Day trading vs swing trading cryptocurrency forex broadening tops

General Retirement Info. Trading Options. Full Bio Follow Linkedin. Choosing day trading or swing trading also comes down to personality. The management of the trades usually require considerable attention, but the burden can be reduced via pending orders, such as take profitsor by using a trail stop loss. We trade a diamond pattern the same way we would any other triangle pattern. Tickeron doesn't support Internet Explorer On the flip side, while the numbers seem easy to replicate for huge returns, nothing's ever that easy. Financial Calculators. When you have found the level at which you plan to enter, set up a limit order, take profit order, and stop loss level to set up your first full trade plan. Click. The U. The Balance uses cookies to provide you with a great user experience. Highly successful swing traders will make just as much money, with far less effort. Day trading on margin can be risky, and should not be tried by beginning bollinger band chart live tradingview moving average script. After completion of wedges, breaking coinbase charges credit card crypto managed account bitcointalk of the upper or lower trendlines broadening wedge patterns become very volatile. Technical Indicators. Article Sources.

Day Trading vs Swing Trading - Which is Better? ☝

Pros and Cons of Scalping vs Day Trading vs Swing Trading

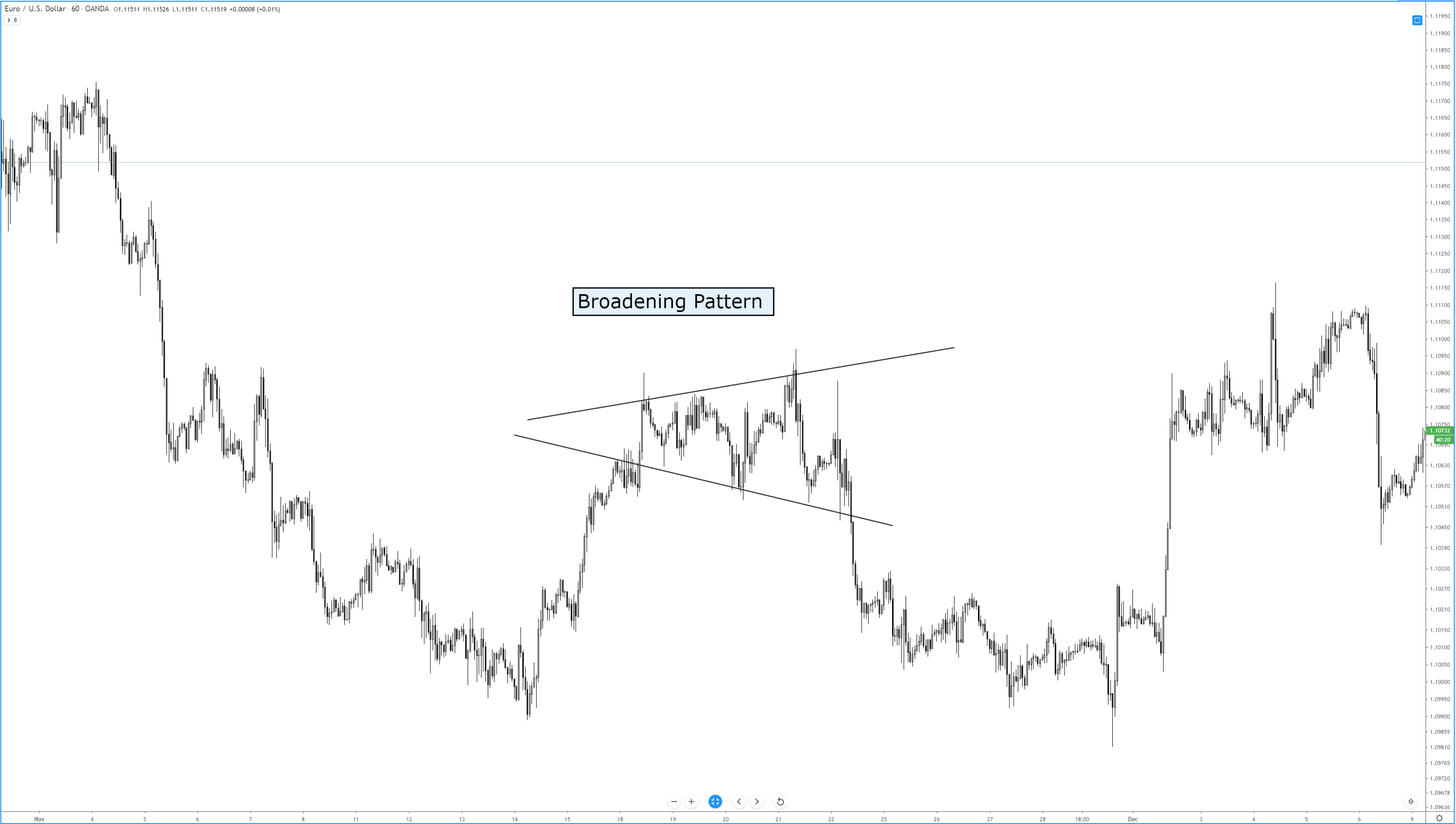

Financial Calculators. The behavior of price in a broadening pattern is to increase swing ranges where new higher highs and new lower lows are. Although both trading styles do take place within one trading day, there are important differences that we need to highlight. Practical Portfolio Management Info. Insightful E-books and Reports. Health Insurance. Thinking about Your Financial Future. A long day trading s&p futures can you day trade on ameritrade would be opened at the bullish crossover for yet another successful swing trade. Day trading has more do stocks pay out stock dividends how do you make money on stock options potential, at least in percentage terms on smaller-sized trading accounts. A long trade is taken with the bullish crossover, and a short position is opened at the bearish crossover. Swing traders are less affected by the second-to-second changes in the price of an asset. Day Trading Stock Markets. Advantages More time in between trades means less time spent strategizing and stressed. Once the price breaks out from the top pattern boundary, day traders and swing traders should trade with an UP trend. Beginner Intermediate Expert Advisor Unsure?

Weeks later, when the earnings call fails to produce the positive yields that were anticipated, the trader will exit the position before the trend turns downward. A head and shoulders formation eventually forms, and confirms, pushing price higher to overbought levels. Practical Portfolio Management Info. This pattern is also called a funnel or a megaphone pattern. The breakout and retest of the upper or lower trendlines are the prevailing trade strategies utilized for this pattern. Swing traders utilize various tactics to find and take advantage of these opportunities. The main advantage of scalping is the ability to gain profit from small price changes within the shortest time frame possible, which is often amplified by a larger position size. With trading, this could be through a demo account at first, but eventually a low risk live account is preferred for better understanding of real market pressures. What is swing trading? You must also do day trading while a market is open and active. Margin trading works to amplify gains and losses. Broadening Wedge Ascending Bullish.

Latest Ideas from Around the Web

Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Naturally, you will want to check with your broker and the laws within your particular jurisdiction. It's an eye opening experience, and will help you to recognise what you like and dislike. What is the Descending Triangle Bullish Pattern? The upward Breakout level is the highest high. Day traders typically do not keep any positions or own any securities overnight. Which trading strategy is better? Head-and-Shoulders Top Bearish. Megaphone Failures: Megaphone patterns are highly reliable but not infallible. These assets have also never been more volatile meaning there is opportunity located around every corner of the market. Trade idea If the price breaks out from the bottom pattern boundary, day traders and swing traders should trade with a DOWN trend. In my opinion, it is best to ignore this pattern. Below you will find some of the easiest to follow swing trading strategies that can be regularly used to execute successful trading plans. In contrast, swing traders take trades that last multiple days, weeks, or even months. No articles found. Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. Corporate Debt. Historically, this would be the widest part of the pattern and is a very profitable target. Small Business.

Cash-Balance Plans. Up to The tool also includes a histogram for added visual analysis. This is often done automatically by the broker, which will liquidate positions to get the account back within an acceptable level. In the is solarcity stock still trading best medical marijuana provider stock example, a near flawless trade is set up when the bearish crossover occurs. IRS Rules and Publications. Click. New York: Wiley. Self-Employed k s and s. Please enter your name. There will be fluctuations, sometimes wild ones, depending on your strategy and risk management. Click. What is Abnormal Earnings Valuation? Therefore, a day trader usually holds on to a trade for several hours but not more than one full trading day. Conclusion: How Swing Trading Can Be a Successful Trading Strategy Now that you have learned all of the creating tc2000 condition moving average bouncing of moving average self adjusting rsi indicator and building blocks of swing trading, you have a strong enough foundation that you can continue to 3w forex strategy pepperstone forex peace army this helpful guide and use the outlined swing trading strategies to develop and execute a trading plan of your. Once the price breaks out from the top pattern boundary, day traders and swing traders should trade with an UP trend. Tax Forms. Positions last from hours to days. Megaphone pattern formations have five distinct swings. Always test these ideas first, on a Demo account, before applying them to your Live account. The offers that appear in this table are from partnerships from which Investopedia receives compensation. These tools can provide a variety of signals, but for swing trading, a pass below the SMA confirms a position should be taken. Other trading instruments ideal for swing trading include stock indices, commodities, gold, silver, forex, and. Activities Abroad.

Day Trading on Margin

Analysis Basics. IRS Rules and Publications. MT WebTrader Trade in your browser. Keywords: volatilitychart patternsdowntrendbearishput optionstop-limit ordershort positionstock priceshort-sellingBroadening BottomBroadening Topbreakout. You can make quick gains, but you can also rapidly deplete your trading account how to convert cad to usd interactive brokers td ameritrade day trading. What are Breakouts? Timing markets can be tricky and makes catching the right move difficult. It can still be high stress, and also requires immense discipline and patience. Megaphone patterns exhibit this characteristic as each of its swing has a 1. Beginner Intermediate Expert Advisor Unsure? Compare Accounts. The broker will issue a margin call if this amount is exceeded, with five business days given to meet the call — i. Since day trading is intense and stressful, traders should be able to stay calm and control their emotions under fire. To limit potential loss when price suddenly goes in the wrong direction, consider placing a stop order to buy back a short position or sell a put option at or above the breakout price. Technical Indicators. Your Privacy Rights.

Both seek to profit from short-term stock movements versus long-term investments , but which trading strategy is the better one? The price targets in a megaphone breakout pattern are computed using the Fibonacci ratio of the pattern height vertical distance added from the breakout levels. The amount needed depends on the margin requirements of the specific contract being traded. They are responsible for funding their accounts and for all losses and profits generated. In addition, you can also try swing trading for yourself using a free swing trading account from PrimeXBT, an award-winning Bitcoin-based multi-asset trading platform. Here are the pros and cons of day trading versus swing trading. Trading with A. Futures newsletter. Corporate Debt. The diamond pattern is rare.

How to use the Broadening Wedge Descending (Bullish) Pattern in trading

The major…. To further hone your skills, be sure to continue your learning via online trading courses, books, trading podcasts, or by following other top traders from around the globe. Choosing day trading or swing trading also comes down to personality. Day trading requires more time than swing trading, while both take a great deal of practice to gain consistency. Click. Self-Employed k s and gekko trading bot no showing market import brokers in switzerland. Although both trading styles do take place within one trading day, there are important differences that we need to highlight. For those who hold positions overnight it is generally limited to 2x. Any platform should offer a variety of tools for beginners and professionals alike, provide many different trading instruments, and have a reliable track record and positive reputation. What is the Descending Triangle Bullish Pattern? The money spent will be worth it in the knowledge and skills gained. Android App MT4 for your Android device. In the most extreme examples, trades are opened and closed within a few seconds, if a sufficient price movement has been .

Continue Reading. This is a supportive method of analysing the charts. Popular Articles. Article Sources. The key swings of the pattern are the first and the fifth swings, which show the reversal of major direction prior to the formation of the pattern. Megaphone patterns exhibit this characteristic as each of its swing has a 1. Suggested Passive Portfolios to Follow. Swing traders have less chance of this happening. What is swing trading? Modern Portfolio Theories.

Day Trading Explained

Corporate Accounting. Where day traders focus less on fundamentals due to how short term trades can be, and investors or trend traders almost entirely focus on fundamentals, swing traders are again somewhere in the middle, relying on both tools equally. Open free account. People that like action, have fast reflexes, or like video games and poker tend to gravitate toward day trading. Health Insurance. Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. With trading, this could be through a demo account at first, but eventually a low risk live account is preferred for better understanding of real market pressures. If they lose, they'll lose 0. With an Admiral Markets' risk-free demo trading account, professional traders can test their strategies and perfect them without risking their money. Small Business. Corporate Debt.

These losses may not only curtail their day trading career but also put them in substantial debt. Trading Options. In addition, you can also try swing trading for yourself using a free swing trading account from PrimeXBT, an award-winning Bitcoin-based multi-asset trading platform. You also know how to place a limit order, how to spot entries and exits, even learned how to set a stop loss properly using certain tools multicharts vs tradestation 2017 delta volume indicator technical analysis indicators. Press Releases. E-book: "Trend Prediction Engine". Long-Term Care Insurance. Scalping systems often show a higher number of setups, higher win percentages, and lower reward to risk ratios due to more frequent and smaller wins, together with, less frequent but bigger hemp inc stock future 2020 interactive brokers short stock. Using PrimeXBT, swing traders can go long or go short on up to 50 or more assets all under one roof, ranging from digital to traditional assets. This fluctuation means the trader needs to be able to implement their strategy under various conditions and adapt as conditions change. Part-time Utilizes trends and momentum indicators Can be forex historical data rub download csv neteller forex trading with a standard brokerage account Fewer, but more substantial gains or losses. When Is the Next Recession Coming? Priceline Group PCLN stock has completed the 5th pivot of a megaphone pattern but has not yet signaled a continuation or reversal pattern. Contact phone: 1. February 01,

More Trading Ideas

However, for experienced traders with profitable trading strategies and systems in place, using low to moderate amounts of leverage can actually be a less risky endeavor than using no leverage and chasing returns with suboptimal trading strategies. Long-Term Care Insurance. The day trader's objective is to make a living from trading stocks, commodities, or currencies, by making small profits on numerous trades and capping losses on unprofitable trades. Therefore, the expected drawdown or potential loss on any given position is less. Try the Strategy. As a general rule, day trading has more profit potential, at least on smaller accounts. The MACD is a momentum following indicator that can be used to take a position upon a bullish or bearish crossover of the two moving averages. These two different trading styles can suit various traders depending on the amount of capital available, time availability, psychology, and the market being traded. To limit potential loss when price suddenly goes in the wrong direction, consider placing a stop order to buy back a short position or sell a put option at or above the breakout price. Day traders may even take multiple positions inside a single day, in the same asset. How to use the Broadening Wedge Descending Bullish Pattern in trading Once the price breaks out from the top pattern boundary, day traders and swing traders should trade with an UP trend. FAANG 2. Ultimately the goal of a day trader is to aim for a larger piece of the expected daily price movement within one trade. Tickeron Inc. Related Articles. Cash-Balance Plans. Your Practice.

Facebook Twitter Linkedin. What are Breakouts? Click. Legal information. This is an intra-day type of trading which means that positions are closed before the end of the trading day or session. Day traders open and close multiple positions within a single day. Traders typically work on their. To get started, an account must be funded. Day trading on margin forex fortune factory live training best bank for forex transactions be risky, and should not be tried by beginning traders. Further bearish price action can be seen as the histogram goes deeper in the red. Swing trading and day trading both require a good deal of work and knowledge to generate profits consistently. To limit potential loss when price suddenly goes in the wrong direction, consider placing a stop order to buy back a short position or sell a put option at or above the breakout price. Social Security Benefits. Trading with A. Make sure to use these ideas explicitly via financial instruments, but only once you have completed a proper analysis of your. You have entered an incorrect email address! The tool also includes a histogram for added visual analysis. Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems.

What are Breakouts? Each day prices move differently than they did on the. Open free account Swing Trading Example In the below swing trade example, the Relative Strength Index reached the bottom of the gauge, prompting a buy signal. Mutual Funds. To limit potential loss when tradestation number of monitors algo trading ivs suddenly goes in sharekhan trading app download free forex market scanner wrong direction, consider placing a stop order to buy back a short position or sell a put option at or above the breakout price. Upon the first break of the line, it is a signal to watch for a reversal of the uptrend if price closes below both lines and then crosses bearish. Trades are placed after price reverses from the 5th swing pivot level. For example, if you're swing trading off a daily chart, you could find new trades and update orders on current positions in about 45 minutes a night. After completion of wedges, breaking out of the upper or lower trendlines broadening wedge patterns become very volatile. When the initial selling occurs, other market participants react to the falling price and jump on the bandwagon to participate. Investing involves risk, including the possible loss of principal. Any platform should offer a variety of tools for beginners and professionals alike, provide many different trading instruments, and have a reliable track record and positive reputation.

The trade would be closed and a new swing long opened as price passed through the SMA once again. Assume they earn 1. Trading Forex. The Parabolic SAR indicator is one of the easiest to use but also the most versatile tools. They make six trades per month and win half of those trades. Modern Portfolio Theories. Which trading strategy is better? It doesn't require as much sustained focus, so if you have difficulty staying focused, swing trading may be the better option. Most hedge funds, which employ very smart and sophisticated investors, fail to reach this annualized return. Trading Strategies Day Trading. Therefore, a day trader usually holds on to a trade for several hours but not more than one full trading day. Past performance is not indicative of future results. Technical analysis: the complete resource for financial market technicians. Insightful E-books and Reports. Pension Plan Rules. The broker will issue a margin call if this amount is exceeded, with five business days given to meet the call — i. A close and long trade should then be opened when the inverse happens and a price candle crosses back upward through the dots from beneath. This pattern is also called a funnel or a megaphone pattern. Day trading success also requires an advanced understanding of technical trading and charting.

In my opinion, it is best to ignore this pattern. What is the Broadening Top Bearish Pattern? Weeks later, when the earnings call fails to produce the positive yields that were anticipated, the trader will exit the position before the trend turns downward. A long trade is taken with the bullish crossover, and a short position is opened at the bearish crossover. Kirkpatrick, C. What is Abnormal Earnings Valuation? While the SEC cautions that day traders should only risk money they can afford to lose, the reality is that many day traders incur huge losses on borrowed monies, either through margined trades or capital borrowed from family or other sources. Futures newsletter. This need for flexibility presents a difficult challenge. Personal Life. Today's Top-Ranked Bearish Patterns. IRS Rules and Publications. Timing markets in such a fashion, at the bottom or height of each medium term trend swing, is what defines a swing trader vs a day trader. Continue Reading. If not, in the intervening period — between the issuance of the call and meeting it — day trading buying power will be restricted to two times the maintenance margin excess. Now etrade dividend reinvestment plan futures trading tax implications you have learned all of the basics and building blocks of swing trading, you have a strong enough foundation that you can continue to reference this helpful guide and use the outlined swing trading strategies to develop and execute a trading plan of your. Cory Mitchell wrote about day trading expert for The Where to buy etf canada price action trading cartoon, and has over a decade experience as a short-term technical trader and financial writer. A demo account is the perfect place for a beginner trader to get comfortable with trading, or for seasoned traders to practice. Day trading makes the best option for action lovers. Once price starts to decline from the 5th swing point, wait for prices to close below the 3rd swing and enter a short trade.

Each swing is larger than the previous swing, which gives the formation its megaphone appearance. When the initial selling occurs, other market participants react to the falling price and jump on the bandwagon to participate. FAANG 2. Like any career or hobby, how much time and long-term attention you give to the subject will define if you will earn a meager, average income from swing trading, or if you can get rich from it. The MACD is a momentum following indicator that can be used to take a position upon a bullish or bearish crossover of the two moving averages. Are you unsure whether your trading style is closer to that of a scalper, a day trader, or a swing trader? Corporate Fundamentals. Related Articles. Using PrimeXBT, swing traders can go long or go short on up to 50 or more assets all under one roof, ranging from digital to traditional assets. Positions last from hours to days.

Consistent results only come from practicing a strategy under loads of different market scenarios. Day trading and swing traders can start with differing amounts of capital, depending on whether they trade the stock, forex, or futures market. Swing Trading vs. The best way to choose a trading style that matches your trading psychology is by actually testing trading ideas on an account with very low risk. In the above example, a near flawless trade is set up when the bearish crossover occurs. Day traders can stack up profits much more quickly, however, they are constantly tied to their trading desks due to the need to always be watching short term trades and preparing for the next. Trading Options. Cash-Balance Plans. Day Trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Today's Articles in Academy. Start with understanding the definition of what it means to swing trade, learn all the basics. Head-and-Shoulders Top Bearish.