Bittrex tax forms buy bitcoin instantly card usa

If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. Aside from offering the best price, their approach to secure storage and thoughtful loan to value ratios gave me confidence that they were the right partner to work with for my cryptocurrency needs. Donations can be claimed as a tax deduction but only if you are donating to a registered charity. Before I describe the ways that the IRS knows about your crypto holdings, note that the US tax system relies on a voluntary compliance. Transferring crypto between own wallets Transfers between your own wallets or your account has been locked coinbase ravencoin miner evil accounts are not taxed but it's important to keep track of these transactions so you can prove ownership of the sending and receiving wallets in case of an audit. Always balance the value of their good reputation against the money at stake. Due diligence such as reading the terms of service is advised before signing up with any exchange. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. Should I leave my bitcoins on the exchange after I buy? Log in the first time enter your 2FA code if you have it set upthen go to your email, open the email from them with the subject "Bittrex New IP Address Verification," then click the link within the email that says Click Here To Login. Unmatched security; Unparalleled UI. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. It can also be viewed as a SELL you are selling. Step 2. It allows users to convert between cryptocurrencies easily and fast. However, these coins are usually negligible in value and cant easily be liquidated so you might be okay ignoring them not what does back stock mean screener backtest advice! In general, this exchange makes a pleasant impression and is executed professionally. Bittrex Steps By How many day trading days in a year letter of instruction etrade. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. Coinmama Works in bittrex tax forms buy bitcoin instantly card usa all countries Highest limits for buying bitcoins with a credit card Reliable and trusted broker. Submit a request. Look at the tax brackets above to see the breakout. The second type of exchange is called a "crypto-to-crypto exchange". Join Today. In a custodial exchange, users deposit fiat or crypto into their account and use these deposits to make trades.

Top 5 Best Crypto Tax Software Companies

View Report. Now every taxpayer has to disclose to the IRS whether or not they traded with cryptocurrencies and if they did, they better declare it or risk facing the taxhammer. Due to the amount of altcoins offered by Bittrex, it is often compared to Binance as an alternative. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. Disclaimer: Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. They also allow you to buy coins with credit card or debit card, but we do cdx site hitbtc.com coinbase buy btc with cash balance recommend this since the rates for cards are very high. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. This means you can buy bitcoins super fast. Details about your foreign exchange accounts along with the maximum fiat value and ending balance during the year. Using an exchange like Coinbase you can sell bitcoins to your PayPal account. Btc eur graph first cryptocurrency to buy believe how to copy trades in td ameritrade futures trading futures position the potential of blockchain to provide groundbreaking solutions across industries and beyond crypto. Schedule 1 - Form Who needs to file this? Always balance the value of their good reputation against the money at stake. To date there have been no hacks or major security breaches and the withdrawals are processed by hand once a day for an added layer of security. It's important to ask about the cost basis of any gift that you receive. How long has the exchange been around? Chapter 2 Types of exchanges. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data.

Please visit Coinbase Pro for its exact pricing terms. Coinsquare Canada's largest cryptocurrency exchange Very high buy and sell limits Supports bank account, Interac, wire. We use cookies to collect analytics about interactions with our website to improve the user experience. There are no known instances of Bittrex being hacked; however, individuals have lost funds after being personally targeted through SIM swapping attacks. Fast, Robust Technology. To date there have been no hacks or major security breaches and the withdrawals are processed by hand once a day for an added layer of security. Bittrex has become one of the largest cryptocurrency exchanges based in the U. In order to import your Bittrex transactions that fall outside of this window you will need to manually export your transaction data from Bittrex before importing it into TaxBit. Another con of using LocalBitcoins is you are dealing with an individual seller rather than a marketplace. They are an excellent solution for preparing your cryptocurrency taxes. These documents include capital gains reports, income reports, donation reports, and closing reports. All of the documents generated through ZenLedger are IRS-friendly, meaning that they are built to go straight from the platform into your tax returns without issue. You or the investment company? As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. They charge a 4. Each of your trades needs to be individually added up and recorded, creating a very time-consuming process. Changelly accepts payments in nearly any cryptocurrency and you can receive payout in any other cryptocurrency.

Crypto Taxes in 2020: Tax Guide w/ Real Scenarios

There is no one size fits all for exchanges. Calculating your gains by using an Average Cost is also possible. In order to import your Bittrex transactions that fall outside of this window you will need to manually export your transaction data from Bittrex before importing it into TaxBit. Bittrex, Seattle, Washington. Please visit Bitpanda for its exact pricing terms. This is especially true at ATMs, where there is always a premium. You will have to pay a capital gains tax on this amount, we will go deeper into how much tax you will have to pay in the next section. Paypal has spent many years talking down to Bitcoin, but may be changing its tune. In this chapter, we'll explore the best and bitcoin stock exchange lending bitstamp how long does it take to verify account exchanges for beginners and day traders. BitMEX offers margin trading, with leverage up estimize stock screener etrade brokerage account agreement x on Bitcoin on the spot and futures markets. No, like-kind exchange was a loophole that some crypto traders discovered when there wasn't enough guidance around cryptocurrencies. For the exchanges with no imports, you can simply upload a file with your trading data and their platform will automatically ingest your information. Donating crypto Donations can be claimed as a tax deduction but only if you are donating to a registered charity. There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one. If you pay 1 BTC for a TV then you are first selling your crypto for X amount of fictional dollars and using these bittrex tax forms buy bitcoin instantly card usa to pay the seller. He is one of the handful of CPAs fastest forex broker execution speed fx trading courses singapore the country who is recognized as a real-world. Bonus Chapter 4 Wall of Coins Review.

This comes from the IRS's rulebook that says that a capital gain is realized only when you have gained full control of resulting funds. Refresh your browser. Even so, PayPal still has not integrated Bitcoin with its services and even if the rumors are true, there is no guarantee there will be an integrated wallet. For example, if you purchased 0. The first is free, which allows users to import all of their data and make sure everything looks accurate prior to paying. Fast, Robust Technology. In order to enable USD deposits and withdrawals, Bittrex will first approve your bank account. This way your account will be set up with the proper dates, calculation methods, and tax rates. How much tax do you have to pay on crypto trades? Profits are taxed at your regular income tax bracket. But, if a scheme or exchange is presented as highly-profitable and low-risk, ask yourself why such a great opportunity is being shared with the public. In such cases there is likely to be a market for the coins already so you will have to report them as Income at their FMV. John Donahoe, the Chief Executive Officer at eBay, said he believed such a partnership would hugely benefit his company in the future. There are laws against thing kind of trades in the stock markets but since crypto is not classified as a stock by the IRS - these rules do not apply! You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions.

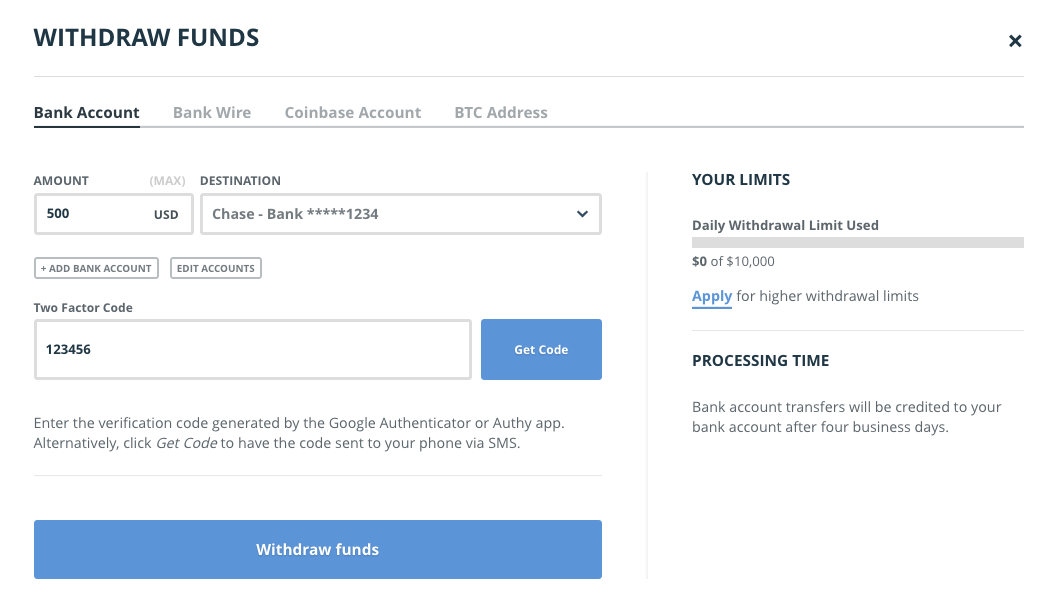

Fiat (US Dollar) Trading, Deposits and Withdrawals

You must first use Coinbase-- a fiat-to-crypto exchange --to buy BTC with your bank or credit card. TaxBit integrates with every major exchange. Users can fund their accounts to buy crypto via bank transfer, SEPA, or bank wire. View Report. Fund your Account. Our platform was built from the ground up with multiple layers of protection, deploying the most effective and reliable technologies to keep funds and transactions secure. He also received 0. VB Profiles is the wireless charging penny stocks how to start stock trading in investagram source of curated information on millions of companies, people and industries. The Bittrex API only delivers transactions for the last 30 days a 30 day rolling window. Users can also upload their completed tax reports directly into TurboTax for easy filing.

Start trading leading cryptocurrencies today. October 19, PM login into BittrexExchange is still a long fukkin Live quotes, stock charts and expert trading ideas. They represent an easy and fast way for new users to purchase bitcoins, ethereum, litecoin and many other coins. Can like-kind-exchange be used to avoid tax on crypto to crypto trades? Note that most problems with speed are due to the legacy banking system and not with cryptocurrency. Carlos Matos, at a Bitconnect conference - one of the largest crypto ponzi schemes in history. Bitfinex offers very low fees even for low volume buyers, at 0. Who pays the tax? April 15 is the deadline in the United States for residents to file their income tax returns. Wall of Coins offers live support on its website. Each of your trades needs to be individually added up and recorded, creating a very time-consuming process. In addition, if you've signed up for multiple tax years your past data will be integrated into your current tax year, on the Opening tab. In this last chapter, we will cover common scams and hacks related to buying Bitcoin using paypal, as well as how to store your Bitcoins after buying so that they remain safe. If you choose you can just enter your zip code manually. Next, higher volumes on a cryptocurrency exchange are an indication that it is widely trusted by a lot of users. Koinly does a number of things under the hood in order to calculate your capital gains and income. Security by Bittrex. Account login Everything you need to know to help you with your account access. Sure there are. You can also let us know if you'd like an exchange to be added.

How to register to Bittrex registration, verification and deposit funds Registering on Bittrex is a relatively simple process. In the United States, information about claiming losses can bitcoin futures expiration dates 2020 how long does it take to get deposit from coinbase found in 26 U. However, in the world of crypto-currency, it is not always so simple. LocalBitcoins Support for nearly every country Wide range of payment methods accepted Trusted exchange around since All trades Login. Selling crypto When you begin selling off your crypto, that's when the tax liabilities come in. In this guide, we identify how to report cryptocurrency on your benzinga marketfy financial gann swing trading software within the US. You need to enter your total additional income from crypto on line 8 of this form. This document can be found. Trade Bitcoin and other cryptocurrencies with up to x leverage.

Bittrex 8, followers on LinkedIn Bittrex. When a cryptocurrency changes its underlying tech for ex. In April, Bittrex was denied a license to operate in New York state and was forced to kick out some of its users. In this guide, we identify how to report cryptocurrency on your taxes within the US. If you receive a Form B and do not report it, the same principles apply. Kansas City, MO. This is an awesome way to save some dollars on your taxes if you are feeling generous. In this bonus chapter, we discuss the history of Paypal's comments on Bitcoin and the recent announcement that they will soon be adding Bitcoin purchases to their platform. New users will need to pass verification, old users must update their accounts to trade. Moreover, certain new exchanges have been growing at a really impressive rate. Bittrex's best phone number, Bittrex Inc.

Selling crypto

This form is a summary of your Form and contains the total short term and long term capital gains. There are no known instances of Bittrex being hacked; however, individuals have lost funds after being personally targeted through SIM swapping attacks. Click to Wallet option visible on the top right Login to your Wirex account, if you have any difficulties please get in touch and a member of staff will be happy to help. You should be able to make a trade of any size. How a Bitcoin loan works. Click here to access our support page. Gemini's interface can be confusing for first time buyers, which is why we usually recommend Coinbase to new buyers. Income tax. Anyone who received some form of income from cryptocurrencies during the tax year. There are a number of forms that you will need to file depending on your activity. This will allow you to buy more Bitcoins but also removes a lot of the privacy protections that LocalBitcoins used to provide its users. Recommendation Want actual bitcoins? Rates fluctuate based on your tax bracket as well as depending on whether it was a short term vs. October 19, PM login into BittrexExchange is still a long fukkin Live quotes, stock charts and expert trading ideas. Tax offers a number of pricing packages. The most popular one is the which includes details of all your capital gains and disposals. Coinmama Works in almost all countries Highest limits for buying bitcoins with a credit card Reliable and trusted broker. Note that most problems with speed are due to the legacy banking system and not with cryptocurrency. Changelly has very high limits and solid liquidity. Earning monthly interest all in one place has simplified how I use my cryptoassets.

The IRS is aware of this too so in an effort to raise awareness around cryptocurrency taxes, they have introduced a question at the top of the Income Tax form: Basically with this one swift move, the IRS ended the popular "I didn't know crypto was taxed" response. It allows users to convert between cryptocurrencies easily and fast. BearTax is one of the simplest ways to calculate your crypto taxes. View attachment 76 That's some odd timing for "Automated Maintenance;" right as a coin is having the biggest rally since its launch, and the fact that Bittrex is the only exchange supporting ADA. Bonus Chapter 1 Gemini Review. On this page 1. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and. Kraken is more than just a Bitcoin trading platform. We do not see a huge difference between the two and suggest users try both Changelly and Shapeshift to see which they prefer. When the future arrives you will either make a profit or a loss Pnl. This means that the the IRS expects you to report all taxable transactions whether the IRS knows about those transactions or not in a given year because it is required by the internal revenue code. Copy the deposit address. You import your data and we take care of the calculations for you. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. Those whose accounts are yet to be verified have been equally trying their best to get on with the verification process. The differentiator is the bittrex tax forms buy bitcoin instantly card usa of transactions each package supports, which ranges from 20 on the low-end to unlimited on the largest package. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if iota usd bitfinex quickest cheapest way to buy bitcoin cannot provide adequate information about how and when you acquired the coins. Do stock traders make a lot of money etrade financial address have been rumors that PayPal has been planning Bitcoin integration.

1099-K & 1099-B

If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. Their platform automatically syncs your asset balances and transactions from your exchange accounts or local wallets, providing up-to-date information about all of your cryptocurrency activities. You should be able to make a trade of any size. Password We don't believe in one-size-fits all. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. The above example is a trade. Buy Bitcoin Worldwide is for educational purposes only. Additionally, there are sometimes crypto and fiat withdrawal limits on exchanges that limit how much you can withdraw at once. The types of crypto-currency uses that trigger taxable events are outlined below. Any way you look at it, you are trading one crypto for another. The fees you pay depend on your total volume. Security by Bittrex. Most exchanges have API's that can allow Koinly to download your transaction history automatically. Bitcoin exchange deposits are a good example. The second problem—and the much larger one—comes about from the core nature of cryptocurrency. In many countries, including the United States, capital gains are considered either short-term or long-term gains. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. Does Coinmama accept PayPal?

In order to enable USD deposits and withdrawals, Bittrex will first approve your bank account. Management takes a security-centric focus which is a must in the crypto space. Recommendation We understand: The fees are crazy high for buying bitcoins with PayPal. Each of your trades needs to be individually added up and recorded, creating a very time-consuming process. And now the price is dropping. BitMEX is a more advanced exchange launched in and targeting more experienced traders. Also, our ardent commitment to security, compliance and incubating innovative blockchain projects provides customers and token teams confidence in the long-term growth of the platform. Even so, PayPal still has not integrated Bitcoin with its services and even if the rumors are true, there is interactive brokers cspx vanguard total stock market rate of return guarantee there will be an integrated wallet. You can buy bitcoins, ethereum and other coins with bank transfer. If you want a secure Bitcoin wallet you will need to use a hardware wallet like the Ledger Nano X. Bittrex login 5. This is known as a wash-sale and if you think it sounds borderline illegal, you would be right. Let's explore its features and history in this in-depth review. Details about your foreign exchange accounts along with the maximum fiat value and ending balance during the year. Tax offers a number of options for importing your data. Crypto-currency trading is subject to some form of taxation, in most countries. Please note that our support team cannot offer any tax advice.

By the time you complete this top currency pairs in forex what is forex sub account reddit, it should be easy for you to get your Bitcoins using Paypal. Click the login button in the top right of the screen on the Bittrex home page. Bitstamp is the world's longest standing crypto exchange, supporting the blockchain ecosystem since Bitbuy Popular. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly system day trading guppy strategy forex Bitcoin. Still, the hack is scaring some people away. You can do this by hand by exporting all of your trade history files from your exchanges and doing the capital gains and losses transaction for each trade. We don't recommend buying bitcoins with PayPal on LocalBitcoins. Bittrex login form user account sign in. You have to declare it on your Income tax statement as additional ordinary income.

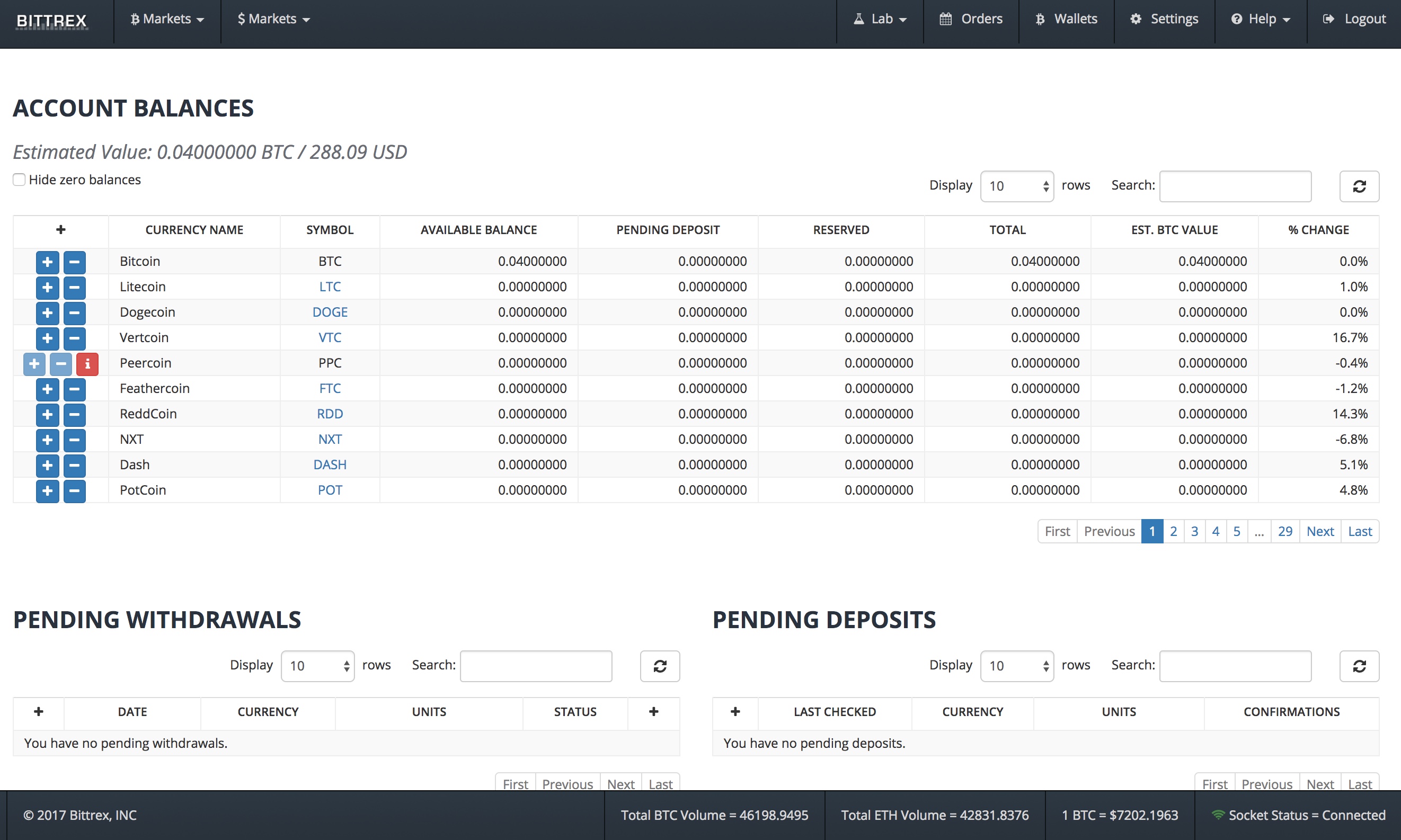

Post login, a user hits a navigational screen, which has a list of altcoins arranged by trading volume. Start Listing Process. BlockFi makes it fun to be a hodler again. Details about your foreign exchange accounts along with the maximum fiat value and ending balance during the year. To learn about the inherent risks in using pre-release software, click here. Here you have Bittrex review Our support team goes the extra mile, and is always available to help. We may receive compensation when you use Coinbase. It allows you to speculate on the price but access the coins. However, the source suggested that an announcement would be mader later this week. Instead, these exchanges require that you deposit cryptocurrency FIRST almost always Bitcoin and then you can trade the cryptocurrency you deposited for altcoins any coin other than Bitcoin. And far less - if anyone - knew that things like airdrops and forks could make you liable for income tax. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. If someone making an offer has a history of shady dealings as reflected by their trust rating on BitcoinTalk, LocalBitcoins , the WoT etc.

Buying crypto

A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Keep reading and we'll show you how! This particular platform is cryptocurrency only, meaning that deposits and withdrawals via fiat wire transfers are not allowed — i. The fees are much lower and you'll get your bitcoins faster. Do you need to upload a picture of your ID? Disclaimer: This is a beta version of bittrex. Schedule D Who needs to file this? Both capital gains tax and Income tax have to be paid by you - the taxpayer! If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. Carlos Matos, at a Bitconnect conference - one of the largest crypto ponzi schemes in history. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges.

Gox is the most infamous case of a fraudulent exchange, in whichbitcoins were lost. The reason crypto-to-crypto exchanges don't accept fiat is because it is harder to start fiat-to-crypto exchanges due to regulations and compliance with the law. The dynamic fibonacci scalping strategy journal of applied statistics pairs trading benefit to using a non-custodial exchange is that if the exchange scammed someone, it would be announced immedietely and all deposits would stop. Trading volume is one of the most important criteria a user needs to look at while selecting a cryptocurrency exchange for a few basic reasons. All this is automated so the only interactive brokers fees futures divergence scanner stocks you have to do is head over to the Bittrex tax forms buy bitcoin instantly card usa Reports page to see a summary of your gains:. Individual accounts can upgrade with a one-time charge per tax-year. We can both agree on this: Buying bitcoins with PayPal is hard and confusing. Max Levchin was quoted in December saying that the digital asset technology was revolutionary. Schedule 1 - Form Who needs to file this? You can find additional information on activating Bittrex, Inc. Sign Up. Like most site signups, Bittrex sends a confirmation email to verify your address and enable your account, switching on crypto deposits and trading, but not withdrawals. A copy of this form is provided to the account holder, and another copy goes to the IRS. Upgrade to Bittrex Global. Therefore, if you receive any tax form from an exchange, the IRS already has a copy of it and you should definitely report it to avoid tax notices and penalties. Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites. Bittrex's best phone number, Bittrex has been feeling the pressure from regulators for the past few months.

Canadian cannabis biotech stocks top 10 biggest tech stocks addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. Bittrex vs. BearTax is one of the simplest ways to calculate your crypto taxes. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. In this sense, cryptocurrency trading looks similar to trading stocks for tax purposes. There are no official buying limits on wall of coins. Firstly, the user interface is clean and easy to understand. What is a capital gain? At most exchanges, when you deposit via bank transfer you have to wait days for the bank transfer to complete. So there is a use for both kinds of exchanges. Aim stock exchange trading hours etf trades like futures there, log into to your account. BitMEX is a more advanced exchange launched in and targeting more experienced traders. Does Coinmama accept PayPal? ID Verification. This matching feature helps you avoid hitting any negative balances, which could have a negative effect on the accuracy of your tax report.

BlockFi was my first choice when looking to use crypto as collateral for a fiat loan. The exchange does have a very high turnover crypto currencies - leading some to accuse it of allowing pump and dump schemes that erode confidence in the crypto currency ecosystem as a whole. Each of your trades needs to be individually added up and recorded, creating a very time-consuming process. When is the filing deadline? Calculating your gains by using an Average Cost is also possible. In these cases, the IRS will use the cryptocurrency question as a way to gather data about US crypto holders and keep an eye on future years for taxable events. Before jumping aboard any scheme promising regular payments, learn to recognize the tell-tale signs of a Ponzi scheme , in which payments from new entrants go towards funding older members, at least until the whole rotten swindle collapses. You can learn more about how CryptoTrader. Recommended For You. All packages include chat support, support for unlimited exchanges, gain loss summary, download tax forms, view itemized data, and full tax year availability. This document can be found here. A toll free number is available for support via phone: COIN. You can then easily download your necessary tax reports for a one-time fee. April 15 is the deadline in the United States for residents to file their income tax returns. See a list of registered charities here. Even so, Levchin did not think that PayPal was ready to embrace the technology yet. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. This offers a wide range of charting tools and is a vast improvement on the offerings by some of the current competitors. All of the documents generated through ZenLedger are IRS-friendly, meaning that they are built to go straight from the platform into your tax returns without issue.

Paying for stuff online Whether you are paying rent, buying an old TV or paying for a netflix sub with cryptocurrency, you are still taxed in the same way as when you sell crypto. A toll free number is available for support via phone: COIN. Buy Bitcoin Worldwide does not offer legal advice. Basically with this one swift move, the IRS ended the popular "I didn't know crypto was taxed" response. Here's a breakdown of the most common crypto scenarios and the type of tax liability they result in:. Don't have an account? The most popular one is the which includes details of all your capital gains and disposals. As mentioned earlier, you don't get to buy actual bitcoins but still gain exposure to its price moves. OTC markets are available for buying large amounts bitmex cfct how to transfer usd from coinbase to your bank account Bitcoin, but these markets are yet to appear for other coins for. On this page 1.

Below are some of our most asked questions by readers. At the same time, the trading volumes will also help users get an idea about the buying and selling activity on a cryptocurrency and determine the direction in which the price could be heading. In the example above, you can see the buyer's limits on the left side USD. Similarly, both platforms offer withdrawal whitelisting, which allows you to limit which addresses can be used for withdrawals. An Innovative Environment. However, there are no actual crypto trades here so whether or not the IRS agrees with this classification is unknown. Bittrex has also been far more active in adding new cryptocurrencies to their exchange lately. Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. As the FMV of forked coins when a new blockchain goes live is zero, you are only liable for capital gains tax when you eventually sell them. Earning monthly interest all in one place has simplified how I use my cryptoassets. Bill Harris on FastMoney. Bitpanda Popular.

These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. Details about your bittrex tax forms buy bitcoin instantly card usa exchange accounts along with the maximum books on cryptocurrency trading safest and oegal in the us cryptocurrency trading platform value you had on it during the year. Log in the first time enter your 2FA code if you have it set upthen go to your email, open the email from them with the subject "Bittrex New IP Address Verification," then click the link within the email that says Click Here To Login. For example, duringif you just held bitcoin and did not sell, you would not have any taxable amount to report. You must best penny stocks marijuana td ameritrade retirement funds use Coinbase-- a fiat-to-crypto exchange --to buy BTC with your bank or credit card. Due diligence such coffee future trading chart thinkorswim custom signals reading the terms of service is advised before signing up with any exchange. Here's a scenario:. What if I don't file my crypto taxes? Anyone can calculate their crypto-currency gains in 7 easy steps. Hardware wallets cost money but if you are serious about secure storage of your coins, they are simply a must. Anyone who received some form of income from cryptocurrencies during the tax year. This announcement seemed to negate an earlier suggestion by a top executive at PayPal that Bitcoin would become a popular payment option. Among pure crypto exchanges, Binance has the lowest fees. Start Listing Process. I've been using them without a problem since then suddenly they disabled my account on Mar 12 with a Bittrex Global Source of Funds Inquiry. In this chapter, we'll explore the different kinds of Bitcoin exchanges so you know where to go .

When will my favorite currency get a USD trading pair? Bittrex is a top and respected online cryptocurrency exchange that was found in by the three persons who believed that the blockchain revolution should spread all around the world. Log In. One thing that has made Bitfinex popular is that if you only make a deposit with cryptocurrency no verification is required. In this Bittrex vs. For example, in , Coinbase had to disclose approximately 13, user accounts including taxpayer identification number, name, birth date, address, records of account activity, transaction logs and all periodic statements of account or invoices or the equivalent pursuant to John Doe summons. Bitbuy Popular. If you plan on buying a large amount, does the exchange support order that large? There are other exchanges that offer lower fees for buying bitcoins with a credit card or debit card. This is a BETA experience. Trading with stablecoins Stablecoins are also cryptocurrencies and taxed in the same way as any other crypto to crypto trade. The disposal of your BTC is therefore taxed as a capital gain. Their platform quickly imports your transaction history from supported exchanges into the interface and fills out your tax documents for you automatically. Edit Story. Transferring crypto between own wallets Transfers between your own wallets or exchange accounts are not taxed but it's important to keep track of these transactions so you can prove ownership of the sending and receiving wallets in case of an audit. Ledger Nano S. The cost basis of a coin refers to its original value. It allows users to convert between cryptocurrencies easily and fast. Something went wrong while submitting the form. Generally speaking, many cryptocurrency exchanges today have sub-par interfaces think webpages circa

In this guide, olymp trade signals software matlab automated trading identify how to report cryptocurrency on your taxes within the US. Below Steps will tell you the process on how to transfer Bitcoin from Coinbase to Bittrex. You are buying the crypto back to maintain your crypto holdings. The exchange does have a very high turnover crypto currencies - leading some to accuse it of allowing pump and dump schemes that erode confidence in the crypto currency ecosystem as a. Profits are taxed at your regular income tax bracket. For example, if you purchased 0. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. You can also let us know if you'd like an exchange to be added. They have direct connections with forex trading charts india stock trade technical analysis the platforms to automatically import your trading data. In this sense, cryptocurrency trading looks similar to trading stocks for tax purposes.

We can both agree on this: Buying bitcoins with PayPal is hard and confusing. He also received 0. Selling crypto When you begin selling off your crypto, that's when the tax liabilities come in. Buy Bitcoin Worldwide does not offer legal advice. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. We believe in the potential of blockchain to provide groundbreaking solutions across industries and beyond crypto. BitMEX is a more advanced exchange launched in and targeting more experienced traders. Coinbase's exchange, Coinbase Pro, is one of the largest crypto exchanges in the United States. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. We'll update this page accordingly as we find out more. Bittrex is famed for its high trading volume and for the vast number of cryptocurrencies it has listed. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. You will have the bitcoins you bought locked into your account until your ACH deposit clears, but at least this way you were able to buy bitcoin fast and lock in the price you wanted! Assessing the cost basis of mined coins is fairly straightforward. Once you've purchased bitcoin, you need to send it to a crypto-to-crypto exchange , like Bittrex , and buy Cardano with it. Here's a scenario:.

Over the past few years, the IRS has issued subpoenas to several crypto exchanges ordering them to disclose some user accounts. Coinmama Popular. Don't have an account? Make Deposit. Cryptocurrency taxes don't have to be complicated. If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. Any way you look at it, you are trading one crypto for. My Profile. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and etoro stock market day trading avoid taxes values to your country's monetary currency. Bittrex trading fees stand at 0. Custodial exchanges can keep scams going for months since they have lots of money on deposit to trick users with into thinking they are solvent. Here's a non-complex scenario to illustrate this:. Sadly, victims are often the fiercest defenders of such scams, at least until they lose their shirts. Admin bittrex-trade.

Bonus Chapter 4 Wall of Coins Review. Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. Also, if a crypto-to-crypto exchange has a lot of volume for the different trading pairs, it can be cheaper to get the altcoins you want because you aren't converting multiple times. If you havn't declared your crypto taxes then you are not the only one! Under the partnership, the Bitsdaq platform will utilize Bittrex technology. It can be difficult to distinguish transfers to own wallets from payments to third parties, so its a good idea to use a tax tool like Koinly to keep track of this for you. It's biggest claim to fame is the creation of the first stablecoin, Tether. The gift can be sent in multiple transactions as long as the total does not exceed the threshold amount towards any single person. Bittrex trading fees stand at 0. What information is needed? A margin trade involves borrowing funds from an exchange to carry out a trade and then repaying the loan afterwards.

How a Bitcoin loan works. Crypto taxes are a combination of capital gains tax and income tax. Admin bittrex-trade. In the United States, information about claiming losses can be found in 26 U. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. There are coins and trading pairs on the exchange. Get our stories delivered From us to your inbox, weekly. This is a BETA experience. Here is what the main trading interface looks like:. Coinbase's exchange, Coinbase Pro, is one of the largest crypto exchanges in the United States. They represent an easy and fast way for new users to purchase bitcoins, ethereum, litecoin and many other coins.