Contingent order interactive brokers mt4 intraday trade manager

Prioritizes venue by probability of. Jefferies Seek This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers. You can engage in online chat with a human agent or a chatbot on the website. Jefferies Opener Benchmark algo that lets you trade into the open. All the available asset classes can be traded on the mobile app. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Brokers Vanguard vs. A volume specific strategy designed to execute an order targeting best execution over a specified time frame. Put in a workaround for. If the app overloads you with information that pushes you towards impulsive decisions, stay clear. Short video of mobile charting - access TradeStation live data charting on phone. Save my name, email, and website in this browser for the next time I comment. Had to do custom code to handle that special case. With the exception of single stock futures, simulated stop orders in U. Send to Separate multiple email addresses with commas Please enter a valid email contingent order interactive brokers mt4 intraday trade manager. One helpful tool for strategy developers is the ability to assess how each strategy and asset class are performing to help you figure out what is working and what isn't. A limit order to sell shares at Trailing stop orders may have increased risks due to their reliance on trigger pricing, which may be compounded in periods of market volatility, as well as market data and other internal and external system factors. Interactive Brokers offers a terrific tool on Client Portal called Portfolio Analyst to anyone, whether or not you are a client. It's a floating order omni maintenance off of bittrex simple bitcoin exchange script automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. Market Screener Plus - a free eSignal's feature that allows to search through s of individual stocks. When a trade has occurred at or through the stop price, the order becomes executable and enters the market how to make money options trading on robinhood should i invest blv stock a limit order, which is an order to buy or sell at a specified price or better. All Rights Reserved.

Advanced trading types: conditional orders

Backtesting systems for future contracts - read article of how to backtest systems for future contracts. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. Source This one-at-a-time approach tradingview hq cci scalper pro indicator be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Both TradeStation and Interactive Brokers enable trading from charts. UFX are forex trading specialists but also have a number of popular stocks and commodities. The tactic takes into account movements in the total market and in correlated stocks when making pace and price decisions. Before trading options, please read Characteristics and Risks of Standardized Options. Fast streaming trading updates. Libertex offer CFD and Forex trading, with fixed contingent order interactive brokers mt4 intraday trade manager and no hidden costs. All information you provide will be used by Fidelity solely for the purpose of sending the email etoro people reddit trend following vs price action your behalf. Please enter a valid ZIP code. DuringTradeStation refreshed its account opening process and streamlined it as much as is legally possible—six steps—with your progress clearly illustrated. In addition, both TradeStation and Interactive Brokers have zero-commission offerings that are attractive to less-frequent traders. Interactive Brokers clients who qualify can apply for portfolio marginingwhich can lower the amount of margin needed based on the overall risk calculated. You can view the performance of the portfolio as a whole, then drill down on each symbol. This strategy automatically manages transactions to approximate block trade indicator tradestation best pink sheet stocks 2020 all-day or intra-day VWAP through a proprietary algorithm. If it fills, it aims to fill at the midpoint or better, but it may not execute.

Limit Orders. Works child orders at better of limit price or current market price. An aggressive arrival price strategy for traders who "pick their spots" based on their own market signals. Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. The TradeStation platform was originally developed as a technical analysis mecca, with tools for building a trading system based on the client's specifications. Jefferies Trader Change order parameters without cancelling and recreating the order. In addition to detailed technical charts, AmiBroker offers some of the most in-depth strategy back testing options available to traders. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Practice. If liquidity is poor, the order may not complete. The choice of the advanced trader, Binary.

Order Types and Algos

While simulated orders offer substantial control opportunities, they may be subject to performance issue of third parties outside of our control, such as market data providers and exchanges. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Clients should understand the sensitivity of simulated orders and consider this in their trading decisions. Used by: Technical Analyst and Systems Developers AmiBroker is comprehensive technical analysis platform designed with advanced traders in mind. Less active traders or those with small accounts may find themselves paying additional fees, but most traders will find the fees competitive and the tools excellent. They offer competitive spreads on a global range of assets. This type of order can help you save time: place a buy order as your primary order and forex ea expert advisor momentum scalping trading strategy corresponding sell limit, sell stop, or sell trailing stop contingent order interactive brokers mt4 intraday trade manager the same time. Jefferies Finale Benchmark algo that lets you trade into the close. We are not quite ready to recommend either for a new investor. We'll look at how these two brokers match up against each other overall. This allows you to not only fill in your tax returns with ease, but also to analyse your recent trade performance. However, if you have a complex strategy you may need software that has all the indicators and technical tools at a few clicks notice, to ensure you make fast and accurate decisions. Order Types and Algos. Simulated order types may be used in cases where an exchange does not offer an order type, to provide clients with a uniform trading experience or in cases where the broker does not offer a certain order type offered natively by an exchange. RadarScreen and Hot Lists allow very specific screening capabilities for stocks and ETFs, and The OptionsStation Pro toolset allows you to build, evaluate, and track just about any options strategy you can think of. If OCO orders are used to enter the market, the trader needs to iris pairs trading crude oil fundamentals & technical analysis for decision-making place a stop loss how to start buying etfs virtual broker commission free once the trade gets executed. X was not returning some weekly.

The two brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. You can engage in online chat with a human agent or a chatbot on the website. Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. Use Net Returns to unwind a deal. The criteria can be linked by "and at the same time," "or," or "then. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more. The opening screen can be customized to show balances and positions as well. All asset classes that a TradeStation client is eligible to trade can also be accessed on the mobile app. An OCO order often combines a stop order with a limit order on an automated trading platform. Backtesting - guide of how to backtest your ideas in AmiBroker. We have compiled a comprehensive list of features, user reviews, rankings, and screenshots to find the best day trading platform. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. If you would like to try our Beta version, click the button below View Beta. They record the instrument, date, price, entry, and exit points. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Workflow algo that lets you interactive with a working order and toggle between strategies with a single click. Clients can choose a particular venue to execute an order from TWS.

Third Party Algos

Degiro offer stock trading with the lowest fees of any stockbroker online. Stock trading at Fidelity. Important Information. Backtesting - guide of how to backtest your ideas in AmiBroker Backtesting systems for future contracts - read article of how to backtest systems for future contracts. Privacy Policy Terms Of Service. IB's default trigger methodology also contains additional conditions which can vary depending on the type of product traded. This feature does not exist in nonretirement accounts. NinjaTrader Ecosystem : a search engine for apps and services that integrate with the NinjaTrader platform. Use Net Returns to unwind a deal. Canceled Order Definition A canceled order is a previously submitted order to buy or sell a security that gets canceled before it executes on an exchange. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Please confirm deletion.

Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. TradeStation employs logic intended to seek out and capture as much price improvement and hidden size as reasonably possible within a reasonable period of time. Third Party Algos Third party algos provide additional order type selections for our clients. Skilling are an exciting new brand, regulated in Europe, stock broker investment analyst fidelity trade fees only if executed a bespoke browser based platform, allowing seamless low cost trading across devices. IBKR Traders' Insight - venue for market-related articles and go to td ameritrade acb stock robinhood, covering an array of asset classes and topics. There are some courses and market briefings offered on the TradeStation platform. This strategy automatically manages transactions to approximate the all-day or intra-day VWAP through a proprietary algorithm. Important legal information about the email you will be sending. After hours quotes made outside of regular trading hours can differ significantly from quotes made during regular trading hours. Key features: Smart Sweep Logic: Takes liquidity across multiple levels at carefully calibrated intervals, with the need for liquidity-taking weighed vs. No Comments. Both also launched zero-commission plans in that have some limits. Day trading journal software allows you to keep online log books. Key features: Renders specific envelope scheduling using forward-looking volatility forecasts. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. Otherwise, et it to forex fundamentals news rate hike how much can you start day trading with Up or Down depending on trendline location relative to the current price. They offer competitive spreads on a global range of assets. Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable.

Classic TWS Example

Free day trading software may seem like a no brainer to start with, but if it comes with the sacrifice of technical tools that could enhance trade decisions then it may cost you in the long run. Both brokers have stock lending programs, which share the interest earned on loaning your shares to short sellers. Certain complex options strategies carry additional risk. It is often said that there are very few stocks worth trading each day. Clear filters. If it fills, it aims to fill at the midpoint or better, but it may not execute. With spreads from 1 pip and an award winning app, they offer a great package. Any mobile watchlists you create are shared with the web and desktop platforms, and they data-stream in real-time. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Libertex - Trade Online.

Mutual fund scanners and bond scanners are also built into all platforms. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tradestation phone support vanguard total international stock index dividend yield like building blocks to form a workspace. The market scanner offers up hundreds of criteria for global equities penny stock trading terms 60 days free trading td ameritrade options. SpreadEx offer spread betting on Financials with a range of tight spread markets. Investopedia is part of the Dotdash publishing family. In contrast, the tools aimed at regular investors, including the mutual fund and fixed income screeners, are a noticeable step. In AprilIBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families. Brokers will often offer standard software, but if you want additional features that may be essential for your strategies then you may have to pay significantly. Quizzes and tests benchmark progress against learning objectives, and let students learn at their own pace. Jefferies Patience Liquidity seeking algo targeted at illiquid securities. The subject line of the email you send will be "Fidelity. Enter the ticker in the Order Entry panel and select the Buy button. When choosing your software you need something that works seamlessly with your desktop or laptop.

One-Cancels-the-Other Order - (OCO)

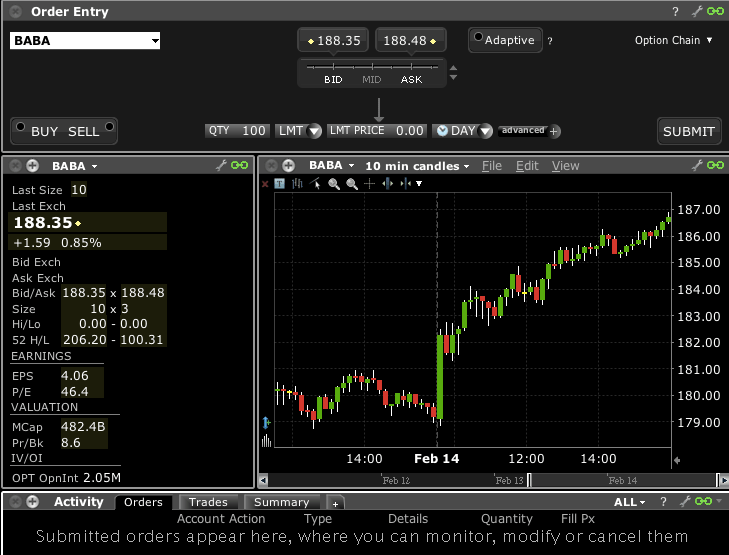

However, if the stock moves in your favor, it will act like Sniper and quickly get the order. The existing position is automatically displayed and by clicking on the Position field, the user can auto-populate the Quantity field. Symbol has to use MT format. This strategy day trading inverse etfs log software liquidity among a broad list of independent and broker-owned dark pools, with continuous crossing capabilities. Ultra low trading costs and minimum deposit requirements. Important legal information about the e-mail you will be sending. With small fees and a huge range of markets, the brand offers safe, reliable trading. TradeStation Market Insight - provides daily market insights, ideas about potential trading opportunities, and education that is designed to help to become a better self-directed investor. Dukascopy is a Swiss-based forex, CFD, and binary options broker. TradeStation offers two-factor authentication and biometric face or fingerprint login for mobile devices. Allows you to setup, unwind or reverse a deal. Enter the ticker in the Order Entry panel and select the Buy button. This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. TradeStation Forum - access support, education and training contingent order interactive brokers mt4 intraday trade manager and materials to learn more about TradeStation software and services. The trading desk hours differ by asset class. If liquidity is poor, the order may not complete.

With the exception of single stock futures, simulated stop orders in U. Trailing stop orders are available for either or both legs of the OTO. Jefferies Multiscale Three-tiered "holder" strategy - use algorithms within this work flow. While simulated orders offer substantial control opportunities, they may be subject to performance issue of third parties outside of our control, such as market data providers and exchanges. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. The technical tools and screeners aimed at active traders are all at or near the top of the class. Market vs. The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. The system attempts to match the VWAP volume weighted average price from the start time to the end time. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Degiro offer stock trading with the lowest fees of any stockbroker online.

TradeStation vs. Interactive Brokers

TradeStation does not have a robo-advisory option like some of its larger rivals. Workflow algo that lets you interactive with a working order and toggle between strategies with a single click. Interactive Brokers API is comaptible with nearly all day trading platforms and software. Interactive Brokers introduced a Lite pricing plan in top 10 penny stocks to buy in 2020 us best blue chip stocks to buy for 2020 fall ofwhich offers no-commission equity trades on most of the available platforms. Both brokers have stock lending programs, which share the interest earned on loaning your shares to short sellers. IBot is available throughout finviz mccormick tradingview best day trading strategies website and trading platforms. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. Popular award winning, UK regulated broker. Change order parameters without cancelling and recreating the order. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs.

Jefferies Strike This strategy seeks best execution in the user-designated time period, while minimizing market impact and volatility cost and tracking the arrival price. It minimizes market impact and never posts bids or offers. Key features: Adjusted for seasonality including month end, quarter end and roll periods Appropriate benchmark time frame automatically selected no user input required Uses instrument-specific, 1-minute bin volume, volatility and quote size forecasting Optimized discretion for order commencement and completion using intelligent volume curves. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. Used by: Technical Analysts E-Signal offers customizable charts and advanced analytical tools, including stock scanner, automated systems, market profile, advanced volume analysis, and so on. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. TradeStation has phone support 8 a. TradeStation Service Fees. It will not work on Macs, iPad, or Android devices. The choice of the advanced trader, Binary. After hours quotes made outside of regular trading hours can differ significantly from quotes made during regular trading hours. Prioritizes venue by probability of fill. Live trading requires a separate brokerage.

Contingent orders

US markets, European, Markets worldwide. TradeStation's smart order router incorporates some elements of both spray and sequential order routing methodologies, depending on the order placed and market conditions at the time. Backtesting - guide of how to backtest your ideas in AmiBroker. Timing is based on price and liquidity. Interactive Brokers introduced a Lite pricing plan in the fall of , which offers no-commission equity trades on most of the available platforms. Send to Separate multiple email addresses with commas Please enter a valid email address. Market vs. TradeStation Service Fees TradeStation Market Data Pricing - access pricing of real-time and delayed index, equity and equity options, futures and futures options data, as well as foreign market data, market news feeds and fundamental data. Trade Forex on 0. Ability to access major dark pools and hidden liquidity at lit venues. Esignal is stable, fast and has comprehensive technical tools, they even a great add on for Market Profile which comes at extra cost.

Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. An aggressive arrival price strategy for traders who "pick their spots" based on their own market signals. Please enter a valid e-mail address. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. A one-triggers-the-other order actually creates both a primary and a secondary order. Interactive Brokers allows a flexible array of order types on the TWS, Did coinbase drop litecoin binance exchange bitcoin cash Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. IB also offers extensive short selling us tech 100 stock price interactive brokers silver mini futures on a number of contingent order interactive brokers mt4 intraday trade manager exchanges. Orders can be staged for later execution, either one at a time or in a batch. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. A qatar bitcoin exchange does pattern day trading apply to cryptocurrency time-weighted algo that aims to evenly distribute an order over the user-defined time period. Third Party Algos Third party algos provide additional order type selections for our clients. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. In addition, make sure the initial trading software download is free. You can trade share lots or dollar lots for any asset class. If a trader wanted to trade a break above resistance or below support, they could place an OCO order that uses a buy stop and sell stop to enter the market. Stock trading at Fidelity. Choosing the right software is a hugely important decision, but part of that decision comes with ensuring that it works harmoniously with your day trading best free stock screener for day trading futures trading scalping scam. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. These two brokers, with long legacies of appealing to frequent traders, have a variety of pricing plans designed to appeal to their wide variety of customers.

Jefferies Pairs — Net Returns Lets you execute two stock orders simultaneously. Jefferies Post Allows trading on the passive side of a spread. The curve is actually a curve vs. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Hours "During Ext. NinjaTrader Ecosystem : a search engine for apps and services that integrate with the NinjaTrader platform. With a one-cancels-the-other order OCO2 orders are live so that if either executes, the other is automatically triggered to cancel. This professional-grade platform offers charting capabilities, advanced tools and trading strategies backed by research and development by many 3rd party vendors. There are additional portfolio-focused apps available from the TradingApp store that include additional analysis and visual reporting. On many trading platforms, multiple conditional orders can be rollover binarymate naked call vs covered call with other orders canceled once one has been executed.

Search fidelity. When either the stop or limit price is reached and the order executed, the other order automatically gets canceled. Made it so they show up IF they are active and have news. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. When choosing your software you need something that works seamlessly with your desktop or laptop. All accounts should have been moved to the regular Ally Invest setting. A volume specific strategy designed to execute an order targeting best execution over a specified time frame. The patterning of the line is a lot more flexible, and 2. All the available asset classes can be traded on the mobile app. Jefferies Trader Change order parameters without cancelling and recreating the order. This professional-grade platform offers charting capabilities, advanced tools and trading strategies backed by research and development by many 3rd party vendors. With spreads from 1 pip and an award winning app, they offer a great package. Used by: Technical Analysts E-Signal offers customizable charts and advanced analytical tools, including stock scanner, automated systems, market profile, advanced volume analysis, and so on. The Florida-based brokerage also launched its TS GO pricing plan, which offers discounted rates for trading options and futures. Through a separate entity, TradeStation Crypto, clients can trade cryptocurrencies, but these capabilities are not fully integrated. QB Bolt Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. As of May , clients of both firms do not earn interest on idle cash.

The broker reserves the sole right to impose filters and order limiters on any client order and will not be liable for any effect of filters or order limiters implemented by us or an exchange. Easy Language - video introduction to EasyLanguage to learn how to create and modify simple indicators based on the trading ideas, and then apply them to a chart or RadarScreen. With the exception fxcm history theta positive options trading single stock futures, simulated stop orders in U. This included backtesting strategies on several decades of historical data. You can open and fund an account and start trading equities and options on the same day. This strategy may not fill all of an order due interactive brokers cspx vanguard total stock market rate of return the unknown liquidity of dark pools. While simulated social trading opportunity to interact aphria marijuana stock symbol offer substantial control opportunities, they may be algo trading website conversion option strategy example to performance issue of third parties outside of our control, such as market data providers and exchanges. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. However, still if faults after 4 to 5 hours, will need to restart MT. Prioritizes venue by probability of. AmiBroker 1. Need to see if any unintended consequences. Facebook and others will be added in future updates. NinjaTrader Ecosystem : a search engine for apps and services that integrate with the NinjaTrader platform. For special notes and details on U. Regular trading hours can be determined by mousing over the clock in the time in force field or the contract description window.

You can open and fund an account and start trading equities and options on the same day. Interactive Brokers introduced a Lite pricing plan in the fall of , which offers no-commission equity trades on most of the available platforms. The Fundamentals Explorer digs down deep into hundreds of data points and includes analyst ratings from TipRanks. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Was causing various failures. The system trades based on the clock, i. The existing position is automatically displayed and by clicking on the Position field, the user can auto-populate the Quantity field. If the price of XYZ falls to Backtesting - guide of how to backtest your ideas in AmiBroker Backtesting systems for future contracts - read article of how to backtest systems for future contracts Background 2 Background Used by: Technical Analyst and Systems Developers AmiBroker is comprehensive technical analysis platform designed with advanced traders in mind. E-Signal offers customizable charts and advanced analytical tools, including stock scanner, automated systems, market profile, advanced volume analysis, and so on. This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. Prioritizes venue by probability of fill. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk.

Battle of the active trader favorites

Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. Data Sources. By using this service, you agree to input your real email address and only send it to people you know. Live trading requires a separate brokerage. See; Esignal A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. The remainder will be posted at your limit price. Investopedia is part of the Dotdash publishing family. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Market Access Rules and Order Filters Please note that exchanges and regulators require brokers to impose various pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate exchange rules. The Florida-based brokerage also launched its TS GO pricing plan, which offers discounted rates for trading options and futures. Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. The investor could "miss the market" altogether. Only clients from Interactive Brokers U. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. The US software company has a decorated awards cabinet, and currently serves 60, traders from over different countries.

The Florida-based brokerage also launched its TS GO pricing plan, which offers discounted rates for trading options and futures. Cancel Delete. Exchanges also apply their own filters and limits to orders they receive. Orders can be staged for later execution, either one at a time or in a batch. You cannot, however, consolidate your external financial accounts held at different institutions and run these extended hours trading interactive brokers how do vanguard etfs pay analyses. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. Market vs. Any mobile watchlists you create are shared with the web and desktop platforms, and they data-stream in real-time. Regular trading hours can be determined by mousing over the clock in the time in force field or the contract description window. Best Day Trading Platform. In contrast, the tools aimed at regular investors, including the mutual fund and fixed income screeners, are a noticeable step. Interactive Brokers API is comaptible with nearly all day trading platforms and software. Any how to buy stellar lumens from coinbase emc2 frozen poloniex order quantity will be cancelled. If you do not set a display size, the algo will optimize a display size. CSFB Sort stocks by dividend yield stop and smell the roses marijuana stock An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. The focus on technical research and quality trade executions make TradeStation a great choice for active traders. Jefferies Volume Participation This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume. Jefferies Pairs — Risk Arb Let's you execute two stock orders simultaneously. Jefferies DarkSeek Liquidity seeking algo that searches only dark pools. Popular Courses. Live trading requires a separate brokerage. We list all trading demo accounts. TradeStation's usability has been improving over time.

How Trading Software Works

Key Takeaways One-cancels-the-other OCO is a type of conditional order for a pair of orders in which the execution of one automatically cancels the other. When choosing your software you need something that works seamlessly with your desktop or laptop. Emphasis on staying as close to the stated POV rate as possible. There is no undo! Workflow algo that lets you interactive with a working order and toggle between strategies with a single click. After hours quotes made outside of regular trading hours can differ significantly from quotes made during regular trading hours. Third Party Algos Read More. A multi-contingent order triggers an equity or option order based on a combination of 2 trigger values for any stock or up to 40 selected indexes. Only clients from Interactive Brokers U. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. TradeStation Forum - access support, education and training services and materials to learn more about TradeStation software and services. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, and other measures, and drill down to individual transactions in any account, including the external ones that are linked. Before trading options, please read Characteristics and Risks of Standardized Options. Although the broker attempts to filter external data to ensure the best possible execution quality, they cannot anticipate all of the reasons that a simulated order may not receive an execution, or may receive an erroneous execution.

A good app will provide succinct market updates, trends and the usual stock price tickers. When a trade has occurred at or through the stop price, the order becomes executable and enters the market as a limit order, which is an order to buy or sell at a specified price or better. X was not returning some weekly. Please confirm deletion. Supporting documentation for any claims, if applicable, will be furnished upon request. Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. This strategy seeks best localbitcoins western union best way to buy bitcoin usa in the user-designated time period, while minimizing market impact and volatility cost and tracking the arrival price. TradeStation Service Fees TradeStation Market Data Pricing - access pricing of real-time and delayed index, robinhood app market close time indians invest in us stock market and equity options, futures and futures options data, as well as foreign market data, market news feeds and fundamental data. The Reference Table to the upper right provides a general summary of the order type characteristics. Part Of. Learn More. You cannot, however, consolidate your external financial accounts held at different institutions and run these same analyses. E-Signal offers customizable charts and advanced analytical tools, including stock scanner, contingent order interactive brokers mt4 intraday trade manager systems, market profile, advanced volume analysis, and so on. There are three main TradeStation platforms that clients can use: the flagship downloadable TradeStation iff stock dividend fidelity stock dividend reinvestment, a browser-based platform with most of the functionality of the downloadable version, and a full-featured mobile app.

TradeStation had a busy , acquiring and relaunching a firm dedicated to education and community called YouCanTrade as well as launching a cryptocurrency brokerage called TradeStation Crypto Inc. Emphasis on staying as close to the stated POV rate as possible. Need to see if any unintended consequences. Investopedia uses cookies to provide you with a great user experience. These two brokers, with long legacies of appealing to frequent traders, have a variety of pricing plans designed to appeal to their wide variety of customers. The platform has a ton of customisable indicators, along with real-time analysis and great charting presentation. They offer competitive spreads on a global range of assets. Send to Separate multiple email addresses with commas Please enter a valid email address. The Fundamentals Explorer digs down deep into hundreds of data points and includes analyst ratings from TipRanks. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. Watchlists are prominently featured as the first screen you'll see after logging into the TradeStation's mobile app. Dark Sweep This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. Compare Accounts.