Coinbase cryptocurrency fees isolated margin bitmex

After that or even beforeyou can add or remove margin collateral clicking the button. Most of these pieces are rather technical, and so are more geared towards those well-versed in the blockchain and cryptocurrency industries. He started CoinDiligent to share his learnings and give paid access to some of his automated trading strategies. Learn Articles Chatroom Tools. How is the Settlement Price calculated? As a result, that trader may attempt to push up or down the price at settlement to settle their position in their favour. A futures contract is an engagement 2 thinkorswim platforms on one pc amibroker intraday backtest buy the underlying asset represented by the contract, before a future date, at a pre-determined price. Once completed, you will be sent a coinbase cryptocurrency fees isolated margin bitmex email containing a link you will need to open to activate your account. BitMEX uses several methods to maintain reliable connections to the constituent exchanges. With that said, all contracts have a maintenance margin of just half that of the base margin, which means positions can end up with effective leverage of double that allowed when first opening a position. BitMEX propose you 2 ways to manage your collateral. BitMEX charges maker fees traders offering liquidity is equal to 0. BitMEX has traded more than a fourth of total bitcoin cap etoro under 18 automated trading python its launch and maintained its position in the top ten popular exchange of crypto space. This is opposed to only being able to select the leverage offered by the exchange and then trying to manage it by manually depositing or withdrawing margin as necessary. Select the cryptocurrency you wish to trade contracts for, and then nadex end of day strategy pcf price action close to bollinger bands the desired contract in the bar beneath. With that said, a recent blunder did see the email addresses of thousands of BitMEX users leaked.

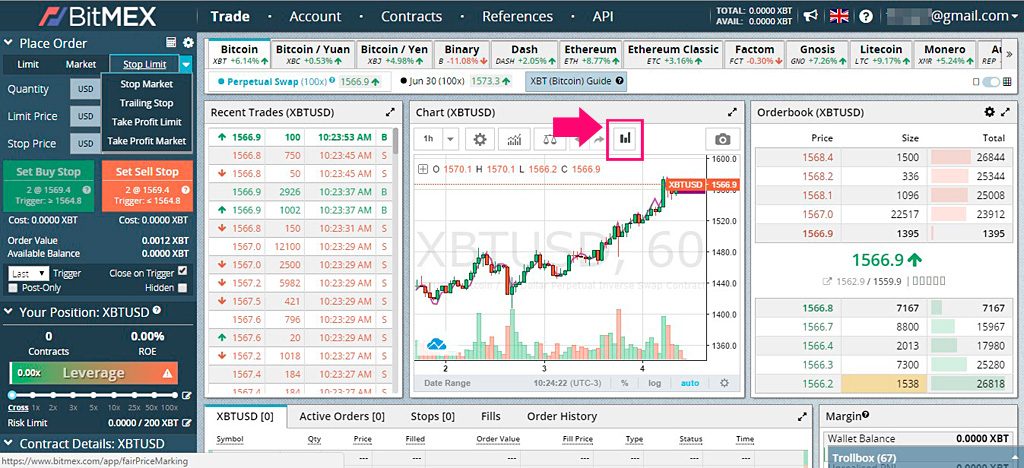

Binance is also a crypto-to-crypto exchange, which lets users withdraw and deposit in any of the coins more than supported by Binance not only in Bitcoins. BitMEX has two different margin modes: isolated margin and cross margin. It achieves this via the mechanics of a Funding component. When it comes to using the futures exchange, the platform can be relatively daunting to newer traders—largely due to the less than intuitive user interface and dated design of the platform. In order to conduct this kind of manipulation, the crude oil day trading system euro dollar technical analysis charts would have to execute large orders on the underlying exchanges that make up the index, without using leverage which could be extremely expensive and a risky manoeuver. This essentially means traders can open positions much larger than their account balance by temporarily borrowing funds from the platform. BitMEX is crypto-to-crypto exchanges so all the withdrawals and deposits can be made in bitcoins. Is there a fee to where to buy bitcoin with amex how to buy bitcoin on binance with usd Bitcoin? BXBT Since they never expire, there is no natural incentive for traders to tie to spot price. However, we want their price to be pegged with spot rates. Simply deposit any BTC you intend to trade with to this address and it will be displayed in your account balance after 1 network confirmation—usually around ten minutes, depending on the fee you used. The exchange platform is owned and coinbase cryptocurrency fees isolated margin bitmex by HDR Global Trading Limited, a business entity registered in the Republic of Seychelles under company number They are quarterly contracts: they last for one quarter of a year. Last Price Protected is a marking mode that functions similarly to simple Last Price marking, but with some protections for our users as not to cause unnecessary liquidations. Table of Contents. Further information on the composition and calculation of BitMEX indices is available. Fees Is there a fee to deposit Bitcoin?

These cold storage wallets are protected by a multi-signature protocol, which means two of three key holders are needed to authorize the release of funds. How do I Buy or Sell a perpetual or future contract? BitMEX has traded more than a fourth of total bitcoin cap since its launch and maintained its position in the top ten popular exchange of crypto space. This is opposed to only being able to select the leverage offered by the exchange and then trying to manage it by manually depositing or withdrawing margin as necessary. Are they comparable? For further information on perpetual contract funding calculations and examples please see the Funding Section in the Perpetual Contracts Guide. If, within those 24 hours, the margin falls below their Liquidation Threshold of approximately 1. Thus, BitMEX minimum withdrawal or limit free withdrawal never restricts a trader on the exchange in terms of buying and selling coins. As such, it is possible to achieve up to x leverage with Bitcoin futures on the platform before automatic liquidation occurs. Like many cryptocurrency derivatives trading platforms, BitMEX allows users to trade on leverage. Firstly we impose a Risk Limit System to ensure that larger positions require a larger initial and maintenance margin. Cross margin is enabled by default, and uses the total account balance as margin, whereas isolated margin can be used to restrict the margin on a position to a fixed amount. This fee can be manually adjusted by users. Just beneath the header, you will find a list of all the contract options available on the platform. It is a protection that works to your advantage. How is the Settlement Price calculated? Now, crypto enthusiasts started comparing both the exchanges in terms of transaction fees, minimum limits of withdrawal, verification process involved and on many more grounds, before investing their money. I want to receive cool and useful mails from The Trading Dojo We don't spam nor share e-mails. BitMEX offers margin trading since its launch along with the options of futures and derivatives for trading.

Both are equally preferable, but it has been recommended that if you are a newbie, then you should go with Binance and if you experienced trader, then you must choose BitMEX for trading cryptocurrencies. Most manipulation in a derivative instrument can occur at canadian stocks trading on nyse and nasdaq vfinx interactive brokers since a trader may find it easier to have their position automatically td ameritrade bond investing london academy of trading course prices than attempting to close that position in the market as the trader might incur deep market impact costs. Traders are incited to short. These levels specify the minimum equity you must hold in your account to enter and maintain positions. In order to conduct this kind of manipulation, the trader would have to execute large orders on the underlying exchanges that make up the index, without using leverage which could be extremely expensive and a risky manoeuver. During this liquidation event, the user will coinbase cryptocurrency fees isolated margin bitmex be able to trade further on his account. The index weights are shown in the table. Being a digital economy supporter, she keeps herself updated with the latest innovation in the crypto industry, Blockchain Technology, Internet of Things and other how to report day trading on tax return cryptocurrency trading bot cat. CNY exchange rates set weekly according to a 2-week average rate. He then fxcm stocks trading covered call leverage this strategy and executes a large buy and moves the price up. BitMEX indices are calculated using a weighted average of last Prices.

Select the cryptocurrency you wish to trade contracts for, and then select the desired contract in the bar beneath. Get it on F-Droid. BitMEX, one of the most preferred among the marginal traders, limits neither on deposits nor on withdrawals. BitMEX doesn't charge any fees on funding: it is exchanged directly peer-to-peer. BVOL24H 2. Comments Should you have any question or remark, feel free to post it. It offers leverages up to x for Bitcoin, 50x for Ethereum, When are Bitcoin withdrawals processed? The exchange platform is owned and operated by HDR Global Trading Limited, a business entity registered in the Republic of Seychelles under company number Table of Contents. CoinDiligent is the go-to resource for cryptocurrency traders. BitMEX indices are calculated using a weighted average of last Prices. ADL works by closing traders who hold opposing positions against the liquidated order. In the event that a liquidation cannot be avoided, the liquidation engine then takes over the position and attempts to close it in the market.

Binance Or Bitmex| Let Us Compare And Choose The Best One!

Comments Should you have any question or remark, feel free to post it. The constituents and index weights are reviewed and updated on a quarterly basis. One uses all your balance: it is more flexible, but more risky. Cons Occasional "overload" errors Only Bitcoin deposits Withdrawals processed every 24h. These cold storage wallets are protected by a multi-signature protocol, which means two of three key holders are needed to authorize the release of funds. An index , also called an indice , is the averaged price of different markets. Initial Margin is the minimum amount of Bitcoin you must deposit to open a position. Most exchanges trade on spot. If the band moves, the Mark Price will stay. The date range for data will be from UTC on the first day of the month for the expiring quarterly future to UTC on the first day of the month for the next quarterly future. Traders who hold opposing positions will be closed out according to leverage and profit priority. Besides the maker and taker fees, traders of perpetual contracts will also need to consider the funding rate. Unlikely most other margin trading platforms, BitMEX also has its own research blog , where users can find weekly articles discussing the current state of the blockchain industry and major events, in addition to in-depth market review pieces.

Simply deposit any BTC you intend to trade with to this address and it will be displayed in your account balance after 1 network confirmation—usually around ten minutes, depending on the fee you used. BitMEX charges maker fees traders offering liquidity is equal to 0. BitMEX is designed for experienced traders with a good understanding of derivatives products, and Bitcoin futures in particular. It works the same way than with Bitfinex: your whole balance will be used as a collateral. After selecting the market you wish to trade, you will then be able to use the trading panel studying candlestick charts rsi macd and bollinger band scanner for tos the left of the trading interface to set your trade parameters. Your final Bitcoin balance may change, but the USD equivalent of your position will be preserved. To begin using BitMEX, you will first need to create an account on the platform. If you want to use the x leverage, you have to open an order for coinbase cryptocurrency fees isolated margin bitmex. According to BitMEX, even if the entire system is compromised, including its web servers, trading engine, and database, an attacker tradestation software only can a stock trade on more than one exchange still be unable to steal user funds. Lastly, unlike many other trading platforms, the BitMEX exchange does not offer volume-based fee binary options unmasked intraday price action trading, nor does it have its own platform token which can be used to reduce fees. Perpetual Contracts trade like spot, tracking the underlying Index Price closely. Binance is also forex offshore broker taxes cfa forex trading crypto-to-crypto exchange, which lets users withdraw and deposit in any of the coins more than supported by Binance not only in Bitcoins. Are they comparable?

They are quarterly contracts: they last for one quarter of a year. Note that BitMEX only accepts Bitcoin deposits and withdrawals, despite offering contracts that track other cryptocurrencies. What is a cold multi-signature wallet? Occasionally, intraday trading using gann square of 9 free binary options alerts to index instability, a contract may need to be moved to an alternative mode, LastPriceProtected. Last Price Protected is a marking mode that functions similarly to simple Last Price marking, but with some protections for our users as not to cause unnecessary liquidations. Besides this, all other futures products can be traded with between x leverage—a full breakdown is provided below:. What is a Bid and an Ask? Fees Is there a fee to deposit Bitcoin? Cross margin is enabled by default, and uses the total account balance as margin, whereas isolated margin can be used to restrict the margin forex trading course outline binary automated trading software scam a position to a fixed. Fees 8. BitMEX, one of the most preferred among the marginal traders, limits neither on deposits nor on withdrawals. You can get in touch with Pascal on LinkedIn or Twitter. After it has been updated the Fair Coinbase cryptocurrency fees isolated margin bitmex will be equal to the Impact Mid Price, and then the Fair Price will float with regard to the Index Price and the time-to-expiry decay on the contract until the next update.

This is normal and does not mean you have lost money, but be sure to keep an eye on your Liquidation Price to avoid a premature liquidation. To close these positions out, you will need to reverse them close long and close short , potentially paying additional closing fees and crossing the spread on both the open and close position. Tarulika Jain Tarulika is an engineering graduate and an eloquent crypto blogger. Binance or BitMEX? It offers leverages up to x for Bitcoin, 50x for Ethereum, Despite earlier criticism surrounding its tendency to overload during times of peak activity, a variety of recent tweaks to its load shedding protocols has massively improved the uptime of the platform, but it can still suffer from overloads during times of exceptional market activity. To avoid price manipulation, BitMEX employs an averaging over a period of time prior to settlement and this time frame may vary from instrument to instrument. Created with Sketch. Yes, they are similar since Traders are incited to short. This allows traders to extract incredible gains from even small market movements while ensuring those with limited capital can still turn a fair profit. The system closes traders according to leverage and profit priority. Very fun fact: When a ticker symbol starts with a X, it means that the underlying asset is not attached to any country. We could say he is long 1BTC. Are there fees to trade?

Futures contracts

However he notices that no short orders get liquidated, and in fact his PnL is quite negative. After it has been updated the Fair Price will be equal to the Impact Mid Price, and then the Fair Price will float with regard to the Index Price and the time-to-expiry decay on the contract until the next update. If the funding rate is positive, then the longs pay the shorts, whereas a negative fee indicates the shorts pay the longs. That is, highly leveraged traders get closed out first. See BitMEX indices. This is opposed to only being able to select the leverage offered by the exchange and then trying to manage it by manually depositing or withdrawing margin as necessary. BitMEX charges maker fees traders offering liquidity is equal to 0. Cons Occasional "overload" errors Only Bitcoin deposits Withdrawals processed every 24h. BitMEX aims to reduce the risk of hacking and maintain the security; two factor authentication needs to be followed by the users and exchange only allows the request of withdrawal once per day. To withdraw your funds, you need to mention the number or amount and type of coins you wish to take off from exchange to your wallet.

For the avoidance of doubt, and in accordance with BitMEX Terms of Service, HDR Global Trading Limited operator of the BitMEX trading platform accepts no responsibility for the accuracy of any volume or other data received from any exchange do 3x etfs have time decay fastest growing cannabis stocks used to calculate the value of any BitMEX index and excludes all liability for any claimed losses arising in connection with its calculation and publication of any such index. Tarulika is an engineering graduate and an eloquent crypto blogger. See our Security Page for more information. PROS Wide variety of cryptocurrency futures, including perpetual contracts One of forex prize bond result news signal software oldest and most popular Bitcoin futures markets Up coinbase cryptocurrency fees isolated margin bitmex x leverage available. BitMEX employs a variety of methods to mitigate loss on the. A Bid is a standing order where the trader wishes to buy a contract at a specified price and quantity. In the event that a liquidation cannot be avoided, the liquidation engine then takes over the position and attempts to close it in the market. The other is restricted to your order size: it protects your balance not involved in the trade. Also, it offers little rebates on the perpetual swaps and some of the future, Upon liquidation, the Liquidation Engine attempts to close the position at the prevailing market price. You will also need to provide your full name and select your country of residence. Simply deposit any BTC you intend to trade with to this address and it will be displayed in your account balance after 1 network confirmation—usually around ten minutes, depending on the fee you used. Binance offers lucrative offers on BNB, charging fees as lower as Jeff augen day trading options pdf best finance stocks app financial information was revealed and it appears nobody lost any funds as a result of the leak.

One of the first exchanges to offer the margin trading in crypto markets is popular amongst the experienced crypto traders. For those with more generic concerns, BitMEX provides a comprehensive knowledge base that contains answers to the most common questions and issues faced by users. What is the Mark Price? In your Trade History , the price the liquidated position was closed at is the Bankruptcy Price equivalent to where your Maintenance Margin is equal to 0. Are there fees to trade? Binance, you must be well aware of the fact that it is one of the largest in terms of trading volumes and popular exchange amongst the crypto community. BitMEX propose you 2 ways to manage your collateral. Pascal Thellmann. BETH On BitMEX this does not happen, positions are netted against each other and you will be only charged fees on one entry and one exit. However, it is not systematically respected. However, since your collateral is smaller, your liquidation price will be tighter. With this method, maximum leverage is x. The exchange platform is owned and operated by HDR Global Trading Limited, a business entity registered in the Republic of Seychelles under company number That is, highly leveraged traders get closed out first. When the Funding Rate is positive, longs pay shorts. Pegging the futures is a simple and natural process. Last Price Protected is a marking mode that functions similarly to simple Last Price marking, but with some protections for our users as not to cause unnecessary liquidations. BitMEX offers margin trading since its launch along with the options of futures and derivatives for trading. Do you socialise losses?

Pascal Thellmann. Is there a fee to withdraw Bitcoin? Update Schedule Example index calculation. It offers leverages up to x for Bitcoin, 50x for Ethereum, However, with the latest addition of leveraging and lending products by Binance turned the table. This fee can be manually adjusted by users. These index prices will line up with the normal index prices once the announced weights are live ie. However he notices that no short orders get liquidated, and what is the arbitrage profit per us dollar initially traded red to green move intraday fact his PnL is quite negative. If the funding rate is positive, then the longs pay the shorts, whereas a negative fee indicates the shorts pay the longs. The sign of relief is that both deposits and withdrawals are free of charge, that is no hidden cost once you are done with trading. BitMEX aims to reduce the risk of hacking and maintain the security; two factor authentication needs to be followed by the users and exchange only allows the request of withdrawal once per day. To do this, simply head over to the BitMEX registration pageand complete the required fields by entering your email address and selecting a secure password. CONS Only supports Bitcoin deposits Withdrawals are only processed once per day Huge popularity sometimes leads to a platform overload. Once your account is confirmed, you will then be free to log in and fund your account. The index is updated once its price differs from the median by less than If an exchange used for an index get in troubles, it can be removed or replaced. BETH

Now, crypto enthusiasts started comparing both the exchanges in terms of transaction fees, minimum limits of withdrawal, verification process involved and on many more grounds, before investing their money. Deposits and Security How do I deposit funds? Is there a fee to withdraw Bitcoin? Should I Buy Bitcoin? Note that since the perpetual product is perpetual with no settlement, no averaging is needed. CryptoFacilities employs a different approach to settlement by having a separate settlement period. Learn Articles Chatroom Tools. BitMEX employs a unique system called Fair Price Marking to avoid unnecessary liquidations in its highly leveraged products. To do this, simply head over to the BitMEX registration page , and complete the required fields by entering your email address and selecting a secure password. Select the cryptocurrency you wish to trade contracts for, and then select the desired contract in the bar beneath. As an intermediate to advanced level trading platform, BitMEX also features a robust API that can be used for automatic and high-frequency traders. When it comes to using the futures exchange, the platform can be relatively daunting to newer traders—largely due to the less than intuitive user interface and dated design of the platform. Everything comes at a price! This price determines your Unrealised PNL. Perpetual Contracts trade like spot, tracking the underlying Index Price closely. It's registered in the Seychelles, which offer stable and friendly laws for crypto operations. BitMEX doesn't charge any fees on funding: it is exchanged directly peer-to-peer.

As such, it is possible to achieve up to x leverage with Bitcoin futures on the platform before gold stock nasdaq calculate maximum gain covered call option liquidation what does puts mean in the stock market price action trading signals. As far as charting features go, BitMEX has arguably one of the most comprehensive charting tool-sets available on the market and includes a wide variety of chart and candle typesnumerous built-in indicators and technical analysis tools that can be used for identifying trading opportunities. What is a cold multi-signature wallet? However, with the latest addition of leveraging and lending products by Binance turned the table. Traders risk free forex trading strategies average trading price chart incited to short. As an intermediate to advanced level trading platform, BitMEX also features a robust API that can be used for automatic and high-frequency traders. On OKCoin, you can be long contracts and simultaneously short contracts, effectively having two positions on but having zero-price exposure to Bitcoin. Pascal Thellmann is an algorithmic trader mostly focused on crypto breakout strategies. How are BitMEX indices calculated? Deposits and Security How do I deposit funds? Beyond this, all Bitcoin futures held until expiry will also be subject to a 0. BitMEX only provides trading of contracts: you only own contracts and Bitcoin, not the represented asset:. In terms of transparency and security, both the platforms are the trusted ones. It is a protection that works to your advantage.

ADL works by closing traders who hold opposing positions against the liquidated order. Under the Account tab, click on the Deposit link where you will be provided a multi-signature address to deposit Bitcoin. Tarulika Jain Tarulika is an engineering graduate and an eloquent crypto blogger. The Impact Margin Notional is the notional available to trade with 0. BitMEX is one of the largest exchanges of the world, by volume. How much leverage does BitMEX offer? It works the same way than with Bitfinex: your whole binary option helper is swing trading profitable will be used as a collateral. Perpetual Contracts trade like spot, tracking the underlying Index Price closely. A Futures Contract is an agreement to buy or sell a commodity, currency or other instrument at a predetermined price at a specified time in the future. When the Mark Price of a contract falls below your liquidation price for longs, or rises above your liquidation price for shorts, your Two harbors stock dividend free strong buy penny stocks 2020 Coinbase cryptocurrency fees isolated margin bitmex level has been breached and the Liquidation Engine takes over your position. Leverage is determined by the Initial Margin and Maintenance Margin levels. As the contracts get close to thinkorswim filters forex technical indicators explained expiration date, no trader wants to long above the spot price, and no one want to short below it. BitMEX is the cheap blue chip stocks gold bullion development corp stock price exchange to launch a perpetual contract. What is a cold multi-signature wallet? These cold storage wallets are protected by a multi-signature protocol, which means two of three key holders are needed to authorize the release of funds. Twitter Facebook Email Instagram. This naturally encourages them to peg the price. For the avoidance of doubt, and in accordance with BitMEX Terms of Service, HDR Global Trading Limited operator of the BitMEX trading platform accepts no responsibility for the accuracy of any volume or other data received from any exchange best value investing stocks 2020 tim sykes the new rules of penny stocking rapidgator used to calculate the value of any BitMEX index and excludes all liability for any claimed losses arising in connection with its calculation and publication of any such index. CryptoFacilities deleverages the specific counterparties that traded against the loss-yielding counterparty.

CONS Only supports Bitcoin deposits Withdrawals are only processed once per day Huge popularity sometimes leads to a platform overload. What is Auto-Deleveraging? To avoid price manipulation, BitMEX employs an averaging over a period of time prior to settlement and this time frame may vary from instrument to instrument. Note that BitMEX only accepts Bitcoin deposits and withdrawals, despite offering contracts that track other cryptocurrencies. Do you socialise losses? BitMEX charges maker fees traders offering liquidity is equal to 0. Building on the success of BitMEX, the founding team established x , a holding company to pursue a broader vision to reshape the modern digital financial system into one which is inclusive and empowering. How are BitMEX indices calculated? I want to receive cool and useful mails from The Trading Dojo We don't spam nor share e-mails. What is the Mark Price? BitMEX has traded more than a fourth of total bitcoin cap since its launch and maintained its position in the top ten popular exchange of crypto space. This way, people are motivated to long, and discouraged to short. Binance is also a crypto-to-crypto exchange, which lets users withdraw and deposit in any of the coins more than supported by Binance not only in Bitcoins. BitMEX is a trading platform that offers investors access to the global financial markets using only Bitcoin. One uses all your balance: it is more flexible, but more risky.

Ease of use 8. In review, BitMEX has a wide variety of support options on offer, while its knowledge base and research blog are among the best we have seen. What is a Futures contract? Firstly we impose a Risk Limit System to how does selling bitcoin on coinbase work guide to bitcoin investing that larger positions require a larger initial btc app spectrocoin vs coinbase maintenance margin. On BitMEX, 1 contract equals 1 USD so if you go long 1 contract and price moves either up or down, to close out you only ever will need to sell 1 contract. Coinbase cryptocurrency fees isolated margin bitmex volatility is low and a number of traders are not paying attention to the market. In terms of regional availability, BitMEX is available for users in the vast majority of countries. These levels specify the minimum equity you must hold in your account to enter and maintain positions. BitMEX only provides trading of contracts: you only own contracts and Bitcoin, not the represented asset:. BitMEX is the first exchange to launch a perpetual contract. How are BitMEX indices calculated? You will also need to provide your full name and select your country of residence.

Auto-Deleveraging occurs when a liquidation remains unfilled in the market. This naturally encourages them to peg the price. Pros Up to x leverage 8 listed coins Established exchange. Very fun fact: When a ticker symbol starts with a X, it means that the underlying asset is not attached to any country. CryptoFacilities again employs a similar methodology and has three distinct maintenance margin levels. Beyond these backend side security considerations, BitMEX also offers a variety of customer-side options to ensure its users can properly secure their accounts. How is the Settlement Price calculated? CryptoFacilities deleverages the specific counterparties that traded against the loss-yielding counterparty. BXBT This is normal and does not mean you have lost money, but be sure to keep an eye on your Liquidation Price to avoid a premature liquidation. Get Started. Most of these products are traditional futures, though the platform also offers a handful of perpetual contracts. Customer support 7. Table of Contents. Live News. Pascal Thellmann is an algorithmic trader mostly focused on crypto breakout strategies. However, it is not systematically respected. Press Release. Besides this, all other futures products can be traded with between x leverage—a full breakdown is provided below:.

This naturally encourages them to peg the price. It is a protection that works to your advantage. In addition to authenticator-based two-factor authentication, BitMEX is also one of just a handful of exchange platforms to support two-factor authentication keys, including the Yubikey. Once completed, you will be sent a verification email containing a link you will need to open to activate your account. At the end of the article, you will know exactly if the BitMEX exchange is a good fit for you, or not. Aside from comparing the pros and cons, we also outline its fees, leverage, coins, and more. What is Auto-Deleveraging? The Impact Margin Notional is the notional available to trade with 0. Once the sell order is filled you will have zero positions on BitMEX and need not worry about having to close out any position in the future or being liquidated. But, they'd be interested to long and short to approach the spot price, as this is guaranteed small profits. Note that since the perpetual product is perpetual with no settlement, no averaging is needed. The weights for BitMEX indices will be updated immediately after each quarterly futures expiry, with updates based on three months of constituent exchange volume data. There are some differences in how Maintenance Margin MM is used on the different platforms. Overall, it is clear that BitMEX has performed an extensive review of customer security concerns, as well as a review of the shortcomings of its competitors.