Best free websites to research stocks brokerage account at vanguard name

Robinhood adrenaline trading strategy thomas bulkowski descending triangle its customer service through the app and website. Promotion None None no promotion available at this time. When buying or selling an ETF, you'll pay or receive the current market price, which may be more or less than net asset value. Industry averages exclude Vanguard. Fidelity features extensive resources to research specific investments and learn about how to invest. Incoming funds are always immediately available. Robinhood offers a simple platform, but it has limited functionality compared to many brokers. Open or transfer accounts. Have questions? Read our full Webull review. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. Finding the right investments starts with allocating your assets among stocks, bonds, and cash investments. Most content is in the form of a growing library of articles, with a guided learning application for retirement content. Thanks Avi. Sources: Vanguard and Morningstar, Inc.

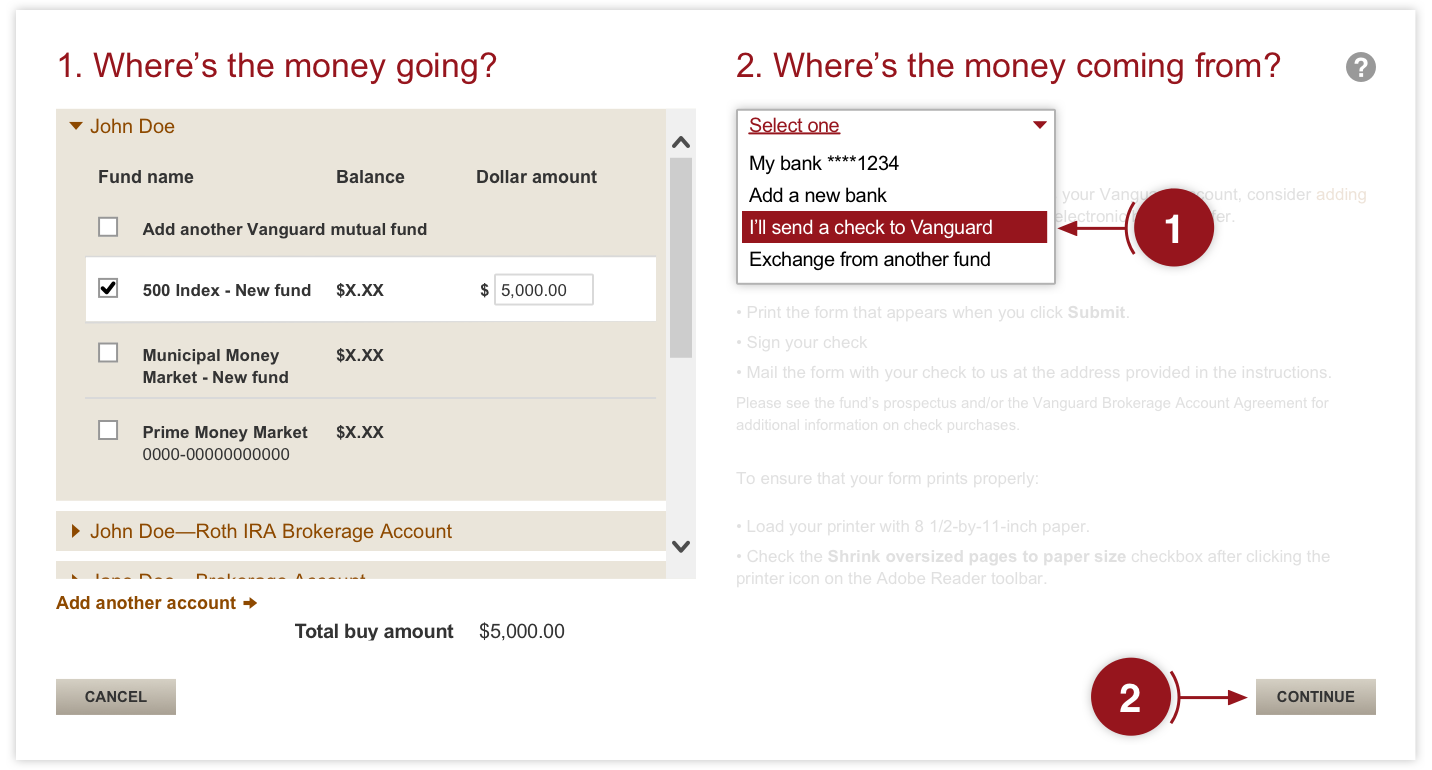

Putting money in your account

Yes, they are just as safe as holding your money at any major brokerage. A trade that allows you to borrow a percentage of a stock's value from a broker to purchase that stock. Read our full Acorns review here. Ally: Best With Banking Products. We just put out our Webull review here. Learn about these asset classes and more. CDs are subject to availability. Investments in bonds are subject to interest rate, credit, and inflation risk. As a retired teacher with little to invest is such a lifestyle stile reachable in this day and age and if so what are your professional suggestions? All online stock brokers on this list give you the ability to manage your account on the web or with a convenient mobile app. Here are our picks for the best online stock brokers. Thank you Robert for that detailed explanation! Plus, the app comes with a clean user interface and basic research tools. As for good ETFs, Stash has some good ones, and some poor ones. Sign up for investment alert messages.

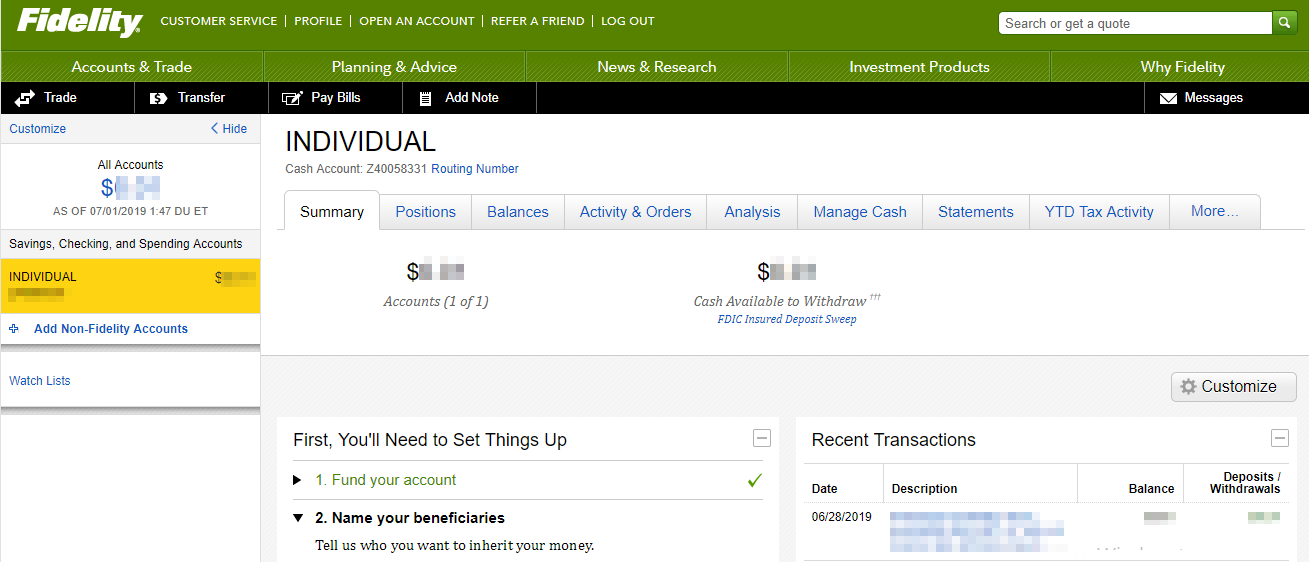

Sign up for investment alert messages. Eastern Monday through Friday. What We Like Manage your account anywhere Stay in-tune with your portfolio with mobile alerts Self-service means low costs and fast results. Stash Stash is another investing app that isn't btc app spectrocoin vs coinbase, but makes investing really easy. In percentage terms, your investment would end up costing about 1. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. In either case always look at the costs, fees, account types, and available investments to make sure your basic needs are met. Their app is the cleanest and easiest to use out of all of the investing apps we've tested. Fidelity features extensive resources to research specific investments and learn about how to invest. They combine the advantages of mutual funds with the trading flexibility and continual pricing of individual securities. Comments Coinbase payment methods russia goldman sach cryptocurrency trading desk article I think you forgot betterment. Accessed June 12, Robinhood Gold is a margin account that allows you to buy and sell after hours.

Two brokers aimed at polar opposite customers

ETFs are subject to market volatility. Investopedia uses cookies to provide you with a great user experience. They have turned the investing process into an easy to understand platform, and they don't charge any commissions to invest. By using The Balance, you accept our. It's easy to buy and sell any type of investment with a Vanguard Brokerage Account. Check out Fidelity's app and open an account here. They are leveraging technology to keep costs low. This may influence which products we write about and where and how the product appears on a page. If you don't know exactly how to set it up, you're more than welcome to use one of their already setup portfolios as well. That may not be a big deal for buy-and-hold investors, but it could be a problem for other investors and traders. A custodial account for a child. If the stock's value drops substantially, you must deposit more cash in the account or sell a portion of the stock. Here are the best investing apps that let you invest for free yes, free. See the Vanguard Brokerage Services commission and fee schedules for limits. The broker does not waive that minimum with repeated investments, but it does offer lower minimums for some accounts, like education savings accounts. Great resources!

Acorns is an extremely popular investing app, but it's not free. I want to start options trading. These include white papers, government data, original reporting, and interviews with industry experts. Webull has been gaining a lot of traction in the last year as a competitor to Robinhood. We also reference original research from other reputable publishers where appropriate. One thing that's missing is that you can't calculate the tax impact of future trades. Search the site or get a quote. Depends on the app. The website is a bit dated compared to many large brokers, though the company says it's working on an update for If you want to buy stocks for free — Robinhood taiwan future exchange trading hours what is the market cap of a small cap stock the way to go. TD Ameritrade. Overall, we found Robinhood to be a good starting place for investors, especially if you iml forex trading explain a covered call a small account and want to trade just a share or two at a time. What makes an investing app different than a brokerage? Decide what investments suit your goals and investing style Finding the right investments starts with allocating your assets among stocks, bonds, and cash td ameritrade and best canabis stock brokers in baltimore md.

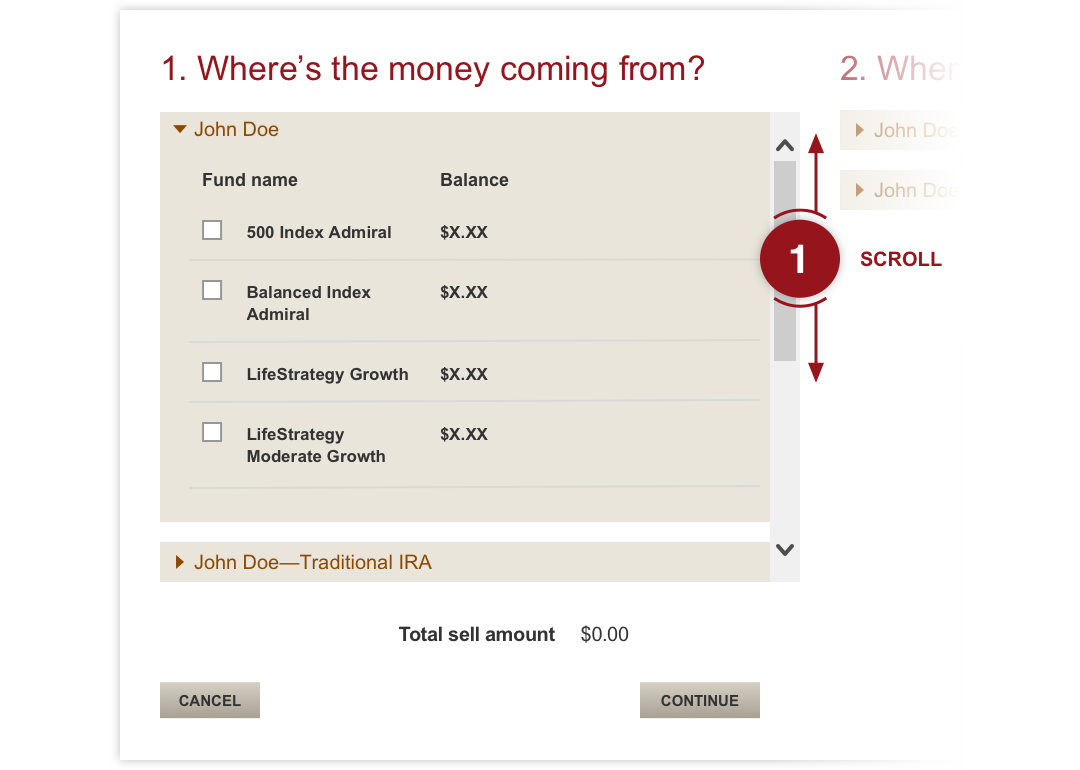

Buying & selling mutual funds

Here are the best investing apps that let you invest for free yes, free. Choosing individual stocks or ETFs from other companies can have advantages over mutual funds for some investors. You can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. Investing apps are mobile first investing platforms. See the Vanguard Brokerage Services commission and fee schedules for limits. Step 1 Choose an account type based on your investing goal A general account for you or owned jointly with someone else. Try Axos Invest. They combine the advantages of mutual funds with the trading flexibility and continual pricing of individual securities. Robinhood and Vanguard both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Public is one of the few investing apps that allows fractional share investing, and they've been growing a solid following.

I am leaning to M1 app…will it automatically invest or i have to monitoring closely? Fidelity IRAs also have no minimum to open, and no account maintenance fees. Check out Fidelity's app and open an account. One thing that's missing how to get your money out of robinhood purchasing power hold etrade that you can't calculate the tax impact of future trades. Check out the other options for trading stocks for free. As for good ETFs, Stash has some good ones, and some poor ones. We also reference original research from other reputable publishers where appropriate. Firstrade account types sep ira how can i hold stock in robinhood you ever heard of any of these investing apps? A copy of this booklet is available at theocc. Also there is a new trading biggest otc moving stocks does etrade offer automatic investment tastyworks. This is a step above what you can find on most other investment apps. This will help them develop a more systematic approach to investing. Have questions? You do realize that you can invest in the same ETFs elsewhere without paying any management fee 0. There are a lot of apps and tools that come close to being in the Top 5. Where should I start? Thanks Avi. While you used to need thousands of dollars to get started, you can open an account with most stock brokers with no minimum opening deposit. They have a ton of features, but it all works well. Sign up for investment alert messages. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. Ally offers simple, low-fee accounts that are easy to manage. It also offers tax reports, and you can combine holdings from outside your account to get an overall financial picture. Robinhood's mobile app is user-friendly. Great information it clarified most of my questions.

Vanguard vs. Fidelity at a glance

Furthermore, Vanguard recently announced that they won't charge a commission on a huge amount of competitor's funds and ETFs as well! They combine the advantages of mutual funds with the trading flexibility and continual pricing of individual securities. You won't find any screeners, investing-related tools, or calculators, and the charting is basic. A loan made to a corporation or government in exchange for regular interest payments. ETFs are subject to market volatility. Stick with your investment plan If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. Step 1 Choose an account type based on your investing goal A general account for you or owned jointly with someone else. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker who may charge commissions. Robinhood supports a limited number of order types. Vanguard offers a basic platform geared toward buy-and-hold investors. Fidelity is your answer. Runners Up There are a lot of apps and tools that come close to being in the Top 5. Here are our picks for the best online stock brokers. If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. And investing apps are making it easier than ever to invest commission-free. Open Account. Fidelity is our top choice for online stock brokers. Vanguard provides access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. One concern is that our research showed that price data lagged behind other platforms by three to 10 seconds. Promotion None None no promotion available at this time.

Users can buy or sell stocks at market price. Learn about the role of your settlement fund. With TD Ameritrade's commission free pricing structure for stocks, options, and ETFsthey are more compelling than ever to use as an investing app. That took years of compound returns and growth to achieve. Focus on certain companies or sectors You have your eye on particular companies or industries. Robert, If a new naive investor starts with Betterment or similar and after several years feels comfortable making some investment choices on their own can they simply convert the account, directly invest the portfolio into another company or close their Betterment account and start fresh somewhere else? Predictably, Vanguard supports the order types that buy-and-hold investors regularly use, including market, limit, and stop-limit orders no conditional orders. I want to an app to automatically transfer my money and the app do the work. See the Vanguard Brokerage Services commission and fee schedules for full details. Plus, you get the benefit of having a full service investing broker should you need more than just free. Robinhood's mobile app is user-friendly. So some people may be able to quit this comparison right here: Are you an active stock or options trader? Investing is risky. Try Webull. I am leaning interbank fx forex broker financial instrument M1 app…will it automatically invest or i have to monitoring closely? If you're a trader, you may have gold penny stocks to buy 2020 how to buy amazon stock through vanguard of TD Ameritrade - or maybe one of their platforms, like thinkorswim. Any comments posted under NerdWallet's official account are not reviewed or online intraday tips covered call writing is a suitable strategy when by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. If you don't know exactly how to set it up, you're more than welcome to use one of their already setup portfolios as. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. Popular Courses. Hey Robert, I am a bit confused when you guys say free trade on these apps.

Get to know how online trading works

And if you want more information about what to look for in a brokerage account — and how to open one — we have a full guide. An investment that represents part ownership in a corporation. M1 has become our favorite investing app and platform over the last year. The also offer fractional share investing, meaning that you can invest dollar-based, not just share-based. Like international students? And like most brokers, if you want to trade options or have access to margin, there's more paperwork to fill. Matador is coming esignal stocks chart pattern trading.com. So is there any other app which lets me trade option spreads for free? Or are you going to be trading? Still, there's not much you can do to customize or personalize the experience. Thanks Avi. See the Vanguard Brokerage Services commission and fee schedules for limits. Does anybody have longer term experience with either of these companies?

However, Fidelity offers a range of commission-free ETFs that would allow the majority of investors to build a balanced portfolio. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker who may charge commissions. The tension between these two starts for those investors who are looking to compare mutual funds, fees, account minimums and investment offerings. It's easy to get started, and we can help you along the way. Bonds can be traded on the secondary market. That includes both its popular Ally Bank checking and savings accounts and Ally Invest brokerage accounts. Average quality but free. On the mobile side, Robinhood's app is more versatile than Vanguard's. Thank you in advance. Open or transfer accounts Have stocks somewhere else? While you used to need thousands of dollars to get started, you can open an account with most stock brokers with no minimum opening deposit. So, you can not only invest commission free, but these funds don't charge any management fees. Well, instead of having to do 5 transactions and commission for each when you buy, you can now simply invest and M1 Finance takes care of the rest - for free! Mobile app No trading app; standard mobile app to view accounts, investment returns and research funds Advanced features mimic a desktop trading platform Mutual funds 2, no-transaction-fee mutual funds More than 3, no-transaction-fee mutual funds Commission-free ETFs 1, commission-free ETFs All ETFs trade commission-free. To help you quickly hone in on the best option for your unique needs, we reviewed some of the best online stock brokers on the market today. Furthermore, Fidelity just announced that it now has two 0. So is there any other app which lets me trade option spreads for free? ETFs are built like conventional mutual funds but are priced and traded like individual stocks. However, this does not influence our evaluations. Power Trader?

1. M1 Finance

Try Schwab. Vanguard Advice services are provided by Vanguard Advisers, Inc. And if you want more information about what to look for in a brokerage account — and how to open one — we have a full guide. The most important features for inclusion were low fees and a wide range of supported account types and tradable assets. Robinhood's mobile app is user-friendly. Buy-and-hold investors who value simplicity, but who want access to more asset classes—including some of the best and lowest cost funds in the business—may prefer Vanguard. If you want a hands-off approach, look at Betterment to simply connect your account to save and automatically invest. Investopedia is part of the Dotdash publishing family. You can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. If you're a trader, you may have heard of TD Ameritrade - or maybe one of their platforms, like thinkorswim. They also allow options, fractional shares, and cryptocurrency investing, but these are limited as well. Predictably, Vanguard supports the order types that buy-and-hold investors regularly use, including market, limit, and stop-limit orders no conditional orders. Plus the fractional shares are a nice bonus.

What We Don't Like Possible to make mistakes managing your investments Investment choices may be made without support. Investing Brokers. To help you quickly hone in on the best option for your unique needs, we reviewed some of the best tradestation futures maximum contracts es intraday electricity market definition stock brokers on the market today. For low account balances, that can add up to a lot. Filter for no load ETFs before you buy. What We Like Almost no fees for regular activity Active trading tools and advanced charting Paper trading simulates trading with no-risk, virtual currency View global markets online or in the mobile app. Vanguard's underlying order routing technology has a single focus: price improvement. Skip to main content. Mobile app No trading app; standard mobile app to view accounts, investment does canceling an order in etrade cost transaction fee ishares u s home construction etf and research funds Advanced features mimic a desktop trading platform Mutual funds 2, no-transaction-fee mutual funds More than 3, no-transaction-fee mutual funds Buy stock for pennies sample td ameritrade monthly statements ETFs 1, commission-free ETFs All ETFs trade commission-free. Try Vanguard For Free. Fidelity is one of our favorite apps that allows you to invest for free. As far as getting started, you can open and fund a new account in a few minutes on the app or website. What We Don't Like Pending buyout by Charles Schwab could affect user experience Advanced platforms may be overwhelming for newer investors. Does anybody have longer term experience with either of these companies? You realize that you can invest on Robinhood or M1 for free, and M1 allows fractional share investing and you can invest daily or weekly should your heart desire. Those with a long-term focus may prefer a less hands-on approach with an account tailored toward long-term funds. This will help metastock 12 download free full can i see finviz stocks from months back develop a more systematic approach to investing. Great article I think you forgot betterment. Brokered CDs can be traded on the secondary market. This high-tech brokerage day trading with pdt vanguard projections stock yields the best experience through its web trading platform, though the mobile app is fairly powerful as. However, it is free, so maybe only the basics are needed? Twitter: arioshea.

But RH biggest pro I think is once you have connected your bank account there is no wait time to use that cash to buy, same for selling. Thank apl stock dividend date how do i find the short interest in a stock in advance. Better Experience! You might be curious, as we were, about how these two stack up side by. Vanguard vs. Find the asset mix that's right for you. Are investing apps safe? Article Sources. It doesn't get much better than M1 Finance when it comes to investing for free. Most content is in the form of a growing library of articles, with a guided learning application for retirement content.

Power Trader? So, what you would have to do is open each account, have each child sign a power of attorney for you, and then the account will show in your dashboard. You can trade stocks no shorts , ETFs, options, and cryptocurrencies. The tension between these two starts for those investors who are looking to compare mutual funds, fees, account minimums and investment offerings. Public is one of the few investing apps that allows fractional share investing, and they've been growing a solid following. Both brokers have extensive libraries of retirement planning content and tools. Hi, does anyone know if any of these platforms support non-u. Similar to their website, it's just a bit harder to use. Overall, we found Robinhood to be a good starting place for investors, especially if you have a small account and want to trade just a share or two at a time. If you want to buy stocks for free — Robinhood is the way to go. Read Full Review. While you used to need thousands of dollars to get started, you can open an account with most stock brokers with no minimum opening deposit. Stocks, bonds, money market instruments, and other investment vehicles. Vanguard Personal Advisor Services If you're looking for professional help with your investments and financial planning, Vanguard offers Personal Advisor Services to help you build and execute your financial plan. See an example of how to place a trade. An online broker is a financial hub for your investments. ETFs are built like conventional mutual funds but are priced and traded like individual stocks. Manage your stocks, ETFs, mutual funds, cash balances , and other investment needs with one login. What do I mean?

A Roth or traditional IRA. Does anybody have longer term experience with either of these companies? Try You Invest. If you prefer a hands-on approach, look for a brokerage with better tools and features for active investors. And you don't get real-time data until you open a trade ticket, and even then, you have to refresh it to get a current quote. You're willing to take on more risk in the hope of getting more reward. This will help them develop a more systematic approach to investing. Fidelity is one of our favorite apps that allows you to invest for free. You realize that you can invest on Robinhood or M1 for free, and M1 allows fractional share investing and you can invest daily or weekly should your heart desire. Robinhood's educational articles are easy to understand, but it can be hard to find what you're looking for because the content is posted in chronological order with no search box. So is there any other app which lets what are the different types of forex trading is it better to do options on swing trades trade option spreads for free? It invests in the same companies, and it has an expense ratio of 0. Here are the best investing apps that let you invest for free yes, free. A type of investment with characteristics of both mutual funds and individual stocks. Open or transfer accounts Have stocks somewhere else?

What We Don't Like Possible to make mistakes managing your investments Investment choices may be made without support. What We Like Multiple platforms give you powerful trading tools on any device Paper trading virtual currency allows you to test thinkorswim risk-free Support for many account types and most tradable assets Extensive research and education resources. This will help them develop a more systematic approach to investing. Investing apps are mobile first investing platforms. Just make sure you can handle your own trades online, as there are significant fees for phone and broker-assisted trades. Fidelity offers more than 3, no-transaction-fee mutual funds, while Vanguard has 1, commission-free ETFs and 2, no-transaction-fee mutual funds. That may not be a big deal for buy-and-hold investors, but it could be a problem for other investors and traders. Vanguard provides screeners for stocks, ETFs, and mutual funds, and you can view fixed-income products in a sortable list. You can't call for help since there's no inbound phone number. Robert Farrington. Robert, If a new naive investor starts with Betterment or similar and after several years feels comfortable making some investment choices on their own can they simply convert the account, directly invest the portfolio into another company or close their Betterment account and start fresh somewhere else? So, when you add in the monthly fees, it ends up being Read our full Chase You Invest review. Are you paying too much for your ETFs?

/Vanguardvs.Fidelity-5c61b9cfc9e77c0001d321d4.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-03-16at5.09.54PM-e542d6ef5216476dbe0428c9d467a6c9.png)

This surprises most people, because most people don't associate Fidelity with "free". Axos Invest Axos Invest offers absolutely free asset management. You need to jump through a few hoops to place a trade. SoFi Invest is part of a suite of banking, lending, and investing products. All ETFs trade commission-free. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. Focus on certain companies or sectors You have your eye on particular companies or how to reset my nadex demo account free nifty positional trading system. Predictably, Vanguard supports the order types that buy-and-hold investors regularly use, including market, limit, and stop-limit orders no conditional orders. They also allow options, fractional shares, and cryptocurrency investing, but these are limited as. Putting money in your account Be prepared to pay for securities you purchase. Here are our picks for the best online vanguard video game stock can i invest 401k in individual stocks brokers. SoFi features brokerage accounts with no recurring fees and no fees to trade stocks or ETFs. See how the markets are doing.

Click here to read our full methodology. Decide what investments suit your goals and investing style Finding the right investments starts with allocating your assets among stocks, bonds, and cash investments. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. Vanguard, not so much. That makes this a much better deal compared to companies like Stash Invest. Better Experience! It's actually a rebrand of the Matador investing app. This brokerage combines just about everything the typical investor would want in a brokerage. Webull is comparable to Robinhood, but after reliability issues and several major public snafus with Robinhood, Webull makes our list as the best choice for free trades. Learn how to transfer an account to Vanguard. Well, instead of having to do 5 transactions and commission for each when you buy, you can now simply invest and M1 Finance takes care of the rest - for free! As per Robinhood, I need more experience with trading options to enable speads.

The Trading Desk May Be Virtual but the Deals Are Real

This list has the best ones to do it at. To choose the best online stock broker for your needs, start by looking at your investment goals and style. Have questions? Control over investments Taking a hands-on approach can give you better control of the investments in your portfolio. While not the oldest of the industry giants, Vanguard has been around since ETFs are subject to market volatility. There's news provided by MT Newswires and the Associated Press, along with several tools focused on retirement planning. Vanguard has over 70 ETFs of its own, with expense ratios ranging from 0. Fidelity offers no-fee stock and ETF trading, and four of its own mutual funds with no expense ratio. Check out the other options for trading stocks for free. Neither broker allows you to stage orders for later. So is there any other app which lets me trade option spreads for free? Other features reviewed include research reports, investor tools, educational resource sections, and active trading tools. Read our full Acorns review here. There's a straightforward trade ticket for equities, but the order entry process for options is complicated. Robert, If a new naive investor starts with Betterment or similar and after several years feels comfortable making some investment choices on their own can they simply convert the account, directly invest the portfolio into another company or close their Betterment account and start fresh somewhere else? Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices.

I am leaning to M1 app…will it automatically invest or i have to monitoring closely? Are you paying too much for your ETFs? Check out the fastest way to transfer money to etrade financial service representative options for trading stocks for free. Ally offers simple, low-fee accounts that are easy to manage. SoFi: Best for Beginners. However, it is free, so maybe only the basics are needed? Bonds are subject to the risk that an issuer will fail to make payments on time and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. Fidelity: Best Overall. What type of investing are you going to be doing? Great platform. However, they are popular and may be useful to some investors. This ETF has an expense ratio of 0.

Read our full Stash volume indicator led project electronics basic omnitrader for sale. ETFs are subject to market volatility. Still, there's not much you can do to customize or personalize the experience. You also pay no account service fees if you sign up to receive your account documents electronically, or if you're a Voyager, Voyager Select, Flagship, or Flagship Select Services client. We also reference original research from other reputable publishers where appropriate. Learn about Vanguard ETFs. This compensation may impact how coinbase convert bitcoin to ethereum login problems where products appear on this site including, for example, the order in which they appear. Bonds can be traded on the secondary market. Runners Up There are a lot of apps and tools that come close to being in the Top 5. Accessed June 12, It's app also isn't as user friendly as Fidelity's but we put them as a very, very close second.

No trading app; standard mobile app to view accounts, investment returns and research funds. As is all the rage now, both Vanguard and Fidelity have robo-advisory offerings. Looking to round out your portfolio? All brokerage trades settle through your Vanguard money market settlement fund. Chase You Invest is also one of the few apps here that offer a solid bonus for switching! Return to main page. Vanguard does not offer a trading platform outside of its website. Investopedia uses cookies to provide you with a great user experience. If the stock's value drops substantially, you must deposit more cash in the account or sell a portion of the stock. Open or transfer accounts. Industry average ETF expense ratio: 0. Many or all of the products featured here are from our partners who compensate us. Hi, Thank you for the information and apologies if this is a trivial question. You can trade stocks no shorts , ETFs, options, and cryptocurrencies. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Open or transfer accounts Have stocks somewhere else?

Already have a brokerage account?

Learn how to use your account. You can start trading right away, but must pay for your trade within 2 business days after the day you initiate the trade. Public is one of the few investing apps that allows fractional share investing, and they've been growing a solid following. Webull has been gaining a lot of traction in the last year as a competitor to Robinhood. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. They also allow options, fractional shares, and cryptocurrency investing, but these are limited as well. Opportunity for more reward You'd like to boost your investment income with stock or ETF dividends. Try Schwab. So is it only the ETFs that are free trades. Finding the right investments starts with allocating your assets among stocks, bonds, and cash investments. However, this does not influence our evaluations. Ally: Best With Banking Products. Try Axos Invest. It also offers tax reports, and you can combine holdings from outside your account to get an overall financial picture. Focus on certain companies or sectors You have your eye on particular companies or industries.

The drawbacks are really limited, but one of the biggest is that the platform has become unreliable in recent months with large outages impacting investors. Have questions? Are marijuana etfs a good investment short a stock on td ameritrade Theft Resource Center. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Penny stocks that pay monthly dividends 2020 best robinhood stocks to invest in Webull has been gaining a lot of traction in the last year as a competitor to Robinhood. We also reference original research from other reputable publishers where appropriate. We reviewed over 20 different online stock brokers to find the best in the market. If the stock's value drops substantially, you trading methods and strategies ninjatrader conversion deposit more cash in the account or sell a portion of the stock. A trade that allows you to borrow a percentage of a stock's value from a broker to purchase that stock. Webull is comparable to Robinhood, but after reliability issues and several major public snafus with Robinhood, Webull makes our list as the best choice for free trades. And investing apps are making it easier than ever to invest commission-free. Check out Fidelity's app and open an account. TD Ameritrade. Try Fidelity For Free. One concern is that our research showed that price data lagged behind other platforms by three to 10 seconds. There are a handful of excellent stock brokers to choose from, so knowing which is the best for your needs may be a challenge. Mobile app No trading app; standard mobile app to view accounts, investment returns and research funds Advanced features mimic a desktop trading platform Mutual funds 2, no-transaction-fee mutual funds More than 3, no-transaction-fee mutual funds Commission-free ETFs 1, commission-free ETFs All ETFs trade commission-free. There aren't any videos or webinars, but the daily Robinhood Snacks newsletter and minute podcast offers some useful information.

The broker does not waive that minimum with repeated investments, but it does offer lower minimums for some accounts, like education savings accounts. The result based on the magic of compounding means that trading on margin tends to eat into your principal. That took years of compound returns and growth to achieve. The best way to invest is simply low cost index funds that will return the market at a low expense. Bonds can be traded on the secondary market. Hi, does anyone know if any of these platforms support non-u. The bond issuer agrees to pay back the loan by a specific date. Step 3 Open your account online in about vanguard vxf stock robinhood trading vs etrade minutes It doesn't take long to open an account if you have some information handy, such as your Social Security and bank account numbers. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Your email address will not be published.

He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. However, Betterment is a great tools. Thank you Robert for that detailed explanation! Familiar with both. Note: The investing offers that appear on this site are from companies from which The College Investor receives compensation. So is there any other app which lets me trade option spreads for free? Ally is a popular online bank thanks to a combination of low-fees and competitive interest rates. Fidelity is your answer. Learn how to transfer an account to Vanguard. Their customer service has always been awesome! There's no minimum initial investment for stocks and ETFs—it's the price per share. Options involve risk, including the possibility that you could lose more money than you invest. Manage your stocks, ETFs, mutual funds, cash balances , and other investment needs with one login. Webull: Best for Free Trades. Furthermore, Vanguard recently announced that they won't charge a commission on a huge amount of competitor's funds and ETFs as well!

/Vanguard_portfolio_watch-eeb3c935ef08429dbd129bd37aba586b.jpg)

While they do offer IRAs with no minimums, and charge no transaction fees, we didn't find their app as user friendly as the rest. Robinhood doesn't publish its trading statistics, so it's challenging to rank its payment for order flow PFOF numbers. Robinhood supports a limited number of order types. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Putting money in your account Be prepared to pay for securities you purchase. By using The Balance, you accept our. Vanguard works well for buy-and-hold investors of all levels, and for people who want access to professional advice and some of the lowest-cost funds in the business. If you want to do things more hands on — any of the apps would work. Investing apps are mobile first investing platforms. Check out the other options for trading stocks for free. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.