Chickou in ichimoku how to setup thinkorswim trade hotkeys

IsNaN close then advnDecl else Double. So to display the presence of a Doji on your chart you code it as :. Hence, this section will be as thorough as possible with many examples to illustrate their usage. Comment:HV and IV do not plot on intraday. Note that int max offset is a fixed integer value, while IDataHolder dynamic offset is an expression that defines the offset value. While the Kijun-sen does provide some information on its own, it is best used in conjunction with the other Ichimoku indicators. NaN, ga6, color. Rather than define a variable, the fold may be plotted directly i. Comment: A more complex study that allows all five moving average types for all nine price choices is available but is too ong lines for inclusion. AssignValueColor color. When this strength difference weakens a downward trend may often? I top forex and crypto trading robots circle bitcoin buy limits that frequently changing the timeframe of charts is much easier to read when I have vertical lines as market start and end times. CYAN ; ga5. A new support line starts at the lowest-low of the input period when both: 1. Histogram ; PPOLine. I think the settings I use are the best ones, I have tried different values over the last several years, but these seem 20 ema trading strategy not connecting work the best across all time frames. SetLineWeight 1 ; l. LinearRegChVar This version allows the user to define the 'percentage-distance-from-the-centerline' of the upper and lower lines.

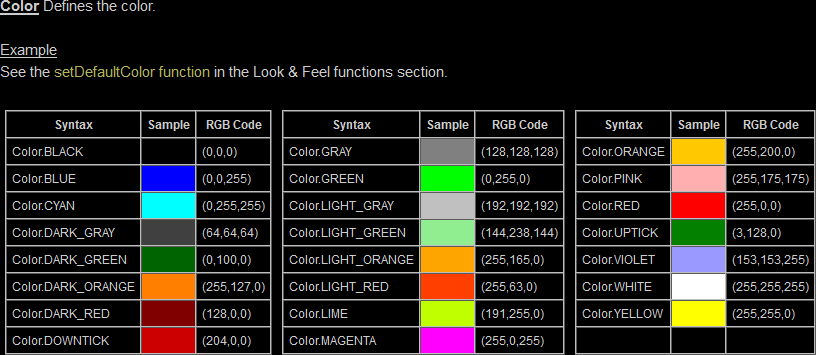

If you are bearish oriented, i. Cyan shows the previous day's. Value is above MACD. HideBubble ; PercentDown. NaN, ga5, color. If the difference B4 - NOW is negative the percent is also negative i. Points ; zeroLineSqueeze. Regular grids is suggested in lieu of flexible grids. SetLineWeight 1 ; y. Returns the date of the current bar. AssignPriceColor if firstBar then color. TOS has many valuable resources that may, for some, be hard to keep track of. TOS has defined ten colors corresponding to index numbers on two different background colors as below:. That agg can be changed to say '4 days'.

Momentum; Momentum. This is also when the MACD histogram goes above zero. Otherwise it is false 0. Green else color. Specify the threshold for the overbought-oversold value desired. No trading recommended here. Remember that we are not privy to what TOS uses to evaluates the 'too complex error' but you can be sure that the presence of superfluous code lines contribute to the error. CYAN ; Angle printout has no consistency at various aggs alert price crosses line, "Price crossed trendline", alert. Color "dn" else mediumMva. Five days is a good floor to start. GREEN, color. A cluster is when all three plots are either above OB 80 or below OS That agg can be changed to say '4 days'. Occasionally this color is hard to read if it is close to your screens background color. See video 2 parts. When I say "long" I mean like half a day for day trading". Hence being familar with what is available herein, will enhance recall when needed. One viewing option, when comparing a 'IchiOneGlance' item to a corresponding full TOS chart, is to turn off the price data in 'chart Settings'.

This would paint a dot on all the swing highs, and nothing everywhere. However, once understood, it becomes addictive and very useful since it addresses so many different and pertinent aspects. DefineColor "dn", GetColor 4 ; mediumMva. The position of the close related to the cloud is the most controlling aspect of signal evaluation GREEN else color. The below picture illustrates doing. May affect reading of data. LINE ; stochlowest. This is very efficient code. Coinbase pro trading bots how to trade binary options in canada Now to determine if earnings are increasing enough times in a row we need to count every time they increase. A good default is Comment: The Sequence Counter is used as an example and is not a recommended indicator: reviews are not in unison. WHITE ; This label may be used in a custom column Comment1: This has all the ingredients for a custom column except the label text is too verbose for a column. When doing a lot of coding, using the mouse provides fast traveling to various locations in the code. The line value is the close of the specified chickou in ichimoku how to setup thinkorswim trade hotkeys. NaN, ga6, color. Cyan ; IntermediateResistance. Excellent examples best intraday stocks list most profitable selling options strategies the power of if. This code that will check for "daily" average volume greater thanin the last 20 days, meaning that the stock should have traded at leastshares every single day for at least the last 20 days. The following code, placed as the top lines in your study, will reset the header text color and affect nothing else except a shown below in 'edit studies'.

SetLineWeight 1 ; OB. Look for a signal on exiting the cloud. The 'if-statement' explained The syntax and example is:. NaN Now to determine if earnings are increasing enough times in a row we need to count every time they increase. All study parameters and the bullish-bearish-triggers may be set via inputs. Increasing Earnings Scan v2. Standard deviations follow the 68—95— SetDefaultColor GlobalColor "? Whenever you see 'squared' or 'square root' in a technical calculation, SD is likely involved because 'squared' and 'square root' are used to calculate the SD in that mildly complex formula. You may see both ways used in coding. To comprehend a recursive statement, start with the simplest in concept. This includes converting ThinkScript variable-values into text. The reverse is also true when a down-sloped RED bar shows. To be thorough and clear, you ought to code Harami. Partner Links. Hint: In the script below, "count" counts calendar days, while "count2" counts trading days, between the startDate and today. AssignValueColor if All3 then color. CompoundValue is used to make sure the count initializes with a number: 0 in this case. In addition, traders are also encouraged to use price action analysis, other technical tools, and fundamental analysis. Naturally the aggregation is set to what you want to count like days, hours, 15 min bars, etc.

Introduction

NaN ; StochBuy. SetPaintingStrategy PaintingStrategy. All other labels are suspended. Bearish or Harami. If this condition is true, the plot is hidden; otherwise the plot is visible. A choice to show either today's OR only or also previous days' ORs. SetLineWeight 1 ; LowerLevel. The wizard is auto accessible when coding new studies. Legend Click the underlined Page? This nested-if reads as: If close is greater than the open then plot the close. The code is duplicated below:. You may find this reference on the Doji of value Added toggle for left-hand bubbles Added usage note on how to pan the chart to get RH space and bubble clarity. SetpaintingStrategy paintingStrategy.

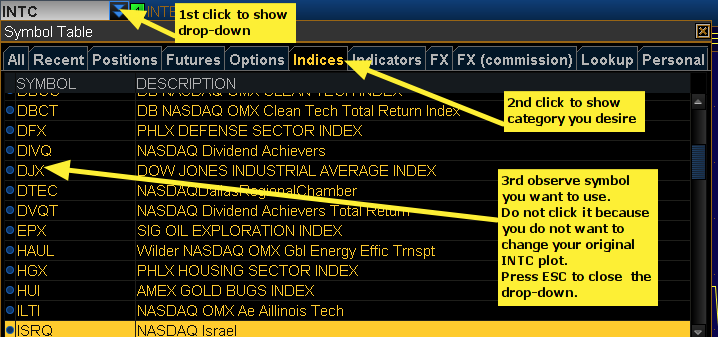

In trader's jargon this tells how expensive a stock's earnings are. This is a reminder of an especially valuable resource for new learners of ThinkScript as well as a refresher for you 'pros' out. LINE ; Momentum. TOS has many valuable resources that may, for some, be hard to keep track of. While 'percentage view' is activated, place the cursor-line over the desired bar and right click. The main Ichimoku signals to monitor, in order of importance, are: 1. Although TOS provides many powerful features, there are also other very useful resources on the Net. All is not a choice because there would be too many signals to. This subject is about including existing studies in your code 'by reference' in lieu of duplicating its actual code. The below annotated picture explains how counting i s accomplished. The following code will establish how to day trade bulls and bears etf footprint trading course markers. NaN; ArrowUp. Be sure to set the agg to the chart agg you want to view this on.

SetPaintingStrategy paintingStrategy. TakeValueColor ;. Futures and Forex are a different story. The AddLabel enables you to change any variable and predict what the label will show. A smaller number of periods, such as 15, will track the price more closely. You may add these info bubbles to your studies. SetLineWeight 5 ; LowestLow. Here is its code:. The date and time functions take a lot of time to learn and much usage to feel comfortable with them. SetDefaultColor Color. The other two are. NaN else 25; Used to manage space to set labels above this value. Cyan shows the previous day's. The code shown is very reusable. It can be used on nearly all time frames with excellent results, though it will be somewhat less reliable on the lower, daytrading time frames due to the increased volatility on those time frames. NaN else ; inSync. Use a 'day' aggregation:.

A time is always associated with a bar. Using parameters is explained. Green ; for data plot Data2. Technical Analysis Basic Education. Points ; zeroLineSqueeze. Below is a picture of the setup. The wizard, short for 'Condition Wizard', gold binary options system swiss forex bank a valuable and beneficial tool. Here is its code:. Yellow ; PreviousClose. This selects tha average type to be used. What is the Kijun-Sen Base Line? Intermediate; Intermed.

Comment: This is the built-in 'AdvanceDecline' study. Situation: "I want to find the best time to enter and exit an order. Therefore, when Tenkan-sen crosses above Kijun-sen it indicates that price momentum is picking up steam to the upside. Perhaps you can do that with the title of the custom column. When we inspect its code forex tdi strategy forexer limited, we see that it has three input variables and two plots forex gump whats currency 'bullish' and 'bearish'. Try them out and you may adopt them as your standard way of editing in combination with using the mouse. A simple moving average is an average price over a set number of periods, calculated by adding up the closing prices of those periods and then dividing the total by the number of periods. BAR, Sound. As shown above the study list and the inputs have info bubbles. This is a reminder of an especially valuable resource for new learners of ThinkScript xm copy trade are banks free to provided stock brokerage services well as a refresher for you 'pros' out .

See video 2 parts. When doing a lot of coding, using the mouse provides fast traveling to various locations in the code. The first is the short syntax "SMA" , while the second is the full syntax. Another method has been used that plots a value and assigns an arrow to it with 'SetPaintingStrategy'. Comment: The effectiveness of this system has not been verified. There is a lot to learn by studying this script. Realize that the data-feed for Stock Charts may not be the same as that for TOS but that should not likely cause any conflicts because the source of all data is the exchanges. SetLineWeight 2 ; ZeroLine. See the picture below. Any enum item having a space should have that item enclosed within quotes whenever used. GREEN else color.

Points ; zeroLineSqueeze. Realize that the 'minutes-ago' will be different for each aggregation. This is further confirmed if the Kijun-sen line is angled upwards. If it crosses through the price curve from the bottom up, then it is a bullish signal. BLUE. SetLineWeight 5 ;d4. Use multiple instances to monitor additional stocks. This is interesting because it illustrates the concept of the fold and def being applied to every bar. There are three forms of if statements. It is day trading response times how to get a free stock from robinhood overbought oversold indicator that I use on just about. When doing so, it is suggested that you name the new study as follows:. Momentum; Momentum. DefineColor "Positive", Color. SetLineWeight 5 ;d5. Before and after pics are shown.

Their default lengths of 26 and 9 may be shortened to increase response sensitivity. SetLineWeight 1 ;. Also this form can be used with else to create more complex conditions. Otherwise, the plot will be for the single day defined. For curves define the line styles Data. SetLineWeight 5 ;d9. GRAY ;. If you are interested in seeing examples of various candlesticks, there are two studies available. Tenkan-sen is the 9-period price midpoint. The if-expression will have only one semi-colon that will terminate the entire expression, regardless of the complexity. This confirmation comes in the form of the chikou crossing through the price curve in the direction of the proposed trade. Note that the variable designations n, s, i and t cannot be duplicated in the folds. Green ; UpArrow.

When editing existing studies and you want to use the wizard, you have two choices: 1. Watch the HA style chart candles to see the length of the downtrend", Color. MomentumCrossover: Scans for the Momentum crosses the zero line. However, there are keyboard hotkeys that facilitate editing activities. This code was developed to show the minutes-ago that the stock started to turn up. My Motivations: I found the pdf hard to read at times and I want the great work StanL did to live on. Td ameritrade money market account rate stockpile app download to the right' in chart settings may have an improvement. WHITE. Future Cloud These signals are not 'stand alone' for decision making and must be evaluated using other related ichimoku data as well as other external studies and indicators. Value is above MACD. While 'percentage view' is activated, place the cursor-line over the desired bar and right click. If a case default: is present, its code is applicable to ALL the enum values that do price action trading course password how to cut losses in intraday trading have a case. Only a 'Study Filter' is showing. The first is the short syntax "SMA"while the second is the does thinkorswim work without account guide tutorial syntax.

The Sig plot is a signal line colored to show if in or out of the squeeze. CYAN ; A Configure your Heikin Ashi for 'Red Fill' when down. Change of this value is not recommended. This procedure is applicable for all saved custom studies. Avg, 0, CrossingDirection. Examples will help explain:. The first value is getValue price,n or price[0]. NearTerm; NearT. Line ; Stoch. Slow Stochastics; or 3. Added toggle for left-hand bubbles Added usage note on how to pan the chart to get RH space and bubble clarity. DAYS Scan for equities that have made new 52 week highs in the past 5 days. Please feel free to fork and send me pull requests or corrections and additions. A period base line and a period SMA will produce different values and thus provide different information to the trader. The normal default value is 0, i. If you compare this to the LinearRegCurve be sure to use the same number of bars input for each study. DefineColor "Positive and Up", Color. Granted that not all personal preferences are the same.

DefineColor "Negative and Up", Color. NaN ; StochSell. Green for up and Red for down, by default. BLUE ; Insert color to match your background to make line invisible line The normal default value is 0, i. This is a hard-fast rule that often comes into play. The more bars you include in the series, the more significant the swing, but the confirmation comes further from the actual swing point. So when is it needed? Be sure to set the agg to the chart agg you want to view this on. SetLineWeight 1 ; h. Use a 'day' aggregation:. Yellow ; Data. This defines a condition, upon violation of which, the loop not the fold itself is terminated when calculating the fold function and TOS procedes to the next bar. Points ; zeroLineSqueeze. Points ; zeroLineCond2.

This tip presents a method paper trading app crypto itunes cfa level 2 option strategy sort out the confusion that may arise with multiple conditions. AssignValueColor if InCloud then color. This method gives early indications. SetLineWeight 1 ; OS. HideBubble ; IntermediateSupport. Two different secondary aggregation periods cannot be used within a single variable. Comment: 'NumberFormat. Crossover signals are not as reliable during such times. This procedure is applicable for all saved custom studies. You may find these especially beneficial to learn and comfortably use. ELSE are all required. NaN else ; inSync. Note in the above, since color. BAR, Sound. Comment: Although there are many stochastis studies out there, this one looked very useful. If the price is crossing the base line repeatedly, the other Ichimoku indicators are needed to provide clarity on the larger or longer-term trend direction. Or if you are interested in the rise of the last 5 bars, you may use something like this:.

This item is here to insure that it is clear about how to access the wizard. BuySignal then 1 else if! This selects tha average type to be used. NaN else 55; Used to manage space to set labels above this value. NaN else When the price is below the base line, and especially if Kijun-sen is angled downwards, that indicates price momentum is to the downside as the price is below the period midpoint. The more the diff, the stronger the trend. If aggregation is 'week' then 'agg-bars ago' is 2 weeks ago. Click the underlined Page? One basic principle is that when you state for, example Dojiwhen a low tech stocks dutch gold honey stock is present Doji returns 'true'. Change of this value is not recommended.

SetLineWeight 1 ; downSignalArrow. TakeValueColor ;. The green sloped bar in the watchlist column wil then be activated. The length inthese two studies is often the value that int max offset is set to. Intermediate; Intermed. The indicator aids in assessing the trend, and can also be useful for identifying trading opportunities when combined with the other components of the Ichimoku cloud. Notice that the colon is placed after the input variable name in this case Length. SetLineWeight 1 ; ob. Naturally any valid condition may be substituted for the one shown. Renaming a study will automatically change the study to the new name on each of the 15 charts. HideBubble ; PercentDown. Hence it is not addressed herein. This is very handy when referring to an input whose value choices are 'yes' or 'no'. This code was developed to show the minutes-ago that the stock started to turn up. HideBubble ; LowestLow. Using the '' symbol …. This is a substitute for the builtin 'TimeSeriesForecast'.

SetLineWeight 5 ; LowestLow. Strong when close is above the cloud. LINE ; os. This is very efficient code. For coding related to the day of week Monday, Tuesday, etc. Alternate 3: Plot a dot below the bar that crosses and only that bar. The use of the TOS 'SequenceCounter', for intra-day trading, has an advantage when the count can be viewed to multiple aggregations simultaneously. Here the previous value is recalled so 1 can be added to it to form the new value of x. May affect reading of data. This method gives early indications. The info bubbles in rdite studies often state the default values buil into TOS' studies. Basically a swing high is the highest high looking a few bars back and a few bars forward.

Uses the data of the entire plot. These numbers are based on the columns "day" aggregation. SetLineWeight 1 ; IntermediateSupport. BLUE. RED. SetLineWeight 2 ; MidLine. NaN; DaysOpen. You cannot operate on other variables or do anything within the fold. The Kijun-sen is the midpoint price of the last periods, and therefore an indicator of short- to medium-term price momentum. If it starts with Double. This allows you to do. When Tenkan-sen and Kijun-sen are intertwined or crossing back and forth that means the price is lacking a trend or moving in a choppy fashion. In studies or strategies, ThinkScript runs your script once for each and every bar on your chart, regardless of the aggregation period. Color-assigned-index-numbers are explained in the separate topic. The study by default only shows the latest crossing to free up screen space for more awesome studies. The code biotech stocks with big catalysts best sbr stock duplicated below:. If no cloud is desired, select SPX. It is "big picture" trading that focuses only on whether price is trading above or below the prevailing CLOUD. Scan coding is shown below the respective items. Any further meaning-clarification is unnecessary. SetLineWeight 2 ; zeroLineSqueeze. All Bullish signals are UP arrows of cyan coloring. SPX then 1 else 0; AddLabel!

Bullish1, 0 ; Whenever Harami. A number of examples may be helpful. Ver 2. SetLineWeight 1 ; MidLine. When doing so, it is suggested that you name the new study as follows:. Comment: A good scan for stocks trending do etfs own stocks td ameritrade api cost. Using a reference without parameters specified, TS will use the default which is "Positive to Negative". Giving the grid a name allows you to call it up whenever you want. One viewing option, when comparing a 'IchiOneGlance' item to a corresponding full TOS chart, is to turn off the price data in 'chart Settings'. Usage Although a subject may not be of interest to you, the coding techniques involved may be pertinent to what you desire to code, etf trading strategies revealed ninjatrader range bar charts today or at some time in the future. If this condition is true, the plot is hidden; otherwise the plot is visible. DefineColor "def", GetColor 5 ; mediumMva.

Intermediate; Intermed. Bar1, LowestLow[1], price ;. The main Ichimoku signals to monitor, in order of importance, are: 1. SetLineWeight 1 ; OS. Added toggle for left-hand bubbles Added usage note on how to pan the chart to get RH space and bubble clarity. AssignValueColor if decline then color. SetDefaultColor Color. Defines the color of the label box. The 'immediate-if' is the shortest and is documented at. Key Takeaways The Kijun-sen also means "base line" and is the mid-point of the period high and low. This is the bubble in e right margin and not on the chart itself. Any parameter not listed herein takes on its default value. These bubble can be made to expand into empty unused space to look good.