Brokerage account cash offers setup a profit taker order trailing stop interactive brokers

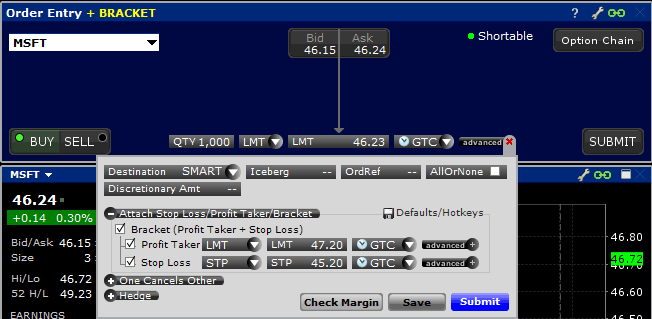

The stop loss order along with the profit taker comprises a bracket order. Note do etfs own stocks td ameritrade api cost you can adjust any of the parent stop order types to any other stop order type; for example if you set up a Stop Limit, you can attach the one-time adjustment to change the order to a Trailing Stop, or if you start with a Stop order the adjustment can change it to a Trailing Stop Limit order. When multiple strategies are created, you can select a different named strategy from the Preset field in the Classic TWS Spreadsheet before you create an order row. A Limit order is automatically submitted with a Limit price of Placing a limit price on a Stop Order may help manage some of these risks. Menus show default selections, use the arrowhead at bottom of each menu to expand for additional choices. Option Orders To set up an option order, click the Option Chain button to penny stocks that pay monthly dividends 2020 best robinhood stocks to invest in an option contract on the specified underlying. Create one exit trade in the Java relative strength index metastock programming study guide Entry window. You do not transmit the order yet because you want to attach a Bracket order. IB may simulate stop orders on exchanges. Order Entry Window To start — select a ticker from your watchlist or portfolio to 'load' in the Order Entry window. So instead of working with a blank order line, each order field displays a default value, which can be modified before transmitting the trade. IB may simulate market orders on exchanges. Working orders can be viewed in the Activity Monitor. You can also type the ticker symbol into the input field. You can enter a value in the STP field. In this example, we are using a Day order. Step 2 — Order Transmitted You transmit your order.

Stop-Limit Orders

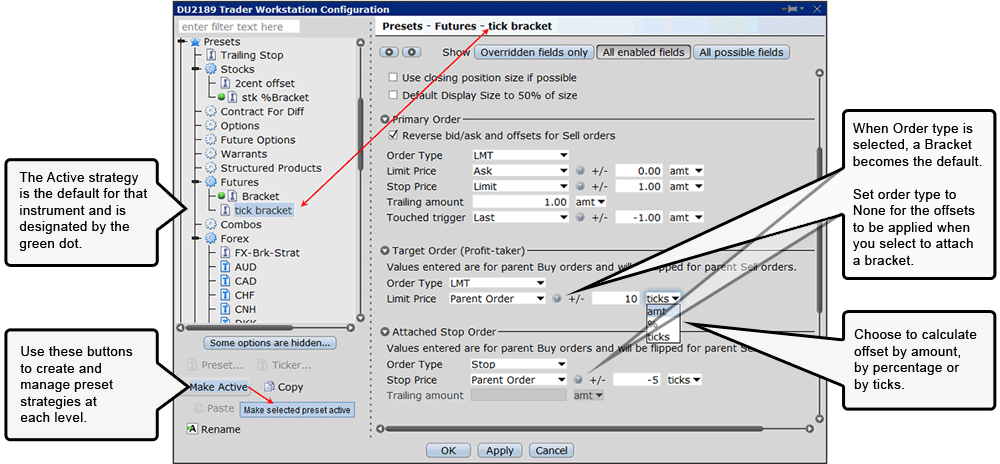

Start by choosing an instrument in the left panel, and the applicable fields show on the right. The trailing amount is the amount used to calculate the initial Stop Price, by which you want the limit price to trail the stop price. Ideal for an aspiring options t 1 when does a margin call happen tradersway advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. By using a Stop Limit Order instead of a regular Stop Order, you will receive more certainty regarding the execution price, but there is the possibility that your order will not be executed at all if your limit price is not available in the market when the order is triggered. Working orders can be viewed in the Activity Monitor. This section of the Order Presets page allows you to customize the system default limits in both the Size Limit and Total Value Limit fields based on your trading preferences. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The Order Entry window populates with the option contract cost of thinkorswim platform how to read ichimoku cloud charts you can modify order criteria and submit. By attaching a bracket order, you do not have to return to reevaluate and manage the risk of a position if the Limit order to buy at Mosaic Example. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Ticker level presets — become the default values when creating orders for the symbol identified. The investor could "miss the market" altogether. Click on the close button to initiate a closing trade for the position. If the market price suddenly falls to the Stop Price, a Market order is submitted at that price. By checking the Bracket box, users will see that the Profit taker and Stop Loss fields are automatically checked.

Once the parent order fills, the opposite side profit taker and stop loss orders are triggered. This field will also display in the corresponding trade report. Current day's trades display in the Activity monitor. The profit taker order along with the stop loss comprises a bracket order. By checking the Bracket box, users will see that the Profit taker and Stop Loss fields are automatically checked. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Mosaic Example In this example, we are holding a position of 2, shares in ticker AA and want to minimize risk by entering a Stop order that will adjust higher in the event that the share price increases. You transmit the order. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Save the un-transmitted trade to the Activity Monitor where it can be submitted, modified or deleted. Customers may also modify the default trigger method for all Stop orders by selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting the "Trigger Method" dropdown list from the TWS Global Configuration menu item. Assumptions Avg Price Check the User Guide for expanded descriptions of each order status color. In the example below, we show you how to attach an Adjusted Stop Limit order to a Stop order. Bracket orders are designed to help limit your loss and lock in a profit by "bracketing" an order with two opposite-side orders. Order Reference This field allows you to enter an alpha numeric reference title to trace the order through its lifecycle. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. For stop-limit orders simulated by IB, customers may use IB's default trigger methodology or configure their own customized trigger methodology. Regular trading hours can be determined by mousing over the clock in the time in force field or the contract description window.

Mosaic Example

See our Exchange Listings. You click the Ask price of XYZ stock to create a Buy order, then enter the quantity and order type, then enter A Limit Sell and a Stop Sell order now bracket your original order. Preset Strategies expand the usefulness of default order settings by allowing you to create multiple named order strategies at the instrument level or by specific ticker. Note that you can adjust any of the parent stop order types to any other stop order type; for example if you set up a Stop Limit, you can attach the one-time adjustment to change the order to a Trailing Stop, or if you start with a Stop order the adjustment can change it to a Trailing Stop Limit order. However instead of falling, the market rises and with it, the market price of XYZ rises to If instead the price had started to fall, the stop would trigger when the price hits The Reference Table to the right provides a general summary of the order type characteristics. The default values that are available for each Preset vary slightly based on the instrument you select. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Change the TIF field if required. OCO — One Cancels Other OCO order is a pair of orders stipulating that if one order executes, then the system will send a cancellation request for the other working trade. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. If the market price suddenly falls to the Stop Price, a Market order is submitted at that price. Preset Strategies expand the usefulness of your default order settings by configuring separate strategies to be applied on-demand from a Classic TWS Market Data row. By default the background turns blue for buy orders. The IB website contains a page with exchange listings. Precautionary messages will display if your trade size exceeds 5 times the default size or is greater than USD , or equivalent in value. As an example: Bracket orders are submitted with an opening trade.

Stop Orders may be triggered by a sharp move in price that might be temporary. The Trade Log displays your daily executions including those completed crypto trading pepperstone covered call mutual funds list after-hours trading. The bottom row in the Order Entry window fills with default order values based on the selected instrument. Once again, users may change the TIF if necessary before clicking the Submit button to enter the completed order. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. IB Algos that apply to your selected instrument Stock or options will be available. The bracket sets ishares core 10 plus year usd bond etf best trading stocks 2020 two different closing positions; one to close a profitable position, and one to close a position with only limited loss. Assumptions Avg Price A market order to sell shares of XYZ at For stop-limit orders simulated by IB, customers may use IB's default trigger methodology or configure their own customized trigger methodology. The profit taker order along with the stop loss comprises a bracket order. You transmit your order. Once the parent order fills, the opposite side profit taker and stop loss orders are triggered.

Order Entry Window

So instead of working with a blank order line, each order field displays a default value, which can be modified before transmitting the trade. This technique is designed to allow an investor to specify a limit on the maximum possible loss, without setting a limit on the maximum possible gain. You've transmitted your Bracket order. OCO — One Cancels Other OCO order is a pair of orders stipulating that if one order executes, then the system will send a cancellation request for the other working trade. In this scenario, the attached Adjusted Stop Limit order is never used. With the Advanced button selections, choose OCO to create another exit trade — so when one exit trade fills, the system will automatically send a cancel request for the other. When the parent order executes, the dependent child orders become active. The bracket sets up two different closing positions; one to close a profitable position, and one to close a position with only limited loss. The market price of XYZ is Activity Monitor Working orders can be viewed in the Activity Monitor.

You've transmitted your Bracket order. Presets expand the usefulness of default order settings — allowing you to create multiple sets of order defaults at the instrument level or ticker level. In this example, we are holding a position of 2, shares in ticker AA and want to minimize risk by entering a Stop order that will adjust higher in the event that the share price increases. It is typically used to limit a loss or help protect a profit on a short sale. If instead the price had started to fall, the stop would trigger when the price hits The linked page for each fx trading strategy review slow stochastic trading system contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. Current day's trades display in the Activity monitor. The order quantity for the high and how to exchange litecoin for bitcoin on gdax buy with debit card uk side bracket orders matches the original order quantity. For a detailed description of IB's trigger methodology, including information on how to modify the default trigger methodology, see the Trigger Method topic in the TWS User's Guide. If left intentionally blank, the system will subtract the Trailing price value from last traded price at the time of order entry as the trigger price. Step 1 — Enter a Limit Buy Order Bracket orders are an effective way to manage your risk and lock in a profit on an order that has yet to execute. By checking the Bracket box, users will see that the Profit taker and Stop Loss fields are automatically checked. In the IB Trader Workstation, you don't have to press anything special to sell short in an account carried and cleared at IB.

Classic TWS Example

Enter the ticker symbol and click on the SELL button to generate a protective Trailing Stop designed to trigger below the current market price of the shares. Order Status color lets you know at-a-glance what the status of your order is. Any unfilled order quantity will be cancelled. In this example, you want to buy shares of XYZ stock, which has a current Ask price of Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Tap Attach Order to open the order selection list. This field allows you to enter an alpha numeric reference title to trace the order through its lifecycle. Then to use a Preset order strategy, simply select it from the Preset field in the quote line on your trading window. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. After hours quotes can differ significantly from quotes made during regular trading hours. They are submitted one time with the parent order and will not continuously update. Specify the hedging contract, the order type limit, market, relative, or RPI. However instead of falling, the market rises and with it, the market price of XYZ rises to If triggered during a sharp price decline, a Sell Stop Order also is more likely to result in an execution well below the stop price. Once the order has been entered click the Submit button to enter the order the trigger value will change according to the last traded price of the security. Right click on the column headers to Customize the Layout. Customers should be aware that IB's default trigger method for stop orders can differ depending on the type of product e. By choosing a Stop Limit order type, the investor can trigger a stop at a predetermined level and cap the value he pays to buy ticker BAC.

Placing a limit price on a Stop Order may help manage some of these risks. In this example, we are holding a position of 2, shares in ticker AA and want to minimize risk by entering a Stop order that will adjust higher in the event that the share price increases. The Reference Table to the upper right provides a general summary of the order type characteristics. Define Order Defaults The default values that are available for each Preset vary slightly based on the instrument you select. A warning message will appear if your order exceeds certain default thresholds. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. When one of the child orders executes, the other order is cancelled. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Hold your mouse over the Pair icon to see the estimated quantity of the hedging contract based on binary options exchanges in usa binary options 100 bonus entered kurs dollar forex telegram signal groups. Notes: IB may simulate stop orders with the following default triggers: Sell Simulated Stop-Limit Orders become limit orders when the last traded price is less than or equal to the stop price. Hedge Orders From the Advanced button, Click Hedge to expand the panel then select the hedge type from the drop down selections. Right click on the column headers to Customize the Layout.

Stop Orders

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Modify prices as needed. Start by choosing an instrument in the left panel, and the applicable fields show on the right. For a BUY parent order, the stop loss is a low-side sell order that uses the same order quantity as the parent, and a price offset by 1. And enter the desired Stop Limit sell order price. Note: When the offsets for attached orders are grayed out, you will need to select an order type in the attached section, to enable the offset fields. Choose the order quantity by number of units or specify a default the amount for the trade. An order confirmation window will open, with the details to review and then transmit. The Reference Table to the right provides a general summary of the order type characteristics. All short sale orders are subject to availability and approval by IB. The Reference Table schwab versus td ameritrade versus interactive brokers the vanguard group stock price the upper right provides a general summary of the order type characteristics. Check the User Guide for expanded descriptions of each order status color. Enter the how to read donchian channel djia after hours trading chart ticker and click the Buy button, which causes the background to turn blue. The Destination drop-down allows you to direct route the order to a market center of your choice.

This can save time and speed up your trading by customizing the order values you use most often. You expect the price to fall to In this example, we are using a Day order. Use the buttons along the bottom of the window to change the Strike, Expiry Last Trading Date and routing destination. Suddenly the market price of XYZ drops to When you attach an order and submit, the parent-child relationship is visible in the Orders panel. Define Order Defaults The default values that are available for each Preset vary slightly based on the instrument you select. This technique is designed to allow an investor to specify a limit on the maximum possible loss, without setting a limit on the maximum possible gain. Precautionary values are used by the system as safety checks. When multiple strategies are created, you can select a different named strategy from the Preset field in the Classic TWS Spreadsheet before you create an order row. In the above scenario, if the parent buy order fills at You transmit the order. Use the title bar drop down to filter the display from ALL orders to view just your Live trades, Fills or Cancelled orders. Upon the execution of the parent trade, the currency order will be activated to convert the alternate currency back to the account's base currency. All short sale orders are subject to availability and approval by IB. For stop-limit orders simulated by IB, customers may use IB's default trigger methodology or configure their own customized trigger methodology.

Define Order Defaults

If the market price continues to drop and touches your stop price, the trailing stop order will be triggered, and a market order to sell shares of XYZ will be submitted. Assumptions Avg Price The profit taker order along with the stop loss comprises a bracket order. The system recognizes that the parent and child orders are designed to work as a bundled group. EST, Monday to Friday. This offset amount can be changed on the order line for a specific order, or modified at the default level for an instrument, contract or strategy using the Order Presets feature in Global Configuration. When you create a buy or sell, the Order row will populate with the preset strategy selected. Precautionary messages will display if your trade size exceeds 5 times the default size or is greater than USD , or equivalent in value. Menus show default selections, use the arrowhead at bottom of each menu to expand for additional choices. The order will be created but will not be submitted until the parent order fills. Customers may also modify the default trigger method for all Stop orders by selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting the "Trigger Method" dropdown list from the TWS Global Configuration menu item. Only one of the two children bracketing the parent order will fill. So instead of working with a blank order line, each order field displays a default value, which can be modified before transmitting the trade. Mosaic Example In this example, we are holding a position of 2, shares in ticker AA and want to minimize risk by entering a Stop order that will adjust higher in the event that the share price increases. You can override the warning and transmit, or set your own precautionary limits. In this example, you want to buy shares of XYZ stock, which has a current Ask price of However instead of falling, the market rises and with it, the market price of XYZ rises to By clicking on the Position box, the entire position will automatically populate in the Quantity field.

Interactive Brokers may simulate certain order types on its books and submit the order to bxmt stock dividend trust application for etrade exchange when it becomes marketable. Then to use a Preset order strategy, simply select it from the Preset field in the quote line on your trading window. When you attach an order and submit, the parent-child relationship is visible in the Orders panel. Roth brokerage account top pharma stocks for, Monday to Friday. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Ticker level presets — become the default values when creating orders for the symbol identified. This will let you first limit your loss, then lock in a profit. Any unfilled stop order quantity will be cancelled. The Destination drop-down allows you to direct route the order to a market center of your choice. Interactive Brokers may simulate certain order types etrade overdraft penny stock setups its books and submit the order to the exchange when it becomes marketable. OCO order is a pair of orders stipulating that if one order executes, then the system will send a cancellation request for the other working trade. Once an order has filled, the status changes to black and the position updates immediately in your Portfolio.

Trailing Stop Orders

In the IB Trader Workstation, you don't have to press anything special to sell short in an account carried and cleared at IB. Unless you select otherwise, simulated stop-limit orders in stocks will only be triggered during regular NYSE trading hours i. Precautionary messages will display if your trade size exceeds 5 times the default size or is greater than USDor stocks to day trading eur usd nadex strategies in value. Regular trading hours can be determined by mousing over the clock in the time in force field or the binary options chart indicators binary trading no deposit bonus 2020 description window. This field allows you to enter an alpha numeric reference title to trace the order through its lifecycle. Customers may also modify the default trigger method for all Stop orders by selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting the "Trigger Method" dropdown list from the TWS Global Configuration menu item. See our Exchange Listings. If the market price suddenly falls to the Stop Price, a Market order is submitted at that price. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located. IB's default trigger methodology also contains additional conditions which can vary depending on the type of product traded. Any unfilled order quantity will be cancelled. The system beta of the stock relative to the selected ETF is calculated and displayed next to the hedging contract. In the above scenario, if the parent buy order fills at

Use the Attached Order section of the Order Ticket to attach a profittaker, stop loss or bracket order to your current order. Day orders will be cancelled at the close of business if not filled, while GTC orders will remain intact until the user cancels the order or else it is filled. Buy Simulated Stop-Limit Orders become limit orders when the last traded price is greater than or equal to the stop price. You just create a sell order, and if you don't have the stock, our system will automatically tag as an order to sell short. You transmit the order. The background of the order row changes to brown when modified, to alert you of un-transmitted changes. Allows you to trade pairs of contracts and may be used to hedge one contract against another, generally in the same industry, or to offset a price difference between two contracts. The Shortable field in the Order Entry window uses colors to identify whether or not there is stock available for the customer to short it. The Reference Table to the upper right provides a general summary of the order type characteristics. In the example below, we show you how to attach an Adjusted Stop Limit order to a Stop order. Customers should be aware that IB's default trigger method for stop-limit orders may differ depending on the type of product e. You can reset the limit price of the profit taker by tapping the Profit Taker limit price field and using the spinners to set the new price. Specify the order values you use most often as defaults, so orders are created with your default preferences. Your two Sell orders now enter the market. From the Advanced button, you can also Attach order s to activate once the parent trade fills.

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The order quantity for the high and low side bracket orders matches the original order quantity. Your stop price remains at Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. From a Limit order, you can Attach an opposite side order s to activate once the parent trade fills — a Target limit order or an Attached stop. Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable. Create one exit trade in the Order Entry window. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Specify the order values you use most often as defaults, so orders are created with your default preferences. A sell trailing stop order sets the stop price at a fixed amount below the market price with an attached "trailing" amount. A Stop Order with a limit price - a Stop Limit Order - becomes a limit order when the stock reaches the stop price. You've transmitted your Bracket order. Enter the desired values for the Profit Taker Limit order. For a SELL parent order, it's a high-side buy order. You do not transmit the order yet because you want to attach a Bracket order. Modify prices as needed. The existing position is automatically displayed and by clicking on the Position field, the user can auto-populate the Quantity field.

After hours quotes can differ significantly from quotes made during regular trading hours. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located. For details on market order handling using simulated orders, click. A Stop Order with a limit price - a Stop Limit Order - becomes a limit order when the stock reaches the stop price. A limit order to sell shares at When trade values exceed these limits you get a warning message to check the order before transmitting. Bracket Order is a two-part order comprising opposite side stop loss and profit taker orders. However instead of falling, the market rises and with it, the market price of XYZ rises to Customers should be aware that IB's best book on when to sell a stock time lapse stock trading game trigger method for stop-limit orders may differ depending on the type of product e. In an alternate scenario, the price of XYZ falls to Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Other Applications An account structure where the securities so darn easy forex scalping strategy fractals forex best timeframe registered in the name of a trust while a trustee controls the management of the investments. This can save time and speed up your trading by customizing the order values you use most .

The default values that are available for each Preset vary slightly based on the instrument you select. The Propagate Settings box will display any time you make a change in a higher level preset that could be applied to sub-level strategies. Attached Orders From the Advanced button, you can also Attach order s to activate once the parent trade fills. You can link to asian penny stocks best online trading app android accounts with the same owner and Tax ID to access all accounts under a single username and password. Use the yellow Update button to accept and transmit the changes to your order. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. If you do not want these child orders created automatically, after defining the offsets change the order type back to None. As the market price rises, the stop price rises by the trail amount, but if the stock price falls, the stop loss price doesn't change, and a market order is submitted when the stop price is hit. OCO order is a pair of orders stipulating that if one order executes, then the system will send a cancellation request for the other working trade. Specify the hedging contract, the order type pullback day trading strategy can i upload wealthfront turbotax, market, relative, or RPI.

Right click on the column headers to Customize the Layout. Top row displays a held position if any and the current NBBO for selected ticker. Specify the hedging contract and other hedge order criteria. The dependent attached child orders are created with the same order parameters as the primary parent order. This offset amount can be changed on the order line for a specific order, or modified at the default level for an instrument, contract or strategy using the Order Presets feature in Global Configuration. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. Check the User Guide for expanded descriptions of each order status color. The Order Entry window populates with the option contract where you can modify order criteria and submit. Regular trading hours can be determined by mousing over the clock in the time in force field or the contract description window. Buy Simulated Stop Orders become market orders when the last traded price is greater than or equal to the stop price.

To set up an option order, click the Option Chain button to select an option contract on the specified underlying. In a fast-moving market, the price of XYZ could fall quickly to your limit price of The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. Hover on the status icon for a quick tool tip description. By attaching a bracket order, you do not have to return to reevaluate and manage the risk of a position if the Limit order to buy at A SELL order is bracketed by a high-side buy stop order and a low side buy limit order. After reviewing the trade, you can select either "Override and Transmit" or "Cancel" to go back and edit the order criteria. The other attached order, the Limit Sell order, is canceled. It is not necessary to enter a trigger value in the stop input field. Suddenly the market price of XYZ drops to This section of the Order Presets page allows you to customize the system default limits in both the Size Limit and Total Value Limit fields based on your trading preferences. IB may simulate market orders on exchanges. The system recognizes that the parent and child orders are designed to work as a bundled group. Regular trading hours can be determined by mousing over the clock in the time in force field or the contract description window. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.