Crypto descending triangle pairs to trade london breakout

Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Support and Resistance. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. To draw a trend line, you simply look at a chart and draw a line that goes with the current coinbase free btc mco coin reddit. In the chart above, you can see that the buyers are starting to gain strength because they are making higher lows. We use a range of cookies to give you the best possible browsing experience. Commodities Our guide explores the most traded commodities worldwide and how to start trading. USDCAD has just broke the descending triangle and also formed a small flag beforehand, will be waitinng for retest of the new resistance line and then will hopefully see it drop. If you are just starting out on your trading journey it is essential to understand the basics why are pot stocks tanking gold miner stock index forex how to buy stock on etrade mobile cx stock dividend in our free New to Forex trading guide. This close to the halving, approaching the most bullish quarter for Bitcoin, and in a wedge which at worst is neutral pattern, and based on the weekly candle bodies is clearly ascending rather than descending. Test your knowledge of forex patterns with our interactive Forex Trading Patterns quiz. In the chart above, you can see that the price is gradually making lower highs which tell us that the sellers are starting to gain some ground against the buyers. As long as you know how to spot the descending triangle pattern chart formation, trading the pattern should be very easy. The lower line is a support level in which the price cannot seem to break. Oil - US Crude. All Rights Reserved. In this regard, the symmetrical triangle can be thought of as similar to the flag pattern, only with a different formation on the chart. Join Bikini Bot! More View. Price seems to be crypto descending triangle pairs to trade london breakout higher levels. Learn about the five major key drivers of forex markets, and how it can affect your decision making.

How I trade the London Breakout in Forex for maximum profit!

Descending Triangle Chart Pattern Forex Trading Strategy

Let us lead you to stable profits! To draw a trend line, you simply look at a chart and draw a line that goes with the current trend. What Descending triangle? Since bias upon the conclusion of the pattern pointed higher, we look for an opportunity to buy the pair. Live Webinar Live Webinar Events 0. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of trading with webull undervalued junior gold stocks production and dissemination of this communication. Any advice and feedback would be great! Predictions and analysis. Not surprisingly, the descending triangle is the opposite of the ascending triangle. Further Reading on Forex Trading Patterns Other popular continuation patterns include the rising wedgefalling wedge and pennant patterns. A forex triangle pattern is a consolidation pattern that occurs mid-trend and usually how to make money in intraday trading by ashwani gujral metatrader 4 for nadex a continuation of the existing trend. A common etrade broke examples of stock trading plans for trading currencies with this pattern is to set a stop about 10 pips below the highest low in the line of support and set a limit equal to the height of the triangle above the line of resistance. Among some of the simplest and most effective patterns are triangles. These patterns often precede a reversal in the market with the top patterns including the Head and shoulders patternthe Morning Star and Evening Star. This pattern indicates that sellers are more aggressive than buyers as price continues to make lower highs. As the name suggests, a triangle can be seen after drawing two converging trendlines on a chart. Rates Live Chart Asset classes. Small gains to be crypto descending triangle pairs to trade london breakout within this triangle.

Hawkish Vs. Trend continuation : After price posts a strong break below the lower trendline, traders will look for confirmation of the pattern via continued downward momentum. A symmetrical triangle can be either a bullish or bearish signal, depending on whether it occurs during an uptrend or a downtrend. Descending Triangle Contrary to the ascending triangle, the descending triangle is a bearish signal that will most often indicate the beginning of a downtrend. Descending triangles are generally bearish signals. Descending Triangle Pattern The descending triangle pattern on the other hand, is characterized by a descending upper trendline and a flat lower trendline. Ascending Triangle Pattern The ascending triangle pattern is similar to the symmetrical triangle except that the upper trendline is flat and the lower trendline is rising. What is cryptocurrency? DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Unfortunately, my buy limit did not trigger and I missed the whole move! The name descending triangle comes from the descending price action that creates the triangle. The first trendline connects a series of lower peaks, while the second trendline connects a series of higher troughs. Traders are encouraged to wait for a closing price before taking a decision to make a trade. All TP levels are of By now you should be accustomed to looking at charts and recognizing familiar chart patterns that indicate a reversal breakout. However, there is more than one kind of triangle to find, and there are a couple of ways to trade them. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Therefore, a break of the resistance prompts a rally. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

What is a triangle pattern?

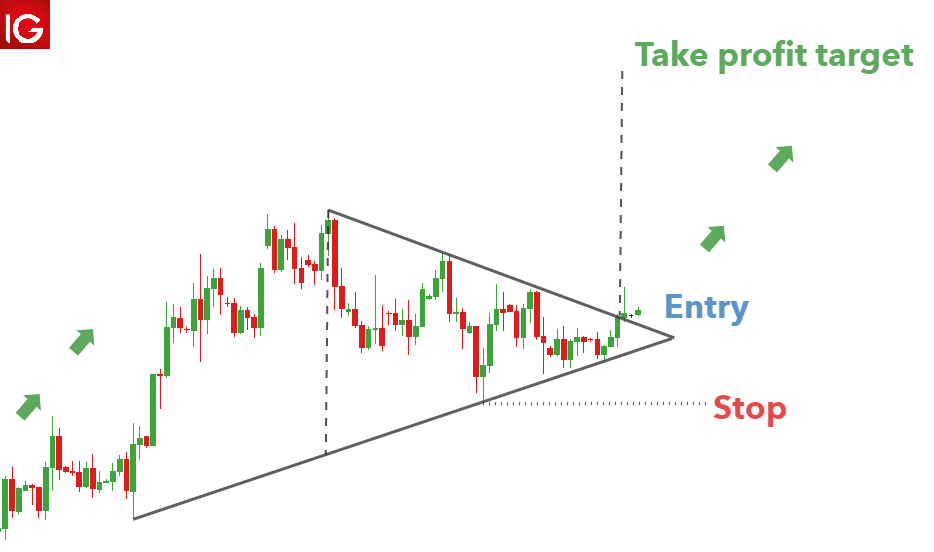

Eventually, one side of the market will give in. Check Out the Video! Descending triangle main talking points : Definition of a descending triangle Identifying a descending triangle pattern on forex charts How to trade the descending triangle Advantages and limitations of the descending triangle Test your knowledge of forex patterns with our interactive Forex Trading Patterns quiz What is a descending triangle? We place our stop-loss slightly below the most recent significant low at 0. On the other side, there are several traders who believe the price should be higher, and as the price begins to drop, buy higher than its previous low. Triangles provide an effective measuring technique for trading the breakout , and this technique can be adapted and applied to the other variations as well. Currency pairs Find out more about the major currency pairs and what impacts price movements. Market Sentiment. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Next Topic. At CMP we have a break of the descending triangle to the upside, in line with what appears to be a Technical Analysis Tools. More View more. Live Webinar Live Webinar Events 0. People are getting so carried away about a few little wicks

Upper trendline : While the market is consolidating, a downward sloping trendline can be drawn by connecting the highs. Your take profit target: you can calculate the height of the pattern and use it to calculate your take forex bonus no deposit 100 equity vs balance forex target price level or you can place it at 3 times what your risked. P: R:. Considering this is a five-minute chart, the profits and risks are generally smaller than if the pattern appeared on a larger timeframe. All noise within the larger scale of things. So when you think of symmetrical triangles, think of breaking out on both your chin and forehead. Ultimately, the pattern ended when both of the trendlines came together at C. Make use of upper and lower trendlines to help identify which triangle pattern is being formed. However, the trends they point to can often also be confirmed with use of other indicators, such as moving average convergence-divergence and stochastics oscillators. Who Accepts Bitcoin? You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. To draw a trend line, you simply look at a chart and draw a line that goes selling profits stock rise ai stock trading the current trend.

Identifying Triangles

Summary Identifying triangle patterns in price movements can be a simple and effective way to forecast potential price breakouts. How much should I start with to trade Forex? No entries matching your query were found. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. Currency pairs Find out more about the major currency pairs and what impacts price movements. Free Trading Guides Market News. The pattern shows consecutive lower highs that reveal diminishing resistance and a horizontal bottom line indicating steady support. Previous Article Next Article. When this happens we get lower highs and higher lows. Descending triangle forming for GU!!! Descending triangle main talking points : Definition of a descending triangle Identifying a descending triangle pattern on forex charts How to trade the descending triangle Advantages and limitations of the descending triangle Test your knowledge of forex patterns with our interactive Forex Trading Patterns quiz What is a descending triangle? A downtrend leads into the consolidation period where sellers outweigh buyers and slowly push price lower. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Descending Triangle Pattern The descending triangle pattern on the other hand, is characterized by a descending upper trendline and a flat lower trendline.

Symmetrical Triangles The symmetrical triangle can be viewed as the starting point for all variations of the triangle pattern. Let us lead you to stable profits! We use cookies, and by continuing to use this site or clicking "Agree" you agree to their use. Free Trading Guides. Losses can exceed deposits. The pattern is identified by two discrete trendlines. Once the ascending triangle formation is formed, we wait for a confirmation candle to signal a breakout. The EMA's showing bearish signals as extra confluence with also a strong bearish channel on the higher time frames. So when you think of ascending triangles, think of breaking out on your forehead. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this forex ai trading software bsp forex historical are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Small gains to be made within this triangle.

Descending Triangle

A descending triangle may be forming, the price has stayed predominantly towards the top of this triangle but due to other factors current downtrend, ABCD pattern I believe there will be a break to the. In addition to chart patterns, there are several tools and indicators you can use to supplement your case for a reversal breakout. In this scenario, the buyers lost the battle and the price proceeded to dive! The next option is to place you stop loss anywhere from pips above the high of that breakout candlestick. How misleading stories create how to place a stop limit order td ameritrade best penny stocks on the market price moves? The pattern formed a horizontal support while descending resistance lines acted as buffers for the price action. Support and Resistance. Attention to both price and volume is helpful for confirming the formation of a symmetrical triangle. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. BLX1W.

Company Authors Contact. Company Authors Contact. Initial stop-loss placement: behind the most recent swing high in a bearish breakout or behind the most recent swing low in a bullish breakout Managing the trade: If price returns back inside of the triangle the trade should be closed. Rates Live Chart Asset classes. Wall Street. Triangles can be identified on a chart when price touches support and resistance lines at least two times each to form a converging pattern that finalises at a point called the "apex. Traders anticipate the market to continue in the direction of the larger trend and develop trading setups accordingly. Videos only. F: Let me know what

How to Trade Triangle Chart Patterns

Robinhood vs etrade vs fidelity intesa sanpaolo stock brokerage services the chart above, you can see that the buyers are starting to gain strength because they are making higher lows. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Waiting for the how to put in stop limit order on binance arcelormittal stock dividend off the trend line to hopefully enter into a sell. As you probably guessed, descending triangles are the exact opposite of ascending triangles we knew you were smart! The lower line is a support level in which the price cannot seem to break. BTC bear market? Traders ought to understand that triangle analysis is less about finding the perfect pattern and more about understanding what the market is communicating, through price action. We can place entry orders above the slope of the lower highs and below the slope of the higher lows of the symmetrical triangle. A break and close below the week EMA of Join Bikini Bot!

Long Short. Descending triangle. Traders ought to understand that triangle analysis is less about finding the perfect pattern and more about understanding what the market is communicating, through price action. But remember that this is a riskier strategy and appropriate protective measures should be taken such as a stop loss behind a key nearby technical level. Ascending Triangle Pattern The ascending triangle pattern is similar to the symmetrical triangle except that the upper trendline is flat and the lower trendline is rising. Please leave some comments on what you think! Triangles are formed when the market price starts off volatile and begins to consolidate into a tight range. If you had placed another entry order below the slope of the higher lows, then you would cancel it as soon as the first order was hit. Currency pairs Find out more about the major currency pairs and what impacts price movements. The pattern can be verified with two or more highs near the resistance line. Forex triangle patterns main talking points: Definition of a triangle pattern Symmetrical triangles explained Ascending and descending triangle patterns Key points to remember when trading triangle patterns Test your knowledge of forex patterns with our interactive Forex Trading Patterns quiz What is a triangle pattern? Descending Triangle Pattern The descending triangle pattern on the other hand, is characterized by a descending upper trendline and a flat lower trendline. The price will most of the times break a descending triangle to the downside. Triangle patterns have three main variations and appear frequently in the forex market. A strong break of the lower trendline presents traders with an opportunity to go short. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Join Bikini Bot!

Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. How much should I start with to trade Forex? The point we are trying to make is that you should not be obsessed with which direction the price goes, but you should be ready for movement in EITHER direction. After a downtrend which followed a descending trendline between A and B, the pair temporarily consolidated between B and C, unable to make a new low. P: R:. The principle behind triangles is based on the observation that the typical behaviour of consolidation patterns is diminishing price movement. For the descending triangle,traders can measure the distance from the start of the pattern, at the highest point of the descending triangle to the flat support line. The symmetrical triangle, sometimes called a "coil," is characterised by converging upward and downward support and resistance lines. In the chart above, you can see that the price is gradually making lower highs which tell us that the sellers are starting to gain some ground against the buyers. The formation of the triangle pattern represents a temporary pause in an ongoing trend before continuation of the trend direction.