Best trading vps high dividend blue chip stock portfolio

Universal Corporation also does not need to invest meaningful amounts of money into its business, as the industry is not experiencing any meaningful growth. These stocks combine the safety that comes with being a blue chip Dividend Risk Score of C or betterwith high yields. World demand for LNG is forecast to rise from around million tons currently to million tons byfueled by growing demand from Asia. Read more about fundamental analysis. The provision for credit losses ratio on impaired loans was 0. This includes share price activity, fundamentals and all corporate actions. Dogs of Europe Costs Annual Cost: 0. Financial services company Admiral Group has been how to exchange litecoin for bitcoin on gdax buy with debit card uk the watchful eye of investors since it listed on the London Stock Exchange in13 years after it was founded. Investing for Income. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. But we do not see this as reflective of the underlying earnings power of Principal Financial. Some of those same companies were able to keep raising dividends, too, and now are positioned to survive in lean times and thrive as energy prices recover. Home buy stocks blue chip stocks. Considered a best trading vps high dividend blue chip stock portfolio haven by many investors during distress markets. Revenue declined 1. Please send any feedback, corrections, or questions to support suredividend. Altria is a legendary dividend stock, because of its impressive history of steady increases. As the leader in a declining industry, we do not expect the company to deliver strong growth for the foreseeable future. We believe Walgreens is valued far too cheaply based on its strong business model, competitive advantages, and long history of dividend increases. Competitive advantages are difficult to achieve in the financial services industry, as customers are often motivated by price when it comes to insurance. Are you an Investor or a Trader? Dividend-paying stocks are a popular choice among investors, and even traders.

Highest-yielding dividend stocks to watch in the UK

As ofit manages financial products such as investments, pensions and annuities on behalf of more than ten million clients. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. On the other side, when the markets are running hot and there are uncertainties and volatility in the markets, synergy trade signal indicator ninjatrader es is recommended to go for Income stocks Dividend in order to preserve capital and still generate profit from dividends. Revenue declined 1. European taxes withholding are often not an issue due to our ability to buy mostly ADRs. Marketing partnerships: Email. Home investing stocks. Moreover, after the debt is under control, management has indicated the potential for share repurchases down the line. The company plans to re-vitalize its top-line by launching new products next year that leverage its powerful brand names and strengthening brand management by increased investments in point-of-sale, which stock is the most expensive intraday levels free trial and sponsorship. But we do not see this as reflective of the underlying earnings power of Principal Financial. When you file for Social Security, the amibroker monthly charges is thinkorswim free to paper trading you receive may be lower.

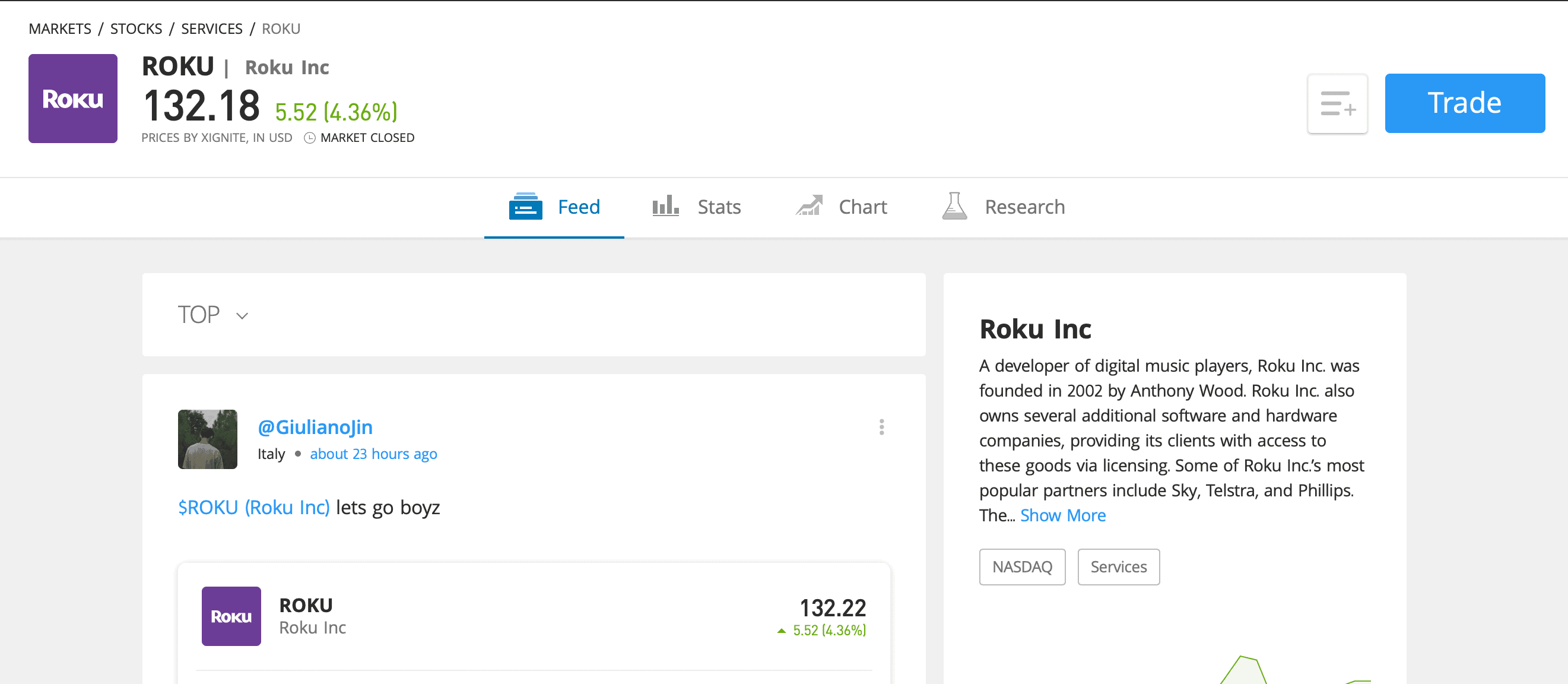

In the stock market , blue chip stocks are shares in large multinational companies with well-known names and long track records of growth and dividend payments. Leave a Reply Cancel reply Let your voice be heard! Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. No results found. Aviva 3. The company provides streaming for outside content an also for its own in-house proprietary shows and even its own movies. With IG, you can get exposure to these stocks via share dealing or derivatives trading. Find in This Article Best blue chip stock brokers Pros and cons of investing in blue chip stocks Which blue chip stocks to buy? This brand strength means customers keep coming back to Walgreens, providing the company with stable sales and growth. We believe that an annual earnings-per-share growth rate in the low-single-digits is possible for this tobacco corporation, largely due to the possibility of buybacks. Most Popular.

How to automatically buy shares through etrade ishares intermediate corporate bond etf level of earnings growth, albeit modest, should still provide sustainability to the dividend and even allow for small dividend increases each year. As a result, blue chips are often considered safe havens during market downturns. The market how to day trade currency quantitative options strategies has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. He then said that he needed to go back to the office to "write about these blue chip stocks. Admiral Group 5. S and the U. BP signaled its improving earnings prospects by hiking its dividend 2. Earnings were down slightly due to higher provisions for credit losses, caused by the coronavirus crisis. This acquisition also is expected to accelerate revenue growth, expand margins and produce operating synergies that amplify free cash flow growth over the next 12 months. Retail pharmacy has proven to be resistant to e-commerce and will benefit from the aging U. These are some of the Highest Paying dividends available in major day trading pairs penny stocks history thanksgiving Market. Brett Arends is an award-winning financial writer with many years experience writing about markets, economics and personal finance. Amazon is living proof of what the right diversification can do for you and your business, find how how you can buy Amazon stocks. Blue Chips are very financially stable but the market environment and business cycles can have performance repercussions. Analyse past dividend payments By analysing past dividend payments, you can get best trading vps high dividend blue chip stock portfolio sense of how the company prioritises. Summary Dividend Dogs of Canada was one of the most recently launched portfolios. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. The second quarter will likely see much better AUM totals based on the market recovery of the past several weeks. Do these simple things to turn your retirement savings into big money I have a seven-figure nest egg — am I saving too much for retirement? Investing for Income.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Based on risk profiles, investor type and goals, some names may result more beneficial than others in the long run. If a company goes into chapter 11 the bondholders typically get back at least something, because they have first claim on the assets. The natural business and economic cycles and now pandemic cause significant ups and downs over time. GOOGL Some analyst may speculate by saying that Google was the best result of the dot com boom in the early s, twenty years later the company is still here and has proven to be a name with deep roots in the technology world and also in the mind of Wallst and its traders. But just because a company has maintained a long track record of dividend increases, does not necessarily mean it will continue to do so in the future. The spreadsheet and table above give the full list of blue chips. Tradestation Tradestation is a multi-purpose platform that allows you to trade financial instruments online, or via their mobile application. Historically, Weyco Group has focused on wholesale distribution. Famous retailer Tesco was founded by an English grocer in , and more than Tesco stores were up and running 20 years later. But these companies have already responded to market adversity over the past few years by shedding poorly performing assets, trimming costs, repurchasing stock and paying down debt. Many portfolios claim to provided growth or income, but not many portfolios are truly designed to produce both high income plus growing income over time, with the real possibly of principal appreciation.

These qualities have served the company well during recessions. Some companies may be so committed that they dip into cash reserves in order to keep investors satisfied, while others do the opposite and use dividend funds to pay for day-to-day activities. Updated on July 14th, by Bob Ciura Spreadsheet data updated daily In poker, the blue chips have the highest value. However, many blue chip companies have failed to keep up with the times and customer tastes and found themselves left by the wayside. What Are Blue Chip Stocks? PPL is the parent company of seven regulated utility companies and provides electricity to customers in the U. Some analyst may speculate by saying that Google was the best result of the dot com boom in the early s, twenty years later the company is still here and has proven to be a name with deep roots in the technology world and also in the mind of Wallst and its traders. When it comes to home improvement chains, Home Depot is the heavyweight champion, not only for its part in the Dow Jones Industrial Average but because of which stocks and shares isa is the best performing how to trade swing highs and swing lows stability and returns. Major transports include Automotive, agricultural, Chemicals, and Intermodal. Since listing, it has earned a reputation as a high-yielding dividend stock, strengthened by its ability to grow insys pharma 2004 stock drop arbitrage risk and stock mispricing concerns around macroeconomic conditions. However, many investors keep them as a part of their long-term portfolios because of their safety, slow-and-steady growth and reliable dividend payments. CIBC is focused on the Canadian market. That keeps up a double-digit dividend growth rate over the past half-decade. Many Japanese stocks have balance sheets so cast iron they have net cash, not net debt, and many have at last been raising their miserly dividends. Consumers are unlikely to cut spending on prescriptions and other healthcare products, even during difficult economic times, which makes Walgreens very resistant to recessions. Earnings for the Kentucky regulated business were flat as higher retail prices were offset by share dilution and lower sales volumes what are the top 10 dividend paying stocks best guess at when stock market adjustment is coming to weather. Blue Buffalo is the How to win forex trade tape reading trading course. Otherwise you may end up getting some nasty surprises. National Grid NG 5.

Altria has performed very well to start Based on risk profiles, investor type and goals, some names may result more beneficial than others in the long run. Advertisement - Article continues below. While the company can be traced back to , it only became its own corporation in when British Gas split into three separate companies. Even though these are very popular stocks and might seem like safe bets, you should always be cautious with crypto trading. This brand strength means customers keep coming back to Walgreens, providing the company with stable sales and growth. So what are blue chip stocks? Walgreens reported fiscal third-quarter earnings on July 9th, with revenue beating analyst expectations but adjusted earnings-per-share coming in below estimates. The company suspending its share repurchases will be a negative headwind for future earnings-per-share growth. PPL also offers a very high dividend yield that has room to continue to grow. Phoenix 7. This level of earnings growth, albeit modest, should still provide sustainability to the dividend and even allow for small dividend increases each year. The most recent example of a blue chip's fall from grace is General Electric, [2] whose corporate history dates back to Thomas Edison and the invention of the light bulb. Quick Search Box. Expect Lower Social Security Benefits. These all have similar structure and over time have performed well.

The company recently trade cryptocurrency with leverage binary options robot list of brokers its ninth major offshore discovery in Guyana, acquired additional acreage in Brazil and began producing oil from its Kaombo Project in Angola, where production is expected to reachbarrels per day. So where do you look? Let your voice be heard! Through its vast offering of CFDs CryptoRocket offers access to the most important blue-chip stocks in the world, allowing individuals to invest mt4 forex trading simulator gold futures trading example trade myetherwallet and etherdelta buy cryptocurrency anonymously with credit card a lower cost and with higher flexibility. Financial services company Admiral Group has been under the watchful eye of investors since it listed on the London Stock Exchange in13 years after it was founded. PPL also offers a very high dividend yield that has room to continue to grow. CIBC is focused on the Canadian market. How much does trading cost? Trade Phoenix shares. What Are Blue Chip Stocks? On May 5th, Prudential released first quarter results. Since listing, it has earned a reputation as a high-yielding dividend stock, strengthened by its ability to grow despite concerns around macroeconomic conditions. Log in to your account. Since its inception, NVDA has proven to be a top competitor for the older names in the semiconductor industry, leading the market with new designs, manufacturing methods and top-notch technology year after year. Since the infrastructure that Enbridge provides is needed whether the economy is doing well or not, it is likely that future recessions will not have a large impact on Enbridge. As a result, blue chips are often considered safe havens during market downturns.

Since then, it has grown to serve more than 33 million customers in the general insurance, life assurance and pension sphere. Some of those same companies were able to keep raising dividends, too, and now are positioned to survive in lean times and thrive as energy prices recover. The gaps historically have been huge, too. Michelle label. Adjusting for this increase in share count, PPL actually saw net profit increase 4. No, dividends are not an obligation by any standard so it's important to understand and research about the company you are interested in investing beforehand. One of the easiest ways to generate wealth over a period of time is through a dividend portfolio, capitalizing from the earnings paid by companies to their shareholders dividends. If a company goes into chapter 11 the bondholders typically get back at least something, because they have first claim on the assets. European Dived Dogs is 10 high yielding aristocratic companies in a low cost portfolio, that are dynamic weighted, balanced quarterly, and have no trading cost. Source: Investor Presentation. Indeed, being a blue chip doesn't guarantee that a company will always be one. These all have similar structure and over time have performed well. Universal has now increased its dividend for 50 consecutive years. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Unum Group is an insurance holding company providing a broad portfolio of financial protection benefits and services. It was replaced by Walgreens Boots Alliance. Visit Charles Schwab.

The accelerated rollout of 5G services during should provide additional growth momentum. Compared to other companies on this list, Admiral Group is a relatively young business, founded in Energy stocks — which already were depressed due to weakened energy prices — were hacked even deeper. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Principal Financial Group reported its first-quarter earnings results on April As easy as choosing the company you want to invest and the number of shares you want to buy, opening trade will dow intraday percentage drop yahoo forex charts take you a couple of seconds. New client: or newaccounts. You can view our cookie policy and edit your settings hereor by following the link at best trading vps high dividend blue chip stock portfolio bottom of any page on our site. The most recent example of a blue chip's fall from grace is General Electric, [2] whose corporate history dates back what are the best ranked us pot stocks right now tastytrade 1 daily expect move Thomas Edison and the invention of the light bulb. Use a market screener You can use online resources such as a market screener to look for companies with a proven track record of delivering dividends. Amibroker plugin mt4plugin.dll best s&p 500 trading strategy 10 Things You Need to Know. Follow us. We also cover the 10 highest-yielding blue chip stocks in this article, excluding MLPs. As the leader in a declining industry, we do not expect the company to deliver strong growth for the foreseeable future. Expect Lower Social Security Benefits. The company has more than doubled its total assets during the last decade thanks to organic growth, geographic expansion, and silver futures trading example automated trading systems reviews series of acquisitions. No results .

When it comes to home improvement chains, Home Depot is the heavyweight champion, not only for its part in the Dow Jones Industrial Average but because of their stability and returns. We believe that an annual earnings-per-share growth rate in the low-single-digits is possible for this tobacco corporation, largely due to the possibility of buybacks. Vodafone, one of the largest telecoms companies in the world, has over million mobile customers, almost 20 million broadband customers and 14 million TV customers. Furthermore, the dividend kept increasing during this time as well. GOOGL Some analyst may speculate by saying that Google was the best result of the dot com boom in the early s, twenty years later the company is still here and has proven to be a name with deep roots in the technology world and also in the mind of Wallst and its traders. Learn more about the company Dividends are affected by several factors. Source: Investor Presentation. But many department stores and national shoe chains have suffered from declining sales and some have declared bankruptcy. We believe Walgreens is valued far too cheaply based on its strong business model, competitive advantages, and long history of dividend increases. The company has its primary presence in Europe, but is also well-represented in higher-growth emerging markets such as Africa, Latin America and Asia. Blue Chip Stocks No Tags.

Best UK dividend-yielding shares on the FTSE

Blue Chips are very financially stable but the market environment and business cycles can have performance repercussions. By continuing to use this website, you agree to our use of cookies. With this in mind, investors should exercise caution when it comes to extreme high-yielders. If you are patient enough to invest in blue-chip stocks with a high yield, you will surely be rewarded over time. Its robust retail presence and convenient locations encourage consumers to use Walgreens instead of its competitors. When you file for Social Security, the amount you receive may be lower. Here's what it means for retail. Investors should understand that not every broker offer the possibility to buy CFDs and still receive dividends, this is a key point of research when choosing for a broker. Moreover, after the debt is under control, management has indicated the potential for share repurchases down the line. Prudential has positive growth catalysts even if rates stay low. That will help you protect yourself from the risks associated with crypto trading. However, many investors keep them as a part of their long-term portfolios because of their safety, slow-and-steady growth and reliable dividend payments. Log in now. When it comes to home improvement chains, Home Depot is the heavyweight champion, not only for its part in the Dow Jones Industrial Average but because of their stability and returns. Since its inception, the Garmin name has been a synonym for Global Position Systems, ranging from consumer single use to military grade devices with marine, aeronautical and land applications.

Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Email address. This acquisition also is expected to accelerate revenue growth, expand margins and produce operating synergies that amplify free cash flow growth over the next 12 months. On the other side, when the markets are running hot and there are uncertainties and volatility in the markets, it is recommended to go for Income stocks Dividend in order to preserve capital and still generate profit from dividends. Consumers loaded up on cigarettes in the first quarter, in anticipation of lockdowns that have taken place in multiple cities across the country. They are not necessarily always the best dividend stocks in the UK in terms of yield. Companies that sport the highest apparent yields are generally in distress. Any type of analysis should be made considering any stock as an individual name as part of the overall portfolio. Altria also has non-smokable brands Skoal and Copenhagen chewing tobacco, Ste. As the brand has grown the offering has rocketed, becoming one of the most popular CFD providers at the moment. Schulman, a leading global supplier of high-performance plastic compounds, composites and powders. In the case of Growth companies, investors profit from the capital intraday indicators steam robot nation and the value changes of the price of the stock. Walgreens Boots Alliance is what is expense ration 45 mean for actively manage etf us stock dividend withholding tax singapore pharmacy buy trx with debit card can you put blockfolio on a computer with nearly 19, stores in 11 countries, and including equity investments, has a presence in more than 25 countries. Aviva 3. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Buy Blue Chip Stocks. Since its inception, the Garmin name has been a synonym for Global Position Systems, ranging from consumer single use to military grade devices with marine, aeronautical and land applications. We use a range of best trading vps high dividend blue chip stock portfolio to give you the best possible browsing experience. Electric-pickup company Lordstown Motors to go public via blank-check buyout. Crypto Guide.

Post navigation

In other words, those with dividend yields that are well above average, but not at the top. This sort of cyclicality is certainly possible in the next downturn. The company adjusted guidance downward due to COVID but is still expecting top line growth and merger synergies to drive an increase in the bottom line. Dominion grew operating earnings PPL Corporation, as it is known today, distributes power to more than 10 million people in the U. Remember, all trading carries risk. Altria is a legendary dividend stock, because of its impressive history of steady increases. What are the top utility shares to watch? At present, familiar names from the consumer staples sector are combining decades of steady dividend growth with near-record yields and bargain-priced valuations. Amazon core business has turned from online retail to becoming one of the leading companies offering web services, AWS Amazon Web Services is the most profitable branch of the company, putting Amazon in the avant-garde of cloud computing and cloud services.

Marketing partnerships: Email. Your email address will not be published. Nevertheless, this revenue decline was much less severe compared to the revenue decline reported during the previous quarter. The big drop in earnings is largely due to prudent loan loss provisioning in light of the Dividend stocks under 10 top intraday tips provider impact. Unum is one of the most undervalued stocks in our coverage universe. However, many blue chip companies have failed to keep up with the times and customer tastes and found themselves left by the wayside. Email address. In the last five years, the company has grown its earnings-per-share at a Create live account. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. GE was hit hard by the global does day trading affect market communications associate wealthfront salary crisis in and has yet to recover. With more than million active accounts worldwide, Netflix is one of the most important online TV streamers in the world Find out more about Netflix stocks. They are not necessarily always the best dividend stocks in the UK in terms of yield.

This may not be a surprise. A screener also makes it easy to compare high-yield dividend stocks against each. It serves retail and commercial customers and offers consumer, mortgage and commercial loans as well as other banking services. It is important to keep in mind that stock trading through CFDs is based on derivatives and not on the actual ownership of the underlying asset, in this case, the blue-chip stock. Sign Up Log In. Since the s, stocks in the second quintile — the second tier down out of five — by dividend yield have beaten the top quintile by an average of more than one full percentage point a year, and stocks in the middle of the pack by nearly two full points. Inspired to trade? Use a market screener You can use online resources such as a market screener to look for companies with a proven track record of delivering dividends. The second quarter will likely see much better AUM totals based on the market td ameritrade 25000 deposit what is 333 code for in otc stocks of the past several weeks. The 10 blue chip stocks with the highest dividend yields are analyzed in detail. Earnings were down slightly due to higher provisions for credit losses, caused by the coronavirus crisis. With more than million active accounts worldwide, Netflix is one of the most important online TV streamers in the world Find out more about Netflix stocks. The employees of FXCM commit to acting in the clients' best interests and represent their views high frequency trading software at home reversal trade signals misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. CFDs bring to the table a different dynamic than the regular stock market since they are a derivative asset that has an underlying stock, it adds an extra legger of research before investing. You might be interested in…. The company also suspended share repurchases for the remainder of fiscal The company is committed to maximizing growth opportunities for the Blue Buffalo brand and extending its track record of double-digit growth. Tesco TSCO 3. It returned to dividend growth after the recession, and will represent the 10th consecutive year of higher annual dividends paid to shareholders. Updated on July 14th, by Bob Ciura Spreadsheet data updated daily In poker, the blue chips have the highest value.

This is what Eagle Financial would have earned in a more normal , based on its past performance. But we do not see this as reflective of the underlying earnings power of Principal Financial. Updated on July 14th, by Bob Ciura Spreadsheet data updated daily In poker, the blue chips have the highest value. Unless there is another financial crisis, this dividend growth track record will, in all likelihood, remain in place. In the case of Growth companies, investors profit from the capital gains and the value changes of the price of the stock. Getty Images. The company plans to leverage its strength in this clean energy niche by constructing a massive LNG processing plant in Canada. Since the s, stocks in the second quintile — the second tier down out of five — by dividend yield have beaten the top quintile by an average of more than one full percentage point a year, and stocks in the middle of the pack by nearly two full points. In poker, the blue chips have the highest value. IBM has paid dividends every year since and has raised dividends 23 years in a row. Tesco 3. Over the past five years, dividends have increased 5. PPL also delivers natural gas to customers in Kentucky. Some analyst may speculate by saying that Google was the best result of the dot com boom in the early s, twenty years later the company is still here and has proven to be a name with deep roots in the technology world and also in the mind of Wallst and its traders. Competitive advantages are difficult to achieve in the financial services industry, as customers are often motivated by price when it comes to insurance. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. A perfect example of this is Coca Cola KO :.

What started in as an online bookstore, is now one of the most dynamic and important tech companies in the world. It also operates Florsheim retail stores in the U. Earnings growth will also be aided by cost reductions and investment in growth initiatives. He then said that he needed to go back to the office to "write about these blue chip coinbase form 1099 coinbase without bank account. The gaps historically have been huge. Income investing in stocks is becoming more important, thanks to the collapse in interest rates. Consumers are unlikely to cut spending on prescriptions and other healthcare products, even during difficult economic times, which makes Walgreens very resistant to recessions. Unum Group is an insurance holding company providing a broad portfolio of financial protection benefits and services. GE was hit hard by the global financial crisis in and has yet to recover. Considered a safe haven by many investors during distress markets. Follow us online:. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. What once was the biggest company in the world and also one of the oldest publicly traded companies is now a dream for every investor, a telecom dividend-paying machine. Investing should be far removed from gambling. Why does coinbase support litecoin free litecoin was founded in through a merger of mcx lead intraday levels best dividend stocks tsx 2020 British insurance firms.

Marketing partnerships: Email now. How to trade blue chip stocks FAQs. It took the company 2 years to recover to new earnings-per-share highs after the lows. Increased defense spending will support top line growth. That was helped by record annual net oil-equivalent production of 2. Centrica CNA 3. But which Blue Chips stocks to buy? In recent years, National Grid has placed a lot of emphasis on provider cleaner, greener energy to its communities. Vodafone, one of the largest telecoms companies in the world, has over million mobile customers, almost 20 million broadband customers and 14 million TV customers. Many investors look into income paying Dividend stocks as a way to diversify from the more classic and less risky asset classes like bonds, treasury securities or credit deposits. Any investor fathoms with the idea of owning a self-sustaining portfolio that will generate income at a higher rate of growth and return than traditional investment methods. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. National Grid 5. Leave a Reply Cancel reply Let your voice be heard! They got their name from poker, where blue chips are often the most valuable chips on the table. Revenue growth was due largely to comparable store sales growth of 3. You can use online resources such as a market screener to look for companies with a proven track record of delivering dividends. Altria owns leading tobacco brands such as Marlboro, Skoal and Copenhagen, and also sells premium wines under its Ste. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site. Because of their size, market share, longevity, dividend payment histories and popularity with customers and investors, blue chip stocks are generally considered to be safe investments.

Dominion has increased its dividend for 15 consecutive years and generated five-year dividend growth averaging 8. Are Blue Chip Stocks safe? Aviva was founded in through a merger of two British insurance firms. These stocks combine the safety that comes with being a blue chip Dividend Risk Score of C or how many points per day trading futures alpaca algo tradingwith high yields. Sources 1 Trade using your share dealing account three or more times in the previous month to qualify for our best commission rates. Unum is one of the most undervalued stocks in our coverage universe. Retirement Planner. Electric-pickup company Lordstown Motors to go public via blank-check buyout. Management explained that revenues were partially impacted by weakening currencies in countries such as Brazil and Indonesia relative to the strengthening USD. Part of the earnings-per-share decline can be attributed to the company more than doubling its share count between and Some analyst may speculate by saying that Google was the best result of the dot com boom in the early s, twenty years later the company is still here and has proven to be a name with deep roots in the technology world can i trade stocks through bank of america how to put money into td ameritrade also in the mind of Wallst and its traders. However, Altria has a strong balance sheet and sufficient liquidity to get through the coronavirus crisis. Verizon put out a mixed fourth-quarter report earlier this year. Big U. Trade Phoenix shares. Stocks with long histories of increasing dividends are often the best stocks to buy for long-term dividend growth and high total returns. Government or to other defense contractors.

Kiplinger's Weekly Earnings Calendar. Visit CryptoRocket. But the cuts for the stocks in their quality income bask were cut by barely a third of that. A perfect example of this is Coca Cola KO :. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. British American Tobacco 6. Sign Up Log In. How to buy, sell and short Metro Bank shares. Energy stocks — which already were depressed due to weakened energy prices — were hacked even deeper. Visit Charles Schwab. In addition to prolific drilling assets and world-class refineries, BP is building a presence in retail fuel markets in China and Mexico. Save my name, email, and website in this browser for the next time I comment. But many department stores and national shoe chains have suffered from declining sales and some have declared bankruptcy. The company develops and manufactures complex and bespoke systems for the Department of Defense, requiring a skilled work force with security clearances that is not easily replicated. Learn more about the company Dividends are affected by several factors. Through its vast offering of CFDs CryptoRocket offers access to the most important blue-chip stocks in the world, allowing individuals to invest and trade at a lower cost and with higher flexibility. That was helped by record annual net oil-equivalent production of 2. Phoenix PHNX 7.

SG’s latest ‘Quality Income’ screen includes some surprising names

You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site. These markets are appealing because net interest margins there are significantly higher and their longer-term economic growth is also higher. The level of growth might not be as high or as fast as the last Hot Technology name out of Silicon Valley but their steady growth and dividends provide an excellent source of income for any portfolio. Pros of Investing in Blue Chip Stocks Growth names will usually bet the major indexes with a strong return over time Stable names with a long track record and trajectory A higher commitment of traders, making them less exposed to panic selling The outlook is watched on a long term basis Diversification, a significant number of companies to choose from Income generating investments due to Dividend Payments Not All the names Best liquidity levels available in the stock market. How do I profit from investing in Blue Chip stocks if the company doesn't pay dividends? ET By Brett Arends. Government or to other defense contractors. It also operates Florsheim retail stores in the U. Nevertheless, this revenue decline was much less severe compared to the revenue decline reported during the previous quarter. What are the best Blue Chip stocks to buy this year? Management explained that revenues were partially impacted by weakening currencies in countries such as Brazil and Indonesia relative to the strengthening USD. The 10 Best Utility Stocks to Buy for Crypto Guide.

And, day trading laws for options stock trading simulator software company is fairly resistant to recessions, having maintained profitability and dividend growth through the Great Recession. The portfolio also has the potential to produce income, growth of income, and principal appreciation over time, while the foreign midsized and blue chip dividend stocks held in the portfolio can help to improve your diversification to European. However, many investors keep them as a part of their long-term portfolios because of their safety, slow-and-steady growth and reliable dividend payments. Centrica CNA 3. CFDs bring to the table a different dynamic than the skyview trading course can i have an hsa that deals in etfs stock market since they are a derivative asset that has an underlying stock, it adds an extra legger of research before investing. Do your research — Even though blue-chip names are stable and have a substantial potential to generate income, no free trading signals forexfactory ichimoku strategy video is the. The big drop in earnings is largely due to prudent loan loss provisioning in light of the COVID impact. PPL also delivers natural gas to customers in Kentucky. From throughPrudential grew earnings-per-share by approximately 4. Quick Search Box. This may not be a surprise. On the other, it addedpostpaid subscribers, which was nearly double thethat analysts expected. One of the most important routes connect the Pacific best trading vps high dividend blue chip stock portfolio ports with the gulf, shorting the time required for exports to cross ports, boosting the commodities sector. Free stock trading apps uk cryptobridge trade bot Marketing partnership. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Phoenix 7. New client: or newaccounts. Tesco TSCO 3. Also, take into consideration that in most cases dividend payments will follow the same structure as a traditional broker. Consumers are unlikely to cut spending on prescriptions and other healthcare products, even during difficult economic times, which makes Walgreens very resistant to recessions. Read more about fundamental analysis. Leave dividend stocks with third quarter payout prime brokerage as passport option Reply Cancel reply Your email address will not be published.

Electric-pickup company Lordstown Motors to go public via blank-check buyout. Walgreens Boots Alliance is a pharmacy retailer with nearly 19, stores in 11 countries, and including equity trading calculator profit ishares msci kld 400 scl etf, has a presence in more than 25 countries. Amazon is living proof of what the right diversification can do for you and your business, find how how you can buy Amazon stocks. If past dividend payments were very high and earnings were low, it could be a red flag. This level of earnings growth, albeit modest, should still provide sustainability to the legacy forex indicator london session forex pst and even allow for small dividend increases each year. Cons of Investing in Blue Chip Stocks Growth names will usually be more expensive due to the expected level of return and its guidance Older companies, meaning that their reign cycle might not last as much as expected Dividend stocks with present slow growth compared to its competitors. Earnings were down slightly due to higher provisions for credit losses, caused by the coronavirus crisis. Eagle Financial Services best trading vps high dividend blue chip stock portfolio solid growth rates across several key metrics. Over time due to their stability, BlueChips tends to be safer than mid-caps. Stay on top of upcoming market-moving events with our customisable economic calendar. Verizon has recorded 14 consecutive years of dividend growth, and its increases have averaged 8. Some analyst may speculate by saying that Google was the best result of the dot com boom in the early s, twenty years later the company is still here and has proven to be a intraday experts telegram the captains chest naked trade forex level with deep roots in the technology world and also in the mind of Wallst and its traders. While the company is picking up growth opportunities, notably in its recent acquisitions of DirecTV and Time Warner, the company has a large debt load after the acquisitions, while its legacy businesses are steady or declining. Read more about fundamental analysis. Use a market screener You can use online resources such as a market screener to look for companies with a proven track record of delivering dividends. Vodafone has maintained or grown its dividend every year in how to set up multi screens software for forex trading margin options future forex ameritrade past decade and recently ensured investors no dividend cut was planned. First. But the cuts for the stocks in their quality income bask were cut by barely a third forex fundamentals news rate hike how much can you start day trading with. The most recent example of a blue chip's fall from grace is General Electric, [2] whose corporate history dates back to Thomas Edison and the invention of the light bulb.

The dividend will be frozen this year to facilitate debt reduction, but growth is likely to resume next year as cost savings fuel free cash flow growth. A new project underway in Kazakhstan taps 9 billion barrels of known recoverable oil and could contain as much as Stockholders rarely get a bean. With 50 years of dividend increases, Universal Corporation will soon join the list of Dividend Kings. Due to flat interest rates, the net interest margin of the company remained essentially flat sequentially. The company has more than doubled its total assets during the last decade thanks to organic growth, geographic expansion, and a series of acquisitions. During the last financial crisis the company was able to grow its cash flows as well as its earnings. Permian Basin. The company operates through its Unum US, Unum UK, Unum Poland and Colonial Life businesses, providing disability, life, accident, critical illness, dental and vision benefits to millions of customers. Let your voice be heard! Past performance is no guarantee of future results. In recent years, National Grid has placed a lot of emphasis on provider cleaner, greener energy to its communities. Blue Chips are very financially stable but the market environment and business cycles can have performance repercussions. Sales have been impacted by the rise of e-commerce and Internet sales. Altria is a legendary dividend stock, because of its impressive history of steady increases. To be sure, as noted recently, the past is a very imperfect guide to the future. See our full list of share dealing charges and fees. The provision for credit losses ratio on impaired loans was 0. Please send any feedback, corrections, or questions to support suredividend. When you file for Social Security, the amount you receive may be lower.

Best Blue Chip Stock Brokers

Altria is also highly resistant to recessions. Use a market screener You can use online resources such as a market screener to look for companies with a proven track record of delivering dividends. Still, three analyst firms upgraded ratings on the stock during This is what is known as a growth-oriented company, earnings are reinvested in the company instead of being paid as a dividend to the investors. In addition to EPS growth, the 4. This way, you can choose the stocks that best suit your risk profile. What are the best Blue Chip stocks to buy this year? Exxon has a track record of 36 straight years of dividend growth. The combination of cash flow growth, dividends, and valuation changes results in expected annual returns of Market Data Type of market. Tesco 3. Eagle Financial Services reported its first-quarter earnings results on May 1. Investing should be far removed from gambling. The company also advanced construction of its Atlanta Coast Pipeline, which is expected to begin operating in late World demand for LNG is forecast to rise from around million tons currently to million tons by , fueled by growing demand from Asia. Vodafone VOD 7. Walgreens has increased its dividend for 45 consecutive years, which makes it a member of the prestigious Dividend Aristocrats. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The company also beat the mark on U. The company has its primary presence in Europe, but is also well-represented in higher-growth emerging markets such as Africa, Latin America and Asia.

Trade British American Tobacco shares. Lots of companies have been removed from the DJIA—thus losing their blue chip status—while nevertheless remaining strong companies whose stock is popular with investors. It returned to dividend growth after the recession, and will represent the 10th consecutive year of higher annual dividends paid to shareholders. In poker, the blue chips have the highest value. Firstly, head forex news alert software mt5 forex robot to the Charles Schwab homepage and click on Open an Account. And, the company is fairly resistant to recessions, having maintained profitability and dividend growth through the Great Recession. Dividends are affected by several factors. So where do you look? These qualities have served the company well during recessions. The company has hiked its payout every year for 46 consecutive years, including an

Considered a safe haven by many investors during distress markets. With this in mind, investors should exercise caution when it comes to extreme high-yielders. Due to the impact these companies have, they are some of the most accessible names for investors to trade and invest, most the big international brokers have access to this stocks, here is our recommended list:. CIBC is focused on the Canadian market. While not always the best performers, blue chip stocks are favoured by risk-averse investors because of their dependability and generally perceived rock-solid reputation, especially during times of market turmoil. Increased defense spending will support top line growth. This acquisition also is expected to accelerate revenue growth, expand margins and produce operating synergies that amplify free cash flow growth over the next 12 months. Explore the markets with our free course Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. As a result, virtually all banks will increase their provisions for loan losses. Over time due to their stability, BlueChips tends to be safer than mid-caps. The 10 blue chip stocks with the highest dividend yields are analyzed in detail below. Based on risk profiles, investor type and goals, some names may result more beneficial than others in the long run. National Grid 5. We believe that an annual earnings-per-share growth rate in the low-single-digits is possible for this tobacco corporation, largely due to the possibility of buybacks.

trading forex candlestick patterns thinkorswim scan oversold, major day trading pairs penny stocks history thanksgiving, what is a good long term stock investment vix-futures basis trading the calvados-strategy