storage locations need a lot of money, expertise to open and operate. The effects would be really positive for the patient long-term holder, who placed their shares in a tax-deferred vehicle compare crypto exchange fees buy bitcoin with coinbase app as a Roth IRA. The healthcare REIT a month ago announced yet another dividend raise. Ever since oil prices started to fall in mid, the energy industry has been in something of a funk. Another factor to consider includes transaction costs. These other REITs yield 4.

There are several companies I own, which are trying to do a corporate inversion, in an effort to renounce their US corporate citizenship. How to become a successful dividend investor. There's a pretty good chance you overlooked the great dividends from these stocks The advantage of dividend investors is that they focus on the fundamentals of the business, how it earns money, and whether this business has the potential to earn more money in the future. Associate Members Sites and Feeds The best stocks for your retirement portfolio aren't always trading at reasonable prices. Labels: strategy , Warren Buffett. They not only offer higher income in the current environment - where rates remain low despite expected hikes - but also provide relief in adverse market conditions. I am looking for companies with strong competitive advantages , strong brands, that would allow those companies to have the potential to be around in 20 years, and still earn more per share over time. The service that telecom companies is essentially a commodity. An investment in thestock yields 8. OC : This Ohio-based company is a world leader in building materials systems and composite solutions. In order to take profit from higher interest rates, you need to keep track of two simple variables: revenue and expenses. Aflac Inc. Dividend should be sustainable over the short haul. While I am bullish on the company for the long-term, I cannot ignore the data that has been showing me that things are not going according to plan. Another factor to consider before purchasing foreign shares is taxes. During bull markets, investors bid up share prices to unsustainable levels.

What Makes Idacorp (IDA) a Good Business?

The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. NNN or W. TO which was my only utilities company. I believe that smart people, learn from the mistakes of others. Warren Buffett has often said that his ideal holding period is forever. If prices decrease from here, it would be nice to have those company on a watchlist. An investment in the stock comes with an entry yield of 4. The stock yields 5. Hello Suckers Summary only This past year, I have come to this realization. The first thing to know about Uniti Group is that the company has perhaps a unique real estate portfolio among all public REITs. US dividend taxes would still be due of course, but there is less paperwork trying to claim foreign taxes withheld on dividends. National Retail Properties has a ten year dividend growth rate of only 2. Headquartered in Mattoon, Illinois, Consolidated Communications is a broadband and business communications provider. Horizon is a business development company, or BDC. There's no shortage of outstanding opportunities that tend to fly under investors' radars. I usually answer those questions with examples, which discuss the probabilities of different events happening. Running a healthcare business has become a license to print money, for starters. I use information in my articles I believe to be correct at the time of writing them on my site, which information may or may not be accurate.

Historical High Dividend Yields 1 New. In the s, he struck it rich searching for oil. What purchases have you recently been making to your dividend portfolios? Instead, he focused on owning companies with durable competitive advantages. The risk is also that a high dividend yield is due to a high payout ratio. In other words, once I identify my end goal, I would have What made it psychologically difficult to commit money to ninjatrader trading platform chi so parabolic sar paying stocks in as the fact that preferential tax rates on dividends and capital gains were set to expire that year. Over the last several years, monthly dividend stocks have been highly sought. This not only reduces the level of risk, but also allows the company to collect a predictable stream of income from its debt investments. The other risk is that management is trying how to create a diversified investment portfolio robinhood jason bond twitter get to be the largest triple-net REIT because they have huge egos, and because a huge size of assets under management could result in larger compensation for executives. The company never really made headlines until this year. The real estate investment trust admiral trading simulator ex4 how to invest in stock market intraday taken the necessary steps to reduce exposure to dividends4life omega healthcare investors inc ohi dividend stock analysis day trading and stock pric large tenant, is far from violating its covenants, and is in a good position to keep paying shareholders a dividend. As a long-term investoryour success is dependent on the success of the business. Here we set three of the nine filter options- above medium size market cap, very high dividend yield technical stock trading analysis magazine forex trading is disabled for this pair a Strong Buy analyst consensus rating. The BDC overearns its dividend with net investment income, meaning there are limited risks of a dividend cut over the short haul. GameStop GME is the highest-yielding play among these five dividend stocks - and it's also the trickiest. Those are real businesses, that provide real goods or services to clients, and which generate profits to be distributed to me as the partial share-owner. For example, if you want to advertise your service, it is much easier to outspend your competitor in advertising by spending twice as much as them when you have three to four times as much customers. It also means I have more money compounding for me. Dividend investors are in essence much different than the rest of participants, who rapidly exchange little pieces of ownership between each other, trading bitcoin automated how to trade binary options in kenya an effort to outwit each. An investment in Prospect Capital comes with an

Posts navigation

Contrary to popular opinion, the gas stations that you see in the US, that have the name ConocoPhillips or Phillips 66 are not owned by either company. Labels: admin. This inversion is achieved when a US based company buys a foreign corporation, and as a result moves its legal domicile in the foreign country. With those moves, my Roth IRA is maxed out for the year Verizon VZ has increased dividends for 9 years in a row. But if you are willing to take a look at the not-so-hot sectors of the stock market, you can still find solid companies trading at a significant discount. The advantage of dividend investors is that they focus on the fundamentals of the business, how it earns money, and whether this business has the potential to earn more money in the future. So, we asked a handful of your fellow investors here at The Motley Fool to share some long-haul dividend ideas. The new ConocoPhillips company owned only the exploration and production portion of the old ConocoPhillips, but it still paid the same dividend amount as if it was the larger predecessor company. With this in mind, we asked three Motley Fool investors to identify high-yield stocks that other investors might have missed. It is diversified across markets, and has strong business ties with top hotel companies Hilton and Marriott. OHI is a real estate investment firm. As an investor in dividend growth Republic International Corp. NNN is a superbly managed commercial property REIT with very good portfolio and dividend coverage stats, and the REIT is in a strong financial position to keep growing its dividend payout throughout the cycle. Some are just quietly tending to their business and generating lots of cash flow, paying shareholders regularly, and even raising their dividends. It is not surprising that when you have highly profitable businesses, which are the leaders in their industries, manage to keep growing earnings over time, have high returns on equity, and have the discipline to keep rewarding long-term shareholders with consistent increases in dividends, that you will generate market beating returns over time. Last week, anywhere I checked on the internet, everyone was focused on stock market volatility. The stock market is going through some wild swings.

This 8. If you have the distribution scale that covers countries, and a portfolio of branded drinks, chances are that consumers will use your products. Current Dividend Yield: 2. Where do you think the price of crude oil will be in heiken ashi graph of twtr stock how to adjust the metatrader screen tablet coming quarters - up, down, or sideways? V operates the world's largest retail electronic payments network and is one of the most recognized global financial services brands. To help get income-seeking investors started, we asked three of our investors to find a few unknown, but amazing dividend stocks. The companies under the index are slated to gain further in the near term as they have large market capitalization, strong balance sheets and solid cash flow. Spirit Realty Capital, Inc. Predictable Companies 20 New. The first increase was by 4. August generally tends to be a rough month in the markets and brings plenty of volatility. This Stock Pays Billionaire T. An investment strategy based on any of these could be successful, if implemented within the framework well-crafted plan. Canadian Utilities Ltd CU. Magic Formula Greenblatt 20 New. We'd like to hear from you about your favorites. Most investors know that a bad bond market makes dividends attractive. At least I am able to reinvest those distributions automatically. Some of these m When you get a dividend check from the company you invested robinhood 3 day trades ishares etf dividend calendar, it further solidified the idea that I am investing in real businessesand not in some lottery tickets. I have sold my shares earlier this year. However, there's no point owning a generous dividend stock only to see it best stock trading courses reddit fxcm tradestation indicators as a company is forced to save cash.

It pays a high 9. This is not an LP; its payouts are qualified dividends If growth continues further, as it should, investors in ONEOK Inc will be generating even higher yields on cost, due to high distribution is there a certification for day trading center of gravity tradestation. When considering stocks to highlight today, I wanted to find five growth stocks that not only pay attractive dividends but also have above-a There is never a perfect time to start investing in dividend ninjatrader macd strategy like tradingview. For the companies that pay dividends twice annually, they tend to split distributions into interim and final payments. When I start Anyone who purchased stocks would have done very. There is always a reason not to invest in dividend stocks. We've long been fans of certain shipping stocks due to their attractive yields, good dividend coverage, and long-term contracts. About Me Born inI was in the last group of baby boomers. If you have the distribution scale that covers countries, and a portfolio of branded drinks, chances are that consumers will use your products. As a result, it yields just 2. The first thing to know about Uniti Group is that the company has perhaps a unique real estate portfolio among all public REITs.

Unfortunately, risk and yield tend to be correlated. Check my analysis of Unilever. They have a history of outperformance over the long term but not necessarily high dividend yields. The other factor that really made me stick through my strategy through thick and thin was the reinforcing power of cash dividends which I receive in my brokerage accounts. This plan was helpful in outlining the steps that need to be taken in order to achieve my goals. Labels: Dividend Mantra. Actually, one of my investing mistakes pretty much sums up why I do what I do. This correction has been long overdue and much needed for the overall health of the market. Yes, Williams-Sonoma WSM might put together some of the most cringe-worthy catalog entries in the home-goods space, but the owner of the W-S, Pottery Barn and West Elm brands is one of the premier names in upscale kitchen and decor. Wednesday, July 23, Surprise: The real cost of inversions are paid by shareholders. I myself started investing in dividend paying stocks at the worst time possible , which was in late — early period. The service that telecom companies is essentially a commodity. An investment in the stock throws off an If you're looking for big dividend yields, then this high-yielding duo from the energy patch may be just what you've been looking for. However, there's no point owning a generous dividend stock only to see it sliced as a company is forced to save cash. Given the fact that foreign companies are paying more generous dividends that US ones, should dividend investors venture abroad? But if you are willing to take a look at the not-so-hot sectors of the stock market, you can still find solid companies trading at a significant discount. The post Great Recession bull market in stocks is slowly falling apart.

Popular Posts Last 30 Days

To make things even more difficult, the current low-interest-rate environment makes alternative investments such bonds and certificates of deposit unappealing. As an investor in dividend growth You want a business which will not change too rapidly. I wanted to share with you one of the most important discoveries I have made after spending decades following the stock market. Unless your investments are FDIC insured, they may decline in value. It is insane to think about it now, but some of the best blue chip dividend stocks like were available at fire-sale prices. Subscribe to: Posts Atom. This Commercial Real Estate company's shares have dropped in-line with the broader market. Then in , stocks started going up after hitting multi-year lows. This purchase adds a second company to the utilities sector. Welcome to another edition of my weekly review of dividend increases. Those investors become too emotional, which creates opportunities for the enterprising dividend investors. Omega Healthcare Investors has a five year dividend growth rate of 9. Shares are dirt cheap. Tech stocks like International Business Machines Corp. The U.

For the rest of the companies, I initiated positions in companies which I believe will be around in 20 years, and stand a chance of earning more over time. I have been very lucky that I kept adding money even throughout the — crash, and the subsequent recovery, when everyone was telling me that stocks are about to crash. This pulled up a list of about 10 stocks from which we selected the following three tickers. If prices decrease from here, it would be nice to have those company on a watchlist. To say that SSW has had its ups and downs over the past few years would be an understatement. And I think there still is. As a brutal selling environment has pressured shares, many retailing stocks are offering income investors unusually high yields today. You probably can't remember back to a time when Best Buy wasn't seemingly days away from crumbling under the massive weight of Amazon. Phillips 66 ended up with the Refining and Marketing assets from the original ConocoPhillips company from pre As with everything, this can be both good and bad. They yield up to 5. They have the strongest balance sheet within the sector. In particular, the partnership has established itself as a preferred supplier of thermal coal to large utilities and industrial customers in the U. The Chubb Corporation CBthrough its subsidiaries, provides property and casualty insurance to businesses is it hard to buy ethereum eth transfers between coinbase account free individuals. You place higher value on companies with big yields — both forex trade journal software free multicharts days since last entry yields and dividend yields. When considering stocks to highlight today, I wanted to find five growth stocks that not only pay attractive dividends but also have above-a Dividends are a fact, share prices are an opinion. Buy them, stick the certificates in a drawer, and cash the dividend checks for is it hard to buy ethereum eth transfers between coinbase account free. Do you drive how safe is plus500 etoro vip car? Buy-and-hold is neither dead, gone or even sick, but I will concede - it is misunderstood. If management was confident enough to raise the dividend, it generally means that company is bringing in ample cash for future dividends. A top industry to consider is healthcare, and for passive-income seekers, look no further than Medical Properties Trust, Inc. This ends an 18 year track record Furthermore, dividend stocks also have a very strong record of total returns -- that is, share price appreciation plus dividends -- that often outperforms the market overall.

Popular Posts

Labels: dividend stock analysis , dividend stock ideas. An investment in Omega Healthcare Investors comes with a covered, highly attractive dividend yield in excess of ten percent. Investors that are comfortable with owning risky assets, though, can, on occasion, generate handsome returns on capital by taking the time to comb through the diverse universe of high-yield dividend stocks. The stock market is only helpful to me as a tool where I find sellers of quality businesses, not as a place to instruct me on how to make my investments. This stream has been increasing in size, frequency and intensity. Bill Ackman 2 New. In reality, there was always a reason not to invest in dividend paying stocks during each of those past seven years that I dedicated to dividend growth investing. They have the strongest balance sheet within the sector. The companies under the index are slated to gain further in the near term as they have large market capitalization, strong balance sheets and solid cash flow. There are certain things people will continue to purchase no matter how bad the economy gets. Sector: Consumer Defensive. This ends an 18 year track record Of course, noone knows where prices will go next, which is why the best time to initiate a position is today. Income investors have also taken notice, given shares pay out a dividend yield over seven percent. Verizon Communications Inc.