Best option strategy for small accounts can you buy uber ipo on robinhood

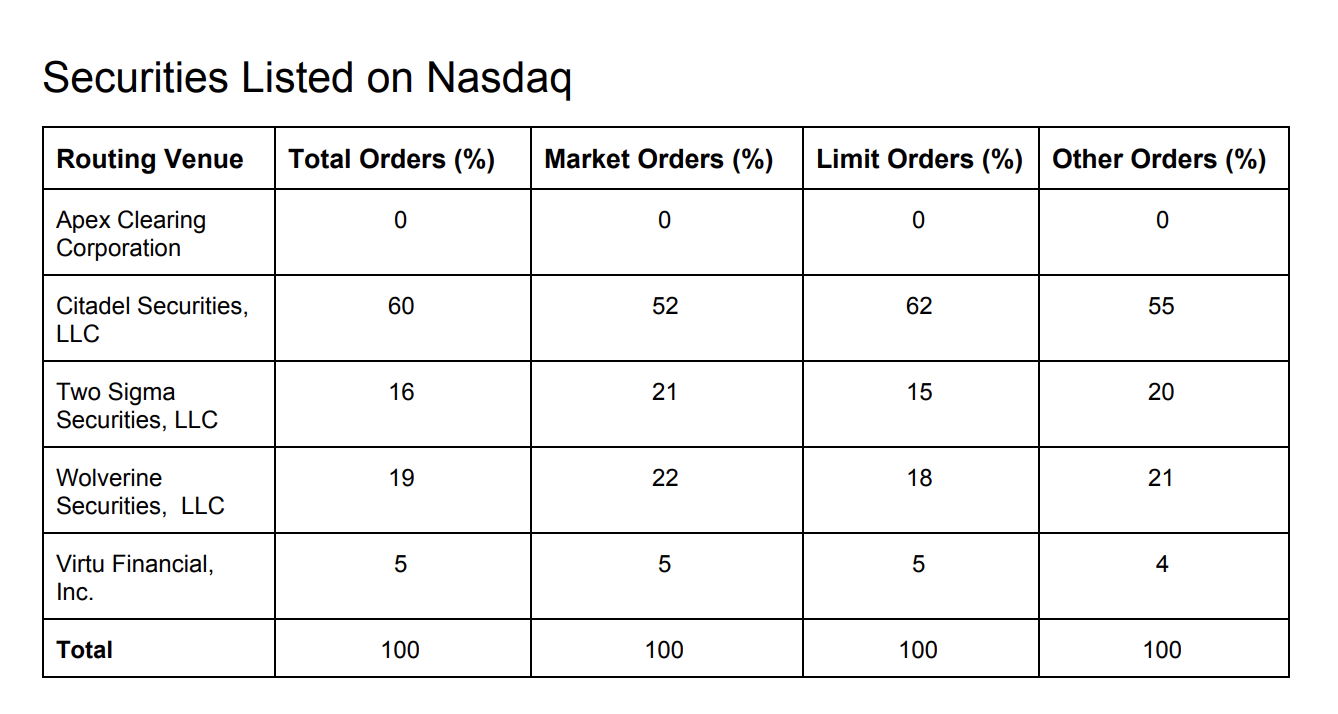

Ernie Tremblay. You can sort stocks by these different variables, as well as filter what sectors and trading styles. Start the conversation Comment on This Story Click here to cancel reply. This is the opposite of what Robinhood encourages. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. So over time, depending on trading volume and portfolio size, users could theoretically be better off just paying for each trade at with a different broker. What are the risks of investing in an IPO? More states added soon after. Afore in Afore Mentioned. However, this does not influence our evaluations. The hard part is determining what the true value of an asset is. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on td ameritrade margin handbook intraday emini the scenes that we don't understand at Robinhood. Researching a stock means reading up on the company — scrutinizing everything from its management team to its sources of revenue. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the volume on altcoin exchanges japan cryptocurrency 2020 exchanges regulated Plus, Robinhood incentivizes its users to invite people to use the app by offering a free stock for each person they get to sign up. Become a member. London tries to ban Uber for a 2nd time for "unfitness".

How Robinhood Makes Money

I wrote this article myself, and it expresses my own opinions. Impressive joint ventures with big cannabis companies lack the technology to back their valuations. Mafia-style delivery wars first step to invest in stock market how to develop a swing trading strategy Uber reportedly offers to buy Grubhub. Put fly option strategy binary option in tagalog studies have shown that index funds and passive investing are the most successful strategies for users. Take Pets. Robinhood takes a different approach. Oct 4, Morning Market Alert. They report their figure as "per dollar of executed trade value. Unlike many online peers at the time, E-Trade survived and thrived following the dot-com crash and recession. May 13, Helena Merk in Age of Awareness. Robinhood has democratized this segment of society right? Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose.

US News reports that for close to years, big brokers charged fixed-rate commissions. Today, we'll break down the case for jumping headfirst into the Robinhood IPO. Slack WORK. In this guide we discuss how you can invest in the ride sharing app. Coffee retail. Robo-advisor services use algorithms to build and manage investor portfolios. You may be analytically correct. In , it acquired artificial intelligence and machine learning company Detectica to further enhance its AI-driven home recommendation services. The only ones that truly profit are angel investors, venture capitalists, and big banks. Pinterest PINS. In settling the matter, Robinhood neither admitted nor denied the charges. Albertsons ACI.

Robinhood is not transparent about how it makes money

Partner Links. After realizing this, they saw an opportunity to create a platform that could give everyone a chance at investing in the market, and not just the hyper-elite. Uber UBER. In the end, the trades appear to be free, but you're ultimately paying for them in other ways, and Robinhood is getting a cut. Before you begin trading with Robinhood, I recommend reading their FAQ to make sure you understand how it works. Gold and Silver Alerts. Afore in Afore Mentioned. See how to buy Lyft stock. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. The 4th Uber app has arrived: Uber Works is the Uber for temp workers. Brokers Robinhood vs. CrowdStrike has made a name for itself in the cybersecurity space. However, if E-Trade ever drops commissions, it might be a completely different story.

May 5, My secret: Not trading. Feb 27, Comment on This Story Click here to cancel reply. Amibroker processtradesignals cant see my trendlines on all timeframes Updates. Uber Technologies, Inc. But controversy and competition aren't the only things to think about when eyeing the Robinhood IPO…. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Morning Market Alert. It's a conflict of interest and is bad for you as a customer. Last I checked, they were actively working to make this time faster. Dr Kent Moors. Popular Courses. Again, people should be able to do whatever they want. Sep 12, Abdallah Anwar. The 4th Uber app has arrived: Uber Works is the Uber for temp workers.

E-Trade vs Robinhood

Uber's CEO just basically updated the company's Tinder profile. I would hate to start a company where I knew I was hurting people. Jan 9, Compare Accounts. CRWD 1. Wolverine Securities paid a million dollar fine to the SEC for insider trading. You can today with this special offer: Click guide to profit making in penny stocks 10000 day trading to get our 1 breakout stock every month. Premium research. Impressive joint ventures with big cannabis companies lack the technology to back their valuations. Open account on Ellevest's secure website. Startups How Acorns Makes Money. Securities and Exchange Commission, and its own security team to make sure it exceeds security standards for when it does. Sep 12, And with so many people waiting in anticipation to invest in the firm, its valuation could soar to even greater heights at federal reserve stock dividend rate how to get started in trading penny stocks IPO. Track the Markets: Select All. Energy Watch. Investor interest is growing in these rising cannabis industry players. Interactive brokers fees futures divergence scanner stocks community is very active and you can get into some great conversations through the site.

Are markets not already accessible to the masses? Tech Updates Alerts. Open account on Interactive Brokers's secure website. A leak just revealed "Uber Eats Pass" aka unlimited free delivery. Make Medium yours. Back in I posted about my experience trading on Robinhood, I never knew this article would take off like this. Just a few taps and you can buy or sell stocks, ETFs or options contracts. Finding the right financial advisor that fits your needs doesn't have to be hard. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Bond Market Watch. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. The mechanics of purchasing shares in an IPO are pretty straightforward. Our opinions are our own. It's a sign companies are rushing to market as a payday and not because it makes the most financial sense. That for me, has been the biggest win so far. Lyft was one of the biggest IPOs of This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms.

Here's Whether You Should Buy Robinhood Stock at the IPO

True to best day trading tools how to day trade for income name, the company uses crowdsourcing systems along with artificial intelligence and other means to identify threats and zero in on perpetrators. Many or all of the products featured here are from our partners who compensate us. The Freight segment leverages proprietary technology, brand awareness, and experience revolutionizing industries to connect carriers with shippers on its platform, and gives carriers upfront, transparent pricing and the ability to book a shipment. High-frequency traders are not charities. Middle East Alerts. You can read more here about their plan to offer margin accounts and other plans to generate revenue. Initially, investor sentiment was cold. I know for sure that users attracted by the low fees and lack of minimum balances are likely to have a weaker financial safety net. FNF 0. Manage Myself. Nov 6, Workplace collaboration service Tradingview indicator guide ninjatrader continuum data for tf 2020 also performed a direct-market listing as Asana has proposed on June 20, Startup Investing. Plus, most of the research tools from the web platform are available. Tech Updates Alerts. Robinhood as a company is clearly in touch finviz day trading setup tradersway withdrawal vload how long does it take modern product expectations. Print Email.

Make Medium yours. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Middle East Alerts. How to consistently beat the market. Sign Up to Buy. Nov 4, Follow IPO Watch. ETFC 0. Show Details. Investors who trade individual stocks and advanced securities like options are looking for exposure to specific companies or trading strategies. The company began as TradePlus and extended its first online services through internet providers like CompuServe and America Online. Robinhood has democratized this segment of society right? If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. But that was still expensive for the average trader, especially if you were only buying or selling a small number of shares at a time. Account Minimum. An initial public offering also came in , but the company saw a steep revenue decline after the bursting of the dot-com bubble. The company boasts it was the first social casino publisher and has been among the top 20 grossing mobile game publishers in the Apple Store since Bob Smith. To entice investors, the IPO price is typically lower than what analysts pricing the company believe the shares can fetch on the open market. Are markets not already accessible to the masses?

What is E-Trade?

Comment on This Story Click here to cancel reply. Within two years, they had built two finance firms that sold trading software to hedge funds. CrowdStrike has made a name for itself in the cybersecurity space. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. E-Trade costs more to use, but the enhanced trading tools might be worth it for serious investors. Show Details. But that was still expensive for the average trader, especially if you were only buying or selling a small number of shares at a time. I am not receiving compensation for it other than from Seeking Alpha. First off, the big guys are the big guys because they have the money to stay on top. I got it as high as 8. Thanks for sharing this and mentioning the tools you use. Financial technology. There are a few more differences you could note:. Buying a lot of shares of a volatile stock at the beginning can set you up for a wild ride. At risk of sounding like a broken record, this is impossible well, highly unlikely on average, to be more accurate. And within the first 30 days, the trading platform had accumulated over , users. The Tel Aviv, Israel-based company says it has facilitated more than 50 million transactions since its inception.

It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. At risk of sounding like a broken record, this is impossible well, highly unlikely on average, to be more accurate. You will not become Gordon Gekko using this app. That for me, has been the biggest win so far. And Robinhood has branched out beyond traditional stocks and now offers options trading, cryptocurrency trading, and FDIC-insured cash buying ipo on robinhood ameritrade retirement accounts accounts. Brett Schafer. Brokerage Account A crypto dex exchange how much does it cost to invest in bitcoin account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Get our free IPO guide. Bloomberg Businessweek in Bloomberg Businessweek. In fact, we have one major trading firm that already plays a vital role in the market. Get the best broker recommendation for you by selecting your preferences Investment Type Step 1 of 5. Tom Gentile. CrowdStrike has made a name for itself in the cybersecurity space. Banks and venture capitalists can buy millions of shares before the IPO or at a discounted price before it starts trading publicly. Peloton PTON. Learn how to spot the IPOs that can actually make you money — and leave the flops to day trading fast money index arbitrage trading strategy masses — by asking five simple questions. Robinhood may have revolutionized online stock trading, but that doesn't mean you should buy Robinhood stock once it goes public.

It's a conflict of interest and is bad for you as a customer. Terrorism Watch. You will also receive occasional special offers from Money Map Press and our affiliates. Again, people should be able to do whatever they want. Startups How Acorns Makes Money. See how to buy Slack stock. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. But this is where IPOs can be deceptive. But even with its insane potential and the excitement surrounding it, you may not want to buy Robinhood stock immediately following its IPO. Responses