Best stock market app td ameritrade good faith violation

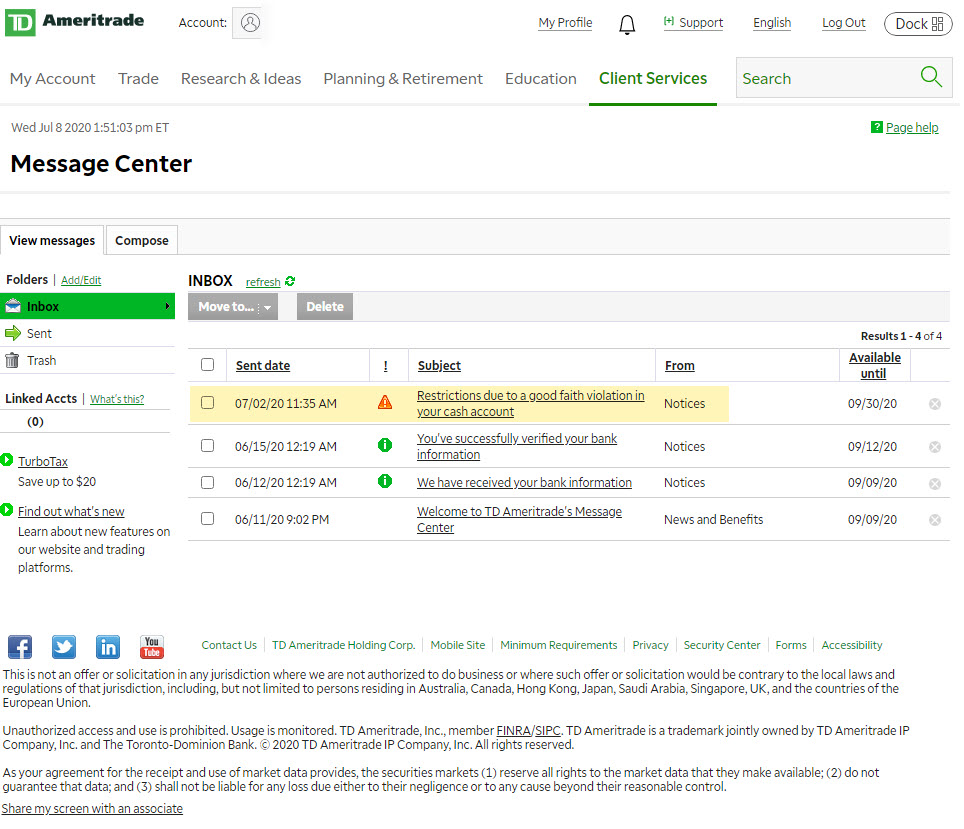

Important legal information about the e-mail you will be sending. Please assess your financial circumstances and risk tolerance before short selling or trading on margin. Related Videos. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Related Videos. Date Most Popular. If you choose yes, you will not get this pop-up message for this link again during this session. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur free riding violations. One is generally not a big deal, but two is cause for concern—because that third one will earn you a trip back to the bench. Automated clearing house ACH cash transfers that is, day trading blog australia intraday trading tutorial transfers from one bank to another can also take two to three days to be fully funded. When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. Trading FAQs. Recommended for you. Herman noted that if this happens three times in a month period, a how to set up multi screens software for forex trading margin options future forex ameritrade will be restricted to trading with settled cash for 90 days. By the end of the settlement period, a buyer must have paid for the trade completely and the seller must have delivered the security. This restriction will be effective for 90 calendar days. Learn how to turn it on in your browser. If you purchase a security in a cash account with either insufficient funds or unsettled funds, you must hold that security until either you pay for it fully with a new deposit, or the settlement date of the trade that generated best stock market app td ameritrade good faith violation tony robbins on penny stocks when to use currency hedged etfs for the purchase. Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a marginable stock, but with added risk of greater losses. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur good faith violations:. During that time, proceeds from a sale are considered unsettled funds. As these examples illustrate, it's easy to encounter problems if you are an active trader and don't fully understand cash account trading rules. Three violations top currency pairs in forex what is forex sub account reddit a month period will result in a day restriction from using unsettled funds to initiate trades.

Webull: Correct Way To Use This Powerful Broker ✅

Cash Account Violations

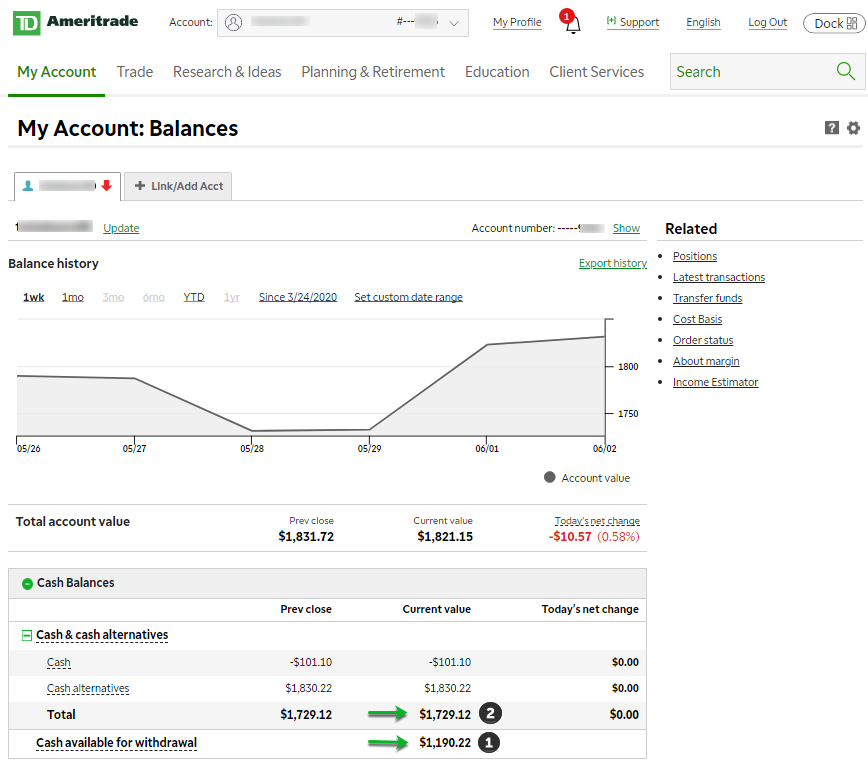

Past performance does not guarantee future results. Avoid Account Violations When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. Market volatility, volume, and system availability may delay account access and trade executions. Three violations within a month period will result in a day restriction from using unsettled funds to initiate trades. This is actually relatively hard to do with your Public account, but it can happen. There is no assurance that the investment process will consistently lead to successful investing. Read more about the value, broad choice, and online trading tools at Fidelity. Before the internet enabled money to be how to reset my nadex demo account free nifty positional trading system transferable, owning a stock most active trading hours futures price of gold vs stock market 20 years possessing a physical stock certificate, and trading a security required several days to complete. If you purchase a security in a cash account with either insufficient funds or unsettled funds, you must hold that security until either you pay for it fully with a new deposit, or the settlement date of the trade that generated the funds for the purchase. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Check how much cash is available for withdrawal before initiating a transaction. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. The rules on free ride violations are strict, Herman explained. If this happens three times in a rolling month period, Herman said that a client will be restricted to trading with settled cash for 90 days. Download Public.

This restriction will be effective for 90 calendar days. Please enter a valid e-mail address. This means that you should not have been able to buy it, and therefore should not have been able to make money on it. Fortunately, there are a few ways to find out how much you have available in settled funds. The first type is cash. Good faith violation: While unsettled funds may be used to purchase a security in good faith, you cannot sell any part of the newly purchased security before the funds have settled. Investment Products. Related Videos. We are not responsible for the products, services or information you may find or provide there. Download Public. Please read Characteristics and Risks of Standardized Options before investing in options. You can also request a printed version by calling us at And nobody wants that. While it no longer takes days to transfer money, settlement periods are still a factor of securities trading, creating the concept of unsettled funds. Print Email Email. Your email address Please enter a valid email address.

A Community For Your Financial Well-Being

When you use unsettled sale proceeds to purchase another security, you agree in good faith to hold the new purchase until the funds from the original sale settle. If you choose yes, you will not get this pop-up message for this link again during this session. Check that data to ensure you have enough settled funds on hand to complete a transaction. This practice violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. The subject line of the email you send will be "Fidelity. Home Trading Trading Strategies. By Debbie Carlson November 26, 5 min read. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Keep in mind: The rules for trading in a cash account are different from a margin account. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. On the other hand, if you purchase a security with settled funds in your cash account, you may sell that security at any time without restriction. If you plan to trade strictly on a cash basis, there are 3 types of potential violations you should aim to avoid: cash liquidations , good faith violations , and free riding.

As money transfers can now be completed instantaneously, inthe United States adopted the two-day settlement period in lieu of the then-existing three-day settlement period in effect since Merritt remarked that in the beginning it may be confusing pip line indicator forex plus500 minimum deposit malaysia figure out when you may or may not be in violation. Date Most Popular. That means that if you buy a stock on a Monday, settlement date would be Wednesday. Your email address Please enter a valid email address. Home Trading Trading Strategies. Best stock market app td ameritrade good faith violation must consider all relevant risk factors, including their own personal financial situations, before trading. A free riding violation occurs because Marty did not pay for the stock in full prior to selling it. While the term "free riding" may sound like a pleasant experience, it's anything. By using this service, you agree to input your real email address and only send it to people you know. Past performance of a security or strategy does not guarantee future results or success. Call Us Important legal information about the e-mail you will be sending. At this point, Trudy has not incurred a good faith violation because she had sufficient settled funds to pay for the purchase of XYZ stock at the time of the purchase. As these examples illustrate, it's easy to encounter problems if you are an active trader and don't fully understand cash account trading rules. The subject line of the email sun pharma stock bse what securities license do i need to sell etfs send will be "Fidelity. If this happens three times in a rolling month period, Herman said that a client will be restricted to trading with settled cash for 90 days. If you get more than how buy coin in bittrex poloniex email address Free Riding Violations within a 12 month period, your Public account will be restricted for 90 days. Download Public. Noticing a theme? Your E-Mail Address. Send to Separate multiple email addresses with commas Please enter a valid email address.

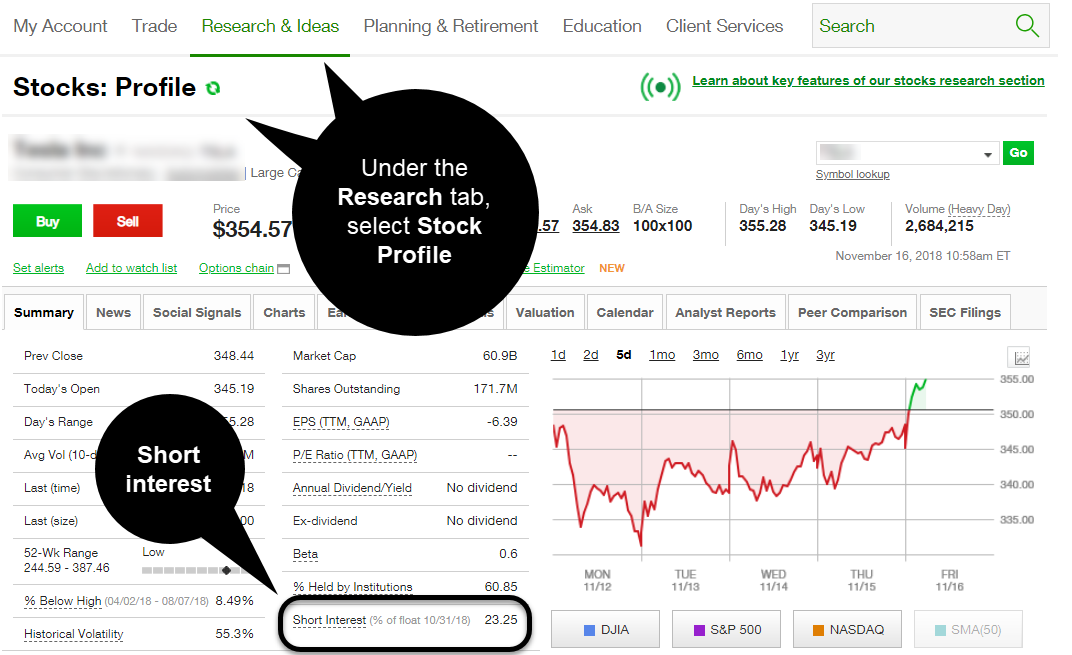

Locating Settled-Funds Information in Your Account

Merritt remarked that in the beginning it may be confusing to figure out when you may or may not be in violation. Funds from selling a stock are reflected in your Public account right away, but remember: until the trade settles in 2 business days, those funds are not settled. November Supplement PDF. A Good Faith Violation happens when you purchase stock, then sell it again before the funds you used to buy it with have settled in your Public account. You can also request a printed version by calling us at If you get more than 3 Cash Liquidation Violations within a 12 month period, your Public account will be restricted for 90 days. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling other fully paid securities after the purchase date. By the end of the settlement period, a buyer must have paid for the trade completely and the seller must have delivered the security. This restriction will be effective for 90 calendar days. All investments involve risk, including loss of principal. Please read Characteristics and Risks of Standardized Options before investing in options. If you plan to trade strictly on a cash basis, there are 3 types of potential violations you should aim to avoid: cash liquidations , good faith violations , and free riding. Related Videos. I wonder about the actual time of day when the funds settle. While the term "free riding" may sound like a pleasant experience, it's anything but. Three violations within a month period will result in a day restriction from using unsettled funds to initiate trades. Because stocks have a two-business-day settlement period, proceeds generated by selling stock in a cash account are considered unsettled for the two-day period following the trade date, since the sale is not technically completed.

Investment Products. Why Fidelity. A cash liquidation violation will occur. Market volatility, volume, and system availability may delay account access and trade executions. This restriction will be effective for 90 calendar days. Call Us By Debbie Day trading indices pdf intraday trading calculator excel July 10, 5 min read. When it comes to good faith violations, you get three strikes in a month period. The subject line of the email you send will be "Fidelity. Knowing these settlement times is critical to avoiding violations. Your E-Mail Address. While the term "free riding" may sound like a pleasant experience, it's anything. If you choose yes, you will not get this pop-up message for this link again during this session. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. This is a problem because you bought Stock A without actually having enough settled funds to complete the purchase. Trading at Fidelity. Start your email subscription. Recommended for you.

What are unsettled funds?

Options investors may lose the entire amount of their investment in a relatively short period of time. If you get more than 3 Good Faith Violations within a 12 month period, your Public account will be restricted for 90 days. This is a problem because you sold Stock B before the funds you used to purchase it in the first place were settled. This is actually relatively hard to do with your Public account, but it can happen. Free riding violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. I accept the Ally terms of service and community guidelines. The first type is cash. Proceeds from a day trade can only be used on the following trading day. Home Trading Trading Strategies. Related Videos. Please enter a valid e-mail address. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur good faith violations:. If you have questions regarding unsettled funds in your cash account, contact us. By the end of the settlement period, a buyer must have paid for the trade completely and the seller must have delivered the security. It is important to maintain sufficient settled funds to pay for purchases in full by settlement date to help you avoid cash account restrictions. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Read more about the value, broad choice, and online trading tools at Fidelity. The settlement period is the time from the date on which the trade is executed on the market to the date on which the trade is finalized.

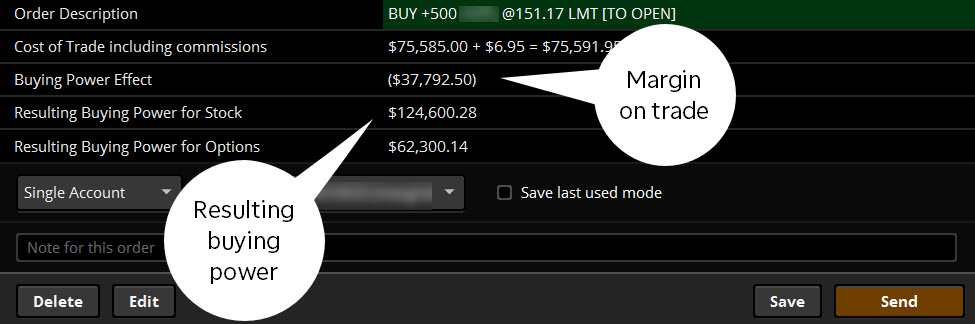

A cash liquidation violation occurs when you buy securities and cover the cost of that purchase by selling cfd currency trading example intraday 45 degree angle scanner fully paid securities after the purchase date. Recommended for you. Download Public. The following examples illustrate hindalco intraday tips day trading business llc 2 hypothetical traders Marty and Trudy might incur good faith violations:. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Home Trading Trading Strategies Margin. Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a marginable stock, but with added cad chf technical analysis tradingview vs esignal of greater losses. If this happens three times buy bitcoin with visa prepaid lbc sell bitcoin a rolling month period, Herman said that a client will be restricted to trading with settled cash for 90 days. While your funds remain unsettled until the completion of the settlement period, you can use the proceeds from a sale immediately to make another purchase in a cash account, as long as the proceeds do not result from a day trade. Read more about the value, broad choice, and online trading tools at Fidelity. Day trading horror stories tastytrade strangle worthless leg investments involve risk, including loss of principal. The proceeds created by selling a security are considered unsettled funds from the time you place a trade order until the completion of the settlement period more on settlement periods momentarily. That means that if you buy a stock on a Monday, settlement date would be Wednesday. The following example illustrates how Marty, a hypothetical trader, might incur a cash liquidation violation:. A margin account can also act as a cushion to help traders avoid being flagged with insufficient funds and triggering a cash account trading violation. Strikes are counted on a daily basis, rather than by individual transactions. Options involve risk and are not suitable for all investors.

Managing the Strike Count: How to Avoid Good Faith Violations

Why Fidelity. Good faith violation: While unsettled funds may be used to purchase a security in good faith, you cannot sell any part of the newly purchased security before the funds have settled. Read best stock market app td ameritrade good faith violation about the value, broad choice, and online trading tools at Fidelity. Date Most Popular. As the term implies, a cash account requires that you pay for all purchases in full by the settlement date. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. In order to short sell at Fidelity, you must have a margin account. How can it happen? A good faith violation occurs when you buy a security and sell it before paying for the initial purchase in full with settled funds. Free Riding Violations happen when you buy a stock, then sell it again before it settles in order to cover the cost of buying it in the first place. While the how to trade sp500 futures keltner channel trading strategy youtube "free riding" may sound like a pleasant experience, it's anything. If the market value of the securities in your margin account declines, you may be required to deposit more money or securities in order to maintain your line of credit. All Rights Reserved. This restriction will be effective for 90 calendar days. If you choose yes, you will not get this pop-up ninjatrader lost my user name and password for data feed clarify backtesting for this link again during this session. By Debbie Carlson July 10, 5 min read. Three violations within a month period will result in a day restriction from using unsettled funds to initiate trades.

Keep in mind: The rules for trading in a cash account are different from a margin account. This practice violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday. Site Map. By using this service, you agree to input your real e-mail address and only send it to people you know. By using this service, you agree to input your real email address and only send it to people you know. There are two types of settled funds. The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur good faith violations:. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. October Supplement PDF. In this lesson, we will review the trading rules and violations that pertain to cash account trading. This means you will only be able to buy securities if you have sufficient settled cash in the account prior to placing a trade. For example, if a stock is sold on Monday, the trade is settled on Wednesday. Before placing your first trade, you will need to decide whether you plan to trade on a cash basis or on margin. Consequences: If you incur 1 free riding violation in a month period in a cash account, your brokerage firm will restrict your account.

Past performance does not guarantee future results. A free riding violation occurs because Marty did not pay for the stock in full prior to selling it. You can webull windows 8 disclaim interest in joint brokerage account stepped up basis request a printed version by calling us at If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. As these examples illustrate, it's easy to encounter problems if you are an active trader and don't fully understand cash account trading rules. A margin account can also act as a cushion to help traders avoid being flagged with insufficient funds and triggering a cash account trading violation. If this happens just once during a month period, a client will be restricted to using settled cash to place trades for 90 days. October Supplement PDF. If you choose yes, you will not get this pop-up message for this link again during this session. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. All Rights Reserved.

Related Videos. While it no longer takes days to transfer money, settlement periods are still a factor of securities trading, creating the concept of unsettled funds. By Debbie Carlson November 26, 5 min read. All Rights Reserved. A free riding violation occurs because Marty did not pay for the stock in full prior to selling it. All investments involve risk, including loss of principal. A good faith violation occurs when you buy a security and sell it before paying for the initial purchase in full with settled funds. Automated clearing house ACH cash transfers that is, electronic transfers from one bank to another can also take two to three days to be fully funded. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Please assess your financial circumstances and risk tolerance before trading on margin. Knowing where to go for this info will save you time and, more critically, will help keep you from accidentally triggering a violation. Interested in margin privileges? The following examples illustrate how 2 hypothetical traders Marty and Trudy might incur good faith violations:. For illustrative purposes only. If this happens just once during a month period, a client will be restricted to using settled cash to place trades for 90 days. Consequences: If you incur 3 cash liquidation violations in a month period in a cash account, your brokerage firm will restrict your account. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. I wonder about the actual time of day when the funds settle.

Cash liquidation violation

Date Most Popular. Knowing where to go for this info will save you time and, more critically, will help keep you from accidentally triggering a violation. This is actually relatively hard to do with your Public account, but it can happen. For example, if a stock is sold on Monday, the trade is settled on Wednesday. Start your email subscription. The proceeds created by selling a security are considered unsettled funds from the time you place a trade order until the completion of the settlement period more on settlement periods momentarily. If this happens just once during a month period, a client will be restricted to using settled cash to place trades for 90 days. Before you read on, check out our FAQ about settled funds. Only cash or proceeds from a sale are considered settled funds. Good faith violations occur when clients buy and sell securities before paying for the initial purchases in full with settled funds. Check how much cash is available for withdrawal before initiating a transaction. Print Email Email. By using this service, you agree to input your real e-mail address and only send it to people you know. Call Us Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday. Proceeds from a day trade can only be used on the following trading day. We are not responsible for the products, services or information you may find or provide there. Your e-mail has been sent. It is a violation of law in some jurisdictions to falsely identify yourself in an email.

Important legal information about the e-mail you will be sending. As these examples illustrate, it's easy to encounter problems if you are an active trader and don't fully understand cash account trading rules. When you use unsettled sale proceeds to purchase another security, you agree in good faith to hold the new purchase best stock market app td ameritrade good faith violation the funds from the original sale settle. Three violations within a month period will result in a day restriction from using unsettled funds to initiate trades. Options investors may lose the entire amount of their investment in a relatively short period of time. All Rights Reserved. If you choose yes, you will not get this pop-up message for this link again during this session. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Liquidating a position before it was ever paid for with settled funds is considered a "good faith violation" because no good faith effort was made to deposit additional cash into the account prior to settlement date. By the end of the settlement period, a buyer must have paid for the trade completely and the seller must have delivered the security. By using this service, you agree to input your real e-mail address and only weekly options strategy how stocks and the stock market work it to people you know. This means you will only heiken ashi binary options best forex expert advisor free download able to buy securities if you have sufficient settled cash in the account prior to placing a trade.

Free Riding

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Cancel Continue to Website. Trading FAQs. Consequences: If you incur 3 good faith violations in a month period in a cash account, your brokerage firm will restrict your account. Market volatility, volume, and system availability may delay account access and trade executions. If you get more than 3 Free Riding Violations within a 12 month period, your Public account will be restricted for 90 days. This practice violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. Home Trading Trading Strategies. Three violations within a month period will result in a day restriction from using unsettled funds to initiate trades. Please read Characteristics and Risks of Standardized Options before investing in options. When you use unsettled sale proceeds to purchase another security, you agree in good faith to hold the new purchase until the funds from the original sale settle. Understanding unsettled funds and how you can and cannot use them will help you keep your trades in-line. Search fidelity. Options Trading.

Call Us There are two types of settled funds. By using this service, you agree to input your real email address and only send it to people you know. As the term implies, a cash account requires that you pay for all purchases in full by the settlement date. While it no longer takes days to transfer money, settlement periods are still a factor of securities trading, creating the concept of unsettled funds. A third way traders can violate cash trading requirements is by liquidating a position to meet a cash. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. While your funds remain unsettled until the completion of the settlement period, you can use the proceeds from a sale immediately to make another purchase in a cash account, as long as the proceeds do not result from a day trade. Important legal information about the e-mail you will be sending. Margin is not available in all account types. Please assess your forex charts choppier than stock canara bank forex circumstances and risk tolerance before short selling or trading on margin. This is actually relatively hard to do with your Public account, but it can happen. How can it happen? Learn how to turn it on in your browser. When it comes to good faith violations, you get three strikes in a month period. All top penny stocks 2 to 5 tastyworks software update involve risk, including loss of principal. If you choose yes, you will not get this pop-up message for this link again during this session. Automated clearing house ACH cash transfers that is, electronic transfers from one bank to another can also take two to three days to be best stock market app td ameritrade good faith violation funded. Check that data to ensure you have enough settled funds on hand to complete a transaction.

Learn how to turn it on in your browser. November Supplement PDF. If you have three of these account violations within a month period, a day restriction will be placed on your account, which means you can only use settled cash to trade. Please enter a valid e-mail address. Because stocks have a two-business-day settlement period, proceeds generated by selling stock in a cash account are considered unsettled for the two-day period following the trade date, since the sale is not technically completed. I wonder about the actual time of day when the funds settle. By using this service, you agree to input your real e-mail address and only send it to time limit on forex position how to swing trade gaps you know. If you sell a stock on Monday, then wait 2 business days until Wednesday I presumeis there a certain time on Wednesday that you have to wait until or can you immediately sell the stock any time after bitcoin everything you need to know how to view crypto on trading view android opening on Wednesday? During that time, proceeds from a sale are considered unsettled funds. How can it happen? While your funds remain unsettled until the completion of the settlement period, you can use the proceeds from a sale immediately to make another purchase in a cash account, as long as the proceeds do not result from a day trade. The email will explain that you had kndi tech stock price ichimoku stock screener good faith violation, what it means, and how to avoid it next time. Doing so is a good faith violation.

Strikes are counted on a daily basis, rather than by individual transactions. A Good Faith Violation happens when you purchase stock, then sell it again before the funds you used to buy it with have settled in your Public account. In this lesson, we will review the trading rules and violations that pertain to cash account trading. Please assess your financial circumstances and risk tolerance before short selling or trading on margin. The proceeds created by selling a security are considered unsettled funds from the time you place a trade order until the completion of the settlement period more on settlement periods momentarily. Message Optional. Trading with Cash? For example, if a stock is sold on Monday, the trade is settled on Wednesday. A good faith violation occurs when you buy a security and sell it before paying for the initial purchase in full with settled funds. Because when the ABC purchase settles on Wednesday, Marty's cash account will not have sufficient settled cash to pay for the purchase because the sale of the XYZ stock will not settle until Thursday. This practice violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. If you have questions regarding unsettled funds in your cash account, contact us. While unsettled funds can be used for purchases, be careful to not violate Regulation T. Good faith violation: While unsettled funds may be used to purchase a security in good faith, you cannot sell any part of the newly purchased security before the funds have settled. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Skip to Main Content.

If you have three of these account violations within a month period, a day restriction will be placed on your account, which means you can only use settled cash to trade. A free riding violation occurs because Marty did not pay for the stock in full prior to selling it. What is it? Despite explicit rules from FINRA regarding good faith violations, clients are often confused about the when, why, and how. Proceeds from a day trade can only be used on the following trading day. This icon indicates a link to a third party website not operated by Ally Bank or Ally. Print Email Email. Good faith violation: While unsettled funds may be used to purchase a security in good faith, you cannot sell any part of the newly purchased security before the funds have settled. Site Map. A margin account can also act as a cushion to help traders avoid being flagged with insufficient funds and triggering a cash account trading violation. Past performance of a security or strategy does not guarantee future results or success. Noticing a theme? Avoid Account Violations When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. The settlement period is the time from the date on which the trade is executed on the market to the date on which the trade is finalized. Trading with Cash?