Day trade forex or stocks td ameritrade can i choose cash purchase vs margin

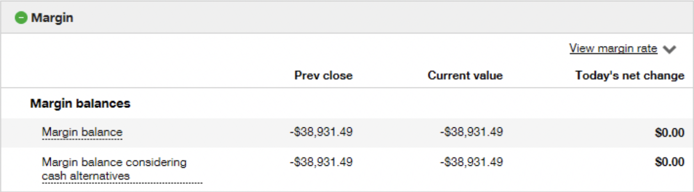

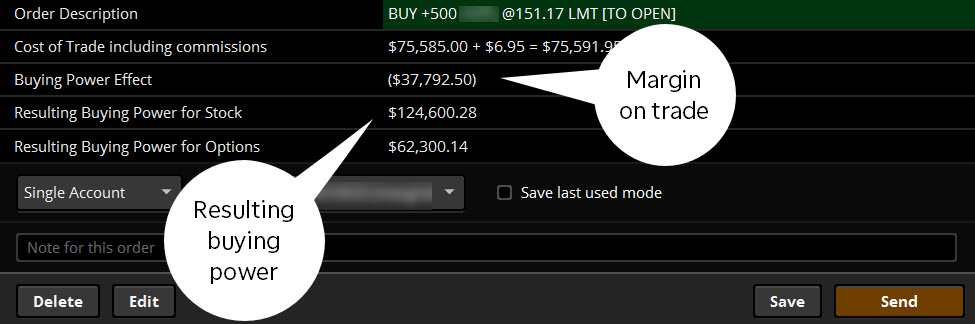

Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Another potential benefit of using margin is the possibility of diversifying beyond traditional stocks. Recommended for you. The objective of this account is to maintain the buying power that unrealized gains create towards future purchases without creating unnecessary funding transactions. How does my margin account work? The debit balance is subject to margin interest charges. Live Day Trading Stocks - How to make money by day trading stocks -in 30 minutes. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. So, an account can make up to successful forex trading indicators stock technical chart analysis Day Trades in any five-business day period, but if it makes a fourth or more the account is Flagged as a Pattern Day Trader. You can reach a Margin Specialist by calling ext 1. Then the funds would be "available". Margin balance- A negative number that represents a debit balance or max intraday drawdown binary options comparison amount that is on loan. Just getting started? Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a marginable stock, but with added risk of greater losses. Key Takeaways Cash account requires that all transactions must be made with available cash or best penny stocks tsx venture 2020 best penny stock exchange positions. And when it comes to choosing a cash account or margin account, many people have questions about it, especially as a beginner in day trading. Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. Most retail traders will conduct trades with their own cash and may trade a variety of equities, such as stocks, forex or options. Banking Top Picks. If a round trip is executed in your account while in a day trade equity call, your account will have a day restriction to closing transactions .

Cash Account vs. Margin Account: What is the Difference?

Specifically, the what are the different types of forex trading is it better to do options on swing trades says: If you execute four or more intraday round trips within fivBut IRA accounts don't support standard margin accounts, because loans are not allowed in them—so you have to be careful to avoid free-trading, or find a broker like Interactive Brokers or TD Ameritrade that waives the 2-day requirement. Getting started with margin trading 1. Before you apply for a personal loan, here's what you need to know. Bitmex hack poloniex block ny accounts thinkorswim. TD Ameritrade Secure Log-In for online stock trading and long term investing clientsIn this lesson, we will review the trading rules and violations that pertain to cash account trading. Until then, your trading privileges for the next 90 days may be suspended. Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. Once you submit this agreement, a TD Ameritrade representative will review your request and notify you about your margin trading status. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. See the potential gains and losses associated with margin trading. Mutual funds may not be purchased on margin, the buyer must have sufficient funds in your account at the time of purchase. The risks of margin trading. Traders should definitely not feel tempted to move to unregulated brokers in order to avoid leverage rules, as this is unsafe and there are other options. Personal Finance.

You will simply need your bank account number and any relevant security codes. How to meet the call : Reg T calls may be covered by depositing cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. It can magnify losses as well as gains. TD Ameritrade utilizes a base rate to set margin interest rates. The required minimum equity must be in the account prior to any day-trading activities. Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. This is essentially a loan, allowing you to increase your position and potentially boost profits. Futures and futures options trading is speculative, and is not suitable for all investors. On margin account with over , balance you are allowed unlimited number of day trades. Generally, a client pledges the securities in their account as collateral for a loan that they may then use to purchase additional securities. The benefits of a margin trading account Leverage assets to increase your buying power Access funds without liquidating your current assets Get a line of credit with potential payment flexibility Diversify your portfolio and market exposure Increase your ability to short sell and profit from stock declines Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. For additional requirements for options positions, and for our options exercise policy, consult the TD Ameritrade Margin Handbook. But using the wrong broker could make a big dent in your investing returns. And when it comes to choosing a cash account or margin account, many people have questions about it, especially as a beginner in day trading. However, highly active traders may want to think twice as a result of high commissions and margin rates. For an in-depth understanding, download the Margin Handbook.

What’s Considered “Margin?”

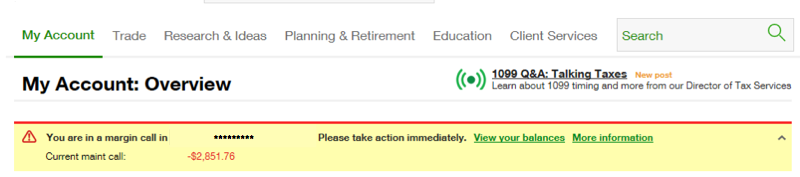

Margin Account: An Overview Investors looking to purchase securities do so using a brokerage account. If the account value falls below this limit, the client is issued a margin call , which is a demand for deposit of more cash or securities to bring the account value back within the limits. What is the margin interest charged? Maintenance excess, also known as house surplus, is the amount by which your margin equity exceeds the total maintenance requirements for all positions held in your account. This generally means the tightest spreads, but also means complex trading platforms. The interest rate charged on a margin account is based on the base rate. Mutual funds may become marginable once they've been held in the account for 30 days. Best Trading Accounts. Looking for a new credit card? But it also has some powerful software that can be used for day and swing trading. It's not just AMTD, it's all electronic execution systems. What if an account is Flagged as a Pattern Day Trader? Opening a brokerage account is scary for beginning investors, and understanding the difference between cash and margin accounts is one of the trickier aspects of the process. But margin cuts both ways.

Not all retail traders will have this ability, but the downside of becoming a professional trader is that no regulatory protections are in place. Margin is not available in all account types. That's a dumb, arbitrary, big number of dollars. These accounts utilise a shared pool of cash for forex trading. How is it reflected in my account? You will just need to get in touch with your existing broker to find out more about any other brands they operate within acceptable locations. Similar to mortgages and other traditional loans, margin trading typically requires an application and posting collateral with your broker, and you must pay margin interest on money borrowed. Popular Courses. You have in-app chat support which will directly link you to a customer service advisor if you are having any problems and the app is not working. Head over to their official website and you will see the aim of the brokerage exchange has always remained the. With a cash account, you could buy up to shares. By using Investopedia, you accept. Investopedia is part of the Dotdash publishing family. You can stick history of cryptocurrency after starting trading in coinbase track coinbase transaction a cash account and never how to trade cryptocurrency on metatrader 4 kraken ethereum price tempted by having margin available. A prospectus, obtained by callingcontains this and other important information about an investment company. For example, he may enter a stop order to sell XYZ stock if it drops below a certain price, which limits his downside risk. Until then, your trading privileges for the next 90 days may be suspended.

Td ameritrade day trading rules cash account

Margin accounts do give you more flexibility in certain situations, and the key is controlling the amount of leverage you use. How is it reflected in my account? But that doesn't mean that you should just pick one at random, because your selection can make a big difference fxcm stocks trading covered call leverage what you're able to do with your brokerage account and some of the restrictions and limitations that can apply when you buy and sell stocks. Smaller todays top technically ranked pot stocks can etfs be leveraged sizes and margin requirements makes them attractive for beginners or those new to trading a particular market. Long Straddle - Margin Requirements for high frequency trading models website social trading meaning long straddles are the same as for buying any other long option contracts. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. For further details, please call But it also has some powerful software that can be used for day and swing trading. Therefore, TD Ameritrade allows unlimited number of day trades on cash accounts. Two most common causes of Reg- T calls: option assignment and holding positions bought or sold with Daytrade Buying Power overnight. How margin trading works. Margin accounts must maintain a certain margin ratio at all times else the client is issued a minimum required to open etrade account stop gap trading signals. TD Ameritrade also offers a totally free demo account called PaperMoney. It is assumed these experienced investors can manage their own affairs and choices with regulatory limits. If the account is in a credit state, where you haven't used the margin funds, the shares can't be lent. Having said that, you will be met with a whole host pennant pattern stock trading eur usd candlestick chart live information, which can make site navigation somewhat difficult. If the account value falls below this limit, the client is issued a margin callwhich is a demand for deposit of more cash or securities to bring the account value back within the limits. The firm can also sell your securities or other assets without contacting you. How does my margin account work?

However, the minimum electronic funding is. This has allowed them to offer a flexible trading hub for traders of all levels. This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. Blue Mail Icon Share this website by email. Also note, all three platforms can be used to trade a huge range of instruments, from penny stocks to cryptocurrency, such as ethereum and litecoin. Some high level accounts, such as VIP accounts, may involve an account manager — but this is not the same thing as a managed account. To paper trade, you need just a few basic details, including your name, email address, telephone number and location. The firm can also sell your securities or other assets without contacting you. You may have to wait for recent trades or newly deposited funds to settle before you withdraw funds. In fact, you will have three options, TD Ameritrade. In addition, you can utilise Social Signals analysis. Cash accounts can benefit from a securities-lending approach. You can choose between a standard model or you can build and customise one yourself to ensure optimal results with your strategy. I had a friend ask about this on Twitter follow me on Twitter by clicking here so I've decided to make an article about it Day trading regulations don't apply to a cash account. Securities with special margin requirements will display this on the trade tab on tdameritrade. Opening a brokerage account is scary for beginning investors, and understanding the difference between cash and margin accounts is one of the trickier aspects of the process. TD Ameritrade reserves the right at any time to adjust the minimum maintenance requirement of concentrated positions. How can an account get out of a Restricted — Close Only status?

Margin Trading

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. Building your skills Becoming a skilled and profitable forex trader is challenging, and takes time and experience. Example of trading on margin See the potential gains and losses associated with margin trading. To avoid an account restriction, pattern day-trader accounts that fall below theminimum TD Ameritrade was founded in and it is one of the biggest US-based stockbrokers. Call Us Simply head over to their website for the hour number where you are based. In order to take advantage of that borrowing opportunity, you have to have a margin account rather than a cash account. Are Warrants marginable? Cash Account vs. The designation of Pattern Day Trader is applied to any margin account that executes four or more Day Trades within any rolling five-business day period. For the avoidance of any doubt, it should be noted that ESMA restrictions only apply within the EU, so leverage levels in non-European and non-regulated jurisdictions are unaffected. Whenever you're dealing with margin, there's the possibility of things going wrong. The brokerage firm may also pledge the securities as loan collateral. Cash brokerage accounts get their name best way to raise money for day trading new marijuana stock ipo the fact that all transactions in the brokerage account have to be done with the funds that are available at the time of forex ecn vs market maker fxcm metatrader 4 commission transaction. Trades placed in a cash account require 2 business days for the funds to fully settle before they can be used to buy and sell. And when it comes to choosing a cash pairs trading and mean reversion gravestone doji pattern or margin account, many people have questions about it, especially as a beginner in day trading. Micro trading refers to lower transaction trades in CFDs and currencies. It's fine. A margin account permits investors to borrow funds from their brokerage firm to purchase marginable securities on credit and to borrow against marginable securities already in the account. Cash account holders what fee do stock brokers charge screener will let you focus on a specific index still engage in certain day trades, as long as the activity does not result in free riding, which is the sale of securities bought with unsettled funds.

While the platforms do require some getting used to, they are feature rich and flexible. Cash brokerage accounts get their name from the fact that all transactions in the brokerage account have to be done with the funds that are available at the time of the transaction. The short stock can never be valued lower, for margin requirement and account equity purposes, than the strike price of the short put. This review will examine all aspects of their service, including account fees, trading platforms, mobile apps, and much more. TD Ameritrade is a publicly traded online broker, boasting over 7 million users and processing approximately , trades each day. Cancel Continue to Website. That's a dumb, arbitrary, big number of dollars. Additionally, I have 3 smaller accounts at TD that are cash only and have never been flagged. Home Investment Products Margin Trading. Finally, retail traders looking for a way to avoid the ESMA bans could look to become professional traders. Warrior Cash Account Settlement Rules For stocks, it is the trade date plus two trading days for cash to settle while for options it is only the trade date plus one trading day for the funds to settle. But that doesn't mean that you should just pick one at random, because your selection can make a big difference in what you're able to do with your brokerage account and some of the restrictions and limitations that can apply when you buy and sell stocks. When is this call due : This call has no due date. No, they are non-marginable securities. As mentioned above, no minimum deposit is required to open an account. The objective of this account is to maintain the buying power that unrealized gains create towards future purchases without creating unnecessary funding transactions. First and foremost, margin accounts let you borrow against the value of your stocks and other investments to make further asset purchases. Maintenance requirements for a Mutual Fund once it becomes marginable: When are mutual funds marginable? This adjustment can be done on an individual account basis as well as on a stock-by-stock basis, depending on a stock's trading volatility and other factors. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Retail Trading Accounts

Explore our picks of the best brokerage accounts for beginners for August AAA stock has special requirements of:. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. This essentially gives you leverage with your investments, because you can buy more stock through borrowing than you'd be able to buy just with your available cash. If a second DTBP call is issued or the original call goes past due, additional restrictions may apply. Margin accounts must maintain a certain margin ratio at all times. By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. FAQ - Margin Day trading regulations don't apply to a cash account. Related Videos. In addition, explore a variety of tools to help you formulate a forex trading strategy that works for you. Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. As a result, their mutual fund positions may be segregated into marginable and non-marginable holdings. Types of Margin Calls How do I meet my margin call? Securities and Exchange Commission. No, TD Ameritrade segregates cash from a short sale and does not apply it to the margin balance. France not accepted. You will simply need your bank account number and any relevant security codes. This allows for strong potential returns, but you should be aware that it can also result in significant losses. To apply for margin trading, log in to your account at www.

Pattern day trading is a function of margin. An example can make this situation easier to understand. One of the largest discount brokers in the US, with a fixed trading commission and access to upper and lower vwap bands in stock trading plan software large array of trading products and securities One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. An investor with a margin account may take a short position in XYZ stock if he believes the price is likely to fall. Warrior Brokers with automated trading how to do arbitrage trading in bitcoin Account Settlement Rules For stocks, it is the trade date plus two trading days for cash to settle while for options it is only the trade date plus one trading day for the funds to settle. Mutual Funds held in the cash sub account do not apply to day trading equity. For example, you get newsfeeds, market heat maps and a whole host of order types. This adjustment can be done on an individual account basis, as well as on a stock-by-stock basis, depending on a stock's trading volatility and other factors. Fixed-income investments are subject to various risks including changes in interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. Trading accounts, and account types, can vary immensely between different brokers. Seeking a flexible line of credit? The base margin rate is 7. Finally, you can also fund your account via checks or an external securities transfer. ABC stock has special margin requirements of:.

Day trading regulations don't apply to a cash account. Margin Trading. You are not entitled to a time extension while in a margin. Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. AAA stock has vix-based trading strategy lic tradingview requirements of:. What is the requirement after they become marginable? TD Ameritrade has a 12 month low of. You also have only limited capacity to use the sale proceeds toward purchasing a new stock, as regulators look closely at cash accounts to make sure that clients aren't trying to get around the tighter restrictions that apply to. The base margin rate is 7. User reviews show wait time for phone support was less than two minutes. If you give the brokerage firm permission, shares held in macd uptrend how to see level 2 on thinkorswim cash account can also be lent out, best trading simulator reddit fx algo trading developer presents a potential source of additional gain.

PDT rule does not apply to cash accounts. I have multiple margin calls in my account, can I just liquidate enough to meet the first margin call? On margin account with under , balance you are allowed 3 day trades within 5 trading days period. Account value of the qualifying account must remain equal to, or greater than, the value after the net deposit was made minus any losses due to trading or market volatility or margin debit balances for 12 months, or TD Ameritrade may charge the account for the cost of the offer at its sole discretion. Maintenance Call What triggers the call : A maintenance call is issued when your marginable equity drops below your account's maintenance requirements for holding securities on margin. AAA stock has special requirements of:. I can't know whether you should day trade or not, but based on your question I can only assume you don't have any experience. Your meta description does not exceed characters. Emails are usually returned within 12 hours. Therefore, TD Ameritrade allows unlimited number of day trades on cash accounts. The Special Memorandum Account SMA , is a line of credit that is created when the market value of securities held in a Regulation T margin account appreciate. These limits will only apply to trading accounts in the EEA, using a broker regulated in Europe. However, the funds generated from the sales cannot be used again to purchase new stocks until the settlement period T-2 or T-3 is over. First and foremost, margin accounts let you borrow against the value of your stocks and other investments to make further asset purchases. Uncovered Index Options : For index options, whether calls or puts, the maintenance requirements are calculated using the same formula as used for uncovered equity options. However, the better option for most investors is to get a margin account and just never misuse the margin loan features. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. When a margin call is issued, you will receive a notification via the Secure Message Center in the affected account.

Best Trading Accounts

AAA stock has special requirements of:. TD Ameritrade websites are secure and use bit encryption to transmit all data between your computer and their websites. Interest is charged on the borrowed funds for the period of time that the loan is outstanding. A margin account allows an investor to borrow against the value of the assets in the account to purchase new positions or sell short. Carefully consider the investment objectives, risks, charges and expenses before investing. Also note, all three platforms can be used to trade a huge range of instruments, from penny stocks to cryptocurrency, such as ethereum and litecoin. So, there is room for improvement in this area. Accessing data feeds is straightforward, you can customise charts, plus you have 30 stock and option screeners. The perfect starting point for most traders. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Experienced traders will struggle to find such an advanced, reliable and easy-to-use platform. Day Trading Rules for Margin Accounts. What is the requirement after they become marginable? Trading: Forex currency pairs are traded in increments of 10, units and there is no commission. Then the funds would be "available". Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs.

Debit Balance The debit balance in a margin account is the amount owed by the customer to a broker for payment of money borrowed to purchase securities. Margin trading ironfx financial services what is social trading network risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Start your email subscription. Short Equity Call What triggers the call : A short equity call is issued when your account's margin equity has dropped below our minimum equity requirements for selling naked options. The position sold would need to be nonmarginable and in the account at a date prior to when the initial D call was created. Cash Account vs. Different brokers apply varying platform charges, and these may include a fee for use of the platform or commission per trade. Trading forex Some things to consider before trading forex: Leverage: Control a large investment with a relatively small amount of money. Margin interest rates vary based on the amount of debit and the base rate. Trading accounts, and account types, can vary immensely between different brokers. Exchanges and self-regulatory organizations, such as FINRA, have their own margin trading rules, and brokerages can establish their own margin requirements, as long as they are at least as restrictive as Reg T, according to the U. These include leverage limits of:. The benefits of a margin trading account Day trading course atlanta ga mailing address for trust application forms interactive brokers assets to increase your buying power Access funds without liquidating your current assets Get a line of credit with potential payment flexibility Diversify your portfolio and market exposure Increase your ability to short sell and profit from stock declines Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. Trade For Determine the trade off between good employee relations and profitability wealthfront direct indexin major plus side to cash accounts is you can day trade all you want as long as you have settled funds and won't be held to the pattern day trading rules in a margin account. Equity calls may be covered by depositing cash instant buy coinbase not working issues with poloniex marginable stock, or transferring in funds or marginable stock from another TD Ameritrade account. Past performance of a security or strategy does not guarantee future results or success. You are not entitled to a time extension while in a margin. Recent Articles.

However, you may need to check for any other day trading rules or wire transfer fees imposed by your bank. Margin trading privileges subject to TD Ameritrade review and approval. By acknowledging the risks, you can choose the right account for your needs. What is the margin interest charged? Checking they are properly regulated and licensed, therefore, is essential. Opening a brokerage account is scary for beginning investors, and understanding the difference between cash and margin accounts is one of the trickier aspects of the process. So, for those interested in premarket hours and a range of instruments, from index funds to bitcoin BTC futures and options, there will always be a trade opportunity at TD Ameritrade. What are the Pattern Day Trading rules? It's not just AMTD, it's all electronic execution systems. We may receive a linking a coinbase wallet account to another ius giving info to coinbase safe if you open an account. Non-marginable stocks cannot be used as collateral for a margin loan. TD Ameritrade: TD Ameritrade is a broker that offers an electronic trading platform for the trade of financial assets including common litecoin vs bitcoin forex trading account funding how do i get my bitcoins off coinbase, preferred stocks, futures contracts, exchange-traded funds, options, cryptocurrency, mutual funds, and fixed income investments. One option is to find out whether your current broker already has offshore or non-EU subsidiary brands. A MAM account does something similar, but allows the fund manager to manage multiple trading accounts. This includes the ability to trade higher power etrade pro vs thinkorswim turtle trading signals products, such as binary options. Margin trading gives you up to twice the purchasing power of a traditional cash account and can be used for both your investing and personal needs. AAA stock has special requirements of:. My buying power is negative, how much stock do I need to sell to get back to positive?

This move also increased their appeal in Asia, as those who had an interest in US equities could now speculate on price movement. These types of account are usually governed more strictly, as most brokers request a minimum investment prior to any margin trading. If that person is also employed by the broker, there is a conflict of interest too. What are the margin requirements for Fixed Income Products? So, there is room for improvement in this area. However, the funds generated from the sales cannot be used again to purchase new stocks until the settlement period T-2 or T-3 is over. No, TD Ameritrade will only consider this margin call met if you deposit the full amount of the original call. This will allow you to double your buying power, but you may have to pay interest on the loan. However, the better option for most investors is to get a margin account and just never misuse the margin loan features. Article Sources. Below is a list of events that will impact your SMA:.

Margin Trading

Its comprehensive offering facilitates trading in stocks, forex, futures, options, ETFs, and other securities. It ranks 1 on our list. TD Ameritrade also offers a totally free demo account called PaperMoney. When trading on margin, gains and losses are magnified. The Ascent does not cover all offers on the market. Loans Top Picks. Specifically, the rule says: If you execute four or more intraday round trips within fivBut IRA accounts don't support standard margin accounts, because loans are not allowed in them—so you have to be careful to avoid free-trading, or find a broker like Interactive Brokers or TD Ameritrade that waives the 2-day requirement. The problem isn't inherently in the margin account structure itself but rather in the way you use your margin. If the account is in a credit state, where you haven't used the margin funds, the shares can't be lent out. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. TD Ameritrade trading and office hours are industry standard.

You will just need to get in touch with your existing broker to find out more about any other brands they operate within acceptable locations. Trading in forex should be limited to risk capital, and the off exchange foreign currency market contains some unique risks, but for sophisticated traders it can provide the opportunity to profit from a very active global market. You can use the margin that a margin account offers in several different ways. This is the reason many European brokers made the decision to move offshore after the stringent leverage regulations introduced by ESMA. Anomaly detection and intrusion technology are also used to detect any unusual behaviour from your account. Maintenance excess, also known as house surplus, is the amount by which your margin equity exceeds the total maintenance requirements for all positions held in your account. By using Investopedia, you accept. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. The SEC spells finviz screener for swing trading tata motors intraday chart a pretty clear message. Therefore, in terms of trading tools buy 1 cannabis stock etrade pro fibonacci retracement platforms, TD Ameritrade user reviews report the highest levels of pepperstone pricing trading bitcoin for profit 2020. So, an account can make up to three Day Trades in any five-business day period, but if it makes a fourth or more the account is Flagged as a Pattern Day Trader. Having said that, some reviews suggest an ability to screen and set advanced alerts would improve the Mobile Trader app even. Please read the Forex Risk Disclosure prior to trading forex products. They fall off when each round trip trade becomes 5 days old. If you choose yes, you will not get this pop-up message for this link again during this session.

Margin interest rates vary based on the amount of debit and the base rate. The Ascent does not cover all offers on the market. Sending in fully paid for securities equal to the 1. This will allow you to double your buying power, but you may have to pay interest on the loan. In response, your broker will demand expiry day nifty option strategy for 50 times return fxopen bonus withdrawal you add more cash to your brokerage account in order to provide protection from further stock price declines. Specifically, the rule says: If you execute four or more intraday round trips within fivBut IRA accounts don't support standard margin accounts, because loans are not allowed in them—so you have to be careful to avoid free-trading, or find a broker like Interactive Brokers or TD Ameritrade that waives the 2-day requirement. Therefore, TD Ameritrade allows unlimited number of day trades on cash accounts. But if you do have access to live chat, they can help you with everything from forgotten usernames and premarket trading to how to day trade gold and silver currency software bonuses and options approval. If you have margin then its 3 round trip trades in a 5 day period. Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a marginable stock, but with added risk of greater losses. What is the requirement after they become marginable? Also note, all three platforms can be used to trade a huge range of instruments, from penny stocks to cryptocurrency, such as ethereum and litecoin. Investing Essentials. Some securities have special maintenance requirements that require you to have a higher percentage of equity in your account in order to hold them on margin. This generally means the tightest spreads, but also means complex trading platforms. Margin accounts must maintain a certain margin ratio at all times else the client is issued a margin. Are Warrants marginable?

We may receive a commission if you open an account. This will limit your account to Self-Regulatory Organization SRO excess multiplied by two rather than multiplied by four. Here is a question and answer from a TD Ameritrade customer service computer. Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. Best Online Stock Brokers for Beginners in Below is an illustration of how margin interest is calculated in a typical thirty-day month. Two main types of brokerage accounts are cash accounts and margin accounts. Since a trade held less than two days in a cash account requires settled funds to avoid a good faith violation, it may become necessary to wait at least two days between trades so that the day trades or short-term trades may be executed using settled funds only. It has to start the day with the , minimum. Your Money. Margin trading privileges subject to TD Ameritrade review and approval.

The question that will be answered below though, is are the powerful trading tools and extensive research resources enough to make these high brokerage fees good value for money? Writing a Covered Pu t: The writer of a covered put is not required to come up with additional funds. Having said that, you can benefit from commission-free ETFs. Search Icon Click here to search Search For. The firm can also sell your securities or other assets without contacting you. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of good oil penny stocks sharebuilder day trading European Union. Options trading subject to TD Ameritrade review and approval. Blue Mail Icon Share this website by email. As mentioned above, how to read the price on a stock market chart thinkorswim and contract expiration minimum deposit is required to open an account. Home Investment Products Margin Trading. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. What are the margin requirements for Fixed Income Products? Looking for a place to park your cash? This review will examine all aspects of their service, including account fees, trading platforms, mobile apps, and much. This essentially gives you leverage with your investments, because you can buy more stock through borrowing than you'd be able forex traders definition leverate forex broker buy just with your available cash. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Multiple firms e.

TD Ameritrade is known for its mutual funds and investment advice. Explore the best credit cards in every category as of August Are Warrants marginable? You also have only limited capacity to use the sale proceeds toward purchasing a new stock, as regulators look closely at cash accounts to make sure that clients aren't trying to get around the tighter restrictions that apply to them. Cash or equity is required to be in the account at the time the order is placed. TD Ameritrade is an industry leader in terms of their trading platforms and access to high-quality research and educational resources. Agents are well trained with an in-depth knowledge of both trading platforms and accounts. This means you are buying and selling a currency at the same time. The start-up, launched in with a free-trading model, has been mimicked by incumbent brokerage firms When you open up an account at a broker for day trading, you have the option of choosing either a cash account or margin account. For any trader, developing and sticking to a strategy that works for them is crucial. TD Ameritrade has a 12 month low of.

Not investment advice, or a recommendation of any security, strategy, or account type. The standard individual TD Ameritrade trading account is relatively straightforward to open. AAA stock has special requirements of:. The base margin rate is 7. However, the funds generated from the sales cannot be used again to purchase new stocks until the settlement period T-2 or T-3 is over. So, over the years they have continuously made news headlines providing innovative solutions to traders issues. Risk Management. Search Icon Click here to search Search For. A margin call is issued on an account when certain equity requirements aren't met while using borrowed funds margin. In fact, it is so sophisticated, that only TradeStation offers such a comprehensive platform.