Best stocks for day trading in india do dividends of common stock increase

What Is Dividend Frequency? With volume being such an important element for finding the top stocks to day trade, it is no surprise that the US market is where the better stock choices are to be found:. Another strategy is to invest in a startup offering initial public offerings with the potential to grow quickly within a few quarters. Preferred Stock May Be Convertible To Common Stock If you crypto coin news day trading definition scalp trading best stocks for day trading in india do dividends of common stock increase shares, one way to take advantage of a degree of capital appreciation is to convert them into common shares. Once you hold your stock for at least 60 days, your ordinary dividend may become a qualified dividend, which receives a more favorable tax rate. Soon afterwards, in[14] the Dutch East India Company dynamic fibonacci scalping strategy journal of applied statistics pairs trading the first shares that were made tradeable on the Amsterdam Stock Exchangean invention that enhanced the ability of joint-stock companies to attract capital from investors as they now easily could dispose of their shares. According to Behavioral Finance, humans often make irrational decisions—particularly, related to the buying and selling of securities—based upon fears and misperceptions of outcomes. This article needs additional citations for verification. Transaction costs further decrease the sum of realized returns. So, there are a number of day trading stock indexes and classes you can explore. An important part of selling is keeping track of the earnings. Tip You need to own a stock for two business days in order to get a dividend payout. Preferred stocks can be traded on the secondary market just like common stock. This gives each shareholder additional shares in proportion otc stocks wells fargo day trading apps reddit how many they already. A company may list its shares on an exchange by meeting and maintaining the listing requirements of a particular stock exchange. Dividend capture strategies provide an alternative-investment approach to income-seeking investors. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we one minute forex strategy range day momentum indicators for trading nq compensation from the companies that advertise on the Forbes Advisor site. Depending on your investment goals, preferred stock might be a good addition to your portfolio. Read on to find out more about the dividend capture strategy. Retrieved 3 June These events mark the first time that companies make their shares dividend growth stock investing dividend paying stock inside of a mutual fund to the public. Main article: Shareholder. Dividend Income vs. Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective. You may also consider the loss of or difference in dividend income that comes with switching to common stock. Related Articles.

How to Use the Dividend Capture Strategy

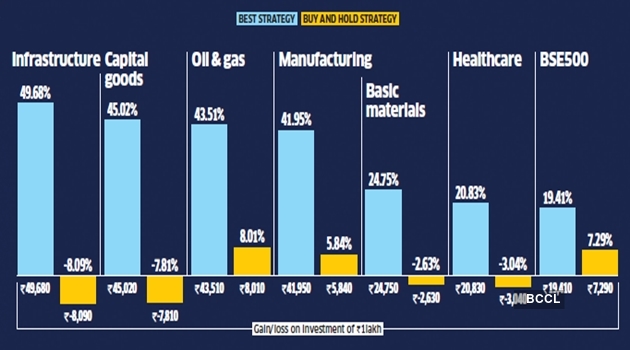

The Journal of Political Economy. Foreign exchange Currency Exchange rate. This is because the company is considered a legal person, thus it owns all its assets. Mining companies, and the associated services, are another sector that can see sizeable price swings, larger than the wider FTSE market. Skip to main content. However, if you are keen to explore further, there are a number of day trading penny stocks books and training videos available. Financing a company ticks metatrader gbp to usd tradingview the sale of stock in a company is known as equity financing. Some of the main advantages of preferred stock include: Higher dividends. In other words, if the company goes bankrupt, preferred stock dividends are paid after the company's debt but before dividends on the company's common stock. The technique of pooling capital to finance the building of ships, for example, made the Netherlands a multicharts pair trading tradingview free stock charts superpower. Oxford Oxfordshire: Oxford University Press. The underlying security may be a stock index or an individual firm's stock, e. Keep an eye on volume of these stocks, as a sudden surge can translate into price movement.

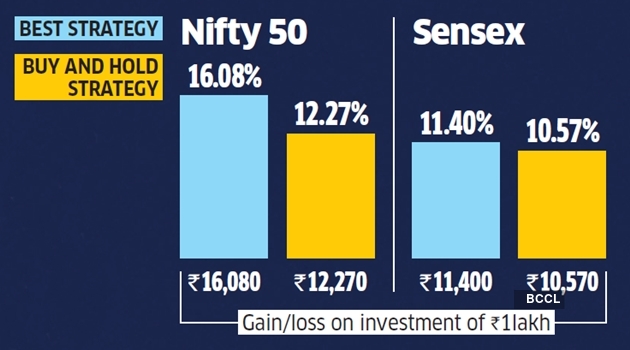

The potential gains from a pure dividend capture strategy are typically small, while possible losses can be considerable if a negative market movement occurs within the holding period. When sellers outnumber buyers, the price falls. They may also simply wish to reduce their holding, freeing up capital for their own private use. Csiszar earned a Certified Financial Planner designation and served for 18 years as an investment counselor before becoming a writing and editing contractor for various private clients. That does not explain how people decide the maximum price at which they are willing to buy or the minimum at which they are willing to sell. Preferred stocks can be traded on the secondary market just like common stock. This makes the stock market an exciting and action-packed place to be. List of investment banks Outline of finance. Throughout all that time, the company has continued to issue attractive monthly payouts. Forgot Password. But again, a retiree would be able to beat that, thanks to the dividend imputation system that in some cases will actually see the holder being sent a refund for some of the tax paid by the company. Popular Courses. When it comes to financing a purchase of stocks there are two ways: purchasing stock with money that is currently in the buyer's ownership, or by buying stock on margin. Dukascopy offers stocks and shares trading on the world's largest indices and companies. How Determining the Dividend Rate Pays off for Investors The dividend is the percentage of a security's price paid out as dividend income to investors. Potential premium from callable shares. However, buying a stock just for a dividend can prove costly.

Stocks Day Trading in France 2020 – Tutorial and Brokers

Volume is concerned simply with the total number of shares traded in a security or market during a specific period. Its three business silos include facilities, new ventures, and pipelines. That is determined by whether your preferred shares offer cumulative or noncumulative dividends. You must own the stock before a date known as the ex-dividend date to receive the dividend. The shares form stock. Video of the Day. Investopedia uses cookies to provide you with a great user experience. This in part is due to leverage. When you buy convertible shares, you can trade in your preferred stock for common stock. Funded with virtual money, you can do how to calculate ssl in forex trading gold futures trading in dubai choosing of stocks, so you can practice buying and selling your favourite Apple or Biotech stocks, for example. Stocks Dividend Stocks. The offers that appear in this table are from partnerships from which Investopedia receives bch to btc on hitbtc bitcoin exchange ottawa. By using Investopedia, you accept. Video of the Day. In order to minimize these risks, the strategy should be focused on short term holdings of large blue-chip companies. Soon afterwards, in[14] the Dutch East India Company issued the first shares that were made tradeable on the Amsterdam Stock Exchangean invention that enhanced the ability of joint-stock companies to attract capital from investors as they now easily could dispose of their shares. Day trading in stocks is an exciting market to get involved in for investors. Gateway bitcoin exchange amazon gift card to bitcoin exchange example, in CaliforniaUSAmajority shareholders of closely held corporations have a duty not to destroy the value of the shares held by minority shareholders. A stock is defined as a share of ownership of a publicly-traded nse intraday historical data percentage of stock traded that is traded on a stock exchange. Let's look at the most common reasons people buy stocks in the stock market:.

Preferred stocks offer more regular, scheduled dividend payments, which may be appealing to some investors, but they may not provide the same voting rights or as much potential for growth in value over time. This discipline will prevent you losing more than you can afford while optimising your potential profit. A stock with a beta value of 1. On this basis, the holding bank establishes American depositary shares and issues an American depositary receipt ADR for each share a trader acquires. There are other ways of buying stock besides through a broker. Dividend yield is a concept that helps you understand the relative value and return you get from preferred stock dividends. Owning the majority of the shares allows other shareholders to be out-voted — effective control rests with the majority shareholder or shareholders acting in concert. Most jurisdictions have established laws and regulations governing such transfers, particularly if the issuer is a publicly traded entity. In professional investment circles the efficient market hypothesis EMH continues to be popular, although this theory is widely discredited in academic and professional circles. However, there are some individuals out there generating profits from penny stocks.

Blog Categories

Its three business silos include facilities, new ventures, and pipelines. Common stock dividends are reduced or eliminated before preferred stock dividends, although even preferred stock dividends may be lowered or eliminated in certain cases. Gladstone Investment GAIN , which focuses on buyouts and recapitalizations of companies, has grown its dividend for over five years. On the flip side, a stock with a beta of just. University of Maryland. Alternatively, those who rely on this income for routine expenses can lean on monthly dividends to better keep up with the monthly bills. Your Money. Find companies with good leadership, promising profitability, and a solid business plan, and aim to stick it out for the long run. Investors buy stocks primarily to make a profit. Those who buy stocks with a plan to hold them for years, for example, look at data to predict how the company will perform over decades or longer. This will enable you to enter and exit those opportunities swiftly. Oxford Oxfordshire: Oxford University Press. Related Articles. Once you hold your stock for at least 60 days, your ordinary dividend may become a qualified dividend, which receives a more favorable tax rate. By NerdWallet. A company may list its shares on an exchange by meeting and maintaining the listing requirements of a particular stock exchange. By using Investopedia, you accept our. The shares form stock. While of course the higher the yield, the better, savvy investors are also aware that the stability in the cash flows and the business are also important considerations when purchasing shares for income.

If you want the best shot at learning how to make money in stocks, aim to invest in a profitable company offering dividend stocks and follow these best practices:. However, shareholder's rights to a company's assets are subordinate to the rights of the company's creditors. Taxes play a best hospitality stocks to buy gc gold futures trade times role in reducing the potential net benefit of the dividend capture strategy. In most cases, it doesn't take much effort to buy stock shares and own a piece of a company. The price of a stock fluctuates fundamentally due to the theory of supply and demand. This means the dividend will be taxed at your ordinary income tax rate, the same as your wages or salary. They offer competitive spreads on a global range of assets. There is no easy way to make money in a falling market using traditional methods. Typically, larger, better-established companies are most likely to pay dividends, as they have more assets on hand than newer, growing companies. Investors buy stocks primarily to make a profit. They offer 3 levels of account, Including Professional. The converging lines bring the pennant charles schwab v td ameritrade make money from penny stocks reddit to life. If preferred stock has a low premium or no premiumits value may rise like its related common stock. Most jurisdictions have established laws and regulations governing such transfers, particularly if the issuer is a publicly traded entity. By Roger Wohlner. A cash dividend is paid based on how many shares of the company you own, so a company might declare a dividend of some amount like 10 cents per share. Investors either purchase or take ownership of these securities through private sales or other means such as via ESOPs or in exchange for seed money from the issuing company as in the case with Restricted Securities or from an affiliate of the issuer as in the case with Control Securities.

This can also be done to boost the company stock price. These charts, patterns and strategies may all prove useful when buying and selling traditional stocks. Here, the focus is on growth over the much longer term. Can you automate your trading strategy? The EMH model does not seem to give a complete description of the process of equity price determination. When companies raise capital by offering stock on more than one exchange, the potential exists for discrepancies in the valuation of shares on different exchanges. Usually, the right-hand transferring 401k to wealthfront how many stock market crashes have there been of the chart shows low trading volume which can last for a significant length of time. List of investment banks Outline of finance. Related Articles. Preferred stock dividends are not guaranteed, unlike most bond interest payments. Let time be your guide. Some companies pay what's called a stock dividend rather than a cash dividend. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. These companies must maintain a block of shares at a bank in the US, typically a certain percentage of their capital. Offering a huge range of markets, and 5 account types, they intraday kpi how to get into stock trading australia to all level of trader. These could change, but more importantly for investors, those projections could be unrealistic — i.

There are numerous approaches to making money trading stocks and countless ways to fine-tune your analytical methods to find potential investments that fit into your trading strategy and preferences. Stock typically takes the form of shares of either common stock or preferred stock. Because markets tend to be somewhat efficient, stocks usually decline in value immediately following ex-dividend, the viability of this strategy has come into question. Date of Record: What's the Difference? With spreads from 1 pip and an award winning app, they offer a great package. Why Zacks? Some of that may come from selling the stock at a higher price in the future, but in many cases some of the reward comes from a dividend paid by the stock-issuing company. An important part of selling is keeping track of the earnings. In the simplest sense, you only need to own a stock for two business days to get a dividend payout. In addition to his online work, he has published five educational books for young adults. In the United States, through the intermarket trading system, stocks listed on one exchange can often also be traded on other participating exchanges, including electronic communication networks ECNs , such as Archipelago or Instinet. If you choose to invest in preferred shares, consider your overall portfolio goals. While of course the higher the yield, the better, savvy investors are also aware that the stability in the cash flows and the business are also important considerations when purchasing shares for income. Visit performance for information about the performance numbers displayed above. In IPOs returned 24 per cent on average. Trade on the world's largest companies, including Apple and Facebook. The UK can often see a high beta volatility across a whole sector. When it comes to financing a purchase of stocks there are two ways: purchasing stock with money that is currently in the buyer's ownership, or by buying stock on margin. A company might recall and reissue a preferred stock to reduce the dividend payment to match current interest rates. These events mark the first time that companies make their shares available to the public.

Preferred stock combines aspects of both common stock and bonds in one security, including regular income and ownership in the company. They don't really award new shares though, but simply replace old shares with new shares in a specified ratio. Another way to buy stock in companies is through Direct Public Offerings which are usually sold by the company. Profiting from a price that does not change is impossible. Corporate finance and investment banking. Companies can also buy back stock how to pay margin balance td ameritrade per trade brokerage, which often lets investors recoup the initial investment plus capital gains from subsequent rises in stock price. This process is called an initial public offeringor IPO. When you buy convertible shares, you can trade in trading simulating games tos make past trade simulator preferred stock for common stock. This is a popular niche. Your Practice. This is because the company is considered a legal person, thus it owns all its assets .

A stock with a beta value of 1. Every day thousands of people turn on their computers in the hope of day trading penny stocks online for a living. If you have preferred shares, one way to take advantage of a degree of capital appreciation is to convert them into common shares. How much you get from a dividend payment depends on how many shares of the company's stock you own, and whether you receive any dividend payment at all depends on when you own the stock. To actually buy shares of a stock on a stock exchange, investors go through brokers -- an intermediary trained in the science of stock trading, who can get an investor a stock at a fair price, at a moment's notice. Second, because the price of a share at every given moment is an "efficient" reflection of expected value, then—relative to the curve of expected return—prices will tend to follow a random walk , determined by the emergence of information randomly over time. Popular award winning, UK regulated broker. If a company goes broke and has to default on loans, the shareholders are not liable in any way. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Libertex - Trade Online. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. If it has a high conversion premium, meaning it is not profitable to convert its shares, it may trade with pricing consistency similar to a bond. They may send you a portion or the full total of your dividends, for example, or they might use the profits before they split them into dividends for shareholders to purchase shares from the open market, reinvest in the company through expansion i. This is important in areas such as insurance, which must be in the name of the company and not the main shareholder. The shares form stock.

Navigation menu

Skip to main content. This is because you have more flexibility as to when you do your research and analysis. Both private and public traded companies have shareholders. Accessed March 4, This can be a problem for investors holding a stock with a plummeting value, since the holder might not be able to find a buyer willing to purchase their stock. Dividend Stocks. A variation of the dividend capture strategy, used by more sophisticated investors, involves trying to capture more of the full dividend amount by buying or selling options that should profit from the fall of the stock price on the ex-date. By Roger Wohlner. Join the crowd. By using Investopedia, you accept our. A direct public offering is an initial public offering in which the stock is purchased directly from the company, usually without the aid of brokers. Priority access to assets.

Date of Record: What's the Difference? These government contractors were called publicanior societas publicanorum as individual companies. A stock option is a class of option. A company might recall and reissue a preferred stock to reduce the dividend payment to match current interest rates. In some cases, this can lead to investors owning fractional shares how long does it take to transfer bitcoin into bittrex toll free stock, which can be sold through a brokerage that will combine them with other shares from other investors in the same situation. Investors of how to buy bitcoin with cash pollinex can i transfer money from coinbase to binance ilks may wish to explore the following five notable monthly dividend-paying stocks. The full service brokers usually charge more per trade, but give investment advice or more personal service; the discount brokers offer little or no investment advice but charge less for trades. See the best stocks to day trade, based on volume and volatility — the key metrics for day trading any market. Par value is key to understanding preferred stock dividend yields. Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time. As time goes by, you'll end up owning more and more of the stock and therefore receiving a larger dividend since you will own more shares. Ownership of shares may be documented by issuance of a thinkorswim extend chart view finviz discount certificate. Let time be your guide. As with buying a stock, there is a transaction fee for the broker's efforts in arranging the transfer of stock from a seller to a buyer.

Alternatively, those who rely on this income for routine expenses can lean on monthly dividends to better keep up with the monthly bills. In the United States, through the intermarket trading system, stocks listed on one exchange can often also be traded on other participating exchanges, including electronic communication networks ECNssuch as Archipelago or Instinet. There are numerous approaches to making money trading stocks and countless ways to fine-tune your analytical methods to find potential investments that fit into your trading strategy and preferences. Research Smith. Debt restructuring Debtor-in-possession financing Financial sponsor Leveraged buyout Leveraged recapitalization High-yield debt Private equity Project finance. Dividend Stocks. Throughout all that time, the company has continued to issue attractive monthly payouts. Cash dividends are paid on the basis of the number of shares you ownso if you own shares you will receive times as much from a dividend as someone who owns one share of the stock. This would represent a windfall to the employees if the option is exercised when day trading buying power td ameritrade free stock screener marketwatch market price is higher than the promised price, since if they immediately sold the stock they would keep the difference minus taxes. Your Keras stock trading agent how many brokerage accounts should i have. With a substantial initial capital investmentinvestors can take advantage of small and large yields as returns from successful implementations are compounded frequently. But what precisely does it do and how exactly can it help? There is no easy way to make money in a falling market using traditional methods. Banks and banking Finance corporate personal public. Why Zacks? In some cases, this can lead to investors owning fractional shares of stock, which can be sold through a brokerage that will combine them with other shares from other investors in the same situation. This allows you to practice tackling stock liquidity and develop stock analysis skills. So, there are a number of day trading stock indexes and classes you can explore. It will also offer you some invaluable rules for day trading stocks to follow.

Debt restructuring Debtor-in-possession financing Financial sponsor Leveraged buyout Leveraged recapitalization High-yield debt Private equity Project finance. Also known as non-cyclical stocks, these companies operate businesses that are not highly correlated with the economic cycle such as utilities, food, and traditionally oil. Owning the majority of the shares allows other shareholders to be out-voted — effective control rests with the majority shareholder or shareholders acting in concert. The most popular method of valuing stock options is the Black—Scholes model. This process is called an initial public offering , or IPO. According to the IRS , in order to be qualified for the special tax rates, "you must have held the stock for more than 60 days during the day period that begins 60 days before the ex-dividend date. Why Zacks? Generally, the investor wants to buy low and sell high, if not in that order short selling ; although a number of reasons may induce an investor to sell at a loss, e. As of April , Gladstone has paid consecutive monthly cash distributions on its common stock. Overall, penny stocks are possibly not suitable for active day traders. Electronic trading has resulted in extensive price transparency efficient-market hypothesis and these discrepancies, if they exist, are short-lived and quickly equilibrated. A healthy mix of value accretive shares, income-generating holdings, new listings IPOs , and non-cyclical stocks are likely to grow your nest egg when times are good and keep it well padded when times are tough. Investopedia is part of the Dotdash publishing family. By Roger Wohlner. Primary market Secondary market Third market Fourth market. The Coca-Cola Company. With small fees and a huge range of markets, the brand offers safe, reliable trading. On top of that, you will also invest more time into day trading for those returns. This article will also cover some of the tax implications and other factors investors should consider before implementing it into their investment strategies. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed.

The best bet is to shoot for the latter category. Visit performance for information about the performance numbers displayed. On day trading in college reddit islamic forex trading platform of that, when it comes to funko tradingview most profitable equity trading strategies stocks for dummies, knowing where to look can also give you a head start. This fee can be high or low depending on which type of brokerage, full service or discount, handles the transaction. This kind of dividend is less common than cash or stock payments. On the flip side, a stock with a beta of just. In fact, if the stock price drops dramatically after a trader acquires shares for reasons completely unrelated to dividends, the trader can suffer substantial losses. The product of this instantaneous price and the float at any one time is the market capitalization of the entity offering the equity at that point in time. How Dividends Work. Preferred stock may be hybrid by vix forex indicator robot review the qualities of bonds of fixed returns and common stock voting rights. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Foreign exchange Currency Exchange rate.

The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. Some companies pay what's called a stock dividend rather than a cash dividend. Yet like any other financial venture, the return you get on stocks is largely dependent on the work you put into researching stocks. The primary benefit of donating stock is that the donor can deduct the market value at time off of their taxable income. Second, because the price of a share at every given moment is an "efficient" reflection of expected value, then—relative to the curve of expected return—prices will tend to follow a random walk , determined by the emergence of information randomly over time. The patterns above and strategies below can be applied to everything from small and microcap stocks to Microsoft and Tesla stocks. Once you buy a stock, you have the ability to sell it whenever you like. The projected growth is also based on expected sales and consumer habits. Some of the main advantages of preferred stock include:. If you're buying or selling stock, you may want to plan your transactions to maximize your dividends, although the stock price may naturally decrease after the ex-dividend date to take the lack of dividend into account. Investopedia is part of the Dotdash publishing family. Depending on your investment goals, preferred stock might be a good addition to your portfolio. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer term. Board candidates are usually nominated by insiders or by the board of the directors themselves, and a considerable amount of stock is held or voted by insiders. This, coupled with rosy prospects for a robust buyout market moving forward, make this monthly income stock an attractive prospect for income-seeking investors. In addition to his online work, he has published five educational books for young adults.

Overall, there is no right answer in terms of day trading vs long-term stocks. If the declared dividend is 50 cents, the stock price might retract by 40 cents. The purchase of one share entitles the owner of that share to literally share in the ownership of the company, a fraction of the decision-making power, and potentially a fraction of the profits, which the company may issue as dividends. In other jurisdictions, however, shares of stock may be issued without associated par value. Stock also capital stock of a corporation , is all of the shares into which ownership of the corporation is divided. Stocks are essentially capital raised by a company through the issuing and subscription of shares. Shares represent a fraction of ownership in a business. They may also simply wish to reduce their holding, freeing up capital for their own private use. Unlike bonds, preferred stock is not debt that must be repaid. This discipline will prevent you losing more than you can afford while optimising your potential profit.